What is the Digital Therapeutics Market Size?

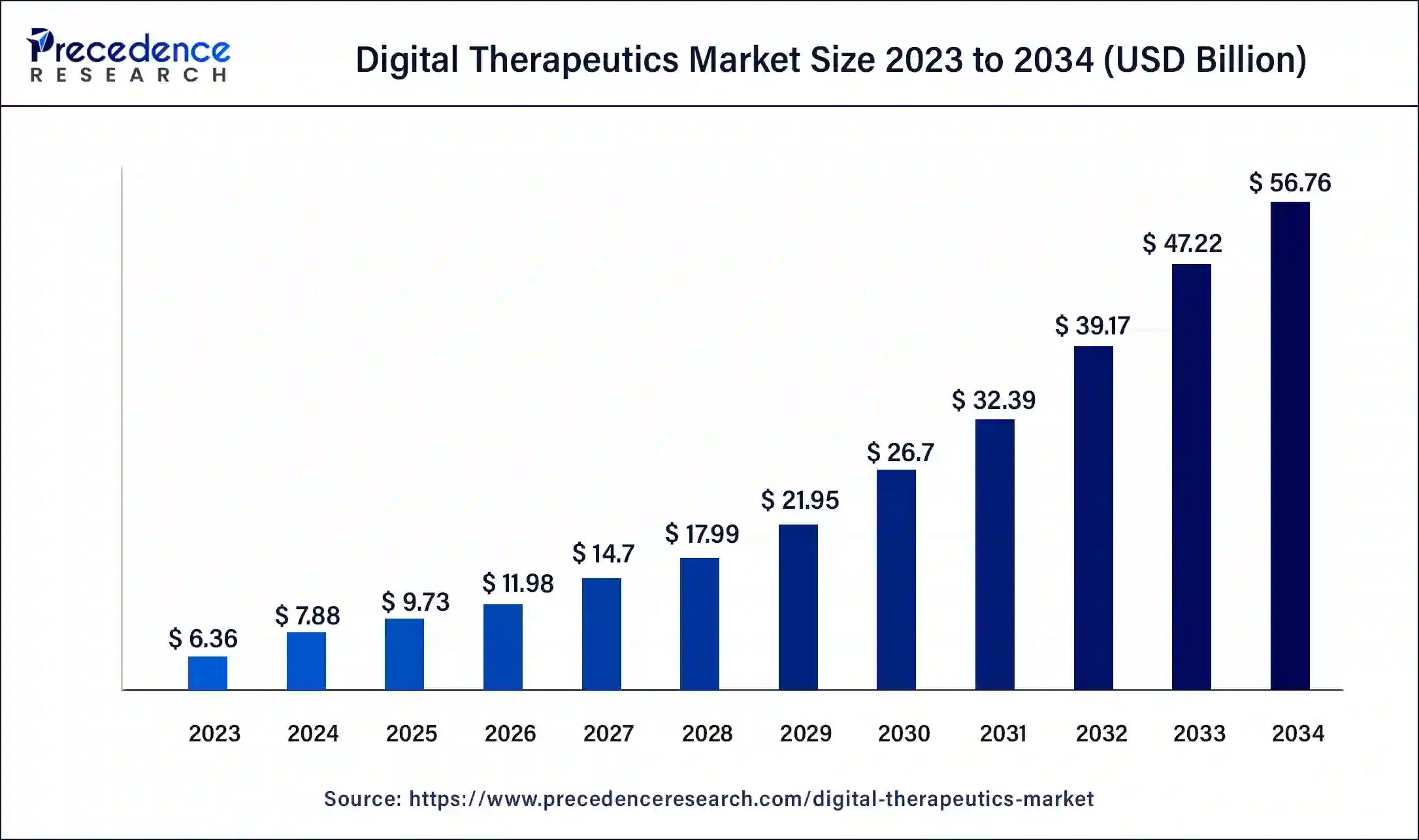

The global digital therapeutics market size is calculated at USD 9.73 billion in 2025 and is predicted to increase from USD 11.98 billion in 2026 to approximately USD 65.31 billion by 2035, expanding at a CAGR of 20.97% from 2026 to 2035. The market is driven by the rising prevalence of chronic diseases, like diabetes, cardiovascular conditions, and mental health disorders.

Digital Therapeutics Market Key Takeaways

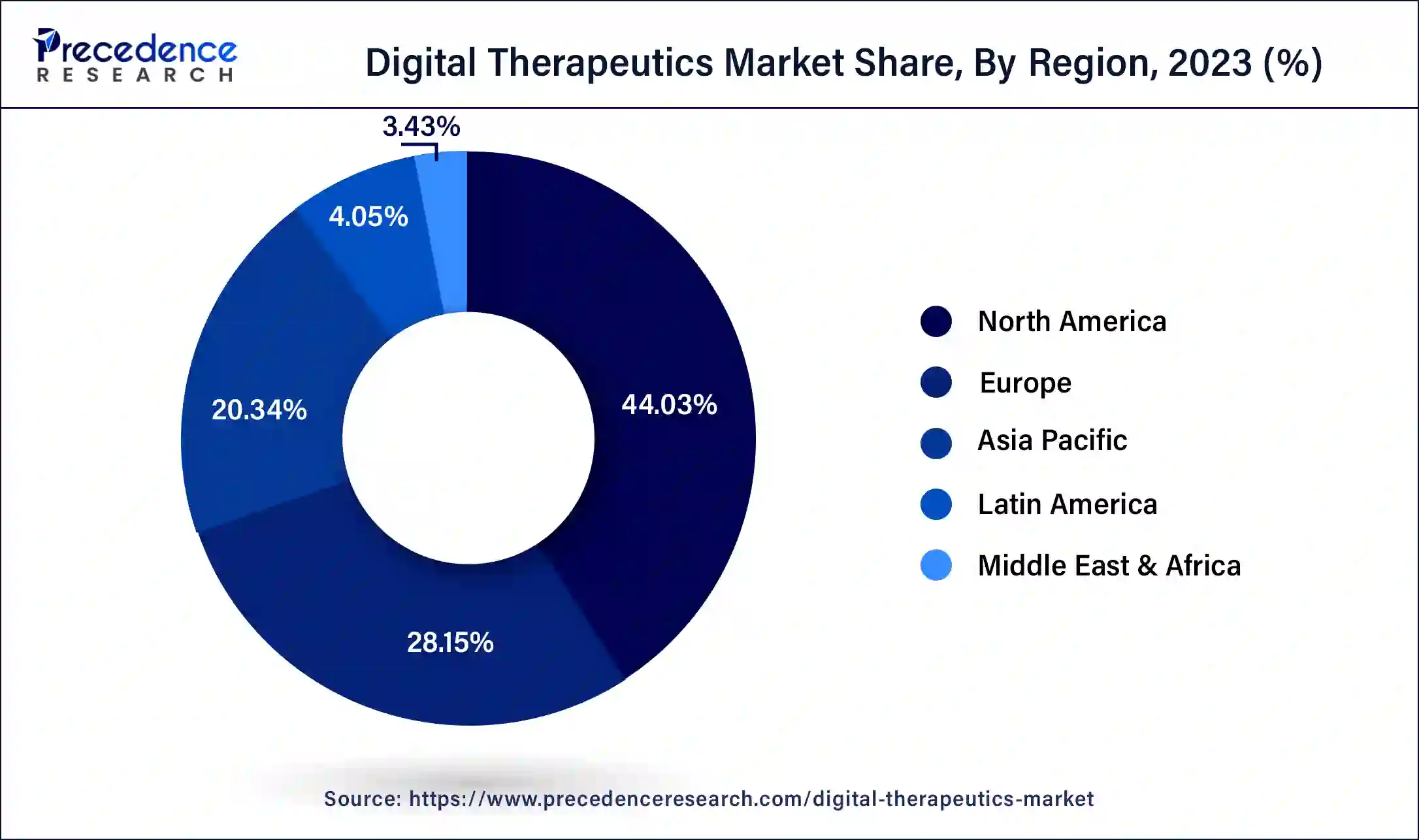

- North America contributed the largest market share of 43.91% in 2025.

- By product type, the prescription digital therapeutics (PDTs) segment dominated the market with 29.40% market share in 2025. The dominance of the segment can be attributed to the rising incidence of chronic diseases.

- By product type, the behavioural & cognitive interventions via digital platforms segment are expected to grow at the highest CAGR of 10.20% in 2025. The dominance of the segment can be credited to the rise in the adoption of smartphones.

- By therapy area, the central nervous system (CNS) / neuroscience segment led the market by holding 32.60% market share in 2025. The dominance of the segment can be linked to the surge in incidence of mental and neurological health disorders.

- By therapy area, the metabolic and endocrine segment is expected to grow at the highest CAGR of 10.80% in 2025. The dominance of the segment can be driven by the rising incidence of diabetes, obesity, and metabolic syndrome.

- By delivery platform, the mobile applications (iOS, Android) segment held a 40.70% market share in 2025. The dominance of the segment is owed to the growing adoption of smartphones and tablets, and innovations in network infrastructure and coverage.

- By delivery platform, the AI-based chatbots or coaching interfaces segment is expected to grow at the highest CAGR of 11.10% in 2025. The dominance of the segment is due to the rising incidence of chronic diseases.

- By business model, the B2B2C segment dominated the market with a 35.80% share in 2025. Digital therapeutics are particularly effective in managing chronic diseases such as diabetes, hypertension, and mental health disorders.

- By business model, the reimbursement-based segment is expected to grow at the highest CAGR of 10.40% in 2025. The dominance of the segment can be attributed to the rising incidence of chronic diseases.

- By end user, the patients segment dominated the market with 47.30% market share in 2025. The dominance of the segment can be credited to the rising incidence of chronic diseases and the global surge in the geriatric population.

- By end user, the payers segment is expected to grow at the fastest CAGR of 9.60% in 2025. The dominance of the segment can be linked to its important role in the adoption of Digital Therapeutics (DTx).

Digital Therapeutics Market Trends

- The incorporation of AI and wearable devices enhances the personalization and effectiveness of digital therapeutics solutions.

- Regulatory advancement and reimbursement models are paving the way for broader adoption.

- Shift towards value-based care models, emphasizing patient outcomes and cost effectiveness.

- Increasing patient engagement and accessibility fur to user-friendly and interactive features.

How is AI Transforming the Digital Therapeutics Market?

AI is transforming the digital therapeutics market by enabling highly personalized, adaptive, and predictive interventions for managing conditions ranging from mental health disorders to chronic diseases like diabetes and hypertension. This shift moves digital therapeutics from static software to intelligent, evidence-based solutions that continuously learn from patient data. AI-driven chatbots and virtual assistants offer 24/7, context-aware support and coaching, enhancing accessibility and reducing stigma, while gamification elements help maintain engagement and adherence to therapy.

Digital Therapeutics Market Growth Factors

The patients can receive evidence-based treatment interventions using digital therapies. It is used to manage, prevent, or treat medical conditions using software applications and equipment. To provide patient care and health results, the digital therapeutics software can be used alone or in conjunction with other therapies.

The rising frequency of preventable chronic disorders such as cancer and diabetes, the need to control healthcare costs, increased investments in digital medicines, and a growing focus on preventive healthcare are all driving the growth of the digital therapeutics market.

One of the key factors driving the growth of digital therapeutics market is the rising focus on preventative healthcare by governments around the world. The governments are taking steps and implementing programs to increase the rate of use of these devices, which is a shift from the traditional healthcare methods.

Increasing penetration of digital healthcare applications & platforms because of rapid adoption of smartphones & tablets expected to spur the market growth over the upcoming years.

Rising prevalence of chronic diseases coupled with increasing need to regulate the escalating cost of healthcare facilities is likely to impel the market growth. Further, constantly changing digital platforms in various sectors has grappled consumers towards using of these digital platforms as well as increasing awareness pertaining to health and fitness are the primary factors that boost the market growth over the forthcoming timeframe.

Although digital therapeutics witnesses significant development and numerous advancements, it is still at a niche phase and the application developers face lot of difficulty due to lack of proper monetization strategy. Presently, advertisements along with the paid content are the prime source of revenue generation, yet are insufficient to meet the financial requirements. The aforementioned factors are anticipated to adversely affect the market growth.

Digital Therapeutics Market Outlook

- Industry Growth Overview: The market is experiencing rapid growth from 2025 to 2034, driven by rising chronic disease prevalence, greater smartphone and internet penetration, and technological advancements. The rising patient demand for convenient, remote care is also driving the market.

- Major Investors: Major investors in the market include venture capital firms like Andreessen Horowitz, General Catalyst, and Rock Health, as well as strategic backers such as Temasek and the European Investment Bank, which provide substantial capital and industry networks to support clinical validation, product development, and market expansion for digital therapeutic startups.

- Global Expansion: The market is growing worldwide as healthcare systems increasingly adopt software‑based, clinically validated interventions to manage chronic diseases, mental health, and other conditions, with strong demand in North America and expanding adoption across Europe and Asia‑Pacific due to rising digital health integration and supportive policies. Emerging regions like Asia‑Pacific, Latin America, and the Middle East & Africa present significant opportunities from large patient populations, growing smartphone and internet penetration, rising chronic disease burdens, and expanding government initiatives.

Market Scope

| Report Scope | Details |

| Market Size in 2035 | USD 65.31 Billion |

| Market Size in 2025 | USD 9.73 Billion |

| Market Size by 2026 | USD 11.98 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 20.97% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Sales Channel, and Region |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing geriatric population

The growing geriatric population globally is one of the primary factors driving up demand for digital therapeutics. The global population of people aged 60 and up is expected to reach 2.1 billion by 2050, according to the United Nations. People over the age of 60 are more susceptible to illnesses such as obesity, cancer, and diabetes, increasing the demand for digital therapeutics. Thus, during the forecast period, the growing geriatric population is driving the growth of the digital therapeutics market.

Restraints

Data privacy concerns

The various health applications lack necessary authorization in several countries, raising issues about the product and data quality, patient privacy, security, and data use responsibly. The patient's information is accessible by digital therapeutics providers, but they are not allowed to share it with anybody who is not involved in the patient's treatment. However, with the use of digital technologies to integrate data, the patient's information is at risk of being accessible by any healthcare professional who is not involved in the patient's treatment program. Thus, the data privacy concerns is hindering the growth of digital therapeutics market during the forecast period.

Opportunities

Rising prevalence of chronic diseases

The chronic disease's high prevalence is a key source of concern for healthcare systems all over the world. The treatment of chronic disorders patients is difficult due to psychological variables influencing the patients. The patients must adapt their behavior as a part of new self-care lifestyle because chronic diseases are generally linked with a high level of unpredictability. Moreover, many chronic diseases and ailments progress with the time, and their prevalence increases as people get older. As a result, chronic problems are likely to increase even more in the coming years as the global senior population continues to grow. As a result, the rising prevalence of chronic diseases is creating lucrative opportunities for the growth of digital therapeutics during the forecast period.

Challenges

Lack of consumer awareness

Motivating people to use digital therapeutics and gaining their trust is a major challenge for providers of digital therapeutics. The old age people are more vulnerable to the chronic disorders. Furthermore, the extent to which behavioral change can be observed with digital therapeutics remains unknown.

Segment Insights

Product Insights

The prescription digital therapeutics (PDTs) segment dominated the market with 29.40% market share in 2025. The dominance of the segment can be attributed to the rising incidence of chronic diseases, along with ongoing innovations in technology, with the increasing focus on personalized and preventative care.PDTs can minimize the need for hospitalizations, frequent doctor visits, and expensive medications.

The behavioural & cognitive interventions via digital platforms segment is expected to grow at the highest CAGR of 10.20% in 2024. The dominance of the segment can be credited to the rise in adoption of smartphones and the enhanced network infrastructure. Also, these platforms provide clinically validated solutions for safeguarding, managing, and treating various conditions like mental health disorders.

Therapy Area Insights

The central nervous system (CNS) / neuroscience segment led the market by holding 32.60% market share in 2025. The dominance of the segment can be linked to the surge in incidence of mental and neurological health disorders and the rising adoption of digital health solutions with innovations in AI and machine learning. Moreover, the increasing emphasis on preventative healthcare, especially for lifestyle-related conditions, can further positively impact segment growth.

The metabolic and endocrine segment is expected to grow at the highest CAGR of 10.80% in 2024. The dominance of the segment can be driven by the rising incidence of diabetes, obesity, and metabolic syndrome, coupled with the increasing adoption of patient-oriented care. The growth is also boosted by innovations in technology, including artificial intelligence and machine learning.

Delivery Platform Insights

The mobile applications (iOS, Android) segment held a 40.70% market share in 2024. The dominance of the segment is owed to the growing adoption of smartphones and tablets, and innovations in network infrastructure and coverage. In addition, the raised regulatory support and the development of reimbursement models for digital therapeutics are also impacting segment growth.

The AI-based chatbots or coaching interfaces segment is expected to grow at the highest CAGR of 11.10% in 2024. The dominance of the segment is due to the rising incidence of chronic diseases and the increasing adoption of mobile internet and smartphones. Furthermore, digital solutions can be more cost-effective than conventional healthcare, which makes them a more accessible solution for individuals and healthcare systems.

Business Model Insights

The B2B2C segment dominated the market with a 35.80% share in 2024. Digital therapeutics are particularly effective in managing chronic diseases such as diabetes, hypertension, and mental health disorders. B2B customers, such as healthcare providers and employers, face significant costs related to these conditions and thus have a strong incentive to adopt digital therapeutics to manage them more efficiently.

Digital therapeutics offer robust data analytics capabilities, providing healthcare providers and employers with actionable insights into patient or employee health trends. This data can be used to personalize treatments, improve health outcomes, and demonstrate the value of these solutions. These solutions are designed to integrate with existing healthcare IT systems, such as EHRs and health information exchanges (HIEs), facilitating seamless data flow and enhancing the overall care delivery process.

The reimbursement-based segment is expected to grow at the highest CAGR of 10.40% in 2024. The dominance of the segment can be attributed to the rising incidence of chronic diseases and the ability of DTx to provide cost-effective and accessible care. Moreover, the shift towards value-based care models, which incentivize suppliers for enhanced patient outcomes, is creating a reliable environment for DTx adoption, impacting positive segment growth further.

End User Insights

The patients segment dominated the market with a 47.30% market share in 2025. The dominance of the segment can be credited to the rising incidence of chronic diseases, global surge in the geriatric population, and increasing demand for accessible and affordable healthcare solutions. Also, innovations in technology and the ongoing transition towards patient-centric care are contributing to the expansion of segments further.

The payers segment is expected to grow at the fastest CAGR of 9.60% in 2024. The dominance of the segment can be linked to its important role in the adoption of Digital Therapeutics (DTx), with the increasing recognition of DTx's value. In addition, payers are rapidly seeking new solutions to mitigate rising costs associated with healthcare, especially for chronic diseases, driving segment growth soon.

Regional Insights

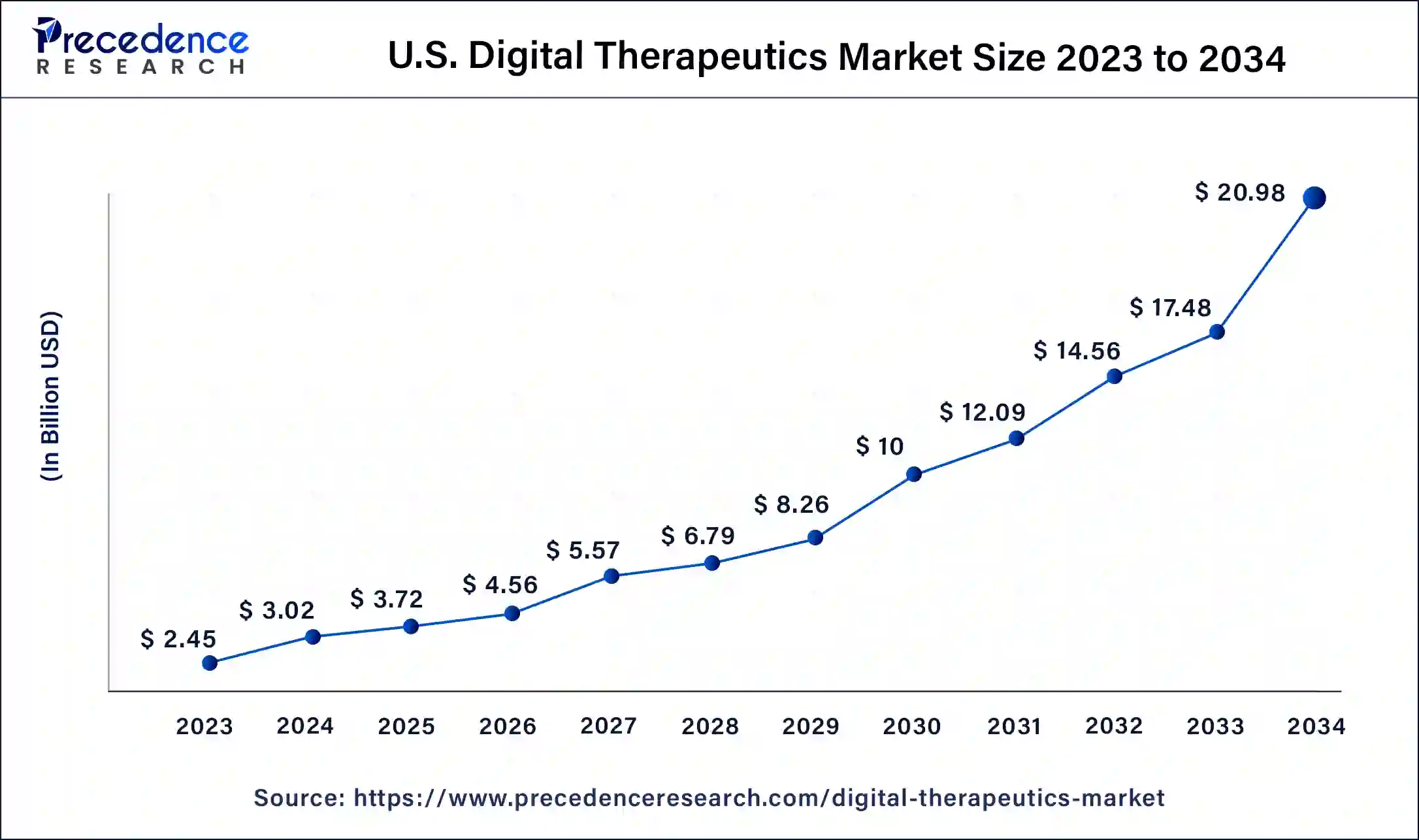

What is the U.S. Digital Therapeutics Market Size?

The U.S. digital therapeutics market size was estimated at USD 3.72 billion in 2025 and is predicted to be worth around USD 24.09 billion by 2035, registering a solid CAGR of 21.38% between 2026 and 2035.

North America Leads the Global Digital Therapeutics Market Driven by Innovation and Policy Reforms

North America emerged as a global leader in the global digital therapeutics market with a revenue share of 43.91% in 2025 owing to the increasing number of reforms pertaining to curtail the rising healthcare spending across the region. Furthermore, the region is a hub for a large number of solutions providers for digital therapeutics that again drive the market growth in the region.

The digital therapeutics market expansion in this region is fueled by factors such as the entry of new startups, changes in the reimbursement structure of digital therapeutics, increased investments in digital therapeutics, and growing government initiatives to assist technological developments.

The UK Accelerates Ahed n Digital Therapeutics Adoption

The UK market is growing due to strong government support for digital health adoption, increasing NHS initiatives, and rising demand for cost-effective chronic disease management. Favorable reimbursement pathways, expanding use of AI-driven and app-based therapies, and growing collaboration between healthcare providers and technology companies are accelerating adoption.

Additionally, increasing patient awareness and acceptance of remote and personalized care solutions are further driving market growth across the country.

U.S. Digital Therapeutics Market Analysis

The market in the U.S. is driven by rising focus on chronic disease management, high demand for convenient, remote therapeutic solutions, and early adoption of digital health technologies. The country is home to a large number of market players. The country's well-established healthcare infrastructure also sustains its leadership in the North American market.

What Makes Asia Pacific the Fastest-Growing Region in the Digital Therapeutics Market?

Apart from this, the Asia Pacific is expected to witness the fastest growth over the analysis period because of a large consumer base along with a rising geriatric population in the region. Due to its early acceptance of new and innovative technology and increased investment through funding, the Asia-Pacific is likely to dominate the market. The investment is related to increased government investment, mergers, and acquisitions.

India Digital Therapeutics Market Analysis

India's market is experiencing rapid growth, driven by increasing prevalence of chronic diseases, such as diabetes and CVDs, high smartphone and internet penetration, and the need for accessible, personalized care. There is a strong focus on diabetes management. Moreover, increasing healthcare expenditure is likely to drive market growth in India.

What Potentiates the Digital Therapeutics Market within Europe?

The European market is fueled by the rising burden of chronic diseases and an aging population, driving demand for cost-effective, scalable, and personalized treatment options. Supportive regulatory frameworks like Germany's Digital Healthcare Act (DiGA) and increasing adoption of digital health tools by healthcare providers and patients further accelerate market growth. Additionally, public and private investments, alongside a growing focus on value-based care, enable the integration of digital therapeutics into existing healthcare systems, fostering widespread acceptance and expanding accessibility across the region.

Digital Therapeutics Gain Momentum Across the Middle East & Africa

The Middle East and Africa digital therapeutics market is expanding due to increasing smartphone penetration, growing prevalence of chronic diseases, and rising government focus on digital health transformation. Investments in healthcare infrastructure, adoption of telemedicine, and national digital health initiatives are supporting market growth.

Additionally, the need for cost-effective care delivery, improved patient access in remote areas, and growing partnerships with global digital health companies are accelerating adoption across the region.

UAE Drives Digital Therapeutics Growth Through Smart Health Initiatives

The UAE digital therapeutics market is expanding due to strong government initiatives promoting digital health, smart healthcare infrastructure, and innovation-led healthcare reforms. High smartphone penetration, growing adoption of AI and remote patient monitoring, and increasing prevalence of lifestyle-related chronic diseases are driving demand. Supportive regulatory frameworks, rising healthcare investments, and partnerships between healthcare providers and technology companies are further accelerating the adoption of digital therapeutics in the country.

Latin America Unlocks Growth Potential in Digital Therapeutics

The Latin America digital therapeutics market is growing due to the increasing burden of chronic diseases, rising smartphone and internet penetration, and demand for affordable healthcare solutions. Governments and healthcare providers are adopting digital health tools to improve access and reduce costs. Growing investments in healthtech startups, expansion of telemedicine services, and increasing patient acceptance of app-based therapies are further supporting market growth across the region.

Brazil Emerges as a High-Growth Digital Therapeutics Market

The Brazilian market is expanding due to rising adoption of mobile health technologies, increasing prevalence of chronic diseases, and growing demand for cost-effective healthcare solutions. Supportive government initiatives, expanding internet and smartphone access, and increased investment by healthtech startups are driving adoption. Additionally, greater acceptance of remote monitoring, digital disease management programs, and partnerships between healthcare providers and technology companies are accelerating market growth in the country.

Value Chain Analysis of the Digital Therapeutics Market

- Research & Development (R&D)

This stage involves ideation, clinical validation, and design of therapeutic software and algorithms.

Key players: Pear Therapeutics, Click Therapeutics, and Omada Health. - Content & Software Platform Development

This stage focuses on developing robust mobile apps, cloud based platforms, user interfaces, and digital modules that deliver therapeutic interventions.

Key players: Noom, Kaia Health, Big Health, Welldoc, and Propeller Health. - Regulatory Approval & Compliance

This stage centers on obtaining necessary clearances and demonstrating safety and clinical efficacy to comply with medical software and health regulations.

Key players: Pear Therapeutics, Akili Interactive, and Voluntis.

Digital Therapeutics Market Companies

- Livongo Health, Inc.: It provides a digital health platform for the management and even prevention of multiple chronic conditions, mainly diabetes and hypertension.

- Pear Therapeutics, Inc.: Pear Therapeutics provides clinically validated, software-based treatments for conditions such as substance use disorder with reSET, Opioid Use Disorder (OUD) with reSET-O, and chronic insomnia with Somryst, delivering cognitive behavioral therapy (CBT) to patients through prescriptions alongside traditional care.

- Omada Health, Inc.: Omada Health offers comprehensive digital care for chronic conditions by integrating connected devices, human health coaching, personalized content, and peer support into a virtual platform.

Other Major Key Players

- Fitbit Health Solutions

- 2MORROW, Inc.

- Medtronic Plc.

- Resmed, Inc. (Propeller Health)

- Proteus Digital Health, Inc.

- Welldoc, Inc.

- Voluntis, Inc.

- Canary Health Inc.

- Noom, Inc.

- Mango Health Inc.

- Dthera Sciences

Recent Developments

- In April 2025, Click Therapeutics, Inc., a leader in prescription medical treatments as both prescription digital therapeutics and software-enhanced drug therapies, launched an updated brand identity and new website to reflect the company's evolution and vision for the future of medicine. This brand update follows a year of significant successes for Click, including the FDA clearance of the first prescription digital therapeutic for the adjunctive treatment of major depressive disorder symptoms.

- In May 2025 A groundbreaking new treatment from Scottish startup Eyesight Electronics has enabled a patient, once classified as legally blind, to recover over 50 percent of their vision in just three months. The innovative therapy, AmblyoFix, is a home-based treatment designed to tackle amblyopia, commonly known as “lazy eye,” a condition that affects more than 100 million people worldwide.

- In May 2025, PreveCeutical Medical Inc., a health sciences company that develops innovative options for preventive and curative therapies utilizing organic and nature-identical products, announced that BioGene Therapeutics Inc., a majority-owned subsidiary of the Company, has officially launched its new website. BioGene is a Texas-based life sciences company focused on advancing innovative therapies in metabolic health and gene-based treatments.

- In November 2024, South Korea's Hanmi Pharmaceutical Co. announced the launch of its anti-obesity drug candidate, efpeglenatide. The company has outlined a mid-to-long-term strategy to grow the product into a blockbuster drug with annual domestic sales of 100 billion won. Efpeglenatide, which has completed patient recruitment for Phase 3 clinical trials, is being developed as a treatment for overweight individuals and those with stage 1 obesity.

- In September 2023, Fitbit introduced Fitbit Charge 6 to track heart rate during workouts.

- In September 2023, 2Morrow and FIT HR entered into a partnership to bring evidence-based digital wellness solutions to more than 120 local and national small to midsize organizations.

Segments Covered in the Report

By Product Type

- Prescription Digital Therapeutics (PDTs)

- Non-prescription DTx (Wellness-validated DTx)

- Digital Companions (for Rx drugs)

- Remote Monitoring Tools / Digital Biomarkers

- Behavioral & Cognitive Interventions via Digital Platforms

- Mobile Health (mHealth) Applications

- Virtual Coaching & Adherence Tools

By Therapy Area

- Central Nervous System (CNS) / Neuroscience

- Depression

- Anxiety

- ADHD

- Schizophrenia

- Insomnia

- Cognitive impairment (e.g., Alzheimer's, MCI)

- Gastrointestinal Disorders (GI)

- IBS (Irritable Bowel Syndrome)

- IBD (Crohn's, Ulcerative Colitis)

- Functional GI disorders

- Post-operative GI management

- Metabolic and Endocrine

- Type 1 & Type 2 Diabetes

- Obesity

- Metabolic syndrome

- Oncology (Supportive care DTx)

- Pain management

- Chemotherapy-induced nausea

- Psychological support (anxiety, depression)

- Fatigue and sleep disturbances

- Rare Diseases (Support & Monitoring)

- DTx applications for remote management, patient engagement, and symptom monitoring in rare genetic/metabolic conditions

- Other Areas

- Cardiovascular health (hypertension, post-MI recovery)

- Respiratory (asthma, COPD)

- Addiction (alcohol, opioids, nicotine)

- Women's health (fertility, pregnancy monitoring)

By Delivery Platform

- Mobile Applications (iOS, Android)

- Web-based Platforms / Portals

- Smart Wearables

- VR/AR-based Interventions

- Connected Medical Devices (e.g., digital inhalers, glucose monitors)

- AI-based Chatbots or Coaching Interfaces

By Business Model

- B2B2C

- Direct-to-Consumer (D2C)

- Pharma-DTx Partnerships (Companion DTx or Co-commercialization)

- Reimbursement-based (Formulary inclusion, CMS approvals)

- Employer Health Programs

By End User

- Patients

- Healthcare Providers

- Payers

- Pharmaceutical Companies

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting