Live Biotherapeutic Products and Microbiome CDMO Market Size and Forecast 2025 to 2034

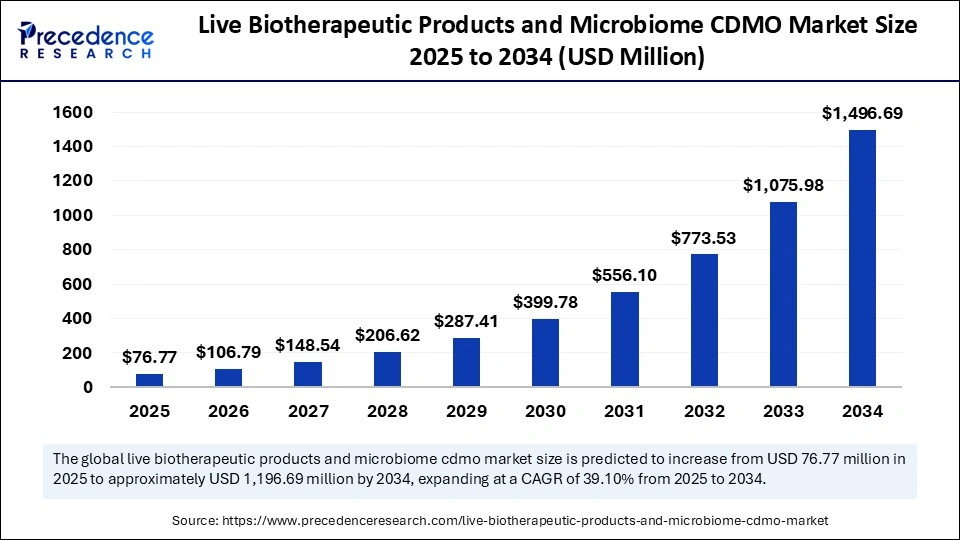

The global live biotherapeutic products and microbiome CDMO market size accounted for USD 55.19 million in 2024 and is predicted to increase from USD 76.77 million in 2025 to approximately USD 1,496.69 million by 2034, expanding at a CAGR of 39.10% from 2025 to 2034. The growth of the live biotherapeutic product and microbiome market is driven by rising chronic disease prevalence. Advancements in microbiome research, increasing demand for personalized medicine, and growing investments in R&D further support market expansion.

Live Biotherapeutic Products and Microbiome CDMO MarketKey Takeaways

- In terms of revenue, the live biotherapeutic products and microbiome CDMO market is valued at $76.77 million in 2025.

- It is projected to reach $1,496.69 million by 2034.

- The market is expected to grow at a CAGR of 39.10% from 2025 to 2034.

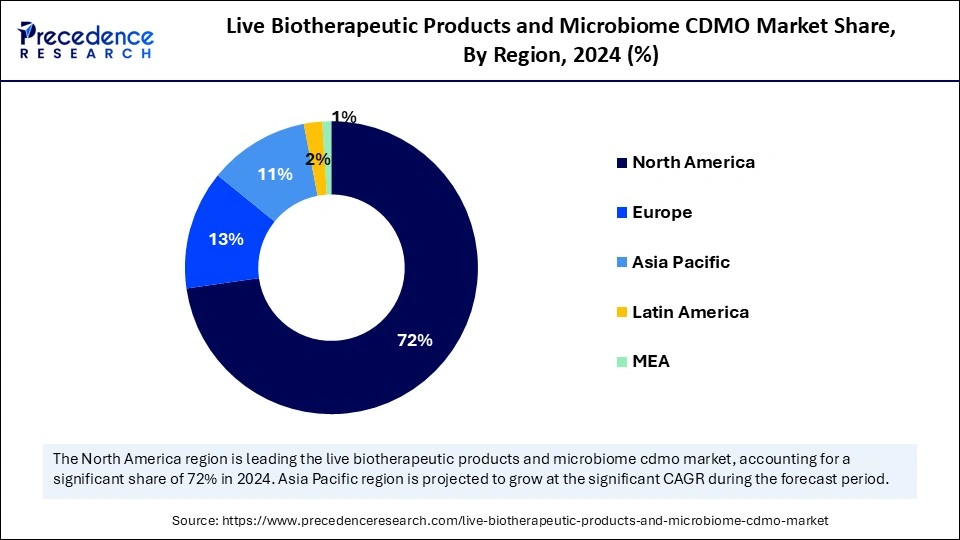

- North America held the major revenue share of 72% in 2024.

- Asia Pacific is expected to expand at a double digit CAGR of 44.95% between 2025 and 2034.

- By application, the C. difficile segment captured the biggest revenue share of 87.11% in 2024.

- By application, the IBS segment is expected to expand at a significant CAGR during the projection period.

AI-Driven Innovation to Drive the Growth of the Live Biotherapeutic and Microbiome CDMO Market

The market for live biotherapeutic products and microbiome CDMO operates in a dynamic model, evolving due to the integration of artificial intelligence in biotechnology. CDMOs are now instrumental in scaling microbiome-based therapeutic applications, from strain development to commercial manufacturing. In addition to addressing challenges with manufacturing, advanced artificial intelligence is also helping with microbial strain selection, development, fermentation, and predicting clinical outcomes in microbiome-based therapeutic applications, and as a result, reducing timelines for development.

In CDMO operations, AI can automate real-time analysis of fermentation data to influence upstream and downstream processing steps for optimization and error discovery. As a result, development cycles will become faster, and live biotherapeutic products can be better scaled. CDMOs with AI capabilities will have a competitive advantage and become vital partners in the delivery of next-generation microbiome therapeutics. As precision medicine increases in importance, AI will fundamentally change how innovation is delivered across the microbiome therapeutic landscape, making development faster, smarter, and more patient-specific.

U.S. Live Biotherapeutic Products and Microbiome CDMO Market Size and Growth 2025 to 2034

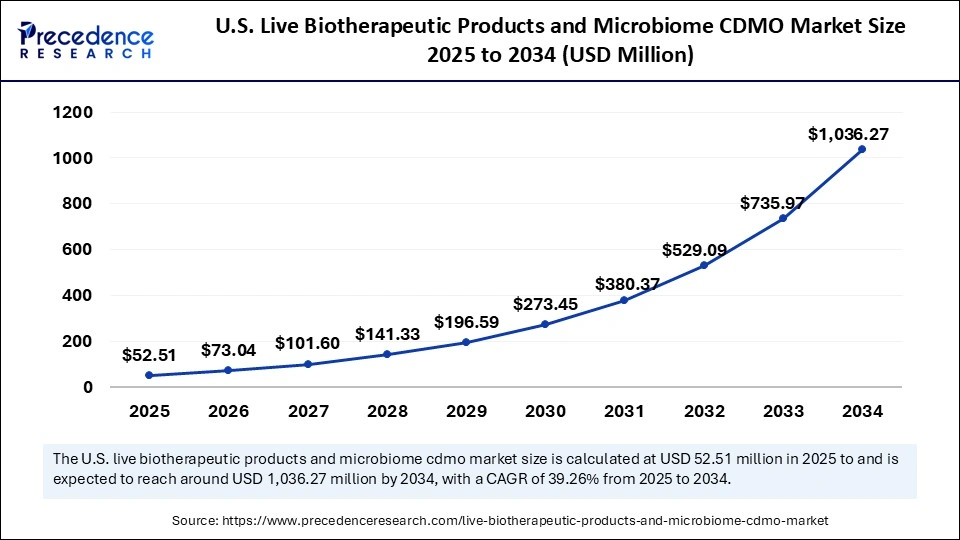

The U.S. live biotherapeutic products and microbiome CDMO market size was exhibited at USD 37.75 million in 2024 and is projected to be worth around USD 1,036.27 million by 2034, growing at a CAGR of 39.26% from 2025 to 2034.

Why did North America Dominate the Live Biotherapeutic Products and Microbiome CDMO Market in 2024?

North America registered dominance in the market with the largest revenue share of 72% in 2024. This is mainly due to a well-established regulatory paradigm, a substantial investment in biotech R&D, and a developing pipeline of microbiome-based therapies. The U.S. FDA has provided extremely helpful guidance in the form of frameworks dedicated to live biotherapeutics, which split considerable detail between the guidance of donor screening and investigational use, leading to clarity for developers and accelerated clinical development pathways. Additionally, the region is home to a large number of CDMOs with the capabilities to manufacture anaerobes and complex microbial formulations, enhancing the scalability of both the development and manufacture of LBPs.

The U.S. takes the lead in the region due to its relatively mature biotechnology landscape and the larger number of clinical-stage microbiome companies. The U.S. is home to pioneering companies like Seres Therapeutics and Finch Therapeutics, which have advanced into the late stages of clinical development for LBP products emerging to treat indications like recurrent C. difficile infection and ulcerative colitis. Additionally, major academic centers like Harvard, MIT, and Stanford contribute significant research to the microbiome pipeline and are funded through NIH's Human Microbiome Project and venture capital.

What are the Major Factors Driving the Growth of the Live Biotherapeutic Products and Microbiome CDMO Market Within Asia Pacific?

Asia Pacific is expected to grow at a significant CAGR of 44.95% in the coming years due to increasing investment in R&D, more clinical trial activity, and expanded structures for biotech. Countries such as China and South Korea are actively promoting microbiome science through topical funds and health initiatives. Increasing demand for precision medicine and personalized microbiome therapies, clinical trial operations, as well as the highest availability of trained talent are causing global companies to locate their development and manufacturing activities in the region.

China is a major player in the market due to a combination of strong government support, an increase in the biotech claim, and an established CDMO ecosystem. The “Healthy China 2030” plan includes microbiome-related research for health outcomes and the associated creation of innovation hubs and funding environments. Chinese biotech companies are progressing their early-stage LBP trials related to gut health, as well as immune health. The National Medical Products Administration (NMPA) is progressively modernizing its regulatory pathways, becoming increasingly receptive to novel biology. China's CDMO sector is rapidly developing capabilities to scale up anaerobic processing and microbial fermentation processes, which are critical to manufacturing live biotherapeutics and biotechnology, placing China as a world leader in the emerging microbiome manufacturing sector.

What Opportunities Exist in the Live Biotherapeutic Products and Microbiome CDMO Market Within Europe?

Europe is considered to be a significantly growing area. This is because of a favorable regulatory framework, strong academic research networks, and increasing investments in microbiome innovation. There are now early-stage observations and advice from the European Medicines Agency (EMA) regarding live biotherapeutics, which is allowing for improved clarity for clinical developers. Several cross-border partnerships and projects funded by the EU, such as the Human Microbiome Action project, further enhance Europe's ability to develop microbiome-based therapeutics. Furthermore, CDMOs in Europe are steadily developing and expanding their specialized capabilities in microbial culture, anaerobic fermentation, and lyophilization to accommodate the complexity of developing LBPs.

Germany is currently the leading country in the region because it has a strong biopharmaceutical sector, the existing regulatory framework for biopharmaceuticals, and excellent research institutes. The CDMO landscape in Germany continues to evolve as companies steadily invest in specialized microbial manufacturing suites and bioprocessing platforms for live biotherapeutics. The German CDMO landscape includes strong and organized government and EU funding, including the High-Tech Strategy 2025, to fund innovation opportunities.

Market Overview

The live biotherapeutic products and microbiome CDMO market revolves around the development and creation of viable microorganisms that exert a beneficial biological effect for disease prevention, treatment, and/or resolution. Live biotherapeutic products (LBPs) differ from traditional probiotics because LBPs are considered drug products and must meet more robust clinical validation. The market includes contract development and manufacturing (CDMO) companies that perform end-to-end services from strain development and formulation, analytical testing, and GMP (Good Manufacturing Practice) production for companies developing therapeutics based on microbiomes.

The market is experiencing significant growth due to the increasing investment in clinical research and advances in biotechnology. Pharmaceutical and biotech companies are increasingly turning to CDMOs to navigate the complexities associated with developing drugs based on living microorganisms. Growing development pipelines, advances in microbiome science, and clear regulatory guidance support growth and establish significant prospects for the future for LBPs in therapeutic areas including but not limited to gastrointestinal, metabolic, and immune.

What Are the Key Trends in the Live Biotherapeutic Products and Microbiome CDMO Market?

- Increased Focus on Gut Health: The increasing focus on improving gut health and increased awareness of the gut microbiome's significant role in overall health is driving the growth of the market. Due to the increased recognition, microbiome therapies are gaining traction to treat diseases such as gastrointestinal, metabolic, and immune-related conditions.

- Growing Clinical Pipelines: Biopharma companies are engaging with LBP (live biotherapeutic products) research and development activities, and as a result, there are more clinical trials and more requirements for contract development and manufacturing organization (CDMO) services for development and manufacturing.

- Advancements in Microbiome Science: Advances in sequencing technologies and systems biology will soon enable us to identify host-microbe interactions and accelerate the discovery of new therapeutic strains.

- Supportive Regulatory Environment: Health authorities, including the FDA and EMA, are making clear regulatory pathways for live biotherapeutics, stimulating innovation and investment in the sector.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,496.69 Million |

| Market Size in 2025 | USD 76.77 Million |

| Market Size in 2024 | USD 55.19 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 39.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Escalating Incidence of Chronic Diseases Drives Demand for Therapeutics Targeting Gut Microbiome

The incidence of chronic diseases such as diabetes, inflammatory bowel disease (IBD), obesity, and colorectal cancer is rising at a rapid pace around the world. This, in turn, boosts the demand for therapies targeting gut microbiome to unprecedented levels. Chronically diseased individuals are now widely understood to have dysbiosis (microbial imbalance) in their guts. For example, a study in 2024 conducted by the University of California, San Diego, found individuals with type 2 diabetes had 30-40% lower gut microbiota diversity than healthy controls. This emphasizes the therapeutic importance of restoring microbial balance.

The demand for specialized manufacturing, formulation, and regulatory support from microbiome-focused contract development and manufacturing organizations (CDMOs) is rising as well. CDMOs serve a critical role in scaling complex microbial fermentation processes while meeting product stability and developing GMP standards, depending upon the specific chronic disease treatment or therapy. This continual escalation in chronic disease incidence, coupled with the expanded use and reliance on microbiome therapies, continues to create sustained momentum across the entire LBPs and CDMO microbiome ecosystem.

Restraint

Regulatory Ambiguity and Global Regulatory Discrepancies are Creating Barriers

The lack of harmonized regulatory guidelines for microbiome-based therapies continues to be a major barrier for developers. Unlike standard pharmaceutical products, live biotherapeutic products (LBPs) are often somewhere between biological and probiotic, leaving developers unsure of the path to classification and approval. In 2024, the European Medicines Agency (EMA) started revising its microbiome guidelines to potentially cover donor-derived microbial consortia with new regulatory categories, which will continue to muddy approvals.

Meanwhile, in the U.S., companies are still undergoing compliance with the FDA's new manufacturing guidance, which now includes genomic traceability of bacterial strains and quality assurances for living organisms. Overall, the fragmented and rapidly evolving regulatory landscape contributes to uncertainty, time, and cost of bringing a new product to market. In fact, microbrewers and small and mid-sized biotech companies are likely deterred from this innovation space due to high compliance tension with the product type, thus delaying LBPs and microbiome CDMO innovation and growth efforts.

Opportunity

Can the Global Antibiotic Resistance Crisis Speed Up the Adoption of Microbiome-Based Therapeutics?

The global crisis of antibiotic resistance is expected to create immense opportunities in the live biotherapeutic products and microbiome CDMO market. The WHO's 2024 report emphasizes antimicrobial resistance (AMR) results in 1.27 million deaths per year, and this trend is expected to worsen if alternative therapies are not developed and used. LBPs are a viable alternative that can provide healthy microbiota without antibiotic-resistant growth. Clostridioides difficile infections are also becoming more resistant to traditional antibiotics, and in some cases, approved live biotherapeutic products have gained expedited regulatory approval in these therapeutic areas. This leads to a high demand for CDMO for unique services needed in the clinical development and GMP manufacture of scaled live microbes. As AMR continues to be a public health concern worldwide, microbiome-based therapeutics are increasingly being viewed as a necessity, setting the stage for strategic growth for the LBP and CDMO industry.

Application Insights

What Made C. Difficile the Dominant Segment in the Live Biotherapeutic Products and Microbiome CDMO Market?

The C. difficile segment dominated the market by holding more than 87.11% of revenue share in 2024. This is mainly due to the increased burden of Clostridium difficile infections, especially among the senior and immunocompromised populations. There is an urgency to address recurring infections and antibiotic resistance, creating an impulsion for robust microbiome-based therapeutics. Regulatory backing for live biotherapeutics for gastrointestinal conditions has further reinforced the strong position of this segment. The increased awareness about gut health is boosting the demand for C. difficile microbiome therapeutics, facilitating the market's long-term growth.

The IBS segment is expected to grow at the fastest CAGR over the forecast period. Many factors will underpin this segment's growth, especially due to the recognition that gut microbiota can regulate digestive and immune functions. This means that patients and doctors with IBS are sensitive to various indications of treatment success versus treatment failures. Because standard mildly different treatment usually leads to a very quick change to a different treatment, and because standard treatment options rarely lead to long-term relief or improvement of any form, academics and practitioners are paying increased attention to microbiome-based treatment alternatives that have publicly attractive patient-specific targeted characteristics. There is also increasing investment in patient-specific and promoted R&D evidence support, and a formal acknowledgment of patient management need would further support the diffusion of cost-effective, patient-specific gut microbiota intervention therapies in the treatment of IBS.

Live Biotherapeutic Products and Microbiome CDMO Market Companies

- Arrant Bio

- 4D Pharma

- Cerbios

- Biose Industrie

- Assembly Biosciences, Inc.

- Wacker Chemie AG

- Quay Pharmaceuticals

- NIZO

- Lonza

- Inpac Probiotics

Recent Developments

- In February 2025, Assembly Biosciences, Inc., a biotechnology company developing innovative therapeutics targeting serious viral diseases, announced positive interim Phase 1a results in healthy participants from its ongoing Phase 1a/b study of ABI-1179, an investigational long-acting herpes simplex virus (HSV) helicase-primase inhibitor candidate for recurrent genital herpes.

(Source: https://investor.assemblybio.com) - In September 2024, Nexilico, a pioneer in precision microbiome engineering, and Siolta Therapeutics, a leader in the development of live biotherapeutic products (LBPs), collaborated to address necrotizing enterocolitis (NEC) using innovative microbial therapeutics. This partnership combines Nexilico's modality-agnostic AI-driven discovery platform with Siolta's expertise in developing targeted biotherapeutics, setting the stage for innovative treatment approaches in infant health.

(Source: https://www.businesswire.com)

Segments Covered in the Report

By Application

- C. Difficile

- Crohn's Disease

- IBS

- Diabetes

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting