What is Microfluidics Market Size?

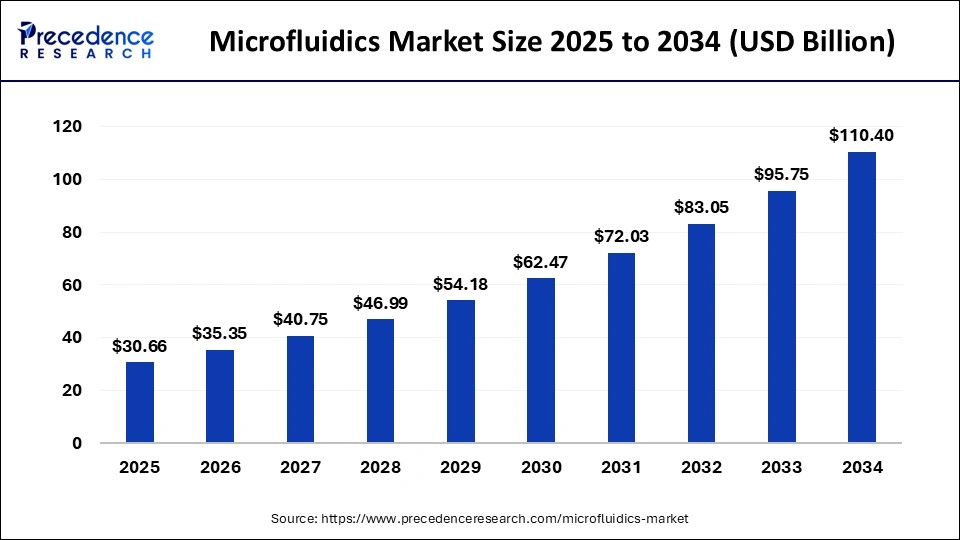

The global microfluidics market size is estimated at USD 30.66 billion in 2025 and is predicted to increase from USD 35.35 billion in 2026 to approximately USD 110.40 billion by 2034, expanding at a CAGR of 15.30% from 2025 to 2034.

Market Highlights

- North America led the global market with the highest market share of 43% in 2024.

- By Material, the polydimethylsiloxane (PDMS) segment is estimated to hold the highest market share of 34.5% in 2024.

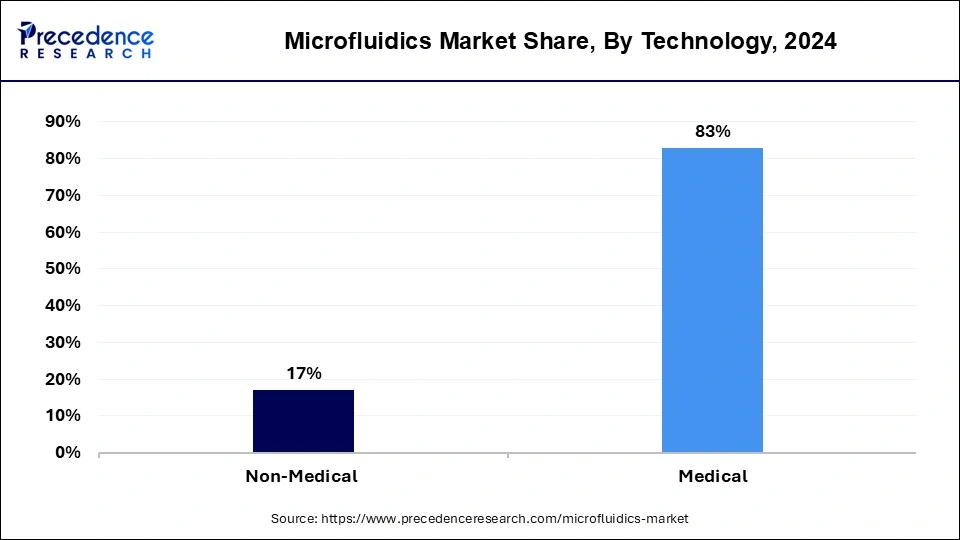

- By Technology, the medical technology segment has held the biggest revenue share of 83% in 2024.

- By Application, the lab-on-a-chip segment had the largest market share of 38% in 2024.

The Science of Small: Big Breakthroughs Flowing Through Tiny Channels

The microfluid market centres on technologies that manipulate minute volumes of fluids typically nanotilers to picoliters within engineered microchannels. These platforms power lab-on-a-chip systems, point-of-care diagnostics, single-cell analysis, drug delivery, organ-on-chip models, chemical synthesis, and advanced life-science research. Their appeal lies in precision, speed, and cost-efficiency, reduced regent consumption, miniaturization, and compatibility with automation. As the healthcare, biotech, and industrial sectors push for faster, portable, and more accurate analytical solutions, microfluidics enables the next generation of diagnostics, therapeutics, and high-throughput research.

Microfluidics Market Growth Factors

Increase in demand for point-of-care (POC) devices anticipated to prominently boost the market size in the upcoming years. Significant demand for low-volume sample analysis, demand for In Vitro Diagnostics (IVD), high-throughput screening methodologies, and development of advanced lab-on-a-chip technologies are further expected to propel the market growth of microfluidics over the analysis timeframe. Microfluidics provides a high return on investment along with it also helps in controlling cost by minimizing errors.

Other key factors propelling the market growth for microfluidics include increasing for microfluidics technology & devices in point-of-care diagnostics, rising technological advancements in diagnostic devices, and rising incidence of chronic diseases across the globe. Hence, the above mentioned factors augment the demand for molecular diagnosis and subsequently impact positively towards the market growth of the microfluidics.

Market Outlook

- Industry Outlook: cartridge systems, while biopharma companies rely on microfluidics for cell sorting, single-cell omics, and high-throughput screening. Meanwhile, specialty OEMs supply chips, pumps, sensors, and fabrication services. Outsourcing to microfabrication foundries, polymer-molding specialists, and contract engineering houses is rising. The industry is defined by rapid prototyping, IP intensity, and a push toward scalable manufacturing using polymers rather than silicon or glass. Integration with cloud analytics and automation ecosystems strengthens competitive differentiation.

- Sustainability Trend: Sustainability influences both design and manufacturing. Microfluidics inherently reduces reagent use, waste, and sample volume—aligning with green laboratory principles. Manufacturers increasingly adopt recyclable polymers, solvent-reduced fabrication processes, and energy-efficient molding technologies. Cartridges are shifting from single-use complex plastics to simplified or biodegradable materials. In diagnostics, sustainable microfluidics enables decentralised testing, reducing transport emissions and central-lab waste. Supply chains are also being optimized for minimal material throughput and sustainable sourcing of specialty plastics and substrates.

- Major Investment: Investment flows into cartridge-based diagnostic platforms, organ-on-chip systems for drug discovery, and scalable manufacturing technologies such as injection molding, roll-to-roll fabrication, and hybrid polymer-glass systems. Venture capital supports next-gen point-of-care devices, cell therapy manufacturing microreactors, and programmable droplet systems. Large corporations acquire microfluidic IP, system integrators, and specialty chip makers to strengthen vertical integration. Research institutions attract public funding for biomedical microfluidics, translational platforms, and emerging environmental monitoring devices.

- Startups: Startups dominate innovation in programmable droplet microfluidics, digital microfluidics, wearable biosensing, microreactors for rapid chemistry, and ultra-miniaturized diagnostic cartridges. Others focus on organ-on-chip disease models, high-speed single-cell sorting, and integrated detection tools for food safety and environmental monitoring. A growing wave of companies offers microfluidics-as-a-service for prototyping, chip design, material selection, and small-batch manufacturing. Many collaborate with pharma and diagnostics giants through co-development and licensing agreements.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 30.66 Billion |

| Market Size in 2026 | USD 35.35 Billion |

| Market Size by 2034 | USD 110.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 15.30% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Material Insights

The polydimethylsiloxane (PDMS)-based microfluidic chips segment dominated the global microfluidics market in terms of revenue at 34.5% in the year 2024 and is anticipated to register the fastest growth rate over the analysis period. PDMS is a prominently used polymer in fast prototyping microfluidic devices. These are highly used by the academic community owing to their ease of fabrication along with their low cost. On the other hand, these polymers are hydrophobic which makes microchannels hard to operate in aqueous solutions. To combat this issue, new PDMS surface modifications are offered to address challenges due to hydrophobicity.

Besides this, polymer-based microfluidic devices proved as a better alternative to the glass and silicon-based microfluidic devices. Polymer-based materials are more affordable, robust, easy to access, and require rapid fabrication techniques as compared to silicon and glass materials. Polymers are one of the most important materials used in microfluidic chips for mass production by applying soft lithography, casting, injection molding, and hot embossing techniques.

Technology Insights

On the basis of revenue,the medical technology segment led the global microfluidics market with an 83% revenue share in the year 2024. This is mainly attributed to the three major benefits offered by the microfluidics for the POC diagnostics that include smaller sample volumes, faster turnaround times, and lesser test costs. These benefits are moderately being utilized for the development of POC devices for detection and diagnosis of a wide range of conditions from cancer to infectious diseases.

For example, the Laboratory of Integrated Bio-Medical/Nanotechnology & Applications (LIBNA) fabricated a microfluidic point-of-care sepsis chip that calculates CD64 expression on neutrophils as well as the overall WBC count in around 30 minutes, by just using 10 microliters of a blood sample.

Application Insights

The lab-on-a-chip application accounted revenue share of 38% in the global microfluidics market in the year 2024 and estimated to continue its position throughout the analysis period. In the field of molecular biology, lab-on-a-chip provides high detection speed despite of maintaining the same sensitivity level during RNA or DNA amplification along with their detection procedures. This application also permits the rapid sequencing of DNA.

Elveflow provides the fastest qPCR system named as Fast gene system that detects viruses and bacteria within 7 minutes. Furthermore, nanopore technology holds an excessive potential to facilitate the rapid genome sequencing of DNA than the lab-on-a-chip by implementing an array technique.

Market Value Chain Analysis

- Raw Material Sourcing: Raw materials include specialty polymers COC, COP, PMMA, elastomers (PDMS), glass and silicon wafers, adhesives, coatings, and microfabrication chemicals. Suppliers must meet strict purity, biocompatibility, and thermal stability requirements. Polymer sourcing increasingly favors medical-grade, low-leachate materials with traceability. Manufacturers diversify across suppliers to mitigate shortages in specialized plastics.

- Technological Advancements: Key advancements include droplet microfluidics, digital microfluidics, paper-based microdevices, hybrid polymer-glass chips, AI-assisted flow control, and integrated optical/electronic sensing. Emerging trends include lab-on-skin wearables, organ-on-chip platforms mimicking physiological functions, high-density single-cell analysis arrays, and microfluidic bioreactors for cell and gene therapy manufacturing.

Key players: PerkinElmer

Microfluidics Market Companies

- Agilent Technologies, Inc.

- Illumina, Inc.

- Perkinelmer, Inc.

- Life Technologies Corporation

- Danaher

- Bio-Rad Laboratories, Inc.

- Hoffmann-La Roche Ltd

- Abbott Laboratories

- Fluidigm Corporation

- Qiagen N.V.

- Thermo Fischer Scientific

- Biomérieux

- Cellix Ltd.

- Elveflow

- Micronit Micro Technologies B.V.

Segments Covered in the Report

By Material

- Glass

- Silicon

- PDMS

- Polymers

- Others

By Technology

- Non-Medical

- Medical

- Gel Electrophoresis

- PCR & RT-PCR

- ELISA

- Microarrays

- Others

By Application

- Organs-on-chips

- Lab-on-a-chip

- Continuous Flow Microfluidics

- Acoustofluidics and Microfluidics

- Optofluidics and Microfluidics

- Electrophoresis and Microfluidics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content