What is the Capillary Electrophoresis Market Size?

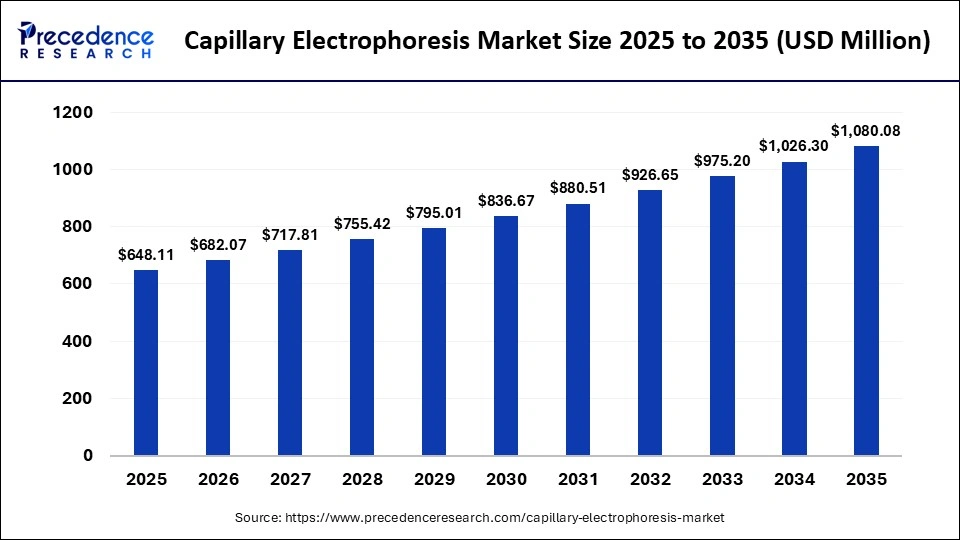

The global capillary electrophoresis market size accounted for USD 648.11 million in 2025 and is predicted to increase from USD 682.07 million in 2026 to approximately USD 1,080.08 million by 2035, expanding at a CAGR of 5.24% from 2026 to 2035. The market growth is attributed to increasing demand for high-resolution, rapid, and reproducible analytical techniques in pharmaceutical, biotechnology, and clinical research applications.

Market Highlights

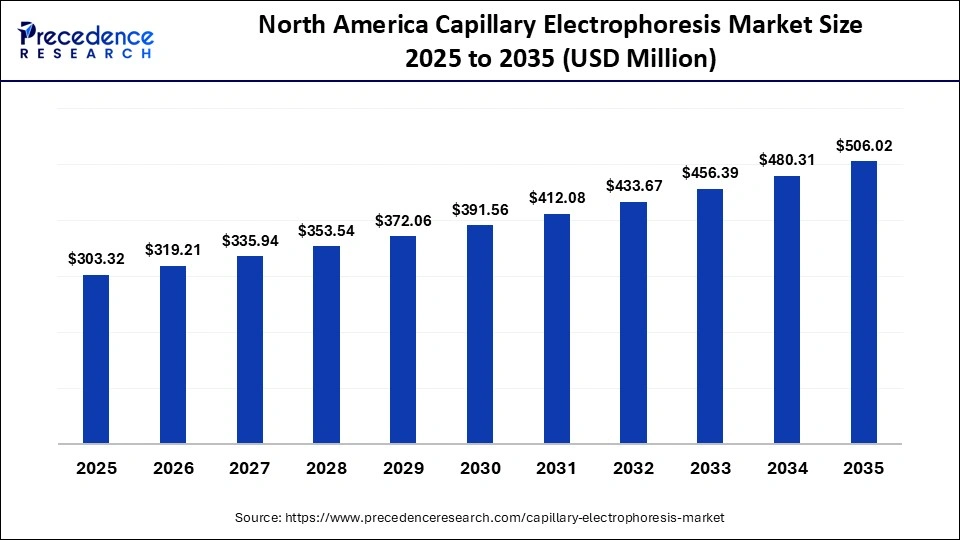

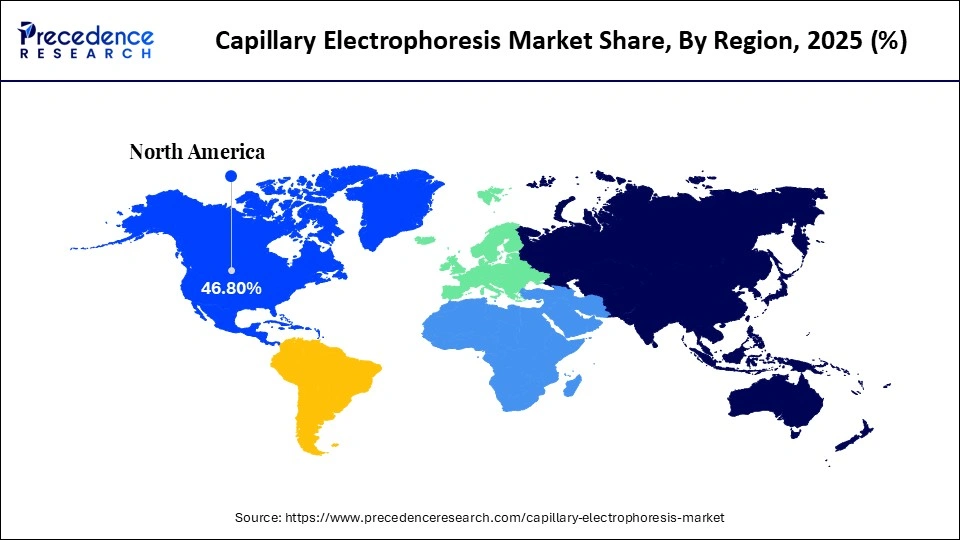

- North America dominated the market with the highest market share of 46.8% in 2025.

- The Asia Pacific is expected to grow at a notable CAGR 7% between 2026 and 2035.

- By product type, the capillary electrophoresis systems segment contributed the biggest market share of 58.8% in 2025.

- By product type, the reagents & consumables segment growing at a solid CAGR of 6.2% between 2026 and 2035.

- By technique, the capillary zone electrophoresis (CZE) segment captured the highest market share of 42.5% in 2025.

- By technique, the capillary isoelectric focusing (CIEF) segment is set to grow at a 6.1% CAGR between 2026 and 2035.

- By end-user, the pharmaceutical & biotechnology companies segment registered dominance by capturing 35.5% of the market share in 2025.

- By end-user, the clinical laboratories segment is poised to grow at a 5.9% of CAGR from 2025 to 2034.

- By application, the drug development and QC segment held a dominant market share of 38.9% in 2025.

- By application, the clinical diagnostics segment is growing at a CAGR of 5.8% between 2026 and 2035.

Market Overview

The capillary electrophoresis market is experiencing strong growth due to the rising demand for high-resolution separation and analysis in drug development and quality control. CE is an electrokinetic separation technique that separates charged analytes through fused-silica capillaries under an electric field. This method separates analytes based on their charge-to-size ratio, requires very small sample volumes, reduces waste, and produces reproducible, sharp peaks.

CE is gaining popularity as pharmaceutical and biotechnology companies work to characterize complex biologics, detect impurities, analyze glycosylation, and identify charge variants. These activities are crucial for regulatory compliance and safety. Advancements in coupling CE with mass spectrometry (CE-MS) have expanded the range of analysis. CE is also being used more widely in clinical labs and research centers for purposes beyond drug development. Furthermore, the increasing demand for biologics and advanced diagnostics worldwide, along with CE's flexibility, is likely to drive further growth and adoption of the CE market.

Impact of Artificial Intelligence on the Capillary Electrophoresis Market

Artificial intelligence (AI) is transforming the capillary electrophoresis market by boosting innovation, increasing analysis efficiency, and enhancing the value of CE systems in pharmaceutical and industrial laboratories. Labs use AI-driven data analysis engines to examine electropherograms more accurately. Developers embed AI into devices to improve method development, predict separation outcomes, and automate complex parameter adjustments. Furthermore, with the growing adoption of AI, more high-value applications are emerging in the development of therapeutics, diagnostics, environmental testing, and food safety analysis.

Capillary Electrophoresis MarketGrowth Factors

- Rising Biopharmaceutical R&D Activities: Growing development of biologics and biosimilars is driving demand for high-resolution CE techniques.

- Expanding Clinical Diagnostic Applications: Increasing adoption of CE for protein profiling, genetic testing, and biomarker analysis is boosting market growth.

- Growing Adoption of Automated CE Systems: Automation in sample handling and analysis is propelling efficiency and throughput in laboratories.

- Advancements in CE–MS Integration: Improved coupling of capillary electrophoresis with mass spectrometry is fuelling enhanced molecular characterization capabilities.

- Increasing Regulatory Compliance Requirements: Stricter guidelines for drug quality control and biopharmaceutical characterization are driving CE adoption.

Capillary Electrophoresis Market Outlook

- Market Growth Overview: The capillary electrophoresis market is experiencing growth due to its high-resolution capabilities, ability to analyze complex molecular structures, and widespread use in pharmaceuticals, biotechnology, and diagnostics. Increased demand for personalized medicine, advancements in proteomics, and growing investments in laboratory automation are also driving the market.

- Global Expansion: The market is expanding globally as demand rises for accurate, fast, and cost-effective analytical techniques, with significant growth opportunities in emerging regions like Asia-Pacific and Latin America, driven by improving healthcare infrastructure and increasing biotechnology research. These regions offer untapped markets where the adoption of CE technologies in clinical diagnostics and drug development is expected to grow substantially.

- Major Investors: Key investors in the market include major biotechnology firms like Thermo Fisher Scientific and Agilent Technologies, along with academic research institutions and government agencies. These players contribute by advancing CE technologies, improving product innovation, and providing extensive support for the integration of CE into both clinical and research environments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 648.11 Million |

| Market Size in 2026 | USD 682.07 Million |

| Market Size by 2035 | USD 1,080.08 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Technique, End-User, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Capillary Electrophoresis Market Segment Insights

Product Type Insights

The capillary electrophoresis systems segment dominated the capillary electrophoresis market, accounting for an estimated 58.8% share in 2025, as they provide high-resolution separation, fast analysis, and accurate quantification of biomolecules. These systems are part of the analysis methods used in the pharmaceutical, biotechnology, and clinical diagnostics industries. Improved capabilities, including automated sample data handling and integration with mass spectrometry, are increasing their demand in various applications.

The reagents & consumables segment is expected to grow at the fastest CAGR of 6.2% in the upcoming period. This is mainly due to the expansion of biologics, monoclonal antibodies, and genetic testing assays. Additionally, the growth of contract research organizations (CROs) and small-scale biotech companies, which rely heavily on consumables rather than expensive instrumentation, further fuels this demand.

Technique Insights

The capillary zone electrophoresis (CZE) segment dominated the capillary electrophoresis market while holding about 42.5% share in 2025. This is mainly due to its ability to analyze proteins, peptides, and small molecules. CZE has extensive biopharmaceutical quality control applications and enables the rapid and accurate assessment of purity and post-translational modifications. Additionally, regulatory compliance, method flexibility, and technical reliability have all contributed to the increasing demand for these techniques.

The capillary isoelectric focusing (CIEF) segment is expected to grow at a 6.1% CAGR over the forecast period. CIEF uses the isoelectric point of proteins to separate them, and it is vital in the charge heterogeneity profiling of monoclonal antibodies and recombinant proteins. Additionally, the popularity of CIEF in biopharmaceutical R&D and QC labs is being driven by regulatory requirements for detailed protein characterization, batch comparability studies, and stability testing.

End-User Insights

The pharmaceutical and biotechnology companies segment dominated the capillary electrophoresis market, holding an estimated 35.5% share in 2025, as these companies rely heavily on capillary electrophoresis for quality control, lot-release testing, and characterization of biologics, monoclonal antibodies, and recombinant proteins. Separation of impurities, charge variants, and post-translational modifications at high resolution is essential for regulatory compliance and batch consistency. Automated CE systems are increasingly adopted by these companies to streamline workflow and boost throughput in high-volume R&D and production environments. Additionally, the current focus on biosimilars and new therapeutics is likely to sustain the widespread adoption of CE in these settings.

The clinical laboratories segment is expected to grow at a 5.9% CAGR over the projection period due to the expansion of outpatient diagnostic services, the rise of specialty laboratories, and the adoption of automated, user-friendly CE systems. The increasing demand for protein profiling, hemoglobin variant analysis, and DNA fragment separation in diagnostics is driving the adoption of CE, with the need for accurate, fast, and repeatable results making clinical labs a key driver of growth in the market.

Application Insights

The drug development & QC segment led the capillary electrophoresis market with a 38.9% share in 2025 due to the growing need for high-precision analytical techniques in pharmaceutical development and quality control processes. CE provides high-resolution analysis of impurities, degradation products, and charge variants, which are crucial for regulatory compliance or ensuring therapeutic safety. Additionally, the ongoing growth of biosimilars, gene therapies, and complex biologics continues to drive high CE usage in drug development and QC processes.

The clinical diagnostics segment is expected to grow at a 5.8% CAGR in the coming years due to the increasing demand for precise, fast, and reliable diagnostic techniques for various diseases and conditions. CE is more commonly used in hemoglobin variant analysis, serum protein profiling, and identifying genetic markers, which help diagnose diseases early and classify patients. Research shows that CE-based tests are more sensitive and specific for hemoglobinopathies and other protein-related diseases compared to traditional methods. Additionally, the use of validated and standardized analysis techniques in regulatory settings also helps promote the global adoption of CE in clinical diagnostics.

Capillary Electrophoresis MarketRegional Insights

The North America capillary electrophoresis market size is estimated at USD 303.32 million in 2025 and is projected to reach approximately USD 506.02 million by 2035, with a 5.25% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Capillary Electrophoresis Market?

North America dominated the capillary electrophoresis market, capturing the largest revenue share of 46.8% in 2025. This is mainly due to the presence of large pharmaceutical and biotechnology centers, developed research facilities, and the early implementation of high-resolution analytical technologies. There is high adoption of multi-capillary CE automated systems, which accelerate analysis, enhance reproducibility, and improve the throughput of quality control and R&D processes. The partnership with instrument suppliers, including Thermo Fisher Scientific, Agilent Technologies, SCIEX, and Shimadzu, enabled the standardization of methods across multiple labs. Additionally, the funds for translational studies at hub facilities like Mayo Clinic and Johns Hopkins University further strengthened the region's leadership.

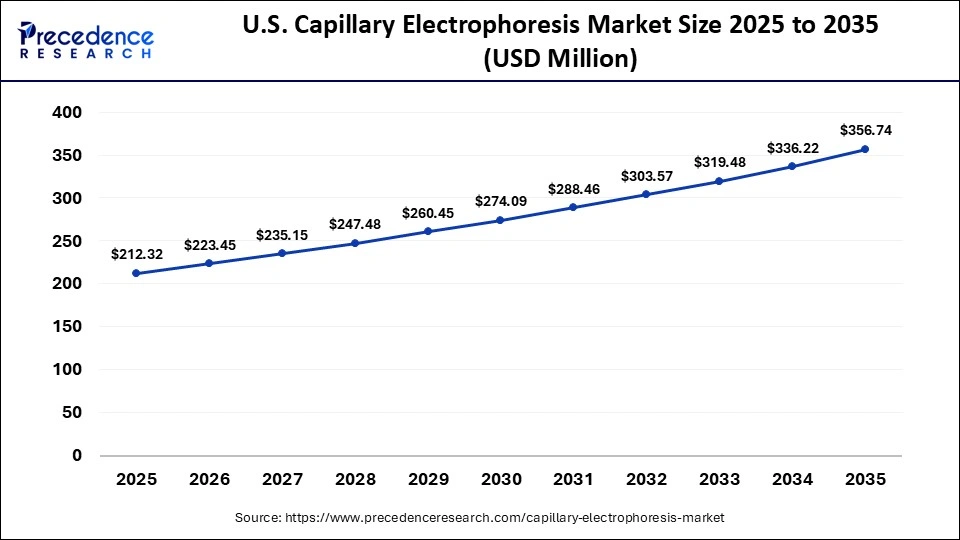

The U.S. capillary electrophoresis market size is calculated at USD 212.32 million in 2025 and is expected to reach nearly USD 356.74 million in 2035, accelerating at a strong CAGR of 5.33% between 2026 and 2035.

U.S. Capillary Electrophoresis Market Analysis

The U.S. leads the North American market due to the high concentration of pharmaceutical companies, biopharma research facilities, and clinical reference laboratories. Between 2023 and 2024, multi-capillary CE became widely adopted in labs for optimizing lot-release testing and biologic characterization. Additionally, the demand from contract research organizations (CROs) and biotech startups has driven the installation of CE instruments and frequent consumable purchases, further boosting market growth.

Asia Pacific is expected to grow at the fastest CAGR of 7% during the forecast period. Pharmaceutical R&D investments in China and India increased to support the adoption of CE in biologics characterization and genetic testing. Co-training efforts between international suppliers and regional CROs, in collaboration with Charles River Laboratories and IQVIA, have enhanced the application of capillary electrophoresis (CE) methods in clinical and research laboratories. Additionally, the growing demand for CE instruments and consumables is expected to continue rising, fueled by the emergence of point-of-care diagnostics and the expanding biosimilar pipeline in the region.

China Capillary Electrophoresis Market Analysis

China leads the market due to rapid growth in biotech research, rising demand for biologics, and increasing academic interest in the field. Chinese scientists are pushing the boundaries of CE by integrating and miniaturizing CE-MS, microfluidic CE, and exploring new sample types, thereby broadening CE's applications beyond traditional small-molecule and protein assays. Additionally, the growing demand for biologics, biosimilars, and advanced diagnostics is driving the adoption of CE in quality control, research, and clinical applications across the country.

Europe is expected to grow at a notable rate in the coming years due to a regulatory focus on biopharmaceutical quality, the increased popularity of CROs, and investment in automated instrumentation. Germany, the UK, and Switzerland experienced a 12% growth in CE installations in pharmaceutical R&D and clinical laboratories from 2023 to 2024, according to the European Pharmaceutical Review in 2024. Additionally, the adoption of CE solutions was further strengthened by new applications in biomarker profiling, hemoglobinopathy detection, and providing high-quality therapeutic control.

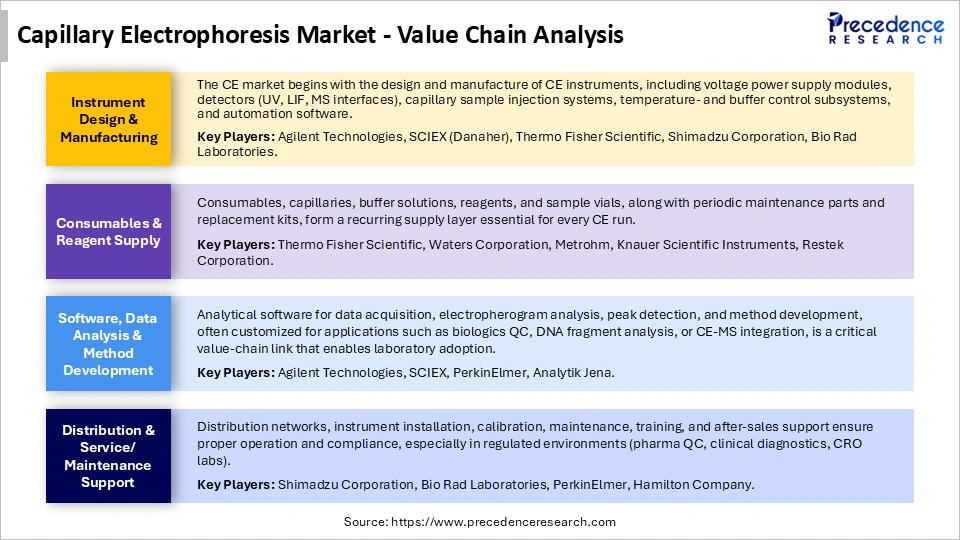

Capillary Electrophoresis Market Value Chain

Top Companies in the Capillary Electrophoresis Market & Their Offerings

- Agilent Technologies (U.S.): Agilent is a leading provider of high-performance analytical instruments, including capillary electrophoresis systems, consumables, and software solutions for life sciences, pharmaceuticals, and biotechnology applications.

- SCIEX (U.S.): SCIEX specializes in CE-MS and CE-UV systems, offering advanced separation and detection technologies for proteomics, metabolomics, and biopharmaceutical analysis.

- Thermo Fisher Scientific (U.S.): Thermo Fisher provides a comprehensive portfolio of CE instruments, reagents, and lab automation solutions for analytical and clinical laboratories worldwide.

- PerkinElmer (U.S.): PerkinElmer delivers capillary electrophoresis platforms and integrated analytical solutions, emphasizing biopharma QC, diagnostics, and research applications.

- Shimadzu Corporation (Japan): Shimadzu offers a wide range of CE systems, focusing on high-precision separation, sensitive detection, and automation for life science and industrial labs.

- Bio-Rad Laboratories (U.S.): Bio-Rad provides CE instruments and accessories, specializing in protein and nucleic acid analysis for clinical, research, and biopharma laboratories.

- Metrohm (Switzerland): Metrohm delivers compact and modular CE systems, emphasizing reproducibility, ease of use, and integration with advanced detection methods.

- Knauer Scientific Instruments (Germany): Knauer manufactures CE instruments and microfluidic systems for precise separation and analytical workflows in research and quality control labs.

- Hitachi High-Tech (Japan): Hitachi High-Tech provides innovative CE systems with enhanced automation and detection capabilities for pharmaceutical, clinical, and research applications.

Recent Developments

- In March 2025, Thermo Fisher Scientific launched the IVDR-compliant SeqStudio Flex Dx Genetic Analyzer. The CE system supports both clinical laboratories and research applications, enabling Sanger sequencing and fragment analysis. It is designed to improve efficiency and provide flexible run schedules. The platform ensures compliance with regulatory mandates while enhancing laboratory workflow.(Source: https://www.technologynetworks.com)

- In January 2024, Agilent Technologies introduced the automated ProteoAnalyzer CE system for protein analysis. The system offers rapid, high-resolution separation of complex protein mixtures, meeting the needs of pharma, biotech, food analysis, and academic research. Growing interest in monoclonal antibodies and protein therapeutics is driving their adoption. The platform simplifies analytical workflows and increases throughput for protein characterization.(Source: https://www.investor.agilent.com)

- In July 2024, Sysmex and Hitachi High-Tech announced a collaboration to develop CE-based genetic testing systems. They aim to create efficient, low-cost platforms for broader clinical use. The partnership focuses on optimized genetic testing for individual diseases. This initiative follows joint research and a feasibility study conducted since 2023.(Source: https://www.hitachi.com)

Capillary Electrophoresis MarketSegments Covered in the Report

By Product Type

- Capillary Electrophoresis Systems

- Accessories

- Reagents & Consumables

By Technique

- Capillary Zone Electrophoresis

- Capillary Gel Electrophoresis

- Capillary Isoelectric Focusing

- Micellar Electrokinetic Chromatography

By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Academic & Research Institutes

- Clinical Laboratories

- Food & Beverage Testing Labs

By Application

- Drug Development & QC

- Genomics & Proteomics

- Clinical Diagnostics

- Food & Environmental Analysis

- Forensic Testing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting