What is the Viral Vectors & Plasmid DNA Manufacturing Market Size?

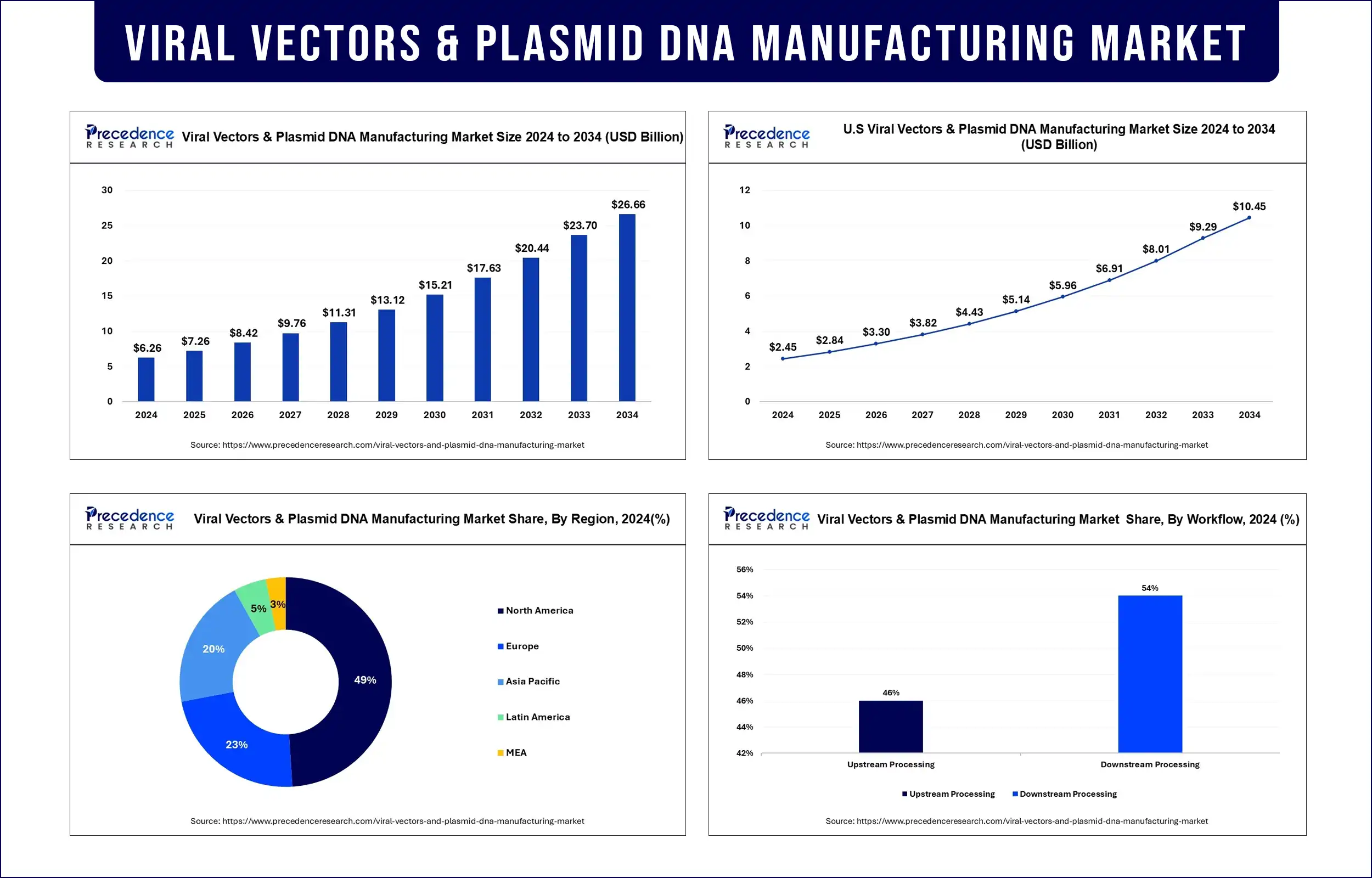

The global viral vectors & plasmid DNA manufacturing market size is calculated at USD 7.26 billion in 2025 and is predicted to increase from USD 8.42 billion in 2026 to approximately USD 29.82 billion by 2035, growing at a CAGR of 15.17% from 2026 to 2035. The viral vectors & plasmid DNA manufacturing market is driven by the increasing adoption of gene therapies for rare and genetic diseases.

Viral Vectors & Plasmid DNA Manufacturing Market Key Takeaways

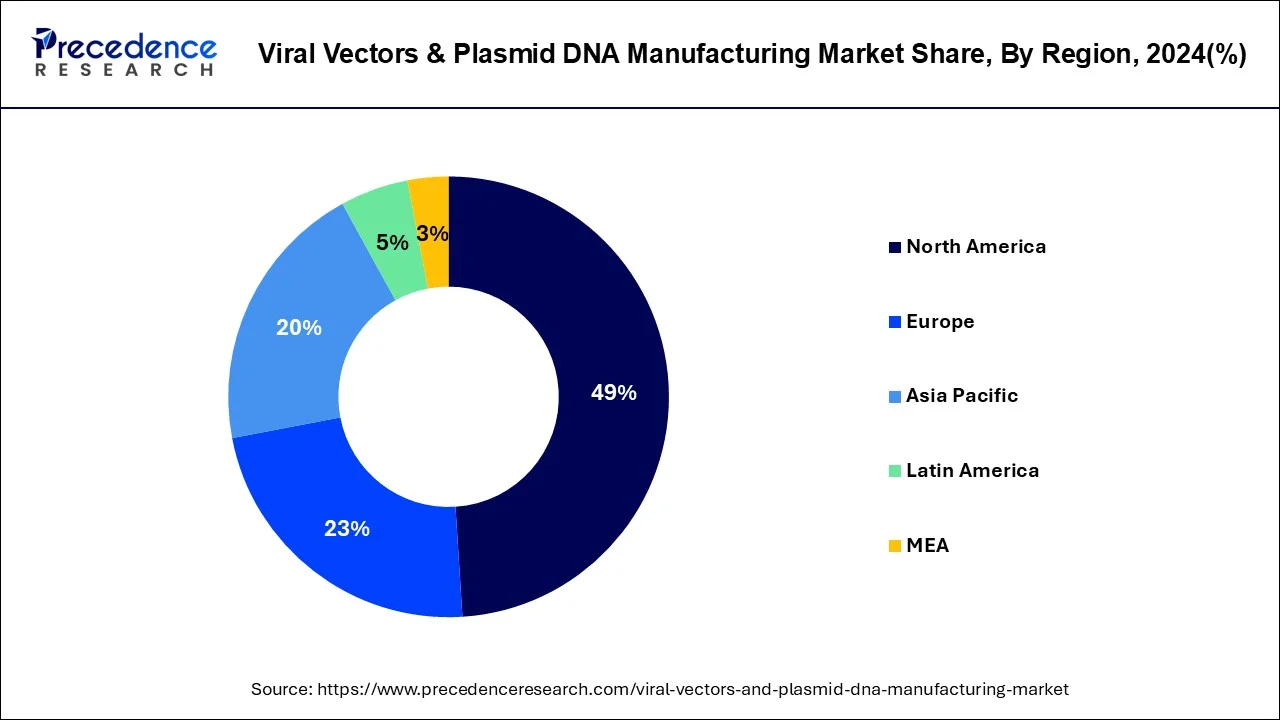

- North America has dominated the market with a revenue share of 49% in 2025.

- By Vector Type, the AAV segment shows a leading growth in the viral vectors & plasmid DNA manufacturing market, accounting for 21% revenue share in 2025.

- By Workflow, the downstream processing segment shows a dominant position in the viral vectors & plasmid DNA manufacturing market, accounting for 54% revenue share in 2025.

- By application, the vaccinology segment has accounted largest revenue share of around 22.5% in 2025.

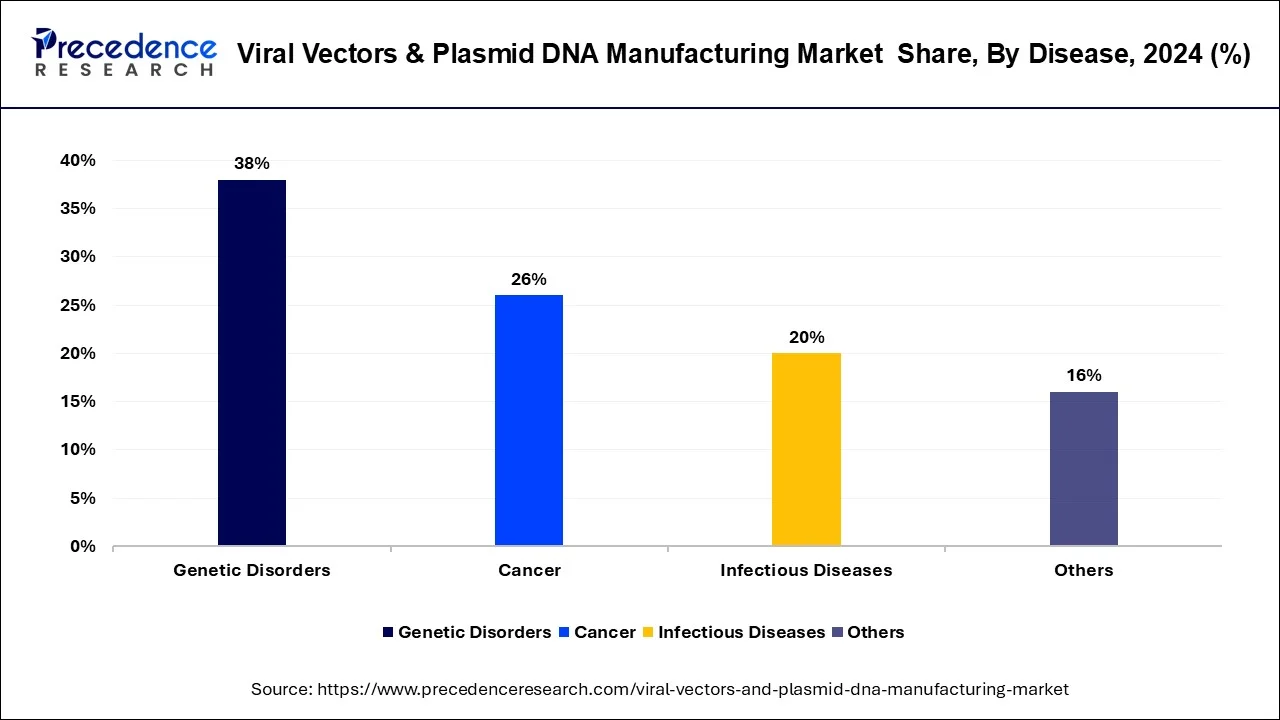

- By Disease, the cancer segment dominated the market with 38% revenue share in 2025.

- By end use, the research institutes segment has captured revenue share of around 58.4% in 2025.

How is AI enhancing the viral vectors & plasmid DNA manufacturing industry?

The creation of vaccines, biotechnology, and gene therapy all depend on viral vector engineering. Gene therapies aim to replace or fix defective genes in a person's cells through genetic engineering, offering the possibility of one-dose treatments for various illnesses.

AI algorithms can detect putative gene targets and confirm their therapeutic significance by analyzing extensive molecular and genomic information. This enables the identification of new gene candidates and the evaluation of their potential for gene therapy treatments. By combining several datasets, AI is excellent at predicting the safety and effectiveness of gene therapy. It improves patient responses using prediction models to evaluate treatment results and streamline procedures.

How has AI benefitted the viral vectors & plasmid DNA manufacturing market?

AI is becoming a major contributor to the viral vectors & plasmid DNA manufacturing market. AI will enable scientists to design better vectors faster by predicting gene programming. AI can evaluate a variety of variables in a large amount of data to provide answers on the best way to manufacture cells to provide healthy, high copies of plasmids and viral vectors. This can save both time and money in the research and development process and manufacturing process. AI allows scientists to maintain observance to the entire process by closely monitoring all variables in real time, and spotting errors sooner to improve the opportunity of replicating these errors during the manufacture of the quantities of product required. AI is being used in quality control and assurance to monitor the linearity, robustness, and reproducibility of the final product which consists of the genetic manipulations being performed for eventually safe and effective end use. A number of companies are now employing AI to directly target specific diseases by using patterns of gene sequencing to find useful treatments. The utilization of AI is massively accelerating the velocity of data and increasing the intelligence of the system which is so critical in developing gene therapy and cell-based therapies.

Market Overview

The Architects of Healing: Viral Vectors Manufacturing to Boom till 2030

The viral vector and plasmid DNA manufacturing market is witnessing rapid expansion as gene and cell therapies move from research to mainstream medicine. With growing approvals for advanced biologics and vaccines, the demand for high-quality, scalable production platforms has surged. Biopharmaceutical companies are increasingly investing in innovative vector systems and optimized plasmid backbones to enhance yield and safety. The market is also benefiting from technological advances in upstream processing, automation, and analytics that streamline manufacturing. Strategic collaborations between biotech firms and contract manufacturers are helping bridge capacity gaps and accelerate clinical development. As the foundation of next-generation therapies, viral vectors and plasmid DNA remain at the heart of precision medicine's transformative growth.

Key Technological Shift in Viral Vectors & Plasmid DNA Manufacturing Market

- The viral vector and plasmid DNA manufacturing industry is undergoing a profound technological renaissance, where bioprocessing artistry meets digital precision. The erstwhile laborious methods of vector amplification are being supplanted by modular, automated, and single-use systems that deliver both efficiency and sterility.

- Synthetic biology and artificial intelligence are reimagining plasmid design, enabling unprecedented control over gene expression and stability. Meanwhile, continuous bioprocessing and high-density cell culture technologies are redefining productivity paradigms.

- The convergence of nanotechnology, bioinformatics, and machine learning augments process predictability and scalability, marking a tectonic shift from craftsmanship to intelligent manufacturing. This technological metamorphosis is not merely an upgrade it is the genesis of a new biomanufacturing epoch.

Rising interest in vector manufacturing area is emphasized by the growing number of partnerships or collaborations amongst the various organizations involved in this sector. The intentions behind these partnerships vary for different purposes. Collaborations have been signed for purposes including production of vector promoters and development or acquisition of manufacturing facilities and out / in licensing of vector manufacturing technology among others.

However, some of the factors limiting the growth of this market include, “noise” during process development.This noise in cell-based assays may offer challenges for the evaluation of process improvements. In order to overcome this trouble, trending is accomplished to develop confidence that an improvement has been achieved.

Market Outlook

- Industry Overview: This industry represents the confluence of molecular artistry and industrial discipline, where DNA is not merely a code but a commodity of healing potential. Viral vector and plasmid DNA production underpins an expanding array of therapeutic frontiers from rare genetic disorders to cancer immunotherapies. The sector thrives on a triad of innovation: biotechnological dexterity, infrastructural robustness, and stringent regulation. Strategic alliances between pharmaceutical behemoths and agile biotech startups have emerged as the industry's heartbeat.

- Sustainability Trend: Sustainability in viral vector and plasmid DNA manufacturing transcends mere environmental rhetoric it embodies a philosophical evolution. The paradigm is shifting toward eco-conscious bioprocessing, where energy efficiency, waste minimization, and biobased raw materials become cornerstones of ethical production. Single-use technologies, though plastic-intensive, are being redesigned for recyclability and reduced carbon footprints. Water reclamation systems, renewable power integration, and digital monitoring are redefining the concept of green labs. The movement toward circular bioeconomy underscores the industry's recognition that scientific progress must coexist harmoniously with planetary stewardship.

- Major Investment: Investment in viral vector and plasmid DNA manufacturing has reached an inflection point, where capital is no longer speculative but strategic. Venture capitalists, sovereign funds, and pharmaceutical giants alike are channelling resources into next-generation facilities equipped with digitalized and automated platforms. Governments are offering grants and tax incentives to foster domestic production capacity and reduce supply chain vulnerabilities. The surge in mergers and acquisitions signifies the consolidation of technological prowess under fewer, more capable entities. This infusion of financial vitality is not merely about scaling production, it is about catalyzing the genomic revolution into a sustainable enterprise.

- Sustainable Ecosystems and Startups: Across global biotech corridors, a new generation of startups is germinating enterprises that blend scientific ingenuity with environmental and social consciousness. These emerging entities are designing plasmid production systems that minimize antibiotic use, developing cell lines with superior yields, and pioneering biodegradable bioprocess materials. Innovation incubators and accelerators are fostering symbiotic ecosystems where academia, industry, and sustainability coalesce. Collaborative consortia are addressing the shared challenges of cost, scalability, and environmental impact through open science frameworks.

Market Scope

| Report Highlights | Details |

| Market Size by 2035 | USD 29.82 billion |

| Market Size in 2026 | USD 8.42 billion |

| Growth Rate | CAGR of 15.17% From 2026 to 2035 |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vector Type, Application, Workflow, End-User, Disease |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, the Middle East, and Africa |

Vector Type Insights

Adeno-Associated Virus (AAV) dominated the viral vectors & plasmid DNA manufacturing market share because it's safe, effective in many gene therapy approaches, and can reach many different sites. There are many ways to use AAV (for example, Luxturna for vision loss). Many approved gene therapies depend on AAV. For AAV gene therapies, the companies now have an abundance of backing for development research and approved and marketed uses and distribution.

Lentivirus is expected to show the fastest rate of growth in the viral vectors & plasmid DNA manufacturing market because it had the ability to carry larger genes and work in dividing/non-dividing cells. It is used in a large number of cell therapies such as CAR-T for cancer therapies. Lentivirus' abilities to deliver long lived gene expression, give it powerful market access and value.

Why Downstream Processing is Dominating the Viral Vectors & Plasmid DNA Manufacturing Market?

The downstream processing is dominating the market by holding a share of 54%, acting as the linchpin for product purity and therapeutic efficacy. This phase encompasses clarification, purification, and formulation steps that demand both precision and technological sophistication. Chromatography, ultrafiltration, and tangential flow filtration have become indispensable in ensuring molecular homogeneity and regulatory compliance. The dominance of downstream processing arises from its critical role in eliminating host cell impurities, endotoxins, and residual DNA fragments. Moreover, innovations such as membrane-based chromatography and automation-driven analytics are enhancing reproducibility and throughput. As the final arbiter of quality, downstream processing remains the cornerstone of biomanufacturing excellence.

Upstream processing is experiencing meteoric growth, fueled by the demand for higher yields, cost efficiency, and scalable vector production. Advances in cell line engineering, optimized expression systems, and high-density bioreactors have revolutionized this phase. The transition from traditional adherent cultures to suspension-based systems enables continuous and large-scale production with remarkable consistency. Automation and real-time monitoring have introduced a new era of process control, minimizing variability and maximizing cell productivity. Furthermore, the integration of AI-driven modeling allows predictive optimization of culture conditions, significantly reducing development timelines. As biopharma firms pivot toward flexible and intensified manufacturing models, upstream processing stands as the vanguard of next-generation productivity.

Application Insights

Vaccinology had the highest market share due to its key role in the future of viral vectors and plasmid DNA during the COVID-19 pandemic. The rapid success of viral vectors and plasmid DNA were tied up to the company's ability to utilize viral vectors and plasmid DNA to deliver yet quickly and safe than conventional vaccine development approaches.

Cell therapy was the fastest-growing sub-sector of gene therapy because it offers hope for cancer and hereditary diseases. Gene delivery into patient cells is done using viral vectors. Gene delivery represents a new treatment modality that can help treat diseases that older small molecule drugs could not solve.

End-use Insights

Research institutes dominated the viral vectors & plasmid DNA manufacturing market in terms of growth as they conduct most of the work on early-stage gene therapy. The research institutes conduct fundamental studies of new properties of viral vectors and plasmid DNA. Ultimately, the research institute end-use type provides a lot of backbone support for future expanded gene therapy and vaccine commercialization.

Pharmaceutical and biotech companies were the fastest-growing segment because they tend to invest large amounts of capital into gene therapies. They develop treatments for rare diseases and cancers using viral vectors and plasmid DNA and the relatively short timeline for private companies means that they have been used to a quicker pace of technology adoption and commercialization of products.

Disease Insights

Different kinds of diseases analyzed in this research study include genetic disorders, cancer, infectious diseases, and other diseases. In 2025, cancer dominated the market in terms of revenue of the total market. Cancer is also projected to grow at highest CAGR during forecast period.

Cancer is projected to gather maximum share of the global market on account of continuously rising research on viral vector gene therapies for cancer. Furthermore, rare and genetic diseases are additional crucial area of attention in gene therapy. Due to almost 350 million patients are diagnosed worldwide with a rare disease, and there are deficiency of efficient treatment modalities. Constantly rising burden of genetic diseases is a crucial driving factor for venture in viral vector manufacturing in order to target genetic disease.

Regional Insights

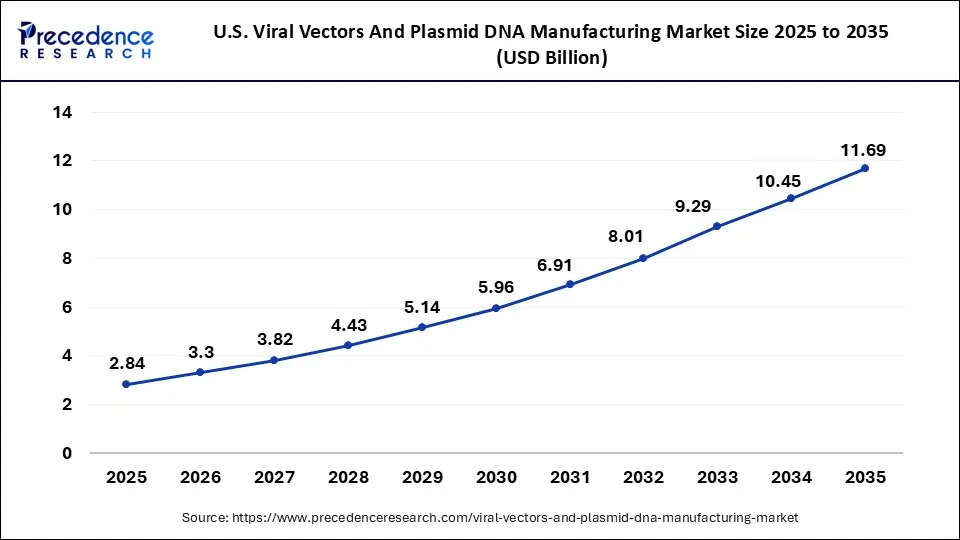

U.S. Viral Vectors & Plasmid DNA Manufacturing Size and Forecast 2026 to 2035

The U.S. viral vectors & plasmid DNA manufacturing market size is valued at USD 2.84 billion in 2025 and is projected to reach around USD 11.69 billion by 2035 with a CAGR of 15.2% from 2026 to 2035.

Current FDA approval of advanced therapies such as Yescarta and Kymriah (tisagenlecleucel) supports the major investment in vector manufacturing market in U.S. Also, industrialization of gene therapy manufacturing and clinical transformation is predictable to persuade noteworthy progress across several Asian nations. In order to speed up vector manufacturing in Asia Pacific many multinational companies are cooperating with Asian based companies. At present, U.S. and Europe have appeared as vector manufacturing hubs in spite of the fact that the first 3 gene therapy candidates (Oncorine, Gendicine andRexin-G) were permitted in Asian countries. This success is attributable to high volume of enduring clinical studies in these established regions. Around 68% of the total international active clinical studies for gene therapies are proceeding in North America. The second foremost market for trial is Europe where about 21% of the trials are under progress.

North America

North was the most dominant region in 2025 in the viral vectors and plasmid DNA manufacturing market due to the strong healthcare systems and best research labs, as well as so many biotech companies in the region. The support of the US government with gene therapy and funding for new research helps push market growth. The region has been seeing a lot of action with clinical trials and approvals for these treatments. With a focus on cancer therapies, North America has a lot of leverage in the rare disease space and improving treatment options. As demand increases for advanced medicine, North America will continue to lead the way in creating better and faster advanced manufacturing methods for gene and cell therapies.

United States

- In November 2024, The University of Texas MD Anderson Cancer Center declared that it is creating the Institute for Cell Therapy Discovery & Innovation to generate cell therapies for cancer, autoimmune diseases, and infections. The institute will conduct scientists and clinicians together to offer insight into immunology and cell engineering with $80 million in support from philanthropic organizations and institutions.

- At its April meeting, the Board of the California Institute for Regenerative Medicine (CIRM) accepted investing about $89 million in projects from its Clinical and Translation programs. Almost $39 million will hold up four projects in the agency's Clinical program, which speeds up support and offers funding for eligible stem cell and gene therapy-based projects through any stage of clinical trial activity.

United States Viral Vectors and Plasmid DNA Manufacturing Market Trends

The United States is a major contributor to the viral vectors and plasmid DNA manufacturing market. The strong presence of biotechnology companies increases the development of viral vectors and plasmid DNA. The increasing investment in R&D of gene therapy and a strong regulatory framework for gene therapy help the market growth. The increasing clinical trials and growing prevalence of genetic disorders increase demand for viral vectors and plasmid DNA. The strong presence of CDMOs and stringent regulatory support for vaccines & gene therapy drives the overall market growth.

Asia Pacific

The Asia-Pacific region is the fastest growing region in the viral vectors & plasmid DNA manufacturing market due to increased healthcare spending, increased recognition that gene therapy provides advanced treatment; and the needs for improved treatment since a lot of new disabilities and sicknesses are emerging. Countries including China, India, Japan, South Korea have seen recent increases in research and development spending. The boom in local biotech companies has allowed infrastructure improvements and increased clinical activity, and some governments supporting innovation as well as new research labs, facilities, and quality systems. The new wave of development is facilitating the rapid growth of the Asia-Pacific region with additional opportunities such as opportunities for partnerships, clinical trials, and development of low-cost treatments in the market which further provides new focus on skilled workers and the increased of stricter regulations.

China Viral Vectors and Plasmid DNA Manufacturing Market Trends

China is a key contributor to the viral vectors and plasmid DNA manufacturing market. The supportive regulatory frameworks, like gene-based research and cell research, increase the development of viral vectors and plasmid DNA. The increasing investment in gene & cell therapy and the presence of a large population help the market growth. The rise in gene therapy trials and the expansion of the biopharmaceutical sector increase the demand for viral vectors and plasmid DNA. The presence of CDMOs key players like ASKbio China, WuXi AppTec, and GenScript drives the overall growth of the market.

India Viral Vectors and Plasmid DNA Manufacturing Market Trends

India is emerging as the fastest growing country in the Asia-Pacific region in the viral vectors & plasmid DNA manufacturing market. With the rise in biotech companies and a growing population of trained scientists and engineers, in unique ways India can compete in this segment of the overall biotech market. The Indian government is putting research funding towards both individuals and companies for funding in the biotech space. India also provides lower manufacturing costs which is another reason for global businesses to locate growth in India. Amongst all the activities, the country is seeing progress with clinical trials, which leads to better understanding of gene therapy for the public. Indian universities and research centers are being combined with their research and development into genetic space for innovation.

Can Europe Maintain its Lead in the Viral Vector and Plasmid DNA Race?

Europe stands as one of the leading hubs in the viral vector and plasmid DNA manufacturing market, driven by a strong biotechnology infrastructure and supportive regulatory frameworks. The region's focus on advanced therapy medicinal products (ATMPs) has created a fertile environment for innovation in gene and cell therapy production. Increased funding from both public and private sectors, coupled with the growing number of clinical trials, is accelerating technological adoption. European manufacturers are prioritizing the development of GMP-compliant facilities to ensure product consistency and safety. Furthermore, collaborations between academic institutions and biopharma companies are enhancing knowledge exchange and process optimization. This synergy positions Europe as a cornerstone in the global expansion of viral vector and plasmid DNA manufacturing.

Germany Viral Vectors & Plasmid DNA Manufacturing Market Analysis:

Germany plays a central role in Europe's manufacturing ecosystem, benefiting from a robust network of biotech startups and established pharmaceutical players. The country's emphasis on automation and process scalability has driven advancements in upstream and downstream technologies. Similarly, the UK's cell and gene therapy sector continues to thrive, supported by initiatives such as the Cell and Gene Therapy Catapult, which fosters commercialization. France and the Netherlands are also emerging as strong contributors, focusing on clinical-grade plasmid DNA production and viral vector development. Italy's investments in biopharmaceutical infrastructure are expanding domestic capabilities, particularly for oncology and rare disease applications. Collectively, these nations are shaping Europe's leadership in producing high-quality viral and plasmid materials for both research and clinical use.

Is the Middle East Asia Ready to Join the Global Gene Therapy Manufacturing Map?

The Middle East and Africa region is gradually emerging as a promising frontier for viral vector and plasmid DNA manufacturing. Although the market is in its early stages, increasing interest in genomic medicine and biotechnology is driving regional growth. Government initiatives to diversify economies and strengthen healthcare systems are fostering investments in local biomanufacturing. Countries such as the UAE and Saudi Arabia are investing in research clusters and life science parks to attract biotech partnerships. The rise of precision medicine programs and the growing focus on rare diseases are opening new opportunities for genetic therapy manufacturing. However, the region still faces challenges related to limited infrastructure, skilled workforce, and technology transfer.

Saudi Arabia Viral Vectors & Plasmid DNA Manufacturing Market Trends:

Saudi Arabia is leading regional efforts with significant investments under its Vision 2030 framework to develop a sustainable biotechnology sector. The UAE follows closely, promoting innovation through collaborations with international biotech firms and academic centers. South Africa remains the continent's primary contributor, leveraging its strong research base and advanced healthcare infrastructure to support biomanufacturing initiatives. Egypt is also emerging as a key market, with growing academic research in molecular biology and gene-based therapies. Nigeria and Kenya are taking gradual steps toward biotechnology adoption, particularly in academic and diagnostic settings. Together, these nations represent the growing momentum toward self-reliant biomanufacturing and a shift from dependence on imported therapies.

Can Latin America Build Its Own Biomanufacturing Powerhouse?

Latin America's viral vector and plasmid DNA manufacturing market is gaining traction, fueled by expanding biotechnology sectors and supportive government initiatives. The region's growing participation in global clinical trials is increasing the demand for reliable manufacturing infrastructure. Public health agencies and private firms are collaborating to establish regional production capabilities to meet local therapeutic needs. Investments in education and technology transfer are enhancing workforce readiness and technical expertise. The growing prevalence of genetic disorders and the need for innovative vaccine platforms are further driving regional demand. Although the market faces challenges such as funding limitations and regulatory hurdles, its long-term potential remains strong.

Brazil Viral Vectors & Plasmid DNA Manufacturing Market Trends:

Brazil stands out as the regional leader, with well-established research institutions and biomanufacturing facilities driving innovation in viral vector production. The country's emphasis on vaccine development and partnerships with global pharma companies is fostering rapid technological advancement. Mexico is also emerging as a competitive hub, leveraging its growing biotech ecosystem and strategic proximity to North American markets. Argentina is focusing on public-private collaborations to expand its gene therapy research capabilities. Chile and Colombia are showing increasing interest through research grants and investments in molecular biology infrastructure. Collectively, these countries are shaping Latin America's growing role in the global landscape of viral vector and plasmid DNA manufacturing

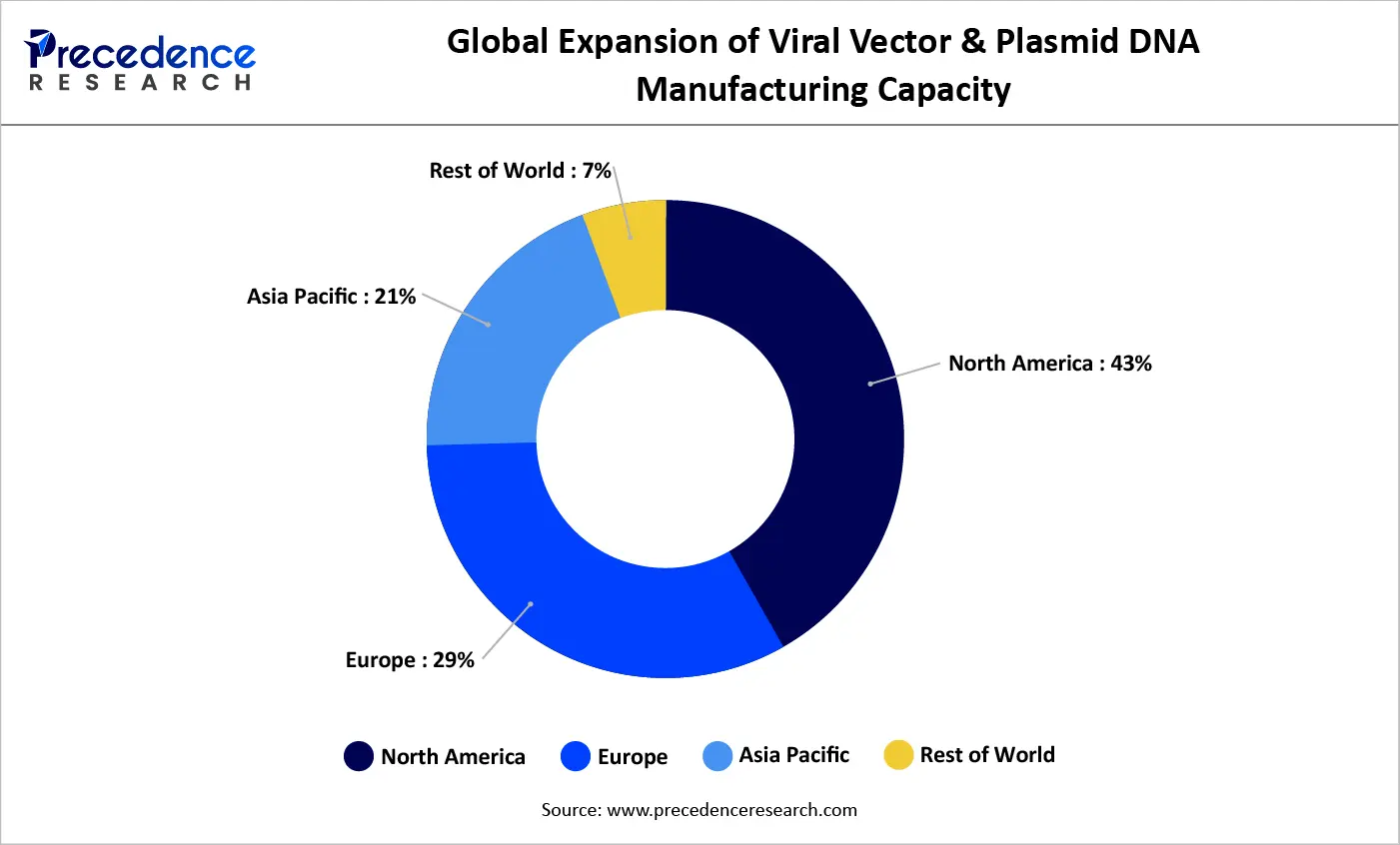

Global Manufacturing Capacity Expansion for Viral Vectors and Plasmid DNA (2021–2025)

Between 2021 and 2025, global manufacturing capacity for viral vectors and plasmid DNA has expanded steadily, reflecting rising demand from gene therapy, cell therapy, and mRNA-based therapeutics. North America continues to lead capacity growth, increasing its share from 40% to 43%, supported by strong biopharmaceutical investment and a mature contract manufacturing ecosystem. Europe has also strengthened its position, with capacity rising from 29% to 30% as regional governments and biotech firms invest in GMP facilities. Asia Pacific shows the fastest expansion, growing from 18% to 21%, driven by increasing clinical activity and localized manufacturing initiatives. In contrast, the rest of the world has seen a relative decline, underscoring the concentration of advanced manufacturing capabilities in established biotech hubs.

| Company | Country | Reported segmentation | Vector focus and capabilities | Milestones |

| Lonza group AG | Switzerland | EBITDA CHF 1.9 bn. | Major cell and gene CDMO offering AAV/LVV development and DNA manufacturing development. | Expanded process development lab space; opened expanded gene therapy facilities. |

| Thermo Fisher Scientific | U.S.A. | US$42.88 bn | Owns Brammer Bio, leading viral vector CDMO capabilities. | Ongoing investment in cell and gene therapy |

| Oxford Biomedicine pic | U.K. | 128.8 revenue | Offers viral-vector CDMO services after acquisition of Paragon Bioservices. | Expanding the carbon footprints. |

Waisman's Company Profile: A Booming Player in Plasmid DNA Production

Company Overview

Corporate Information

- Headquarters: Madison, Wisconsin, USA

- Year Founded: 2001

- Ownership Type: Non-profit / academic-affiliated Contract Development and Manufacturing Organization (CDMO), affiliated with the University of Wisconsin–Madison

History and Background

Waisman Biomanufacturing was established to provide cGMP manufacturing services for clinical-stage biologics. Founded within the University of Wisconsin–Madison, it was designed to bridge the gap between academic innovation and commercial manufacturing. Over the years, the organization has developed robust expertise in producing plasmid DNA, viral vectors, cell therapies, and vaccines, becoming a trusted manufacturing partner for biotech firms and research institutions worldwide.

Key Milestones / Timeline

- 2001: Establishment of the cGMP manufacturing facility at the University of Wisconsin–Madison.

- 2016: Partnered with Agilis Biotherapeutics to produce a gene therapy product for a rare neurological disorder.

- February 2024: Announced a strategic collaboration with RoosterBio for GMP manufacturing of cell- and exosome-based therapies.

- August 2024: Completed the initial transfer of RoosterBio's manufacturing processes, expanding its capacity in MSC and exosome production

Business Overview

Business Segments / Divisions

GMP Manufacturing Services: Plasmid DNA, viral vectors (AAV, adenovirus, lentivirus), vaccines, and cell-based therapies.

Process Development & Analytical Services: Process optimization, scale-up, and quality control testing.

Aseptic Fill/Finish Services: Cryopreservation and clinical-grade product packaging.

Geographic Presence

- Operates a single cGMP facility in Madison, Wisconsin, serving clients globally, including biotech companies, research institutes, and clinical-stage organizations.

Key Offerings

- Plasmid DNA production for gene and cell therapy applications

- Viral vector manufacturing (AAV, adenovirus, lentivirus)

- MSC and exosome production for advanced therapy applications

- GMP fill/finish and cryogenic storage services

End-Use Industries Served

- Biopharmaceuticals and biotechnology companies

- Academic and translational research centers

- Clinical trial sponsors and contract research organizations

- Vaccine and gene therapy developers

Key Developments and Strategic Initiatives

Mergers & Acquisitions

- No recent M&A activity has been publicly disclosed.

Partnerships & Collaborations

- Collaborated with RoosterBio in early 2024 to enhance manufacturing capabilities for cell- and exosome-based therapeutics.

- Maintains longstanding partnerships with biotech and academic organizations for gene therapy and vaccine development.

Product Launches / Innovations

- Expanded production platforms for plasmid DNA and viral vectors.

- Implemented process technologies supporting exosome-based therapeutic manufacturing in 2024.

Capacity Expansions / Investments

- Expanded manufacturing capabilities through technology transfer projects completed in August 2024.

Regulatory Approvals

- Operates under FDA-compliant cGMP standards and supports clients with regulatory documentation for IND submissions.

Distribution Channel Strategy

- Functions as a service-based CDMO offering customized manufacturing and development services directly to clients.

- Focuses primarily on early-stage and clinical-scale biologics production.

Technological Capabilities / R&D Focus

Core Technologies / Patents

- Proprietary processes for plasmid DNA production, viral vector manufacturing, and MSC/exosome development.

- Advanced aseptic processing and cryopreservation systems.

Research & Development Infrastructure

- State-of-the-art cleanroom suites and process development laboratories located within the University of Wisconsin–Madison research ecosystem.

- Integrated analytical testing and quality control units supporting full cGMP compliance.

Innovation Focus Areas

- Scalable plasmid DNA and viral vector manufacturing platforms

- Exosome and MSC-based therapeutic production

- Next-generation bioprocessing and automation technologies

Competitive Positioning

Strengths & Differentiators

- Strong academic affiliation offering access to leading scientific expertise.

- Proven track record in early-stage clinical manufacturing of gene and cell therapies.

- Integrated capabilities across plasmid, viral, and cell-based modalities.

Market Presence & Ecosystem Role

- Serves as a key bridge between academic research and commercial biopharmaceutical manufacturing.

- Recognized for its ability to support clinical manufacturing for innovative therapies.

SWOT Analysis

- Strengths: Broad biologics manufacturing expertise, flexible academic partnership model, strong regulatory foundation.

- Weaknesses: Limited large-scale commercial production capacity.

- Opportunities: Growing demand for viral vectors, plasmid DNA, and exosome manufacturing.

Threats: Competitive pressure from larger CDMOs and rapid technological evolution in bioprocessing.

Recent News and Updates

Press Releases

- February 2024: Announced partnership with RoosterBio for GMP manufacturing of cell and exosome therapies.

- August 2024: Completed process transfer from RoosterBio, expanding MSC and exosome manufacturing capabilities.

Industry Recognitions / Awards

- Widely recognized within the biomanufacturing community for its reliability, quality standards, and contribution to early-stage clinical bioproduction.

Viral Vectors & Plasmid DNA Manufacturing Market Companies

- Novasep: Provides advanced manufacturing solutions for the production and purification of complex molecules used in pharmaceuticals and biopharmaceuticals.

- Aldevron: A major supplier of high-quality plasmid DNA and gene-editing enzymes, which are the fundamental building blocks for developing gene therapies.

- Creative Biogene: Innovates in the field of gene editing by offering advanced platforms, including CRISPR/Cas9 systems, to accelerate discoveries in molecular biology.

- The Cell and Gene Therapy Catapult: A not-for-profit center of excellence established by the UK government to bridge the gap between academic research and the commercialization of cell and gene therapies.

- Cobra Biologics: Works with academic and industry partners to grow a thriving cell and gene therapy industry in the UK, providing access to essential resources, technology, and expertise.

Latest Announcements by Industry Leaders

- A significant year for ongoing breakthroughs in cell and gene therapy (CGT) is 2024. A new era of solid tumor treatment with cell therapy has begun with the introduction of Amtagvi, a Tumor-Infiltrating Lymphocyte (TIL) therapy, on a global scale. Approving PM359, the first lead editing treatment in history, for clinical trials marks yet another advancement in gene editing technology. The development pipeline for CAR-T therapies will be significantly expanded with the upcoming clinical trials of INT2104, the first in vivo modified CAR-T therapy.

- In July 2024, The A-T Children's Project is excited to host an international conference in November to address gene therapy for ataxia-telangiectasia (A-T). This conference will bring together clinicians, academic scientists, and industry leaders in the biotech and pharmaceutical fields who are pioneering DNA replacement and editing approaches.

Recent Developments

- In August 2025, Probio opened its flagship U.S. plasmid DNA and viral vector GMP manufacturing facility. At 96,000 square feet, the site was designed to help gene and cell therapy developers with complete end-to-end services. This facility strengthened Probio's global presence as a CDMO and provided enhanced scalability and speed of production.

[Source: https://www.prnewswire.com] - In August 2025, 3P Biovian introduced two new platforms to allow capacity to enhance AAV and plasmid DNA (pDNA) manufacturing. Their AAV platform focused on preclinical to early clinical, and the pDNA platform supported DNA vaccines and viral vector manufacturing. Both platforms were designed as cost-effective, scalable solutions to support the development pipeline.

[Source: https://www.genengnews.com]

Market Value Chain Analysis

- Raw Material Sources: At the genesis of viral vector and plasmid DNA production lies a symphony of raw materials each a vital note in the biotechnological orchestra. Plasmid backbones are crafted from meticulously sequenced DNA templates, while host cells, predominantly E. coli or HEK293 lines, serve as biological workhorses. Enzymes such as restriction endonucleases, ligases, and polymerases perform their enzymatic ballet to orchestrate replication. Nutrient-rich fermentation media sustain cellular vitality, while high-grade buffers and resins underpin the purification process. The provenance of these materials, whether chemically synthesized, microbially derived, or plant-based, determines not only efficiency but also the sustainability quotient of the manufacturing process. Thus, raw material sourcing becomes both a scientific and an ethical enterprise.

- Technological Advancements: The latest strides in technology have transformed viral vector and plasmid DNA manufacturing from empirical craftsmanship into algorithmic precision. High-throughput screening and CRISPR-enabled cell line optimization have reduced developmental latency. Continuous and closed-loop bioprocessing now enable uninterrupted production with minimal risk of contamination. Digital twins, virtual replicas of manufacturing processes, enable predictive maintenance and process optimization in real time. Furthermore, AI-driven analytics decode massive datasets to refine yield, purity, and consistency. These advancements herald a future where the boundaries between biology, computation, and engineering dissolve into a seamless continuum of innovation.

Market Segmentation

This research report estimates revenue growth at global, regional, and country levels and offers an analysis of present industry trends in everysub-segment from 2026 to 2035. This research study analyzes market thoroughly by classifying global viral vectors & plasmid DNA manufacturing market report on the basis of different parameters including type of vector, application, workflow, end users, disease, and region:

By Vector Type

- Adenovirus

- Plasmid DNA

- Lentivirus

- Retrovirus

- AAV

- Others

By Application

- Gene Therapy

- Antisense &RNAi

- Cell Therapy

- Vaccinology

By Workflow

- Upstream Processing

- Vector Recovery/Harvesting

- Vector Amplification & Expansion

- Downstream Processing

- Fill-finish

- Purification

By End-User

- Biopharmaceutical and Pharmaceutical Companies

- Research Institutes

By Disease

- Genetic Disorders

- Cancer

- Infectious Diseases

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting