What is the Human Microbiome Market Size?

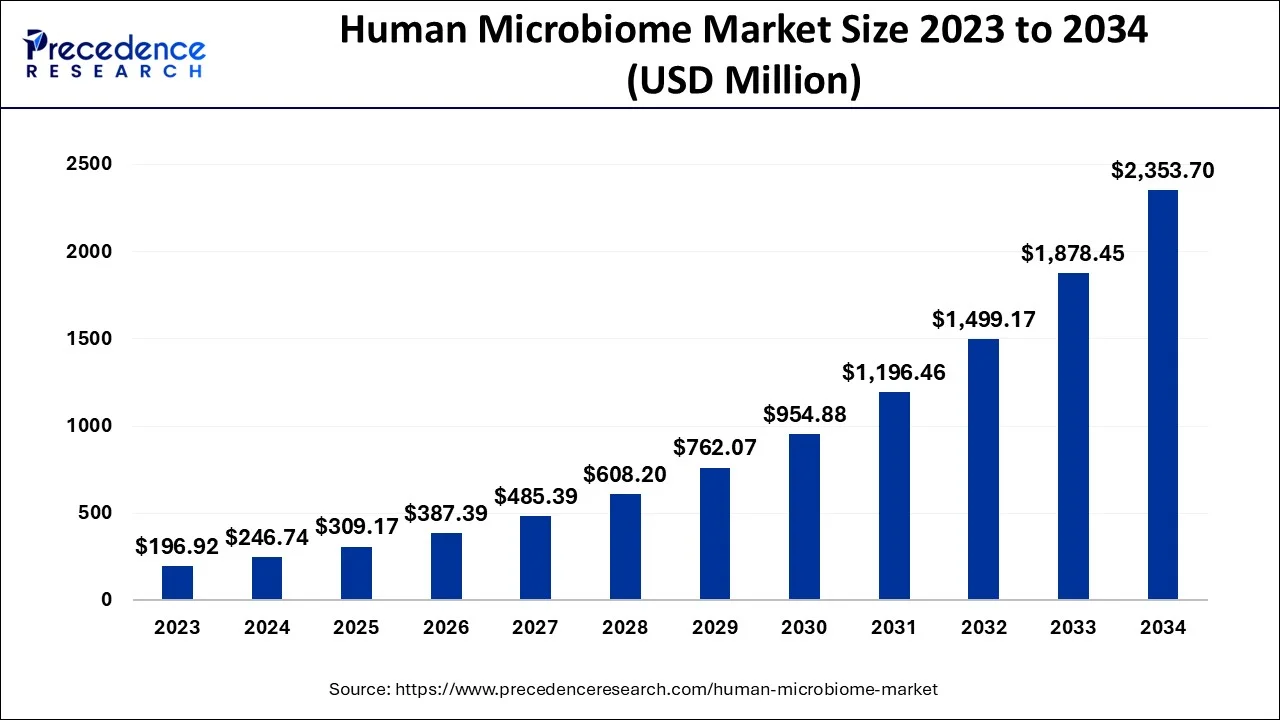

The global human microbiome market size accounted for USD 309.17 million in 2025and is predicted to increase from USD 387.39 million in 2026 to approximately USD 2,764.97 million by 2035, expanding at a CAGR of 24.49% between 2026 to 2035.

Human Microbiome Market Key Takeaways

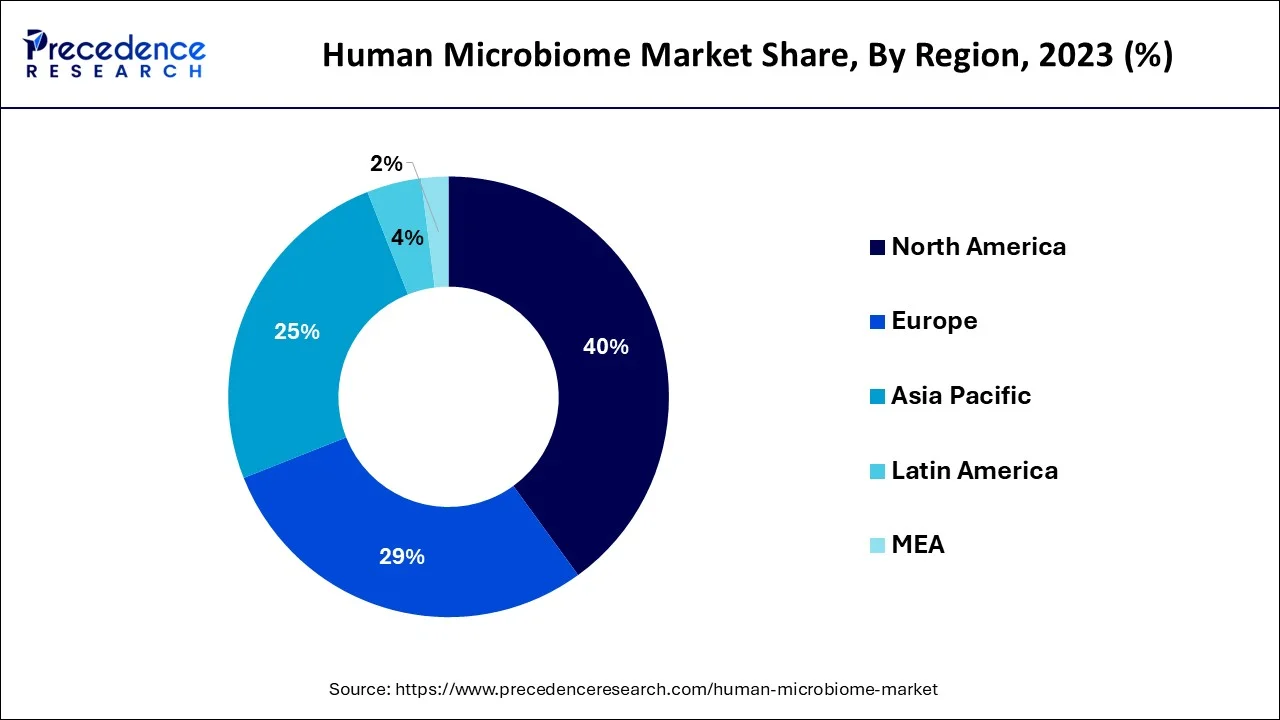

- By geography, The Europe and North America lead the market.

- By product, the drug segment accounted more than 36% of revenue share in 2025.

- By application, the therapeutics segment had the most significant market share in 2025 and is anticipated to achieve a sizable CAGR from 2026 to 2035.

What is the Human Microbiome?

The human microbiome is the collection of microorganisms that live on and inside the human body. It includes bacteria, fungi, and viruses and plays a crucial role in maintaining human health. The human microbiome market is focused on developing products and therapies that manipulate the microbiome to improve human health. This includes probiotics, prebiotics, synbiotics, and other products designed to alter the microbiome's composition. The market for these products is multiplying as more research highlights the microbiome's importance in various health conditions. Some key players in the human microbiome market include Nestle, Danone, and Procter & Gamble.

Due to its links to several respiratory illnesses and immunology, the human microbiome has recently attracted attention. Immune health has been linked to healthy gut flora. Lung, pulmonary, and other diseases can arise as a result of variations in the number of microbes, including firmicute, actinobacteria, and Bacteroidetes, according to research.

For instance, Persephone Biosciences Inc. Started building a microbiome therapeutic that is immune-boosting in April 2020 to aid in the prevention and treatment of the novel coronavirus (SARS-CoV-2) as well as a potential diagnostic test that is stool-based intended to assist in identifying which patients are most at risk for experiencing severe complications and mortality after contracting COVID-19. To confirm this increase, more research investigations on the microbiome are one of the main factors. Since the pandemic raised microbiota therapies and diagnosis awareness, the market will likely continue to grow in this direction even after the outbreak.

The rising burden of diseases linked to a sedentary lifestyle and the increasing elderly population are additional significant drivers of this market's expansion. For instance, the International Diabetes Federation estimates that 52.7 million individuals in Europe between the ages of 20 and 79 have diabetes, with the figure rising to 69 million by 2045. For the forecast period, it is likely that increased gut microbial diversity—more particularly, an increase in butyrate-producing bacteria—will boost insulin resistance and type 2 diabetes risk, adding to the burden of lifestyle diseases like diabetes.

Market Outlook

- Industry Growth Overview:

The processing of the human microbiome is speeding up owing to scientific understanding, new sequencing technologies, and the widening use of the latest therapeutic and diagnostic microbiome innovations. - Sustainability Trends:

The environment is becoming more sustainable by implementing bio-derived solutions that not only enhance the ecological balance but also utilize microbial functions for supporting health and environmental applications globally. - Global Expansion:

The overall global market expansion is being facilitated by broader awareness, increased collaborations across borders, and deeper integration of microbiome solutions in various healthcare sectors. - Major Investors:

The advancements in innovations are made possible by major investors such as Seventure Partners, Flagship Pioneering, Nestlé Health Science, Ferring Pharmaceuticals, Bristol Myers Squibb, and Tencent. - Startup Ecosystem:

Microbiome startups are forced to keep up with their competitors by investing in new therapeutic pipelines, digital microbiome analytics, and novel biotechnologies, thereby creating disruptive growth across new microbiome research areas.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 24.49% |

| Market Size in 2025 | USD 309.17 Million |

| Market Size in 2026 | USD 387.39 Million |

| Market Size by 2035 | USD 2,353.70 Million |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Largest Market | North America |

| Segments Covered | By Product, By Application and By Disease Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Application Insights

The therapeutics segment, under these, had the most significant market share in 2023 and is anticipated to achieve a sizable CAGR in the years to come. This is primarily because of a rise in R&D spending for microbiome-based medicines and technology developments, which promotes segment growth.

Due to technological and scientific advancements in mapping the human genome and the advent of omics technologies, the diagnostics industry will likely grow at the quickest rate by application.

Product Insights

The market includes prebiotics, probiotics, drugs, and medical foods. The drug segment generated more than 36% of the revenue share in 2022. The human microbiota, a collective term for the billions of microorganisms that cover human tissues, contains bacteria, fungi, and viruses. The term "microbiome" refers to all of these microorganisms' genes.

The most significant product section belonged to the drugs category. This segment's considerable market share may be due to an increase in medicinal treatments based on the human microbiome that are now undergoing clinical trials and increasing funding for their development.

Competitive Analysis

The market for the human microbiome is moderately competitive, and many competitors are developing new goods. Organizations including Axial Biotherapeutics, Inc., Series Therapeutics, DuPont, Second Genome, and Synthetic Biologics hold significant market shares. Important firms are improving the therapies pipeline by creating effective and secure medications.

Regional Insights

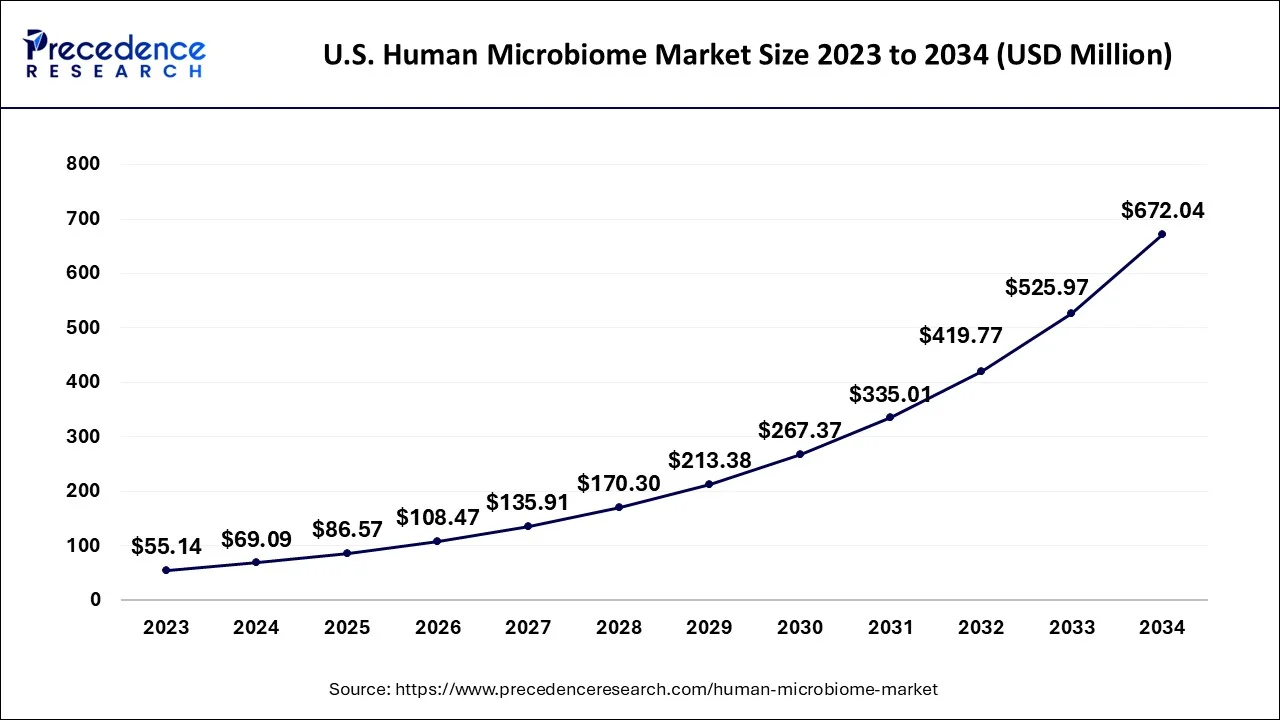

What is the U.S. Human Microbiome Market Size?

The U.S. human microbiome market size is estimated at USD 86.57 billion in 2025 and is expected to be worth around USD 791.53 billion by 2035, growing at a CAGR of 24.77% from 2026 to 2035.

The Global Human Microbiome Market consists of North America, Asia Pacific, Europe, and the Rest of the World based on regional analysis. Because of their superior microbiological andbiotechnologicalresearch infrastructure, Europe and North America lead the worldwide human microbiome market. Rising rates of autoimmune disorders and lifestyle diseases have also contributed to expanding the human microbiome industry in these countries.

The largest market in North America for the human microbiome is in the United States, followed by Canada. Germany, France, Spain, and the United Kingdom hold most of the European human microbiome market.

How is North America leading in the Human Microbiome Market?

With a strong healthcare infrastructure, advanced research capabilities, and active biotechnology development, North America dominates the market. The opportunities arise from the increasing interest in microbiome-based therapeutics, the growing consumer adoption of personalized health solutions, and the expanding support for innovative biological products across clinics.

The region's escalating disease burden is contributing to the market's expansion. For instance, according to the American Cancer Society, there will be around 1,918,030 new cancer cases in the US in 2022. Additionally, the Globocan 2020 numbers show that there are currently 274,364 new cancer cases, with an anticipated 400,564 instances by 2040. As a result, the rising incidence of cancer will likely fuel market expansion as gut microbiota regulate tumor therapy by improving patients' receptivity to immunotherapy and minimizing the adverse effects of chemotherapeutic drugs.

U.S. Human Microbiome Market Trends

The U.S. secures the future through substantial research, ruling out any scientific doubts, and the support of the public, which is conscious of the new technologies. The market for personalized wellness, which is the main reason for the bioinformatics breakthroughs, has already been created, and the development of microbiome-based products is only going to grow through the varied clinical acceptance of the innovations forming and the diagnostics shedding light on the new therapeutic and diagnostic solutions.

The expansion of the market in the area is also being aided by the rising number of research studies and the regulatory bodies' support for the investigation. For example, 4D pharma plc, in February 2022, gained FDA approval for two Live Biotherapeutics, MRx0005 and MRx0029, which are investigational new drugs (IND) for the treatment of Parkinson's disease. The market will likely develop as a result of these approvals.

How is Asia-Pacific Performing in the Human Microbiome Market?

The Asia-Pacific area is going through a rapid growth that is mainly due to the expansion of microbiome research, the rise of awareness regarding gut health, and the adoption of functional foods. The region's diverse and developing markets are the driving force behind the acceptance of microbiome-based wellness solutions, which is achieved through the integration of personalized interventions, healthcare innovations, and the acceptance of microbiome-based wellness solutions in the majority of the markets.

China/India/ Japan Human Microbiome Market Trends

The three countries, China, India, and Japan, are all benefiting from the research in the microbiome area, and every country, in its own way, is progressively making access to modern technology, and they are all backed by the growing interest in personalized medicine. Adoption of probiotics is increasing almost every day, and so is the public's understanding of gut health. The area of connecting microbiome-based products with healthcare and wellness ecosystems is the one getting the most attention in the future.

What are the driving factors of the Human Microbiome Market in Europe?

Europe is a market that continues to grow and is based on a solid foundation of advanced R&D, extensive regulatory pathways, and a powerful CDMO. The occurrence of new applications, the rise of the therapeutic development interest, and the confirmation of the adoption of the microbiome-based innovations along the clinical and preventive healthcare domains are the opportunities that will come.

Germany Human Microbiome Market Trends

Germany is doing well under the supportive reimbursement systems, the state-of-the-art healthcare, and the constant investments into biomedical research. The opportunity prevails with the rising interest in solutions based on the microbiome, and the simultaneous growth of clinical acceptance.

Value Chain Analysis of the Human Microbiome Market

- Research & Development: The process of discovering new microbiome-based drugs involves scientific research, laboratory tests, and identifying the potential therapeutic targets.

Key Players: Seres Therapeutics, Vedanta Biosciences, and Ferring Pharmaceuticals - Clinical trials and regulatory approvals: Human studies involving generating dosage, safety, and efficacy data for regulatory submission and authorization constitute this challenge.

Key Players: Seres Therapeutics, Ferring/Rebiotix - Formulation and Final Dosage Preparation: The classic drug compositions and physical forms meeting the exact standards of patient-ready therapeutic products are the company's objectives.

Key Players: Bacthera, Arranta Bio, and Cerbios-Pharma - Packaging and Serialization: The final products in containers with unique identifiers ensuring traceability, anti-counterfeiting, and supply chain management are the company's activities.

Key Players: Capsugel (now part of Lonza) and WACKER - Distribution to Hospitals, Pharmacies: The logistics and delivery of the finished authorized products are being managed so that the healthcare providers have timely access to the patients who are ready for treatment.

Key Players: Nestlé Health Science, Danone S.A.

Human Microbiome Market Companies

- AOBiome: The company is applying novel microbiome-based techniques to restore the microbial balance and support the overall health developments with inflammation and the use of ammonia-oxidizing bacteria as a therapeutic target.

- Yakult Honsha Co.: Consumers are receiving better digestive wellness through probiotic fermented milk products containing beneficial microbial strains that support gut health and promote microbiome balance from this company.

- Metabiomics Corp.: This company offers a non-invasive functional microbiome test that can detect colon-related diseases at an early stage due to the advanced microbial analysis.

Other Major Key Players

- Enterome Biosciences SA

- Osel, Inc.

- Microbiome Therapeutics LLC

- Second Genome

- Rebiotix, Inc.

- Synthetic Biologics, Inc.

- Seres Therapeutics

- 4D Pharma

- Vedanta Biosciences

- Ferring Pharmaceuticals

- Du Pont De Nemours and Co.

Recent Developments

- In September 2025, Seed launched Co-Biotics, a daily supplement category for humans and their microbiome, focusing on critical biological processes. The initial formulations include DM-02™, AM-02™, and PM-02™, targeting nutrient metabolism, cognitive performance, and sleep restoration.

(Source: https://www.prnewswire.com ) - In January 2025, PacBio and Intus Bio launched GutID, a pioneering gut health test utilizing Intus Bio's Titan-1 platform and PacBio's HiFi sequencing. This comprehensive test achieves strain-level resolution and unmatched accuracy in microbiome analysis. (Source:https://www.selectscience.net/)

- Sept 2022: The FDA's BLA application process for Seres Therapeutics Inc.'s SER-109 drug to stop recurrent C. difficile infection has been completed (CDI). It is a brand-new approach to treating rCDI that aims to advance the existing standard of care.

- Sept 2022:The FDA's Vaccines and Related Biological Products Advisory Committee approved Ferring Pharmaceuticals' RBX2660 for use in its investigational microbiota-based live biotherapeutic trial for its ability to lower the C. difficile infection (CDI) recurrence after antibiotic therapy.

- April 6, 2020:A four-year strategic partnership between Gilead Sciences, Inc. and Second Genome, a pioneer in the field of microbiome research, has been announced. The goal of the association is to find new potential drug candidates and targets for the cure of inflammatory bowel disease as well as to identify biomarkers linked to clinical response in up to five of Gilead's pipeline compounds for the treatment of fibrosis, inflammation, and other diseases (IBD).

- March 8, 2021:According to a press release from DuPont, it has signed a legally binding deal to buy Laird Performance Materials for $2.3 billion from Advent International, one of the biggest private equity companies in the world, using existing cash reserves. The transaction will likely close in the third quarter of 2021, barring any necessary regulatory approvals or other closing conditions.

- December 31, 2020:DuPont announced the start of its exchange offer (split-off), in which DuPont stockholders can choose to surrender their shares in exchange for common stock of Nutrition & Biosciences, Inc. ("N&B"). The exchange offer is a component of the Reverse Morris Trust deal between DuPont and International Flavors& Fragrances, which was previously revealed.

- April 15, 2020:As part of its ongoing efforts to stop the spread of COVID-19 and safeguard healthcare workers, DuPont introduced a new program called Tyvek Together to boost the overall supply of Tyvek personal protective apparel. By enabling others to join us in safeguarding even more frontline responders, our program has the potential to produce 6 million extra non-surgical isolation gowns each month when operating at total capacity.

Segments Covered in the Report

By Product

- Prebiotics

- Probiotics

- Drugs

- Medical Foods

By Application

- Diagnostics

- Therapeutics

By Disease Type

- Metabolic

- Infectious

- Endocrine

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting