What is the Capillary Blood Collection Devices Market Size?

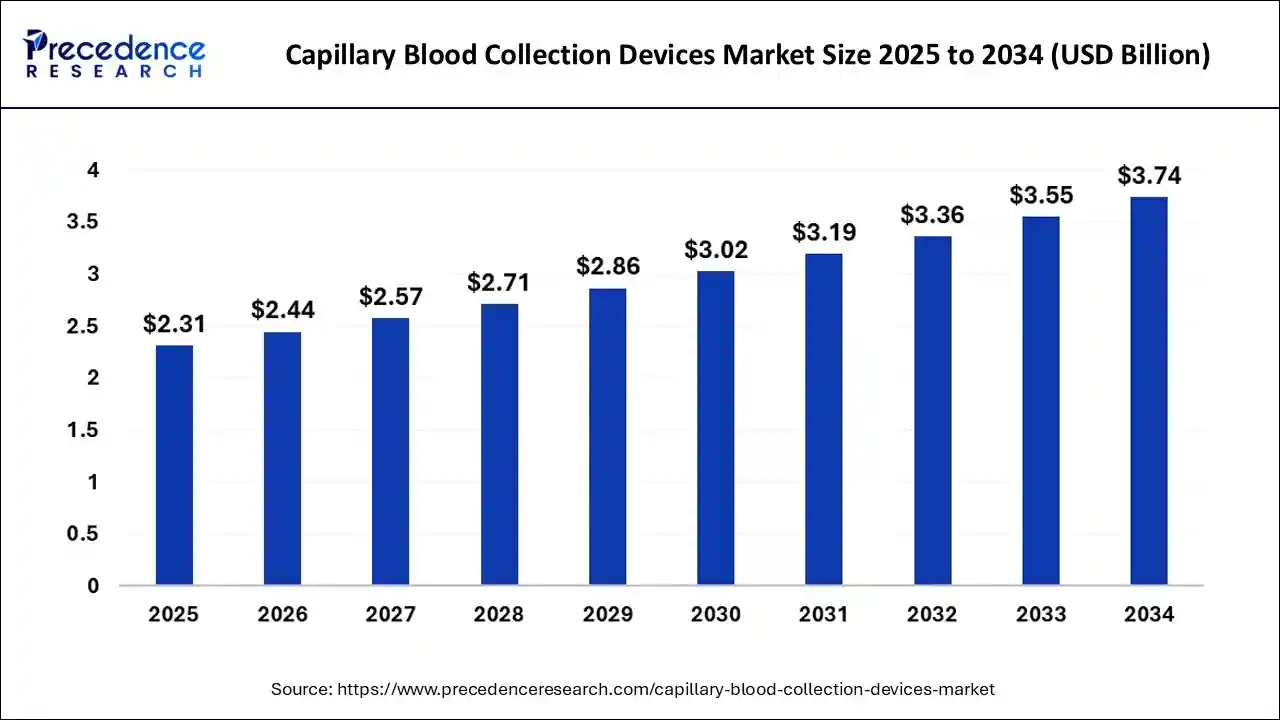

The global capillary blood collection devices market size is accounted at USD 2.31 billion in 2025 and predicted to increase from USD 2.44 billion in 2026 to approximately USD 3.74 billion by 2034, growing at a CAGR of 5.49% from 2025 to 2034. The capillary blood collection procedures can affect the quality of samples and the accuracy of test results, the capillary blood collection devices market is growing, reflecting the urgent need for testing, and widespread standardization.

Capillary Blood Collection Devices Market Key Takeaways

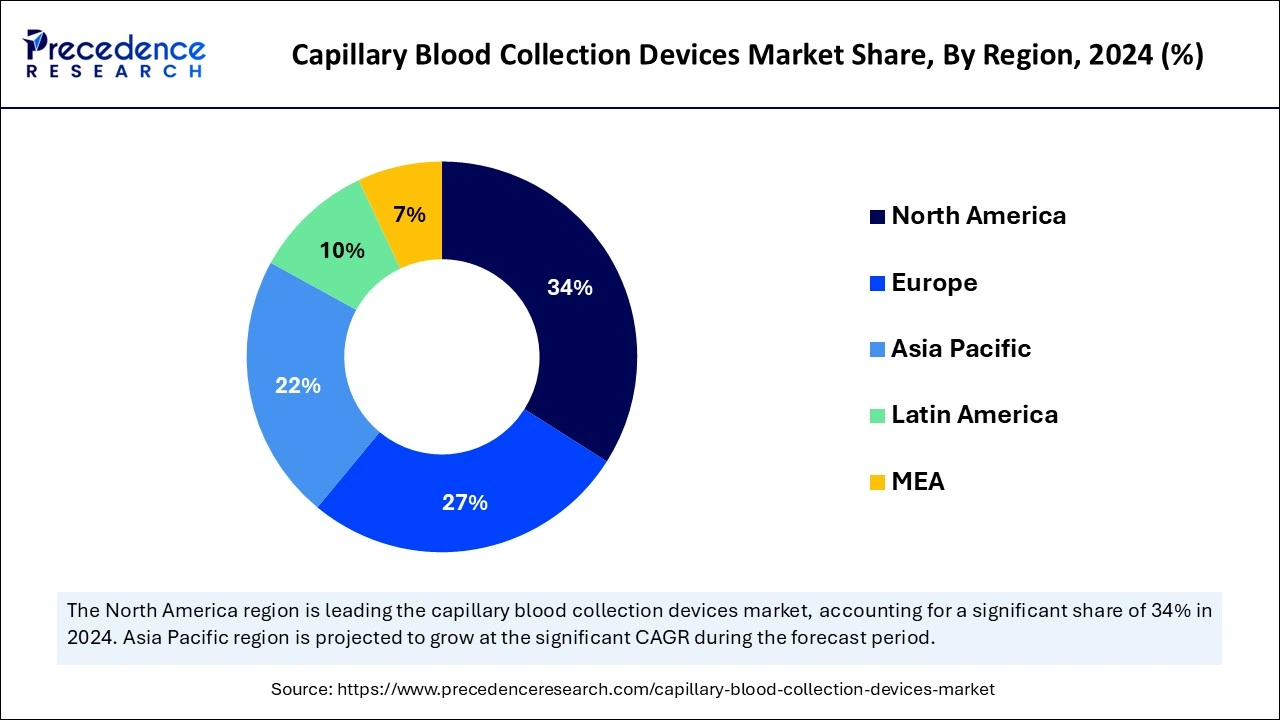

- North America led the capillary blood collection devices market with the largest market share of 34% in 2024.

- Asia Pacific is projected to grow at a solid CAGR of 10.05% during the forecast period.

- By material, the plastic segment has held a major market share of 41% in 2024.

- By material, the glass segment is expected to grow at the fastest CAGR of 8.92% during the studied years.

- By product, the lancet segment generated the highest market share of 34% in 2024.

- By product, the micro-container tube segment is expanding at a CAGR of 9.03% over the forecast period.

- By application, the whole blood tests segment accounted for the largest market share of 25% in 2024

- By application, the plasma/ serum protein tests segment is growing at a CAGR of 9.32% during the forecast period.

- By end-use, the hospitals and clinics segment recorded the biggest market share of 30% in 2024.

- By end-use, the blood donation centers segment is expected to grow at the fastest rate in the coming years.

Impact of Artificial Intelligence (AI) on Blood Collection in the Medical Industry

Remote self-collection of capillary blood using an upper arm device for autoantibody analysis in immune-mediated inflammatory rheumatic diseases by integration of Artificial Intelligence. Analysis and post-analysis evaluation are the most important aspects of clinical practice, new opportunities have emerged to expand the benefits of expertise further. This is a smart approach for many hardworking organizations entering the pre-analytical phase; machine learning (ML) and deep learning (DL) are being used to help classify different types of cancer, facilitate faster diagnosis, and provide the basis for clinical decision-making to achieve better outcomes.

Artificial intelligence is widely used in many areas of science and medicine, including clinical medicine. Robotic devices can guide needles and catheters into small blood vessels with little maintenance. It combines artificial intelligence with near-infrared and ultrasound imaging to perform invisible tasks such as identifying, classifying, and estimating the depth of blood vessels in surrounding tissue and then tracking their work.

- In September 2024, Orchard Software announced its partnership with Babson Diagnostics in Austin, Texas. Babson Diagnostics is developing the BetterWay blood test, a laboratory service that represents a significant advancement in critical care, provides a patient-friendly experience, and enables better measurements in a convenient research environment.

Market Overview

The capillary blood collection devices market is growing rapidly because capillary blood collection is a medical procedure designed to aid in the diagnosis, management, and treatment of patients and is increasingly used worldwide, in part due to the increasing number of medical devices, treatments, and clinical trial growth. It is also frequently used to obtain small amounts of blood for laboratory testing, as it can reduce pain. The capillary blood test system can reflect the quality and accuracy of the test results and indicate that urgent and detailed information is needed.

Capillary blood sampling, where blood is collected by pricking the finger, ankle, or ear, is increasingly used in medicine. It has several advantages over phlebotomy: It is less invasive, requires less blood, and can be performed quickly and easily. This technology is becoming popular, especially with the widespread use of point-of-care testing (POCT), which is becoming the fastest-growing area of medicine. Capillary blood collection has several advantages over venous blood collection. It is easy to draw blood from a vein, but it can be difficult, especially for babies.

- In December 2024, BD, a global healthcare company, and Babson Diagnostics, a leading health technology research company, today announced the expansion of its fingerprint-based blood testing and testing technology for use by U.S. healthcare systems, and other major providers in urgent care, including physicians in offices and other ambulatory care facilities.

What Is Causing the Rapid Growth of the Capillary Blood Collection Devices Market in 2025?

The global market for capillary blood collection devices is expanding rapidly as a result of the growing demand for point-of-care testing and minimally invasive diagnostics. The growing number of chronic diseases, gas profits in the technology surrounding micro-sampling, also continues to act as a catalyst to increase the prevalence of product adoption. Hospitals, diagnostic laboratories, and home healthcare sectors are utilizing capillary blood collection systems due to their accuracy, convenience, and reduced patient discomfort while representing a paradigm shift away from venous blood draws.

Key Factors Influencing Future Market Trends

- Increasing prevalence of chronic diseases: Rising cases of diabetes and heart diseases are aiding in the growth of the capillary blood collection devices market. Since people suffering from these conditions undergo blood tests regularly, there is a need for efficient and low-pressure methods for blood collection.

- Advancements in point-of-care (POC) testing:Technological advancements in POC have led to an increase in capillary blood collection devices. These devices facilitate testing at the place of its necessity, for instance, in hospitals, ambulance vans, emergency rooms, as well as in some far-off locations.

- Popularity of remote patient monitoring:The rise in telehealth services and remote monitoring has boosted the application of capillary blood collection devices. Patients with chronic health issues can perform blood tests easily at home, which enhances their convenience.

Capillary Blood Collection Devices Market Growth Factors

- Blood donation centers increase blood volume by implementing safety procedures, scheduling donation appointments, increasing mobile blood drives, relying on regular donors, repeating monitoring suspension procedures, and conducting community awareness and community engagement projects for donors, which caused the growth of the capillary blood collection devices market.

- Maintaining adequate blood supply and proper utilization in a developing country like India is a major challenge. The National Blood Requirement Estimation in India is a unique study designed to estimate population needs, medical demand, supplies, and utilization; this will help inform policy and create evidence-based plans and programs to strengthen the country's blood.

- Advancements underscore changes in technology to improve clinical practice and patient outcomes. Technology holds the promise of enhancing physician engagement and decision-making, thereby encouraging the development of the capillary blood collection devices market.

- Technological advancements such as the development of efficient, reliable, and fast capillary blood collection devices, the shift to home healthcare, and remote patient care have led to the growth of the market.

Market Outlook:

The capillary blood collection devices market is likely to see tremendous growth, reaching multi-billion-dollar valuations by 2032. The industry will be transformed with advancements in technology, public interest around self-testing, and telemedicine. The companies investing in AI-enabled devices along with sustainable materials will set themselves apart in this reshaping healthcare landscape.

- Industry Growth Overview: The industry has a solid growth trajectory, correlating with the increasing burden of chronic diseases, innovation in micro-sampling devices, and the emergence of home diagnostic tests throughout the world.

- Sustainability Trends: Manufacturers are adopting the use of eco-friendly plastics, recyclable packaging, and energy-efficient manufacturing lines in reduce of their environmental footprint in support of the global movement toward green healthcare technology.

- Global Expansion: Major players in the market have been expanding their presence in geographical locations such as Asia-Pacific, the Middle East, and Latin America in order to focus on local manufacturing, distribution methods, and diagnostic products in lower resource areas.

- Startup Ecosystem: The emergence of innovative startups is leading the next wave of diagnostics, through smart capillary collection kits, wearable blood sensors, and cloud-based connectivity integration to create the future of personalized healthcare worldwide.

Market Scope

| Report Coverage | Details |

| Market Size by 2026 | USD 2.44 Billion |

| Market Size in 2025 | USD 2.31 Billion |

| Market Size in 2034 | USD 3.74 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.49% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, End-use, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Innovation in minimally invasive techniques

The capillary blood collection device market is witnessing significant growth driven by advances in minimally invasive technologies that are important in terms of pain relief and accessibility for people. Capillary blood collection offers a less invasive, less painful, and easier-to-use alternative to venous or arterial blood collection, with the added benefit of having a different body composition, such as ears, forehead, ankles, palms, and arms.

Innovations in medical phlebotomy technology have addressed needle phobia and increased patient compliance through frequent testing for effective disease monitoring and management. Additionally, the development of advanced capillary blood collection technology supports low healthcare standards, leading to new approaches to patient care.

- In July 2022, Rhinostics introduced new ground in sample collection technology with the launch of its patent-pending VERistic collection device, which is intended for the collection of small amounts of blood. Ideal for home and physician-assisted collection systems, VERistic is efficient and effective for testing for antibodies, hormones, and proteins, sexually transmitted diseases (STIs), dried blood (DBS) cards, and genetic testing. Collection of tests, clinical trials, and simple finger prick collection.

Restraint

Limitations in sample integrity and accuracy

The growth of the capillary blood collection device market is limited by challenges in model uniformity and reliability. Capillary blood tests often contain undetermined amounts of venous, arterial, and microvascular blood, as well as contamination from interstitial and intracellular fluids. Many micro-collection devices require adequate sample collection from a single puncture site, increasing the risk of contamination, hemolysis, and clotting. These factors increase the likelihood of false positives and undermine the reliability of capillary blood tests for accurate diagnosis. These limitations constitute a significant constraint on commercial expansion, especially in applications requiring high sensitivity and consistency.

Opportunity

MiniDraw collection system

The BD MiniDraw collection system brings significant opportunities to the capillary blood collection devices market by meeting the basic needs of the patient and the process. It has fewer side effects than venipuncture and is particularly suitable for patients with venous problems or needle phobia, while also yielding consistently good microvolume samples and reducing hemolysis rates compared to traditional methods.

Designed for use by physicians with or without phlebotomy training, MiniDraw enables increased access and convenience for blood collection in non-traditional, patient-centered environments such as retail stores and medical facilities. The MiniDraw system increases sales staff confidence by eliminating the need for specialized training and improving the convenience of healthcare testing, making it necessary for patients and providers.

Material Insights

The plastic segment dominated the global capillary blood collection devices market in 2024 as plastic reduces the risk of infection and prevents injury. They also have self-sealing gaskets that allow air to escape when the tube is filled. Plastic tubes are used for laboratory procedures, while plastic capillary tubes are used for blood collection and hematocrit determination. The ability to be coated with anticoagulants or coatings depending on the intended use has led to the development blood collection sector.

The glass segment is expected to grow at the fastest rate during the studied years as glass capillary tubes are widely used in laboratories to absorb and separate small liquid samples. They are often used in medicine and life sciences to collect and analyze fluids such as blood and urine. Capillary tubes reduce pressure, collect various liquid samples in the laboratory, and control concentration, molarity, and molality.

Product Insights

The lancet accounted for the largest capillary blood collection devices market share in 2024 as blood lancets, or simply lancets, are small medical instruments used to collect blood from a vein. It has a double-edged blade and a pointed tip. A lancet device is used to draw blood and test blood sugar (glucose). This device has two parts: a "lancet holder" that resembles a small pen and a lancet, which is a sharp tip or needle that is placed in a holder.

The micro-container tube segment will grow at a significant CAGR over the forecast period as micro-container blood tubes are designed for ease of use and to aid in the storage of capillary blood. It ensures good capillary blood collection. It provides an easy way to collect small amounts of blood for general analysis.

Application Insights

The whole blood tests segment dominated the global capillary blood collection devices market in 2024 as it is used to check general health and diagnose many diseases such as anemia, cancer, and leukemia. They help doctors diagnose diseases and conditions. They also help analyze the body's functioning and show treatment studies leading to the development of the market.

The plasma/ serum protein tests segment will witness the fastest growth during the forecast period as the test helps doctors make overall health decisions. Plasma protein testing is also called total protein testing. The plasma protein test is a blood test that measures the amount of protein in the blood. This lab work is often done as part of the comprehensive metabolic panel (CMP) during a physical exam.

End-use Insights

- In 2024, the hospitals and clinics segment led the global capillary blood collection devices market because the capillary blood collection process affects the quality of the samples and the accuracy of the results, indicating that it must be done quickly and comprehensively. A current national survey of policies and practices related to capillary blood testing in clinical settings. Capillary puncture can be used to collect samples from infants or adults who have difficulty with venepuncture.

The blood donation centers segment is expected to grow at the fastest rate in the coming year, as capillary blood collection involves accessing the skin system to access the capillary bed through the subcutaneous layer of the skin. Capillary dried blood microsampling has been used for many years in donor centers to test infants on dried blood (DBS) cards. These centers also collect capillary blood for blood lipids and blood sugar.

Regional Insights

U.S. Capillary Blood Collection Devices Market Size and Growth 2025 to 2034

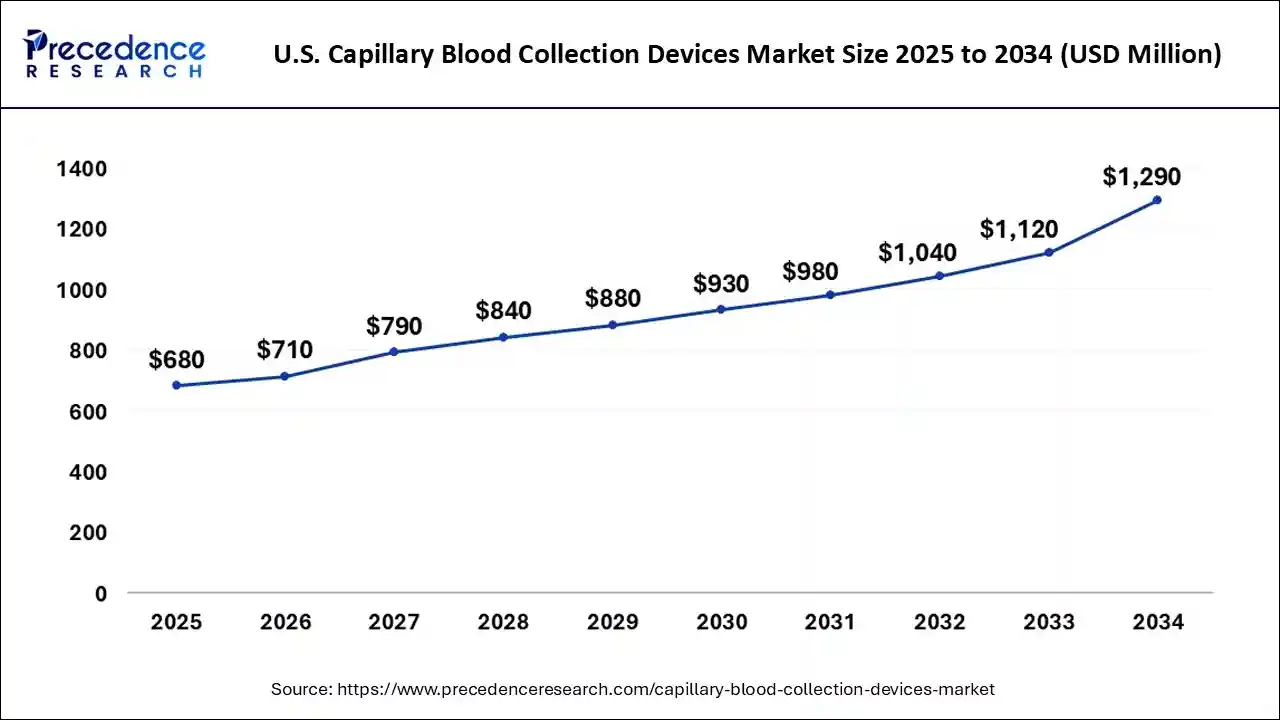

The U.S. capillary blood collection devices market size is evaluated at USD 680 million in 2025 and is projected to be worth around USD 1,290 million by 2034, growing at a CAGR of 5.75% from 2025 to 2034.

Advancements and Initiatives Propel North America

North America dominates the global market due to advances in medical discovery, diagnosis, and treatment. Healthcare companies support the market at the forefront of healthcare by developing new technologies, services, and solutions that improve healthcare for patients and medical procedures for physicians. North American healthcare companies must be able to offer healthcare organizations a robust, reliable portfolio of advanced technologies and materials.

North America: U.S. Capillary Blood Collection Devices Market Trends

The U.S. capillary blood collection devices market is growing strongly, buoyed by increasing demand for minimally invasive testing in point of care and home care settings. Wearable and remote capillary collection devices are emerging as high-growth segments, especially as telehealth and self-monitoring gain traction. Automation and smart technology, such as Bluetooth-enabled and cloud-integrated sampling kits, are improving usability and enabling real-time data capture.

Capillary blood collection devices, which are made from connected materials, can make care more efficient and effective. Government initiatives are helping to support the growth of the capillary blood collection device market, such as J-PAL North America's Healthcare Delivery Initiative (HCDI) for the United States, a randomized trial supporting the country's healthcare strategy plans. A better country that is effective and honest has led to the development of the capillary blood collection devices market.

- In December 2022, ASP Global, a commercial marketing company serving some of the largest healthcare systems, laboratories, and distributors in the United States, announced the acquisition of Nashville-based RAM Scientific.

Rapid Growth Amid Rising Healthcare Demand and Aging Population in Asia Pacific. Asia Pacific will host the fastest-growing capillary blood collection devices market during the forecast period with the increasing medical demand in the region. Healthcare companies are strengthening healthcare services through new services, education, and digitalization. Support better service integration and re-enhance patient care. The prevalence of chronic diseases is increasing in Asia Pacific. Chronic diseases lead to the need for blood tests. The elderly are aging, and the demand for blood tests is increasing; for example, Japan is aging rapidly, and the purpose of the test is to measure the blood sugar function of the increase in blood sugar level after eating sugar.

The European capillary blood collection devices market is poised for significant growth. Point-of-care testing and early diagnosis in Europe are driving the expansion of the capillary blood collection devices market. Since healthcare is more about fast test results and what works for patients, capillary blood collection devices are an important part of standard and continuous disease observation. A growing population of seniors in the region creates more demand for blood testing, as frequent tests are often needed for diseases like diabetes and heart disease.

In the UK, policies for healthcare support early detection and prevention, which make the environment suitable for using such technologies. The NHS has been promoting patient-focused care to allow more patients to manage their long-term conditions from home. This has made it easier for people to do their blood tests and access diagnostics quickly.

Asia Pacific: China Capillary Blood Collection Devices Market Trends

China's capillary blood collection devices market is growing strongly, supported by expanding healthcare infrastructure and rising demand for point of care diagnostics. Manual sampling remains dominant, but automated and wearable capillary blood collection devices are gaining traction. Rapid test cassettes are among the fastest-growing product segments, reflecting increased use in quick diagnostics. Plastic materials continue to dominate the market, though glass and other materials are seeing gradual adoption for specific use cases.

How Is Latin America Growing Its Diagnostic Infrastructure?

The market for devices used for the collection of blood via capillary, is increasing in Latin America because of growing healthcare investments and the launch of prevention-based health screening and testing programs. Countries such as Brazil, Mexico, and Argentina have a higher diagnostic detection rate for diabetes and anaemia. Therefore, there is an increase in the adoption and utilization of capillary blood collection systems in more healthcare settings. The increasing emphasis on remote healthcare and mobile diagnostics in the region is also increasing the penetration of these systems into healthcare, along with government commissions for testing and screening options that are both accessible and affordable.

What Is the Advantage Europe Has for Testing/Screening Development?

Europe has maintained a significant forecasted share of the global market due to the presence of well-established medical distributions and early technology advancements in micro-capillary blood collections. Germany, the UK, and France are shifting towards automated and hygienic techniques, enabling improvements in sample integrity while also increasing safety for patients. Europe has always experienced strict regulations in ensuring the safety and integrity of medical devices. Furthermore, Europe offers the full potential of advancement towards research and investment for early disease detection through point-of-care diagnostics and collection technology.

In What Manner Does the Capillary Blood Collection Devices Supply Chain Propel Global Market Efficiencies?

The capillary blood collection device value chain features harmonization across many stages, from raw material acquisition to product distribution. Leaders in the supply chain work closely on innovation in health and procedural aspects, manufacturing, sterilization standards, and global shipping and logistics, while ensuring trust and accuracy at every level in the process.

- Raw Material Procurement: High-quality plastics, micro-needles, and anticoagulant-coated tubes are at the heart of the device's approach to accomplishing goal accuracy and biocompatibility for testing equipment.

- Manufacturing & Quality Control: Some devices feature automatic assembly lines in ISO-certified facilities to ensure reliable replication; however, real-time inspections add value to product safety and certifiability in any applicable circumstance.

- Distribution & Access to End Users: Strategic partners provide access to health services among primary care physicians or in the home testing markets where UNSURVEYED diseases exist; hospitals in the example of capillary blood collection devices and for sure in 'diagnostic labs,' and health sites services as between pathogens and human health diseases, the online access and to readily obtain viral and vector diseases.

Capillary Blood Collection Devices Companies

- Becton, Dickinson and Company (BD)

- Greiner Bio-One International GmbH

- SARSTEDT AG & Co. KG

- Terumo Medical Corp.

- B. Braun Melsungen AG

- Improve Medical

- Abbott Laboratories

- Cardinal Health

- Retractable Technologies Inc

- Haemonetics Corporation

Latest Announcements by Market Leaders

- In April 2024, Drawbridge Health, a medical technology company focused on reinventing the blood collection experience, announced that its in-house blood collection device, NanoDrop, has received U.S. Food and Drug Administration (FDA) 510(k) clearance for over-the-counter use. The clearance of the new dual nano blood collection needle technology expands a growing product line that includes the OneDraw collection system, which is FDA-compliant as a Class II medical device for blood collection to measure glycated hemoglobin for long-term blood glucose monitoring.

Recent Developments

- In December 2024, Becton, Dickinson and Company (BD) declared an expansion on the use of fingertip blood collection and testing technologies to be used by U.S. health systems and other large provider networks in places like urgent cares, doctor offices, and other ambulatory care settings.

- In July 2024, InnoVero, a global leader in innovation focused on gathering technology for international organizations to prevent doping in athletes, and Tasso, Inc., a leader in patient-focused clinical-grade phlebotomy, announced an expanded partnership.

- In June 2024, Haemonetics Corporation, a global healthcare company focused on delivering innovative solutions to drive better patient outcomes, announced the limited commercial release of its new VASCADE MVPÂ XL center-bore venous closure device. The VASCADE MVP XL System expands Haemonetics' VASCADE Vascular Closure Systems portfolio, featuring innovative collapsible disk technology and a proprietary collagen absorbable patch designed to promote rapid hemostasis.

Segments Covered in the Report

By Product

- Lancets

- Micro-container Tubes

- Micro-hematocrit Tubes

- Warming Devices

- Others

By Material

- Plastic

- Glass

- Stainless Steel

- Ceramic

- Others

By End-use

- Hospitals and Clinics

- Blood Donation Centers

- Diagnostic Centers

- Home Diagnosis

- Pathology Laboratories

By Application

- Whole Blood

- Plasma/ Serum Protein Tests

- Comprehensive Metabolic Panel (CMP) Tests

- Liver Panel / Liver Profile/ Liver Function Tests

- Dried Blood Spot Tests

By Geography

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting