What is Spinning Machinery Market Size?

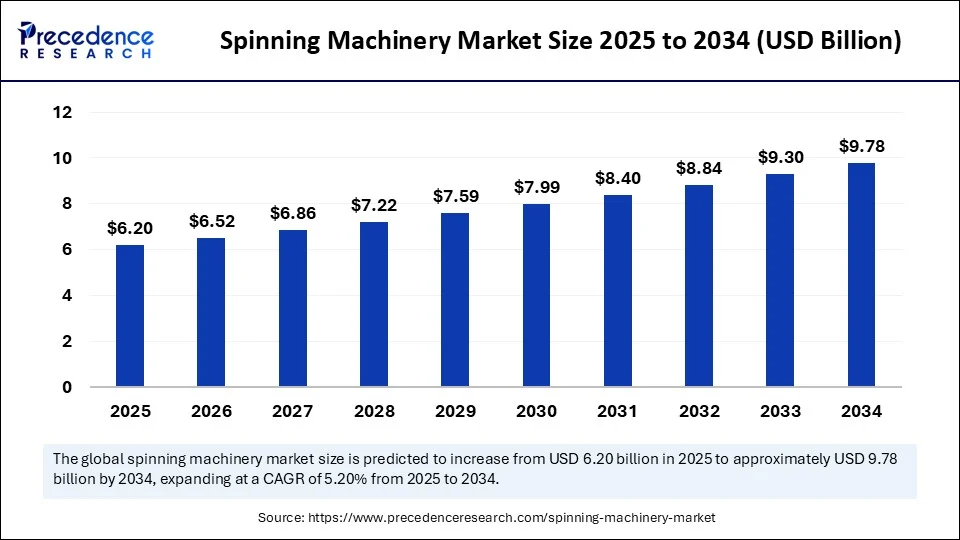

The global spinning machinery market size accounted for USD 6.20 billion in 2025 and is predicted to increase from USD 6.52 billion in 2026 to approximately USD 9.78 billion by 2034, expanding at a CAGR of 5.20% from 2025 to 2034. The market is expanding due to technological advancement in spinning machineries, increasing demand for high-quality yarns, and rising innovative product launches by leading players.

Market Highlights

- Asia Pacific held the largest market share in 2024 and is expected to sustain its growth trajectory during the foreseeable period.

- By machine type, the ring spinning machine segment held the largest market share in 2024.

- By machine type, the air-jet spinning machine segment is expected to witness the fastest CAGR during the projection period.

- By operation type, the automatic segment held the largest market share in 2024 and is expected to sustain the same position during the foreseeable period.

- By material type, the natural fibers segment held the largest market share in 2024.

- By material type, the blended fibers segment is expected to grow at the fastest CAGR in the upcoming period.

- By end-use industry, the apparel & fashion segment held the largest market share in 2024.

- By end-use industry, the industrial textiles segment is expected to witness the fastest growth between 2025 and 2034.

- By spinning process, the short staple spinning segment held the largest market share in 2024.

- By spinning process, the long staple spinning segment is expected to witness the fastest growth during the forecast period.

- By sales channel, the direct sales segment held the largest market share in 2024.

- By sales channel, the online channels segment is expected to expand at the fastest CAGR between 2025 and 2034.

Market Overview

The spinning machinery market comprises machines used in the textile industry to convert natural and synthetic fibers into yarn. These machines perform critical operations such as opening, carding, combing, drawing, roving, and spinning to create high-quality yarns for fabrics. The demand is driven by increasing textile production, rising automation, and a shift toward higher productivity and energy-efficient machines. The market includes both traditional ring spinning and newer technologies such as rotor and air-jet spinning.

How is AI Transforming the Spinning Machinery Market?

Cutting-edge technologies like artificial intelligence (AI) and Internet of Things are revolutionizing the spinning machinery industry, offering unprecedented advancements. These include high-quality yarn manufacturing, improved fabric quality, pattern assessment, color management, and merchandising supply chain optimization, along with other aspects of the textile sector which yet to be uncovered by these technologies. AI-powered systems can automate various processes, from fiber handling to quality control, leading to the development of high-quality textiles. AI algorithms analyze vast amounts of data from machinery sensors to predict potential failures. This enables proactive maintenance and reduces downtime.

AI-powered systems help designers create easy and appealing patterns with different fabrics using more reliable methods, such as 3D representation of fabric, design, and patterns. Additionally, machine learning plays a crucial role, allowing more impartial fabric grading processes using reliable methods. AI facilitates the fineness, staple length, and strength of yarn, which can be calculated with high precision by artificial neural networks.

What are the Key Trends in the Spinning Machinery Market?

- Integration of Smart Technologies: One of the major trends in the market is the rising integration of smart technologies, driven by the rising industrial automation and digitalization. Technologies like AI and IoT enable the real-time monitoring of spinning processes, predict potential threats, and optimize machine efficiency. In a nutshell, smart technologies and the Industry 4.0 revolution are transforming nearly every industry, including the spinning machinery sector.

- Inclination Toward Eco-Friendly Practices:Another major trend in the market is the rapid shift toward eco-friendly and sustainable practices aimed at reducing environmental impact. This opens up new growth avenues for market growth, encouraging the development of energy-efficient spinning technologies. Techniques such as waterless or low-water spinning machines are emerging and are being adopted by many businesses. Energy-efficient motors and sensors also contribute to the development of sustainable spinning machines, which help comply with stringent regulations regarding energy efficiency.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.20 Billion |

| Market Size in 2026 | USD 6.52 Billion |

| Market Size by 2034 | USD 9.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.20% |

| Dominating Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Machine Type, Operation Type, Material Type,End-Use Industry, Spinning Process, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Automation in the Textile Industry

The textile industry's rapid shift toward automation and technological innovations is a major factor driving the growth of the spinning machinery market. Innovations in technologies, such as robotics and advanced control systems, are improving the efficiency of spinning machines. Textile businesses are looking to optimize their production processes to meet the growing demand for textiles. However, automation leads to greater efficiency in production processes and increased output by reducing labor costs. It also optimizes textile quality by enhancing quality control processes. Moreover, the rising population growth and disposable incomes are boosting the demand for textiles, significantly driving the demand for spinning machinery.

Restraint

Substantial Upfront Costs and Volatility in Raw Material Prices

A major factor restraining the growth of the spinning machinery market is the high initial investment required to procure spinning machinery. This creates barriers for small businesses and discourages them from entering the market. Moreover, price fluctuations of raw materials, such as cotton, synthetic fibers, and wool, resulting from economic downturns, government regulations, and other trade policies, affect the profitability of textile businesses. Establishing a comprehensive spinning machinery setup requires substantial investments in technologies such as IoT and automation, leading to increased operational costs.

Opportunity

Emergence of Sustainable Spinning Machineries

The significant opportunity that the spinning machinery market holds is the emergence of sustainable spinning machines and their integration with cutting-edge technologies, such as automation, robotics, and the Internet of Things, which are highly impacting the textile industry across the globe and creating lucrative opportunities to grow exponentially in the near future. To improve productivity while minimizing overall operational costs, modern spinning machines have been developed with energy-efficient components, motors, and automated monitoring processes. Recently, AI-powered assessments have been employed to enable machines to detect failure chances before they occur. Moreover, innovative processes such as vortex-spinning and compact spinning enable reduced fiber loss with enhanced yarn quality, thereby further expanding the growth of the spinning machinery market on a large scale.

Segment Insights

Machine Type Insights

Why Did the Ring Spinning Machine Segment Dominate the Spinning Machinery Market in 2024?

The ring spinning machine segment dominated the market with the largest share in 2024. The segment's dominance stems from its versatility, cost-effectiveness, suitability with various fabrics, and ability to produce high-quality yarns. Its widespread applications in apparel and home textile applications reinforced the segment's dominance. The rising demand for high-quality industrial fabrics, home textiles, and automotive textiles facilitates the long-term growth of the segment.

The air-jet spinning machine segment is expected to grow at the fastest CAGR during the forecast period. The segment growth is attributed to the high production speed and energy efficiency. The rapid shift toward automation and the Industry 4.0 revolution in textile manufacturing, combined with the rising demand for synthetic and blended fabrics, are likely to support segmental growth.

Operation Type Insights

What Made Automatic the Dominant Segment in the Spinning Machinery Market in 2024?

The automatic segment dominated the market with the largest share in 2024 and is expected to continue its growth trajectory in the upcoming period. The segment growth is attributed to the increasing focus on industrial automation and the need to optimize production output. Automatic machines offer enhanced efficiency, productivity, and uniform yarn quality, which are crucial factors for the textile industry. Additionally, automation helps reduce labor costs, which is highly beneficial for areas where manual labor is scarce.

The development of automatic and highly sophisticated spinning machines is made possible by technological advancements in computerized control systems, automated material handling, and sensor-based monitoring. In addition to this, automatic spinning machines are developed with features such as real-time breakage detection, automatic bobbing handling, and a cleaning system that can be automatically processed. Such transformations have led to the widespread adoption of automatic spinning machines globally.

Material Type Insights

How Does the Natural Fibers Segment Dominate the Market in 2024?

The natural fibers segment led the spinning machinery market with the largest market share in 2024. This is mainly due to the increased demand for natural fibers among the masses, as they offer excellent properties such as durability, aesthetic appeal, and comfort. Natural fibers, such as linen, cotton, and silk, are in high demand. This is mainly due to the increased awareness of the functional benefits offered by natural fibers. Among these, cotton is a significantly used yarn across the globe, as it has versatile applications in the home, medical, and sports textiles.

The blended fibers segment is expected to witness the fastest growth in the foreseeable period. The segment is expanding due to factors such as low cost and improved fabric properties of blended fibers. By combining high-cost materials with comparatively lower-cost fabrics, the product reduces costs and offers high affordability for the masses. Additionally, blended fibers provide improved strength, dimensional stability, aesthetic appeal, and high resistance to wrinkles. The rising demand for high-performance product performance further supports segmental growth.

End-use Industry Insights

How did Apparel & Fashion Industry Held the Largest Share in the Spinning Machinery Market in 2024?

The apparel & fashion segment held the largest market share in 2024, due to various factors like evolving fashion trends which require updated machinery, growing consumer demand for various clothing options along with advancement in digital technologies and automation are enhancing the operational efficiency and improved speed of textile production to meet consumers growing demand for fashionable and aesthetically appealing clothes with variety across the world.

The industrial textiles segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The segment is witnessing a significant growth rate due to growing demand for highly specialized yarns which are applicable for transportation, filtration, and construction as well. Industrial textile needs yarns with high performance and characteristics like high tensile strength, durability, flexibility and resistance for environmental wear and tear.

Spinning Process Insights

How did Short Staples Spinning Process Dominate the Spinning Machinery Market?

The short staple spinning segment held the largest market share in 2024, the primary reason behind the dominance of the short staple spinning process is higher demand for natural fibers such as cotton, wool, and organic fibers. A key technology in short staple spinning known as ring spinning, which is majorly adopted by leading companies to generate high quality yarn with low upfront investment, making it an attractive choice for many manufacturers of the spinning machinery market.

The long staple spinning segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. Long staple fibers are generally used to produce high quality and durable fabrics which offer stronger, smoother, and improved quality yarn with uniform structure. It is majorly used for high quality apparel, luxury clothing, and technical textiles like automotive and aerospace.

Sales Channel Insights

How did Direct Sales Dominate the the Spinning Machinery Market in 2024?

The direct sales segment held the largest market share in 2024, due to the ability to easily understand what exactly consumers' needs are, leading to customized solutions with affordability and high quality as well. By removing the need for distributors and agents or other intermediaries reduces total costs related to sales and distribution methods. Direct sales further offer customized and required after-sales services at a reasonable cost and help create a faster machine delivery service by having direct communication with consumers.

The online channels segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The segment is significantly impacting the spinning machinery market due to its offerings like wider product range, expansion of e-commerce, cost-effectiveness, convenience and easy accessibility along with enhanced consumer interaction.

Regional Insights

Asia Pacific

Why is Asia Pacific considered the largest contributor to the Spinning Machinery Market?

Asia Pacific held the largest market share in 2024 and is expected to sustain the same position during the foreseeable period owing to the region's expanding automation in multiple sectors. Due to technological advancement in spinning machinery where industries are embracing highly efficient and automated machines in the spinning machinery sector aiming to boost productivity and minimize overall operational costs. The increasing demand for high-quality textiles and shift towards sustainable and environmentally friendly products are some of the key drivers of Asia pacific spinning machinery market. Moreover, the increasing emphasis on high production and innovations in energy efficient machines further fuels market growth.

What to Expect from India and China in Spinning Machinery Market?

On a country level, like India and China are major contributor for the expansion of spinning machinery market as rapid growth witnessed by these countries in a recent year. These countries are emerging as global exporters of textiles, and leading market players are unveiling advanced machinery to excel further globally.

- For instance, In February 2025, a leader and pioneer in the Indian CNC industry, LMW ltd., launches their cutting-edge CNC machineries with technological advancement at the stage of IMTEX 2025.

Moreover, Southeast Asian countries such as Bangladesh and Vietnam are also showcasing growing trajectory for textile industries. The growth in domestic production, export activities and government support for building textile sector are prominent reasons why these countries are fueling on a large scale and contributing to the global spinning machinery market.

What are the factors contributing to Fastest-Growth of North America Region?

North America is seen as the fastest-growing area for spinning technology, with increased demand fueled by textile reshoring, automated upgrades, and the other aspects of "Industry 4.0" in fiber processing environments. While 2021 saw more adoption of spinning machinery in the U.S. and Canada than any other market, adoption is projected to accelerate in 2022 and 2023 as manufacturers focus on productivity investment strategy. Manufacturers are migrating from labor-dependent operations or are taking advantage of automation redundancy for their initial labor demands, while increasing operational precision. Growing sustainability trends, including recycling fiber manufacturing projects, are causing around-the-clock facilities to demand new equipment.

United States

The U.S. is emerging as a strategic growth area for spinning machinery, including advancements in spinning technologies, with recent revitalization in the U.S. textile industry as well as increased investment new automation & ammunition. Producers have continued to invest in modern companies are significantly upgrading or replacing engagement to emerge even somewhat regional competitors in low-cost. The increase of recycled cotton materials, cotton blends, and performance materials contributes to increased demand for spinning to process materials that contain varying fiber characteristics and simultaneously satisfactory operational output.

How Europe is a Stable and Growing Region?

Europe's spinning machinery sector continues to see steady growth as it benefits from a strong home-grown technical-textile base, high-quality standards, and sustainable fiber processing. Various countries in Western and Central Europe are upgrading spinning systems to enable circular-economy models, particularly in the production of recycled fiber yarns. There is also an increasing use of digital monitoring and predictive-maintenance applications to maximize productivity in older spinning plants.

Germany

Germany maintains its position as a key market in Europe due to high-precision textile engineering technology, heavy industrial automation, and consistent demand for technical-textile manufacturing. German manufacturers are investing in high-speed ring-spinning and compact spinning machinery to improve yarn consistent and productivity and efficiency. Germany's industrial clusters actively work with suppliers of machinery to integrate robotic systems, digital controls, and energy-saving components into spinning machines. Germany's sustainability mandates drive new machines that are design for recycling color and the lowest fall out possible.

Value Chain Analysis for Spinning Machinery Market

- Raw Material Sourcing- Fibers such as cotton, polyester, and blends yarns are obtained for spinning machine usage.

Key Players: Indorama Ventures, Reliance Industries, Arvind Limited, Grasim Industries. - Machinery Manufacturing- Manufacturers develop and manufacture spinning machines (ring frames, rotor spinning machines, compact spinners), emphasizing efficiency and automation.

Key Players: Rieter, Trützschler, Saurer, Toyota Industries. - Intermediate Supply- Suppliers supply machine specific parts such as spindles, drafting systems, and automation software; these parts provide assured performance in the operation.

Key Players: Schlafhorst (Saurer), Lakshmi Machine Works (LMW), Murata Machinery, Oerlikon. - Distribution & Sales- Machines are distributed to textile mills through dealers, agents, and direct sales; includes after-sale service for maintenance and updates.

Key Players: Rieter India, Trützschler India, Saurer India, LMW. - After-Sales Service & Support- Includes maintenance, spare parts, training, retrofitting; provides long life for machines, reduced uptime to a certin minimum, and increased productivity for end-users.

Key Players: Rieter Service, Trützschler Services, Saurer Services, Lakshmi Machine Works.

Spinning Machinery Market Companies

- Rieter Holding AG

- Saurer Intelligent Technology AG

- Lakshmi Machine Works Ltd. (LMW)

- Truetzschler Group

- Marzoli Machines Textile S.r.l.

- Toyota Industries Corporation

- Murata Machinery Ltd. (Muratec)

- Savio Machine Tessili S.p.A.

- Jingwei Textile Machinery Co., Ltd.

- Zhejiang Tatian Co., Ltd.

- Jiangsu Jinlong Machinery

- Electro-Jet S.A.

- SSM Scharer Schweitzer Mettler AG

- Perfect Equipements

- A.T.E. Enterprises

- Veejay Lakshmi Engineering Works Ltd.

- TMT Machinery, Inc.

- Pacific Associates

- Bhagat Textile Engineers Pvt. Ltd.

- Zhejiang Rifa Textile Machinery Co., Ltd.

Recent Developments

Rieter

- Acquisition: In May 2025, a leading market player Rieter announced that, it has acquired Barmag from OC Oerlikon for substantial equity purchase value of CHF 713 million, aiming to become leading player in natural and manmade fibers.(Source: https://www.rieter.com)

Toyota industries

- Privatization: In June 2025, a frontier in the global market, Akio Toyoda offers USD 33 billion bid which convert Toyota industries into private sector, aiming to restructure Toyota's business aiming corporate reshaping movement.(Sourtce: https://www.cbtnews.com)

Segments Covered in the Report

By Machine Type

- Ring Spinning Machine

- Rotor Spinning Machine (Open-End Spinning)

- Air-Jet Spinning Machine

- Friction Spinning Machine

- Others (e.g., Vortex, Electrostatic)

By Operation Type

- Automatic

- Semi-Automatic

- Manual

By Material Type

- Natural Fibers (Cotton, Wool, etc.)

- Synthetic Fibers (Polyester, Nylon, etc.)

- Blended Fibers

By End-Use Industry

- Apparel & Fashion

- Home Textiles

- Industrial Textiles

- Medical Textiles

- Automotive Textiles

- Others

By Spinning Process

- Short Staple Spinning

- Long Staple Spinning

By Sales Channel

- Direct Sales

- Distributors & Dealers

- Online Channels

By Region

- Asia-Pacific

- Europe

- North America

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting