What is the Bacterial and Viral Specimen Collection Market Size?

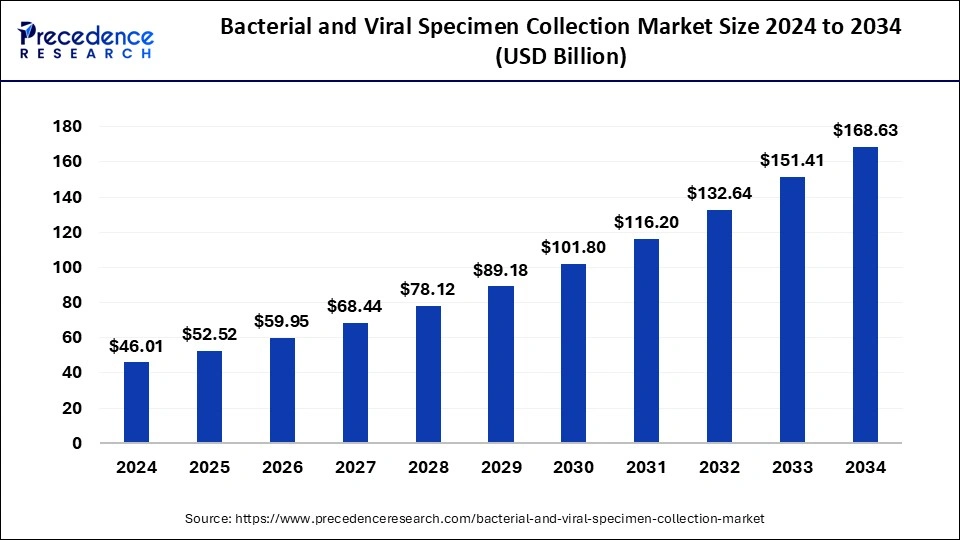

The global bacterial and viral specimen collection market size is accounted at USD 52.52 billion in 2025 and predicted to increase from USD 59.95 billion in 2026 to approximately USD 168.63 billion by 2034, expanding at a CAGR of 13.87% from 2025 to 2034. The rise in rare diseases in human beings has increased the demand for bacterial & viral specimen collection in diagnostic labs, which is estimated to drive the growth of the global bacterial and viral specimen collection market over the forecast period.

Bacterial and Viral Specimen Collection Market Key Takeaways

- The global bacterial and viral specimen collection market was valued at USD 46.01 billion in 2024.

- It is projected to reach USD 168.63 billion by 2034.

- The bacterial and viral specimen collection market is expected to grow at a CAGR of 13.87% from 2025 to 2034.

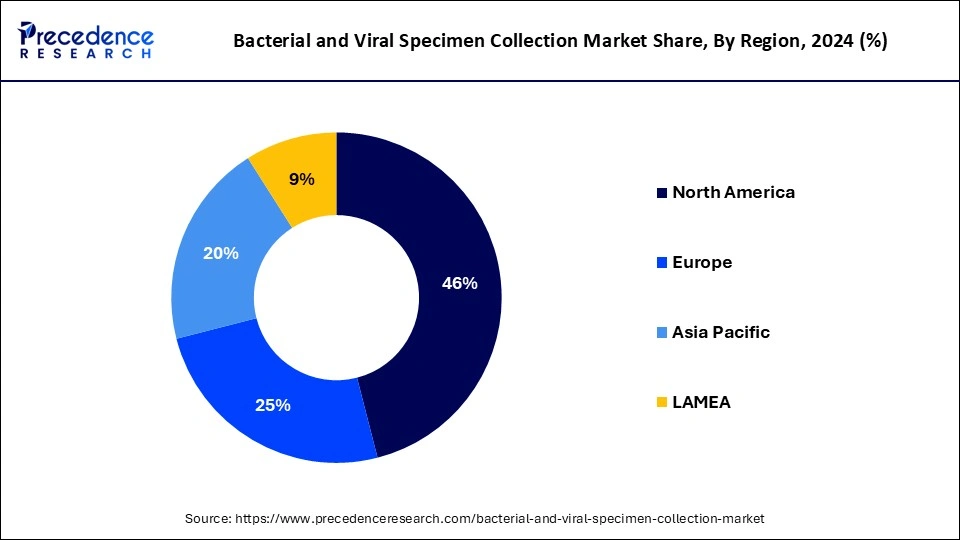

- North America dominated the global market with the largest revenue share of 46% in 2024.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

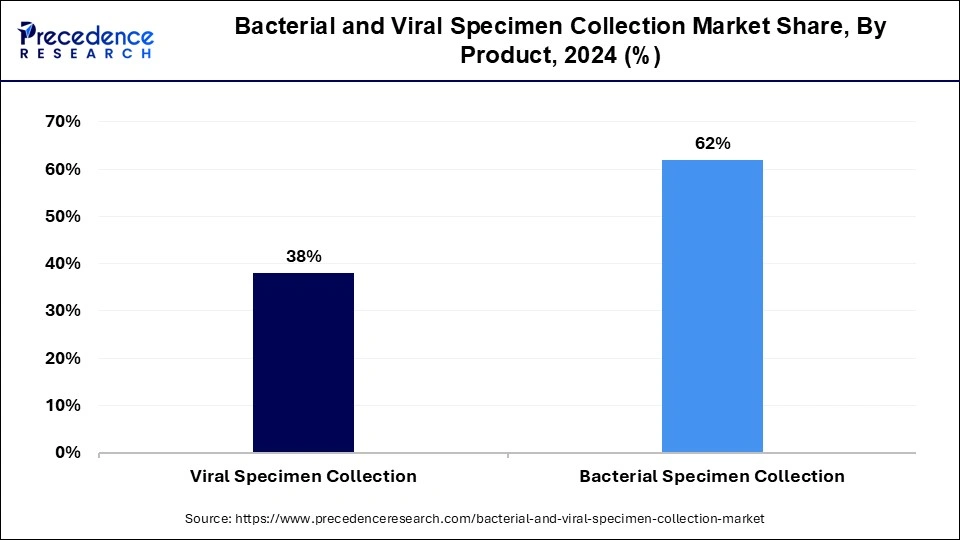

- By product, the bacterial specimen collection segment has held the biggest revenue share of 62% in 2024.

- By application, the diagnostic has contributed more than 74% of revenue share in 2024.

- By end user, the hospitals and clinics segment has recorded more than 61% of revenue share in 2024.

Market Overview

The specimen management procedure plays a crucial role in producing accurate, meaningful, and clinically relevant microbiology laboratory results. The quality of the samples and how they are processed in the microbiology lab still have a significant impact on how the results of the microbiological analysis are interpreted and how accurate they are. Crucial aspects of the diagnostic procedure include the type of specimen, when to collect the sample, and how to sample, store, and transport it. The need to examine and update all sample processing procedures arises from the development of novel laboratory techniques for uncommon diseases.

How Bacterial and Viral Specimen Collection Market is Growing?

The bacterial and viral Specimen collection market plays an important role in carrying out tests to identify whether the patient is infected by bacteria or a virus. The successful laboratory diagnosis of microbial infection depends on numerous factors, beginning with an appropriately collected sample. Adequate specimen transport collection and selection are all crucial to ensure that a specimen is representative of the disease process and slightly contaminated with microorganisms present in adjacent tissues. Clinical microbiologists have started to emphasize specimen management as a procedure that is essential to a successful diagnosis.

Bacterial and Viral Specimen Collection Market Growth Factors

- Expansion of the healthcare services can foster the growth of the global bacterial and viral specimen collection market in the near future.

- Increasing adoption of inorganic growth strategies like mergers to develop new techniques of microbial specimen collection has been estimated to foster the growth of the market over the forecast period.

- The increasing launch of the new policy by the government to support gene therapy is expected to drive the growth of the global market over the forecast period.

- The increasing prevalence of infectious diseases, chronic diseases, and genetic disorders has shown a rise in the demand for bacterial & viral specimen collection, which is expected to drive the growth of the bacterial and viral specimen collection market over the forecast period.

- The key players operating in the market are focused on developing new drug therapies for rare infectious diseases. As a result, the demand for bacterial & specimen collection has risen, which is expected to drive the growth of the global bacterial & viral specimen collection global bacterial & viral specimen collection market. The increasing pediatric as well as geriatric population has raised the prevalence of viral infectious disease, which is expected to drive the growth of the global bacterial & specimen collection market over the forecast period.

- Technology advancement and innovation of new products have created lucrative opportunities to foster the growth of the global bacterial and viral specimen collection market in the near future.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 168.63 Billion |

| Market Size in 2025 | USD 52.52 Billion |

| Market Size in 2026 | USD 59.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.87% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of infectious viral diseases

The rise in the prevalence of infectious viral diseases has increased the demand for bacterial & viral specimen collection, which is estimated to drive the growth of the global bacterial and viral specimen collection market over the forecast period. For instance, On June 9, 2024, according to the data published by the World Health Organization (WHO), an intergovernmental organization, it was estimated that in the last 28 days, the number of COVID-19 cases has increased by 4,528 globally.

Restraint

Challenges and limitations associated with the bacterial & viral specimen collection

Certain limitations, such as the possibility of bacteria becoming resistant to bacteriophages (BPs), issues with selecting the accurate and effective bacteriophages to treat different bacterial infections, and lack of skilled professionals, have been found to hamper the growth of the global bacterial and viral specimen collection market over the forecast period. For instance, in June 2023, according to the data published by the National Center for Biotechnology Information, it was estimated that bacteria have the ability to develop many ways to avoid viral infections, which may lead to the emergence of bacterial resistance against BPs.

These include phage adherence to the bacterial pathogen being prevented by chemicals secreted from hiding, changing, or losing receptors, activating mechanisms to prevent phage Deoxyribonucleic acid (DNA) injection into cells, and inhibiting phage replication and release. The Deoxyribonucleic acid (DNA) of lyticogenic phages is incorporated into the bacterial genome. As such, they may serve as conduits for the horizontal transfer of genetic material and contribute to the spread of genes that confer antibiotic resistance (ARGs). It is theoretically possible for new microorganisms or even more resilient bacteria to arise as a result of transduction.

Opportunity

Increasing launch of microbiology laboratory

The key bacterial and viral specimen collection market players are focused on launching the new microbiology laboratory, which has raised the demand for bacterial & specimen collection and created a lucrative opportunity for the growth of the global bacterial & viral specimen collection market. For instance, in January 2023, SGS, a company focused on manufacturing and developing testing and inspection material, announced the launch and start of the new laboratory facilities for microbiology testing in Phoenix, Arizona, U.S., named Biosafety Level-2 microbiology lab. The Biosafety Level-2 microbiology lab delivers a wide range of microbial testing facilities and services to clients of hand sanitizer and antibacterial hand soap manufacturing industries. Therefore, the launch of the new microbiology laboratory has increased the demand for bacterial & specimen collection kits.

Product Insights

The bacterial specimen collection held the dominating share of the bacterial & specimen collection market in 2024 on account of increasing approval of the product by the regulatory bodies for import and export.

- For instance, in December 2023, HiMedia Laboratories Private Limited, a bioscience company, revealed the approval of the license from Central Drugs Standard Control Organization (CDSCO) for importing NG-Test CARBA 5 kit from NG Biotech, a France-based biotechnology company.

The viral specimen collection segment has witnessed the fastest growth in the year 2023 on account of the increasing launch of the new viral specimen transportation media.

- For instance, in March 2022, Thermo Fisher Scientific Inc., a company focused on manufacturing analytical instruments, announced the launch of the viral transport medium named the ‘InhibiSURE Viral Inactivation Medium' formula. The InhibiSURE Viral Inactivation Medium' assists in the collection and rapid inactivation of the SARS-CoV-2 virus, stabilizes viral RNA at ambient temperature for transportation, and is utilized in in-vitro diagnostic testing procedures. Through the use of a non-hazardous formulation, the InhibiSURE Viral Inactivation Medium quickly renders the SARS-CoV-2 virus inactive, allowing us to facilitate a secure and effective approach for collecting and transporting samples.

Application Insights

The diagnosis segment held the largest share of the global bacterial and viral specimen collection market in 2024. The increasing prevalence of viral infectious diseases is estimated to fuel the growth of the diagnosis segment over the forecast period. For instance, in April 2024, the World Health Organization, an intergovernmental organization, claimed that the number of patients' lives lost due to viral hepatitis is increasing. 1.3 million deaths annually are caused by hepatitis, making it the second most common infectious cause of death worldwide, right behind tuberculosis, which is the ranks first infectious killer.

The research, which was presented at the World Hepatitis Summit, emphasizes that testing and treatment coverage rates have stagnated in spite of improved diagnostic and treatment instruments and falling product costs. However, if quick action is taken, achieving the World Health Organization (WHO) elimination target by 2030 should still be possible. According to the same source, it was estimated that on an everyday basis, 3500 people become victims of death globally due to hepatitis C and hepatitis B infections.

End User Insights

The hospitals & clinics segment held the largest share of the global bacterial and viral specimen collection market in 2024. The increase in new disease breakouts has raised the demand for bacterial & viral specimen collection in hospitals & clinics. For instance, in May 2024, the International Health Regulations (IHR) National Focal Point (NFP), a national office or center for India, reported to the World Health Organization an incidence of human infection with avian influenza A(H9N2) virus diagnosed in a hospital of West Bengal state in India. Due to the youngster's ongoing acute respiratory distress, repeated high-grade fever, and abdominal cramps, the patient was admitted to the pediatric intensive care unit (ICU) of a nearby hospital on February 1, 2024.

Viral pneumonia-induced post-infectious bronchiolitis was the diagnosis made for the patient. After the first case in 2019, this is the second case of avian influenza A(H9N2) in humans that the World Health Organization has been informed from India. After making a full recovery, the child was released from the hospital. A human infection brought on by a novel influenza A virus subtype is considered an occurrence with a high potential impact on public health and needs to be reported to the World Health Organization (WHO).

Regional Insights

U.S. Bacterial and Viral Specimen Collection Market Size and Growth 2025 to 2034

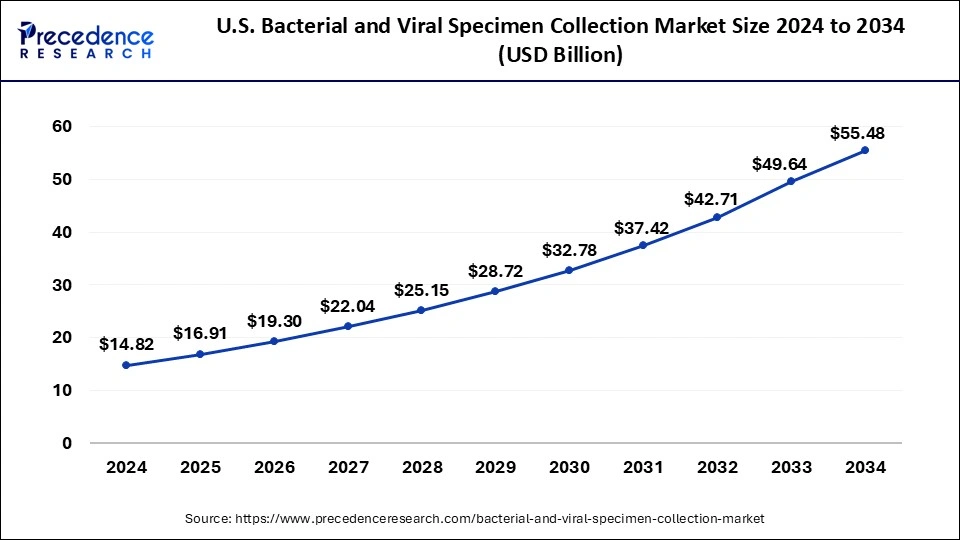

The U.S. bacterial and viral specimen collection market size was exhibited at USD 16.91 billion in 2025 and is projected to be worth around USD 55.48 billion by 2034, poised to grow at a CAGR of 14.11% from 2025 to 2034.

North America witnessed the largest revenue share for the year 2024. Increasing government initiatives and profitable policies for bacterial & viral specimen collection in the North American region are estimated to drive the growth of the bacterial and viral specimen collection Market over the forecast period. For instance, in June 2024, according to the data published by the American Medical Association, it was estimated that the government laboratories would be paid a good charge for specimen collection and transport. The advanced infrastructure required for specimen collection has been developed in American government hospitals. Government college and university students in North America will be trained free of cost for 3 months for specimen collection and testing under the newly launched policy by the government of the U.S.

Asia Pacific is estimated to be the fastest-growing during the forecast period, significantly driven by the launch of a new product for the diagnosis of several diseases in the Asia Pacific region to meet high clinical needs, which indirectly raised the demand for bacterial & viral specimen collection. For instance, in January 2024, QIAGEN, a global provider of diagnostic solutions, announced the launch of the two syndromic testing panels for its QIAstat-Dx instruments in India, including the Encephalitis/ Meningitis Panel and the Gastrointestinal Panel 2. With the Central Drugs Standard Control Organization's (CDSCO) regulatory certification of the QIAstat-Dx system, healthcare providers in India are allowed to diagnose patients by collecting specimens more quickly, correctly, and easily. In under one hour, the QIAstat-Dx Gastrointestinal Panel 2 may identify 22 clinically important viral, parasite, and bacterial pathogens that cause the majority of gastrointestinal infections. Comparing this panel to standard microbiological testing, which frequently necessitates incubating samples for at least 24 hours and up to 10 days, reveals considerable advantages.

Bacterial and Viral Specimen Collection Market Key Companies

- Puritan Medical Products

- COPAN Diagnostics

- Becton, Dickinson and Company

- Thermo Fisher Scientific, Inc.

- Quidel Corporation

- Longhorn Vaccines and Diagnostics, LLC

- Pretium Packaging

- Trinity Biotech

- Medical Wire & Equipment

- HiMedia Laboratories

- Hardy Diagnostics

- Nest Scientific

- VIRCELL S.L.

- DiaSorin

- Titan Biotech

Recent Developments

- On June 04, 2024, according to a study published in The Lancet, a Peer-reviewed journal and the European Health Union, European government faculty revealed that the 29-year-old Dutch scientist Rochelle Niemeijer innovated an affordable, fast, and artificial intelligence-driven tool to collect and diagnose bacterial infectious specimens. Up until July 9, 2024, the Dutch innovator will compete for the Young Inventors Prize, a recognition established by the European Patent Office, against a team from Tunisia and a finalist from Ukraine. Due to her promising work addressing one of the Sustainable Development Goals (SDGs) of the United Nations by making specimen collection and diagnosis more accessible, Niemeijer has been nominated as a finalist for the Young Inventors Prize of the European Inventor Award 2024.

- On January 19, 2024, ELITechGroup, an in-vitro diagnostics company, revealed the launch of the ‘GI Bacterial PLUS ELITe MGB Kit,' which assists in bacterial specimen collection and diagnosis. The in vitro assay made available in ‘GI Bacterial PLUS ELITe MGB Kit' is designed specifically to identify bacterial infections in the gastrointestinal tract. It targets key pathogens such as Yersinia enterocolitica, Clostridium difficile, Shigella species, Campylobacter species, and Salmonella species.

Segments Covered in the Report

By Product

- Bacterial Specimen Collection

- Swabs

- Bacterial Transport Media

- Blood Collection Kits

- Other Consumables

- Viral Specimen Collection

- Swabs

- Viral Transport Media

- Blood Collection Kits

- Other Consumables

By Application

- Diagnostics

- Research

By End-use

- Hospitals & Clinics

- Home Test

- Research Laboratories

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting