What is the Electrophoresis Market Size?

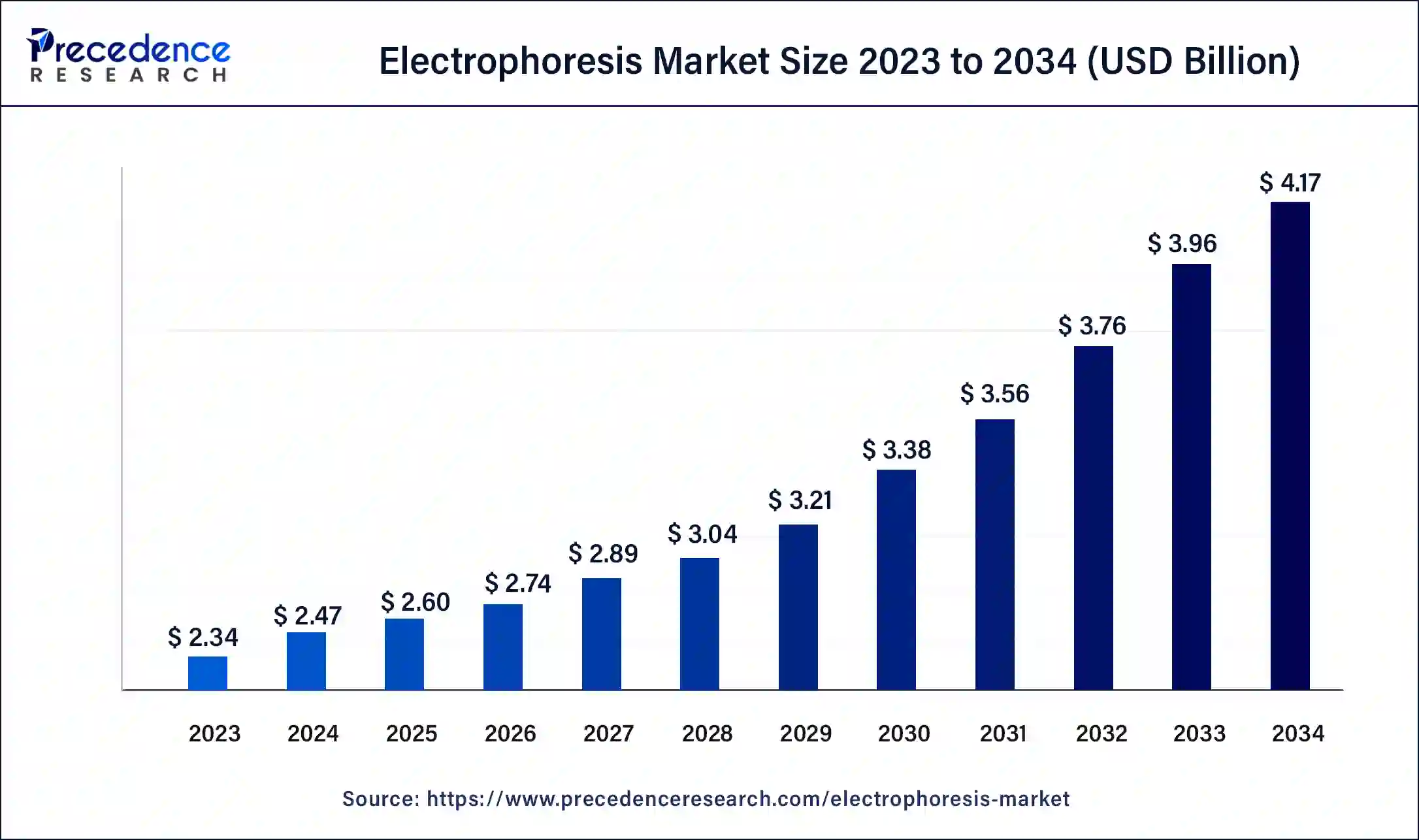

The global electrophoresis market size accounted at USD 2.60 billion in 2025 and is expected to be worth around USD 4.37 billion by 2035, at a CAGR of 5.33% from 2026 to 2035.

Electrophoresis Market Key Takeaways

- The global electrophoresis market was valued at USD 2.47 billion in 2025.

- It is projected to reach USD 4.17 billion by 2035.

- The electrophoresis market is expected to grow at a CAGR of 5.38% from 2026 to 2035.

- Asia Pacific is expected to witness the fastest rate of growth in the electrophoresis market during the forecast period.

- By product, the electrophoresis reagents segment held the largest segment of the electrophoresis market in 2025, the segment is expected to sustain the position throughout the forecast period.

- By product, the gel documentation systems and software segment is expected to grow at a significant rate during the forecast period.

- By end user, the pharmaceutical and biotechnology companies segment is expected to hold the dominating share of the market during the forecast period.

- By end user, the academic institutions segment is expected to grow at a notable rate.

- By application, the research segment is expected to hold the dominating share of the market during the forecast period.

- By application, the quality control and process validation segment is expected to grow at a notable rate.

What is Electrophoresis?

Electrophoresis is a sophisticated lab method used to sort and examine large molecules like DNA, RNA, and proteins by size and charge. It operates by guiding charged particles through a gel matrix under the influence of an electric field, where the gel acts like a sieve, allowing smaller molecules to move more swiftly than larger ones. This process results in distinctive patterns or bands. In practical terms, electrophoresis is pivotal in DNA-related tasks like profiling and genetic fingerprinting.

How is AI contributing to the Electrophoresis Industry?

AI changes the electrophoresis method by automating the interpretation of the gel image and quantification. U-Net neural networks can identify DNA and protein bands in a few seconds of operation and minimize human error. GelGenie tools, including segment band and background, are used to make measurements more accurate. AI is an improvement of serum protein electrophoresis because it detects peaks and abnormalities with high confidence.

Electrophoresis Market Data and Statistics

- On August 1, 2023, Penn Medicine, a healthcare organization in the United States, revealed that it secured a $26 million grant from the National Institutes of Health (NIH), a U.S. government agency, to advance treatments for rare, incurable genetic diseases.

- According to the World Health Organization (WHO), on July 12, 2023, more than 685,000 deaths worldwide were attributed to breast cancer in 2020.

- On August 7, 2023, Pacific Biosciences of California, Inc., a U.S.-based biotechnology company, and GeneDx, a U.S.-based genetic testing company, jointly announced their collaboration with the University of Washington. The partnership aims to explore the capabilities of HiFi long-read whole genome sequencing (WGS) in enhancing diagnostic rates for pediatric patients with genetic conditions.

- As of November 2021, a study published on NCBI suggested that employing conventional PCR in combination with gel-electrophoresis for testing analysis could be a viable approach to enable widespread availability of SARS-CoV-2 diagnostics globally.

Electrophoresis Market Growth Factors

- Continuous innovations and technological advancements in electrophoresis techniques contribute significantly to market growth. The development of more efficient and precise electrophoresis systems enhances the capabilities of researchers and drives adoption.

- Electrophoresis finds extensive applications in drug discovery, pharmaceutical research, and biotechnology. The expanding activities in these sectors contribute to the overall growth of the electrophoresis market.

- Support from government bodies and research organizations, including grants and funding for projects related to genetic research and disease diagnostics, positively impacts the electrophoresis market. Initiatives aimed at advancing healthcare and life sciences research drive market expansion.

- The uptick in genetic disorders has heightened the need for diagnostic tools, including electrophoresis. This method's role in genetic testing aligns with the broader trend of early and accurate detection of genetic conditions.

Market Outlook

- Industry Growth Overview: Reproducible, faster molecular diagnostics and research processes are being driven by automation.

- Sustainability Trends: The use of greener dyes buffers conforms to ESG requirements in the laboratory.

- Global Expansion: Europe has a developed demand based on well-established research centres in the pharmaceutical industry.

- Major investors: Thermo Fisher Scientific, Bio-Rad Laboratories, Merck KGaA, Agilent Technologies, Danaher Corporation, PerkinElmer, QIAGEN.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 5.33% |

| Market Size in 2025 | USD 2.60 Billion |

| Market Size in 2026 | USD 2.74 Billion |

| Market Size by 2035 | USD 4.37 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By End User, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing industry-academia research collaborations

The increasing collaboration between industry and academia in research efforts has become a significant catalyst for the surge in demand within the electrophoresis market. As academic and research institutes delve deeper into genomics, proteomics, and molecular biology, electrophoresis technology plays a pivotal role in facilitating groundbreaking discoveries. Collaborative initiatives, exemplified by partnerships between market players and educational institutions, contribute to heightened awareness and skill development among students and researchers. These synergies foster innovation and the adoption of advanced electrophoresis technologies.

- For instance, programs like the unique Ph.D. initiative introduced by SciGenom Labs in August 2022 not only support academic research but also create a pathway for translating discoveries into real-world applications.

As industry-academia collaborations continue to flourish, the demand for electrophoresis solutions is propelled by a shared commitment to advancing scientific understanding and addressing complex challenges in genomics, diagnostics, and drug development.

Restraint

Availability of alternatives and sample size limitations

The electrophoresis market faces challenges related to the availability of alternatives and sample size limitations, impacting its overall demand. The emergence of alternative technologies, such as next-generation sequencing (NGS) and advanced molecular biology methods, presents compelling options with faster and more comprehensive results compared to traditional electrophoresis. This has led to a shift in preferences, particularly in research settings where speed and efficiency are critical, potentially limiting the demand for electrophoresis in certain applications.

Moreover, sample size limitations pose a constraint on the versatility of electrophoresis. For studies requiring high-throughput analysis or dealing with a large volume of samples, other technologies that offer quicker processing times become more attractive. As a result, the electrophoresis market may experience reduced demand in scenarios where these limitations impact its competitiveness against alternative solutions. To maintain relevance, the electrophoresis market must address these challenges through innovation and adaptability to evolving scientific and technological landscapes.

Opportunity

Increasing demand for personalized medicines

- In October 2021, Israel saw 11 multidisciplinary projects, spanning research areas such as cancers, Crohn's disease, and rare conditions, secure NIS 32 million (USD 9.9 million) in grants. The funding was awarded by the Israel Precision Medicine Partnership, with the goal of expediting the discovery process.

The surging demand for personalized medicines is creating valuable prospects in the electrophoresis market. With a growing emphasis on tailoring treatments to individual genetic profiles, there's a rising need for precise diagnostic tools. Electrophoresis, by meticulously separating and analyzing DNA, RNA, and proteins, emerges as a crucial player in genetic testing. Its ability to provide detailed insights into one's genetic makeup perfectly aligns with the personalized medicine approach, where treatments are uniquely designed for each patient's specific characteristics.

- In October 2021, 4baseCare, a precision oncology firm based in India, joined forces with Cellworks Group, Inc., a prominent player in personalized medicine for oncology and immunology based in the United States.

Furthermore, electrophoresis significantly contributes to developing targeted therapies by aiding in the identification and characterization of biomolecules linked to specific health conditions. As pharmaceutical and biotech companies increasingly pivot towards personalized drug development, the integration of electrophoresis positions it as a cornerstone in advancing personalized medicine, ushering in promising opportunities for growth and innovation in the market.

Segment Insights

Product Insights

The electrophoresis reagents segment dominated the electrophoresis market in 2025; the segment is observed to continue the trend throughout the forecast period. In the electrophoresis market, the reagents segment encompasses essential substances facilitating the separation of biomolecules during electrophoresis procedures. These reagents include buffers, stains, gels, and molecular weight markers crucial for accurate analysis.

- According to the National Clinical Trial (NCT) Registry's July 2022 update, Elsan conducted a clinical study to evaluate serum inflammation profiles using protein electrophoresis in patients admitted to hospitals with SARS-CoV-2 virus infections.

The heightened research and development efforts aimed at formulating effective therapies were anticipated to drive up the demand for electrophoresis reagents amid the COVID-19 pandemic. Moreover, a notable trend in this segment involves the development of more efficient and environmentally friendly reagents, reducing the ecological impact. Additionally, there's a shift towards pre-packaged, ready-to-use reagent kits, streamlining laboratory processes and enhancing the reproducibility of results in electrophoresis applications.

The gel documentation systems and software segment is expected to grow at a significant rate throughout the forecast period. In the electrophoresis market, gel documentation systems and software form a critical segment. Gel Documentation Systems capture and analyze data from electrophoresis gels, allowing for the visualization and documentation of DNA, RNA, or protein samples.

The associated software aids in data analysis, quantification, and storage, enhancing efficiency. A notable trend in this segment involves the integration of advanced features such as real-time monitoring and cloud-based accessibility, providing researchers with more streamlined and collaborative tools for accurate data interpretation and documentation in electrophoresis applications.

End User Insights

The pharmaceutical and biotechnology companies segment is observed to hold the dominating share of the electrophoresis market during the forecast period. In the electrophoresis market, the pharmaceutical and biotechnology companies segment refers to end users employing electrophoresis techniques for drug development, genetic research, and biomolecule analysis. A notable trend in this segment involves an increased focus on personalized medicine, driving demand for electrophoresis in genetic testing and biomarker discovery. Additionally, the adoption of advanced electrophoresis technologies by pharmaceutical and biotech firms is rising, aiding in the precise characterization of molecules and contributing to targeted drug development efforts.

The academic institutions segment is expected to generate a notable revenue share in the market. In the electrophoresis market, the academic institutions segment comprises educational and research institutions leveraging electrophoresis techniques for molecular analysis. A notable trend within this segment involves an increasing emphasis on advancing genomic and proteomic research. Academic institutions utilize electrophoresis for diverse applications, including DNA profiling and protein analysis, fostering a dynamic landscape of innovation. The demand for efficient and precise electrophoresis technologies in academic settings is driven by the continuous pursuit of groundbreaking discoveries in the fields of molecular biology and genetics.

Application Insights

The research segment is observed to hold the dominating share of the electrophoresis market during the forecast period. Within the electrophoresis market, the research sector applies electrophoresis techniques to diverse scientific inquiries. This encompasses activities like DNA profiling, genomics, and proteomics research, wherein electrophoresis is crucial for separating and studying biomolecules. A noteworthy trend in this domain is the growing incorporation of electrophoresis into state-of-the-art research projects, propelled by technological advancements. Researchers are utilizing electrophoresis to delve into the structures of genes and proteins, actively shaping the field of molecular biology and fostering inventive breakthroughs in scientific exploration.

On the other hand, the quality control and process validation segment is expected to generate a notable revenue share in the market. In the field of electrophoresis, the quality control and process validation segment involves ensuring the accuracy and reliability of results. This application ensures that electrophoresis systems meet established standards, maintaining consistency in laboratory processes. The trend in this segment focuses on the integration of advanced technologies for real-time monitoring, enhancing the precision and efficiency of electrophoresis processes. As laboratories increasingly prioritize stringent quality control, the demand for innovative solutions in electrophoresis to validate and maintain process integrity is on the rise, reflecting a key trend in the market.

Regional Insights

Asia-Pacific is poised for rapid growth in the electrophoresis market due to several factors. Increasing investments in healthcare infrastructure, rising research and development activities, and a growing emphasis on personalized medicine contribute to the market's expansion. Additionally, the prevalence of genetic disorders and infectious diseases fuels the demand for advanced diagnostic technologies like electrophoresis. The region's burgeoning biotechnology and pharmaceutical sectors, coupled with supportive government initiatives and collaborations, further propel the adoption of electrophoresis technologies, positioning Asia-Pacific as a key player in the global market.

China Electrophoresis Market Trends

Biotechnology and genomics growth is driven by a strong infrastructure to invest in healthcare. Cost-effective automated instruments and special reagents are provided by domestic manufacturers. Traction and stability. Powdered buffer packs are used to increase stability and transport efficiency. Specialized kits are developed in the fields of agriculture, food safety, and infectious disease testing.

On the other hand, North America dominates the electrophoresis market due to several factors. The region boasts a robust healthcare infrastructure, advanced research facilities, and a high prevalence of genetic disorders, driving the demand for sophisticated electrophoresis technologies. Moreover, strategic initiatives by key market players, substantial investments in R&D, and favorable government support contribute to the market's dominance.

- The presence of advanced laboratories and a considerable healthcare expenditure, estimated at $3.8 trillion in 2020, further cements North America's leading position in the global electrophoresis market.

The presence of prominent pharmaceutical and biotechnology companies in North America further accelerates the adoption of electrophoresis techniques, solidifying the region's leading position in the global market.

U.S. Electrophoresis Market Trends

Automated capillary electrophoresis market impetus through biologics research and antibody characterization. The positive regulatory emphasis on proven reagent kits favors proven suppliers. Multi-capillary systems accelerate drug discovery with the help of AI. The pressure, such as tariffs, promotes stability by sourcing domestic manufacturers of laboratories.

Meanwhile, Europe is experiencing notable growth in the electrophoresis market due to several factors. The region benefits from a robust healthcare infrastructure and increasing investments in life sciences research. The rising prevalence of genetic disorders and cancer, coupled with a growing demand for personalized medicine, drives the adoption of electrophoresis technologies. Additionally, collaborations between academic institutions and key market players contribute to advancements. The European market's expansion is further propelled by supportive government initiatives, creating a conducive environment for innovation and market development in the electrophoresis sector.

UK

The pharmaceutical and biotechnological industries, as well as the institutes in the UK, are well developed. At the same time, the research and development conducted is increasing, which in turn increases the demand for electrophoresis system and their reagents. Moreover, these researches are supported by the government funding promoting their use and adoption.

Germany

The growing diseases in Germany are increasing the use of electrophoresis for the development of new diagnostic approaches. It is also being used in proteomic or genetic analysis. Thus, the development of various tools with the help of electrophoresis is also supported by the growing investments in the healthcare sector.

The Middle East and Africa are expected to grow significantly in the electrophoresis market during the forecast period. The growing diseases in the Middle East and Africa are increasing the demand for electrophoresis-based diagnostic approaches. This, in turn, is increasing the research and development within the industries, leading to new collaborations among them. Moreover, it is also used in the development of advanced therapies as it helps in accelerating gene sequencing. Furthermore, the government, as well as the private sector, are encouraging these developments by investing in them. Thus, all these advancements are promoting the market growth in the Middle East and Africa.

Electrophoresis Market Companies

- Thermo Fisher Scientific Inc.: Offers Invitrogen ready-to-use separation systems and highly sensitive capillary electrophoresis platforms to support the DNA sequencing, proteomics, and biomolecular research workflows.

- Agilent Technologies, Inc.: Offers Bioanalyzer and TapeStation microfluidic systems that operate parallel capillary electrophoresis, which allows high precision characterization of biomolecules with high velocity.

- Bio-Rad Laboratories, Inc.: Provides Mini-PROTEAN vertical and horizontal gel systems, high-quality reagents, and imaging platforms that enable high-quality protein and nucleic acid separation.

Other Major Key Players

- QIAGEN N.V.

- Merck KGaA

- GE Healthcare

- PerkinElmer, Inc.

- Lonza Group Ltd.

- Harvard Bioscience, Inc.

- Danaher Corporation

- Promega Corporation

- SCIEX

- miniPCR bio

- Cleaver Scientific Ltd.

- Sebia Group

Recent Developments

- In March 2025, Thermo Fisher Scientific's Applied Biosystems™ SeqStudio™ Flex Dx Genetic Analyzer is an IVDR-compliant capillary electrophoresis system designed for clinical laboratories. It provides regulatory compliance, efficiency, user-friendliness, and flexibility for Sanger sequencing and fragment analysis in targeted genomic testing. (Source: https://www.technologynetworks.com )

- In July 2025, the acquisition of SERVA Electrophoresis, which is a privately held company well known for its high-quality electrophoresis workflow instrumentation, reagents, and consumables, by LICORbio, which is a leading innovator in life science imaging and analytical solutions, was announced. This acquisition will enhance the commitment of LICORbio for promoting innovation in life sciences research and will solidify its position as a comprehensive solutions supplier in protein analysis. (Source: https://themalaysianreserve.com/)

- On May 18, 2023, SCIEX introduced the BioPhase 8800 system, a multi-capillary electrophoresis platform. Tailored for biopharmaceutical scientists, this system facilitates parallel processing of multiple samples, expediting the development and implementation of sensitive, high-throughput analytical methods. The innovation addresses the demand for efficiency in biopharmaceutical research and analysis.

- In September 2022,miniPCR bio launched the Bandit STEM Electrophoresis Kit, an educational electrophoresis system tailored for students. This initiative by miniPCR bio aims to enhance science education by providing accessible tools for hands-on learning in classrooms and laboratories.

Segments Covered in the Report

By Product

- Electrophoresis Systems

- Gel Documentation Systems and Software

- Electrophoresis Reagents

By End User

- Academic Institutions

- Hospitals and Diagnostic Centers

- Pharmaceutical and Biotechnology Companies

- Research Organizations

By Application

- Diagnostic

- Research

- Quality Control and Process Validation

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting