Advanced Therapy Medicinal Products Market Size and Forecast 2025 to 2034

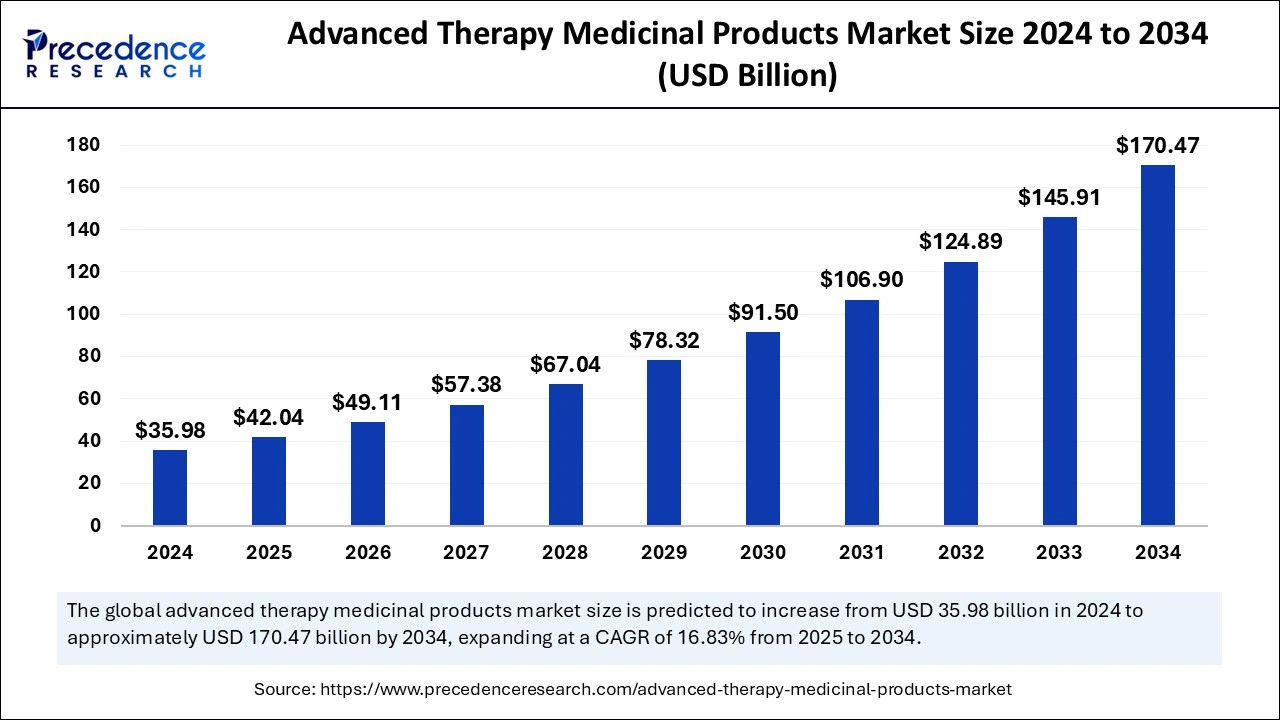

The global advanced therapy medicinal products market size was estimated at USD 35.98 billion in 2024 and is predicted to increase from USD 42.04 billion in 2025 to approximately USD 170.47 billion by 2034, expanding at a CAGR of 16.83% from 2025 to 2034. The market growth is attributed to the increasing demand for personalized and innovative treatments for chronic and rare diseases.

Advanced Therapy Medicinal Products Market Key Takeaways

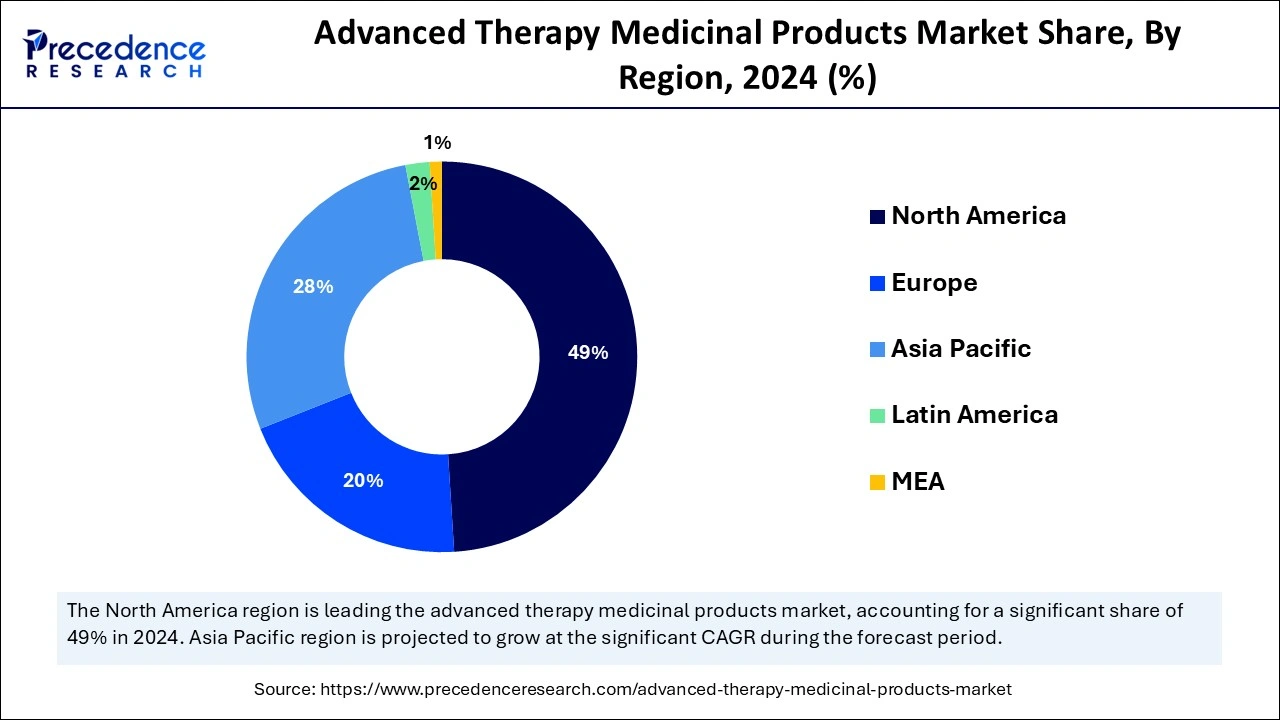

- North America dominated the global advanced therapy medicinal products market with the largest share of 49% in 2024.

- Asia Pacific is projected to grow at a CAGR of 21.43% in the coming years.

- By therapy, the tissue-engineered product segment has held a major market share in 2024.

- By therapy, the gene therapy segment is expected to grow at a significant CAGR in during the forecast period.

Impact of Artificial Intelligence (AI) on the Advanced Therapy Medicinal Products Market

Artificial Intelligence technologies strengthen all stages of advanced therapy, including the development of medicinal products and manufacturing and regulatory aspects, to boost both efficiency and innovation. By using predictive modeling in the advanced therapy medicinal products market, researchers quickly discover promising gene and cell therapy developments that substantially decrease research expenses at early stages. The application of artificial intelligence within automated manufacturing processes improves ATMP production through optimized cell environment control, reduced variations, and better-quality consistency.

U.S. Advanced Therapy Medicinal Products Market Size and Growth 2025 to 2034

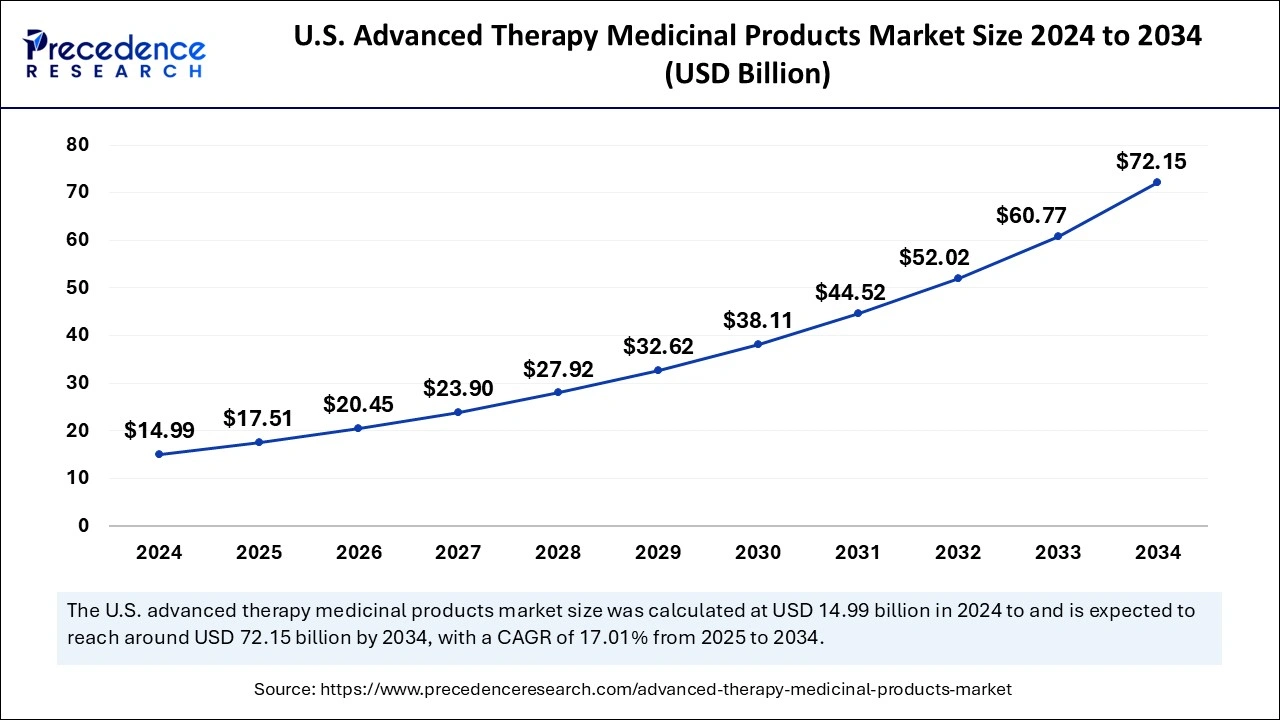

The U.S. advanced therapy medicinal products market size was exhibited at USD 14.99 billion in 2024 and is projected to be worth around USD 72.15 billion by 2034, growing at a CAGR of 17.01% from 2025 to 2034.

North America dominated the global advanced therapy medicinal products market by generating the highest revenue share in 2024 due to regulatory advantages alongside effective product launches and substantial research funding by companies. The U.S. Food and Drug Administration (FDA) allows faster market access through its breakthrough therapy designation program for gene and cell therapies while boosting their market demand. Moreover, the constant gene, cell, and tissue-engineered therapy innovations are supported through regional investments.

- According to the American Society of Gene and Cell Therapy's 2024 report, there are now over 4,000 therapies involving gene, cell, and RNA development.

Asia Pacific is projected to host the fastest-growing advanced therapy medicinal products market in the coming years, owing to the growing healthcare demands and rising investments directed toward biotech and regenerative medicine. China's healthcare system enhancements, together with its innovative therapy focus, have fueled the fast expansion of both stem cell-based treatments and gene therapy applications.

Asia Pacific nations actively modernize their approval systems and promote private-public cooperation to advance biotechnology advancement. The Japan Pharmaceuticals and Medical Devices Agency (PMDA) established unique processes for regenerative medicine. Furthermore, the growing governmental subsidies and investment further fuel the advanced therapy medicinal products market in this region.

- According to the Indian Government's Annual Report for 2022-2023, the government has invested in biotechnology through various initiatives, including the Aatmanirbhar Bharat program. The goal is to support the biotechnology sector in reaching a value of USD 300 billion by 2030.

Market Overview

The advanced therapy medicinal products market continues to grow with increasing disease prevalence. Traditional therapeutic approaches do not offer sustainable treatment solutions to patients suffering from genetic disorders, neurodegenerative diseases, and selected cancers. Advanced therapy medicinal products (ATMPs) that contain gene therapy, cell therapy, and tissue-engineered products address medical needs through their ability to target the fundamental causes of these diseases. Furthermore, the widespread use of ATMPs expands as mounting personalized medicine demands and expanding healthcare accessibility, thus improving treatment prospects for patients who previously had no options.

- The European Medicines Agency approved Casgevy as a new ATMP in 2023, which utilizes CRISPR/Cas9 gene-editing technology for treating beta-thalassemia and severe sickle cell disease in 2023.

Advanced Therapy Medicinal Products Market Growth Factors

- Rising investments in R&D are accelerating the development of innovative ATMPs and expanding treatment options.

- Growing patient awareness is increasing demand for advanced therapies, driving market adoption.

- Expanding manufacturing capabilities ensures timely production and availability of ATMPs, supporting market growth.

- Technological advancements in gene-editing tools like CRISPR are enhancing the precision and effectiveness in the advanced therapy medicinal products market.

- Increased regulatory support speeds up approval processes, fostering market growth and innovation.

- Rising demand for personalized medicine is driving tailored ATMP solutions, improving treatment outcomes.

- Strengthened collaborations between biopharmaceutical companies and research institutions are accelerating ATMP development and market entry.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 170.47 Billion |

| Market Size in 2025 | USD 42.04 Billion |

| Market Size in 2024 | USD 35.98 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for personalized medicine

Rising demand for personalized medicine is anticipated to drive the adoption of advanced therapy medicinal products market as patients and healthcare providers seek targeted treatments with higher efficacy. The growing increase of both chronic conditions and rare diseases enhances the need for advanced therapy medicinal products, as traditional treatment methods prove ineffective in delivering sustained relief.

Among European Union member states, yearly, the population dealing with rare diseases ranges from 27 million to 36 million, while 80% of these cases have genetic roots.

Older adult demographics create additional pressure on regenerative medicine to rebuild cellular operations and enhance lifespan quality. Government entities, together with healthcare institutions, dedicate large budget allocations to research programs that work on developing ATMPs for treating rare and life-threatening diseases. Additionally, the introduction of new ATMPs at biopharmaceutical companies aims to treat medical conditions that have high patient burdens.

Restraint

High development and manufacturing costs

High development and manufacturing costs are expected to challenge the expansion of the advanced therapy medicinal products market, limiting accessibility for patients. The production process of gene and cell therapies includes demanding bioprocessing techniques in addition to stringent regulatory requirements and special infrastructure facilities that make their manufacturing costs very high. Furthermore, the availability of affordable automated production processes is limited by cost constraints, which makes ATMPs unaffordable in areas where healthcare expenditures are restricted.

- According to the NIH 2024 report, each individual ATMP development project costs more than USD 1 billion because of expensive clinical trial work combined with the need for raw materials and advanced biotechnology production constraints.

Opportunity

High regulatory support for innovative therapies

High regulatory support for innovative therapies is likely to boost the market growth of advanced therapy medicinal products as agencies implement frameworks that streamline ATMP approvals. A faster route to beneficial treatments reached patients through new approval approaches established by the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The EMA features a unified ATMP authorization system that executes one issuance evaluation to establish prompt European Union-wide patient pharmaceutical access.

The U.S. Food and Drug Administration demonstrated its urgency regarding important medications for serious conditions by granting priority status to 56% of the 31 drug approvals throughout 2023.

Pharmaceutical companies receive benefits through orphan drug designations, while priority review programs create motivation to develop ATMPs that address rare diseases with no treatment options. The FDA's Office of Orphan Products Development grants medicinal products for rare diseases designation status that provides both tax credits and market exclusivity benefits for pharmaceutical development.

- Additionally, the regulatory agencies work alongside industry stakeholders to develop improved approval frameworks that create better definitions for healthcare development procedures.

Therapy Insights

The tissue-engineered product segment held a dominant presence in the advanced therapy medicinal products market in 2024. The production of biologically active tissues incorporates scaffolding methods that stimulate both new cell development and restoration of harmed tissues. Bioprinting combined with 3D cell culture systems has caused unprecedented improvements in tissue structure development within this sector. The market forecasting predicts fast growth for tissue-engineered therapies, as numerous orthopedic dermatologic and cardiovascular conditions require tissue regeneration. Moreover, the tissue engineering sector expects to propel regenerative medicine forward, as emerging research on both stem cells and biomaterials provides hope to chronically injured patients.

The gene therapy segment is expected to grow at a significant pace in the market during the forecast period of 2025 to 2034, as it has the capability to treat genetic disorders in its original location. Through gene therapy, doctors focus on redesigning patient cellular genes to fight diseases or stop them from occurring, which provides enduring medical outcomes beyond standard therapeutic methods. The growth of gene therapy relies on essential advancements in CRISPR alongside other gene-editing technologies that allow exact genetic material modifications. The regulatory approvals led to investment growth between pharmaceutical companies and research institutions. Furthermore, pharmaceutical companies will develop treatments for uncommon hereditary illnesses to further facilitate the segment in the coming years.

- Regulatory committees such as the U.S. FDA and European Medicines Agency (EMA) provided rapid approval in 2025 to Zolgensma for spinal muscular atrophy patients and Luxturna for treating inherited retinal disease.

Advanced Therapy Medicinal Products Market Companies

- Bluebird Bio, Inc.

- Celgene Corporation

- Gilead Lifesciences, Inc.

- JCR Pharmaceuticals Co., Ltd.

- Kolon TissueGene, Inc.

- MEDIPOST

- Novartis AG

- Organogenesis Inc.

- PHARMICELL Co., Ltd

- Spark Therapeutics, Inc.

- UniQure N.V.

- Vericel Corporation

Latest Announcements by Industry Leaders

- Feb 03, 2025 - Ocugen, Inc

- CEO – Shankar Musunuri

- Announcement - Ocugen, Inc. (NASDAQ: OCGN), a biotechnology company focused on discovering, developing, and commercializing novel gene and cell therapies, biologics, and vaccines, announced that the European Commission has granted a positive opinion from the European Medicines Agency's (EMA) Committee for Advanced Therapies (CAT) for the OCU400 Advanced Therapy Medicinal Product (ATMP) classification. “Receiving ATMP classification is another significant milestone toward bringing OCU400 to the market in Europe,” said Dr. Shankar Musunuri, Chairman, CEO, and Co-founder of Ocugen.

Recent Development

- In December 2023, the U.S. Food and Drug Administration approved two milestone treatments, Casgevy and Lyfgenia, representing the first cell-based gene therapies for the treatment of sickle cell disease (SCD) in patients 12 years and older. Additionally, one of these therapies, Casgevy, is the first FDA-approved treatment to utilize a type of novel genome editing technology, signaling an innovative advancement in the field of gene therapy.

- In September 2023, The Cell and Gene Therapy Catapult (CGT Catapult), with support from Scottish Enterprise, Scotland's national economic development agency, announced the launch of a new cooperative network to foster collaboration and boost the sharing of knowledge and expertise within the advanced therapies industry across the north of the UK.

- In August 2024, The U.S. Food and Drug Administration approved Tecelra (afamitresgene autoleucel), a gene therapy indicated for the treatment of adults with unresectable or metastatic synovial sarcoma who have received prior chemotherapy, are HLA antigen(s) A*02:01P, -A*02:02P, -A*02:03P, or -A*02:06P positive, and whose tumor expresses the MAGE-A4 antigen as determined by FDA authorized companion diagnostic devices.

- In July 2024, INOVIO, a biotechnology company focused on developing and commercializing DNA medicines to help treat and protect people from HPV-related diseases, cancer, and infectious diseases, announced that the European Medicines Agency's Committee for Advanced Therapies (CAT) has certified the quality and non-clinical data for INO-3107, INOVIO's lead candidate for the treatment of Recurrent Respiratory Papillomatosis (RRP). The certification confirms that INOVIO's chemistry, manufacturing, and controls (CMC) data and nonclinical results available to date comply with the scientific and technical standards that would be used for evaluating a European Marketing Authorization Application.

Segments Covered in the Report

By Therapy

- Gene Therapy

- Tissue Engineered Product

- Cell Therapy

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting