What is the Digital Biomarkers Market Size?

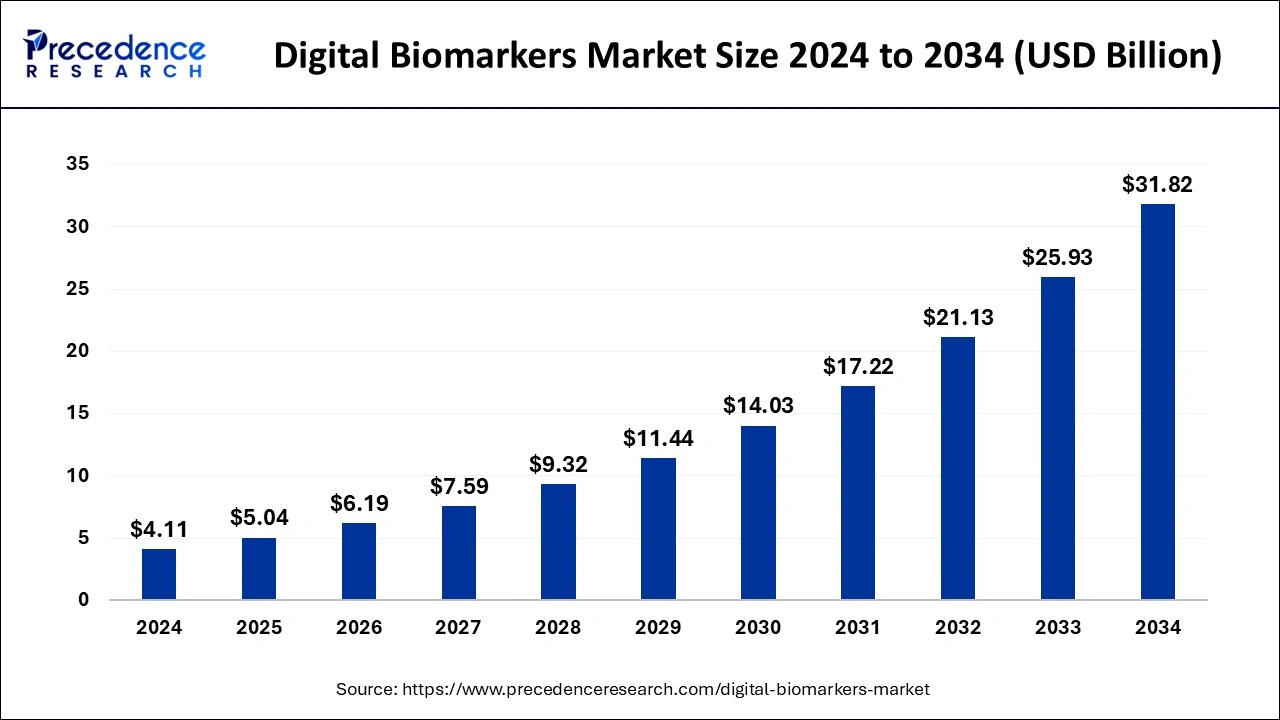

The global digital biomarkers market size is calculated at USD 5.04 billion in 2025 and is predicted to increase from USD 6.19 billion in 2026 to approximately USD 36.98 billion by 2035, expanding at a CAGR of 22.05% from 2026 to 2035.

Digital Biomarkers Market Key Takeaways

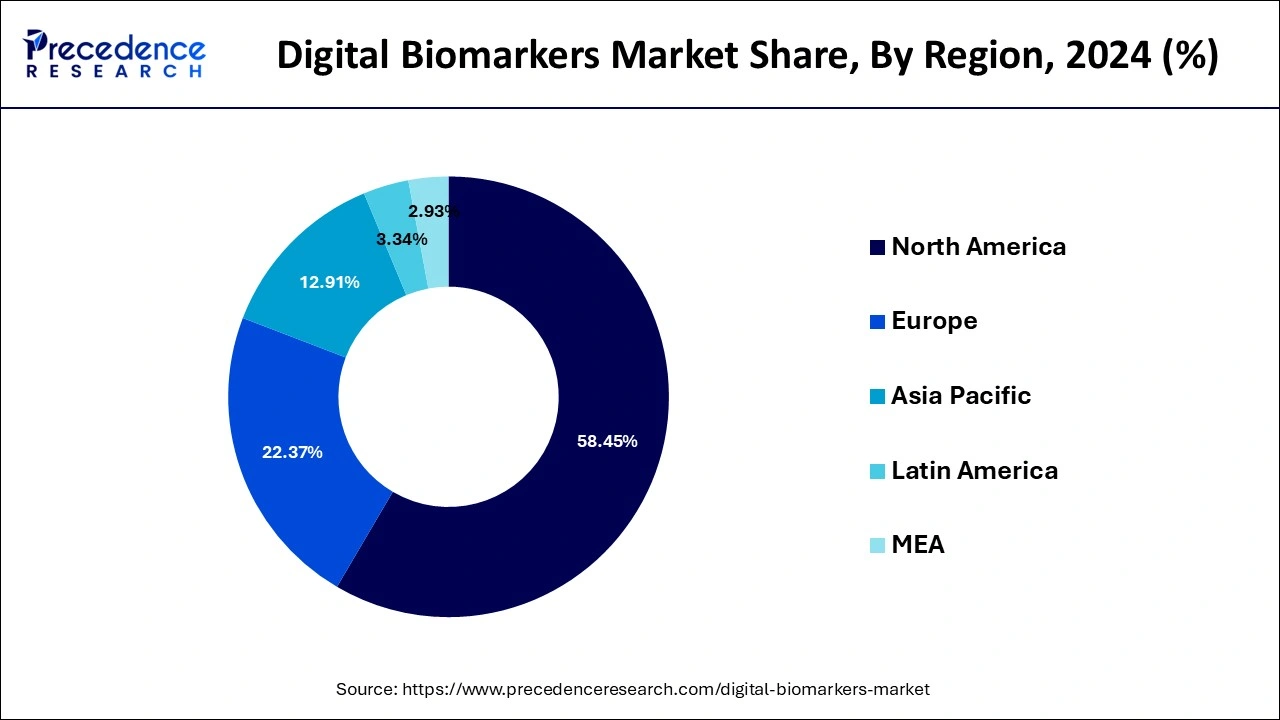

- North America dominated the digital biomarkers market with the largest market share of 58.45% in 2025.

- Asia Pacific is expected to expand at a double digit CAGR of 23.52% during the forecast period.

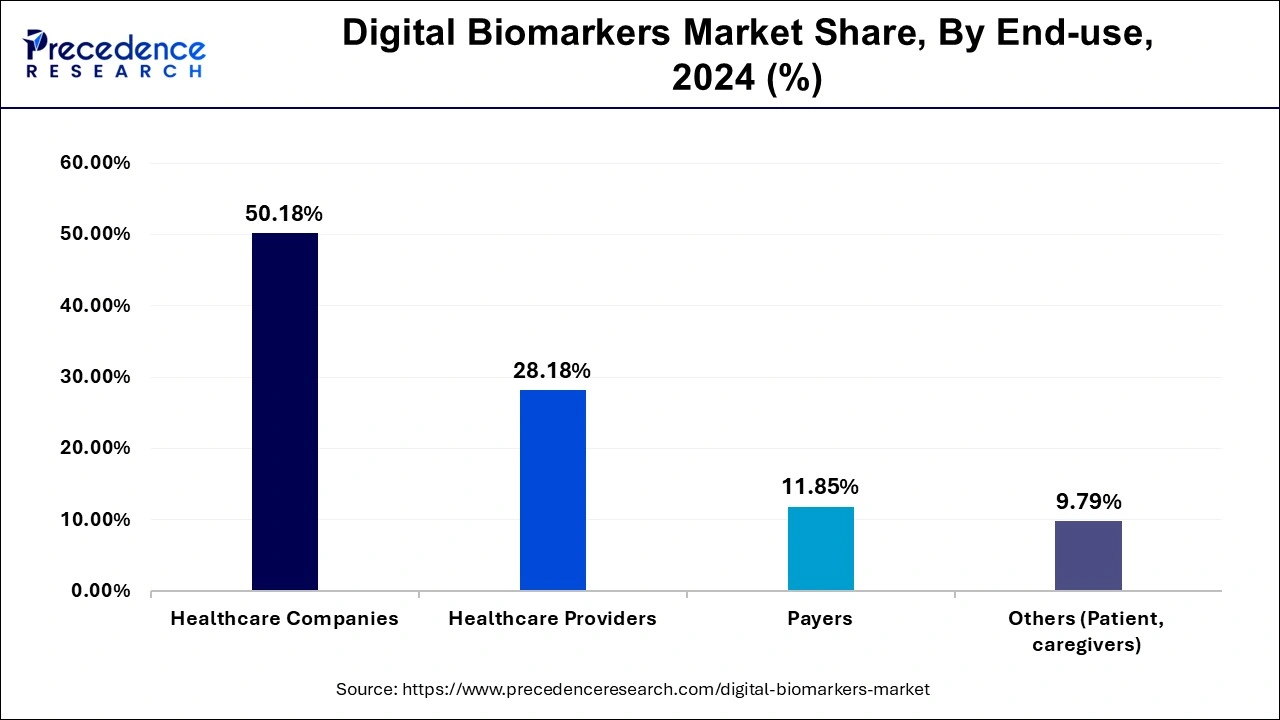

- By end-use, the healthcare companies segment contributed the biggest market share of 50.18% in 2025.

- By end-use, the payers segment is projected to grow at a solid CAGR of 24.5% during the forecast period.

- By clinical practice, the diagnostic digital biomarkers segment contributed the highest market share in 2025.

- By system component, the data collection tools segment led the market in 2025.

- By system component, the data integration systems segment is likely to experience the fastest growth during the forecast period.

- By application, the cardiovascular diseases segment held the largest market share in 2025.

Market Overview

The digital biomarkers market is a crucial segment of the life sciences industry. This industry deals in developing digital biomarkers for manufacturing different medicines. There are different types of components used in this industry comprising of mobile apps, wearable, digital platforms, biosensors, desktop-based software and some others. There are various kinds of biomarkers available in the market consisting of diagnostic digital biomarkers, monitoring digital biomarkers, predictive and prognostic digital biomarkers and some others. These biomarkers are used in various therapeutic areas including cardiovascular and metabolic disorders (CVMD), respiratory disorders, psychiatric disorders, sleep & movement disease, neurological disorders, musculoskeletal disorders and some others. This industry comprises of several end-users such as Healthcare Companies, Healthcare Providers, Payers and some others.

What is the role of AI in Digital Biomarkers Market?

AI has transformed the landscape of the overall healthcare industry. The biomarker companies have started developing AI-based platforms for deriving information of health. In genomics sector, AI algorithms including convolutional neural networks (CNNs) helps in decoding genomic sequences, identifying variations with precision for developing novel medicines. In proteomics, AI enhances mass spectrometry-based protein analysis that improves the process involved in drug discovery. In epigenetics, AI helps in identifying different diseases and enhances chromatin accessibility and histone modifications that are integral for biotech companies. Thus, AI plays a transformative role in the positively shaping the digital biomarkers market.

- In June 2024, BioAI collaborated with Genomic Testing Cooperative (GTC). This collaboration is done to utilize AI technology for discovery of novel biomarker.

Digital Biomarkers Market Growth Factors

- The rising uses of the digital biomarkers in various application areas such as diabetes, respiratory diseases, CVDs, and sleep disorders.

- The rising investments in the research and development of drugs are resulting in the increased cost of the drugs.

- The growing prevalence of chronic diseases and growing geriatric population across the globe is fueling the demand for the digital biomarkers.

- The increasing usage of health informatics in the healthcare industry.

- The necessity of the patients to regularly monitor their health conditions and have consultations from doctors.

- Digital biomarkers can provide cost-effective and personalized treatment to ensure efficient patient care.

- The various developmental strategies adopted by the market players to develop advanced digital biomarkers.

- The rapid development of the telecommunications and the IT infrastructure

Market Outlook

What's Driving the Rapid Increase of the Global Digital Biomarkers Industry?

- Industry Growth Overview: Increased usage of remote patient monitoring (RPM), decentralized clinical trials (DCT), and real-time disease monitoring driven by advanced artificial intelligence (AI) technology and regulatory recognition for using digital endpoints across medicine is increasing the overall growth of this market.

- Sustainable Trends: Digital biomarkers support a more sustainable healthcare model by creating fewer hospital visits, lowering the costs of diagnosis, and creating less resource-intensive clinical trials, allowing for long-term remote monitoring with both reduced environmental impact and reduced operational costs.

- Global Growth: The rapid global growth of digital biomarkers is being driven by an increasing number of smartphone users and the development of comprehensive telemedicine platforms in emerging markets, which have improved access to and use of telemedicine services.

Digital Biomarkers Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.04 Billion |

| Market Size in 2026 | USD 6.19 Billion |

| Market Size by 2035 | USD 36.98 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 22.05% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | System Component, Application, End Use |

Market Dynamics

Driver

Regulatory Flexibility Towards Digital Health Solutions Drives the Industry

For digital biomarkers, FDA has employed more than approach in order to increase the number of products in the market. For instance, the agency has modified its guidelines regarding the software as-medical-device (SaMD). This agency has also launched a pre-certification program, PreCert. As per the program, FDA would approve the company and not the product manufactured by it. By this program, the agency aims to improve the entry process of a company in the market and add in product modification process of the company. Other than the new initiatives, the agency has also revised its stand on digital health tools and FDA's Center for Devices and Radiological Health has made a committee solely focused on the software solutions. Thus, the regulatory flexibility towards digital health solutions is anticipated to boost the growth of the digital biomarkers market.

Restraint

Data Security Issues along with Sample Collection Issues Hampers the Industry

The digital biomarkers market faces several issues in their daily operations. Firstly, there are various security related issues related to biomarkers that creates negative impact in the industry. Secondly, numerous problems arise in sample collection and processing. Thus, these factors are expected to restrain the growth of the digital biomarkers market.

Opportunity

Rapid Adoption of Wearables and Advancements in Sensors to Shape the Upcoming Days

The popularity of wearables among people has gained traction in recent times. These wearables are used for generating real-time health data which can be further translated into digital biomarkers. It is also used for evaluating the efficacy and/or safety of any medical intervention. Moreover, numerous technological advancements in medical sensors are useful for various applications such as data collection, data analysis, digital biomarker fingerprint. Thus, rising adoption of wearables and technological advancements in sensor technology is expected to create ample growth opportunities for the companies in the future.

Segment Insights

System Component Insights

The data collection tools segment led the market in 2025. Data integration systems segment is likely to experience the fastest growth during the forecast period. This is attributable to the increased adoption of the smartphones and wearable devices among the population that helps in the collection of data significantly. The wireless connectivity and internet is a major tool that facilitates easy data collection and easy transfer of the data. The biosensors constitute a major portion of the data collection tools.

The data integration systems segment is the fastest growing in the digital biomarkers market during the forecast period. Digital biomarkers generate huge amounts of data from numerous sources. To make this information useful, robust systems are required to integrate, clean, and harmonize it. Integrated information facilitates seamless partnership between different healthcare stakeholders, including clinicians, researchers, and patients. Effective data integration permits for the creation of comprehensive patient profiles, allowing personalized treatment plans and enhanced clinical decision-making.

Application Insights

The cthe cardiovascular diseases segment held the largest market share in 2025. In terms of revenue and is estimated to sustain its dominance during the forecast period. This is simply attributed to the increased prevalence of cardiovascular diseases among the global population. According to the World Health Organization, the cardiovascular diseases accounts for around 32% of the global deaths. It is known as the leading causes of deaths. The rising prevalence of cardiovascular diseases due to various factors like increased consumption of tobacco, unhealthy food habits, and smoking is further expected to augment the growth of this segment in the forthcoming years. The cardiovascular diseases segment accounted for over 25% of the market share in 2020. The digital biomarkers collects the patients' data and enhances the patient care and treatment outcomes.

On the other hand, the respiratory disease segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the rising prevalence of respiratory diseases like asthma and chronic obstructive pulmonary disease across the globe.

The cardiovascular diseases segment dominated the digital biomarkers market in 2024. This supremacy is largely attributed to the high incidence of cardiovascular diseases and the increasing acceptance of wearable technology for managing heart health. Digital biomarkers, mainly those found in wearable devices, permit early detection of potential heart issues and facilitate continuous monitoring of patients, contributing to enhanced management and potentially better results.In 2023, nearly 1 out of every 6 deaths from cardiovascular diseases (CVDs) was among adults younger than 65 years old.

The respiratory disease segment is the fastest growing in the digital biomarkers market during the forecast period. This growth is boosted by a combination of factors, including the rising prevalence of respiratory illnesses, developments in digital health technologies, and a growing need for remote patient monitoring. Digital biomarkers, which are measurable features obtained via digital health technologies, are proving to be valuable methods for tracking and managing respiratory conditions.

Clinical Practice Insights

The diagnostic digital biomarkers segment contributed the highest market share in 2025. These biomarkers are used for improving several healthcare applications including early disease detection, disease management, personalized treatment, revolutionizing diagnosis and management and some others. The growing use of diagnostic digital biomarkers in research institutes has boosted the market expansion.

The monitoring digital biomarkers segment is projected to rise with the highest growth rate during the forecast period. These biomarkers are used for several applications such as personalized treatment, health status monitoring, neurological and motion disorders and some others. The rising use of monitoring digital biomarkers for detecting CVDs has driven the market growth.

End Use Insights

The healthcare companies segment contributed the biggest market share of 50.18% in 2025. The rising adoption of advanced technologies in healthcare companies has boosted the market growth. The healthcare companies have started using biomarkers for different applications used in drug development. These biomarkers are used in clinical trials for evaluating different therapies. It also helps pharmaceutical companies for finding efficient ways for monitoring patients long-term such as with sensing modules in drug delivery devices.

The ayers segment is projected to grow at a solid CAGR of 24.5% during the forecast period. The rise in number of insurance companies providing several healthcare policies has driven the market growth. These insurance companies have started using digital biomarkers for detecting the efficacy of diseases that are claiming their policies for treatment. Thus, the adoption of biomarkers by insurance providers enhances the disbursement process and helps in providing the legal claims to the authenticated consumers.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing. The various developmental strategies like acquisitions and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Regional Insights

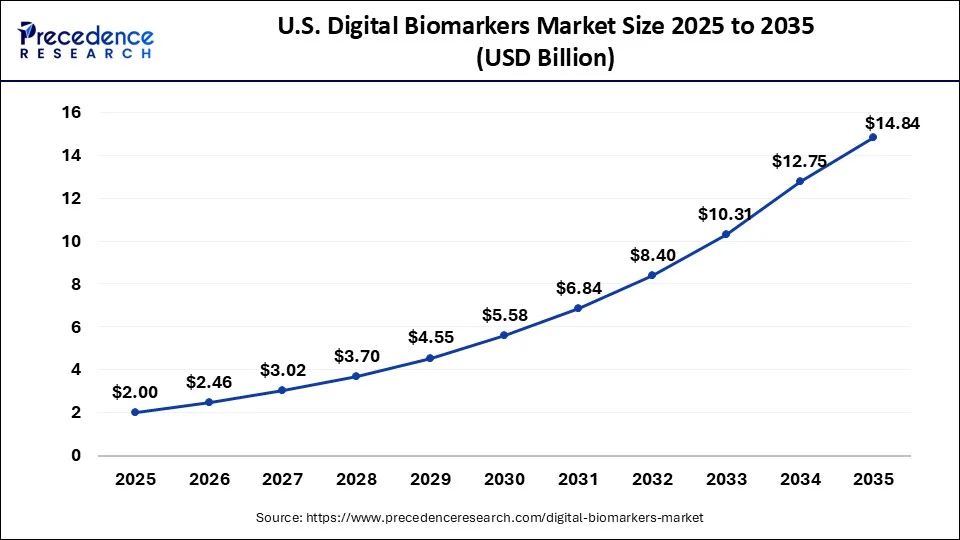

What is the U.S. Digital Biomarkers Market Size?

The U.S. digital biomarkers market size was evaluated at USD 2 billion in 2025 and is predicted to be worth around USD 14.84 billion by 2035, rising at a CAGR of 22.19% from 2026 to 2035.

North America dominated the digital biomarkers market with the largest market share of 58.45% in 2024. The increased healthcare expenditure along with the presence of huge geriatric population in the developed market such as U.S. and Canada is augmenting the adoption of the digital biomarker in the North American healthcare industry. The higher adoption rate of digital technologies in North America has significantly driven the market growth.

In USA, the presence of several digital biomarker companies such as BrainStorm Cell Therapeutics, Amgen Inc. and Empatica Inc. has boosted the market growth. Moreover, there are several research institutes involved in medicine discovery that increases the demand for digital biomarker, thereby fostering the industrial expansion.

- In April 2024, BrainStorm Cell Therapeutics Inc announced the peer-reviewed publication of Phase 3 biomarker data in Muscle and Nerve.

Asia Pacific is expected to expand at a double digit CAGR of 23.52% during the forecast period. The increased government expenditure on the development of the strong and advanced healthcare infrastructure in the region in the past few years has significantly boosted the adoption of the digital biomarkers in the Asia Pacific market. The proliferation of the digital technologies and its increasing adoption in the healthcare sector in Asia Pacific is fueling the growth of the market. Moreover, the presence of huge population and rising prevalence of chronic diseases along with the growing geriatric population is expected to exponentially augment the demand for the digital biomarkers in the foreseeable future.

Europe: Innovative Digital Health Regulation Driven by Regulation:

On Europe's shores, a strong data protection framework, along with the existence of a national digital health strategy, and the large adoption of digital endpoints are driving the growth of the digital health market in Europe. Large-scale validation projects are being developed through collaboration between public and private stakeholders.

In Germany, the country has received approvals through DiGA processes and established reimbursement pathways for digital biomarkers that will help support the adoption of digital biomarkers.

Latin America: Mobile First Healthcare Transformation:

Due to a high mobile penetration and a growing rate of adoption of telemedicine solutions, Latin America is benefiting from a high volume of deployable smartphone-based digital biomarkers across all facets of healthcare, particularly in the areas of chronic care management & mental health management.

Brazil is generating substantial annual growth rates from a high focus on digitization activities and investment in private health technologies.

Middle East and Africa (MEA): Expansion of Smart Healthcare Technology

The overall expansion of the MEA Region has been driven by an overall growth in smart hospital projects, increased adoption of government-led digital health reforms, and increased utilization of wearable technologies for population health monitoring and the activity-based management of chronic diseases.

Within the UAE, there has been significant investment into the development of AI-based platforms for healthcare, including but not limited to precision medicine initiatives.

Value Chain Analysis of the Digital Biomarkers Market

- Data Generation and Device Level: Wearable devices, smartphones, implantable devices, and environmental sensors collect physiological and activity information such as heart rate variability, gait patterns, sleep patterns, and speech measures.

Key Players: Apple, FitBit (Google), and Garmin. - Data Processing, Analytics, and AI Integration: This is where clinicians convert the raw data into clinically relevant digital biomarkers. This occurs through the use of artificial intelligence algorithms and machine learning models, and through the use of signal processing technology.

Key Players: Evidation Health, Koneksa, and Biofourmis. - Clinical Validation, Deployment, and End User Integration: As a result of working with validated digital biomarkers, clinical trials have the ability to deliver these digital biomarkers to pharmaceutical research and development, payers, and providers in their normal workflow.

Key Players: Roche, Novartis, and IQVIA.

Digital Biomarkers Market Companies

- Bayer AG

- Biogen Inc.

- ActigraphLLc

- Amgen Inc

- F. Hoffmann-La Roche Ltd

- Fitbit Inc

- GlaxoSmithKline Plc

- Koninklijke Philips N.V.

- Mindstrong Health

- Medical Care Corporation

- Medopad Ltd

Industry Leaders' Announcements

- In September 2024, Chris Benko, the CEO of Koneksa announced to provide biotech and pharma companies with real-time data sharing and analysis to check the validation and adoption of digital measures for deriving more data insights in clinical trials.

- In March 2024, Guilhem Dupont, the CEO of Indivi announced to develop biomarkers for treating patients suffering from multiple sclerosis.

Recent Developments

- In October 2024, Proscia launched Concentriq. Concentriq is an AI-based platform designed for discovering biomarkers to develop novel therapeutics.

- In September 2024, Roche announced partnership with Lunit. This partnership is done for enhancing precision medicine and improving cancer biomarker testing.

- In August 2024, Paige launched an AI-powered biomarker module. This biomarker module has the capability of evaluating around 505 genes and identifying 1,228 molecular biomarkers from a single pathology slide.

Segments Covered in the Report

By System Component

- Data Collection Tools

- Mobile Apps

- Wearable

- Digital Platforms

- Biosensors

- Desktop-Based Software

- Data Integration Systems

By Application

- Sleep & Movement Disease

- Cardiovascular Diseases

- Respiratory Disease

- Neurodegenerative Disorders

- Diabetes

- Gastrointestinal Disease

- Psychiatric Disorder

- Others

By Clinical Practice

- Diagnostic Digital Biomarkers

- Monitoring Digital Biomarkers

- Predictive And Prognostic Digital Biomarkers

- Other's (Safety, Pharmaco dynamics/ Response, Susceptibility)

By End-use

- Healthcare Companies

- Healthcare Providers

- Payers

- Others (Patient, caregivers)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content