Microbiome Manufacturing Market Size and Forecast 2025 to 2034

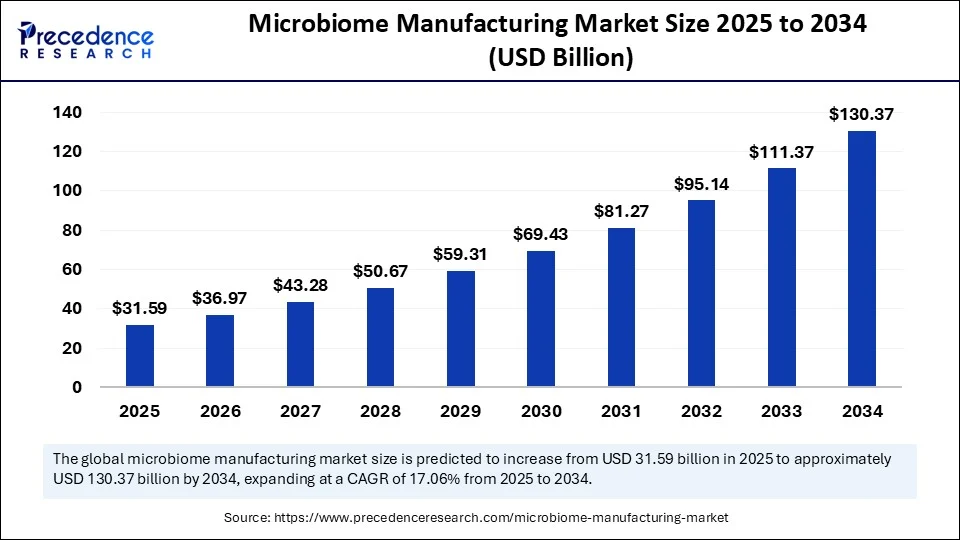

The global microbiome manufacturing market size accounted for USD 26.98 billion in 2024 and is predicted to increase from USD 31.59 billion in 2025 to approximately USD 130.37 billion by 2034, expanding at a CAGR of 17.06% from 2025 to 2034. The market growth is attributed to rising investments in microbiome research, regulatory approvals of live microbial therapeutics, and the expansion of GMP-compliant manufacturing capabilities.

Microbiome Manufacturing MarketKey Takeaways

- In terms of revenue, the global microbiome manufacturing market was valued at USD 26.98 billion in 2024.

- It is projected to reach USD 130.37 billion by 2034.

- The market is expected to grow at a CAGR of 17.06% from 2025 to 2034.

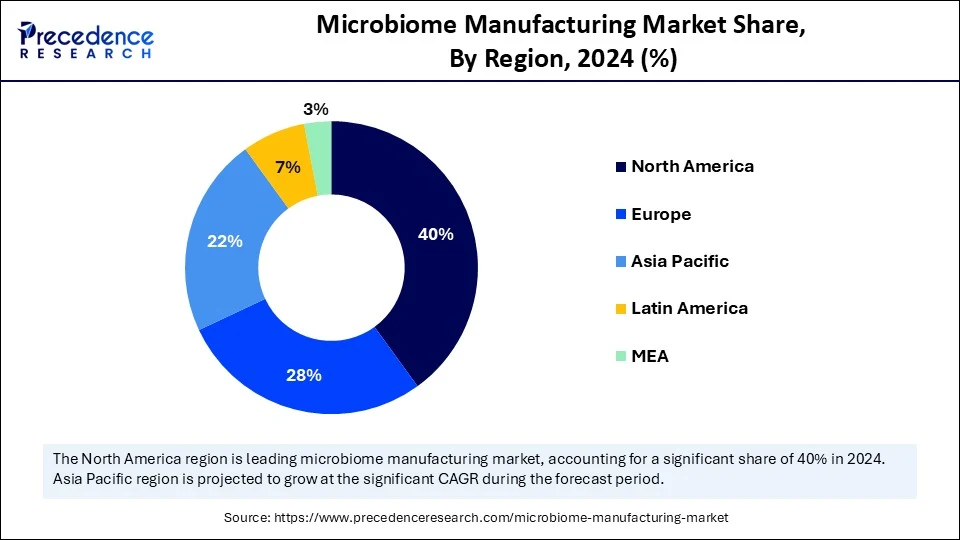

- North America dominated the microbiome manufacturing market with the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By product type, the probiotics segment held the major market share of 40% in 2024.

- By product type, the live biotherapeutics segment is projected to grow at a CAGR between 2025 and 2034.

- By manufacturing process, the fermentation segment contributed the highest market share of 50% in 2024.

- By manufacturing process, the formulation & packaging segment is expanding at a significant CAGR between 2025 and 2034.

- By end user, the pharmaceutical & biotechnology companies segment captured the maximum market share of 55% in 2024.

- By end user, the contract development manufacturing organizations (CDMOs) segment is expected to grow at a significant CAGR over the projected period.

- By technology/platform, anaerobic fermentation platforms segment generated the major market share of 45% in 2024.

- By technology/platform, the microfluidics-based culturing segment is expected to grow at a notable CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Microbiome Manufacturing Market

Artificial intelligence is revolutionizing the manufacturing of microorganisms by producing more intelligent, quicker, and reliable processes throughout the entire value chain. Using AI tools, researchers decipher the complex microbial communities and identify the most promising strains for therapeutic and diagnostic purposes. Moreover, AI-driven platforms control fermentation parameters in real-time, adjust nutrient feed, and forecast yield results. This enables companies to sustain high product consistency while reducing waste and production expenses, allowing for significant growth in the microbiome manufacturing market

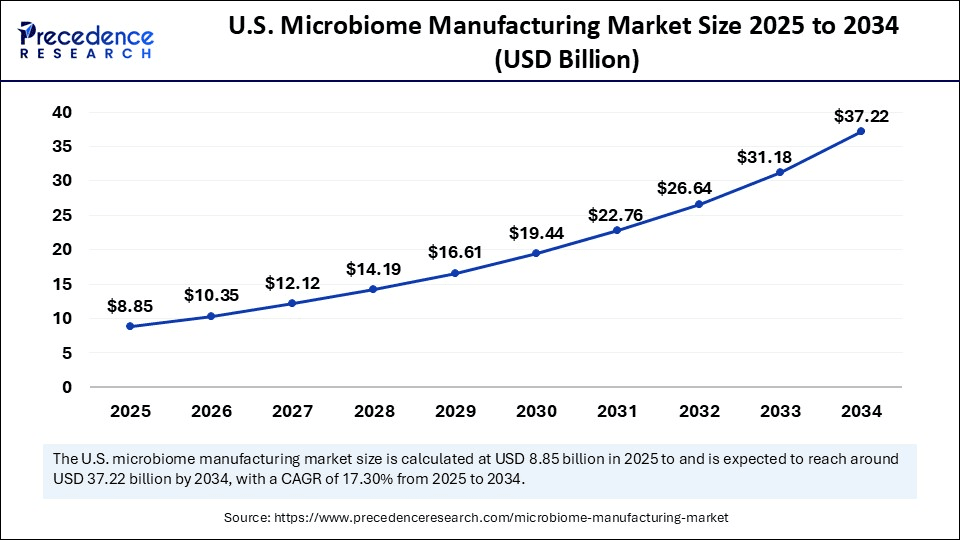

U.S. Microbiome Manufacturing Market Size and Growth 2025 to 2034

The U.S. microbiome manufacturing market size was exhibited at USD 7.55 billion in 2024 and is projected to be worth around USD 37.22 billion by 2034, growing at a CAGR of 17.30% from 2025 to 2034.

Why Did North America Lead the Regional Landscape of the Microbiome Manufacturing Market?

North America led the microbiome manufacturing market, capturing the largest revenue share in 2024, due to its advanced clinical pipelines, sound regulatory frameworks, and the concentration of biotech companies that have pioneered live microbial therapeutics. Large research institutes such as Harvard Medical School, Stanford University, and the UC San Diego Center for Microbiome Innovation fast-tracked translational initiatives that pipelined candidates to GMP production and tech transfer pipelines.

Big CDMOs and other equipment vendors invested in anaerobic fermentation suites, aseptic fill-finish lines, and digital biomanufacturing systems. This is estimated to reduce production lead times and increase the reproducibility of batches. In 2024, the NIH tripled targeted microbiome funding, including a significant USD 10.7 million grant to build a translational center, which is expected to add a skilled workforce and pilot-scale infrastructure. Furthermore, industry-academic collaborations and federal grants are likely to expand process validation capabilities and accelerate regulatory-compliant manufacturing operations across North American locations. (Source: https://news.okstate.edu)

The Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the upscaling of R&D investment, regulatory transparency, and increased production capacity undertaken by governments and institutions in 2024. In 2024, India became home to the microbiome consortia, which were established in collaboration with the DBT and ICMR, further boosting clinical trial activity and specialized bioprocess team training. Additionally, the strategic alliances of multinational sponsors and talent development in the region in 2024 are expected to enhance tech transfer, regulatory filings, and commercial roll-outs in the Asia-Pacific markets.(Source: https://itif.org)

(Source: https://dbtindia.gov.in)

Market Overview

The microbiome manufacturing market encompasses the development and large-scale production of live microbial therapeutics, probiotics, and microbial consortia for human health, nutrition, and diagnostics, facilitated by the use of advanced fermentation technologies and live-biotherapeutic production systems. Scientists can cultivate complex microbial communities in a tightly controlled growth environment, ensuring potency, stability, and therapeutic precision.

Regulatory development reflects the maturity of this field. The U.S. FDA's approval of Vowst in 2023 and Rebyota in 2022 were landmark approvals as the first microbiome-based products for recurrent Clostridioides difficile infection (CDI). These approvals confirmed the scientific and regulatory pathways necessary for live microbial products and paved the way for the further commercialization of these products. Moreover, regulatory bodies, such as the EMA and Health Canada, have launched supportive structures for microbiome-based products, indicating a concerted global push to speed adoption.

Microbiome Manufacturing MarketGrowth Factors

- Driving Demand for Personalized Nutrition: Rising consumer awareness of gut health is driving interest in microbiome-based dietary solutions tailored to individual needs.

- Growing Pipeline of Oncology Applications: The expanding use of microbiome-derived therapies in cancer treatment is boosting both clinical and commercial research activity.

- Rising Integration of AI and Machine Learning: Advanced computational models are fuelling faster strain discovery and optimization in microbiome production workflows.

- Boosting Partnerships Between Pharma and Biotech: Strategic collaborations between large pharmaceutical companies and microbiome-focused start-ups are accelerating product development.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 130.37 Billion |

| Market Size in 2025 | USD 31.59 Billion |

| Market Size in 2024 | USD 26.98 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Manufacturing Process, End User, Technology / Platform, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Increasing Prevalence of Chronic and Lifestyle-Related Diseases Fueling Growth in the Microbiome Manufacturing Market?

The increasing prevalence of chronic and lifestyle-related diseases is expected to drive the microbiome manufacturing market in the coming years. This presents high-potential opportunities for microbiome-based therapeutics in addressing gastrointestinal disorders, metabolic syndromes, autoimmune disorders, and obesity. Healthcare providers and patients are undergoing a paradigm shift toward microbiome-modulating solutions that target the root cause of microbial imbalances rather than their symptoms. To address those conditions, companies are progressing targeted bacterial consortia and live biotherapeutic products, and large-scale production necessitates advanced microbial culture, fermentation, and formulation systems. (Source: https://www.who.int)

This trend encourages manufacturers to invest in scalable platforms that enable high volumes and complex microbial consortia for clinical and commercial applications. This is further compounded by the global obesity epidemic, WHO 2024 reporting identifies 2.5 billion adults overweight, and 890 million living with obesity across the globe in 2022. Furthermore, with an additional 35 million children under the age of 5 expected to be overweight in 2024, this drives downstream demand for microbiome interventions. In addition, CDC data in 2024 suggest that 2.4-3.1 million US adults are living with inflammatory bowel diseases, which further validates the therapeutic target of microbiome products. Moreover, the surging demand for precision medicine is expected to drive manufacturing innovation, thereby further propelling the market in the coming years.(Source:https://www.cdc.gov)

Restraint

High Manufacturing Complexity Anticipated to Challenge Scalability

High manufacturing complexity is anticipated to challenge scalability, further hindering the microbiome manufacturing market in the coming years. Cultivated different strains of microbial organisms for the live biotherapeutic products that require highly controlled growth conditions. Tiny discrepancies in fermentation conditions lead to batch-to-batch variation, increasing the likelihood of finished product rejection. Moreover, high production and operational costs are expected to negatively impact profitability, further hindering market growth.

Opportunity

Why Are Growing Investments in Microbiome Research and Development Accelerating Manufacturing Demand Across the Market?

Growing investments in microbiome research and development are projected to accelerate manufacturing needs, further creating immense opportunities for the market. Billions of dollars are being invested in microbial genomics, synthetic biology platforms, human trials, and other projects directed at the human microbiome. Tech companies, drug giants, and international organizations are funding biotech startups that are experimenting with new microbial treatments.

Research programs also support innovation in bioprocessing technologies, which enable higher yields and efficiency while adhering to stringent regulatory requirements in the microbiome manufacturing market. In 2024, the NIH announced that more than 25% of its microbiome-related funding would be dedicated to translational and clinical projects that focus on scale-up and manufacturing readiness for live biotherapeutics. Horizon Europe 2024 calls included dedicated funding for microbiomes under health cluster calls, which fund projects that combine bioprocess engineering with clinical pipelines. Furthermore, the high strategic collaborations between biotech firms and large pharmaceutical companies are anticipated to boost industrial-scale production.(Source: https://commonfund.nih.gov)

Product Type Insights

Which Product Type Emerged as the Leading Driver of Growth in the Microbiome Manufacturing Market?

The probiotic segment led the growth of the microbiome manufacturing market in 2024, accounting for an estimated 40% market share, as manufacturers provided stable and shelf-stable formulations across all capsule, powder, beverage, and synbiotic products that consumers and retailers rely on.Many brands utilized proven strain libraries and substantiated health claims in digestive support and immune support, which accelerated product refresh cycles and line extensions. Furthermore, partnerships with large food and ingredient manufacturers are expected to drive formulation innovation, such as the development of heat-stable and shelf-stable probiotic systems.

The live biotherapeutics segment is expected to grow at the fastest rate in the coming years, owing to its specific focus on specific diseases with characterized consortia or single strains. Clinical programs are predicted to increase following regulatory precedents of live microbial therapeutics.Developers combine metagenomics, AI-based strain selection, and anaerobic fermentation controls that are expected to increase consistency and potency in GMP batches. Moreover, the Quality-by-Design and real-time release testing approaches are being adopted by sponsors and are likely to streamline comparability and global submissions.

Manufacturing Process Insights

How Did the Dominant Manufacturing Process Shape Competitive Advantage in the Microbiome Manufacturing Market?

The fermentation segment held the largest revenue share in the microbiome manufacturing market in 2024, accounting for 50% of the market share, as manufacturers used controlled bioreactors to cultivate and sustain high-density cultures of target strains within stringent environment setpoints.

This helps yield and maintain consistent activities and strengths across clinical batches and commercial batches. Furthermore, the FDA guidance on chemistry, manufacturing, and control of live biotherapeutic products highlights fermentation-related data expectations, which is projected to maintain heavy investment in fermentation infrastructure.

The formulation & packaging segment is expected to grow at the fastest CAGR in the coming years, owing to the greater emphasis on stability, shelf life, and route-sensitive delivery of live products. This led to investments in lyophilization, microencapsulation, and controlled-release matrices that maintain the viability of products during storage and transit. Moreover, industry research has improved analytical procedures in recovery and viability testing to enable optimization in formulation and regulatory submissions aimed at product comparability.

End-User Insights

Which End User Segment Accounted for the Largest Share in the Microbiome Manufacturing Market?

Pharmaceutical & biotechnology companies accounted for the largest share of the microbiome manufacturing market in 2024, as they incorporated microbiome discovery into their current drug pipelines and subsidized translational research. These enterprises had microbiome teams that combined metagenomic analytics, strain engineering, and translational pharmacology to drive innovation. Furthermore, this accelerates candidate selection and IND-enabling operations, which increase internal manufacturing needs, thereby fueling segment growth.

The contract development and manufacturing organizations (CDMOs) segment is expected to grow at the fastest rate in the coming years, driven by the increasing demand for outsourcing complex fermentation and anaerobic processing in medical manufacturing. To address the GMP demands of live products, major CDMOs have invested in microbial-specific suites, single-use fermenters, and real-time environmental monitoring to lower technical barriers to clinical scale-up.

Lonza has completed specific microbial manufacturing expansions in 2024 and has announced additional programmatic investments in 2024-2025. This supports microbial biologics and drug-product services, which are expected to expand the availability of outsourced supplies. Additionally, the growing demand for end-to-end CDMO services, which incorporate formulation, packaging, and cold-chain logistics, further facilitates segment growth.(Source: https://www.lonza.com)

Technology/Platform Insights

Which Technology/Platform Established Leadership in the Microbiome Manufacturing Market?

The anaerobic fermenters segment established itself as the largest revenue share in the microbiome manufacturing market in 2024, holding a share of approximately 45%. Anaerobic fermenters were the workhorse of generating strict anaerobes and obligate gut commensals. Furthermore, the regulatory reviewers focused on comprehensive CMC packages based on anaerobic process characterization, which has been estimated to support heavy investment in such platforms.

The microfluidics-based culturing segment is expected to grow at the fastest rate in the coming years, owing to the accelerated discovery and small-scale production enabled by high-throughput isolation, single-cell cultivation, and controlled co-culture interactions. They are predicted to grow as developers work towards personalized and precision microbial therapies. Additionally, investing in standardized microfluidic toolkits and compatibility with AI-led analytics is expected to reduce the cost of R&D, thereby propelling the segment.

Microbiome Manufacturing Market Companies

- 4D Pharma

- ActoBio Therapeutics

- AOBiome

- Axcella Health

- BioGaia

- BiomX

- Enterome

- Exeliom Biosciences

- Ferring Pharmaceuticals

- Finch Therapeutics

- MaaT Pharma

- Microbiotica

- NuBiyota

- Prokarium

- Rebiotix (a Ferring Company)

- Second Genome

- Seres Therapeutics

- Synlogic

- Vedanta Biosciences

- Evelo Biosciences

Recent Developments

- In February 2025, MicrobioTx, an emerging company in gut microbiome research, introduced a new range of probiotics tailored to support diverse wellness needs. Developed under the guidance of renowned Indian microbiome scientist Dr. Palok Aich, the formulations aim to address the unique microbiome requirements of the Indian population. The flagship line includes DigesTx, MoodTx, GlucoTx, and LeanTx, targeting digestive health, mental wellness, glucose metabolism, and weight management, respectively.(Source: https://www.indianpharmapost.com)

- In June 2025, Danone North America, one of the largest Certified B Corporations globally, announced the 2024–2025 recipients of its Annual Gut Microbiome, Yogurt and Probiotic Fellowship Program. This year's $25,000 research grants were awarded to Owen Hale of Vanderbilt University and Ella Ramamurthy of Rice University, supporting innovative projects aimed at deepening the scientific understanding of yogurt, probiotics, and the gut microbiome.

(Source: https://www.prnewswire.com) - In February 2025, MGI Tech Co., Ltd. launched its Microbiome Metabarcoding Sequencing Package (MMSP), which is built on the company's DNBSEQ-G99 and DNBSEQ-E25 sequencing platforms. Designed for global microbiome researchers, the new package enables comprehensive community analysis using 16S/ITS rDNA sequencing, offering an efficient and cost-effective method for microbial classification and functional exploration. The technology enables scientists to study microbial diversity, abundance, and interactions across various domains, including human health, the environment, industry, and agriculture.

(Source: https://en.mgi-tech.com) - In April 2025, Metabolon, Inc., a global leader in metabolomics, unveiled an advanced microbiome research solution that combines metagenomics sequencing with a novel microbiome metabolite panel. This integrated toolkit not only identifies microbial species and genetic potential but also reveals their metabolic activities and bioactive compound production, providing deeper insights into host-microbe interactions relevant to diagnostics, therapeutics, and precision medicine.(Source: https://www.metabolon.com)

- In January 2025, Biohm Technologies announced the launch of its Longevity Gut Report as part of its gut microbiome testing platform. Leveraging AI and advanced bioinformatics, the feature assesses how an individual's microbiome composition may influence the aging process. By analyzing over 10 million data points and identifying nearly 100 key bacterial and fungal taxa associated with longevity, the company has developed a predictive model powered by machine learning and deep learning techniques.(Source: https://www.nutraceuticalsworld.com)

Segments covered in the Report

By Product Type

- Live Biotherapeutics

- Single-strain Products

- Multi-strain Products

- Probiotics

- Dietary Supplements

- Functional Foods & Beverages

- Infant Nutrition

- Postbiotics

- Prebiotics

- Microbiome-targeted Therapeutics

- Small Molecule Therapeutics

- Biologics

- Fecal Microbiota Transplant (FMT) Products

- Others

By Manufacturing Process

- Fermentation

- Batch Fermentation

- Continuous Fermentation

- Bioreactor Scale (Lab-scale, Pilot-scale, Commercial-scale)

- Downstream Processing

- Purification

- Concentration & Stabilization

- Freeze-drying / Lyophilization

- Cell Encapsulation / Microencapsulation

- Formulation & Packaging

- Liquid Formulations

- Freeze-dried Formulations

- Encapsulation & Delivery Systems

- Blister / Sachet Packaging

- Quality Control & Testing

- Microbial Assays

- Genomic & Metagenomic Testing

- Stability & Shelf-life Testing

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Research Institutes & Academic Centers

- Nutraceutical & Food Companies

- Hospitals & Clinical Trial Centers

By Technology / Platform

- Anaerobic Fermentation Platforms

- Aerobic Fermentation Platforms

- Microfluidics-based Culturing

- Automated High-throughput Systems

- Single-use Bioreactors

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting