Co-Packaged Optics (CPO) Market Size?

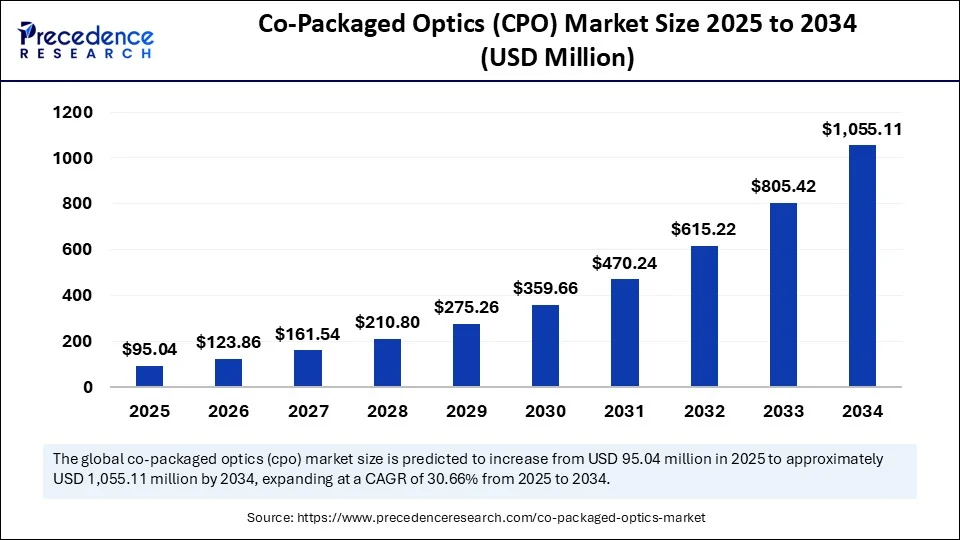

The global co-packaged optics (CPO) market size accounted for USD 95.04 million in 2025 and is predicted to increase from USD 123.86 million in 2026 to approximately USD 1,055.11 million by 2034, expanding at a CAGR of 30.66% from 2025 to 2034.

Market Highlights

- North America dominated the co-packaged optics (CPO) in 2024.

- Asia-Pacific is set to be the fastest-growing during the forecast period.

- By component, the optical engines / transceivers segment captured the biggest market share in 2024.

- By component, photonic integrated circuits (PICs) are the fastest growing during the forecast period.

- By integration / packaging type, true co-packaged optics segment accounted for a considerable share in 2024.

- By integration / packaging type, on-board optics are set to be the fastest growing segment during the forecast period.

- By reach / interconnect length, intra-rack / intra-chassis (10 mm–3 m) is the contributed the highest market share in 2024.

- By reach / interconnect length, the intra-package / intra-die (<10 mm) segment is the fastest growing during the forecast period.

- By end-use application, the hyperscale data centers segment held the largest share in 2024.

- By end-use application, the AI driven high-performance computing (HPC) segment is expected to grow during the forecast period.

- By distribution channel, direct OEM / hyperscaler supply segment generated the major market share in 2024.

- By distribution channel, contract manufacturing partnerships segments are seen to be the fastest-growing segment during the forecast period.

What is the Role of AI in the Co-packaged Optics Market?

Artificial Intelligence is playing a transformative role in the co-packaged optics market. The explosive growth in AI systems and tools has created a need for ultra-high bandwidth and low-latency data transfer within hyperscale data centers. Nowadays, traditional pluggable optical receivers are unable to meet high-performance requirements, as they consume more power and occupy more space, thereby delivering lower scalability. This is where AI comes into play. By integrating AI tools, it enables faster data movement with a significantly reduced power consumption rate, making it a popular technology. Companies such as NVIDIA, Google, and Microsoft have already begun building massive clusters of AI and are looking forward to CPO solutions to maintain steady growth.

Beyond driving demand, AI also plays a vital role in the development and deployment of CPO technology. Machine learning tools are now being used to optimize optical component design, predict signal losses, and improve thermal and power management across co-packaged optics systems. Various AI tools can enable engineers to identify bottlenecks more quickly and also assist them with complex, interconnected architectures. In the manufacturing domain, AI-driven quality control systems are helping ensure precision when assembling fiber arrays, photonic integrated circuits, and packaging materials, which are critical components for the reliability of co-packaged optics modules.

Through all these factors, we can see how AI is not only helping create demand but also shaping the market in terms of innovation, production, efficiency, and deployment, thus making it a cornerstone for technology and next-gen computing.

Co-Packaged Optics: Ultra-Fast, energy-Efficient Next-Gen Data Centers and AI Networks

The co-packaged optics (CPO) market refers to the ecosystem of technologies, components, and solutions where optical transceivers and photonic elements are integrated within the same package or near high-speed electronic devices such as switch ASICs, GPUs, or other processors. This architecture reduces electrical interconnect distances, lowers power consumption, and enables ultra-high bandwidth density, making it crucial for hyperscale data centers, AI/HPC systems, and next-generation networking infrastructure. This innovation is primarily utilized in high-performance computing, data centers, telecommunications, and AI systems, where there is a growing demand for low-latency and high-bandwidth solutions.

Co-packaged optics is becoming an increasingly important technology for supporting the ever-expanding needs of hyperscale data centers, 5G networks, and cloud computing infrastructures, as it provides faster data throughput with comparatively lower power consumption. The market is expected to grow at a rapid pace throughout the forecast period, driven by an increase in data traffic, the adoption of AI applications, and a shift toward more energy-efficient systems. As the demand for faster and more efficient data transmission continues to grow, CPO will remain a vital player in the development of next-generation networking and computing infrastructures.

What are the Key Trends in the Co-packaged Optics Market?

- Rising demand for data: The market is expanding due to the rising demand for data-driven by cloud computing, streaming services, 5G networks, and IoT applications. Co-packaged optics are useful in this field as they reduce signal travel distance by directly integrating optical components with semiconductor chips. This lowers latency, making it ideal for applications such as online gaming, video conferencing, and even driverless cars, where real-time data processing and quick reaction times are crucial aspects. Higher data transmission bandwidths are possible due to the integration of optical components with semiconductor processors.

- Technological advancements: To fulfill the needs of high-speed networks and applications, we need the development of optical components and materials that can enable higher data transfer rates. Furthermore, heat control is also an essential aspect for co-packaged optics, enabling the avoidance of overheating and ensuring dependable performance. This is made possible by innovations in thermal management technologies, such as heat sinks and specialized materials, which provide consistent performance in demanding environments.

- Evolution of network architectures: Another co-packaged optics market trend is the evolution of network architectures in the telecommunications sector. Due to the global rollout of 5G networks and the emergence of 6G research, telecom operators are compelled to deliver higher bandwidth and lower latency to support advanced applications such as autonomous vehicles, IoT, and immersive media. Co-packaged optics enable telecom equipment manufacturers to design compact, scalable, and high-capacity switching platforms that can handle massive data loads without compromising on energy. Additionally, the technology's ability to support data rates of 400G, 800G, and above proves attractive to telecom operators aiming to maintain a competitive edge in a rapidly evolving digital landscape.

Market Outlook

- Industry Growth Offerings- The market is growing due to demand for high-speed, energy-efficient data transmission. Industry offerings include integrated optical transceivers, photonic packaging, and smart interconnects for data centers, AI, and 5G networks.

- Global Expansion- The global market is expanding as hyperscale data centers, cloud computing, and 5G networks grow worldwide. Increased adoption of high-bandwidth, low-latency, and energy-efficient solutions is driving market growth across North America, Europe, and the Asia-Pacific.

- Startup ecosystem- The co-packaged optics (CPO) startup ecosystem is thriving with innovative companies developing advanced photonic integration, optical engines, and high-speed interconnect solutions. Startups focus on AI, data centers, and 5G applications, attracting investments and partnerships to scale globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 95.04 Million |

| Market Size in 2026 | USD 123.86 Million |

| Market Size by 2034 | USD 1,055.11 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 30.66% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segment Covered | Component, Integration / Packaging Type, Reach / Interconnect Length, End-Use Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The co-packaged optics (CPO) market is growing rapidly, driven by increasing demand for high-speed data transmission, fueled by AI and machine learning, as well as cloud services and massive data centers. CPO, which integrates optics into ASICs or switch chips, decreases power consumption, latency, and improves bandwidth efficiency, and is becoming an essential aspect for future 800G and 1.6T networks. The expansion of cloud computing is also expected to significantly boost the market, leading to increased bandwidth and more effective data transport systems to accommodate large-scale data processing.

The surge in demand for high-speed data processing and transmission is another growth factor for the co-packaged optics market. As data centers and high-performance computing environments face the challenges of bandwidth bottlenecks and escalating power consumption, co-packaged optics technology offers a solution by integrating optical and electronic components within a single package. This integration thus minimizes signal loss, reduces latency, and enhances energy efficiency, enabling operators to meet the increasing requirements for data throughput. The adoption of AI, machine learning, and real-time analytics further accelerates the need for co-packaged optics. As a result of all this, leading technology firms and hyperscale data center operators are seen making significant investments in co-packaged optics to develop and update their infrastructure.

Restraint

Despite significant growth potential, the market has its fair share of challenges. Creating and implementing CPO solutions requires expensive techniques that merge optical components with silicon chips. Upgrading data center infrastructure to enable CPO technology also raises capital costs. These high initial expenses can be challenging for smaller businesses. Moreover, the lack of standardized interfaces and interoperability between different vendors' solutions can create integration challenges, leading to slower market growth.

Scalability issues are another reason that could hamper the growth of the co-packaged optics market, as addressing the increasing demands of hyperscale data centers is a challenging task. The integration and production of optical components on such a wide scale requires consistent performance and cost efficiency. Inadequacy in this field may lead to failure in achieving all the intended benefits for large-scale organizations.

Opportunity

The co-packaged optics (CPO) market is experiencing significant growth, presenting numerous expansion opportunities. Emerging applications in quantum computing, scientific research, and smart city infrastructure are expected to drive the future demand for co-packaged optics.

The growing emphasis on sustainability and operational efficiency is also fueling market expansion. Data centers are significant energy consumers, and the need to reduce power consumption without compromising performance has become a strategic priority for operators worldwide. Co-packaged optics address this challenge by enabling higher-density and lower-power interconnects, resulting in cost savings and a reduced environmental impact. Regulatory initiatives and industry standards focused on green data centers further encourage the adoption of energy-efficient optical technologies. Additionally, the adoption of silicon photonics is a key trend driving the market, as it directly integrates optical components into silicon chips, thereby enhancing the performance of these devices. This integration enhances performance, reduces costs, enables higher scalability, and minimizes power consumption. Silicon photonics also increases data transmission speeds, making it suitable for high-performance applications. Leading firms such as Intel, Broadcom, and Cisco have already begun making significant investments in this technology to enhance their co-packaged optics solutions.

Segment Insights

Component Insights

Which Component Dominated the Co-Packaged Optics Market in 2024?

The optical engines/transceivers segment held the dominant share in the co-packaged optics market as of 2024. This is due to their critical role in enabling high-speed optical data transmission within and between data centers. Co-packaged transceivers integrate multiple optical and electrical components in a single module, significantly reducing power consumption and physical footprint compared to traditional pluggable optics. The demand for transceivers is further being fueled by the growing need for scalable, high-density interconnected solutions in hyperscale data centers and next-generation network architectures. Continuous advancements in transceiver design, such as the adoption of silicon photonics and advanced packaging techniques, are further enhancing performance and reliability, making them an indispensable aspect in modern optical networks.

The photonic integrated circuits (PICs) are set to be the fastest-growing segment in the forecasted years. This is because they represent the future of scalable, energy-efficient optical networking. PICs integrate multiple photonic functions, such as lasers, modulators, detectors, and filters, onto a single chip, which helps significantly reduce cost, size, and power consumption without sacrificing efficiency. They also enable greater system integration and can keep up with the demands of hyper-scale data centers, a capability that traditional transceivers alone cannot achieve.

Integration Type Insights

What Type of Integration Is Currently Dominating the Co-Packaged Optics Market in 2024?

True packaged optics continue to dominate the market because they integrate the optics and the ASIC into the same package, enabling the shortest electrical connections. This helps to drastically reduce power consumption and signal loss, which are the two biggest challenges in this field. Several companies are already considering the adoption of true packaged optics, as they are critical for supporting AI training clusters, cloud computing, and 5G core networks.

On-board optics segment is set to experience the fastest rate of market growth from 2025 to 2034 with this growth being attributed to their role as a bridge between pluggable optics and fully integrated, packaged optics. This segment involves placing optics very close to the switch ASIC, but not inside the same package, allowing for easier thermal management and greater design flexibility. This makes it particularly popular for Tier 2 cloud providers, telecom operators, and enterprises that want higher bandwidth density without the heavy capital investments.

Reach / Interconnect Length Insights

Why Did Intra-Rack Lead the Co-Packaged Optics Market in 2024?

The intra-rack segment led the co-packaged optics (CPO) market in 2024, largely because most data center operators want to upgrade their infrastructure and handle growing traffic within a single rack. These types of racks are crucial for managing power consumption and facilitating seamless data transfer between switches and servers. The advantage of this segment lies in its ability to align well with current industry demands, making it highly adaptable. It strikes the right balance between cost efficiency, technical feasibility, and immediate performance gains, making it a popular choice in the global co-packaged optics market.

Intra-package reach is emerging as the fastest-growing segment as of 2024. This is due to its ability to offer unmatched improvements in bandwidth density, ultra-low latency, and reduced signal loss compared to others. Unlike Intrarack, which focuses on efficiency across servers and switches, intra package places the optics directly alongside the switching chips, thus removing the traditional limitations of electrical connections.

End-Use Application Insights

Which End User Segment Held the Largest Share in the Co-Packaged Optics Market Last Year?

Data centers are the dominant segment in the co-packaged optics market as of 2024 with this dominance attributed to the rapid growth of cloud computing, big data analytics, and AI-driven workloads, which have increased demands for data center infrastructure and spurred the adoption of high-speed, energy-efficient optical interconnects. It enables data center operators to achieve higher port densities, lower power consumption, and improved scalability, thus boosting demand as operators aim to optimize performance and reduce operational costs in complex and distributed environments.

AI-driven High-performance computing (HPC) is seen to be the fastest-growing segment this year. HPC environments, such as supercomputing centers and AI training clusters, require interconnect solutions that can support massive bandwidth and minimize signal loss over both short and long distances. The integration of co-packaged optics with advanced switching and processing technologies allows HPC operators to achieve breakthrough performance levels, supporting scientific research, financial modeling, and complex simulations. The adoption of co-packaged optics in HPC is expected to accelerate further in the coming years, as organizations continue to pursue computing and other data-intensive initiatives.

Distribution Channel Insights

Which Distribution Channel Enjoyed a Prominent Position in the Co-Packaged Optics Market Last Year?

Direct OEMs continue to dominate the market this year. This dominance is due to large companies, such as NVIDIA and Cisco, preferring to design, test, and deliver their solutions directly to hyper-scale data centers and telecom operators. This enables them to have complete control over product quality, intellectual property, and to integrate with existing networking infrastructures. Direct OEM sales also enable faster customization, making them a popular choice in today's market.

Contract manufacturing partnerships are the fastest-growing segment as of this year. As the demand for co-packaged optics increases along with the rising integration of AO workloads and machine learning tools, OEMs are finding it challenging to scale production processes in-house. Partnering with contract manufacturers enables them to expand their manufacturing capacities, reduce costs, and introduce products to the market more quickly. This approach also allows small-scale companies to commercialize their technologies without any massive upfront investments.

Regional Insights

Why Is North America Dominating the Co-Packaged Optics Market?

North America is currently leading the co-packaged optics market. This dominance is driven by a growth in data center technologies, high-speed networking requirements, and increased investments in cloud computing infrastructure. The presence of major cloud service providers, advanced research institutions, and a robust ecosystem of optical component manufacturers in the region, especially in the U.S.A. and Canada, has positioned North America as a leading force in technological innovation and adoption.

The regional co-packaged optics market also benefits from rapid digital transformation, the increase of 5G networks, and a rising demand for energy-efficient optical solutions in hyperscale data centers. Technology giants like Google, Amazon, and Microsoft are already heavily investing in next-generation data center infrastructure.

What Are the Advancements in the Asia-Pacific Region?

The Asia Pacific is expected to be the fastest-growing region during the forecasted period in the co-packaged optics market. The rapid digital transformation in countries such as China, Japan, and South Korea drives this growth. The region's robust manufacturing base, coupled with supportive government policies and substantial investments in research and development, is driving innovation in co-packaged optics technology. Additionally, the presence of major tech companies and semiconductor manufacturers in the Asia-Pacific is also helping in accelerating the adoption and development of these advanced optical solutions. The market's growth is further accelerated by the increasing implementation of 5G networks, the expansion of cloud services, and the continuous evolution of AI and IoT applications, positioning the Asia-Pacific region as a key player in the global co-packaged optics market.

U.S. Leads Co-Packaged Optics Market Amid Trade and Tech Shifts

The U.S. market is expanding due to the rapid growth of hyperscale data centers, AI applications, and high-performance computing, which demand ultra-low latency and high-bandwidth solutions. Increasing adoption of energy-efficient technologies, the rise of 5G networks, and the need for faster data transmission are driving investment in CPO solutions. Advanced manufacturing capabilities and strong presence of key technology players in the U.S. further accelerate market growth, making it a critical component of next-generation networking infrastructure.

China's Lead in High-Speed Networking: Co-Packaged Optics on the Rise

The China market is growing rapidly due to the country's expanding data center infrastructure, increasing adoption of AI and cloud computing, and the rollout of 5G networks. Rising demand for high-speed, low-latency data transmission and energy-efficient solutions is driving investment in CPO technologies. Supportive government initiatives, advancements in semiconductor and optical component manufacturing, and the presence of major technology players in China are further accelerating market growth, positioning the country as a key player in next-generation networking.

Powering Europe's Digital Future: Growth in Co-Packaged Optics

The Europe market is increasing due to growing investments in hyperscale data centers, AI-driven applications, and next-generation networking infrastructure. Rising demand for high-bandwidth, low-latency, and energy-efficient data transmission is driving adoption of CPO solutions across telecommunications, cloud computing, and high-performance computing sectors. Technological advancements, government support for digitalization, and the presence of leading optical and semiconductor companies in Europe are further fueling market growth, making CPO a critical enabler for faster and more efficient networking systems.

Accelerating the UK's Network Revolution: Co-Packaged Optics Expansion

The UK market is increasing due to rising demand for high-speed, low-latency data transmission in data centers, AI applications, and cloud computing infrastructure. Expansion of 5G networks and investments in energy-efficient, high-bandwidth solutions are driving adoption of CPO technologies. Technological advancements, supportive government initiatives for digital infrastructure, and the presence of key optical and semiconductor companies in the UK further accelerate market growth, positioning CPO as a vital technology for next-generation networking and computing systems.

Country-Level Analysis

The United States is at the forefront of technological innovation and adoption, thanks to leading technology firms that are investing heavily in co-packaged optics to support data center modernization and the deployment of 5G networks.

The primary reasons for the country's co-packaged optics market growth are the recent adjustments in trade policies, which have introduced new tariff structures affecting a range of semiconductor and photonic components used in co-packaged optics assemblies. Components such as laser sources, optical engines, and electrical integrated circuits have been re-classified under newly revised duty schedules, leading to increased import costs for manufacturers. These changes are pushing executives to reassess vendor relationships and total landed cost models. This is due to significant investments in hyperscale data centers and AI research initiatives, which are driving up the rapid adoption of co-packaged optics. Furthermore, the application of tariffs to substrates and advanced photonic packaging processes has put pressure on assembly and module production. Suppliers are now examining alternative manufacturing locations, including nearshore facilities and free-trade zones, to mitigate the financial impact of the crisis. This supply chain realignment is influencing lead times, inventory strategies, and logistics planning, as companies seek to mitigate the effects of unpredictable policy shifts.

Value Chain Analysis

- Raw Material Procurement

Raw material procurement for co-packaged optics (CPO) involves sourcing advanced photonic and electronic components.

Key materials include lasers, silicon wafers, and specialized packaging substrates.

The process requires coordination across a multi-vendor, highly integrated supply chain to ensure high-bandwidth, energy-efficient systems.

Key players: Intel, Molex, IBM, Ciena, and Marvell, Furukawa Electric, and Quanta Computer - Wafer Fabrication

Wafer fabrication for co-packaged optics (CPO) uses silicon photonics to produce optical and electronic components on a single wafer.

This integration reduces costs and improves performance by embedding modulators, waveguides, and photodetectors alongside processing chips.

The process leverages existing CMOS semiconductor manufacturing techniques for efficiency and scalability.

Key players: Intel, IBM, Marvell, Molex, Huawei Technologies, Ayar Labs - Photolithography and Etching

Photolithography and etching in co-packaged optics (CPO) adapt standard semiconductor techniques to create integrated optical and electronic features on a single silicon substrate.

Photonics-specific requirements introduce challenges in controlling feature size, profiles, and material integration.

These processes ensure precise fabrication of modulators, waveguides, and photodetectors for high-performance CPO systems.

Key players: IBM, Marvell, Ciena, Molex, Coherent, NVIDIA

Key Players in Co-Packaged Optics Market and Their Offerings

- Intel: Develops advanced co-packaged optics solutions and semiconductor components for high-speed data transmission.

- Molex: Provides optical interconnects, connectors, and photonic integration solutions.

- IBM: Offers AI-driven data center and networking technologies supporting CPO adoption.

- Ciena: Delivers optical networking systems and high-bandwidth communication solutions.

- Marvell: Supplies semiconductor and optical components for data center and cloud infrastructure applications.

Recent Developments

- In December 2024, IBM unveiled breakthrough research in optics technology that could dramatically improve how data centers train and run generative AI models. They have introduced a new CPO prototype module that can enable high-speed optical connectivity. This technology could significantly increase the bandwidth of data center communications, minimizing GPU downtime while drastically accelerating AI processing. By designing and assembling the first publicly announced successful polymer optical waveguide (POW), IBM researchers have demonstrated how CPO will redefine the way the computing industry transmits high-bandwidth data between chips, circuit boards, and servers.(Source: https://newsroom.ibm.com)

- In June 2025, Polymer Waveguides Revolutionize Co-Packaged Optics for Faster Data Transmission. Recent research led by Dr. Satoshi Suda and his team from the National Institute of Advanced Industrial Science and Technology in Japan highlights the potential of single-mode polymer waveguides as a crucial component in the future of co-packaged optics technology. With their ability to maintain low polarization-dependent loss, low differential group delay, and high polarization extinction ratio, these polymer waveguides can significantly enhance the performance and reliability of CPO systems that use external laser sources. As data centers and high-performance computing systems continue to evolve, the integration of polymer waveguides into CPO systems could play a pivotal role in achieving faster, more efficient, and more reliable data transmission.(Source: https://www.sciencenewstoday.org)

Segments Covered in the Report

By Component

- Optical engines/transceivers

- Photonic integrated circuits (PICs)

- Lasers

- Modulators

- Electrical ICs / SerDes

- Optical fibers and waveguides

- Connectors and interfaces

- Thermal management solutions

- Packaging substrates and interposers

- Testing and alignment tools

By Integration / Packaging Type

- True co-packaged optics (same package as ASIC)

- Co-located optics (adjacent module integration)

- On-board optics (PCB-level integration)

By Reach / Interconnect Length

- Intra-package / intra-die (<10 mm)

- Intra-rack / intra-chassis (10 mm–3 m)

- Inter-rack / data-hall (3 m–100 m)

By End-Use Application

- Hyperscale data centers (AI/cloud)

- AI-Driven High-Performance Computing (HPC)

- Enterprise data centers

- Telecom and metro networks

- Edge data centers

By Distribution Channel

- Direct OEM / hyperscaler supply

- Channel / distributor-based sales

- Contract manufacturing partnerships

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting