What is the Bacterial Therapeutics Market Size?

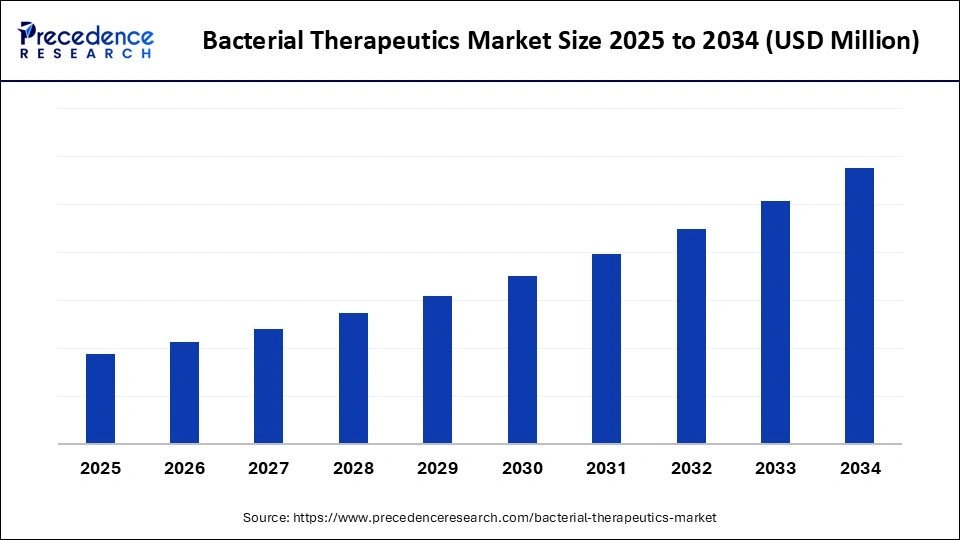

The global bacterial therapeutics market is witnessing strong growth as engineered bacteria and live biotherapeutics offer new treatment options for various diseases.The market is experiencing significant growth, reflecting advances in microbiome-based treatments. With increasing research and development, this sector is anticipated to expand substantially over the next decade.

Bacterial Therapeutics Market Key Takeaways

- North America dominated the market, holding largest market share of 45% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR in the bacterial therapeutics market between 2025 and 2034.

- By product type, the live biotherapeutic products (LBPs) segment held the largest market share, accounting for 45% in 2024.

- By product type, engineered bacterial strains is expected to grow at a remarkable CAGR between 2025 and 2034.

- By mechanism of action, the microbiome modulation segments held the largest market share of 40% in 2024.

- By mechanism of action, the metabolite delivery segment is expected to grow at a remarkable CAGR between 2025 and 2034 in the bacterial therapeutics market.

- By therapeutic application, the gastrointestinal disorders: IBD segment held the largest market share of 35% in 2024.

- By therapeutic application, the oncology segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By delivery route type, the oral segment held the largest market share, accounting for 60% of the market in 2024.

- By delivery route type, injectables are expected to grow at a remarkable CAGR between 2025 and 2034.

- By technology platform, the fermentation & manufacturing technologies segment held the largest market share of 35% in 2024.

- By technology platform, synthetic biology engineering is expected to grow at the highest CAGR between 2025 and 2034.

- By technology platform, the fermentation & manufacturing technologies segment held the largest market share of 35% in 2024.

- By technology platform type, synthetic biology engineering is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end user, the pharmaceutical & biotechnology companies segment led the bacterial therapeutics market in 2024, accounting for a 40% share.

- By end user, the contract research organisations segment is set to grow at a substantial CAGR during the forecasted years.

What is the Bacterial Therapeutics Market?

The bacterial therapeutics market encompasses the development and commercialization of live biotherapeutic products (LBPs) and engineered bacterial strains intended to prevent, treat, or manage diseases by modulating the human microbiome or delivering therapeutic functions. Unlike traditional antibiotics, bacterial therapeutics leverage beneficial bacteria to restore microbial balance, enhance immunity, and deliver targeted molecules. These therapeutics are being explored for the treatment of gastrointestinal disorders, infectious diseases, oncology, metabolic conditions, and autoimmune diseases.

Advances in synthetic biology, microbiome sequencing, and microbial engineering are accelerating innovation in this space. The market is supported by the growing recognition of the microbiome's role in health, the rising prevalence of chronic diseases, and a strong research and development pipeline. North America dominates, while the Asia Pacific is the fastest-growing region, driven by increasing investments in microbiome research.

Market growth in the bacterial therapeutics market is driven by a resurgence in microbiome science and an urgent need for novel therapies that harness the therapeutic potential of living microorganisms. These therapeutics, ranging from engineered probiotics to bacteriophage adjunct formulations, promise to modulate disease pathways with precision that small molecules and biologics sometimes cannot attain. The promise is as much scientific as it is economic, with potential breakthroughs in areas such as gastroenterology, oncology adjuncts, metabolic disease, and infectious disease mitigation that could reshape treatment paradigms. Regulatory frameworks, as they evolve, are gradually accommodating the biologically nuanced nature of live microbial interventions.

Key Technological Shift in the Bacterial Therapeutics Market

The pivotal technological shift is the convergence of precise genetic engineering with advanced delivery and formulation science, enabling the development of safer and more targeted live microbial therapeutics. CRISPR-enabled editing and synthetic biology permit the construction of microbes that sense, compute, and respond to physiological cues within the host. Simultaneously, progress in encapsulation, lyophilization, and microencapsulation mitigates stability and targeting challenges, expanding the range of feasible delivery routes.

Single-cell sequencing and metabolomics analytics refine the understanding of host–microbe interactions, guiding the rational design. The melding of these technologies converts conceptual interventions into clinically actionable products. In sum, the field is transitioning from empirical probiotic use to engineered, controllable biological therapeutics with definable mechanisms of action.

- Companies developing reusable microbial chassis and gene circuits.

- Strategic pharma biotech alliances accelerating clinical translation.

- Focus on niche indications with clear pathways to clinical endpoints.

- Robust investment in CMC and GMP-compliant microbial manufacturing.

- Increasing regulatory engagement to define quality and safety frameworks.

- Growing emphasis on patient-centric formulations and reduced cold-chain dependency

Bacterial Therapeutics Market Outlook

- Industry Growth Overview: Industry growth is propelled by converging incentives, unmet clinical needs, investor appetite for platform technologies, and the capacity to engineer microbes with increasing precision. Biotech firms innovate around chassis organisms, programmable genetic circuits, and targeted delivery systems to enhance safety and efficacy. Established pharmaceutical players are entering the market through licensing, joint ventures, or acquisitions to augment their immunology and oncology portfolios.

- Sustainability Trends: Sustainability in bacterial therapeutics manifests primarily through greener manufacturing and reduction of waste compared with certain resource-intensive biologics. Advances in fermentation efficiency, renewable feedstocks, and closed-loop water systems are lowering the environmental footprint of microbial production. Additionally, localized manufacturing and stable formulations that relax cold-chain dependence can reduce transportation emissions and supply-chain vulnerability. Ethical sourcing of raw materials and transparent lifecycle assessments are gaining traction among investors and regulators. The industry's intrinsic reliance on living organisms also promotes circular thinking, whereby by-products can be repurposed or treated biologically rather than chemically. Therefore, sustainability is not an afterthought but increasingly a design principle in product development and manufacturing.

- Major Investors: Capital originates from a mosaic of venture capital funds specialising in life sciences, strategic pharma corporate venture arms, and a rising cohort of impact investors who value durable healthcare innovations. Large pharmaceutical firms deploy balance-sheet investments to secure platform access and bolster late-stage pipelines. Public markets and SPAC-style vehicles have periodically catalysed capital inflows for ambitious bacterial-therapeutic ventures. Moreover, philanthropic and disease-specific foundations sometimes underwrite early clinical studies in areas with high unmet needs. Overall, the investor base blends risk-tolerant biotech backers with pharma strategists seeking differentiated modalities.

- Startup Economy: The startup ecosystem is vigorous, populated by platform-focused companies engineering microbial chassis, enacting controlled gene circuits, and developing sophisticated delivery matrices. These ventures often spin out of academic labs with robust IP and early proof-of-concept studies, benefiting from incubators and domain-specific accelerators. Startups prioritise modular, scalable manufacturing approaches and frequently partner with CDMOs to bridge technical gaps. Collaboration with clinicians and payers early in development helps align trial design with real-world acceptance. While many enterprises remain pre-revenue, successful translational examples will catalyse further investment and consolidation. The startup economy thus fuels the market's creative and translational velocity.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Mechanism of Action, Therapeutic Application, Delivery Route, Technology Platform, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Programmability: Biology as a Therapeutic Code

A dominant driver in the market for bacterial therapeutics is the ability to program microbes to perform therapeutic functions, such as delivering molecules, modulating immunity, or restoring metabolic balance, thereby transforming biology into an actionable therapeutic code. This programmability unlocks interventions that can act locally, reduce systemic toxicity, and adapt dynamically to disease states. It enables bespoke solutions for indications where conventional drugs have shown limited efficacy. Investors and clinicians alike are enthused by the prospect of modular platforms that can be rapidly tailored to multiple indications. Furthermore, programmability fosters regulatory dialogue by clarifying mechanisms and controllability, supporting safer trial designs. Consequently, the ability to "program" biology is reshaping therapeutic possibilities and investment decisions.

Restraint

Manufacture and Margin: The CMC Conundrum

Despite the market's growth, one of the factors that proves to be an obstacle in the bacterial therapeutics market expansion is the complexity and cost of manufacturing live biological therapeutics at GMP scale while preserving safety, potency, and stability. CMC challenges, including aseptic processing, strain stability, containment, and validated release assays, inflate development timelines and capital requirements. Cold-chain logistics and batch-to-batch variability further complicate commercialization for global markets. Until manufacturing platforms and standards mature, these hurdles will constrain broad market penetration and compress margins. Hence, the CMC conundrum remains a central restraint on the field's rapid scaling.

Opportunity

Adjunct to Precision Medicine

The principal opportunity lies in positioning bacterial therapeutics as precise adjuncts to existing modalities, enhancing immunotherapies, reducing antimicrobial use, or correcting metabolic dysregulation. Their capacity for targeted action makes them ideal companions to oncology checkpoint inhibitors or for microbiome-mediated mitigation of drug toxicities. Additionally, the ability to engineer microbes for mucosal delivery opens routes for novel vaccine vectors or localized enzyme delivery. Both economic and health benefits, such as reduced hospitalizations, fewer antibiotic courses, or improved therapy adherence, can underpin favorable reimbursement narratives. Thus, bacterial therapeutics can expand the armamentarium of precision medicine while generating compelling commercial value.

Segment Insights

Product Type Insights

Why Live Biotherapeutic Products Are Dominating the Bacterial Therapeutics Market?

The live biotherapeutic product is leading the bacterial therapeutics market, holding a 45% share, due to its direct use of living microorganisms, which ensures potent therapeutic outcomes. They are particularly effective in restoring microbiome balance, which underpins their popularity in treating gastrointestinal and metabolic conditions. This robust clinical pipeline, with multiple candidates progressing into late-stage trials, cements their leadership in this market segment. Moreover, their ability to mimic natural symbiosis within the human body enhances acceptance among clinicians. This dominance reflects both scientific maturity and regulatory confidence in their safety profiles.

Engineered bacterial strains are rapidly gaining ground as the fastest-growing sub-segment due to their versatility and precision. These strains are designed with synthetic biology tools to perform specialized functions, such as targeted metabolite secretion or immune modulation. Unlike conventional LBPs, they can be tailored to address complex diseases beyond gut health, including oncology and neurology. Their appeal also lies in their scalability, with engineered platforms enabling reproducible outcomes in industrial-scale production. As innovation accelerates, engineered strains are poised to redefine the future trajectory of bacterial therapeutics.

Mechanism of Action Insights

Why Microbiome Modulation is Dominating the Bacterial Therapeutics Market?

The microbiome modulation segment commands the largest bacterial therapeutics market with a share of 40% because it directly aligns with the therapeutic principle of restoring microbial harmony in individuals with diseases. It leverages bacterial therapies to reset dysbiosis, a hallmark of gastrointestinal, metabolic, and even neurological disorders. This mechanism benefits from a wealth of scientific validation, supported by the development of growing diagnostic tools that map microbiome imbalances. Its dominance also stems from its broad therapeutic application, making it a cornerstone strategy across multiple disease areas. Investors and researchers alike view microbiome modulation as the most reliable and evidence-backed pathway in bacterial therapeutics.

Metabolite delivery is fast emerging as the most dynamic mechanism of action, thanks to its capacity to harness bacteria as miniature bio-factories. These therapeutics release key metabolites directly into the host system, bypassing traditional pharmacological limitations. The approach is particularly compelling in metabolic and autoimmune disorders, where systemic modulation of signaling molecules is required. Advances in synthetic biology and fermentation have amplified the ability to engineer precise metabolite outputs. This innovation positions metabolite delivery as the next frontier in maximizing the therapeutic utility of bacteria.

Therapeutic Application Insights

How Is the Gastrointestinal Disorders IDB Segment Leading the Bacterial Therapeutics Market?

The gastrointestinal disorders IDB segment is leading the bacterial therapeutics market, holding a 35% share, due to the centrality of gut microbiota in disease progression. Therapies here aim to restore microbial balance, reduce inflammation, and promote mucosal healing. The strong clinical evidence supporting efficacy in Crohn's disease and ulcerative colitis reinforces the segment's leadership. Patient demand is high, given the limitations of conventional biologics and immunosuppressants. This therapeutic anchor remains the primary driver of both commercial adoption and clinical innovation.

Oncology is the fastest-growing application as bacterial therapeutics explore uncharted potential in modulating tumor microenvironments. Engineered bacterial strains are being harnessed to deliver immunostimulatory molecules directly into tumors, enhancing precision and reducing systemic toxicity. The growing recognition of the microbiome's role in cancer treatment response further fuels momentum. While still in early stages, collaborations between biotech firms and oncology leaders are expanding pipelines. This frontier application promises to elevate bacterial therapeutics from niche gastrointestinal treatments to mainstream adjuncts in cancer care.

Delivery Route Insights

How Is the Oral Segment Leading the Bacterial Therapeutics Market?

The oral segment dominates the market, accounting for a 60% share in the bacterial therapeutics market, primarily due to patient convenience and compatibility with microbiome-targeted interventions. Oral formulations ensure direct access to the gut, which remains the epicenter of microbiome-related therapies. The scalability of capsule-based delivery also supports commercial viability. Furthermore, oral routes minimize invasiveness, thereby improving compliance in chronic conditions like IBD. This supremacy reflects the intrinsic alignment between therapeutic design and patient-friendly administration.

Injectables are emerging as the fastest-growing route of administration, particularly for systemic and oncology-focused applications. This method enables bacterial therapeutics to bypass digestive barriers and act directly within systemic circulation or localized tissues. It is especially valuable for precision oncology and metabolic interventions where site-specific activity is crucial. Advances in formulation science are mitigating stability challenges, making injectable delivery more feasible. As innovation progresses, injectables are expected to expand the therapeutic reach of bacterial-based medicine.

Technology Platform Insights

Why Fermentation & Manufacturing Technologies are Dominating the Bacterial Therapeutics Market?

The fermentation & manufacturing technologies segment dominated the bacterial therapeutics sector, holding a 35% share of the bacterial therapeutics market, as they underpin the ability to produce live organisms at scale. These traditional yet refined methods ensure reproducibility, purity, and viability of therapeutic strains. Their longstanding industrial infrastructure makes them the backbone of production pipelines. Moreover, continuous improvements in fermentation processes are driving down costs and expanding capacity. This segment's leadership rests on both historical reliability and future scalability.

Synthetic biology engineering is rapidly expanding as the fastest-growing platform, enabling precise manipulation of bacterial genomes for therapeutic functions. This approach allows the design of bacteria with programmable traits, such as controlled metabolite secretion or tumor-targeted activity. It transcends the limitations of traditional fermentation by introducing higher precision and multifunctionality. The platform has also attracted significant venture capital due to its disruptive potential. Synthetic biology thus represents the cutting edge of therapeutic bacterial innovation.

End User Insights

Why Fermentation & Manufacturing Technologies are Dominating the Market for Bacterial Therapeutics?

Pharmaceutical and biotechnology companies dominate the bacterial therapeutics end-user landscape with a 40% share in 2024, given their resources, expertise, and regulatory experience. These firms drive most clinical trials, scale-up initiatives, and commercialization strategies. Their established networks ensure rapid integration of bacterial therapies into broader treatment ecosystems. The segment's dominance reflects the alignment between biotech innovation and pharma execution. Moreover, the pharmaceutical industry's appetite for novel modalities ensures that bacterial therapeutics are propelled into mainstream pipelines.

Contract research organizations are the fastest-growing end-user segment, driven by the increasing outsourcing of research and development by small and mid-sized biotechs. CROs provide specialized services, from preclinical studies to clinical trial management, accelerating therapeutic development. Their flexible models reduce cost burdens for innovators, making them essential partners in a capital-intensive field. As the ecosystem diversifies, CROs are becoming integral players in advancing bacterial therapeutics. This rise underscores a shift toward collaborative, networked innovation across the industry.

Regional Insights

Why Does North America Reign Supreme in the Bacterial Therapeutics Sector?

North America dominates the bacterial therapeutics market, holding a 45% share, driven by the convergence of academic excellence, venture capital intensity, and a regulatory ecosystem prepared to engage with novel biologics. The region's clusters of synthetic biology research, coupled with experienced biotech investors and seasoned entrepreneurs, foster rapid translation from bench to clinic. Large pharmaceutical firms in the region frequently partner with or acquire promising startups, creating robust exit pathways and accelerating clinical development. Regulatory agencies, while exacting, have increasingly shown willingness to dialogue with developers on appropriate endpoints and manufacturing expectations, facilitating roadmap clarity. Moreover, North American healthcare markets offer reimbursement mechanisms and clinical networks amenable to innovative therapies. In aggregate, these factors consolidate North America's commanding position in both innovation and commercialization.

North America's dominance is further reinforced by its manufacturing capacity and service ecosystem, including specialized CDMOs, analytics firms, and logistics providers adept at handling live biotherapeutics. Clinical trial infrastructure in academic medical centres and specialised CROs enables rapid patient recruitment and iterative clinical designs. This ecosystem reduces time-to-market for successful candidates and provides comprehensive support for regulatory filings. Investment density and exit markets also sustain a virtuous cycle that attracts global talent and capital. Therefore, North America not only invents but also industrializes bacterial therapeutics on a large scale.

The United States is the fulcrum of this regional leadership, hosting premier academic institutions, a deep venture capital market, and a regulatory apparatus that engages in proactive scientific dialogue, all of which collectively accelerate the commercialization of bacterial therapeutics.

Why is Asia Pacific Fastest Growing Market for Bacterial Therapeutics?

The Asia Pacific represents the fastest-growing region, buoyed by rising biotech investments, expanding manufacturing capabilities, and large patient populations that are conducive to trial enrollment. Governments across the region are enhancing biotechnology agendas, offering incentives for domestic manufacturing and translational research. Local startups coupled with university spinouts are increasingly focusing on microbiome-based interventions tailored to regional disease burdens and dietary patterns. Furthermore, improving clinical infrastructures and growing pharmaceutical partnerships facilitate faster scale-up and market entry. As manufacturing capacity matures, the region will increasingly compete for both clinical development and commercial supply contracts. Collectively, these dynamics position the Asia Pacific as the fastest-growing market for bacterial therapeutics.

Asia Pacific's growth is also catalysed by cost-effective manufacturing and the strategic aim of achieving supply-chain resilience, prompting multinational companies to regionalise production. This regionalisation reduces logistical complexity for live products and supports local regulatory engagement. Moreover, the region's vast and heterogeneous patient cohorts offer valuable datasets for understanding microbiome variability and therapeutic responsiveness. As public and private investments align, the Asia Pacific will move from trial geography to an innovation hub.

China's rapid biotech industrialization, abundant capital pools, and large domestic market make it a pivotal growth engine for bacterial therapeutics. At the same time, India's strong generic-biologics manufacturing base and burgeoning startup community offer complementary strengths in cost-effective production and translational research.

Analyst Viewpoint: Bacterial Therapeutics Market Dynamics

The global bacterial therapeutics market is evolving as a dual-track ecosystem, defined by a tension between its consumer-nutrition legacy and its pharmaceutical-grade therapeutic future. In its current form, the market is not a monolithic revenue pool but rather a convergence of nutraceutical commercialization and clinical innovation, each operating under distinct regulatory, capital, and risk-return paradigms.

In the near term, demand anchors stem from rising consumer and clinician awareness of the gut microbiome's role in health, coupled with heightened willingness to adopt biologically derived interventions. This provides a structural tailwind, positioning bacterial therapeutics as a key beneficiary of the broader “biome economy.” Yet, the revenue mix remains disproportionately skewed toward preventive and wellness applications, which, while scalable, are inherently commoditized and face margin pressure.

On the opposite end of the spectrum, live biotherapeutic products (LBPs) represent the sector's long-duration growth option, with the potential to redefine standard-of-care across infectious disease, oncology, metabolic regulation, and immuno-inflammatory disorders. However, LBPs remain encumbered by clinical risk density, manufacturing scalability challenges, and regulatory opacity, rendering the trajectory of value realization highly nonlinear. From a market structure standpoint, the industry resembles a two-speed innovation economy:

- Speed One: Near-term commercialization of functional products and adjunctive therapeutics that generate stable but modest value capture.

- Speed Two: Long-horizon clinical assets where value creation is binary, contingent on regulatory inflection points and payer adoption, with the potential to radically recalibrate market size.

Strategically, the sector is entering a capital-intensive maturation phase. Investor sentiment has oscillated between exuberance and caution, tethered to clinical trial outcomes, while regulators grapple with how to calibrate safety standards for live microbial interventions. Meanwhile, convergence with precision medicine and advanced manufacturing technologies (e.g., GMP-compliant microbial engineering, AI-driven strain selection) is expected to drive differentiation in the medium term.

Bacterial Therapeutics Market: Value Chain Analysis

- Raw Material Sources: Raw materials comprise fermentation media components, excipients for formulation and stabilization, and specialized reagents for genetic modification and QC assays. Sourcing high-purity, GMP-grade inputs is essential to ensure product consistency and regulatory compliance.

- Technology Used: Core technologies include advanced fermentation platforms, synthetic biology tools for strain design, and encapsulation/formulation methods that extend shelf life and target delivery. High-throughput screening and multi-omics analytics enable iterative design and elucidation of mechanisms.

- Investment by Investors: Investors predominantly underwrite platform development, CMC scale-up, and late-stage clinical programs that can validate therapeutic claims. Strategic pharma partnerships often provide non-dilutive capital and market channels, de-risking clinical translation.

- AI Advancements: AI accelerates candidate discovery through in-silico strain optimization, predictive modelling of host microbe interactions, and improved biomarker identification for patient stratification. Machine learning also streamlines manufacturing by predicting yield variability and optimizing fermentation parameters to enhance efficiency.

Top Bacterial Therapeutics Market Companies

- Seres Therapeutics – U.S.-based pioneer in microbiome therapeutics, developing live biotherapeutics for infectious and inflammatory diseases.

- 4D Pharma – UK-based biotech specializing in live biotherapeutic products (LBPs) for gastrointestinal and immune disorders.

- Vedanta Biosciences – Develops defined bacterial consortia as microbiome-based therapeutics for cancer, autoimmune, and infectious diseases.

- Finch Therapeutics – Focused on developing microbiome therapies using donor-derived microbial communities.

- Assembly Biosciences – Works on microbiome-based therapies and antivirals targeting hepatitis B and other infections.

- Cynata Therapeutics – Australian biotech advancing stem cell and microbiome-based regenerative medicine.

- Cytovance Biologics – Provides contract development and manufacturing services for biologics, including microbiome-based therapies.

- Defined Bioscience – Develops defined microbial consortia and related technologies for therapeutic applications.

- Evelo Biosciences – U.S. biotech developing orally delivered microbe-derived medicines for inflammatory and metabolic diseases.

- Enterome – French biotech creating microbiome-derived immunotherapies for oncology and inflammatory diseases.

- Axial Biotherapeutics – Focuses on microbiome-based solutions for neurological and CNS disorders.

- Synlogic – Engineering synthetic biotics (engineered bacteria) for rare metabolic and inflammatory diseases.

- Rebiotix (Ferring Pharmaceuticals) – Commercializing microbiota-based live biotherapeutics, notably for recurrent C. difficile infections.

- AOBiome Therapeutics – Develops topical microbiome therapies, including ammonia-oxidizing bacteria for dermatological use.

- Microbiotica – UK biotech developing precision microbiome medicines and biomarkers for oncology and IBD.

- Second Genome – Specializes in microbiome discovery platforms for drug development and precision medicine.

- BioMe Health – Consumer-focused microbiome company offering personalized gut health testing and supplements.

- NuBiyota – Clinical-stage company developing standardized live biotherapeutics from donor-derived microbiota.

- Oragenics – Biotech developing novel antibiotics and probiotics, including oral microbiome solutions.

- Anaerobe Systems – Provides anaerobic microbiology products and technologies to support microbiome research.

Recent Developments

- In September 2025, Cancer treatment today goes far beyond simply addressing tumors or genetic factors. It encompasses a broader understanding of the patient's overall health, environment, and lifestyle, resulting in more holistic and personalized care. Advances in medical science underscore that effective treatment necessitates integrating multiple approaches, ranging from precision medicine to supportive care. This shift is redefining how cancer is managed, moving beyond a narrow biomedical focus toward a comprehensive model of healing.(Source:https://timesofindia.indiatimes.com)

- In March 2025, the European regulatory landscape also evolved: novel frameworks under the Regulation on Substances of Human Origin (SoHO) and emerging microbiome regulatory science have begun shaping how bacterial therapeutics (especially microbiome-based therapies) are conceived, approved, and monitored in Europe—an essential structural change for the field's maturation.(Source: https://www.nature.com)

Segment Covered in the Report

By Product Type

- Live Biotherapeutic Products (LBPs)

- Probiotics with Therapeutic Claims

- Engineered Bacterial Strains

- Bacterial Consortia

By Mechanism of Action

- Microbiome Modulation

- Immunomodulation

- Pathogen Suppression

- Metabolite Delivery

By Therapeutic Application

- Gastrointestinal Disorders

- Inflammatory Bowel Disease (IBD)

- Irritable Bowel Syndrome (IBS)

- Clostridioides difficile Infections

- Infectious Diseases

- Oncology

- Metabolic Disorders (e.g., Diabetes, Obesity)

- Autoimmune & Inflammatory Diseases

- Others

By Delivery Route

- Oral

- Rectal

- Topical

- Injectable

- Others

By Technology Platform

- Microbiome Sequencing & Analysis

- Synthetic Biology Engineering

- Fermentation & Manufacturing Technologies

- Formulation & Encapsulation Technologies

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Hospitals & Clinics

- Contract Research Organizations (CROs)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting