What is the Microbiome Therapeutics Market Size?

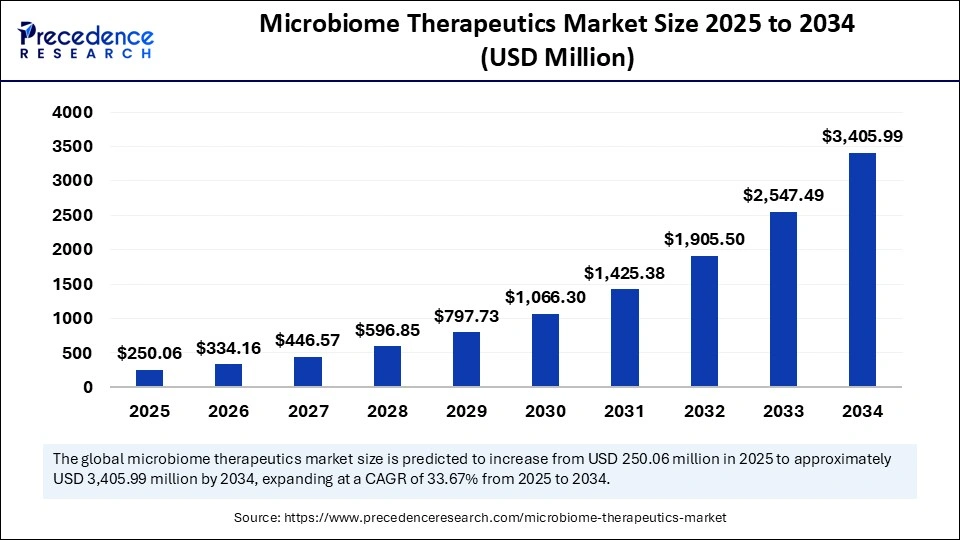

The global microbiome therapeutics market size is calculated at USD 250.06 million in 2025 and is predicted to increase from USD 334.16 million in 2026 to approximately USD 3,405.99 million by 2034, expanding at a CAGR of 33.67% from 2025 to 2034. The market growth is attributed to increasing investment in advanced microbiome research and expanding applications of microbiome-based therapies in treating complex diseases.

Market Highlights

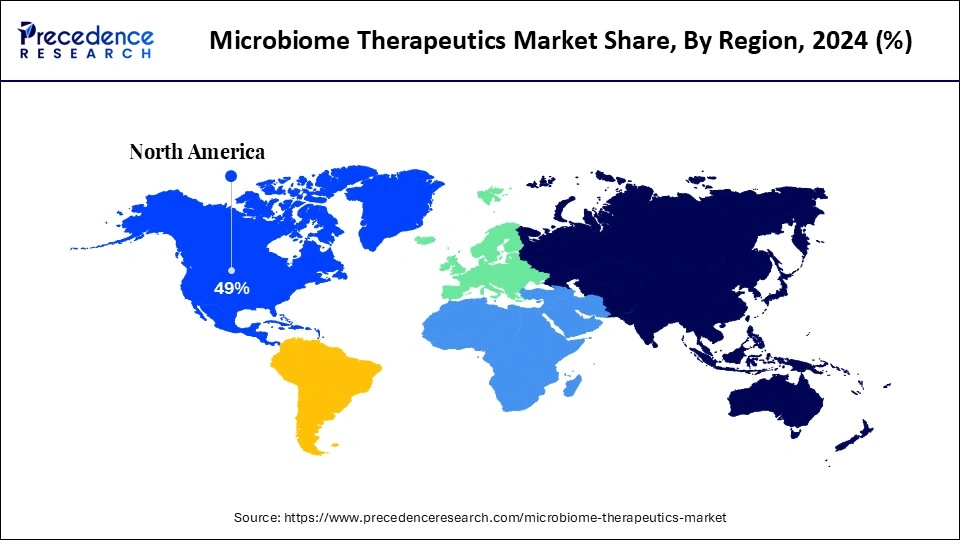

- North America segment dominated the global market with the largest market share of 49% in 2024.

- Asia Pacific segment is expected to grow at the fastest CAGR during the forecast period.

- By product type, the probiotics segment accounted for a considerable share in 2024.

- By product type, the postbiotics segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By therapeutic application, the gastrointestinal disorders segment led the market in 2024.

- By therapeutic application, the oncology segment is set to experience the fastest CAGR from 2025 to 2034.

- By mode of administration, the oral segment captured the biggest market share in 2024.

- By mode of administration, the rectal (FMT delivery) segment is anticipated to grow with the highest CAGR during the studied years.

- By end-user, the hospitals & specialty clinics segment generated the major market share in 2024.

- By material, the research & academic institutes segment is projected to expand rapidly in the coming years.

Market Size and Forecast

- Market Size in 2025: USD 250.06 Million

- Market Size in 2026: USD 334.16 Million

- Forecasted Market Size by 2034: USD 3,405.99 Million

- CAGR (2025-2034): 33.67%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Are Microbiome Therapeutics?

There is a surge in the microbiome therapeutics market, driven by increasing awareness of the gut microbiome's role in health and disease. The development of new sequencing technologies, including next-generation sequencing (NGS). This has enabled the detailed profiling of microbial communities, which can be utilized to develop targeted therapies. The 2024 guidelines of the AGA indicate that faecal microbiota-based therapy may be useful in patients with recurrent, severe, or fulminant Clostridium difficile infection.

Synthetic biology techniques are also being investigated as an alternative approach to creating microbial communities for disease treatment. This may provide remedies for diseases, including obesity and inflammatory conditions. Rising research investments are accelerating the development of microbiome-based therapeutics, which is becoming an exciting potential direction in personalized medicine. Moreover, the incorporation of microbiome research into clinical practice continues to drive the market, introducing additional opportunities for disease prevention and management.(Source: https://pubmed.ncbi.nlm.nih.gov)

Impact of Artificial Intelligence on the Microbiome Therapeutics Market

Artificial intelligence is transforming the microbiome therapeutics market by enabling the rapid discovery of new live biotherapeutics and engineered microbial strains. Firms use AI to develop the next generation of more precise therapeutics, eliminating the need for extensive and expensive tests. Furthermore, the AI processes various microbiome data to provide biomarkers to inform personalised treatment plans.

Microbiome Therapeutics Market Outlook

- Industry Growth Overview: The market is projected to expand rapidly between 2025 and 2034, driven by rising rates of chronic diseases, increased awareness of the microbiome's role in health, and advancements in genomics. Rising demand for Live Biotherapeutic Products (LBPs) to treat infections such as C. difficile, as well as their applications in oncology and metabolic disorders, also contributes to market growth.

- Global Expansion: The market is expanding worldwide as recognition of the microbiome's crucial role in human health grows, driving the development of novel therapeutics targeting diseases such as inflammatory bowel disease, metabolic disorders, and autoimmune conditions. Emerging regions, particularly in Asia-Pacific and Latin America, offer significant opportunities as rising healthcare awareness, expanding research, and improving healthcare infrastructure accelerate the demand for microbiome-based treatments.

- Major Investors:Major investors in the market include large pharmaceutical companies such as Johnson & Johnson, Roche, and Merck, which fund extensive research and development of microbiome-based therapies for various diseases. Additionally, venture capital firms and biotech investment funds are actively supporting startups and biotech firms working on microbiome-based innovations, accelerating the commercialization of novel treatments and expanding market access.

- Startup Ecosystem:A dynamic startup ecosystem focuses on innovation in synthetic biology, AI-driven microbiome mapping, and novel delivery methods. Emerging firms attract significant funding for scalable, targeted solutions, like CRISPR-guided phages.

Key Technological Shifts in the Microbiome Therapeutics Market

The microbiome therapeutics market is undergoing a significant shift due to the impact of precision medicine development. The incorporation of next-generation sequencing (NGS) and multi-omics methods can be considered one of the most significant changes. They enable the entire gut microbiome to be profiled, allowing for the development of specific therapies. Additionally, the Broad Institute Microbiome Program has facilitated metagenomic and metabolomic analysis tools that enable the accurate determination of disease-associated microbial signatures.

The other significant change is the use of synthetic biology to develop microbial strains that have superior therapeutic characteristics. Companies, such as Seres Therapeutics and Vedanta Biosciences, are creating engineered consortia intended to control or reestablish microbial balance in gastrointestinal diseases or regulate immune responses. These advances are facilitated by AI-based strain design tools, which are known to drastically decrease development schedules and improve effect forecasting.

Microbiome Therapeutics Market Growth Factors

- Growing Focus on Microbiome Data Integration: Rising efforts to combine microbiome sequencing data with health records are driving more precise therapeutic development.

- Driving Expansion of Global Research Consortia: The increasing formation of international microbiome research networks fuels collaborative innovation and accelerates the translation of findings to clinical applications.

- Rising Adoption of Microbiome-Based Diagnostics: The growing use of gut microbiome profiling in preventive healthcare strengthens the demand for targeted therapeutic interventions.

- Boosting Advances in Synthetic Microbial Engineering: Continuous improvements in engineered microbial strains are propelling novel treatment possibilities for chronic diseases.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 250.06 Million |

| Market Size in 2026 | USD 334.16 Million |

| Market Size by 2034 | USD 3,405.99 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 33.67% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Therapeutic Application, Mode of Administration, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Major Funding Surges and Strategic Milestones Propel Microbiome Therapeutics Forward in 2025

Metagen Therapeutics, Inc., a biotech innovator in gut microbiome-based drug discovery, announced the successful closings of its Series B financing round, conducted between July and September 2025. The company secured a total of ¥2.32 billion (approximately USD 15 million), adding four new investors—including global players—alongside seven existing backers. This round brings MGTx's cumulative funding to over ¥4.26 billion (approximately USD 28 million), strengthening its pipeline and R&D capabilities. (Source: https://www.metagentx.com)

The U.S. Food and Drug Administration (FDA) granted Breakthrough Therapy Designation to SER-155 for reducing bloodstream infections (BSIs) in adults undergoing allogeneic hematopoietic stem cell transplant (allo-HSCT) for hematologic malignancies, underscoring SER-155's potential clinical impact. (Source: https://www.cancertherapyadvisor.com)

Biocodex, a French family-owned pharmaceutical pioneer in microbiota research for over 70 years, has announced a strategic equity investment of €11 million in MRM Health, a Belgian clinical-stage biotech company developing innovative microbiome therapeutics for inflammatory diseases and immune-oncology. The partnership has the potential to reach approximately €30 million, reflecting Biocodex's long-term commitment to advancing next-generation microbiome treatments. (Source: https://www.businesswire.com)

EnteroBiotix, a Scottish biopharmaceutical company, has closed a USD 21.5 million Series A financing round to advance its drug pipeline targeting the microbiome, which is believed to play a key role in human health. Announced on September 7, 2025, the funding round was led by Thairm Bio and supported by Scottish Enterprise, SIS Ventures, and U.S.-based Kineticos Ventures. The capital will accelerate pipeline advancement across multiple disease areas to enhance gut microbiome health. (Source: https://www.enterobiotix.com)

Pendulum Therapeutics collaborated with BiomeSense to conduct a 14-week exploratory study monitoring Akkermansia muciniphila using BiomeSense's GutLab system. This partnership seeks to enhance understanding of this gut microbe's association with metabolic health through continuous microbiome tracking.(Source:https://www.eurekalert.org)

Global Regulatory Landscape for Microbiome Therapeutics

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. FDA (Food and Drug Administration) | IND (Investigational New Drug) Application- BLA (Biologics License Application)- Enforcement Discretion for FMTI | Clinical trial oversight- Safety and efficacy evaluation- Manufacturing standards | FDA has approved live microbiota-based products like Rebyota and Vowst for specific indications. |

| European Union | EMA (European Medicines Agency) | Clinical Trial Authorization (CTA)- ATMP (Advanced Therapy Medicinal Products) Regulation | Clinical trial oversight- Safety and efficacy evaluation- Manufacturing standards | EMA provides guidance for live biotherapeutic products, including FMT. |

| Japan | PMDA (Pharmaceuticals and Medical Devices Agency) | Clinical Trial Notification (CTN)- ATMP Regulation | Clinical trial oversight- Safety and efficacy evaluation- Manufacturing standards | Japan's regulatory framework for microbiome therapeutics is evolving, with increasing focus on safety and efficacy. |

| China | NMPA (National Medical Products Administration) | Drug Registration Regulation- Microecological Preparation Guidelines | Clinical trial oversight- Safety and efficacy evaluation- Manufacturing standards | NMPA recognizes microecological preparations as a distinct category of biological products. |

| India | CDSCO (Central Drugs Standard Control Organization) | Drugs and Cosmetics Act- Guidelines for Similar Biologics | Clinical trial oversight- Safety and efficacy evaluation- Manufacturing standards | India is developing specific guidelines for microbiome therapeutics, with a focus on safety and efficacy. |

Market Dynamics

Drivers

How Increasing Prevalence of Chronic and Lifestyle-Related Diseases Shaping the Growth in the Microbiome Therapeutics Market?

The increasing prevalence of chronic and lifestyle-related diseases is expected to drive the market for microbiome-based therapies. Researchers are finding correlations between gut dysbiosis and inflammatory bowel disease, obesity, diabetes, and certain types of cancer. Consistent decreases in bacterial diversity and changes to functional outcomes in patients with inflammatory bowel disease support the biological basis of therapeutic microbiome manipulation. (Source:https://pmc.ncbi.nlm.nih.gov)

In 2025, gastroenterology professional guidance formalizes fecal microbiota transplant clinical pathways and identifies approved fecal therapies. This includes REBYOTA and VOWST, in selected indications, to serve as a reference when clinicians incorporate therapeutic microbiome strategies into their practice. Furthermore, the surging adoption of precision medicine approaches is projected to enhance the role of microbiome therapeutics in clinical practice, as patients increasingly demand tailored treatment options based on their genetic and microbial profiles.(Source: https://pmc.ncbi.nlm.nih.gov)

Restraint

How do Regulatory Uncertainty and Complex Approval Processes Hamper Growth

The microbiome therapeutics market is hindered by regulatory uncertainty and complicated approval processes. Both the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) acknowledged that new guidelines were necessary to address the unique characteristics of live biotherapeutic products (LBPs). These are the challenges of consistency, safety, and efficacy of the product that are not properly addressed in the current frameworks. Moreover, the safety and long-term efficacy concerns impede the widespread adoption of microbiome therapeutics.

Opportunity

How is Growing Investment in Biotechnology and Pharmaceuticals Fuelling the Microbiome Therapeutics Market?

Growing investment in biotechnology and pharmaceutical research is anticipated to create immense opportunities for the microbiome-based therapies market. Venture capital groups, big pharma, and specialised biotech groups are focusing resources on gastrointestinal, metabolic, and neuroimmune programs. Industry sponsors and academic centres launched or expanded translational pipelines.

This typically involves connecting sequencing-derived biomarkers with first-in-human studies and reducing the gap between discovery and clinical entry. Institutions, including the Wellcome Sanger Institute and the Broad Institute, were also given renewed funding in 2024. They scale up large-scale microbiome sequencing populations to provide new targets and mechanisms to the industry. Additionally, the increasing partnerships and collaborations among academia, industry, and government bodies are expected to drive market expansion.(Source: https://sangerinstitute.blog)

Segmental Insights

Product Type Insights

Which Product Type Has Dominated the Microbiome Therapeutics Market in Recent Years?

The probiotics segment dominated the microbiome therapeutics market in 2024, driven by high clinical validation and its application in both healthcare and wellness industries. Furthermore, the extensive application of probiotics in preventive and therapeutic scenarios underscores the profound importance of probiotics in maintaining the health of the microbiome.

Postbiotics are expected to grow at the fastest rate in the coming years, owing to their resistance, safety, and specific health benefits, rendering them a competitive substitute for live biotherapeutics, particularly in those groups with impaired immunity or gut sensitivity. Moreover, the development of formulations has facilitated the integration of postbiotics in functional foods, nutraceuticals, and targeted therapeutics at a greater level of consistency and strength.

Therapeutic Application Insights

Why Have Gastrointestinal Disorder Therapies Dominated the Microbiome Therapeutics Market Recently?

The gastrointestinal disorders segment held the largest revenue share in the microbiome therapeutics market in 2024. Due to both clinical support and regulatory permissions, the focus is on repeat Clostridioides difficile infection and other enteral signs. Faecal-derived therapy clinical approvals.Including REBYOTA in 2022 and VOWST in 2023 provided clinical routes and hospital procurement strategies that stimulated massive adoption in gastroenterology practice. Furthermore, the growing incidence of GI-related infectious diseases highlights the high strategic importance of microbiome therapeutics solutions.

The oncology segment is expected to grow at the fastest rate in the coming years, driven by accumulating evidence of the association between gut and tumour-associated microbiota therapeutics. Several multi-center trials, involving microbiome modulation as a supplement to checkpoint inhibitors, were reported to have been completed in 2023-2024.

Initial studies on the mechanisms reported that microbiota-associated biomarkers can stratify responders and non-responders. By mid-2024, the International Human Microbiome Consortium had reported more than 40 oncology-oriented microbiome trials worldwide, with the most activity centered on trials for melanoma, colorectal, and non-small cell lung cancer. Furthermore, the growing number of cancer patients further propels the market in the coming years.(Source: https://pmc.ncbi.nlm.nih.gov)

End-User Insights

Why Do Hospitals and Specialty Clinics Represent the Dominant End-User Segment in Microbiome Therapeutics?

The hospital & specialty clinics segment dominated the microbiome therapeutics market in 2024, as they had the majority of clinical initiatives, initial commercial applications, and acute-care applications of faecal-derived and live biotherapeutic interventions. Large tertiary hospitals establish standardised FMT programs and procurement agreements to facilitate regulatory approvals of products.

They are offering that incorporate these therapies into infectious-disease and gastroenterology formulations. Moreover, the presence of clinician training programs that facilitate safe administration and patient monitoring further facilitates the utilization of microbiome therapeutics solutions.

The research & academic institutes segment is expected to grow at the fastest rate in the coming years, as they lead in translational research, technology testing, and platform commercialisation that expand the therapeutic indications. Furthermore, funding bodies and charity foundations stepped up their support for microbiome mechanistic efforts and clinical proof-of-concept programs, further boosting the segment in the coming years.

Mode of Administration Insights

Which Sub-segment Is Projected to Lead the Mode of Administration in the Coming Years?

The oral segment held the largest revenue share in the microbiome therapeutics market in 2024, due to its ease of administration to patients, its immense ability to scale, and the increasing clinical data of effectiveness. Oral delivery has emerged as a potential treatment option for recurrent Clostridioides difficile infection.

In 2023, FDA approval of oral fecal-derived microbiota products, including VOWST, has made oral delivery a readily adopted option in outpatient environments. The American Gastroenterological Association published a study that found oral microbiome therapeutics to be more effective in terms of patient compliance and similarly effective as invasive interventions. Additionally, the growing utilization of oral delivery for metabolic and immune-mediated disorders makes the segment a long-term leader in the therapeutic delivery of microbiomes. (Source: https://www.fda.gov)

The rectal (FMT delivery) segment is expected to grow at the fastest rate in the coming years, driven by the highly promising clinical efficacy in treating complex gastrointestinal disorders. In Europe and Asia, regulatory bodies have begun developing specific legal frameworks for standardised FMT protocols, which increases the chances of rectal adoption. Furthermore, these considerations make the delivery of rectal FMT a dominant approach in microbiome therapy over the next ten years.

Regional Insights

U.S. Microbiome Therapeutics Market Size and Growth 2025 to 2034

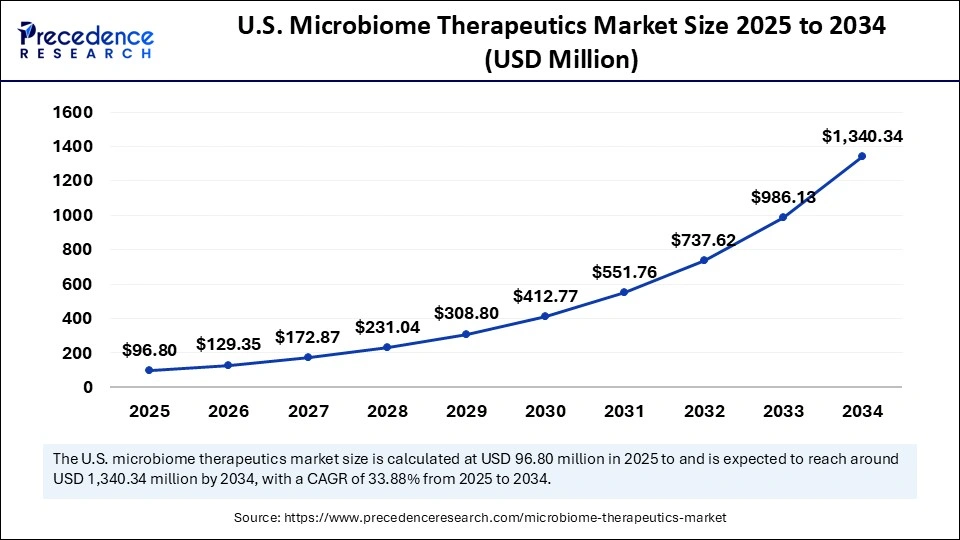

The U.S. microbiome therapeutics market size was evaluated at USD 72.44 million in 2024 and is projected to be worth around USD 1,340.34 million by 2034, growing at a CAGR of 33.88% from 2025 to 2034.

Why Is North America the Dominant Regional Segment in Microbiome Therapeutics?

North America led the microbiome therapeutics market, capturing the largest revenue share in 2024, due to early regulatory standards, a focused clinical infrastructure, and the ability to swiftly translate and adopt live microbiota therapies. The U.S. FDA created direct product lines and hospital procurement patterns, which hospitals and specialty clinics followed in the fields of infectious disease and gastroenterology services.

Large academic facilities, such as the Mayo Clinic, Mount Sinai, and the University of Chicago, as well as national data programs, have incorporated standardized sequencing and outcome registries into trial designs. This minimises the heterogeneity of cohorts and enhances signal coverage of GI indications. Furthermore, these developments encouraged hospital systems to focus on procurement, training, and pathway integration, which consolidated North America's dominance.

U.S. Microbiome Therapeutics Market Trends

The U.S. holds a leading position in the North American microbiome therapeutics market, excelling in research, innovation, and commercialization. Supported by substantial R&D investment and a well-defined FDA regulatory framework, the U.S. serves as the central hub for developing and launching new Live Biotherapeutic Products (LBPs) to treat conditions such as C. difficile infections

What Makes Asia Pacific the Fastest-Growing Region in the Microbiome Therapeutics Market?

The Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, driven by the growth of governments, significant research institutes, and sequencing consortia, which aim to expand national programs. Large-scale projects, such as the Human Microbiome Project and coordinated sequencing exercises, have generated population-level datasets of the human microbiome that can be used to discover and translate targets in specific regions.

The national genomics and sequencing capacity of China (BGI/MMHP-related efforts) provided high-throughput metagenomics capacity in 2024, allowing faster biomarker discovery and trial readiness. Moreover, the national and regional data-sharing platforms, as well as the financial support for translational microbiome research by the state, are expected to strengthen the microbiome therapeutics market in the Asian Pacific in the coming years.

India Microbiome Therapeutics Market Trends

India is an emerging and rapidly growing market, propelled by its unique biodiversity and large population. Its focus is on proactive research, mapping indigenous microbiomes through projects like the Indian Human Microbiome Project, and developing affordable diagnostics and precision probiotics, positioning it for swift future growth.

How is the Opportunistic Rise of Europe in the Microbiome Therapeutics Market?

Europe is a mature and highly innovative market for microbiome therapeutics, with many biotech companies and research institutions. The market is driven by extensive R&D efforts, significant funding from public and private sources, and a high rate of gastrointestinal disorders. Strict yet clear regulatory frameworks established by the European Medicines Agency offer a clear pathway for drug approval, supporting a strong pipeline of new treatments targeting conditions like C. difficile infections, IBD, and various metabolic diseases.

Germany Microbiome Therapeutics Market Trends

Germany is a key player in the market, recognized for its strong biopharmaceutical industry and extensive academic research in the field. The market benefits from significant investment in R&D and a healthcare system eager to adopt innovative therapies. Germany hosts numerous companies focused on developing live biotherapeutic products (LBPs) and other microbiome-modulating treatments, supported by a national strategy to promote advanced biotechnology and address important unmet medical needs.

What Potentiates the Growth of the Latin American Microbiome Therapeutics Market?

The Latin American market is driven by increasing healthcare spending, a rising prevalence of chronic diseases such as inflammatory bowel disease (IBD), and growing awareness of gut health. Research activities are expanding in countries like Brazil and Mexico to explore the microbiome's potential in addressing local health issues. The region presents opportunities for international pharmaceutical companies, although market growth currently faces challenges related to regulatory frameworks and funding for research and development.

Brazil Microbiome Therapeutics Market Trends

Brazil is leading the market in Latin America. Driven by a large population and a significant burden of chronic health conditions, there is increasing interest among healthcare professionals and consumers in new treatment options. Research in Brazil focuses on understanding the unique microbiome profiles of its diverse population. The market is expected to see more investment as clinical trial data for new therapies becomes available, although regulatory pathways for these new drugs are still evolving.

What Opportunities Exist in the Middle East and Africa for Microbiome Therapeutics Market?

The Middle East and Africa (MEA) present significant market opportunities, driven by increased investment in healthcare infrastructure and a focus on enhancing public health outcomes. Key factors include heightened awareness of the connection between the gut microbiome and various diseases, along with a rising prevalence of obesity and diabetes. Although specific therapies remain limited, there is growing interest in functional foods and probiotics within the region. Countries like the UAE are investing in R&D to diversify their economies and advance their healthcare sectors.

UAE Microbiome Therapeutics Market Trends

The UAE is a leading player in the MEA microbiome therapeutics market, fueled by ambitious healthcare objectives and substantial government investment in R&D. As part of its strategy to become a global healthcare hub, the UAE promotes research into personalized medicine and innovative therapies. The market is projected to expand as regulatory authorities in the UAE work to establish clear guidelines for approving and commercializing new microbiome-based drugs and treatments.

Value Chain Analysis

Research and Development (R&D)

This stage focuses on the scientific discovery of the human microbiome's role in health and identifying therapeutic targets.

- Key Players:Seres Therapeutics, Vedanta Biosciences, Finch Therapeutics, and MaaT Pharma.

Clinical Trials and Regulatory Approval

Rigorous clinical testing and regulatory approval processes ensure the safety and efficacy of microbiome therapies.

- Key Players: Seres Therapeutics, Ferring B.V., Vedanta Biosciences, and Finch Therapeutics.

Manufacturing and Production

This involves the complex, large-scale production of microbiome-based products under cGMP standards.

- Key Players: Biose, BacThera, WACKER, Cerbios-Pharma, and Arranta Bio.

Distribution and Supply Chain Management

Ensuring the efficient, temperature-controlled delivery of live therapeutics to healthcare facilities and pharmacies is critical.

- Key Players: Ferring B.V., Nestlé Health Science.

Patient Support, Engagement, and Commercialization

This focuses on patient education, financial management, and the broader commercialization of approved products, amid growing public awareness of gut health.

- Key Players: Viome, Sun Genomics, and Sova Health.

Microbiome Therapeutics Market Companies

- 4D Pharma plc

- AOBiome Therapeutics

- Axial Therapeutics, Inc.

- Enterome SA

- Evelo Biosciences, Inc.

- Finch Therapeutics Group, Inc.

- MaaT Pharma

- Microbiotica Ltd.

- Novome Biotechnologies

- Quorum Innovations

- Rebiotix (Ferring Pharmaceuticals)

- Second Genome

- Seres Therapeutics, Inc.

- Synlogic, Inc.

- Vedanta Biosciences, Inc.

Companies in the Microbiome Therapeutics Market & Their Offerings

- Seres Therapeutics (USA): A pioneer in microbiome-based therapeutics, Seres Therapeutics developed Vowst, the first FDA-approved oral microbiome therapeutic for preventing recurrent Clostridioides difficile infections. The company continues to expand its research into conditions such as ulcerative colitis and antimicrobial resistance.

- Nestlé Health Science (Switzerland): Through collaboration with Seres Therapeutics, Nestlé Health Science co-developed Vowst, marking a major step into microbiome therapeutics. The company leverages its expertise in nutrition and health science to support the development and commercialization of microbiome-based therapies.

- Finch Therapeutics (USA): Finch Therapeutics focuses on developing microbiome-based therapies for recurrent Clostridioides difficile infections. Their approach utilizes microbiome-based interventions to restore healthy microbial communities in the gut.

Vedanta Biosciences (USA): Vedanta develops synthetic microbiome consortia designed to treat diseases such as inflammatory bowel disease and cancer. The company focuses on modulating the human microbiome to achieve targeted therapeutic effects. - MaaT Pharma (France): MaaT Pharma specialises in microbiome-based therapies for oncology and other serious diseases. Their lead product is a stool microbiota-based therapy designed to treat graft-versus-host disease and enhance the response to cancer immunotherapy.

- Enterome (France): Enterome develops microbiome-based therapies for inflammatory bowel diseases and cancer. Their research includes identifying microbial antigens for targeted therapeutic interventions.

- Rebiotix (USA): A subsidiary of Ferring Pharmaceuticals, Rebiotix specialises in microbiota-based therapies, focusing on faecal microbiota transplant products for recurrent Clostridioides difficile infections.

- BiomX Inc. (USA): BiomX develops precision medicine therapies that modulate the microbiome, targeting specific microbial communities to treat disease.

Recent Developments

- In September 2025, BugSpeaks, the consumer brand of Leucine Rich Bio, launched South Asia's first skin microbiome test. This innovation promises to transform personal skin health management, expanding beyond the company's flagship gut microbiome platform. The launch represents a significant step toward integrating precision microbiome diagnostics into the fields of wellness and disease prevention.

- In July 2025, OpenBiome officially transitioned to the OpenBiome Foundation, marking a strategic evolution to accelerate innovation and expand the impact of microbiome science globally. This transformation reflects a shifting regulatory landscape and builds upon the organisation's early successes and expertise in advancing microbiome therapeutics.

- In March 2025, ClostraBio, a Chicago-based biotech company, announced the successful completion of a bridge financing round with institutional investors, including the Illinois Innovation Venture Fund (INVENT) and NextGen Nutrition Investment Partners (NGN). The company also named a new Chief Scientific Officer and revealed plans to launch its first microbiome therapeutic product in summer 2025.

(Source: https://openbiome.org)

(Source: https://ir.serestherapeutics.com)

(Source: https://www.ferring.com)

(Source: https://www.jsr.co.jp)

(Source: https://trial.medpath.com)

(Source: https://www.digitalhealthnews.com)

Segments Covered in the Report

By Product Type

- Probiotics

- Prebiotics

- Postbiotics

- Synbiotics

- Live Biotherapeutic Products (LBPs)

- Fecal Microbiota Transplantation (FMT)

By Therapeutic Application

- Gastrointestinal Disorders (IBS, IBD, CDI, etc.)

- Metabolic Disorders (Obesity, Diabetes, NAFLD, etc.)

- Oncology (Cancer Immunotherapy Adjuncts, etc.)

- Autoimmune Disorders (Rheumatoid Arthritis, Multiple Sclerosis, etc.)

- Neurological Disorders (Parkinson's, Autism, Depression, etc.)

- Other Applications (Dermatology, Infectious Diseases, etc.)

By Mode of Administration

- Oral

- Rectal (e.g., FMT Enemas, Colonoscopy Delivery)

- Topical

- Other Routes (e.g., Injectable, Nasal, etc.)

By End-User

- Hospitals & Specialty Clinics

- Research & Academic Institutes

- Homecare Settings

- Other End-Users (Contract Labs, CROs, etc.)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting