Video Games Market Size and Forecast 2025 to 2034

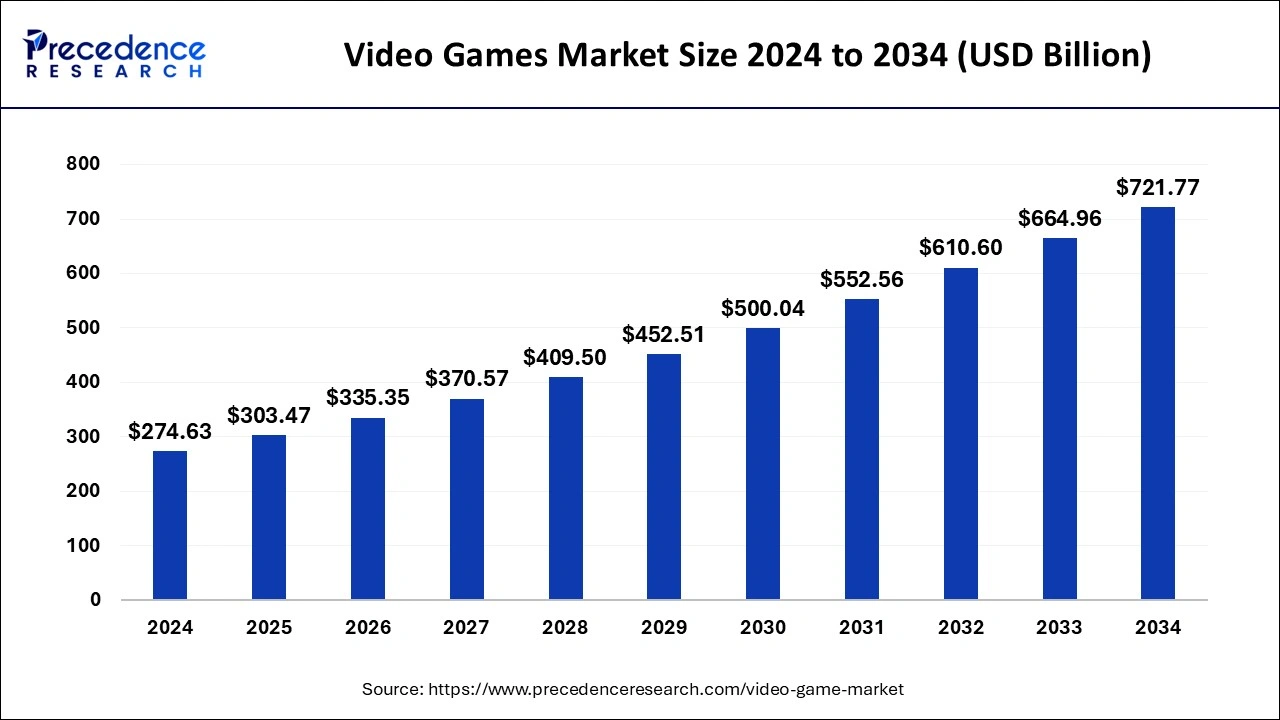

The global video games market size was estimated at USD 274.63 billion in 2024 and it is projected to hit around USD 721.77 billion by 2034, growing at a CAGR of 10.15% during the forecast period 2025 to 2034. The video games market is observed to get accelerated with the rapid adoption ofAugmented Reality and Virtual Reality (AR and VR) technologies that offer immersive gaming experiences.

Video Games Market Key Takeaways

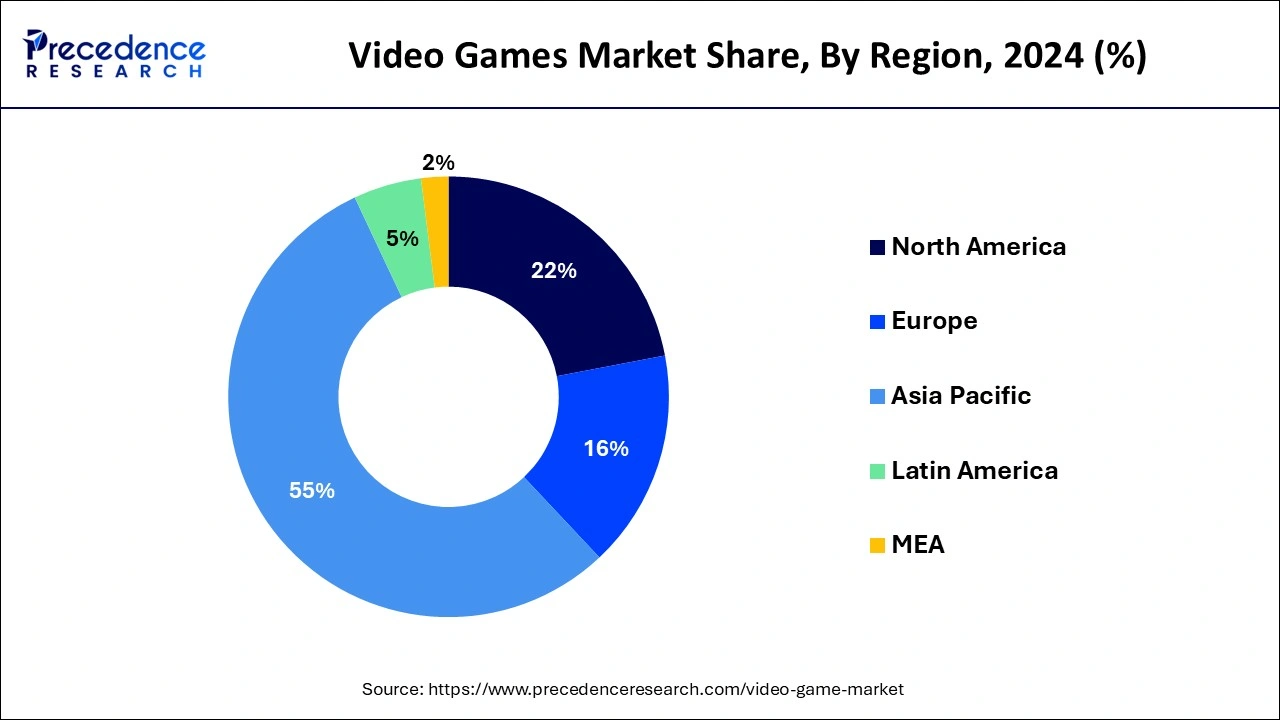

- Asia Pacific region has captured a revenue share of over 55% in 2023.

- By device, the mobile segment has generated a revenue share of around 42% in 2024.

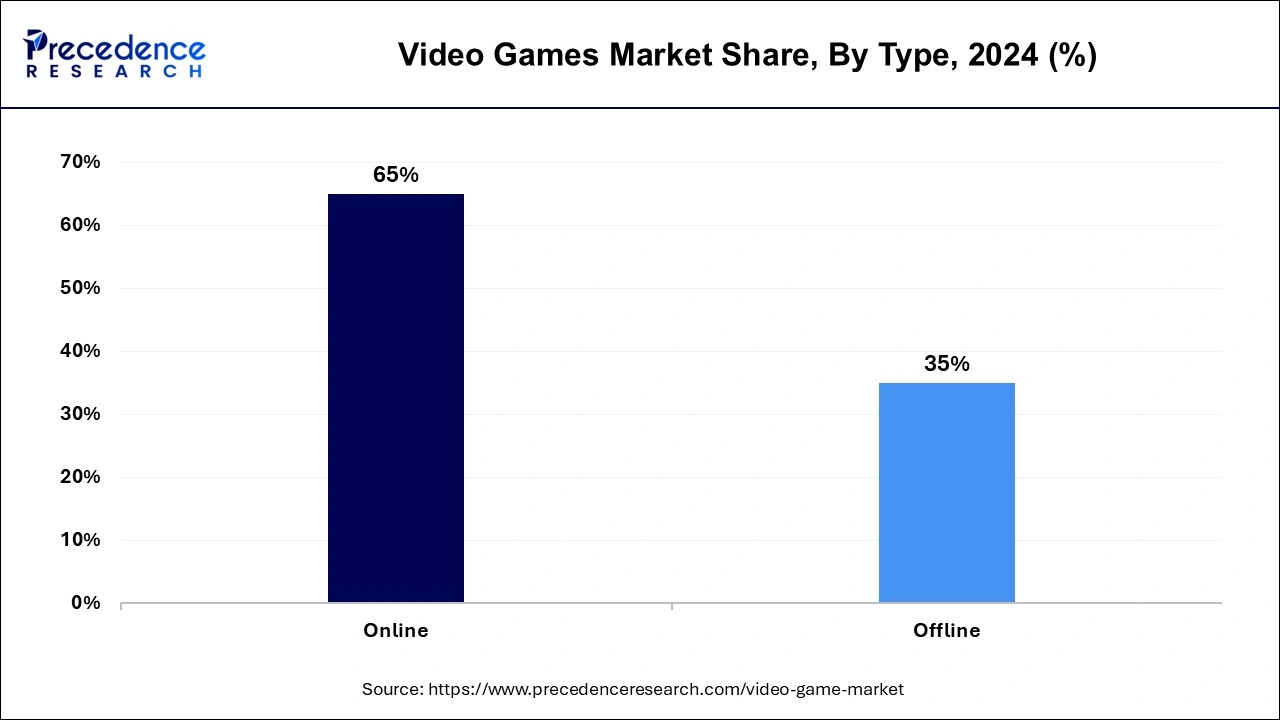

- By type, the offline segment has held a revenue share of 65% in 2024.

Asia PacificVideo Games Market Size and Growth 2025 to 2034

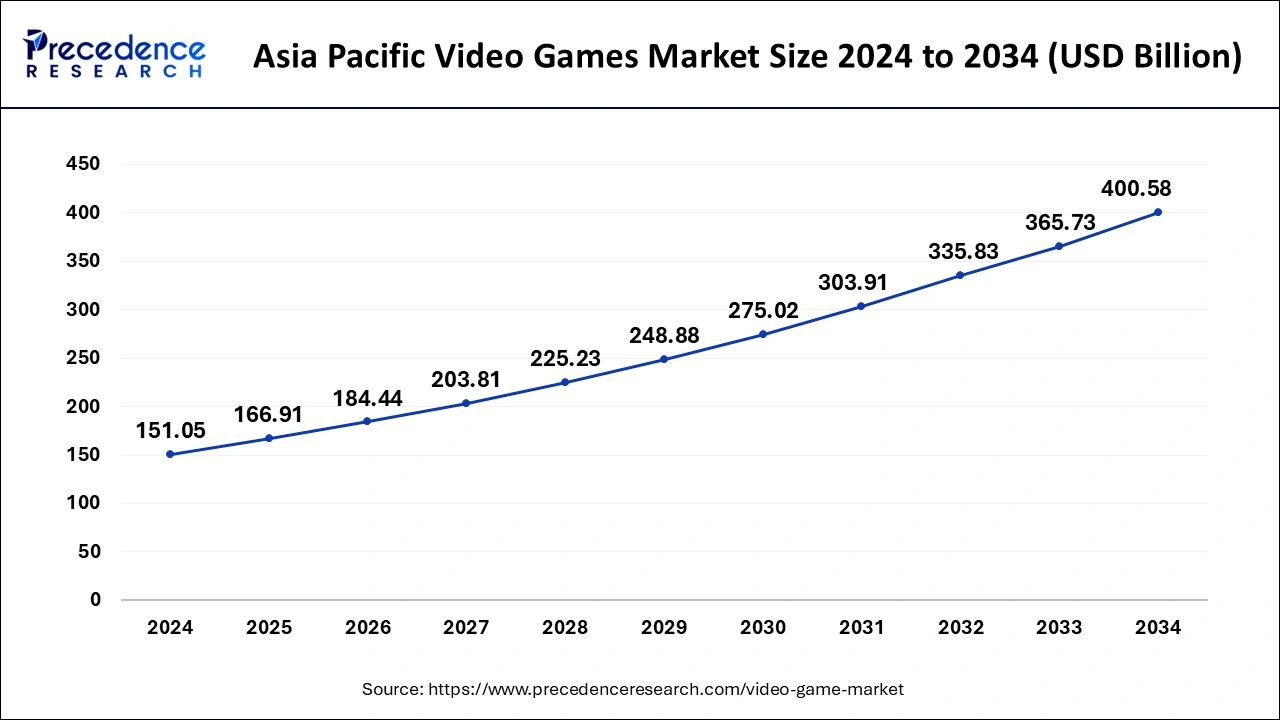

The Asia Pacific video game market size reached USD 151.05 billion in 2024 and is anticipated to be worth around USD 400.58 billion by 2034, poised to grow at a CAGR of 10.24% from 2025 to 2034.

Asia Pacific held the dominating share of the market over 55% in 2024; the region is observed to sustain the position throughout the forecast period. One of the primary factors is the region's rising population which offers a substantial consumer base for the gaming industry. Additionally, the rising disposable incomes and increasing urbanization in countries like China, Japan, South Korea, and India have led to greater spending on entertainment, including video games. Also, the increasing popularity of mobile gaming is expected to support the regional growth of the market in the years to come.

China is observed to be the largest contributor to the growth of the market. The Chinese government has recognized the economic potential of the video games industry and has provided support and policies that encourage its growth. However, there have also been periods of regulatory scrutiny and restrictions.

North America held a share of 22% in 2024. Leading console manufacturers such as Microsoft (Xbox) and Sony (PlayStation) are based in North America. The popularity and global reach of these gaming consoles contribute to the region's dominance in the video games market. North America is home to some of the world's largest and most influential gaming companies, including Microsoft, Sony, Electronic Arts, Activision Blizzard, and others. These companies have a significant impact on the industry, both in terms of game development and console manufacturing.

Europe is expected to grow significantly in the video game market during the forecast period. The growing online gaming platforms and tournaments in Europe are increasing. Moreover, the increasing advancements in video games are attracting the population. The use of AI is offering new features, enhancing the user experience. To support these industries, investments and initiatives are provided by the government. Thus, this promotes the market growth.

Market Overview

A video game, also known as a computer game, is an electronic interactive game that allows players to engage with it using input devices like keyboards, controllers, or joysticks. These games serve the purpose of entertainment, relaxation, competition, and even computer-based learning. Some video games are specifically designed to enhance fine motor skills and hand-eye coordination. In the video game market, innovation plays a crucial role as consumers are more inclined to purchase new games that offer novel experiences. This constant drive for innovation has led to rapid advancements in video game hardware, particularly gaming consoles.

Over the course of more than 50 years, nine generations of gaming consoles have been introduced, with every version surpassing its predecessor. The market's growth is further propelled by technological advancements and ongoing innovations in both hardware and software, particularly in real-time graphics rendering. Additionally, the widespread usage of smartphones, increasing internet penetration, and easy access to online games contribute significantly to the market's growth.

Video Games Market Growth Factors

The rising preference for online gaming is fueling the demand for massively Free2Play (F2P), multiplayer online (MMO), and multiplayer games, a trend that is expected to persist in the foreseeable future. As a result, game developers are prioritizing hardware compatibility and efficiency. Simultaneously, shifting consumer preferences and increasing disposable incomes worldwide are driving the widespread adoption of progressive gaming consoles with advanced features like record and share functionalities and cross-platform gameplay.

Recognizing that many individuals turn to social media to discover their desired video games, game developers are releasing a variety of games across different genres, including action, role-playing, simulation, and strategy, on social media platforms to attract customers. The surging popularity of esports tournaments and the growing number of professional gamers are also boosting the sales of video games and accessories.

Additionally, there is a growing interest in utilizing gaming as an educational tool for cognitive learning, although the concept of "gaming to learn" is still in its early stages but gradually gaining momentum. Furthermore, the expansion of the gaming market is being driven by the rise of social and casual gaming, as millions of people turned to their controllers to combat the boredom and isolation brought about by COVID-19 lockdowns.

Video Games Market Data and Statistics

- According to the Gaming Report India, titled by Dentsu, India is expected to have 700 million gamers by 2025.

- Analysis done by Ampere stated that Sony's PS5 sales increased by 65% in 2023. Whereas the company has set the target of selling 25 million units till the financial year ends in March 2024. Stating the game's sales, Sony was able to ship 10 million units of PS5 from July to December 2023.

- According to the statement made by the Entertainment Software Association in July 2023, 65% Americans play video games.

- The Video Games Statistics stated in October 2023 that approximately 74% of U.S. households consist at least one individual that plays video games on a regular basis.

- The State of India Gaming report for FY21-22 stated that India had the largest share in game downloads while making it 17% in 2022.

- Following the estimation done under a survey in 2022 by Allcorrect Gamers, 92% of respondents played video games on smartphones at least once in a week.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 303.47 Billion |

| Market Size by 2034 | USD 721.77 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.15% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 To 2034 |

| Segments Covered | By Type, By Platform, and By Business Model |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing adoption of cloud

The increase in adoption of cloud gaming is expected to fuel the growth of the video game market during the forecast period and this trend is likely to continue in future. Cloud gaming provides not only affordable and enjoyable entertainment for gamers but also opens up plethora of advantages for companies across various industries.

As cloud gaming continues to mature, service providers are innovating in terms of monetization and use cases, attracting a larger user base and garnering increased attention to the potential of cloud technology. Even established players in the gaming industry, such as Xbox and PlayStation, are embracing cloud gaming to complement their traditional hardware experiences.

The inevitability of cloud-based gaming is evident, with renowned gaming companies poised to win over even the most devoted hardware enthusiasts. Moreover, the hardware and software infrastructure supporting cloud gaming are being leveraged by developers to create the metaverse—a network of interconnected, immersive, and persistent 3D worlds.

Telecom operators must swiftly recognize the benefits of cloud gaming and harness its potential to maintain competitiveness. Combining a cloud gaming service with 5G connectivity is an excellent strategy to attract gamers and cater to the preferences of new generations. Additionally, cloud gaming offers an ideal platform to showcase the capabilities of 5G to end users.

Furthermore, hotels stand to benefit from cloud gaming platforms as they can avoid the high costs associated with investing in consoles for every room. Instead, offering guests access to a cloud gaming platform through a fixed, convenient monthly fee proves to be a cost-effective solution that provides excellent entertainment. These aspects are likely to open up more growth avenues for the video game market in the years to come.

Restraints

Growing complexity in designing games

With the expansion of the gaming industry, there is simultaneous rise in the complexities of the game development. Technological advancements empower designers to craft increasingly complex games, posing new challenges in their design and development. As the industry grows further, there will be growing entry of developers specializing in these spaces, leading to intensified competition and potentially higher compensation rates. Further, the increasing costs associated with developing complex games can act as a barrier for smaller studios and independent developers, limiting the diversity and variety of games available. The longer development cycles required to design intricate games can result in delays, frustrating customers and potentially dampening their enthusiasm.

Additionally, keeping up with rapid technological advancements adds challenges, costs, and time constraints to the development process, making it difficult for developers to deliver cutting-edge experiences. The need for specialized skills and expertise in multiple disciplines poses recruitment and retention challenges, potentially limiting the development capacity of studios. Also, consumers' amplified expectations for immersive experiences place additional pressure on developers to meet these demands, which can be resource-intensive. Thus, this is likely to limit the market's growth during the forecast period.

Opportunities

Introduction of virtual reality (VR) and augmented reality (AR) technologies

The adoption of augmented reality and virtual reality technologies in gaming opens up a host of new opportunities for the video game market in the years to come. These immersive technologies provide players with unprecedented levels of engagement and realism, allowing them to step into virtual worlds and interact with digital content in innovative ways.

The introduction of VR and AR into gaming not only enhances the overall gaming experience but also attracts a wider audience, including casual gamers and those who may not typically engage with traditional video games. This expanded audience base increases the market potential for VR and AR games, leading to new revenue streams and business opportunities. Moreover, VR and AR offer unique gameplay mechanics that take advantage of their respective platforms, enabling developers to create novel and immersive experiences that captivate players.

Additionally, the social and multiplayer aspects of VR and AR gaming provide opportunities for players to connect and interact in virtual environments, fostering community building and collaborative gameplay. Beyond entertainment, the adoption of VR and AR technologies in gaming extends to other industries, such as education, healthcare, and training simulations, further diversifying the market and unlocking additional applications for these technologies. In summary, the adoption of VR and AR in gaming brings forth exciting new dimensions, driving innovation, expanding the market, and transforming the way players engage with video games.

Type Insights

On the basis of type, the online games segment held considerable revenue share in 2024. This is owing to the increasing internet penetration across the globe. As more regions and individuals gain high-speed internet, the potential user base for online gamers are increasing. Additionally, the widespread adoption of smartphones and tablets has made online gaming more accessible than ever before. As per the Mobile Economy 2022 report published by GSMA Intelligence, it is estimated that by 2025, there will be nearly 7.5 billion smartphone connections, accounting for more than four out of five mobile connections.

The majority of regions are expected to witness a threefold increase in mobile data usage over the next six years, primarily due to the rise in smartphone penetration and video consumption. Furthermore, online gaming offers the opportunity for social connectivity and multiplayer interactions which is also likely to augment the segmental growth of the video game market during the forecast period.

Platform Insights

Based on platform, the mobile segment is expected to grow at a significant CAGR during the forecast period. This is owing to the growing adoption of smart mobile phones globally. Mobile gaming excels not only in revenue generation but also in terms of player volume. As per Newzoo's data, the global estimated number of gamers in 2021 reaches 3.22 billion, and surprisingly, a staggering 94% of these gamers engage with games on mobile devices. Mobile games offer compelling features like multiplayer functionalities, leaderboards, and seamless integration with social media platforms, enhancing their appeal and driving their widespread popularity.

Video Games Market Companies

- Tencent Holding Limited

- Nintendo of America Inc.

- Activision Blizzard, Inc.

- Electronic Arts Inc.

- Microsoft Corporation

- Sony Corporation

- Take-Two Interactive Software, Inc.

- Amazon.com, Inc.

- Square Enix Holdings Co., Ltd.

- Gameloft SE

- King Digital Entertainment Ltd.

Recent Developments

- In July 2025, later this month, an exhibition focusing on the storytelling impacted by video games will be held at the Oxford Museum. The newest permanent addition at the Story Museum is the Story Arcade, which is the neon-lit, 1980s-inspired gallery and was publicly opened on the 19th July. Moreover, the evolution of storytelling in video games, as well as the way people connect to the stories through interactive narratives, will be explored in this exhibition. Additionally, the visitors can explore the way of cultural, emotional, and social perspectives that the video games provide by interactive storytelling and will be able to experience landmark moments in gaming history.

- In July 2025, Critical Role, which is the team behind the tabletop web series, will focus on developing its own video game. As per the reports of Variety, this video game is being co-developed by an indie team at AdHoc Studio in collaboration with Critical Role. During the audition for the role in dispatch, which is built in AdHoc's signature style, and is also known as "an interactive narrative game" and "a superhero workplace comedy", the collaboration between Critical Role and AdHoc Studio was formed. The veterans from Night School Studio, Telltale Games, and Ubisoft are the founders of AdHoc Studio. Moreover, the world of Exandria, which is a role-playing game of Critical Role, is an anticipated platform for its new video game release.

- In February 2023, nCore Games invested $1 million in Newgen Gaming, marking the first round of funding for Newgen Gaming, that works under the brand Penta Esports in the esports industry. Penta Esports is engaged in various verticals, including tournaments, leagues, and content, offering opportunities to esports athletes across different titles and platforms.

- In February 2023, Nvidia announced a partnership of 10-year with Microsoft to get Xbox PC games to the NVIDIA GeForce NOW cloud gaming service. With over 25 million members in more than 100 countries, GeForce NOW allows gamers to stream Xbox PC titles on devices like PCs, Chromebooks, macOS, smartphones, and more. Additionally, the partnership will enable the streaming of Activision Blizzard PC titles exclusively on GeForce NOW following Microsoft's acquisition of Activision.

- In October 2022, Electronic Arts Inc. entered into a long-term alliance with Marvel to develop a minimum of around 3 all-new action adventure games for PC and consoles. Each of these games will feature an original story set in the Marvel universe. The first game, currently in development at Motive Studios, will be a third-person, single-player, action-adventure game centered on Iron Man.

Segments Covered in the Report

By Type

- Online

- Offline

By Platform

- Computer

- Console

- Mobile

By Business Model

- Free-to-play

- Pay-to-play

- Play-to-earn

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting