What is the Video Streaming Market Size?

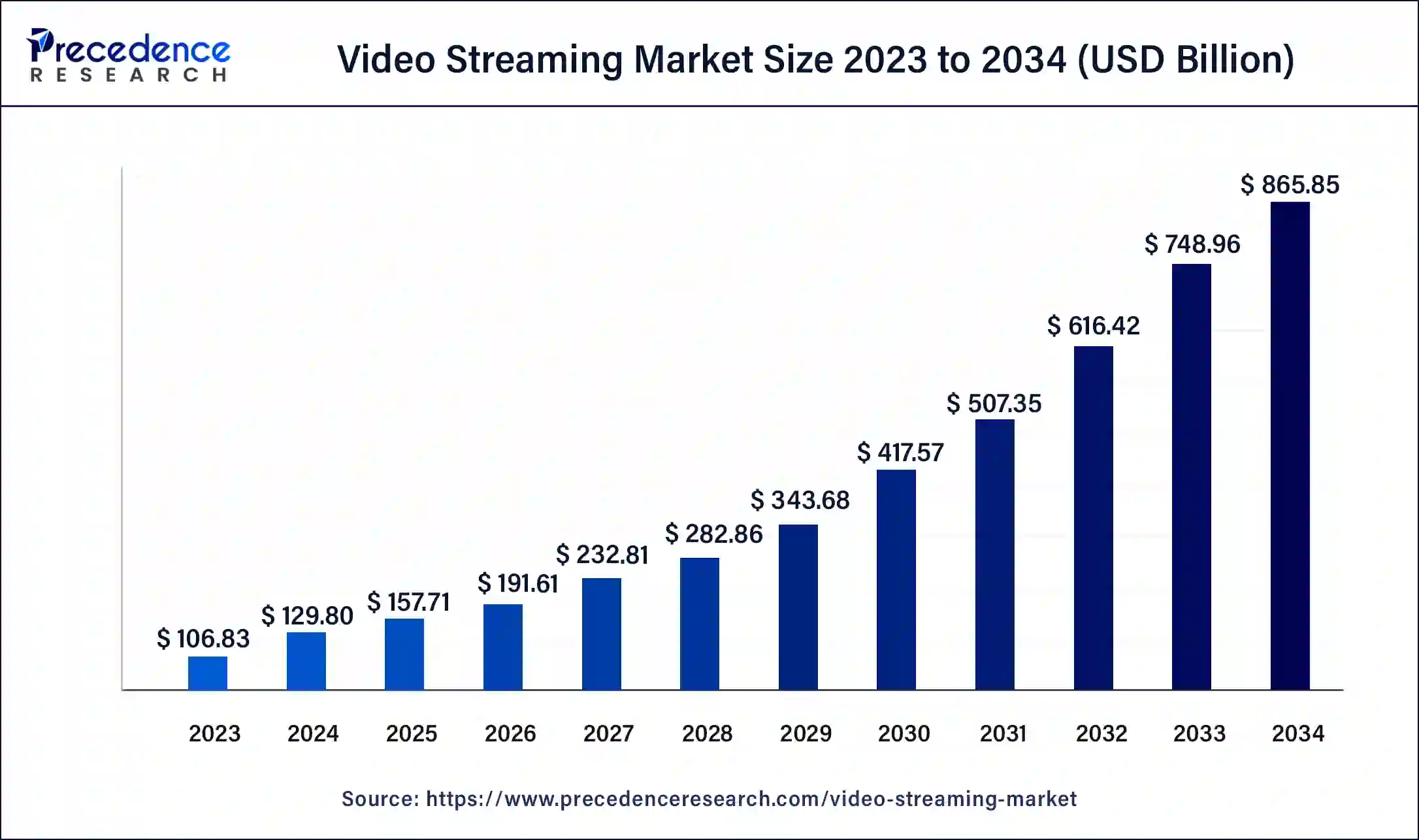

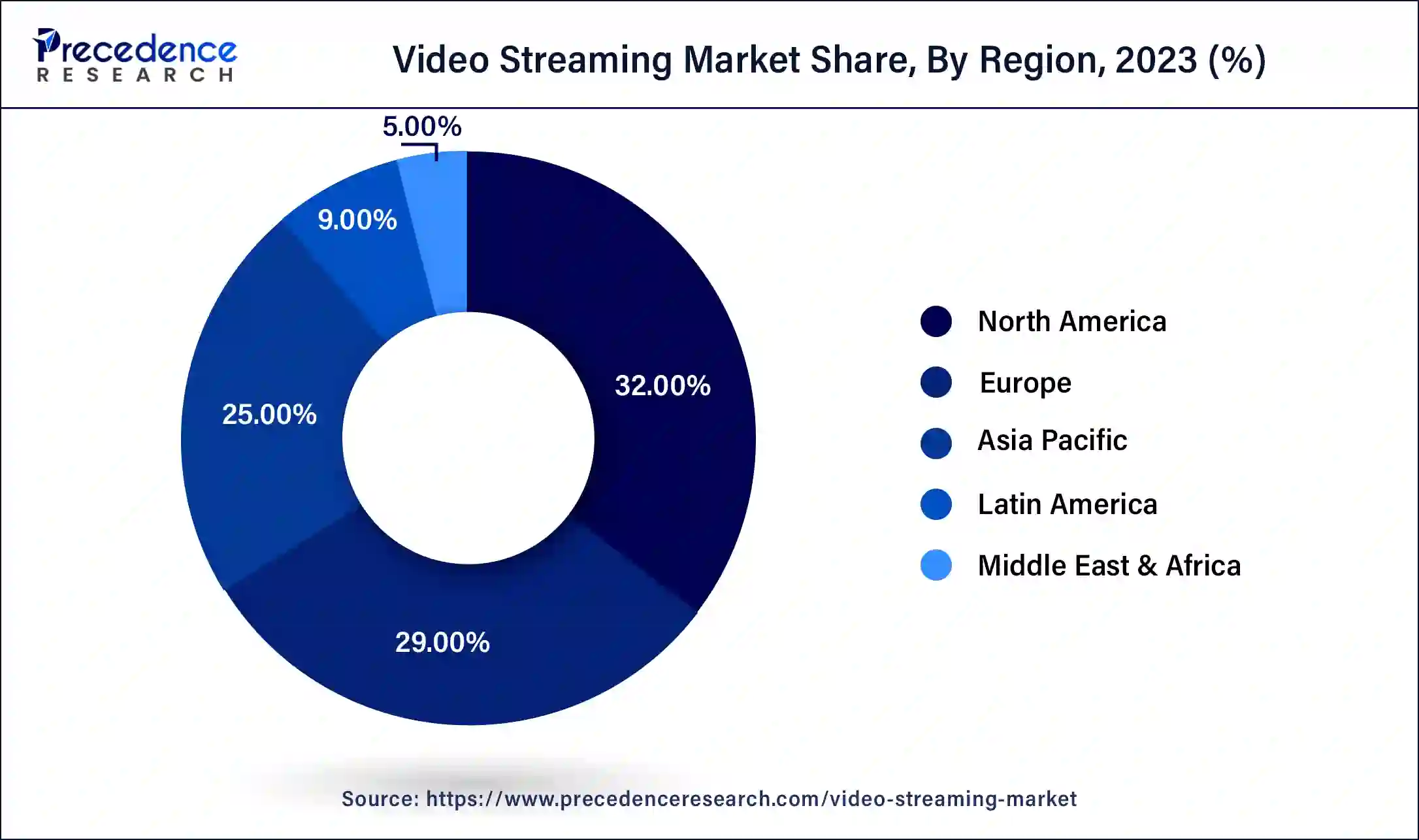

The global video streaming market size is accounted at USD 159.98 billion in 2025 and predicted to increase from USD 195.85 billion in 2026 to approximately USD 873.21 billion by 2035, representing a CAGR of 18.5% from 2026 to 2035. The North America video streaming market size reached USD 53.41 billion in 2025.

Market Highlights

- North America dominated the market with the largest market share of 33% in 2025

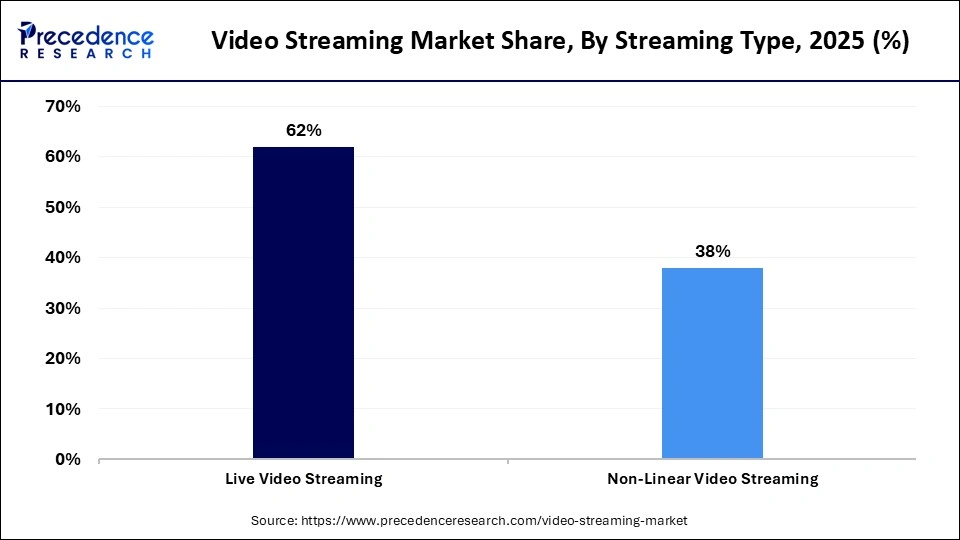

- By streaming type, the live streaming segment held a large share of the market share of 62% in 2025.

- By deployment type, the cloud segment dominated the market share of 59% in 2025.

- By end-user, the consumer segment accounted for a major market share of 54% in 2025.

- By revenue model, the subscription segment held the largest market share of 47% in 2025.

- By service, the training & support segment has garnered a major market share of 39% in 2025.

Market Overview

Instead of being stored on the device's hard drive, video streaming or media streaming is the practice of sending compressed video material over the internet for instant playback. Instead of waiting for the movie to be downloaded to the device and then watching it, the term "streaming" refers to listening to music or watching a video in real time. Typically, streaming videos come from a pre-recorded video clip that has been compressed and can be distributed to several viewers simultaneously. Any device that has internet connectivity and programs that can decompress the contents can use the video streaming services.

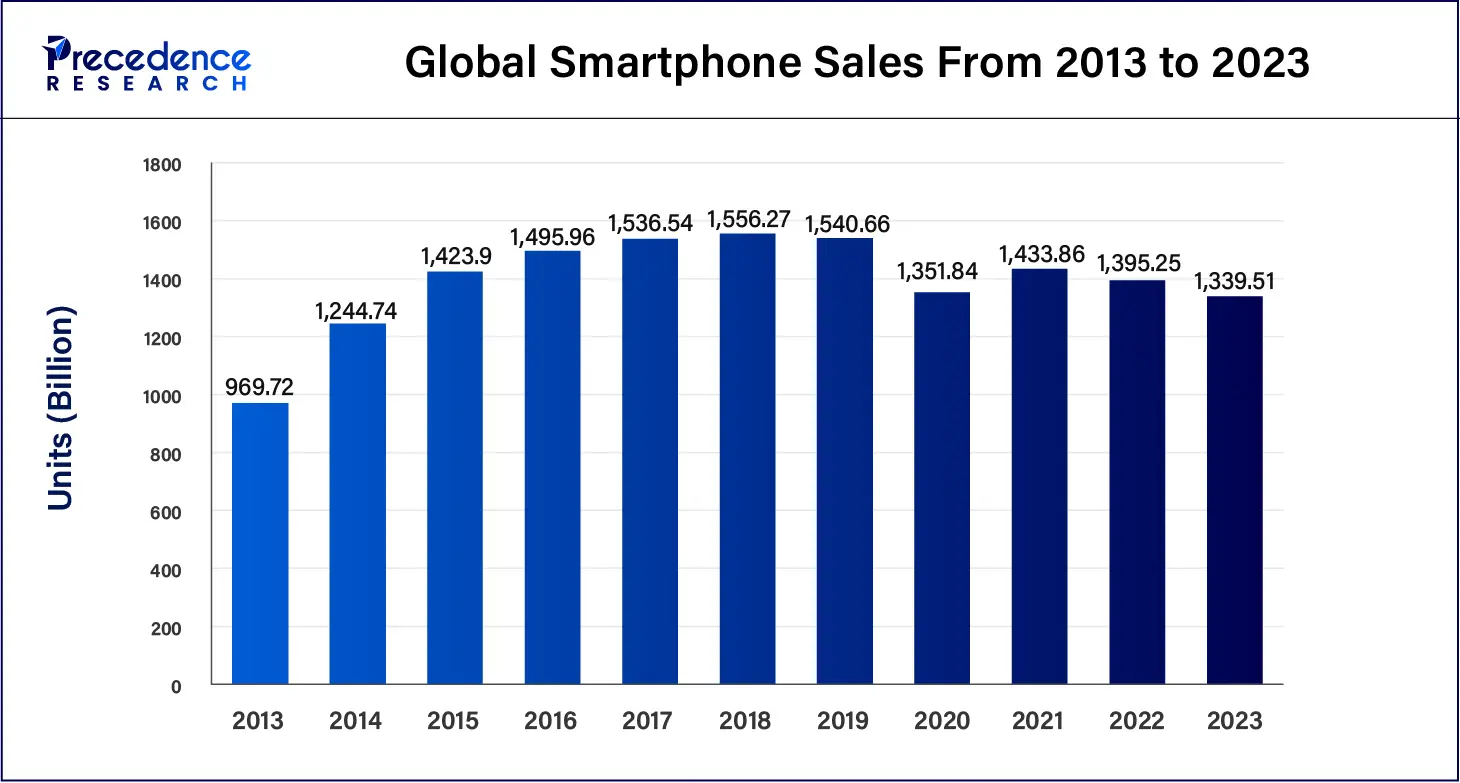

One of the main reasons favorably affecting the industry is the rising use of the internet and the rising sales of mobile phones. For instance, according to a report, globally, approximately 1.39 billion smartphones were sold in 2022 and about 1.34 billion units were sold in 2023.

In addition to this, there has been a noticeable increase in the demand for video streaming services in colleges, universities, and institutions all around the world. This might be attributed to its advantages, which include improved learning processes through visual webinar and course recordings. Additionally, companies utilize live streaming extensively because it helps them promote their goods and services, build their brands, and improve client interaction. Additionally, it has many uses in judicial proceedings, required sessions, town hall meetings, business conferences, and staff training.

The Emergence of AI is Boosting the Video Streaming Market

AI has the ability to enhance functionality of video streaming applications and user experience. AI algorithms analyze user behavior, which aids in offering personalized content recommendations, significantly increasing viewer engagement and satisfaction. Advanced AI techniques such as machine learning and deep learning enhance streaming quality, ensuring seamless playback. AI-driven analytics help streaming platforms optimize their content strategies.

Therefore, leading market participants are incorporating blockchain, machine learning, and artificial intelligence (AI) technologies to enhance video quality. Cinematography, video editing and voice-overs, writing scripts, and other facets of video creation and uploading are all made easier by these technological developments. Additionally, AI aid in data organization, encoding, and distribution, simplifying the digital environment. A positive market forecast is being produced by this as well as the increasing acceptance of cloud-based solutions.

Video Streaming Market Growth Factors

- The demand for Video on Demand (VoD) Streaming Services is rising supports the expansion of the market for video streaming. Due to rising consumer expenditure on media and entertainment, there are more people using video on demand services globally, which helps the business develop.

- Online VoD users increased to roughly 1.11 billion during the COVID-19 epidemic, according to a Motion Picture Association report from 2020, and are predicted to reach 2 billion users by 2023. In addition, compared to 2019, the combined number of online video subscriptions from streaming service providers like Netflix Inc. and Disney+ rose by 26% in 2020, totaling almost 230 million new subscriptions. Such a rise in OTT platform customers has sparked a huge desire for market expansion.

- Additionally, according to Deloitte research from 2020, each home in the United States has access to about 2.5 subscription-based video on demand streaming services. As more people subscribe to these services globally, this helps the business expand.

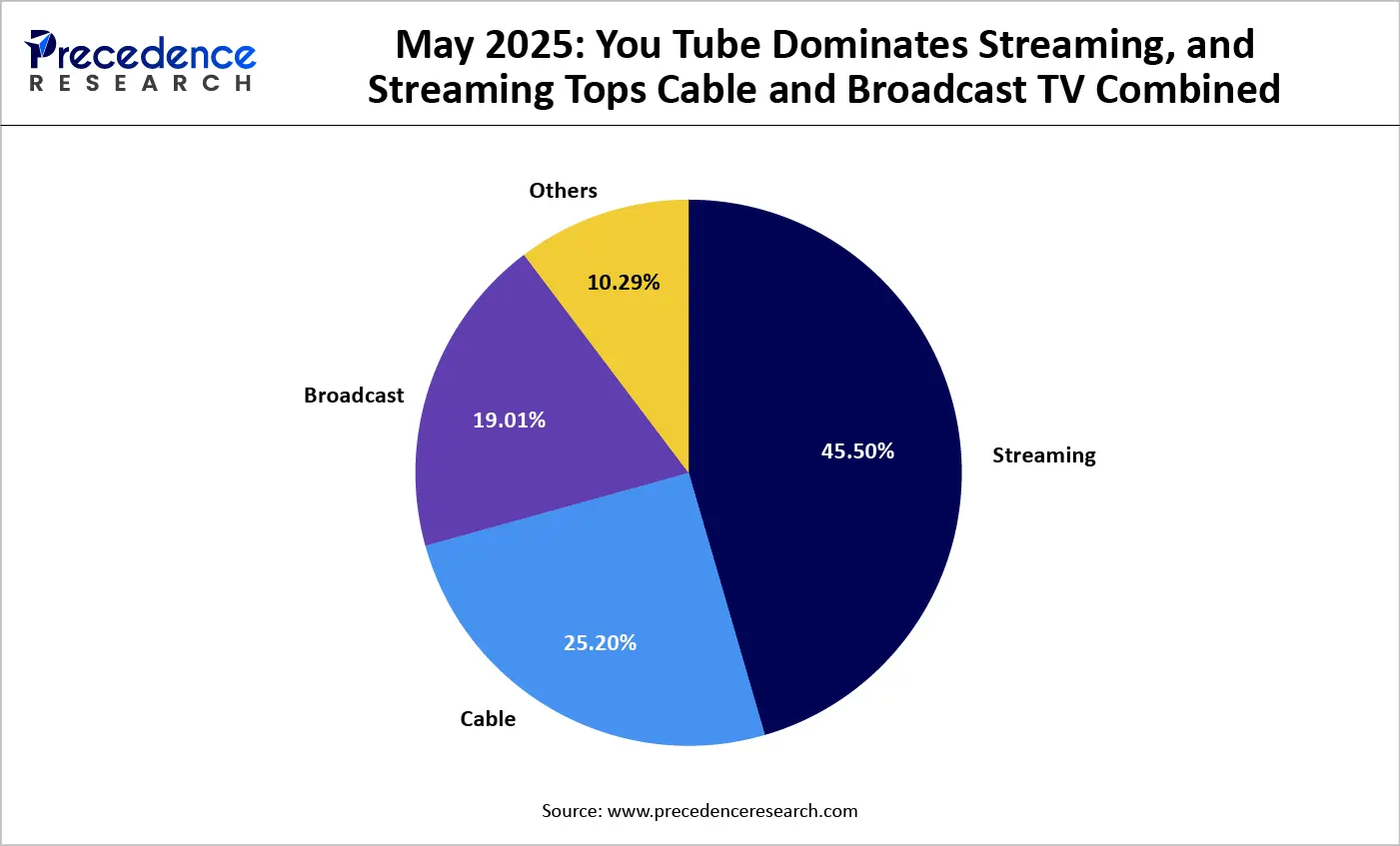

The May 2025 viewership snapshot shows a structural shift in U.S. television consumption, with streaming accounting for 45.50% of total TV usage, surpassing cable and broadcast television combined, according to Nielsen data. YouTube's dominance within streaming reflects a broader recalibration of audience behavior toward always-on, algorithm-driven video consumption rather than scheduled programming. This transition is reinforced by high connected TV penetration, sustained cord-cutting, and advertiser migration toward data-rich CTV environments that offer targeting, attribution, and high ad completion rates. While traditional cable and broadcast still retain relevance for live events and legacy audiences, industry executives increasingly view YouTube as unavoidable infrastructure rather than a competitor. As one streaming executive noted, the strategic response has shifted from resistance to integration, with content owners adapting distribution strategies to align with platforms that now anchor long-term viewer attention and advertising revenue growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 159.98 Billion |

| Market Size in 2026 | USD 195.85 Billion |

| Market Size by 2035 | USD 873.21 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 18.50% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Streaming Type, Component (USD), Solutions, Platform, Service, Revenue Model, Deployment Type, End User and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Popularity of Live Streaming

One of the finest aspects that have been helping to raise the market value of the video streaming industry is live streaming. This function is utilized to grow the company by speaking with the target market directly. So that they won't have any problems comprehending questions concerning business-related issues. It has recently served as a source of increased income. Therefore, the global market for video streaming has lately seen a rise in live video streaming.

Advancements in Technology

The development of the video streaming market has been made possible by recent technological advancements such as artificial intelligence and blockchain technology. People are interested in utilizing video streaming as a result of the development of technology because they prefer it, and as a result, the video quality is increasing. This has recently been a major factor in the growth of the video streaming market.

Challenges

Rising Concern Related to Content Piracy and Protection

The growing user worries about content piracy and protection impedes business operations by lowering customer interest in and consumption of content. This significantly affects the market. For instance, collaborative research by the Digital Citizen Alliance in August 2020 found that the value of pirate subscription services in the US alone is in the billions of dollars. In the US, around 9 million internet users subscribe to a pirate IPTV provider. at least 3,500 unlicensed websites and social media pages are used by users to access these services.

Opportunities

Impact of Video Streaming in the Educational Sector

Videos can help students retain material more effectively, which can have a huge positive impact on education. This category includes, among other things, webinars and video lectures. Educational organizations including universities, schools, and colleges now create interactive information and disseminate it through video presentations. They are effectively using technology to spread knowledge in this way. Teachers' duties are changing significantly as a result of the rising demand for films that may be utilized in the classroom. The latter is now able to teach through video to virtual classes across the world and use a selection of movies in the classroom. As a result, using movies in the classroom helps to create a multimodal learning environment.

Increased Demand for High Internet Connectivity

The growing requirement for high-bandwidth internet access has influenced the growth of the need for video streaming. Additionally, there have been quick changes in the training sector, such Microsoft buying Affirmed Networks in 2020. Affirmed Networks is a cloud-native networking solutions provider for telecom carriers with headquarters in the United States. Microsoft expects that this collaboration will help with the creation of 5G and edge computing technologies. As a consequence, over the projection period, new alliances and technical advancements will drive the market for video streaming services ahead.

Segments Insights

Streaming Type Insights

With a market share of almost 62% in 2025, the live streaming sector generated the most income. The segment's expansion is due to the rise in popularity of digital media devices and the accessibility of faster internet for online media access. Ad-free content, mobile watching, analytics monitoring, the usage of a lot of material, the enormous audience potential, and high-quality broadcasts are a few more elements that enhance live video streaming.

The high value of live video streaming has been kept in live content like sporting and musical events. However, because it is convenient and allows for series linkage, non-linear streaming is anticipated to experience substantial development in the upcoming years. Watch-time viability, absence of buffering, high capacity, and live pause are a few more elements that contribute to the industry's non-linear streaming segment's expansion. Moreover, with both streaming formats, it is anticipated that video-on-demand would become commonplace across all age groups.

Video Streaming Market Revenue, By Streaming Type, 2022 to 2025 (USD Billion)

| Streaming Type | 2022 | 2023 | 2024 | 2025 |

| Live Video Streaming | 52.20 | 65.07 | 80.60 | 99.17 |

| Non-Linear Video Streaming | 31.61 | 39.58 | 49.22 | 60.82 |

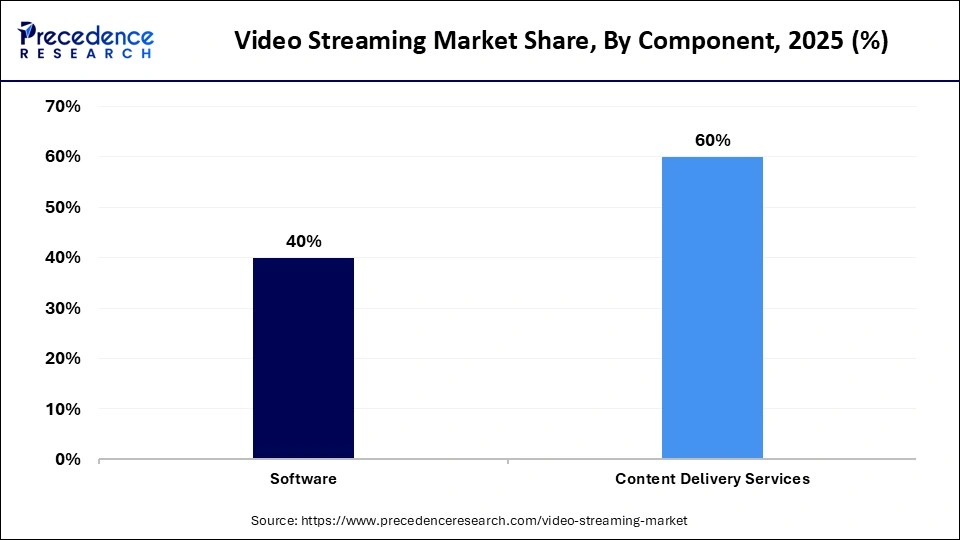

Component Insights

The content delivery services segment held largest share of the market share of of 60% in 2025. The growth of the content delivery services segment is driven by the increasing usage of OTT platforms among consumers. For instance, according to a report published by Business Standards in February 2024, there are more than 800 million internet users in India and 86% of them access over-the-top (OTT) audio and video services. Moreover, consumer spending on entertainment has grown significantly over the past few years, ultimately boosting the demand for VOD, live broadcasting, and other streaming services.

Solutions Insights

The OTT category held the highest share with almost 44% in 2025. OTT solutions allow consumers to access movies and TV shows online without having to pay for traditional cable or Pay-TV subscriptions. The category is anticipated to increase significantly over the course of the projection period due to the growing need for better business process automation and the complete availability of broadband infrastructure. The segment's development is anticipated to be accelerated by new OTT features including hybrid monetization methods, digital original content, and content fragmentation brought on by fierce competition.

Due to a sharp increase in demand for Pay-TV services in nations like China, India, Mexico, and Brazil in 2021, the Pay-TV market accounted for a substantial portion of global income. Customers are also favoring OTT services more and more as a result of rising programming costs for Pay-TV and IPTV services. The number of OTT service providers has also expanded as a result of the expanding availability of unlimited cellphone data plans and free public WiFi. For instance, HBO Now, an internet streaming service that allows online viewing of HBO episodes without a cable membership, was introduced by Home Box Office, Inc.

Video Streaming Market Revenue, By Solutions, 2022 to 2025 (USD Billion)

| Solutions | 2022 | 2023 | 2024 | 2025 |

| Internet Protocol TV | 13.34 | 16.71 | 20.79 | 25.70 |

| Over-the-Top (OTT) | 36.76 | 45.92 | 57.00 | 70.27 |

| Cable TV | 15.05 | 18.74 | 23.18 | 28.48 |

| Pay-TV | 18.65 | 23.28 | 28.85 | 35.53 |

Platform Insights

With nearly 35% of the market, the smartphones and tablets sector generated the most revenue in 2025. This segment is expanding as a result of factors including easier access to the internet, rising disposable money, improved living standards, and shifting lifestyles. Additionally, the smart TV market is anticipated to increase significantly over the course of the forecast period since it provides a wide selection of TV channels in addition to video streaming services like Netflix.

Due to the ubiquity of dependable internet services, live streaming on smartphones and tablets is trouble-free. Due to their mobility and simplicity of remote access, these gadgets are more likely to be chosen for watching internet material. But the proliferation of video streaming services like YouTube TV, Hulu, and PlayStation Vue has generated interest in the smart TV market. Applications that arrange TV material, like PLEX, are expected to drive the segment's growth since they let smart TVs to play any suitable media content.

Video Streaming Market Share, By Service, 2025 (%)

| By Platform | Share (%) |

| Gaming Consoles | 12% |

| Laptops & Desktops | 23% |

| Smartphones & Tablets | 35% |

| Smart TV | 31% |

Service Insights

In 2025, the training & support segment dominated the market share of 39% in terms of revenue generation. Managed services provide personalized experience to users by combining broadcast and OTT solutions into a single online video management solution. Video managed services offer advanced media services, allowing users to achieve enhanced quality content.

Video Streaming Market Revenue, By Service, 2022 to 2025 (USD Billion)

| Service | 2022 | 2023 | 2024 | 2025 |

| Consulting | 23.84 | 29.84 | 37.12 | 45.86 |

| Managed Services | 26.55 | 33.21 | 41.27 | 50.95 |

| Training & Support | 33.43 | 41.60 | 51.43 | 63.17 |

Revenue Model Insights

The subscription segment accounted for the major share of the market share of 47% in 2025. The subscription model allows streaming of online videos. Subscription model enable access to a wide variety of video content offered by OTT platforms, such as Amazon Prime, Disney+, and Netflix Originals. The growing number of video streaming subscriptions across the globe has propelled the segment. For instance, according to the estimations by Forbes, globally, there were 1.1 billion subscriptions to online video streaming services in 2020 and this figure reached to 1.8 billion in 2023.

Video Streaming Market Revenue, By Revenue Model, 2022 to 2025 (USD Billion)

| Revenue Model | 2022 | 2023 | 2024 | 2025 |

| Advertising | 29.71 | 37.16 | 46.19 | 57.03 |

| Rental | 14.89 | 18.53 | 22.91 | 28.13 |

| Subscription | 39.21 | 48.95 | 60.72 | 74.83 |

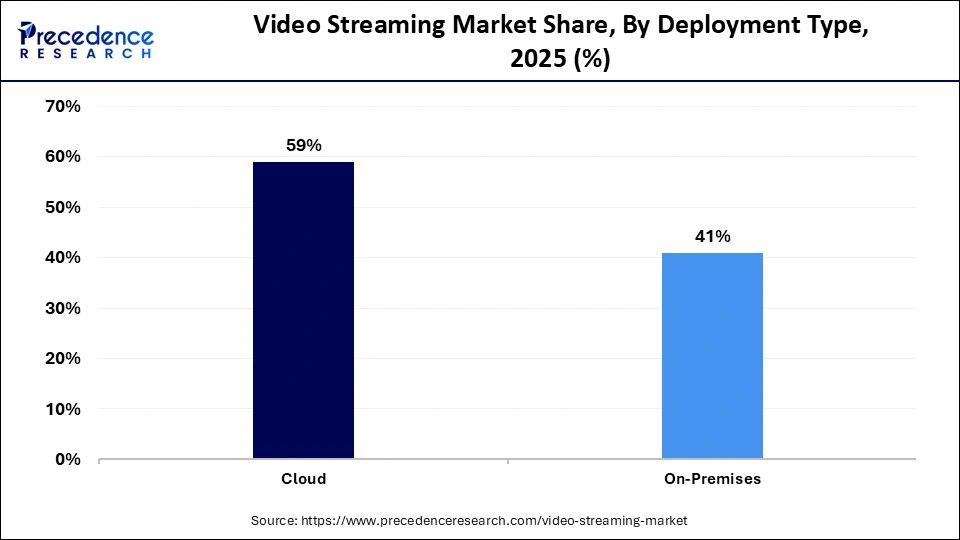

Deployment Type Insights

The cloud segment held a major share of the market share of 59% in 2025 and is anticipated to expand at a considerable CAGR during the forecast period. Advancements in cloud computing have revolutionized the video streaming industry. Cloud-based deployment enables video streaming platforms to distribute their content to a vast network of audience due to high speed and large bandwidth. Cloud-based services enhance viewing experience. Thus, several streaming service providers prefer cloud-based services over on-premise.

End User Insights

The consumer segment is likely to register a fastest growth rate in the coming years owing to the increasing demand for live streaming services and video on demand. The rising proliferation of smartphone encourages people, especially young adults, to use various streaming services, including video streaming services. Furthermore, with the growing popularity of video games, the demand for video streaming services is increasing rapidly. The increasing number of gamers across the globe is likely to propel the segment.

- For instance- According to the Online Gaming Statistics and Facts 2024, worldwide online gaming audiences are anticipated to exceed 1.3 billion by 2025.

Video Streaming Market Share, By End User, 2025 (%)

| By End User | Share (%) |

| Enterprise | 46% |

| Consumer | 54% |

Regional Insights

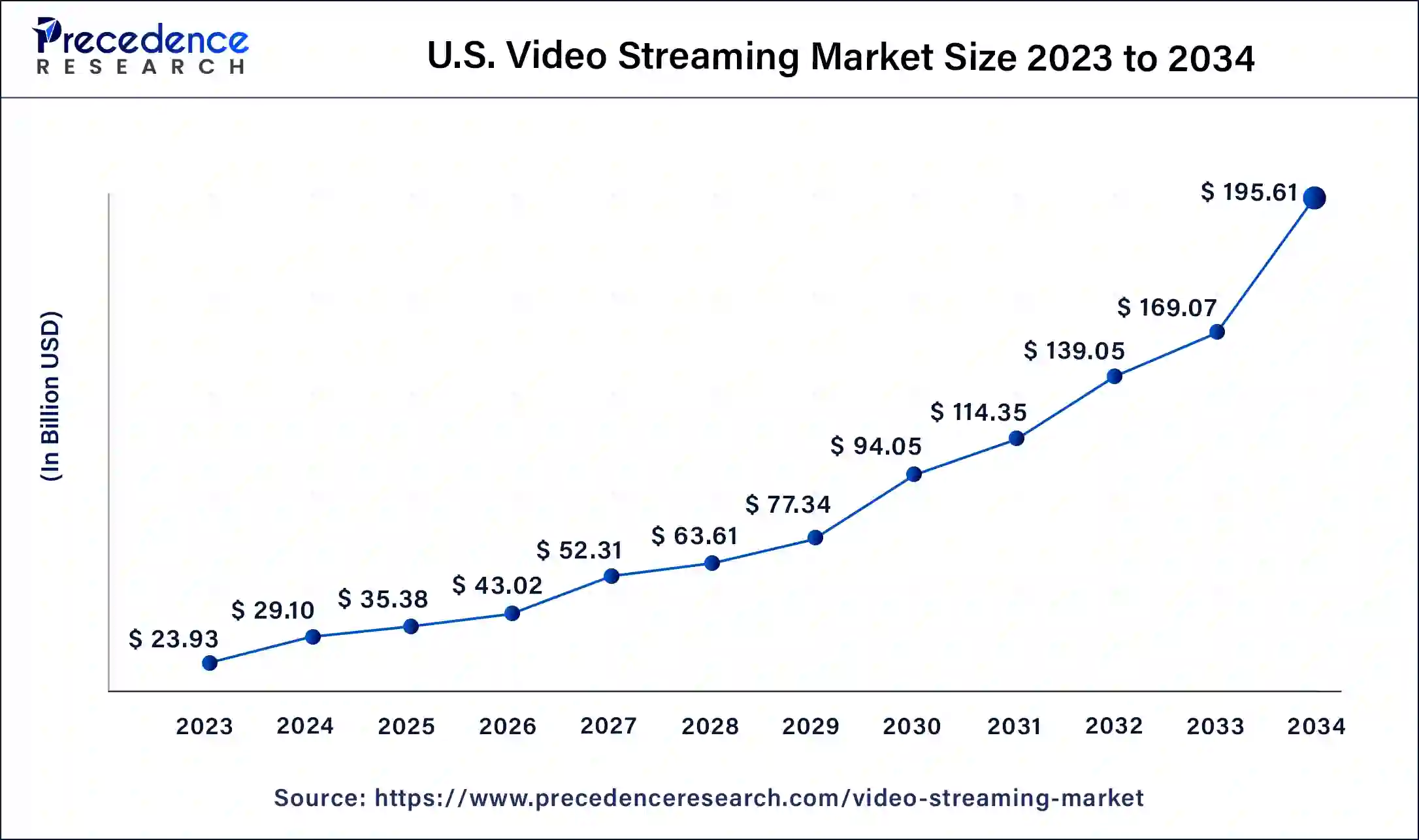

U.S. Video Streaming Market Size and Growth 2026 to 2035

The U.S. video streaming market size is valued at USD 47.62 billion in 2025 and is expected to be worth around USD 253.94 billion by 2034, at a CAGR of 18.22% from 2025 to 2034.

North America held a 33% share of the global market in 2025 and the market in the region is projected to grow significantly during the forecast period. The regional market growth is primarily attributed to the rising demand for cloud-based streaming services. North America boasts leading players such as Amazon Prime, Disney+, and Netflix. This, in turn, augments competition in the region. Furthermore, the rising number of gamers in North America boosts the market. For instance, according to the Statistics of Gamers 2024, as of 2024, there are over 3,000 esports players in the US. Moreover, the gaming industry in the US reached revenue of USD 90 billion in 2023. As the number of gamers increases, so does the demand for video streaming services, which significantly fuels the market.

The market in Asia Pacific is anticipated to expand at a considerable CAGR over the forecast period due to the rising usage of mobile devices and tablets, quickening technical development, and growing acceptance of online streaming.

The consumption of material by viewers in the Asia Pacific region has changed as a result of over-the-top (OTT) solutions. With the help of cutting-edge marketing techniques such as video streaming, well-established telecommunications businesses and multichannel operators in the region have actively sought out business innovation and advancement. Due to the region's fastest-growing broadband internet population, Southeast Asian operators have boosted their revenue choices by offering video streaming multichannel packages alongside fixed-mobile bundles. Furthermore, the growing number of internet users in countries such as India and China is boosting the demand for on-demand entertainment and streaming services. These measures are leading to an expansion of the Asia Pacific market.

How Does Europe Influence the Video Streaming Market?

Europe is expected to experience significant growth in the video streaming market in the foreseeable future. This growth is driven by a high penetration of video subscriptions, a competitive landscape, and an increasing demand for personalized content. A large percentage of households in Europe subscribe to multiple video streaming services. Additionally, the market features both international giants like Netflix, Amazon Prime Video, and Disney+, as well as regional players such as BBC iPlayer and Sky Go, creating a diverse range of content options.

Video Streaming Market Companies

- IBM Corporation (U.S.)

- Alphabet Inc., (U.S.)

- Amazon.com, Inc. (U.S.)

- Netflix, Inc., (U.S.)

- Hulu LLC (The Walt Disney Company) (U.S.)

- Brightcove, Inc. (U.S.)

- Apple, Inc. (U.S.)

- Roku, Inc. (U.S.)

- Haivision, Inc. (U.S.)

- Tencent Holdings Ltd. (China)

Leaders' Announcements

- In April 2025, McKesson Corporation completed its acquisition of a controlling 80% interest in PRISM Vision Holdings, LLC for approximately USD 850 million. PRISM specializes in ophthalmology and retina management, with its physicians retaining a 20% stake. The acquisition enables McKesson to develop a leading retinal and ophthalmology platform and expand the differentiated value proposition of McKesson, clinical services, and distribution offerings.

Recent Development

- In April 2025, MTN Group, the largest mobile network operator in Africa, partnered with UK-based Synamedia to launch a new streaming platform for mobile and fiber users across the continent. MTN has evolved beyond traditional voice and data services by expanding into fintech, digital services, and entertainment. This partnership also opens a unique opportunity to transform video consumption in Africa by providing high-quality and accessible content.

- In February 2025, New Relic introduced new products in its Digital Experience Monitoring suite, including Streaming Video and Ads Intelligence. This marks the introduction of the first intelligent observability solution for streaming media, designed to ensure high-quality video and ad experiences across multiple devices. Additionally, New Relic launched Engagement Intelligence, a tool that automatically collects and correlates user behavior data to help enterprises enhance their digital experiences.

- Y2k Solutions Inc. debuted a cutting-edge Beta 1.0 video streaming platform for instructional video courses in March 2022. The platform provides free web hosting, cloud hosting, video hosting, and streaming solutions and services.

- Tencent Holdings Ltd. launched a video streaming service in Thailand in July 2020 to expand its influence outside of China. The firm grew across Thailand via WeTV, Tencent's JOOX music and streaming service, and its mobile PUBG game.

Segments covered in the report

By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

By Component (USD)

- Software

- Transcoding and Processing

- Video Delivery and Distribution

- Video Management

- Others

- Content Delivery Services

- Live Broadcasting

- VOD & Complementary Content

- Low Latency Video Streaming Services

By Solutions

- Internet Protocol TV

- Over-the-Top (OTT)

- Cable TV

- Pay-TV

By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

By Service

- Consulting

- Managed Services

- Training & Support

By Revenue Model

- Advertising

- Rental

- Subscription

By Deployment Type

- Cloud

- On-Premises

By End User

- Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

By Region

- North America

- Asia Pacific

- Latin America

- Europe

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting