What is the Video Conferencing Market Size?

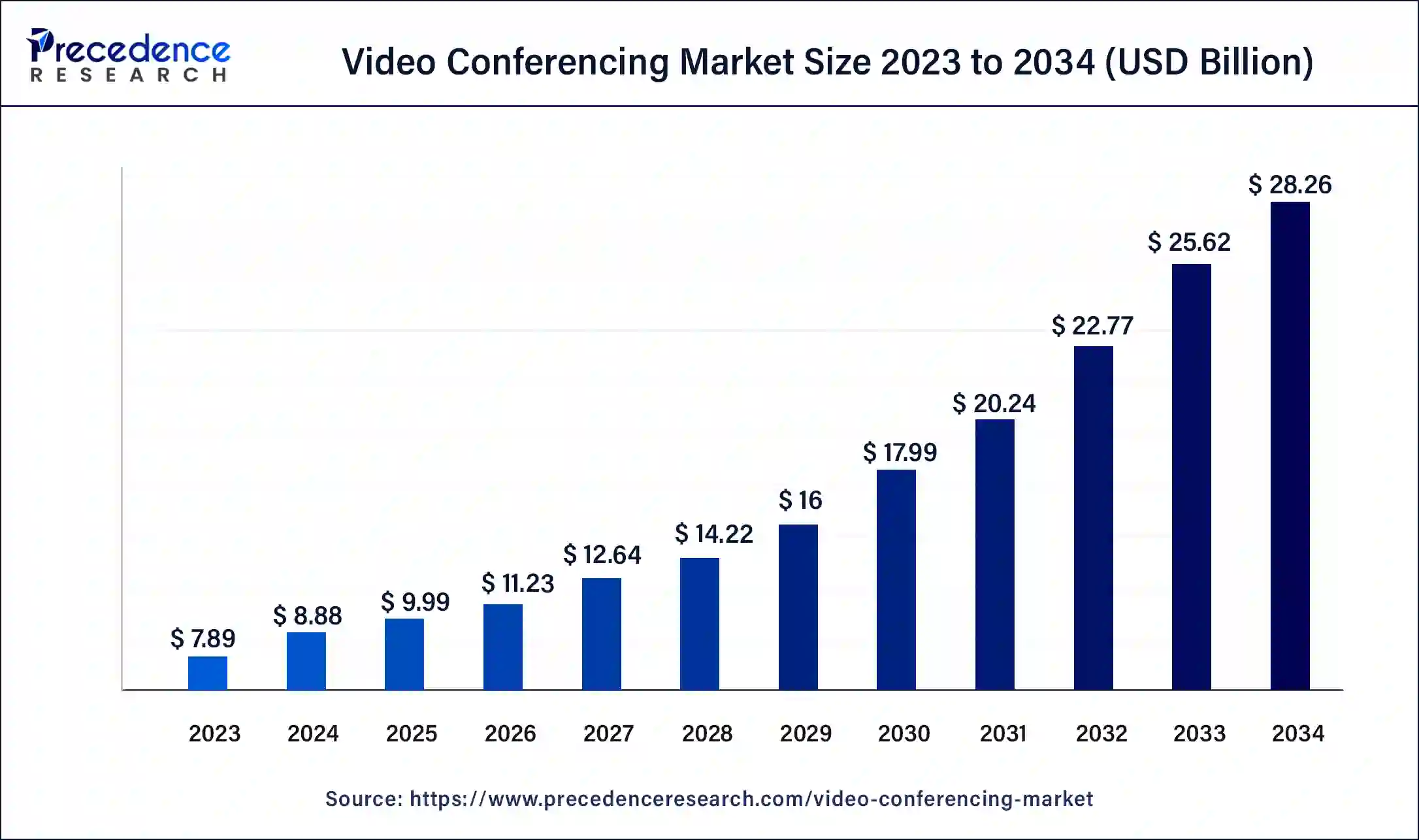

The global video conferencing market size was estimated at USD 9.99 billion in 2025 and is predicted to increase from USD 11.23 billion in 2026 to approximately USD 31.04 billion by 2035, expanding at a CAGR of 12% from 2026 to 2035.

Video Conferencing Market Key Takeaways

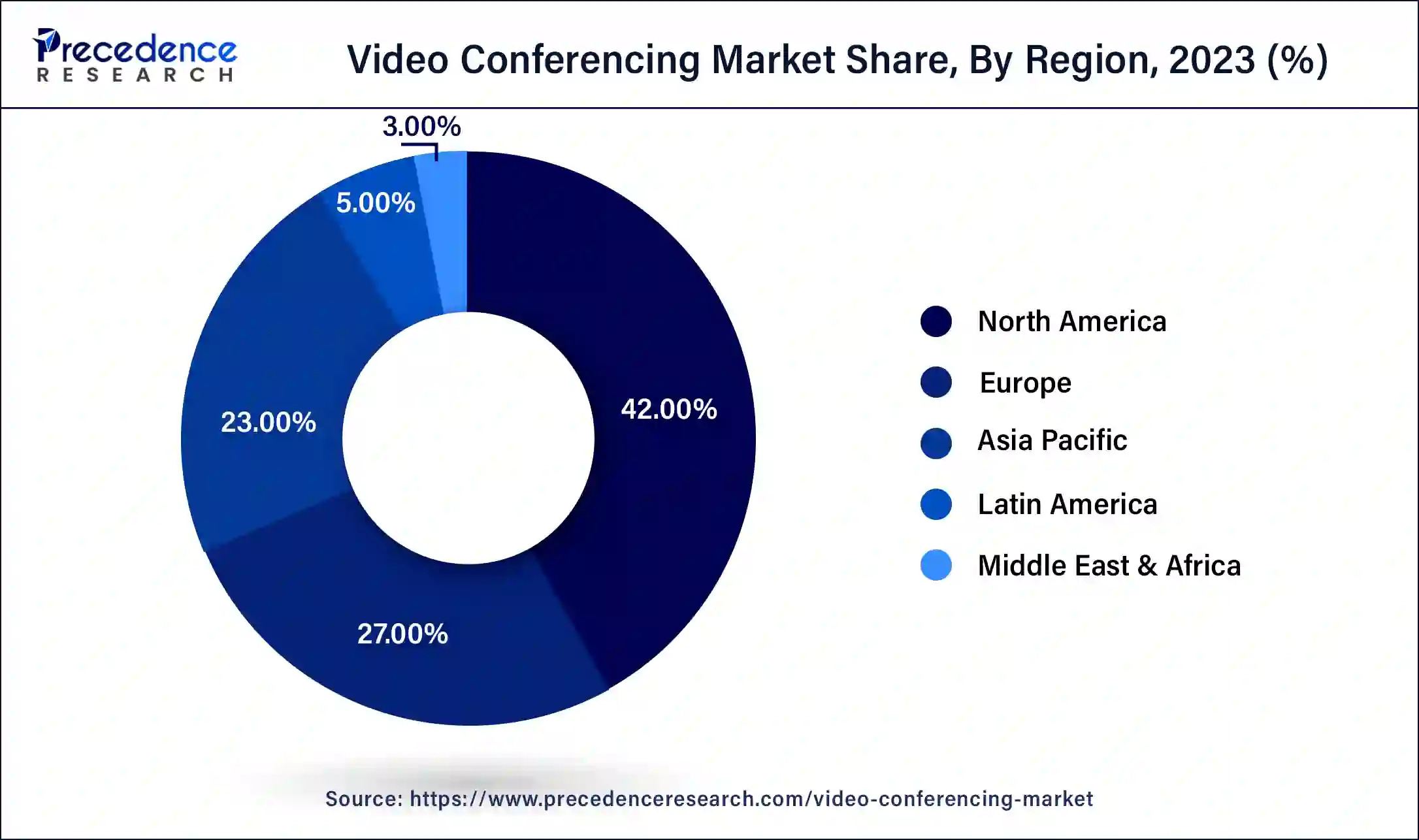

- North America led the global market with the highest market share of 42% in 2025.

- The software segment is expected to witness highest growth at a CAGR of over 12% from 2026 to 2035.

- By component, the hardware segment has held the largest market share of 50% in 2025.

- By deployment, the twin screw extruded segment captured the biggest revenue share of 60% in 2025.

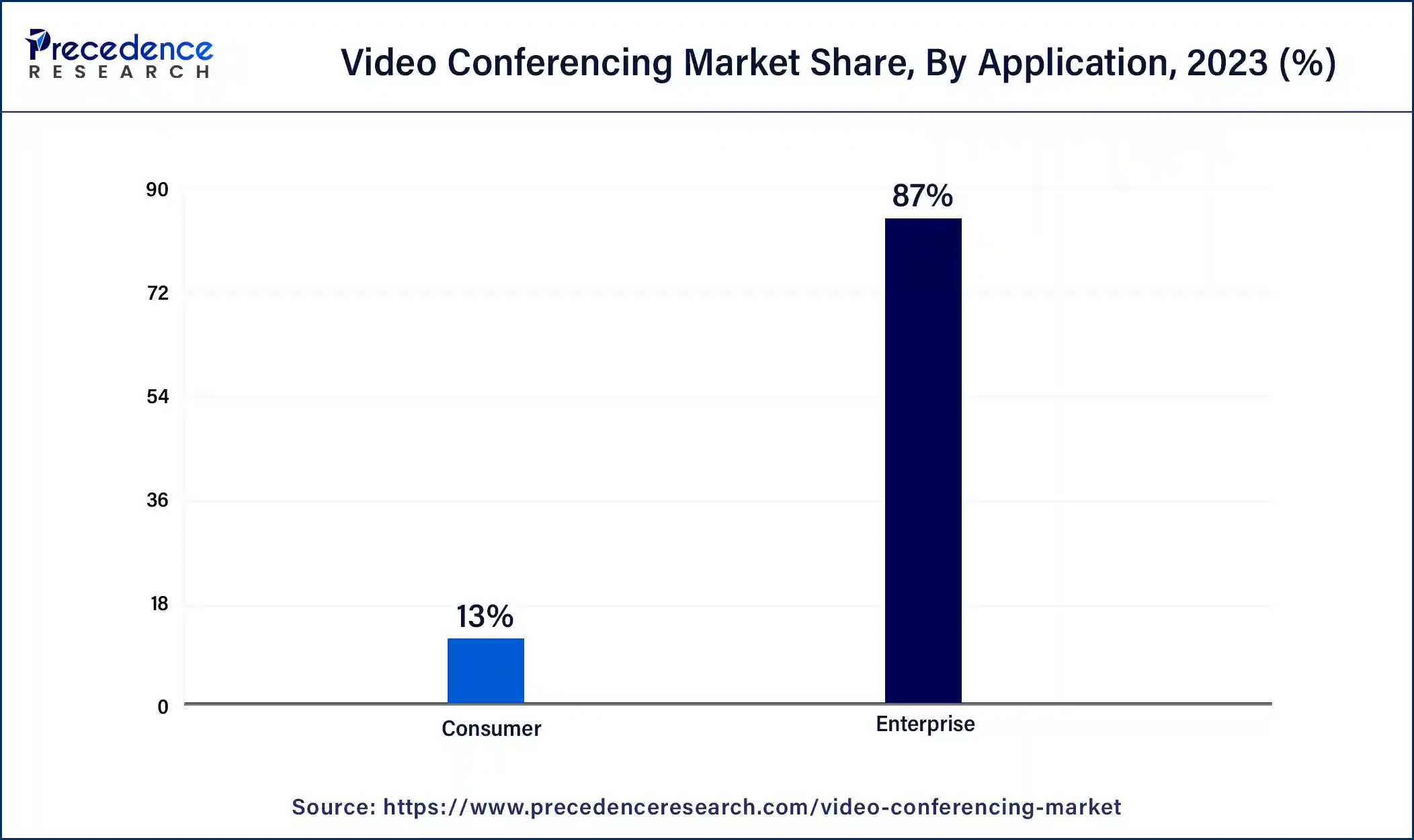

- By distribution channel, the hypermarkets and the supermarket segment registered the maximum market share of 87% in 2025.

How is AI contributing to the Video Conferencing Process?

AI has fundamentally changed video conferencing by making audio and video very clear, and also by performing transcription, translation, summarization, and giving insights. Furthermore, it has brought about conversation security, and even engagement and productivity, while turning the talks into searchable and actionable intelligence. This has resulted in faster decisions, less manual effort, and smoother collaboration for the distributed and hybrid teams that are spread across the globe.

Video Conferencing Market Growth Factors

Real-time visual conferences among one or more users are referred to as video conferencing engagements. In the near future, market development is likely to be driven by the inclusion of established technology regarding internet of things (IoT), Artificial Intelligence (AI) and cloud technology. Also, the rising demand for video based communication, virtual administrative management and cloud technology based collaboration tools are important drivers influencing market expansion in positive manner. Companies and organisations are implementing video collaboration technologies in order to try and make quicker and more efficient decisions and avoid the large expenditures of travel.

Furthermore, rising demand for e-learning is expected to propel market expansion. For example, Cisco Systems, Inc. announced Webex Devices in December 2020, along with Webex's hub camera to improve the distant work experience. Thus these objects promote the adoption of multifunctional workplaces as well.The rise in popularity of online and net banking between clients is expected to fuel the expansion of video conferencing industry trends. Customers that are using video banking alternatives could save time and money. Additionally, video banking allows end users to securely interact with distant clients and colleagues, enhancing productivity. As a result, officers, customer executive staff, financial counsellors, and others in the banking and finance business are increasingly utilizing visual communication solutions. Vendors are creating new solutions to address the increased competition for video products and services in the BASF.

Significant growth is being driven by increased urbanisation, which is crucial for the usage of video conferencing. The market economy is projected to be driven by consumers' high coverage of high-speed internet access. The bandwidth determines the type of connection that may be used for corporate video conferencing. Because of the cost reductions, the expanding startup environment is rapidly using cloud-based video conferencing systems. Many businesses are hesitant to spend in traditional workplace arrangements and infrastructures that is why video conferencing is becoming more popular with startups. A growing percentage of employees want to work remotely and conduct meetings via mobile devices. This practice has drastically cut corporate travel expenditures while increasing company levels of productivity.

Corporations in the video conferencing industry see significant economic opportunities in healthcare industry. This is clear since the income of the healthcare end-use industry is expected to expand rapidly throughout the projected timeframe. The obvious next step in the video conferencing business is clinics adopting video conferencing for post-discharge programmes. Conducting contractual enterprises in a worldwide setting is a significant aspect that is predicted to propel the global expansion of the video conferencing market. Due to increased globalization, corporations from many sectors aspire to run from several branches in different parts of the world in order to utilise the perks of local infrastructure, availability of knowledge, and cost savings in purchasing of materials.

Market Outlook

- Industry Growth Overview: Hybrid work and artificial intelligence capabilities are enabling long term growth in enterprise education and healthcare industries.

- Global Expansion: Providers increase options throughout the Asia Pacific, increasing global connectivity and collaboration.

- Large Investors: Accel, Sequoia Capital, Techstars Storm Ventures, Rho Capital Partners, and Altimeter Capital actively fund.

- Startup Ecosystem: Startups combine assistants with immersive collaboration and productivity-focused hybrid solutions, AI to assistants.

MarketScope

| Report Coverage | Details |

| Market Size by 2035 | USD 31.04Billion |

| Market Size in 2025 | USD 9.99Billion |

| Market Size in 2026 | USD 11.23 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment, Application, Conference Type, Enterprises Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

The hardware industry has accounted for a sizable overall revenue of over 50% in 2025, owing to the increased usage of endpoints such as laptops, smartphones and desktops equipped with high-resolution cameras. Demand for enterprise-based hardware has decreased as more firms embrace the remote working paradigm in 2020.

Cameras and microphones/headphones are two subcategories of hardware segment. Between them, the microphones/headphones category had significant increase in 2024 as a result of rising sales volume during the pandemic, which was fueled by the widespread adoption of video conferencing technologies for team communication. Furthermore, continuous technical breakthroughs in the fields of augmented reality and the Internet of Things (IoT) also hastened the creation of sophisticated equipment, which is likely to boost category expansion even further.

Deployment Insights

In respect of deployment, the on-premise segment held the largest market in 2025, contributing for around 60% of total revenues. This is mostly due to the increased acceptance of this deployment approach throughout large enterprises in result of growing data security concerns. However, the increased preference for cloud technology is projected to impede segment development in the future years.

Over the projection timeframe, the cloud deployment sector is expected to increase at a considerable pace of roughly 14.5%. Cloud technology improves connectivity by providing simple access to video conferencing services via many platforms, such as mobile devices and laptop computers. Furthermore, the growing use of the Software as a Service (SaaS) platform, which has attracted a large number of small and medium-sized businesses, is driving category growth. As per Amazon Web Services, Inc., small and medium companies will boost their cloud operations in India in 2022.

Application Insights

Due to competition for conference video endpoints, which are room-based equipment solutions deployed and installed in meeting spaces, the enterprise segment secured a sales portion of more than 87% in 2023. Given the rising product acceptance as a medium of communication and cooperation among employees, the development prospects for corporation video conferencing solutions were predicted to be stronger prior to the pandemic.

Nevertheless, the outbreak prompted an increase in the market for consumer solutions, prompting industry participants to add increased attributes to their goods and services in order to reach a bigger client base. For example, in September 2022, Logitech released its first pair of TWS earbuds, which were specifically tailored for the burgeoning work-from-home industry. The new TWS earbuds can connect to both PCs and cellphones at the same time.

Regional Insights

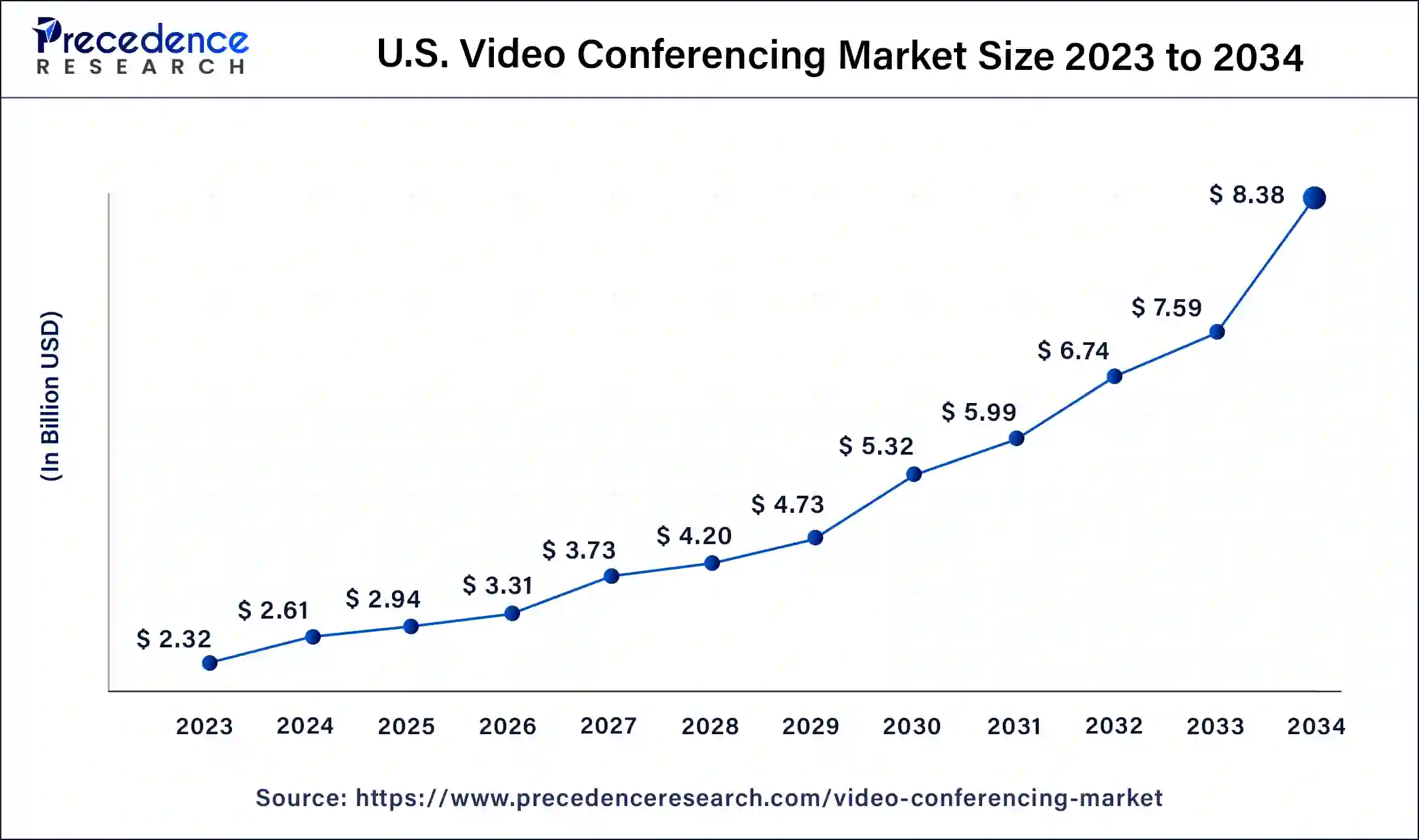

What is the U.S. Video Conferencing Market Size?

The U.S. video conferencing market size was valued at USD 2.94 billion in 2025 and is expected to be worth around USD 9.21 billion by 2035, at a CAGR of 12.10% from 2026 to 2035.

The North America region accounted revenue share of around 42% in 2025. The availability of big significant corporations such as Cisco Systems, Inc., Microsoft Corporation, Zoom Video Communications, Inc. and many more, and even the rapid adoption of technological solutions, are boosting market for these video conferencing solutions in the United States and Canada. The Asia Pacific region is expected to grow at a rapid pace. The increase is attributable to an increase in request for video infrastructure solutions for programmed operations in the academic and training sectors. The appearance of a substantial number of SMEs and a high number of locations of top global 1000 enterprises in the area suggests that the region has enormous market growth prospects.

The United States of America is the most important player in the North American video conferencing market due to a strong digital infrastructure, high remote workforce engagement, and the presence of dominant tech companies such as Zoom, Microsoft, and Cisco Enterprises in the United States quickly adopted video conferencing as a collaboration tool for virtual work, the corporate sector, education and telemedicine. The U.S. federal government, including public and private enterprises, continues investing in secure communication platforms to facilitate collaboration virtually, especially given the ongoing rise of hybrid work culture. In a Forbes report published in 2025, it is reported that over 65% of U.S. businesses are now leveraging video conferencing daily to maintain business continuity.

The European market is projected to expand at a rapid rate of CAGR. The ease of use of a wide range of collaboration between stakeholder's solutions and services has aided growth. Furthermore, rising corporate R&D investments are expected to improve Europe's share in the market in the coming years.

Europe Emerges as a Key Growth Hub in the Video Conferencing Market

The European video conferencing market is growing rapidly due to the rapid adoption of hybrid work, strong digital infrastructure, and increasing reliance on virtual collaboration tools. European countries such as Germany, France, and the UK are spearheading this transition, despite most European countries being physically close. They all have the most to gain from patience and the ability to work efficiently and flexibly. Enhanced features like AI-powered transcription, virtual background replacement, and noise suppression features are increasingly appealing. The deployment of 5G is also producing the delivery of video at even higher quality and reliability, thus supporting the region's strong commitment to digital transformation.

Germany is the leading player in the European video conferencing market. With a large enterprise base and an increasing focus on the transition to hybrid work environments, Germany continues to see strong growth in video conferencing uses. Germany's federal government continues to push digital transformation initiatives in its businesses, education and telemedicine sectors. The relative increase in acceptance for cloud-based platforms (Microsoft Teams, Zoom, etc.) for collaboration has assisted Germany's transition to remote work. The premium on data privacy and GDPR compliance for digital conferencing has led organizations to demand for more secure, local, hosted conferencing applications. A report published by Statista in 2024, indicates that 58% of German SMEs have adopted video conferencing for their operations, therefore demonstrating strong ongoing digital adaptation.

How Is Asia-Pacific Performing in The Video Conferencing Market?

Asia-Pacific is expected to grow at a significant rate during the forecast period mainly because of urbanization, the use of smartphones, and the high demand from both large enterprises and small businesses. Additionally, supporting scalable video communication ecosystems regionally, the enhancements of cloud adoption are key drivers. Mobile-first workflows and cost-sensitive collaboration need quick deployment in corporate, educational, and healthcare environments.

India Video Conferencing Market Trends

India is rapidly adopting technology driven by digital transformation, the acceptance of hybrid work, and the use of mobile devices. Companies are switching to cloud services where they can have scalable and affordable collaboration. Small enterprises are gradually depending more on video tools to improve their productivity, customer engagement, and global competitiveness across different sectors.

Video Conferencing Market Companies

- Cisco Systems, Inc.: Supplies the WebEx platform that offers secure, scalable video meeting calling, and message collaboration features that are enterprise and controlled secure environments.

- Fuze, Inc.: Provides a unified communications platform through a combination of voice, video, and messaging to provide effective workflow collaboration in enterprises and centralized communication management.

- Huawei Technologies Co., Ltd.: Provides video conferencing endpoints and ideahub smart collaboration boards that facilitate intelligent interactive meetings and office spaces.

Other Major Key Players

- Adobe Systems Incorporated.

- Atlassian Corporation Plc.

- JOYCE CR, S.R.O.

- Logitech International S.A.

- LogMeIn, Inc.

- Microsoft Corporation

- Orange Business Services

- Polycom, Inc.

- Vidyo, Inc.

- Visual Systems Group, Inc. (VSGi)

- West Corporation

- ZTE Corporation.

Recent Developments

- In January 2026, AONMeetings, based in Des Moines, is launching operations in India to provide secure communication tools to small businesses, families, healthcare providers, educational institutions, and legal professionals at competitive prices. Founded in 2020, it boasts a 4.9-star rating on G2 and serves over 1,000 businesses in the U.S. market. (Source:https://www.aninews.in )

- In July 2025, Owl Labs launched operations in India, introducing the Meeting Owl 3, now BIS certified. This award-winning device enhances hybrid meetings with its 360° camera, microphone, and speaker, offering an inclusive experience for remote and in-room participants.

(Source: https://www.businesswire.com )

Segments Covered in the Report

By Component

- Hardware

- Camera

- Microphone/Headphone

- Others

- Software

- Services

- Professional Services

- Managed Services

By Deployment

- On-premise

- Cloud

By Application

- Consumer

- Enterprise

By Conference Type

- Telepresence System

- Integrated System

- Desktop System

- Service-based System

By Enterprises Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content