What is the Microbiology and Bacterial Culture Media Market Size?

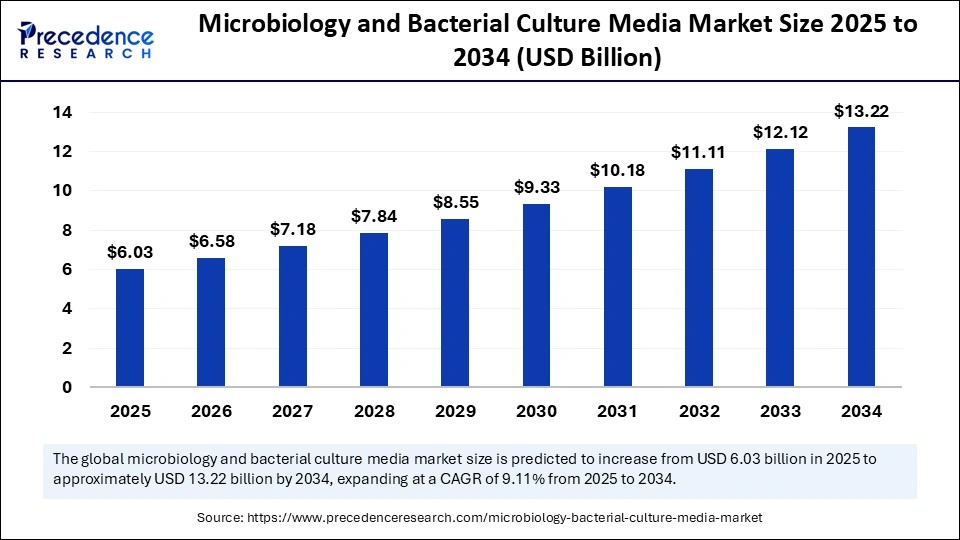

The global microbiology and bacterial culture media market size accounted for USD 6.03 billion in 2025 and is predicted to increase from USD 6.58 billion in 2026 to approximately USD 13.22 billion by 2034, expanding at a CAGR of 9.11% from 2025 to 2034. The microbiology and bacterial culture media market is driven by rising infectious diseases, rigorous food and pharmaceutical safety regulations, technological advancements, and increased R&D in biotechnology and vaccine development.

Market Highlights

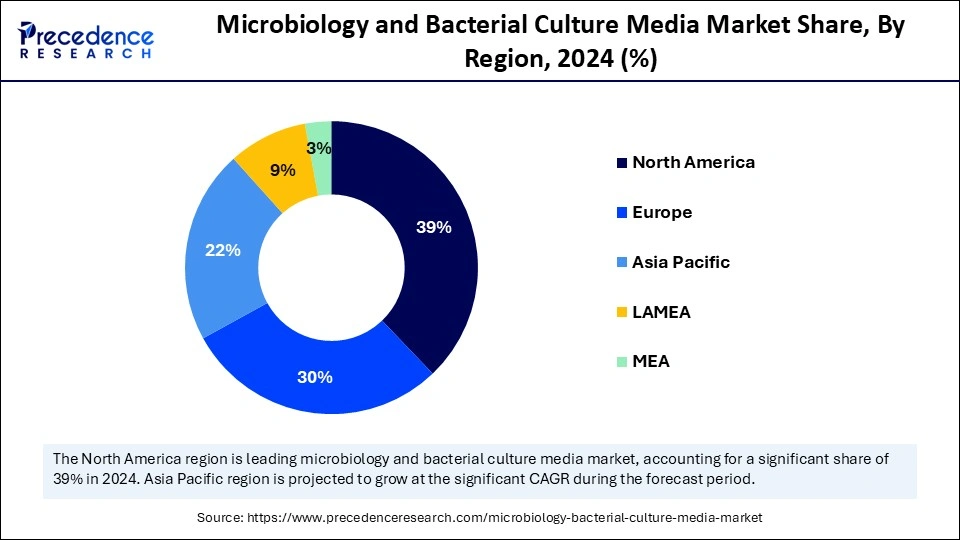

- North America dominated the microbiology and bacterial culture media market with around 39% share in 2024.

- Asia Pacific is expected to grow at a CAGR of 10.50% from 2025 to 2034.

- By type of media, the complex / non-synthetic media segment held approximately 35% share of the market in 2024.

- By type of media, the chromogenic media segment is expected to grow at a 10% CAGR between 2025 and 2034.

- By form, the ready-to-use / liquid form segment captured around 38% market share in 2024.

- By form, the agar plates / solid form segment is expected to grow at a CAGR of 9.50% from 2025 to 2034.

- By application, the clinical / diagnostic microbiology segment captured approximately 40% market share in 2024.

- By application, the industrial applications segment is expected to grow at a CAGR of 9% over the projected period.

- By end user, the hospitals & diagnostic laboratories segment held approximately 42% share of the market in 2024.

- By end user, the pharmaceutical & biotechnology companies segment is expected to grow at a 9.20% CAGR between 2025 and 2034.

- By product, the general purpose media segment held approximately 37% share of the market in 2024.

- By product, the specialized / selective media segment is expected to grow at a 9.80% CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 6.03 Billion

- Market Size in 2026: USD 6.58 Billion

- Forecasted Market Size by 2034: USD 13.22 Billion

- CAGR (2025-2034): 9.11%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Factors are Driving the Growth of the Microbiology and Bacterial Culture Media Market?

The microbiology and bacterial culture media market is being driven by the increasing demand for accurate disease diagnostic testing and growing research in microbial genetics and biotechnology. Increasing global outbreaks and infections have intensified the need for accurate microbial diagnostics and culture media. Moreover, regulatory agencies mandate rigorous microbial testing in food and pharmaceutical production, boosting adoption of bacterial culture media.

The market encompasses the development and use of nutrient-rich growth media capable of sustaining microbial or bacterial growth under controlled conditions. These media are essential for applications in clinical diagnostics, pharmaceuticals, biotechnology, food safety, and academic research. The growing use of automated systems for microbial detection, along with increased R&D in the biopharmaceutical sector, is further accelerating market growth. Moreover, the rising incidence of nosocomial infections and the global demand for safe and effective antimicrobial therapies continue to drive the need for high-quality bacterial culture media.

Microbiology and AI: Rapid Change, Real Impact on Discovery

Artificial intelligence is driving a rapid transformation in microbiology, from early discovery through to bench-level applications. Clinical-stage pharmaceutical companies are integrating AI-powered design pipelines for biologics and antibiotics, significantly reducing design-to-test timelines from months to weeks. In laboratory settings, AI platforms are identifying novel microbiome-derived antimicrobials and mapping drug–microbe interactions, improving the selection of candidates targeting resistant pathogens.

AI-driven colony imaging and automated colony-picking systems are enabling high-throughput culture screening and growth-promotion testing, minimizing human bias and improving turnaround time. Foundation models in molecular biology, such as AlphaFold, are further accelerating target prediction and optimizing media-target interactions.

Collectively, these advancements are reshaping workflows, redefining evidence thresholds in bacterial culture, diagnostics, and antimicrobial discovery, enhancing the capabilities of microbiologists rather than replacing them.

Microbiology and Bacterial Culture Media Market Outlook

- Market Growth Overview: The market is projected to grow rapidly between 2025 and 2034, driven by the increasing number of diagnostic laboratories and their demand for reliable microbial detection tools. Rising needs in clinical diagnostics, food safety testing, and biotechnology research are consistently reinforcing the industry's baseline demand.

- Global Expansion: Emerging economies across Asia Pacific, Latin America, and Africa are scaling up their diagnostic and microbial surveillance infrastructure. This is compelling culture media suppliers to expand their manufacturing presence, improve local distribution networks, and secure regulatory approvals in these fast-growing regions to capture regional market share.

- Research & Development Focus: Innovation in chromogenic, selective, and automated media formats is a key R&D priority, aiming to reduce sample contamination and handling errors. Future development will also include customized media formulations for identifying emerging pathogens and supporting high-throughput screening providing companies with a competitive edge.

- Major Investors: In the U.S., institutions such as the National Institutes of Health (NIH) and other public agencies continue to fund microbiology and infectious disease research through grants and government contracts. Similarly, repositories like India's MTCC and NCIM rely on government support to facilitate academic and industrial microbiology research.

- Key Market Driver: The increasing frequency of disease outbreaks, particularly those linked to antimicrobial resistance (AMR), is driving heightened demand for advanced microbial diagnostics. Regulatory bodies are also mandating validated microbiological testing across pharmaceuticals, food, and water sectors, further propelling demand for certified, high-quality culture media.

- Market Challenges: Despite promising growth, the market faces notable challenges, including stringent regulatory requirements, extended approval timelines for GMP-grade media, and the high cost of raw materials such as growth factors and reagents. Additional barriers include maintaining cold chain logistics and shelf-life stability, particularly in remote or underdeveloped regions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.03 Billion |

| Market Size in 2026 | USD 6.58 Billion |

| Market Size by 2034 | USD 13.22 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.11% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Media, Form, Application, End User, Product, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type of Media Insights

Which Media Type Dominate the Microbiology and Bacterial Culture Media Market?

The complex/non-synthetic media segment dominated the market with approximately 35% share in 2024. The segment's dominance is driven by its versatility in supporting the growth of a large array of microorganisms without specific nutrient formulations. These media are now commonly used in clinical, academic, and industrial microbiology to culture fastidious organisms and conduct routine studies of microorganisms.

The chromogenic media type segment is expected to grow at the fastest CAGR of 10% over the forecasted period. The segmental growth is attributed to the increasing preference for faster and more specific methods of identifying microorganisms. Chromogenic media types allow for distinct colony colors to be easily visualized, improving diagnostic accuracy and the time required for testing in laboratories or industrial quality control.

Form Insights

Which Form of Media Holds the Largest Market Share in 2024?

The ready-to-use/liquid form segment held about 38% share of the microbiology and bacterial culture media market in 2024. This is mainly due to its convenience, time efficiency, and consistent quality. Its practicality, reproducibility, and minimal prep time make it ideal for laboratories that perform high-throughput testing. The segment's dominance is also attributed to the rise in automation of microbiological testing, as well as an increased adoption of pre-prepared media to limit contamination and enhance workflow. Liquid media eliminate the need for time-consuming preparation steps, making them ideal for high-throughput laboratories and clinical settings where rapid diagnostics are critical.

The agar plates/solid form segment is expected to grow at the fastest CAGR of 9.50% in the upcoming period, driven by its widespread use for colony isolation, microbial enumeration, and morphology. Ongoing improvements in prefilled/poured agar plates are improving reliability and workflow in the laboratory. Moreover, it is critical for microbial isolation, observing colony morphology, and ensuring diagnostic accuracy, supporting segmental growth.

Application Insights

Why Did the Clinical/Diagnostic Microbiology Segment Lead the Market in 2024?

The clinical/diagnostic microbiology segment led the microbiology and bacterial culture media market with approximately 40% share in 2024. This is primarily due to the increasing prevalence of infectious diseases and the need for accurate identification of microbes to aid patient diagnosis. Hospitals and laboratories heavily use culture media to identify pathogens, assess antibiotic susceptibility, and generate/initiate infection control measures, which supports the growth of this segment.

The industrial applications segment is expected to grow at the fastest rate with a 9.0% CAGR during the forecast period. The growth of the segment is driven by the increasing use of microbial testing in the food, beverage, and pharmaceutical industries to promote safe products and ensure compliance. Increasing focus on improved quality assurance/quality control protocols, along with monitoring microbial contamination in products, is likely to support segmental growth.

End User Insights

Which End User Holds the Largest Share of the Market in 2024?

The hospitals & diagnostic laboratories segment held about 42% share of the microbiology and bacterial culture media market in 2024. This is mainly due to the high patient testing volume and a significant need for accurate pathogen detection. The rise in hospital-associated infections, surveillance of antimicrobial resistance, and the need for rapid diagnostic solutions drive the demand for culture media in these settings.

The pharmaceutical & biotechnology companies segment is likely to grow at a 9.2% CAGR during the projected period. This is mainly due to their extensive and consistent demand for high-quality culture media in drug development, vaccine production, quality control, and microbial testing. These companies rely heavily on microbial culture media for biopharmaceutical manufacturing, sterility testing, and regulatory compliance, especially under stringent Good Manufacturing Practice (GMP) standards. Additionally, increasing investments in R&D, antibiotic discovery, and microbiome-related therapies further support segmental growth.

Product Insights

Why Did the General Purpose Media Segment Dominate the Market in 2024?

The general purpose media segment dominated the microbiology and bacterial culture media market while holding a 37% share in 2024. This is mainly due to its widespread application for culturing a diverse range of microorganisms for routine testing and research. General-purpose media is widely used by clinical, academic, and industrial laboratories for the growth, maintenance, and identification of microbes and therefore supports multiple diagnostics and trial analyses.

The specialized/selective media segment is expected to grow at a CAGR of 9.8% over the projection period. This is mainly due to the increased demand for the specific detection or differentiation of microbes. Selective media consist of a formulation of material that is intended to isolate specific pathogens or groups of microorganisms, thereby supporting diagnostics and higher-level research with respect to infectious disease and biotechnology.

Regional Insights

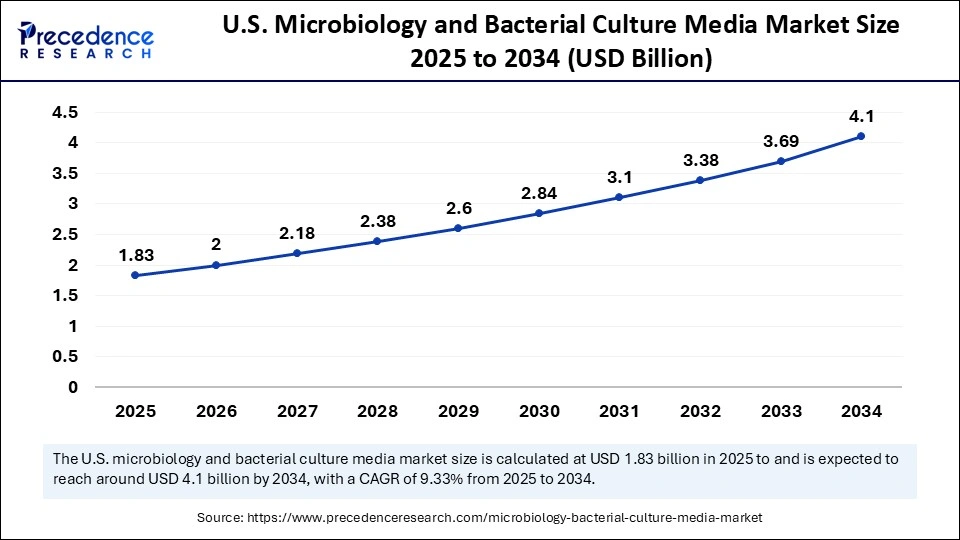

U.S. Microbiology and Bacterial Culture Media Market Size and Growth 2025 to 2034

The U.S. microbiology and bacterial culture media market size is exhibited at USD 1.83 billion in 2025 and is projected to be worth around USD 4.10 billion by 2034, growing at a CAGR of 9.33% from 2025 to 2034.

Why Did North America Lead the Microbiology and Bacterial Culture Media Market?

North America dominated the microbiology and bacterial culture media market, capturing about 39% share in 2024. This is mainly due to the presence of established networks to support clinical diagnostics, significant capacities in food safety and pharma manufacturing, and a public-health surveillance sector with strong institutional support, resulting in robust demand for culture media and consumables. Increased national surveillance of antimicrobial resistance and expanded capacity in hospital laboratories has increased budgets for routine and specialized bacterial testing, increasing institutional demand for ready-to-use validated media and workflow integration of microbiology. The region benefits from a strong presence of major market players, advanced laboratory capabilities, and widespread adoption of automated and high-throughput microbial testing systems.

U.S. Market Analysis

The U.S. is a major contributor to the North American microbiology and bacterial culture media market due to its vast network of hospitals with reference laboratory capabilities, strong public sector investment, and a large number of food-testing facilities. Governance and reimbursement frameworks often encourage or incentivize standardized, high-throughput testing platforms for antimicrobial resistance (AMR) surveillance and pathogen screening. Demand for quality-assured, standardized media is further driven by collaborations with global suppliers that meet strict lot-release and traceability standards. Additionally, innovation is frequently led by major clinical and food safety organizations seeking to reduce time-to-result and operator variability, driving adoption of ready-to-use and rapid-readout media formats.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at a 10.50% CAGR in the coming years. The regional market growth is driven by a rapidly expanding biotech R&D ecosystem, scaling healthcare systems to support higher volumes of clinical testing, and strengthened food-safety enforcement across multiple countries, all contributing to an expanding addressable market. In addition, supply chain re-shoring and the rise of local manufacturing are reshaping procurement dynamics. Buyers are increasingly sourcing locally to reduce lead times and costs, driving demand for regional media producers and contract manufacturing. As a result, growth in the region stems from a combination of increasing test volumes, rising test complexity (e.g., AMR profiling, pathogen surveillance), and procurement trends favoring agile, locally-based suppliers.

China Market Trends

China is emerging as a leading country in the microbiology and bacterial culture media market, supported by its significant domestic manufacturing capacity for reagents and lab consumables. Public policies have further incentivized laboratories and contract research organizations (CROs) to prioritize local life science brands over imported alternatives. Recent developments highlight how major Chinese pharmaceutical and biotech firms are increasingly replacing imported reagents with domestically produced equivalents to reduce costs and avoid import-related delays. This trend extends to culture media and other laboratory consumables, reshaping procurement dynamics across the sector.

What Factors Contribute to the Notable Growth of the Market in Europe?

The market in Europe is expected to grow at a notable rate, driven by regulatory reforms in food safety, increased investment in clinical microbiology, and structured public health programs mandating standardized testing. A prime example is the European Commission's 2025 food audits and analysis initiative, which emphasizes harmonized surveillance across member states, fueling demand for validated culture media, proficiency testing, and accredited supply chains. Additionally, Europe's robust pharmaceutical and biotech industries continue to generate steady commercial demand for specialized media and quality-assured consumables.

Germany Market Analysis

Germany stands out due to its dense clusters of pharmaceutical manufacturing, contract testing labs, and agri-food testing capabilities. The synergy between this industrial base and stringent public programs that emphasize lab accreditation and frequent audits is expected to drive demand for certified culture media and vendors offering extensive documentation. German buyers prioritize traceability, batch consistency, and local technical support, allowing suppliers to command a premium for regulatory-compliant products and localized logistics. This ensures predictable, high-quality procurement and reinforces the value chain across Europe.

Value Chain Analysis of the Microbiology and Bacterial Culture Media Market

- Raw Material Sourcing: The value chain begins with sourcing high-quality raw materials such as peptones, yeast extracts, and agar. These materials must meet strict specifications to ensure consistency, sterility, and adequate nutrients in culture media formulations.

- Formulation and Manufacturing: Manufacturers prepare, sterilize, and blend ingredients to produce specific culture media types tailored for bacterial growth. Strict quality control and regulatory standards are followed to ensure product reliability.

- Quality Testing and Packaging: After formulation, the media is packaged in sterile, contamination-free environments. Extensive microbiological and chemical testing is conducted to verify stability, pH balance, and microbial efficacy before market release.

- Distribution and Supply Chain: Distributors and logistics partners handle the storage and shipping of media products to laboratories, research centers, and diagnostic facilities. Temperature-controlled environments and inventory management are critical during transit and storage.

- End-Use Application: Hospitals, pharmaceutical companies, and academic institutions use microbiological culture media for microorganism identification, antibiotic susceptibility testing, and biotechnological research. The performance of these media plays a vital role in advancing diagnostics and therapeutics.

Top Companies Operating in the Microbiology and Bacterial Culture Media Market

Tier I: Market Leaders

These companies dominate the microbiology and bacterial culture media market by offering extensive, high-quality product portfolios, global manufacturing and distribution capabilities, and strong R&D focus on innovative media formulations and diagnostics.

| Company | Key Offerings |

| Thermo Fisher Scientific | Comprehensive portfolio of standardized and custom microbiological culture media, reagents, and instruments for clinical diagnostics, pharma, and research. |

| Becton, Dickinson & Co | Specialized diagnostic culture media and microbiology testing products, with advanced manufacturing and supply chain capabilities. |

| Merck KGaA | Broad range of culture media and reagents with strong global presence, emphasizing quality control and regulatory compliance. |

| bioMérieux | In vitro diagnostic culture media, reagents, and automated systems, focusing on infectious disease testing and food safety applications. |

Tier II: Established Players

These companies hold significant regional or segment-specific presence, offering specialized or innovative culture media products and catering to growing biotech and clinical markets.

| Company | Key Offerings |

| Hardy Diagnostics | Focus on bacteriological culture media, reagents, and rapid diagnostic kits tailored for clinical and industrial microbiology labs. |

| Lonza Group | Life sciences leader providing media formulations and reagents for biopharmaceutical manufacturing and research. |

| Corning Incorporated | Supplies microbiological culture media alongside cell culture consumables with emphasis on lab automation compatibility. |

| Fujifilm Irvine Scientific | Produces specialized media for biopharma and research sectors with a focus on cell culture and microbiology applications. |

Tier III: Emerging and Niche Players

These companies serve niche markets or emerging regions, often focusing on cost-effective, regional manufacturing, or innovative product offerings.

| Company | Key Offerings |

| HiMedia Laboratories | Leading Indian manufacturer supplying broad range of culture media and reagents with focus on regional market needs. |

| Sigma-Aldrich (Merck) | Provides raw materials, media components, and reagents integrated with broader life science product offerings. |

| Oxoid (Thermo Fisher) | Specialized culture media and reagents for clinical microbiology, food safety, and pharmaceutical applications. |

| VWR International (Avantor) | Global distributor of microbiology consumables, including culture media, reagents, and laboratory essentials. |

Recent Developments

- In June 2025, the Align Foundation and ATCC have partnered to create the world's largest public, AI-ready microbial phenotyping dataset. This project aims to generate high-quality phenotypic data for 1,000 diverse microbial strains across 1,000 cultivation conditions, enabling AI models to better link genotype to phenotype. Combining Align's high-throughput platform with ATCC's authenticated microbial collection and genomics expertise, this initiative addresses the critical need for large, standardized datasets in biological research.(Source: https://www.synbiobeta.com)

- In March 2025, Merck invests more than €300 million into a new Bioprocessing Production Center in Daejeon, South Korea, that provides essential biotech products such as dry powder cell culture media, process liquids, pre-GMP small-scale manufacturing and sterile sampling systems.

(Source: https://www.merckgroup.com)

Exclusive Analysis on the Microbiology and Bacterial Culture Media Market

The microbiology and bacterial culture media market presents a compelling growth trajectory underpinned by multifaceted demand vectors spanning clinical diagnostics, biopharmaceutical R&D, food safety, and environmental surveillance. Escalating incidences of infectious diseases, coupled with stringent regulatory frameworks mandating rigorous microbial testing, underscore the criticality of high-fidelity culture media solutions.

Technological advancements, including automation and AI integration, are catalyzing enhanced throughput and precision, thereby expanding market applicability and driving differentiation among key players. Emerging economies are rapidly augmenting diagnostic infrastructure, creating fertile grounds for regional market penetration and supply chain localization, which collectively mitigate traditional barriers related to cost and logistics.

Moreover, the paradigm shift toward personalized medicine and antimicrobial resistance (AMR) surveillance intensifies demand for specialized, validated culture media tailored to complex pathogen profiles. This, in turn, incentivizes innovation in selective and chromogenic media formulations, positioning the market at the nexus of scientific advancement and regulatory compliance.

Consequently, stakeholders equipped with agile R&D capabilities and robust regulatory alignment are poised to capitalize on burgeoning opportunities, delivering scalable, high-value solutions that address both established and nascent microbiological challenges globally.

Segments Covered in the Report

By Type of Media

- Synthetic / Chemically Defined Media

- Complex / Non-Synthetic Media

- Selective Media

- Differential Media

- Enriched Media

- Chromogenic Media

- Transport Media

- Other Specialty Media

By Form

- Powder Form

- Ready-to-Use / Liquid Form

- Agar Plates / Solid Form

- Broth / Liquid Form

By Application

- Clinical / Diagnostic Microbiology

- Hospital & Clinical Labs

- Infectious Disease Testing

- Research & Development

- Academic & Research Institutes

- Biopharmaceutical R&D

- Industrial Applications

- Food & Beverage Testing

- Water & Wastewater Testing

- Cosmetic & Personal Care Testing

- Pharmaceutical Manufacturing

- Agriculture & Veterinary Microbiology

By End User

- Hospitals & Diagnostic Laboratories

- Research Laboratories & Academic Institutes

Pharmaceutical & Biotechnology Companies - Food & Beverage Industry

- Agricultural & Veterinary Labs

- Government & Public Health Agencies

By Product

- General Purpose Media

- Specialized / Selective Media

- Agar-Based Media

- Broth / Liquid Media

- Ready-to-Use Kits & Plates

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content