What is the North America Co-Packaged Optics Market Size?

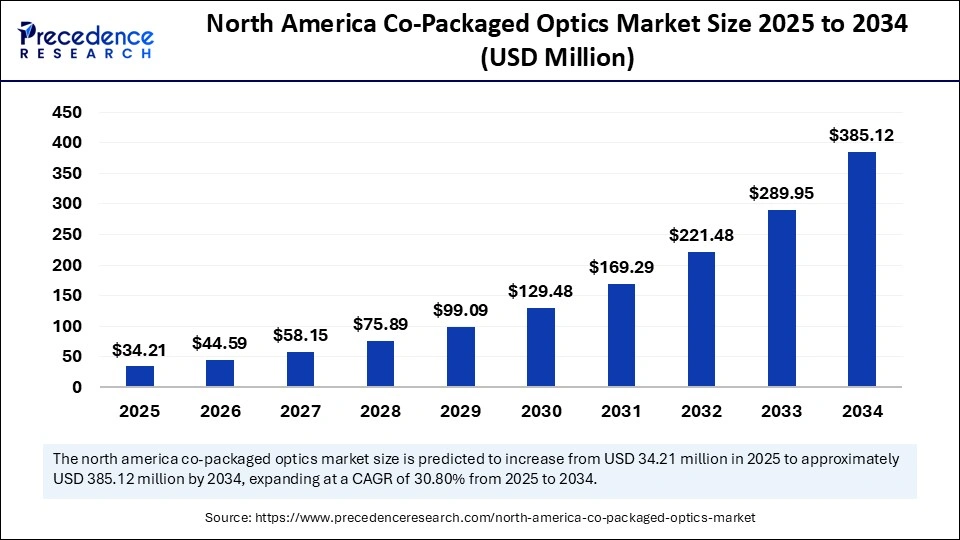

The North America co-packaged optics market size is accounted at USD 34.21 million in 2025 and predicted to increase from USD 44.59 million in 2026 to approximately USD 385.12 million by 2034, expanding at a CAGR of 30.80% from 2025 to 2034.

North America Co-Packaged Optics Market Key Takeaways

- In terms of revenue, the North America co-packaged optics market was valued at USD 26.27 million in 2024.

- It is projected to reach USD 385.12 million by 2034.

- The market is expected to grow at a CAGR of 30.80% from 2025 to 2034.

- By component, optical engines/transceivers dominated the market in 2024.

- By component, photonic integrated circuits (PICs) are the fastest-growing during the forecast period.

- By integration/packaging type, true co-packaged optics segments led the market in 2024.

- By integration/packaging type, on-board optics segment seen to be the fastest growing during the forecast period.

- By reach / interconnect length, intra-rack / intra-chassis segments captured the biggest market share in 2024.

- By reach / interconnect length, intra-package (<10 mm) segment is the fastest-growing during the forecast period.

- By end-use application, hyperscale data centers segments contributed the highest market share in 2024.

- By end-use application, AI-driven HPC systems are expected to grow during the forecast period.

- By distribution channel, direct OEM / hyperscaler supply segment is generated the major market share in 2024.

- By distribution channel, contract manufacturing partnerships are seen to be the fastest-growing segment this year.

What Is the Role of AI in the North America Co-packaged Optics Market?

Artificial Intelligence is playing a transformative role in the North America co-packaged optics market. The explosion of AI clusters and GPU-based systems across U.S. hyperscale data centers has amplified demand for ultra-high bandwidth and low-latency interconnects. Traditional pluggable optics no longer meet scalability needs, as they consume more power and space. Co-packaged optics, combined with AI-driven optimization, address this gap by delivering higher throughput at lower power.

AI is also being deployed in the development and manufacturing of co-packaged optics in North America. Machine learning models optimize optical component design, predict thermal and signal losses, and improve yield during advanced packaging. In manufacturing, AI-driven quality control ensures precision in assembling fiber arrays, photonic ICs, and optical engines, enhancing reliability and scaling.Thus, AI is not only fueling demand for co-packaged optics but also driving innovation and production efficiency, solidifying the U.S. and Canada as leaders in both adoption and technology advancement.

Market Overview

The North America co-packaged optics market refers to the ecosystem of technologies, components, and solutions where optical transceivers and photonic elements are integrated within the same package or positioned close to high-speed electronic devices such as switch ASICs, GPUs, or processors. This architecture shortens electrical interconnect distances, reduces power consumption, and enables ultra-high bandwidth density, making it critical for hyperscale data centers, AI/HPC systems, cloud computing, and next-generation telecom infrastructure across the region.

In the U.S. and Canada, co-packaged optics is becoming a key enabler of high-performance computing and networking. The rapid expansion of hyperscale data centers, the rise of AI-driven workloads, and the continuous growth of cloud services are fueling strong demand for low-latency, high-bandwidth, and energy-efficient solutions. The technology is being adopted at a fast pace throughout the forecast years due to surging data traffic, AI integration, and a regional shift toward more sustainable digital infrastructure.

What Are the Key Trends in the North America Co-packaged Optics Market?

- Rising Demand for Data: The North America co-packaged optics market is expanding due to soaring demand for data, driven by cloud computing, video streaming, 5G rollouts, and IoT applications. Co-packaged optics helps reduce signal travel distances by integrating optical components directly with semiconductor chips. This reduces latency and enhances real-time responsiveness, which is vital for applications like autonomous driving, online gaming, video conferencing, and AI analytics. With U.S. hyperscalers like Google, Amazon, and Microsoft setting benchmarks in data intensity, demand for co-packaged optics continues to grow.

- Technological Advancements: The region is leading in R&D for advanced optical components and thermal management systems. North American firms are pioneering silicon photonics, heat sink technologies, and advanced packaging solutions that ensure reliable performance in demanding environments. These innovations are necessary for networks requiring 400G, 800G, and future 1.6T speeds while keeping energy consumption manageable.

- Evolution of Network Architectures: With the rollout of 5G networks across the U.S. and Canada and the onset of 6G research, telecom operators are under pressure to deliver higher bandwidth and lower latency. Co-packaged optics enables North American telecom equipment providers to design compact, scalable, and energy-efficient platforms. The ability to handle massive data loads without performance degradation makes co-packaged optics vital for next-gen networks and immersive applications such as AR/VR, connected vehicles, and IoT ecosystems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 385.12 Million |

| Market Size in 2025 | USD 34.21 Million |

| Market Size in 2026 | USD 44.59 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 30.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Integration / Packaging Type, Reach / Interconnect Length, End-Use Application, and Distribution Channel |

Market Dynamics

Drivers

The North America co-packaged optics market is driven by the expansion of hyperscale data centers, AI adoption, and cloud infrastructure modernization. The U.S. is at the forefront, with massive investments by tech giants like NVIDIA, Google, Amazon, and Microsoft in building next-generation networks capable of supporting AI, ML, and real-time data analytics. Co-packaged optics reduces latency, cuts power use, and ensures scalability for 800G and 1.6T networks, making it indispensable for the region's data-driven economy.

Restraint

Despite its growth, the North America co-packaged optics market faces hurdles. The high cost of infrastructure upgrades, integration complexity, and lack of standardized interfaces among vendors slow down mass deployment. Smaller data centers in Canada and Tier-2 enterprises across the U.S. often find it challenging to justify the capital expenditure. Scalability at very large volumes also remains a challenge for manufacturers.

Opportunity

Opportunities abound in AI-driven HPC clusters, quantum computing initiatives, and sustainable green data centers across the region. With government policies in the U.S. and Canada prioritizing carbon neutrality, co-packaged optics provides energy-efficient interconnect solutions. Rapid advances in silicon photonics and polymer waveguides in North American labs are also expected to accelerate adoption, ensuring the region remains at the cutting edge of optical networking.

Component Insights

Which Component Is Dominating the North America Market in 2024?

Optical engines/transceivers hold the dominant share in the North America co-packaged optics market as of 2024. This is due to their critical role in enabling high-speed optical data transmission within and between data centers. Co-packaged transceivers integrate multiple optical and electrical components in a single module, significantly reducing power consumption and physical footprint compared to traditional pluggable optics. Demand for transceivers in North America is further being fueled by the growing need for scalable, high-density interconnected solutions among hyperscale data centers and next-generation network architectures operated by regional cloud providers and telecom firms. Continuous advancements in transceiver design, such as the adoption of silicon photonics and advanced packaging techniques, are further enhancing performance and reliability, making them indispensable in modern North American optical networks.

Which Component Is the Fastest Growing in the North America Market in 2024?

Photonic integrated circuits (PICs) are the fastest-growing segment in the North America co-packaged optics market this year. This is because they represent the future of scalable, energy-efficient optical networking. PICs integrate multiple photonic functions, such as lasers, modulators, detectors, and filters, onto a single chip, which helps significantly reduce cost, size, and power consumption without sacrificing performance. They also enable greater system integration and can meet the escalating demands of North American hyperscale data centers and AI clusters, something that traditional transceivers alone may struggle to achieve.

Integration Type Insights

Which Integration Type Is Dominating the North America Co-packaged Optics Market in 2024?

True co-packaged optics continue to dominate the North America co-packaged optics market because they place optics and the ASIC within the same package, enabling the shortest possible electrical connections. This arrangement drastically reduces power consumption and signal loss, two of the most significant challenges for regional operators. Several North American companies and hyperscalers are evaluating and piloting true co-packaged optics because they are critical for supporting AI training clusters, cloud computing infrastructure, and 5G core networks.

Which Integration Type Is the Fastest Growing in the North America co-packaged optics market in 2024?

On-board optics are the fastest-growing segment this year. This growth stems from their role as a practical bridge between pluggable optics and fully integrated co-packaged solutions. On-board optics place optical elements very close to the switch ASIC but not inside the same package, allowing for simpler thermal management and design flexibility. This makes them particularly attractive to Tier-2 cloud providers, regional telecom operators, and enterprises across North America that seek higher bandwidth density without heavy capital investment.

Reach / Interconnect Length Insights

Which Reach Is Dominating the North America Co-packaged Optics Market in 2024?

Intra-rack (intra-chassis) interconnects are the dominant segment in the North America co-packaged optics market in 2024, largely because many regional data center operators are prioritizing infrastructure upgrades to handle growing traffic inside a single rack. These configurations help manage power consumption and enable more efficient data transfer between top-of-rack switches and servers. The appeal of intra-rack solutions in North America lies in their balance of cost efficiency, technical feasibility, and immediate performance gains.

Which Reach Is the Fastest Growing in the North America Co-packaged Optics Market in 2024?

Intra-package (<10 mm) reach is emerging as the fastest-growing segment this year. Its growth is driven by the ability to deliver unmatched improvements in bandwidth density, ultra-low latency, and reduced signal loss compared with longer-reach solutions. Unlike intra-rack approaches, intra-package designs place optics directly alongside switching chips, effectively eliminating many of the limitations of traditional electrical connections and unlocking the highest performance levels for compute-dense North American deployments.

End-Use Application Insights

Which End User Dominates the North America Co-Packaged Optics Market in 2024?

Data centers are the dominant end-use segment for co-packaged optics in North America in 2024. This dominance is attributable to explosive growth in cloud computing, big data analytics, and AI-driven workloads across U.S. and Canadian hyperscalers, which has driven adoption of high-speed, energy-efficient optical interconnects. CPO enables data center operators to achieve higher port densities, lower power consumption, and improved scalability, key objectives as operators optimize performance and operate more cost-effectively across distributed environments.

Which End User Is the Fastest Growing in the North America Co-Packaged Optics Market in 2024?

AI-driven high-performance computing (HPC) is the fastest-growing segment this year. HPC environments, such as supercomputing centers and large AI training clusters, require interconnect solutions that support massive bandwidth while minimizing signal loss over short and mid distances. The integration of co-packaged optics with advanced switching and processing technologies allows North American HPC operators to reach breakthrough performance levels, enabling scientific research, financial modeling, and complex simulations. Adoption of co-packaged optics in HPC is expected to accelerate as more organizations pursue large-scale AI and compute-intensive initiatives.

Distribution Channel Insights

Which Distribution Channel Dominates the North America Market in 2024?

Direct OEMs continue to dominate the North America co-packaged optics market this year. Large technology firms, such as NVIDIA, Cisco, Intel, and major hyperscalers, prefer to design, test, and deliver their co-packaged optics solutions directly to hyperscale data centers and telecom operators. Direct OEM supply gives these firms control over product quality, intellectual property, and system integration, and it allows for faster customization to meet demanding customer requirements.

Which Distribution Channel Is the Fastest-Growing in North America in 2024?

Contract manufacturing partnerships are the fastest-growing distribution channel this year. As demand for co-packaged optics rises alongside the integration of AI workloads and machine learning, OEMs are finding scale-up of in-house production challenging. Partnering with contract manufacturers allows North American OEMs to expand manufacturing capacity, reduce capital outlay, and accelerate time-to-market. This path also enables smaller innovators to commercialize technologies without large upfront investments.

North America Co-packaged Optics Market – Value Chain Analysis

- Raw Materials & Components: Led by North American giants like Corning (optical fibers) and regional suppliers of silicon wafers and polymers.

- Chip Design & Photonic Engines: U.S. leaders Intel, Broadcom, Marvell, Ayar Labs are shaping silicon photonics and engine design.

- CPO Packaging & Assembly: U.S. packaging hubs and partnerships with TSMC (U.S.), NVIDIA, and IBM dominate advanced assembly.

North America Co-Packaged Optics Market Companies

- Intel

- NVIDIA

- Broadcom

- Cisco Systems

- IBM

Ayar Labs - Molex

- Ciena

- POET Technologies (Canada)

- TE Connectivity

Recent Developments

- In December 2024, IBM unveiled a breakthrough co-packaged optics prototype module using polymer optical waveguides, enabling faster AI training and reduced GPU downtime in U.S. data centers.(Source: https://newsroom.ibm.com)

- In June 2025, research collaborations with Canadian institutions highlighted the role of single-mode polymer waveguides in scaling reliable, low-loss CPO systems for AI and HPC applications.(Source: https://ieeephotonics.org)

Segments Covered in the Report

By Component

- Optical engines/transceivers

- Photonic integrated circuits (PICs)

- Lasers

- Modulators

- Electrical ICs / SerDes

- Optical fibers and waveguides

- Connectors and interfaces

- Thermal management solutions

- Packaging substrates and interposers

- Testing and alignment tools

By Integration / Packaging Type

- True co-packaged optics (same package as ASIC)

- Co-located optics (adjacent module integration)

- On-board optics (PCB-level integration)

By Reach / Interconnect Length

- Intra-package / intra-die (<10 mm)

- Intra-rack / intra-chassis (10 mm–3 m)

- Inter-rack / data-hall (3 m–100 m)

By End-Use Application

- Hyperscale data centers (AI/cloud)

- AI-Driven High-Performance Computing (HPC)

- Enterprise data centers

- Telecom and metro networks

- Edge data centers

By Distribution Channel

- Direct OEM / hyperscaler supply

- Channel / distributor-based sales

- Contract manufacturing partnerships

Get a Sample

Get a Sample

Table Of Content

Table Of Content