Plasmid DNA Manufacturing Market Size and Forecast 2025 to 2034

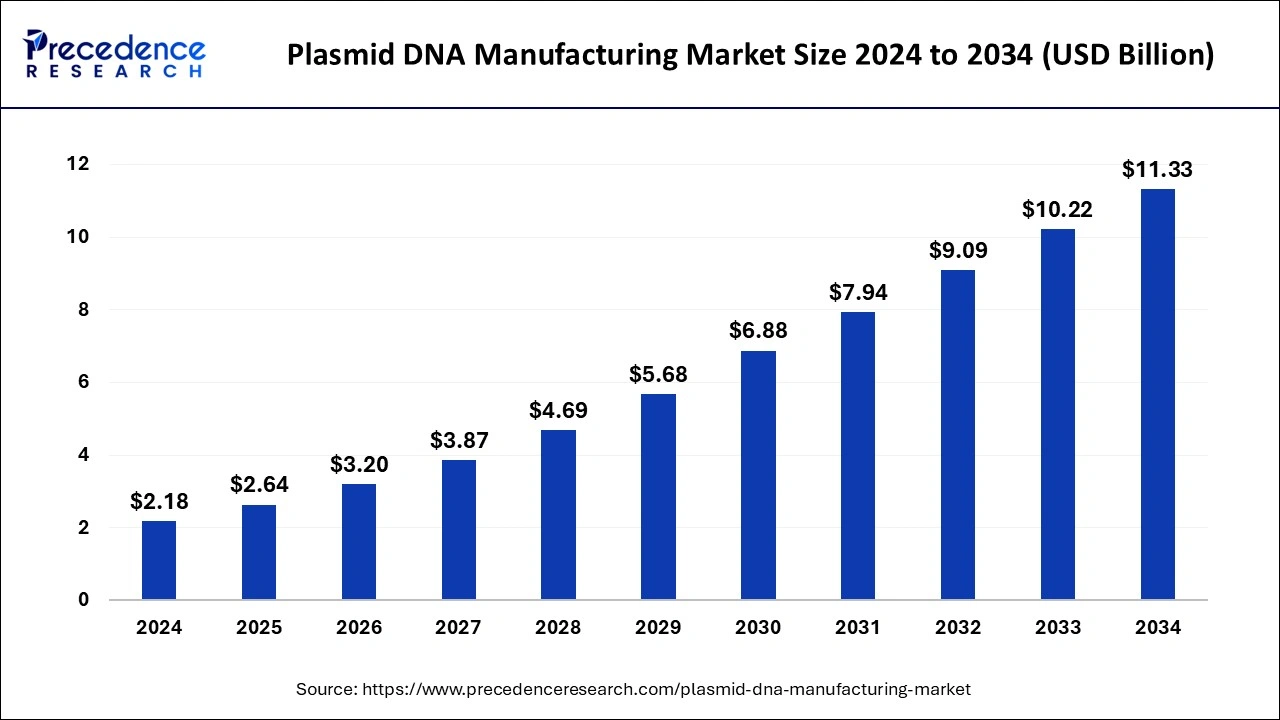

The global plasmid DNA manufacturing market size accounted for USD 2.18 billion in 2024 and is expected to exceed around USD 11.33 billion by 2034, growing at a CAGR of 17.92% from 2025 to 2034.

Plasmid DNA Manufacturing Market Key Takeaways

- The pre-clinical therapeutics development phase segment is expected to grow at a CAGR of 14.3%.

- The cell & gene therapy application segment held a market share of 59% in 2024.

- The cancer disease segment has captured a market share of 37.5% in 2024.

- The GMP grade segment has reached the highest revenue share of 88.4% in 2024.

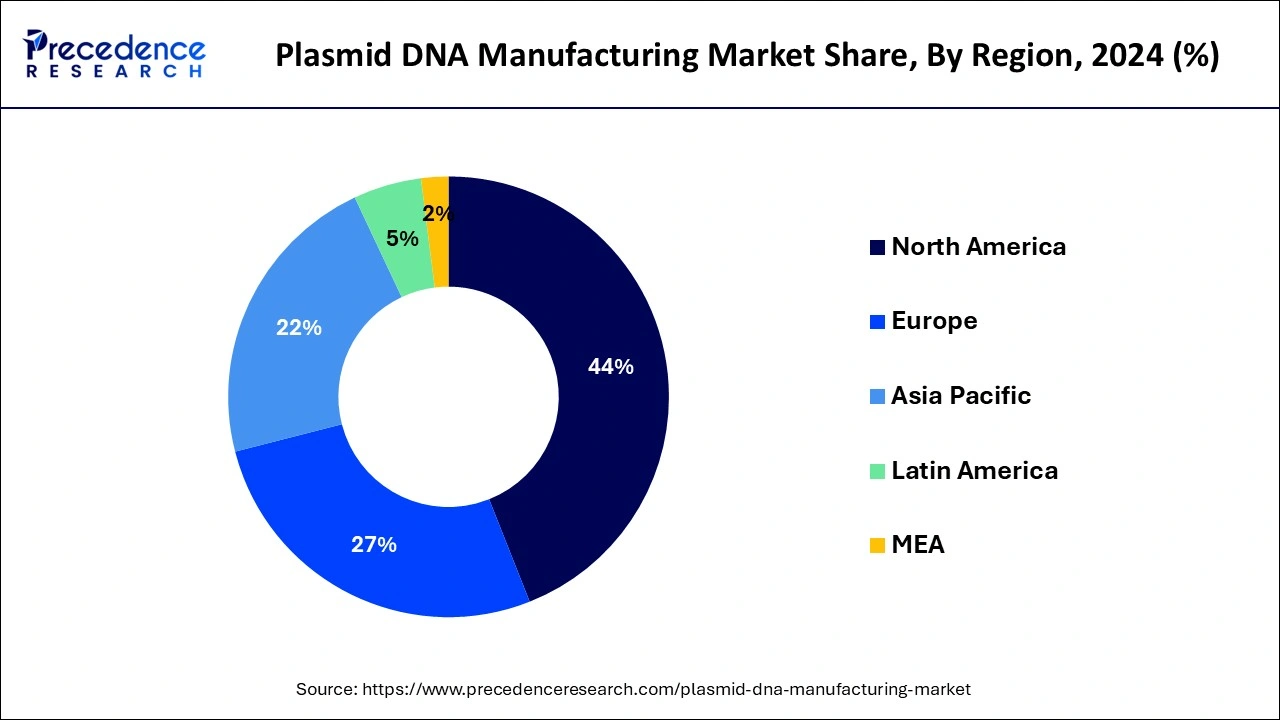

- The North America region has dominated the market with a revenue share of 43.50% in 2024.

U.S. Plasmid DNA Manufacturing Market Size and Growth 2025 to 2034

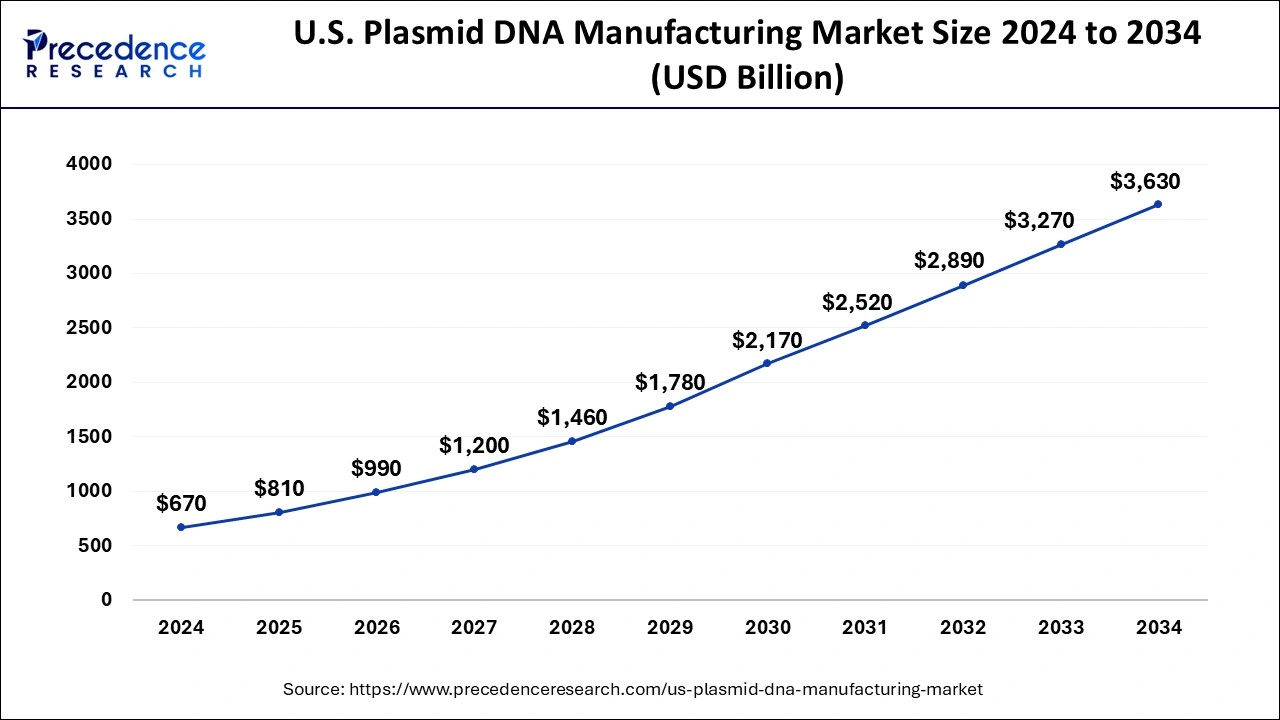

The U.S. plasmid DNA manufacturing market sizewas exhibited at USD 670 million in 2024 and is projected to be worth around USD 3,630 million by 2034, growing at a CAGR of 18.41% from 2025 to 2034.

Based on the region, the North America dominated the global plasmid DNA manufacturing market in 2024, in terms of revenue, and is estimated to sustain its dominance during the forecast period. The presence of numerous biopharmaceutical industry players in North America is exponentially fostering the demand for the plasmid DNA. Furthermore, the region is characterized by high disposable income, increased consumer awareness regarding gene therapies, improved healthcare infrastructure, and increased adoption of gene therapy for the treatment of various diseases. At present, around 362 therapies in clinical development has been found by the biopharmaceutical companies in US, by 2018. The increased pace of research and development in the field of plasmid DNA in US is significantly fostering the growth of the plasmid DNA manufacturing market in North America.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. This is attributable to the increased government investments on healthcare sector and growing investments by the private players in the region to facilitate research and development activities in the field of plasmid DNA. The growing of technologically advanced methods like development of cell culture systems, expression system, and good manufacturing practices (GMP) is exponentially contributing towards the growth of the plasmid DNA manufacturing market in the Asia Pacific region. These factors make this region the fastest-growing market for the plasmid DNA.

Plasmid DNA Manufacturing Market Growth Factors

The plasmid DNA manufacturing market is witnessing an upsurge due to the growing research applications in the genetic vaccination and gene therapy fields. In the present healthcare industry, the plasmid DNA play a crucial role. The plasmid DNA can be used in generation of vaccine antigens/gene therapy and for research studies. The rising number of patients seeking gene therapy is positively driving the market growth. Gene therapy is a dominating field that may offer new possible treatments for a number of diseases. The adeno-associated viral vector can be used in the treatment of Leber's Congenital Amaurosis. Moreover, the rapid growth of the biopharmaceutical industry is significantly boosting the growth of the plasmid DNA manufacturing market. Further the growing demand for innovations in the biopharmaceutical industry is driving the demand for new manufacturing technologies for commercial production of plasmid DNA.

Rising interest in plasmid DNA manufacturing area is emphasized by the growing number of partnerships or collaborations amongst the various organizations involved in this sector. The reason behind these partnerships vary for different purposes. Collaborations have been signed for purposes including production of vector promoters and development or acquisition of manufacturing facilities and out / in licensing of plasmid DNA manufacturing technology among others.

MarketScope

| Report Coverage | Details |

| Growth Rate From 2025 to 2034 | CAGR 17.92% |

| Market Size by 2034 | USD 11.33 Billion |

| Market Size in 2025 | USD 2.64 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application Type, Disease Type, Regional Outlook |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for gene therapies

The rising demand for gene therapy is contributing to the growth of the market due to the need for producing gene therapies that utilize plasmids as vactors to deliver therapeutic genes into cells. This demand has led to increased investmet plasmid DNA manufacturing technologies as well as facilities. Plasmids can be engineered to carry specific genes, regulatory elements and other sequences, allowing for precise control over gene expression.

In January 2024, Charles River Laboratories International announced the launch of plasmid platform, eXpDNA, established from the company's biologic testing experience. The platform effectively promotes the stimulation of cell and gene therapies along with vaccine development process by maintaining the quality and consistency of production. Such rising emphasis on gene therapy production is observed to act as a driver for the global plasmid DNA manufacturing market.

Restraint

Scalability issues for large-scale production

Scalability issues in plasmid DNA manufacturing for large-scale production often revolve around challenges. Maintaining purity, scalability, consistency and quality are a few of them. Plasmid DNA is typically produced using bacterial or mammalian cell cultures. As production scales up, maintaining consistent and healthy cell cultures becomes more difficult. Issues such as oxygen and nutrient distribution, shear stress, and waste accumulation can affect cell growth and plasmid yield. Scaling up production processes often leads to reduced yields and lower efficiency due to various factors such as increased reactor volumes, changes in mixing dynamics, and challenges in maintaining optimal growth conditions for the host cells. This can impact on the overall cost-effectiveness of the manufacturing process. Thus, the scalability issues are observed to be the restraint for the market.

Opportunity

Rising academic research activities

Academic researchers often push the boundaries of scientific knowledge, leading to the development of novel applications for plasmid DNA. For example, researchers might discover new ways to use plasmid DNA in gene editing, synthetic biology, or personalized medicine. This innovation can lead to the creation of new plasmid DNA manufacturing processes and products, driving market growth. Academic institutions frequently collaborate with biotechnology and pharmaceutical companies to translate research findings into real-world applications. These collaborations can result in joint projects that require substantial amounts of plasmid DNA. As such partnerships increase, the demand for plasmid DNA manufacturing can also rise. Increased academic research can drive attention to the regulatory and quality standards associated with plasmid DNA production. Thus, rising academic research activities are observed to serve significant opportunities for the market.

Challenge

Regulatory hurdles

Regulatory hurdles have indeed been a significant challenge for the plasmid DNA manufacturing market. Plasmid DNA is often used in gene therapy and biopharmaceutical applications to deliver therapeutic genes into target cells. Ensuring the safety and efficacy of these treatments is of paramount importance. Regulatory agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have strict guidelines in place to evaluate the safety and effectiveness of such products. Manufacturers must provide extensive preclinical and clinical data to demonstrate the product's safety profile and therapeutic benefits.

Product Insights

By product type, the viral vector segment led the global plasmid DNA manufacturing market with a remarkable revenue share in 2023 and is anticipated to retain its dominance throughout the forecast period. The adeno-associated viral vector is fostering the growth of this due to its applications in most of the cell-based gene therapies across the globe. Integration ability with large transgenes and simple production at high titers are some of the significant factors that help to occupy a considerable share of the viral vector in the overall plasmid DNA manufacturing market.

Application Insights

Based on the application the market is segmented into gene therapy, DNA vaccines, immunotherapy, and others. The gene therapy segment led the global plasmid DNA manufacturing market with a remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the fact that gene therapy is widely used in the treatment of various genetic disorders and inherited disorders. Moreover, continuous technological advancements in developing a reliable and safe treatment for different diseases are boosting the growth of this segment.

Disease Insights

By disease, the infectious disease segment led the global plasmid DNA manufacturing market with a remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. DNA plasmid is effectively used in the treatment of various infectious diseases as it provides a strong immunity through vaccine antigens and prevents pathogen infections.

On the other hand, cancer is estimated to be the most opportunistic segment during the forecast period. The growing use of vectors for the development of cancer treatment therapies is boosting the growth of this segment significantly.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved and efficient solutions. Moreover, they are also focusing on maintaining competitive pricing.

- In January 2023, a supplier of unique molecular tools and services, KromaTiD announced the expansion of its plasmid DNA offering services. The company has expanded the offering by adding a set of plasmid production suites. The expansion by the company aims to support the production of regenerative medicine for commercial purposes.

- In February 2023, BioNTech SE announced that the company has developed a new plasmid DNA manufacturing plant at Marburg, Germany. With the opening of a new manufacturing plant, the company aims to start an independent production of plasmid DNA for clinical product candidates and commercial products.

- In January 2020, Helixmith&Genopis launched a new contract manufacturing unit for the production of plasmid DNA.

- In December 2020, Thermo Fisher Scientific announced their plan for setting up a new GMP plasmid DNA manufacturing unit in California.

The major strategical developments are expected to drive the growth of the global plasmid DNA manufacturing market in the forthcoming years.

Plasmid DNA Manufacturing Market Companies

- VGXI, Inc.

- Akron Biotech

- Cobra Biologics & Pharmaceutical Services

- Aldevron

- Plasmidfactory GmbH

- Vigene Biosciences

- Luminous Biosciences

- Nature Technology Corporation

- Delphi Genetics

- JAFRAL Ltd.

Segments Covered in the Report

By Product

- Viral Vectors

- Plasmid DNA

- Non-Viral

- Electroporation

- Lipid/Polymer

- Nanoparticles

- Others

By Application

- Gene Therapy

- DNA Vaccines

- Immunotherapy

- Others

By Disease

- Infectious Disease

- Genetic Disorder

- Cancer

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting