What is Plastic Processing Machinery Market Size?

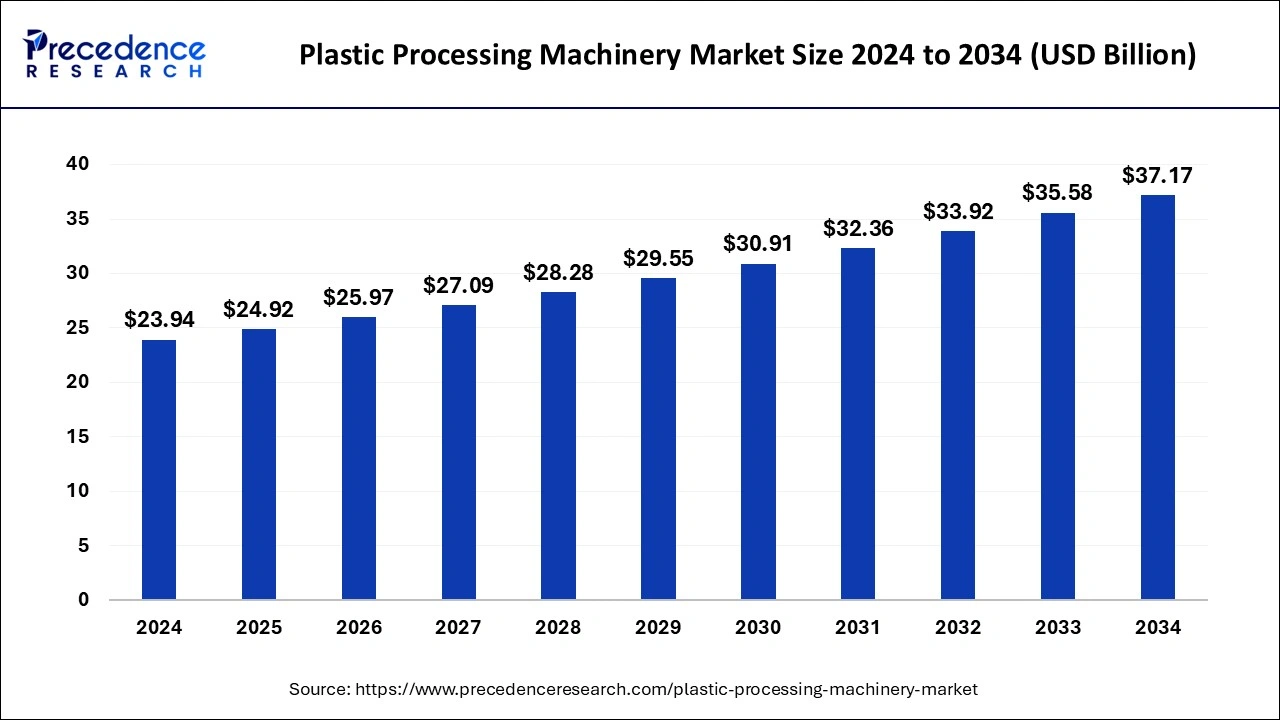

The global plastic processing machinery market size is estimated at USD 24.92 billion in 2025 and is predicted to increase from USD 25.97 billion in 2026 to approximately USD 37.17 billion by 2034, expanding at a CAGR of 4.50% from 2025 to 2034.

Market Highlights

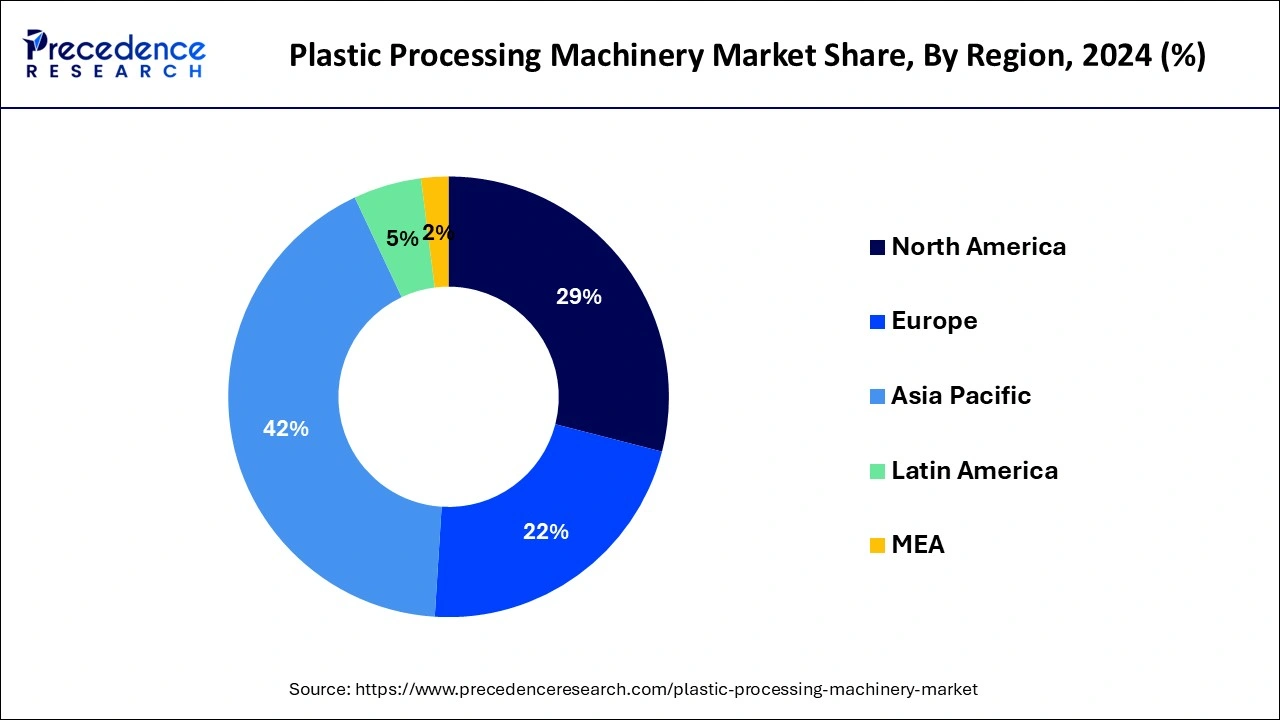

- Asia-Pacific contributed more than 42% of market share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By product, the injection molding machine segment has held the largest market share of 51% in 2024.

- By product, the extrusion machinery segment is anticipated to grow at a remarkable CAGR of 4.16% between 2025 and 2034.

- By industry vertical, the automotive segment generated over 40% of market share in 2024.

- By industry vertical, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

What Integrals are Assisting the Plastic Processing Machinery?

Plastic processing machinery encompasses a diverse range of equipment designed for the manufacturing and shaping of plastic products. These machines play a pivotal role in the entire plastic production process, from raw material preparation to the final product. Injection molding machines, extruders, blow molding machines, and thermoforming equipment are key components of this machinery, each serving a specific purpose in transforming raw plastic materials into a variety of finished goods. Injection molding machines are integral for creating intricate and detailed plastic components, while extruders are crucial for producing continuous lengths of plastic profiles.

Blow molding machines are employed for manufacturing hollow plastic products, and thermoforming equipment molds heated plastic sheets into desired shapes. The efficiency and versatility of plastic processing machinery contributes significantly to the mass production and customization of plastic items across various industries, including packaging, automotive, and consumer goods.

Plastic Processing Machinery Market Growth Factors

- The escalating demand for plastic products across diverse industries, including packaging, automotive, and consumer goods, serves as a primary growth factor for the plastic processing machinery market. The surge in demand is fueled by the versatility and cost-effectiveness of plastic materials.

- Ongoing advancements in plastic processing machinery technology, such as the integration of automation, robotics, and digital control systems, contribute to enhanced efficiency and productivity. Advanced technologies attract industries seeking precision, speed, and improved manufacturing processes.

- Growing awareness of environmental concerns and the push for sustainable practices drive the demand for plastic processing machinery that supports recycling and the use of eco-friendly materials. The market responds to the industry's commitment to reducing environmental impact.

- The globalization of manufacturing processes and the establishment of production facilities in emerging economies contribute significantly to the expansion of the plastic processing machinery market. As industries expand globally, there is an increased need for advanced machinery to meet rising production demands.

- Stringent regulations and standards regarding product quality, safety, and environmental impact influence the plastic processing machinery market. Compliance with these regulations necessitates the adoption of advanced machinery that meets or exceeds industry standards.

- Industries seek plastic processing machinery that offers customization and flexibility to accommodate diverse production needs. Machinery that can adapt to changing product specifications and materials caters to the dynamic demands of various sectors.

- The global trend of rapid urbanization and infrastructure development fuels the demand for plastic products, including pipes, fittings, and construction materials. This, in turn, drives the need for advanced plastic processing machinery to meet the requirements of the construction and infrastructure sectors.

- The adoption of Industry 4.0 principles and smart manufacturing practices in the plastics industry contributes to the growth of the plastic processing machinery market. Integration of smart technologies enhances connectivity, automation, and data exchange, leading to more efficient and optimized manufacturing processes.

Plastic Processing Machinery Market Outlook:

- Global Expansion: A rise in robust demand from industries, particularly packaging, automotive, and construction, and other technological pushes, with sustainable approaches, is impacting the global progression.

- Major Investor:In February 2025, Bain Capital made a major investment in the Milacron Injection Moulding and Extrusion business.

- Startup Ecosystem: In May 2025, ReVentas, a Scottish startup, secured Series A funding for the transition of its plastic recycling process from a pilot plant to commercial operations within the next three years.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 24.92 Billion |

| Market Size in 2026 | USD 25.97 Billion |

| Market Size by 2034 | USD 37.17 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.50% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Dominating Region | Asia Pacific |

| Segments Covered | Product and Industry Vertical and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for plastic products

- According to the World Bank, global plastic production has increased from 225 million metric tons in 2005 to over 368 million metric tons in 2019.

The escalating demand for plastic products across various industries, including packaging, automotive, and consumer goods, acts as a significant catalyst for the surge in market demand for plastic processing machinery. As consumers and industries increasingly favor plastic materials for their versatility, cost-effectiveness, and diverse applications, manufacturers are compelled to enhance production capabilities. This heightened demand necessitates the adoption of advanced plastic processing machinery to meet the growing production requirements. Industries such as packaging rely heavily on plastic materials for their lightweight, durable, and customizable properties. Similarly, the automotive sector utilizes plastics for components that enhance fuel efficiency and reduce vehicle weight. This growing preference for plastic solutions propels manufacturers to invest in cutting-edge plastic processing machinery, ensuring increased efficiency, precision, and the ability to meet the evolving demands of a market driven by the widespread use of plastic products.

Restraint

Global economic uncertainties

Global economic uncertainties present a significant restraint to the market demand for plastic processing machinery. Fluctuations in the global economy, driven by factors such as trade tensions, recessions, or regional economic downturns, can create an atmosphere of uncertainty for industries relying on capital-intensive investments, including the plastic processing sector. During periods of economic instability, manufacturers may exercise caution and delay capital expenditures, including the acquisition of new plastic processing machinery. This hesitancy stems from concerns about unpredictable market demand, financing challenges, and an overall risk-averse approach in the face of uncertain economic conditions. Moreover, a slowdown in economic activities can directly impact sectors that are major consumers of plastic products, such as automotive and construction. Reduced demand for plastic goods translates into diminished requirements for processing machinery. The interdependence of the plastic processing machinery market on the broader economic landscape underscores the vulnerability of the industry to economic uncertainties, affecting investment decisions and hindering the overall growth trajectory of the market.

Opportunity

investment in circular economy initiatives

Investments in circular economy initiatives present substantial opportunities for the plastic processing machinery market. Governments and businesses worldwide are channeling resources into initiatives that promote recycling, reusing, and reducing plastic waste. Plastic processing machinery manufacturers can leverage this trend by developing equipment that supports the use of recycled materials, enhances energy efficiency, and facilitates closed-loop production processes. As a result, there is a growing market for machinery capable of efficiently processing recycled plastics, aligning with circular economy principles.

- The Ellen MacArthur Foundation estimates that transitioning to a circular economy could generate a net economic benefit of USD 4.5 trillion by 2030.

This economic shift creates a favorable landscape for plastic processing machinery manufacturers to innovate and capture a share of the market. Machinery designed to meet the requirements of circular economy practices positions manufacturers as key contributors to sustainability efforts, fostering partnerships with businesses committed to reducing their environmental footprint.

Segment Insights

Product Insights

In 2024, the injection molding machinery segment had the highest market share of 51% on the basis of the product. The injection molding machinery segment in the plastic processing machinery market involves equipment that molds molten plastic material into a desired shape through high-pressure injection. This segment is witnessing a trend towards advanced technologies, including the integration of automation and precision control systems. Manufacturers are focusing on enhancing efficiency, reducing cycle times, and optimizing energy consumption in injection molding processes. The demand for injection molding machinery is driven by its versatility in producing intricate and detailed plastic components across various industries, contributing to the segment's sustained growth.

The extrusion machinery segment is anticipated to expand at a significant CAGR of 4.16% during the projected period. Extrusion machinery in the plastic processing machinery market refers to equipment that shapes and forms plastic materials by forcing them through a die. This versatile segment encompasses single and twin-screw extruders, used in the production of various plastic products, from pipes and films to profiles and sheets. A prominent trend in extrusion machinery involves technological advancements, such as the integration of smart controls and automation, enhancing precision and production efficiency. Additionally, there is a growing focus on developing extruders capable of processing recycled materials, aligning with the industry's shift toward sustainability and circular economy practices.

Industry Vertical Insights

According to the industry vertical, the automotive segment has held 40% market share in 2024. In the plastic processing machinery market, the automotive segment involves the manufacturing of plastic components used in vehicles, ranging from interior parts to exterior body panels. A notable trend in this sector is the increasing adoption of lightweight and durable plastics to enhance fuel efficiency and reduce overall vehicle weight. Plastic processing machinery is pivotal in shaping these automotive components, with a growing emphasis on precision and efficiency. As the automotive industry continues to prioritize sustainability, machinery trends focus on eco-friendly materials and energy-efficient processes to align with global environmental standards.

The healthcare segment is anticipated to expand fastest over the projected period. In the healthcare segment, plastic processing machinery refers to equipment used to manufacture medical devices, packaging materials, and other plastic components essential to the healthcare industry. The machinery caters to the stringent requirements of the sector, ensuring precision, cleanliness, and compliance with regulatory standards. A notable trend in this segment involves the increasing demand for specialized machinery capable of producing complex and biocompatible medical components. This includes the adoption of advanced materials and technologies to meet the evolving needs of the healthcare industry for innovative and safe plastic products.

Regional insights

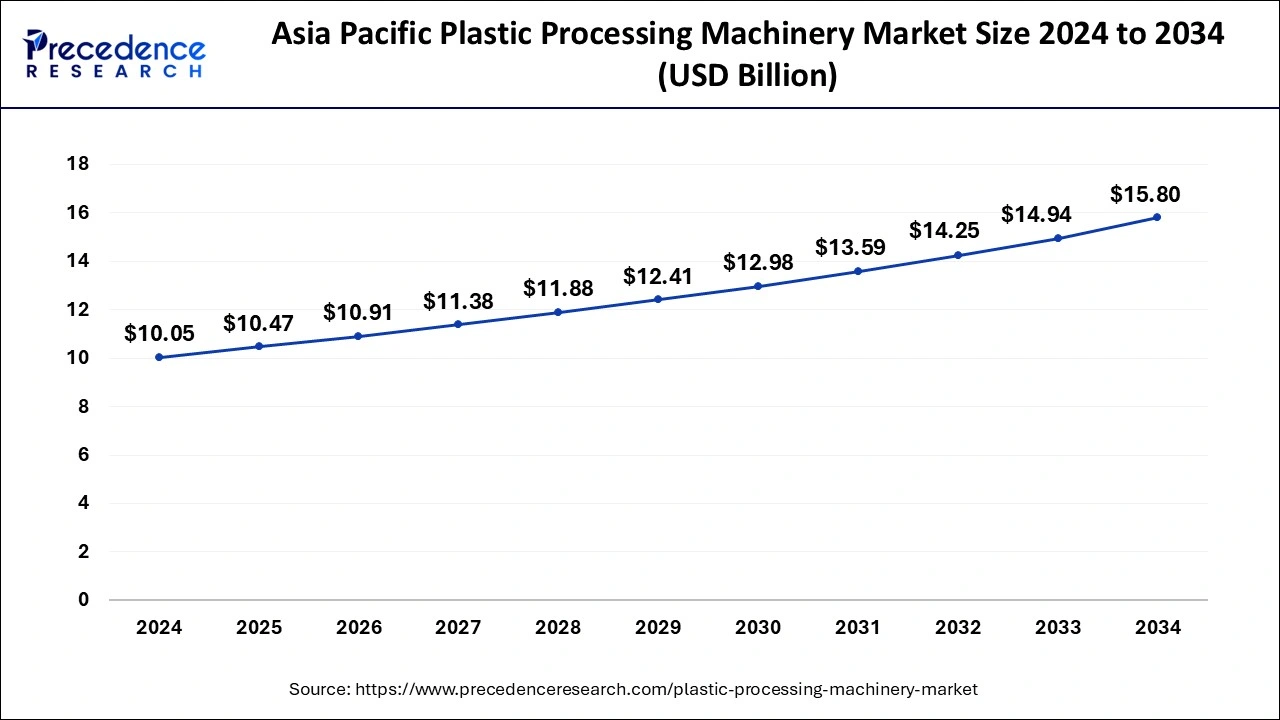

Asia Pacific Plastic Processing Machinery Market Size and Growth 2025 to 2034

TheAsia Pacific plastic processing machinery market size is exhibited at USD 10.47 billion in 2025 and is projected to be worth around USD 15.80 billion by 2034, growing at a CAGR of 4.63% from 2025 to 2034.

How did the Asia Pacific Dominate the Market in 2024?

On the other hand, Asia Pacific held the largest share of 42% in the plastic processing machinery market due to a combination of factors. Asia Pacific dominates the plastic processing machinery market due to robust industrialization, expanding manufacturing sectors, and the region's role as a global manufacturing hub. Countries like China and India witness high demand for plastic products across various industries, propelling the need for advanced processing machinery. Additionally, the availability of cost-effective labor, favorable government policies, and continuous technological advancements further contribute to the significant market share. The region's economic growth, coupled with the thriving plastics industry, positions Asia Pacific as a key player in the global plastic processing machinery market.

Expanding Economy Initiatives are Fueling North America

North America is poised for rapid growth in the plastic processing machinery market due to factors such as increasing demand for plastic products across industries, technological advancements, and a focus on sustainability. The region's robust manufacturing sector, particularly in the United States, contributes to the need for advanced machinery. Additionally, investments in circular economy initiatives and the rising demand for customized and innovative plastic solutions further drive the market. With a favorable economic landscape and a growing emphasis on cutting-edge technologies, North America presents significant opportunities for expansion in the plastic processing machinery sector.

Meanwhile, Europe is experiencing substantial growth in the plastic processing machinery market due to several factors.

- As per Eurostat, the construction sector accounted for 5.6% in 2021 and reached 3.6% in 2022. This growth is attributed to the residential and non-residential market growing at 3.4% and 3.7% respectively, followed by an expected annual growth of between 0.6% and 2.1% until 2024.

Emerging Innovative Technologies are Promoting Europe

Europe is experiencing substantial growth in the plastic processing machinery market due to several factors. The region's focus on sustainability and stringent environmental regulations is driving the adoption of advanced machinery that supports recycling and eco-friendly practices. Additionally, the robust manufacturing sector, especially in automotive and packaging, is increasing the demand for sophisticated plastic processing equipment. Europe's commitment to technological innovation, coupled with investments in Industry 4.0 technologies, further contributes to the region's significant growth in the plastic processing machinery market.

Leveraging Robust Machinery Solutions: China Market Trends

Many leading Chinese companies are supporting the transformation of high-speed, high-precision machines, like the servo-hydraulic MA2100F/580 unveiled by Haitian. This is mainly created for demanding applications, including thin-wall packaging and in-mold labeling (IML). Alongside, Chiona is accelerating innovative materials, like advanced polymers, recycled plastics (rPET), and biodegradable alternatives.

Emphasis on Energy Efficiency: U.S. Market Trend

Emergence of diverse solutions in the plastic processing machinery market of the U.S., like Milacron LLC (USA), introduced energy-efficient injection molding machines and gained automation integrators to provide comprehensive, turnkey solutions. At the same time, Husky Injection Molding Systems launched the HyPET HPP50 Recycled Melt to Preform system for converting washed flake into preforms.

Impactful OPC UA Standard: German Market Trend

The German market has been transforming due to the widespread involvement of the Open Platform Communications Unified Architecture (OPC UA) standard to streamline cross-manufacturer, machine-to-machine communication, allowing feasible integration into smart factory systems. Companies, like ARBURG GmbH + Co KG, presented their ALLROUNDER 720 E GOLDEN ELECTRIC machine for high-precision medical components at the Fakuma trade fair.

Raising Steps into Recycling Approaches are Encouraging MEA

A notable expansion of the plastic processing machinery market in MEA has been driven by the growing shift towards the development of novel recycling solutions, such as Covestro's partnership with Egyptian packaging manufacturers to create recycled plastic for the food and beverage sector. However, the Eastman Chemical Company unveiled its chemical recycling technology to the UAE, focusing on offering sustainable material options.

Plastic Processing Machinery Market: Value Chain Analysis

- Raw Material Sourcing

This mainly comprises sourcing diverse metals, especially high-strength and tool steels, as well as other engineered materials for specialised components.

Key Players: H R PLASTIC INDUSTRIES, Meru Industries, New Orange Plastic Machinery, etc. - Maintenance and After-Sales Service

The company should have cleaning and lubrication, and more comprehensive support, like on-site technical service, spare parts, and operator training.

Key Players: ENGEL AUSTRIA GmbH, Husky Injection Molding Systems Ltd, KraussMaffei, etc. - Product Lifecycle Management

For this, players are using a central "single source of truth" for all product data to enhance collaboration, accelerate productivity, improve sustainability, and boost product quality throughout each stage.

Key Players: Siemens PLM, PTC (with Windchill), SAP, etc.

Recent Developments

- In July 2022, SACMI Group marked a significant milestone by inaugurating its regional headquarters in Mumbai, India, exclusively dedicated to its rigid packaging business. This move signifies the company's strategic commitment to the Indian market and the growing demand for rigid packaging solutions in the region.

- In May 2022, Husky Technologies introduced the HyPET HPP50 Recycled Melt to PreformTM system, revolutionizing preform injection molding. This innovative system converts washed flake into preforms, contributing to sustainable practices by utilizing recycled materials in the manufacturing process.

- In August 2021, Sumitomo Heavy Industries expanded its product lineup with the launch of the SE400HS-CI double-shot injection molding machine. This introduction aimed to enhance productivity, meeting the evolving needs of the injection molding industry.

- In March 2021, Milacron strengthened its presence in North America by introducing the FANUC Roboshot ALPHA-SIB series, incorporating enhanced features to cater to diverse market requirements.

- In January 2021, Haitian Vietnam Ltd., a subsidiary of the Haitian group, established a new 1,000 sq.m. facility in Ho Chi Minh City. This facility serves as a versatile space for product displays, meetings, after-sales support, and offices, reflecting the company's commitment to providing comprehensive services and support to its clients in the region.

Top Plastic Processing Machinery Market Companies and Their Offerings

|

Company |

Strategic Move / Focus |

Offering / Strength |

Impact on Market Growth |

|

Arburg |

Leading on sustainability & digitalisation |

ALLROUNDER electric, hybrid & hydraulic machines, robotic systems, turnkey cells |

Drives innovation in energy-efficient, connected manufacturing |

|

Husky Injection Molding Systems |

Focus on circular economy & rPET. |

HyPET 6e platform: 100% rPET capability, regenerative energy management, real-time remote monitoring |

Boosts sustainability and cost-efficiency in packaging production |

|

Milacron |

End-to-end lifecycle partner, IIoT integration |

Broad injection-molding portfolio: C-Series (large tonnage), eQ (all-electric), Q & N-Series with servo or toggle drives |

Supports diverse applications, helps reduce energy consumption & improve productivity |

|

Sumitomo Heavy Industries |

Core strategic R&D in injection molding |

Produces electric and hybrid injection machines along with automation and precision systems |

Strengthens the market's premium and high-precision segments |

|

Haitian International Holdings Ltd. |

Aggressive global expansion, vertical integration |

Offers all-electric (Zhafir), servo-hydraulic (Mars/Jupiter), and hybrid machines used across many sectors |

Increases accessibility of low-cost, efficient machines and scales machine volume worldwide |

Segments Covered in the Report

By Product

- Injection Molding Machinery

- Extrusion Machinery

- Blow Molding Machinery

- Others

By Industry Vertical

- Packaging

- Automotive

- Construction

- Consumer Goods

- Healthcare

- Other (Agriculture, etc.)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting