What is Food Container Market Size?

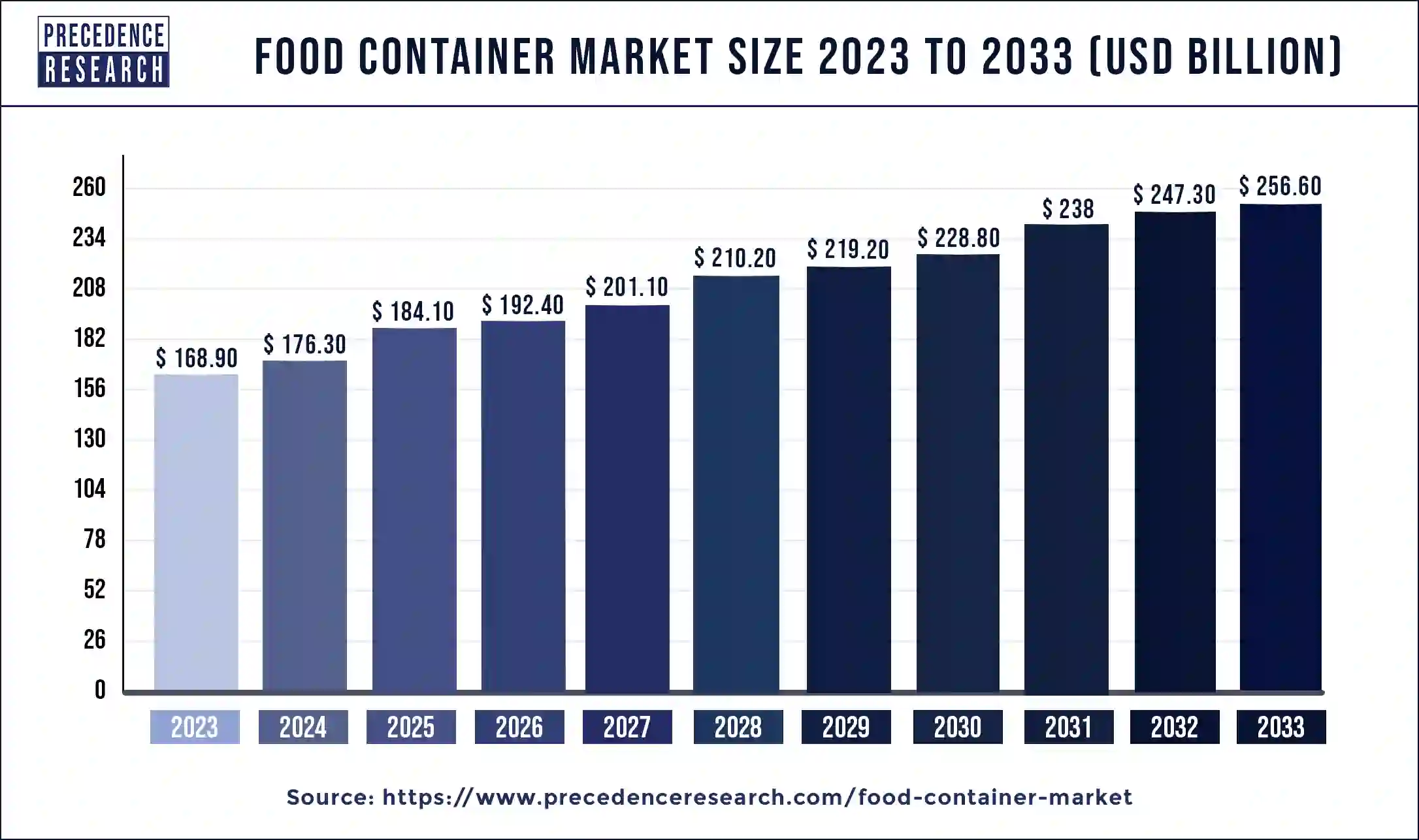

The global food container market size is estimated at USD 184.10 billion in 2025 and is predicted to increase from USD 192.40 billion in 2026 to approximately USD 275.2 billion by 2035, expanding at a CAGR of 4.1% from 2026 to 2035.

Market Highlights

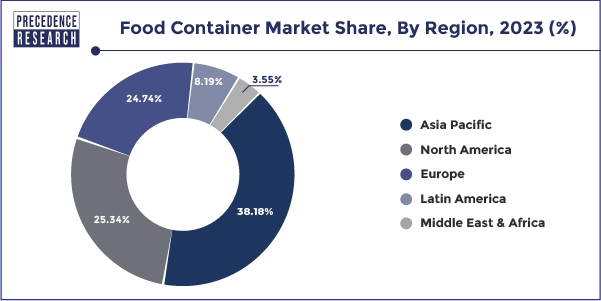

- Asia Pacific has held the biggest revenue share of 38.29% in 2025.

- By Material, the plastic segment captured the largest market share 43.56% in 2025.

- By Material, the glass segment is projected to grow at the fastest CAGR over the projected period.

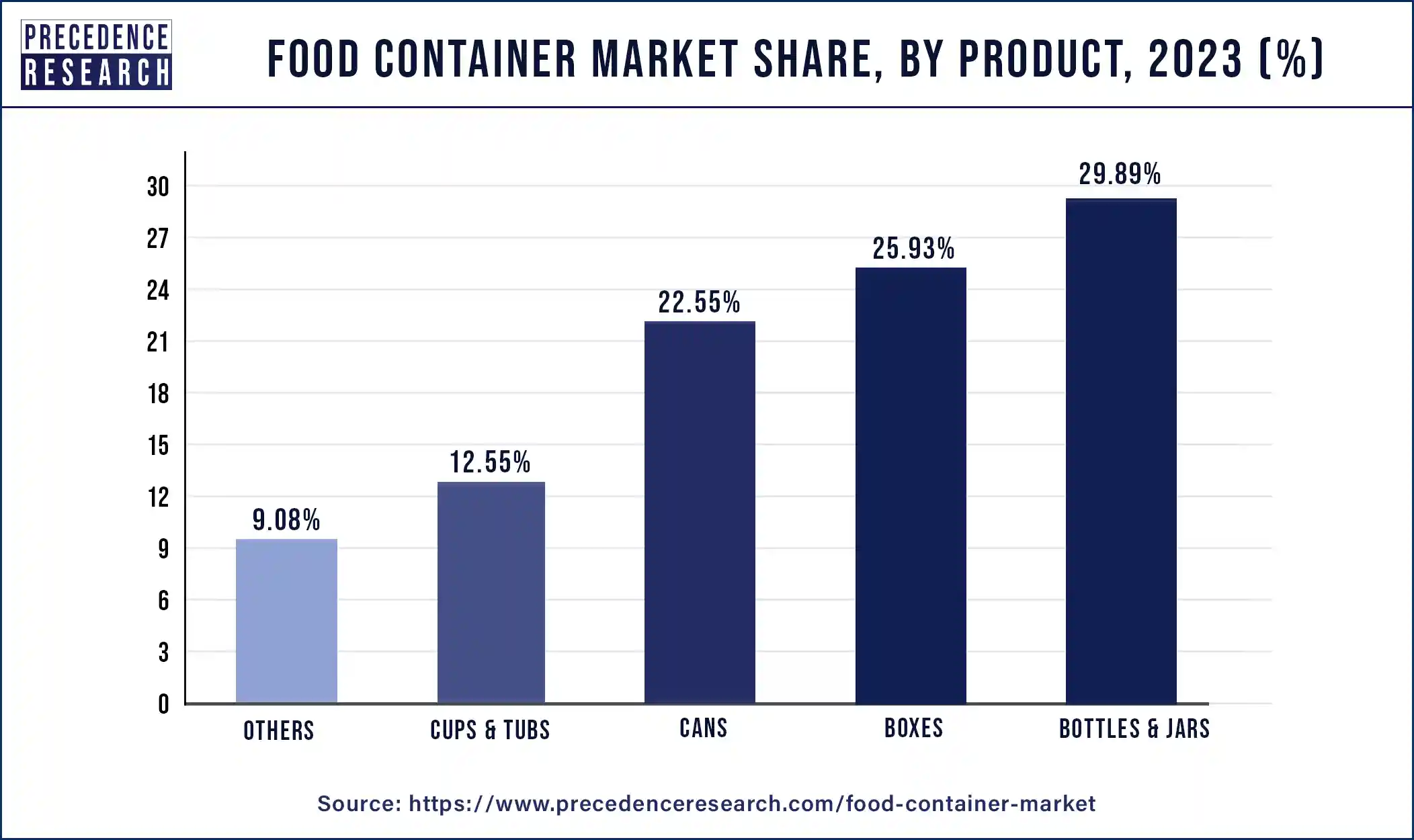

- By Product, the bottles and jars segment has held the highest revenue share 29.83% in 2025.

- By Product, the cups and tubs segment is expected to expand at a fastest CAGR during the projected period.

Food Container Market Growth Factors

The food containers are primarily used for storage, preservation, and transportation in order to extend the food's shelf life. The food containers should be durable enough to prevent spoilage or damage to the contents of the package. The food containers help to preserve the quality of food by allowing it to travel safely vast distances from its source.

There are so many different types of food containers available in the market. Food containers come in a wide variety of sizes, shapes, and colors. For several meals for groups, there are food containers made for single meals for individuals, such as lunch boxes and containers. The different types of food can be stored in containers with and without sections.

The food container market is expected to be influenced by rising consumer awareness of environmental and sustainability issues linked to food packaging. Due to its high use of packaged products, the North America holds the greatest share of the food container market, which is expected to continue during the projection period.

Among all the types of food containers, the plastic food container is very beneficial to use. For a variety of reasons, plastic food containers are typically less expensive than those made of other materials such as metal, glass, and wood. The manufacturing costs for plastic are typically cheaper than those of glass and metal, resulting in reduced selling prices. As these products may be produced in larger quantities, economies of scale benefit them. Also, these type of food containers can be recycled and reused, lowering both financial and environmental expenses.

The lids for plastic food containers are frequently included, and they can be tightly sealed using silicone gaskets and Snap-on latches. These can then keep food fresher for longer period of time by protecting it from dangerous external contaminants such as germs prevalent in the air. The total quality of the food, including its colors, flavors, and textures, can be preserved if it is kept clean, dry, and fresh inside the plastic food containers. Food stored in the aluminum containers and metal pots, on the other hand, has a much shorter shelf life. This is because condensation can collect on the lid, allowing bacteria to multiply more quickly. All these advantages make plastic as an ideal material for food containers.

The global food container market is expanding due to the growing global interest in the development of biodegradable and smart food packaging materials. Furthermore, growing urbanization and a considerable shift away from traditional staples toward processed or packaged meals will boost the growth of the food container market significantly during the forecast period.

In recent years, the growth of packaged food as one of the most profitable divisions of the global food and beverage business has fueled large scale advancements across the food container market. The ever-increasing variety of available product kinds on the food container market, as well as their expanding range of applications, present considerable growth potential for food packaging companies.

The huge rise in global food production is predicted to fuel the global market for food containers. The consumer demands for simple packaging that is easy to carry, consume, and store. As a result, it becomes critical for food container producers to stay up with evolving consumer tastes. The global food container is expected to develop at a quick pace due to advances in technology, logistical applications, distribution channels, and the packaging industry.

The increased number of families consuming packaged goods, the expanding number of working women, and the massive increase in double-income families are all contributing to the global market for food containers' healthy growth prospects. The rising population in metropolitan areas, as well as the rising number of single person households, are likely to fuel the demand for food containers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 184.10 Billion |

| Market Size in 2026 | USD 192.40 Billion |

| Market Size by 2035 | USD 275.2 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.1% |

| Largest Market | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material Type,Product Type, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Opportunity

Innovation In Container Material and Design Expanding the Market

Advancements in material science have resulted in the creation of food containers that offer enhanced protection while also reducing environmental impact. Moreover, progress in manufacturing technologies has allowed for the creation of adaptable and efficient hinged food containers, serving various needs across multiple sectors. Firms that prioritize research and development to produce resilient, affordable, and eco-friendly hinged food containers are likely to achieve a competitive advantage. The combination of cutting-edge materials and ergonomic designs is expected to significantly influence the future of the food containers market.

Restraint

What Are the Challenges Faced by Food Container Market?

The food container industry encounters major obstacles, mainly due to environmental issues and the elevated expenses of eco-friendly options. Amidst the demand for sustainable packaging, single-use plastics are under greater examination and regulation, prompting businesses to explore options. Nonetheless, these options, such as biodegradable or compostable materials, frequently involve greater production expenses, which limits their accessibility for broad implementation, particularly for smaller enterprises.

Segment Insights

Material Insights

The plastic segment dominated the global food container market in 2025. Due to its numerous advantages over other materials, plastic is the most widely used material in the packaging industry. Plastic is more energy efficient to manufacture than other materials and is lighter than other materials. Food containers made of plastic are commonly available and sold in retail stores. Food containers can range in quality from low to high quality depending upon its thickness.

The glass segment is fastest growing segment of the food container market in 2025. The glass containers are also becoming more popular, and they come in colored, frosted, and clear variants. Furthermore, the glass substance aids in the preservation of food for the long period of time.

Food Container Market, By Material, 2022-2024 (USD Billion)

| By Material | 2022 | 2023 | 2024 |

| Plastics | 70.8 | 73.8 | 76.8 |

| Glass | 19.0 | 19.9 | 20.8 |

| Metal | 23.7 | 24.8 | 25.9 |

| Others | 48.4 | 50.5 | 52.7 |

Product Insights

Bottles and jars, particularly those made of plastic, are recognized for their light weight, durability, and cost-effectiveness, making them a favored option for packaging various food items. The rise of convenience foods and online food delivery has heightened the need for single-serving and ready-to-eat meals, thus enhancing the utilization of bottles and jars. The rising emphasis on eco-friendly packaging is boosting the demand for reusable and recyclable glass and plastic bottles and jars.

The cups and tubs category is rapidly expanding in the food container market. This expansion is fueled by the increasing need for convenient and sanitary packaging options for different food items. Cups and tubs are particularly preferred for ready-to-eat meals, frozen foods, and dairy items because of their sturdiness, light weight, and capacity to maintain food quality. In comparison to certain other packaging options, cups and tubs may provide a more economical choice.

Food Container Market, By Product, 2022-2024 (USD Billion)

| By Product | 2022 | 2023 | 2024 |

| Bottles & Jars | 48.5 | 50.5 | 52.6 |

| Cups & Tubs | 20.4 | 21.2 | 22.0 |

| Cans | 36.4 | 38 | 39.8 |

| Boxes | 42.0 | 43.8 | 45.9 |

| Others | 14.7 | 15.3 | 16.0 |

Regional Insights

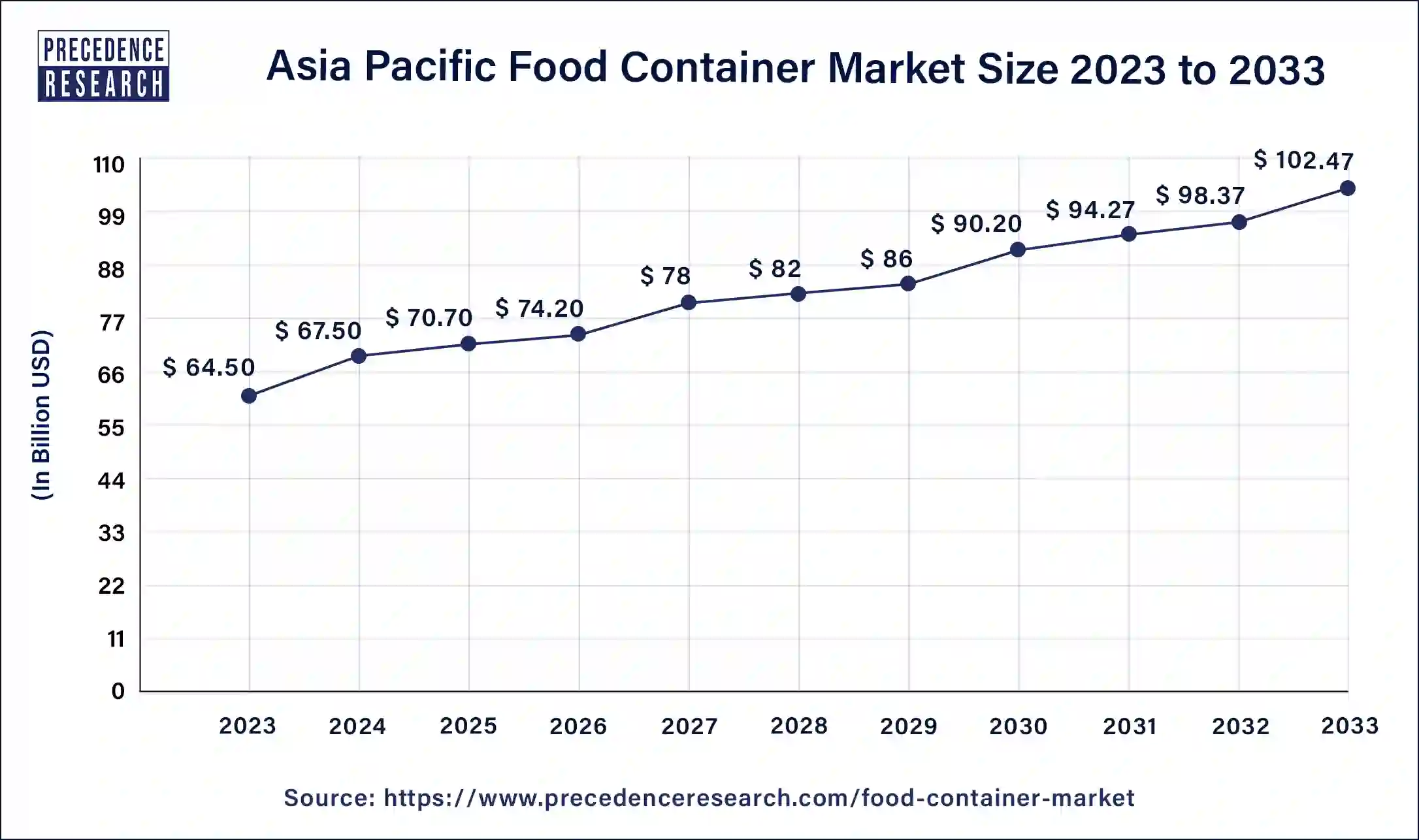

Asia Pacific Food Container Market Size and Growth 2026 to 2035

Asia Pacific food container market size is valued at USD 70.70 billion in 2025 and is expected to be worth around USD 110.67 billion by 2035 with a CAGR of 4.58% from 2026 to 2035

Latin America is expected to develop at the fastest rate of 4.41% CAGR during the forecast period. The rise in demand for packaged and convenience foods among the working population can be related to the expansion of the food container market in the Latin America region.

India Food Container Market Trends

As food delivery and online ordering have increased, the demand for sturdy, leak-resistant containers have grown. In India, the demand for food containers is rising due to the expansion of delivery services and consumers' desire for convenient food packaging options. Packaged items, ready-to-eat dishes, and frozen goods need safe and clean packaging to maintain freshness and longevity. The demand for food containers is strong as lifestyles evolve towards convenience and consumers look for easy meal choices. As shoppers grow more environmentally aware, containers that are biodegradable and compostable, made from substances like paper, cornstarch, and bagasse, are becoming increasingly popular.

North America

North America experienced robust growth in food container market. The area's robust food production industry, combined with the advanced packaging sector, plays a role in the global market share for food containers. The National Restaurant Association projected that in 2023, roughly 749,000 restaurants existed in the U.S., including 349,000 chain restaurants, and 156,715 made up single-location full-service restaurants, as well as chain and independent entities. The increasing need for food containers by restaurants, fast-food chains, and retail industries further enhances market growth in North America.

The market for food storage containers in the U.S. is crucial in the food packaging industry because of its lightweight characteristics and durability. This market comprises an extensive array of products like bags, boxes, bottles, containers, and more, boosting its demand across different sectors. This market is experiencing considerable growth due to the increasing number of employed individuals in the U.S., heightened urbanization, and evolving lifestyles of the populace. The increasing focus on healthy eating and meal prep is continuously driving up the demand for food storage containers. The growing number of e-commerce platforms has made it convenient with numerous choices present in the market.

Europe

The market for food containers in Europe is expected to experience consistent growth during the projected period. The market is propelled by the growing need for sustainable packaging options and the strict regulations related to food safety and packaging standards. The market is driven by European consumers' desire for sustainable and high-quality packaging options. The growth of the food and beverage sector and the increase in e-commerce within Europe also support the consistent expansion of the food container market in the area.

Food Container Market Companies

- PRINTPACK

- Graham Packaging Company

- Bemis Company Inc.

- Ball Corporation

- Constar International UK Ltd.

- Anchor Glass Container Corporation

- Crown

- Berry Plastics Corporation

- Plastipak Holdings Inc.

- Graphic Packaging International LLC

Recent Developments

- In April 2025, PlanetBox, the leader in long-lasting stainless steel lunch boxes, has broadened its range of reusable dining essentials with an exciting new assortment of products designed to endure for years. With the introduction of the new Glass Food Storage Containers, the release of the durable and adaptable Adventurer Insulated Lunch Bag, along with various reusable accessories, PlanetBox remains at the forefront of crafting well-designed, functional, and stylish items for busy families.

- In February 2025, the University of Virginia. Dine has collaborated with ReusePass, an online sustainability initiative that allows diners to borrow and return reusable takeout containers, to introduce this project. The initiative will focus on minimizing waste in dining areas and achieving the objectives of the 2030 U.Va. Sustainable Development Plan.

- In November 2024, Novolex, a forerunner in packaging options, innovation, and sustainability, is launching new transparent containers that maintain food freshness and safety while providing consumers with reassurance. The updated TamperFlag rigid containers from Novolex's Waddington North America (WNA) brand have a tamper-evident “flag” that lifts and remains elevated once opened. The function notifies users that the package has been opened.

Segments Covered in the Report

By Material

- Plastic

- Glass

- Metal

- Others

By Product

- Bottles and Jars

- Cups and Tubs

- Cans

- Boxes

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting