What is In Vitro Diagnostics Market Size?

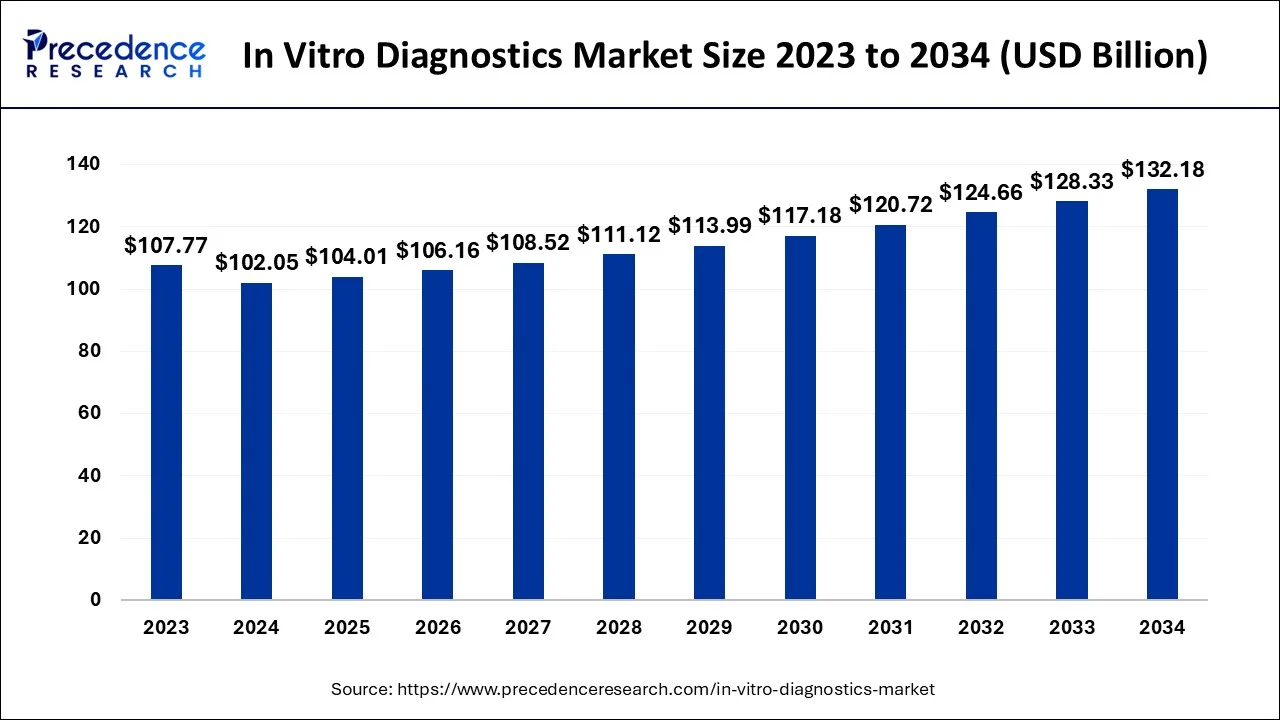

The global in vitro diagnostics (IVD) market size accounted for USD 104.01 billion in 2025, and is anticipated to reach around USD 135.76 billion by 2035, growing at a CAGR of 2.7% between 2026 and 2035. The in-vitro-diagnostics market is expected to grow at a robust pace with the emergence of remote patient monitoring systems that allow and conduct testing for diagnosis purposes outside the traditional healthcare system.

Market Highlights

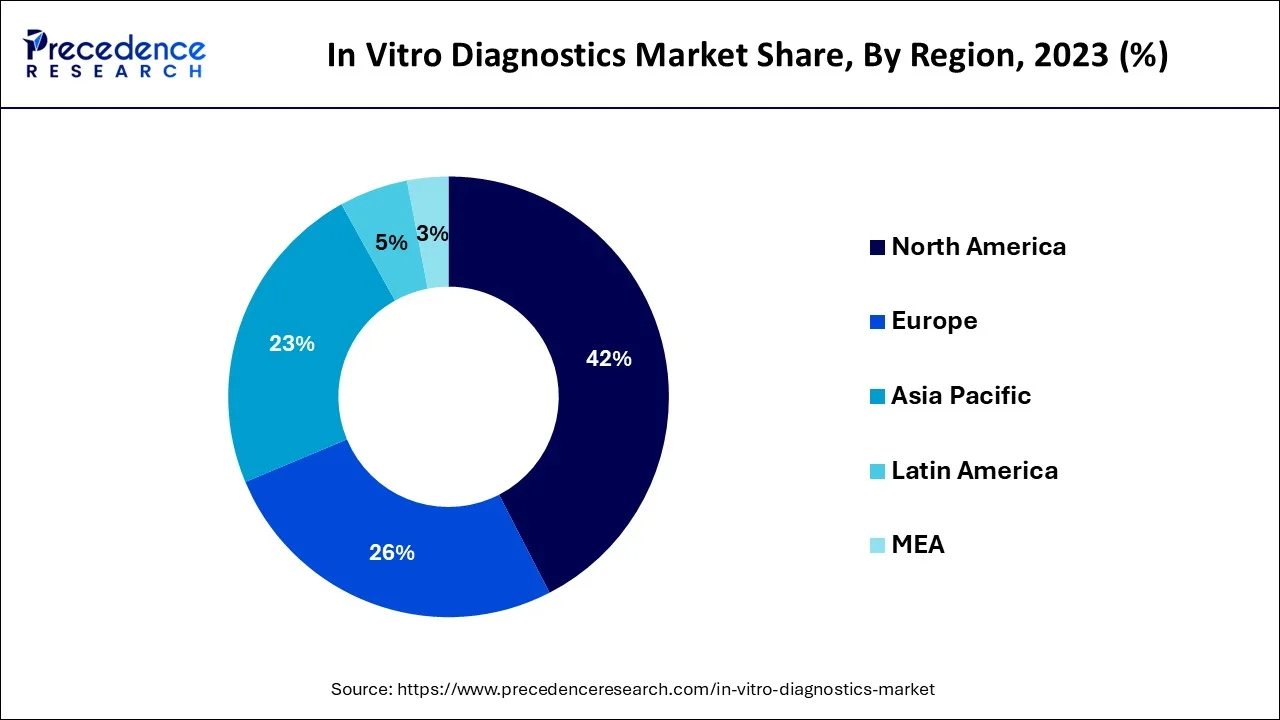

- North America Market has captured a revenue share of 42% in 2025.

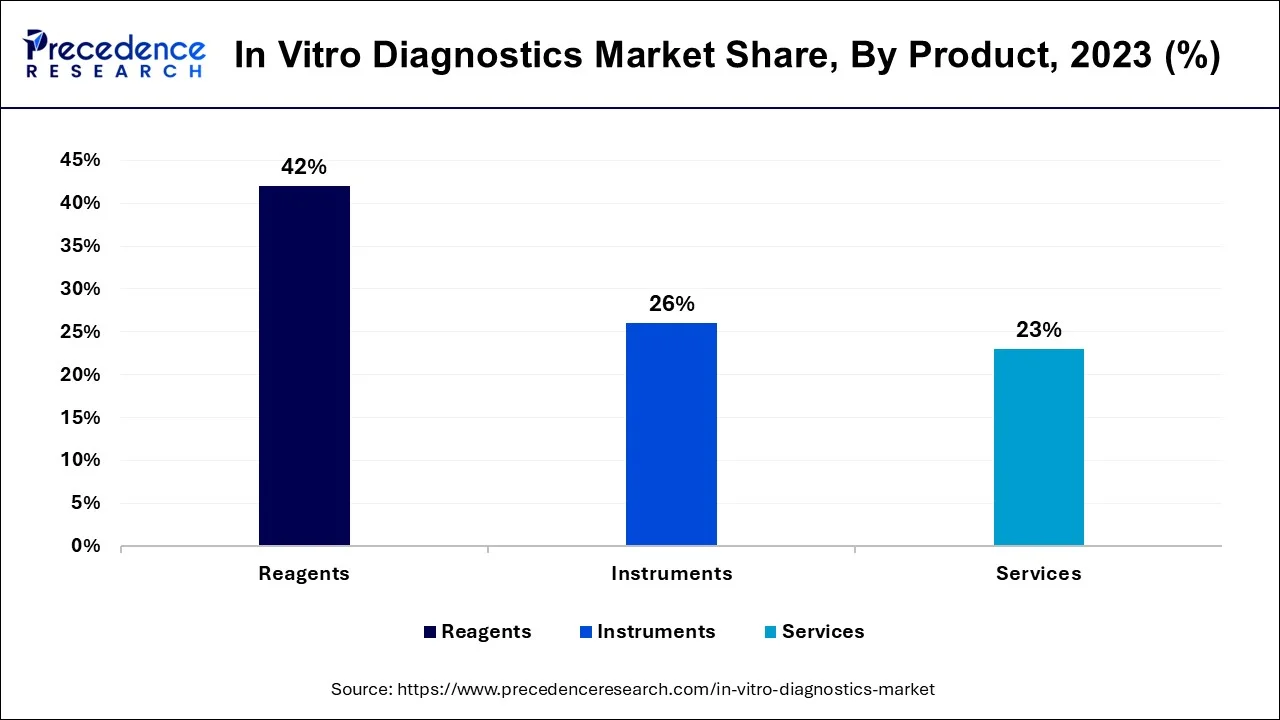

- By product, the reagents segment held a significant share in 2025.

- By product, the instruments segment is anticipated to show considerable growth in the market over the forecast period.

- By test location, the point of care segment held a significant share in 2025.

- By test location, the home care segment is anticipated to show considerable growth in the market over the forecast period.

- By technology, the molecular diagnostics segment held a significant share in 2025.

- By technology, the immunoassay segment is anticipated to show considerable growth in the market over the forecast period.

- By application, the infectious disease segment held a significant share in 2025.

- By application, the oncology segment is anticipated to show considerable growth in the market over the forecast period.

- By end user, the standalone laboratories segment held a significant share in 2025.

- By end user, the hospital segment is anticipated to show considerable growth in the market over the forecast period.

How has AI benefited the Market?

Artificial Intelligence (AI) is witnessing a revolution in the In Vitro Diagnostics market as it facilitates greater levels of accuracy, efficiency, and accessibility. AI algorithms scrutinize reams of data to pick up extra patterns that might elude human-eye identification, rendering tentative diagnosis with higher precision, hastening workflows, lessening manual errors, and augmenting quality control.

Then, it launches into personalized medicine, rendering treatment plans accordingly for adaptation to the peculiar profile of a patient's genetic and medical conditions, thereby enhancing the results of treatment and lessening the incidence of adverse effects. AI serves also as an early-detection system of diseases, lowering costs and offering remote diagnostics that would be a boon to distressed areas. It proceeds with the rapid discovery of biomarkers, practice optimization for clinical trials, and nurturing of new research-based diagnostic methods.

Introduction to In Vitro Diagnostics

“In vitro diagnostics" (IVD) refers to the market for medical equipment and supplies used to perform tests on human tissue samples, bodily fluids, urine, and blood. These tests are performed outside the body, in a laboratory setting, point of care setting, or home testing to diagnose, monitor, and manage various diseases and conditions. In vitro diagnostics is vital in healthcare by providing valued information to healthcare professionals for accurate disease diagnosis, treatment planning, and disease management.

The expansion of molecular diagnostics is one of the key trends in the in vitro diagnostics industry. Molecular diagnostics involves analyzing and detecting genetic material, proteins, and other molecules to diagnose and monitor diseases. Molecular diagnostics has witnessed significant advancements, particularly in genomics and proteomics technologies. These advancements have enabled the identification of specific gene variations and biomarkers associated with diseases, leading to more accurate diagnoses and personalized remedy approaches. The expansion of molecular diagnostics has revolutionized disease management, especially in oncology, infectious diseases, and genetic disorders.

Additionally, integrating artificial intelligence and machine learning is another key trend in the in vitro diagnostics market. Combining artificial intelligence (AI) and machine learning (ML) technologies in the IVD market enhances diagnostic accuracy, efficiency, and predictive capabilities. AI and ML algorithms can analyze large volumes of patient data, identify patterns, and generate insights to support clinical decision-making. These major trends in the in vitro diagnostics market are reshaping the industry and driving advancements in diagnostic technologies, personalized medicine, and patient care. The increasing focus on rapid and accurate diagnostics, integration of AI and ML, and the shift towards personalized medicine are expected to further propel the growth and evolution of the IVD market.

In recent years, in vitro diagnostics industry has recognized significant developments. Rising geriatric population, prevalence of infectious as well as chronic diseases and existence of automated in vitro diagnosis systems for hospitals to offer precise diagnosis are some of the factors are expected to propel the growth of the market. As per the data published by United Nations, around 900 million populations across globe are above age 60 years. Furthermore, World Health Organization declared that, by 2020, the number children younger than 5 years will be lesser than that of people above 60 years. Thus, growing elderly population and subsequent demand for immunoassay-based tests flourishes the market growth. Additionally, increased government funding and other healthcare organizations investment into in vitro diagnostics market is the key drivers to boost market growth over the forecast period. Growing consciousness on personalized medicines and increasing acceptance of point-of-care testing are also high impact rendering market drivers.

Furthermore, growth of condition specific tests, increasing importance of companion diagnostics as well as emerging economies are anticipated to show growth opportunities for players operating in the market. Enhanced and well-organized diagnostic tools, technological advancement in healthcare and surge in the over the counter tests is projected to witness growth in the in vitro diagnostics market. However, high cost involved into in vitro diagnostics services may hamper the industry growth over the forecast period.

Also, rigorous government regulations and adverse reimbursement policies are expected to hinder the growth to some extent. Furthermore, IVDS's have been under growing cost pressure over the last decade owing to increasing use and concerns about ungovernable health expenses. Nonetheless, surging demand for IVD products from the developing nations offers lucrative growth prospects to the market.

In Vitro Diagnostics Market Growth Factors

- Epidemics of Diseases and Chronic Diseases Increasing Burden on Health:Increasing cases of diabetes, cancers, and cardiovascular disorders, accompanied by outbreaks of mpox, place demand for frequent and accurate diagnostic testing.

- Sudden Outbreaks of Infectious Diseases:Red spikes in the mpox have resulted in increased demand for diagnostic tools that are rapid and reliable.

- Aging Population Driving Testing Needs: Aging individuals face higher health risks; therefore, they will require diagnostic tests that are frequent and advances in advance, mainly from Europe, Japan, and US.

- Growth of Personalized Medicine: Treatments tailored with respect to an individual's own genetic profile are increasing the demand for diagnostic solutions advanced.

- Technological Innovations in Diagnostics:Molecular diagnostics, NGS, biomarker-based testing were developments in diagnostics to increase the precision of disease detection and personalised care.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 104.01 Billion |

| Market Size in 2026 | USD 106.16 Billion |

| Market Size by 2035 | USD 135.76 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 2.7% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Technology, Application, and region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Market Dynamics

Drivers

Mounting Prevalence of Chronic and Infectious Diseases

The significantly increased prevalence of chronic and infectious diseases is one of the major causes of growth drivers in the in-vitro diagnostics market. According to the U.S. Department of Health & Human Services, in the U.S., 6 in 10 adults suffer from a chronic disease, and 4 in 10 adults suffer from 2 or mere chronic disease conditions. The various forms of cancer, cardiovascular disorders, diabetes, obesity, etc., are chronic disorders. According to the World Health Organization, cardiovascular diseases accounted for cancers accounted for 9.3 million of all non-communicable disease deaths, followed by chronic respiratory diseases (4.1 million), diabetes (2.0 million, with kidney disease deaths caused by diabetes), and chronic respiratory diseases (17.9 million) per year, reported as of September 2022.

In addition, the in vitro diagnostics market currently generates the most revenue from the rise in infectious diseases, whose treatment and prevention are assisted by early detection. The increasing prevalence of chronic and infectious diseases leads to overall health costs for the nation. For instance, the U.S. Department of Health & Human Services stated that chronic disease conditions accounted for around $4.1 trillion in annual healthcare costs in America, reported as of December 2022. Furthermore, infectious diseases are brought on by microorganisms such as hepatitis, diphtheria, HIV/AIDS, Ebola, flu, human papillomavirus, tuberculosis, etc., and outbreaks like Swine flu, Zika virus, dengue, and Covid-19, which are continuously having a direct effect on the expansion of the infectious disease testing market segment. As reported by the WHO, an estimated 10.6 million people were diagnosed with TB in 2021, an increase of 4.5% from the 10.1 million cases in 2020. Thus, extensively increasing the prevalence of chronic and infectious diseases ultimately results in increased demand for more accurate, fast, and timely diagnosis, which augments the growth of the in-vitro diagnostics market.

Rising Implementation of Technological Innovation and Automation

The In Vitro Diagnostics market is a significant sector that can benefit from implementing Smart Labs-as-a-Service for laboratory automation. Integrating automation technologies and digital solutions in the IVD industry can significantly enhance laboratory services and streamline diagnostic workflows.

Smart labs provide advanced automated solutions that enhance laboratory operations, improving productivity and efficiency. Automation of diagnostic procedures, including sample handling, testing, and result analysis, lowers the chance of human error, speeds up delivery times, and enhances laboratory efficiency overall. In addition, Smart Labs-as-a-Service's subscription-based business model enables end- user labs to access advanced technology and digital services for a reduced price. This can be especially helpful for smaller facilities or laboratories on a tight budget. Laboratories can reduce costs while providing top-notch diagnostic services by pooling resources and utilizing automation.

Furthermore, market players are developing digital solutions for Smart Labs-as-a-Service to enable seamless data management and analysis. Increasing product launches and regulatory approvals related to laboratory automation burgeons the growth of the in vitro diagnostics market. For instance,

- In January 2023, Qiagen, a Europe-based company, launched a platform for automated sampling in diagnostic laboratories called EZ2 Connect MDx IVD. Moreover, advanced laboratory information management systems (LIMS) and data analytics tools efficiently handle and interpret vast amounts of diagnostic data, providing valuable insights for healthcare providers and researchers.

- In September 2022, ADSTEC and its subsidiary ADS Biotec, a market player involved in the development of automated instruments, announced the receiver of CE marking for their HANABI Cytogenetic Automation Instruments under the European Union In Vitro Diagnostic Medical Device Directive (IVDD) 98/79/EC.

Moreover, the advanced approach towards enhanced data management and analysis brings convenience to lab operations, bolstering the in-vitro diagnostics market growth. On top of it, automation in laboratory processes minimizes human errors leading to improved accuracy and quality of diagnostics results. Consistent and reliable testing outcomes provide more precise diagnoses and better patient care. Which in turn, accelerates the growth of in vitro diagnostics market.

Rise in the Demand for Point of Care Testing (POCT)

IVD technologies were only applied in clinical labs in the past. Most clinical chemistry, immunochemistry, and hematology tests continue to be carried out with high throughput equipment with complex automation. However, Point of Care Testing is expanding to meet the demand for quick diagnosis of infectious and chronic diseases near where the patients are located or being treated. According to a survey by the National Library of Medicine for several infectious diseases, POCT is available in all European countries that responded to the study.

In addition, key players are concentrating on releasing quick, portable, transportable, compact, and easy-to-use instruments that can be used outside lab settings. The COVID-19 outbreak has highlighted the need to improve local healthcare, particularly. This demand has increased the diagnostic offer's delocalization, including auto- and home-diagnosis. The rising number of POCT device manufacturers across the globe expands the in vitro diagnostics market growth. For instance, according to initial statistics from the members of the China Association of In Vitro Diagnostics, China currently has more than 1400 manufacturers of IVD products, out of which around 216 were POCT manufacturers in 2020.

Furthermore, the demand for complex diagnostic technologies is fueled by the shift towards personalized medicine, which customizes treatment based on a patient's unique characteristics. Point-of-care testing is essential in supplying real-time patient data that enables individualized treatment choices. Point-of-care testing offers the advantage of convenience and ease of use. It eliminates the need for sample transportation and allows for immediate results, leading to faster decision-making and improved patient management. This further contributes to accelerating the growth of the in vitro diagnostics market.

Restraint

Complex Regulatory Landscape

The complex regulatory landscape is one of the major hindrances to the growth of in vitro diagnostics market. New or modified devices must undergo a thorough FDA evaluation to ensure patient safety at the individual and community health levels. Therefore, devices intended to assist or preserve human life would be subject to the most thorough status of review. Regulations on in vitro diagnostics may restrict a newly developed IVD device from entering the market, which may incur huge losses to the manufacturer. Hence, effectively categorizing a device is essential to avoid entering market delays. Team members working on research and product development must know this to prevent "going back to the drawing board." This is particularly true in the United States, where the FDA deliberately controls additional creativity on devices that have already received approval if the supporting evidence needs to be sufficiently futuristic.

In addition, the European Commission's Directive 98/79/EC establishes legal requirements for producing and selling in-vitro diagnostics products in the European Union. Investments made in R&D could be well-spent if the regulatory authority rejects approval due to the uncertainty surrounding the time frame needed to receive regulatory approval for some IVDs. The EU has universal standards for the planning and production of IVD products and technologies, including Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH).

Regulating IVDs has merit, but no one wants to get caught in a web of rules that go overboard to the point where it prevents the development of novel IVD products that could lead to advancements, particularly in devices deemed higher risks. Documentation is essential to demonstrate how a device complies with all regulatory requirements. This can help to overcome the regulatory restrain.

Opportunity

Increased Funding and Overall Spending on In Vitro Diagnostics Market

Governments worldwide recognize the importance of diagnostics in healthcare and allocate substantial funding to support research and development in the IVD sector. Additionally, healthcare policies focused on early disease detection and prevention drive investment in diagnostic technologies. Companies investing in research and development to enhance their technological capabilities are well-positioned to capitalize on market opportunities.

- In November 2022, the Biomedical Advanced Research and Development Authority (BARDA) awarded Hologic, Inc. a $19 million contract to support its research and development initiatives. The purpose of this funding was to bring The Aptima SARS-CoV-2 assay from Hologic and the Panther Fusion SARS-CoV-2/Flu A/B/RSV assay from Hologic both adhere to the in vitro diagnostic (IVD) standards established by the U.S. Food and Drug Administration (FDA).

- In January 2022, an IVD company, Virtue Diagnostics, revealed the closing of a $100 million Series B funding round. Clinical tests for China and emerging markets are the primary focus of Virtue Diagnostics, founded in 2019. Sequoia China and Morningside Ventures collectively headed the fundraising round with ORIZA Holdings. Existing investors PerkinElmer Ventures and Lilly Asia Ventures took part, and HAOYUE Capital served as the sole financial advisor.

- In November 2021, QuantuMDx received a £15 million ($20.3 million) stake in its company from Vita Spring IVD Fund, a Hong Kong-based venture capital firm, and plans to use the funds to advance the creation of its Q-POC PCR platform for the verge of need.

Emerging markets, particularly Asia-Pacific and Latin America, offer untapped potential for IVD companies. The increasing healthcare spending, improving healthcare infrastructure, and growing patient awareness in these regions provide opportunities for market expansion and increased penetration of diagnostic products. Furthermore, companies that strategically invest in innovation develop partnerships, and focus on meeting the evolving needs of healthcare systems and patients are well-positioned to capitalize on these opportunities and drive future success.

In Vitro Diagnostics Market Segment Insights

Product Type Insights

The instruments segment is expected to grow at a significant CAGR over the forecast period. The ongoing advancement and introduction of new diagnostic tools will serve to improve accuracy and speed in labs and processes, as well as the automation of procedures in labs. Healthcare providers are also seeking high-tech tools to support increasingly complex diagnostic needs, as well as those that offer high-throughput, real-time data analysis, and integration in a digital health platform.

The instruments are essential in most diagnostic processes, such as the detection of infectious diseases and chronic disease surveillance. Research and development are being massively invested in by major market players to keep up with the increasing demand for scalability and cost-effectiveness in the hospital, clinic, and research laboratory setting.

- In June 2023, BD introduced the FACSDuet Premium Sample Preparation System, a new robotic instrument to automate and standardize sample preparation in clinical flow cytometry, which further diversified their cellular diagnostics product line.(Source: https://news.bd.com)

Global In Vitro Diagnostics Market Revenue, By Product Type, 2022-2024 (USD Million)

| Product | 2022 | 2023 | 2024 |

| Instruments | 28,950.5 | 26,909.55 | 25,379.75 |

| Reagents | 75,883.9 | 70,996.28 | 67,404.76 |

| Services | 10,654.3 | 9,861.36 | 9,264.58 |

The reagents lead the IVD market, with continuous innovations in biomarker kits and R&D advancements by big players. Product launches and technological improvements increase in demand, as reagents are an essential component for a variety of diagnostic applications for different diseases.

Instruments are fast-growing segments, boosted by technological advancements and collaborative partnerships. The innovations in diagnostic devices, focusing on ease of use and high performance, present superior efficiency and accessibility for laboratory and clinical uses.

Technology Insights

Based on technology, the in vitro diagnostics market is classified into hematology, molecular diagnostics, immunology, coagulation, clinical chemistry, microbiology and others. Amidst these technologies, molecular diagnosis dominated the global in vitro diagnostics market in 2024. While immunoassay segment held the second position owing to growing adoption of immunoassay based rapid testing and POC testing. Molecular diagnostics is expected to show the fastest growth over the forecast period. Increasing support by regulatory authorities is also supporting the market growth. For example, SOPHiA GENETICS received CE-IVD marking for solid tumor solution which will help to characterize and detects alerted genes in colorectal, skin cancer, lung and brain.

An immunoassay is a procedure that measures the concentration of a macromolecule in a solution using an antibody or immunoglobulin. The huge molecule identified is known as an analyte. The development of immunochemical approaches that bring advantages observed with larger molecular analytes with small molecules such as metabolites and toxins is one example of a technological advancement that increases the efficiency of immunoassay in terms of cost and performance.

Point-of-care testing (POCT) is becoming more and more popular, which is one of the major trends in the immunoassay industry. Rapid and practical diagnostic outcomes provided by POCT enable quick clinical judgment. Due to their ease of use, speed, and capacity to detect numerous analytes at once, immunoassays are ideal for POCT. The expansion of the use of portable and handheld immunoassay instruments in resource-constrained and decentralized healthcare settings is being driven by this trend. The push toward multiplexing is another trend. The simultaneous detection of numerous analytes in a single sample is made possible by multiplex immunoassays, which provide thorough diagnostic data. This trend is being pushed by the demand for better diagnostic solutions, particularly in fields like oncology, autoimmune disorders, and infectious diseases. Multiplexing not only saves time and resources but also allows for a more comprehensive understanding of disease profiles and personalized treatment approaches.

Global In Vitro Diagnostics Market Revenue, By Technology, 2022-2024 (USD Million)

| Technology | 2022 | 2023 | 2024 |

| Immunoassay | 34,688.2 | 32,433.72 | 30,774.22 |

| Hematology | 6,827.4 | 6,345.41 | 5,984.69 |

| Clinical Chemistry | 20,236.7 | 18,978.14 | 18,061.02 |

| Molecular Diagnosis | 38,255.7 | 35,662.26 | 33,736.25 |

| Coagulation | 4,680.5 | 4,328.27 | 4,061.72 |

| Microbiology | 6,384.9 | 5,916.29 | 5,563.15 |

| Others | 4,415.3 | 4,103.12 | 3,868.03 |

Test Location Insights

The point of care (POC) contributed the most revenue in 2024 and is expected to dominate throughout the projected period. Due to POC testing, healthcare professionals are able to carry out diagnostic tests in the patient location or close to the patient location, diminishing the turnaround time, thus leading to faster clinical decision-making. Moreover, these growth drivers include an aging population in the larger populace, an upsurge in cases of chronic illnesses such as diabetes and cardiovascular diseases, and a rising concentration on value-based care. With the transition in the healthcare systems towards more decentralized, efficient ways of performing diagnostic procedures, POC testing will become one of the foundations of modern diagnostics, because it is convenient, quick, and has clinical utility.

The home care segment is expected to grow substantially in the in vitro diagnostics market. The reasons behind such growth are primarily attributed to the worldwide trend aimed at accessible, convenient, and affordable methods of diagnosis. The popularity of such kits creates a new paradigm of patient autonomy in terms of diagnostics. Home-based testing has now taken a broad spectrum that covers glucose testing to infectious diseases and even genetic testing. The patients are getting more interested in the comfort, privacy, and convenience of providing diagnostics at home, in particular, patients who suffer from chronic diseases or have mobility impairments. Due to the constant technological advances and increasing consumer awareness, the homecare IVD segment is likely to grow.

Application Insights

The oncology segment is expected to grow at a significant CAGR over the forecast period. Cancer continues to be the second highest death in the United States, with popular kinds that include lung, breast, prostate, and colorectal cancers, which justify effective diagnostics. Subsequently, the healthcare systems are giving emphasis to cancer screening and monitoring using the advanced tools of IVD. Such innovations as diagnosis-aided AI and digital pathology are assisting in improving the efficiency of workflow and diagnostic accuracy. New technologies facilitate the introduction of personalized cancer care, where it is possible to hold earlier post-intervention and individual treatment plans.

Global In Vitro Diagnostics Market Revenue, By Application, 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Infectious Diseases | 61,149.9 | 56,833.27 | 53,602.44 |

| Diabetes | 9,146.6 | 8,475.36 | 7,969.48 |

| Oncology | 8,727.7 | 8,323.38 | 8,055.14 |

| Cardiology | 9,104.3 | 8,538.03 | 8,125.43 |

| Nephrology | 6,633.3 | 6,127.88 | 5,744.71 |

| Autoimmune Diseases | 5,350.6 | 4,987.83 | 4,718.45 |

| Drug Testing | 3,986.6 | 3,757.30 | 3,593.52 |

| Others | 11,389.6 | 10,724.14 | 10,239.92 |

End User Insights

The hospital contributed the most revenue in 2024 and is expected to dominate throughout the projected period. The rise in the number of hospitalizations and the importance of diagnostic testing in identifying a mode of treatment. A large number of hospitals are acting in partnership with a diagnostic center or, having their full-service laboratory arrangements, can provide faster turnaround and greater integration of care. Moreover, the ongoing process of advancement and extension of medical facilities, particularly in new world economies, will help increase the uptake of hospital-based diagnostic solutions. A large percentage of purchases of IVDs are also made by hospitals, which often buy large amounts of consumables and reagents to cover normal and emergency testing. As the burden of chronic and infectious diseases increases, as well as a need to make fast clinical decisions in acute care environments.

The standalone laboratories segment is expected to grow substantially in the in vitro diagnostics market. This has been encouraged by a high growth rate in the number of independent diagnostic labs, especially in semi-urban and urban regions, which provide various testing services in large quantities. Moreover, outpatient diagnostic testing is gaining traction due to patient demand for such services in terms of efficiency and convenience, and less waiting time. Outsourcing clinical diagnostic services to outside labs by both government and privately owned hospitals serves as a major growth factor for healthcare providers. In the rise of decentralization of health care systems, standalone laboratories are playing a vital part in the diagnostic network because they provide scalable and accessible solutions.

In Vitro Diagnostics MarketRegional Insights

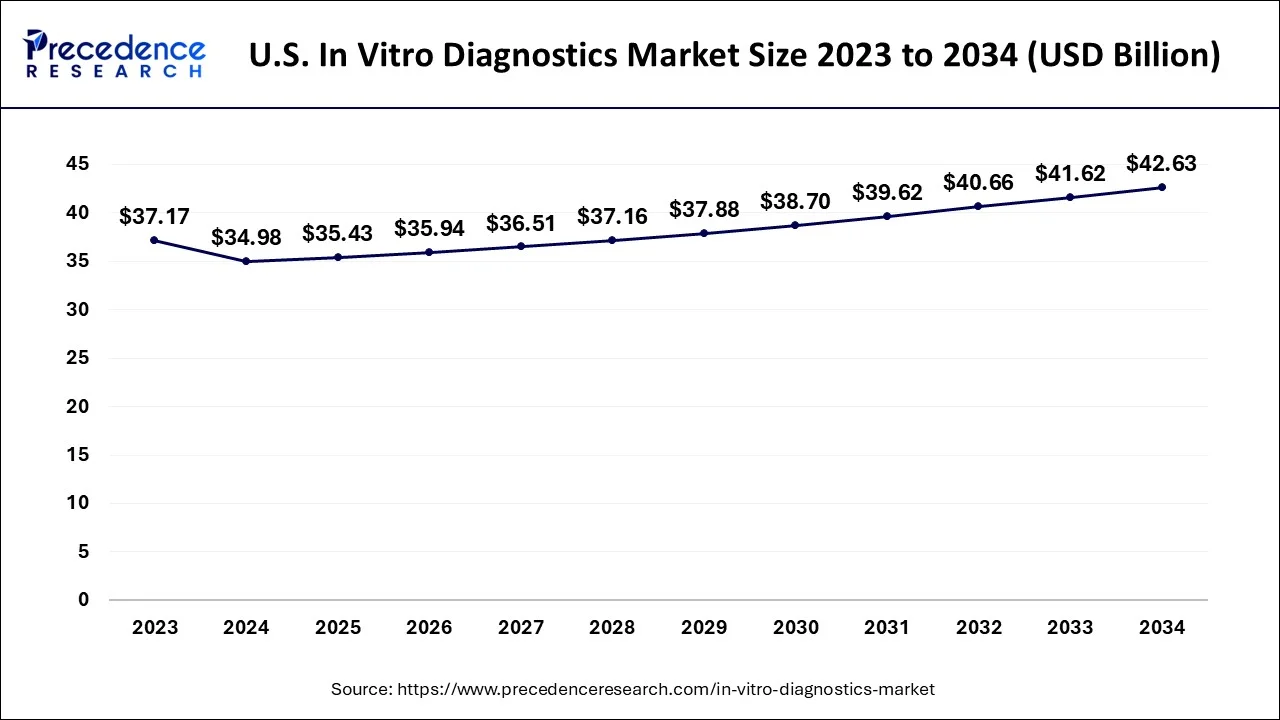

TheU.S. in vitro diagnostics (IVD) market size is exbhited at USD 35.43 billion in 2025 and is predicted to be worth around USD 43.49 billion by 2035, growing at a CAGR of 2.07% from 2026 to 2035.

North America is estimated to top the global market throughout the estimated time period due to high-rise in healthcare awareness among population and its well penetrated healthcare system. In addition, easy accessibility of devices, increasing awareness about usage of these products and existence of huge number of residents suffering from numerous chronic diseases also drives the growth of the market. Furthermore, presence of various key market players in America is likely to enhance the growth of the market in the region.

The growing need for genetic testing for personalized healthcare, diabetes, and cancer is propelling the market in North America. Around 32.2 million Americans are expected to have diabetes by 2021, according to the International Diabetes Federation (IDF). The development of cost-effective, superior medical solutions targeted at attaining lab automation as a result of technological advancements is propelling the in vitro diagnostics market in North America. For instance, a pioneer in molecular diagnostics, BioGX, introduced POC CE-marked COVID-19 assays on their Pixl platform in July 2022. A qPCR detection system called the CFX Opus 384 Dx System and CFX Opus 96 Dx System was introduced by Bio-Rad Laboratories, Inc. in October 2021. This freshly introduced method offers accurate and precise quantification to enhance diagnostic testing workflow efficiency.

The dynamics of the market have changed, with more participants emphasizing the launch of tests for home-based testing. Additionally, in 2021, the FDA designated home molecular diagnostic testing as a major priority. The molecular analytical self-test kit for COVID-19 detection from BATM Advanced Communications Ltd. was slated for availability in March 2021. Furthermore, by allowing for early disease detection, these diagnostics lower the risk of replacements. However, because these tests are so expensive, it is expected that some patients may move to external options. Furthermore, the likelihood of internal modification is high for the detection of developing diseases like SARS-CoV-2, which encourages competition among rivals.

The IVD industry is now seeing tremendous expansion in North America, and this trend is anticipated to continue for a few more years. Due to the region's established healthcare sector and the growing incidence of chronic illnesses, its market share is anticipated to grow in the future.

The European in vitro diagnostics market is expected to account for a substantial market share in 2024, backed up by positive forces of higher demand in advanced diagnostics and a rich healthcare infrastructure. The advances in the sphere of Next-Generation Sequencing (NGS) and testing of the PCR type to transforming parameters such as oncology, infectious diseases, and genetic screening patterns. The direction of such novelties is to make diagnostics faster, more accurate, and more personalized, which is relevant to the trend observed in the region, which requires relying onprecision medicine and the patient-centered approach. They are also enhancing efficiency, workflow optimization, and turnaround times in all hospitals and laboratories by incorporating digital health and AI in the process of diagnosis.

The United Kingdom is one of the IVD markets showing the biggest growth in the region. The country has a very strong healthcare system with the National Health Service (NHS) in the lead, strong health awareness, and a huge government budget to improve the diagnostic services. The rising disposable income and the rise in the economic burden of the chronic and infectious diseases have sparked a developed demand for the right testing solutions.

- In July 2023, Virax Biolabs Group Limited, a biotechnology company focused on the detection of immune response and the diagnostics of viral diseases, confirmed its intent to open two new research and laboratory centers in the UK.

In Vitro Diagnostics Market Companies

- Alere, Inc.

- Hoffmann-La Roche Ltd.

- Arkray

- Beckman Coulter

- Becton Disckinson

- Bio-Rad laboratories

- Danaher

- Sysmex Corporation

- Abbott Laboratories

Recent Developments

- In May 2025, Nepal launched a National Essential In-vitro Diagnostics List and handed over quality-critical laboratory equipment and reagents, supported by WHO through the Pandemic Fund, on 8 May 2025. (Source: https://www.who.int)

- In March 2025, the NIHR HealthTech Research Centre in In Vitro Diagnostics, funded by NIHR, aims to support diagnostics development and adoption through collaboration between industry, academia, and healthcare sectors. (Source: https://www.imperial.ac.uk)

- In February 2025, ABL Diagnostics will be able to produce and market the full scale of UltraGene PCR tests obtained in the course of the acquisition by the parent company, Advanced Biological Laboratories. The tests have a plate coverage of more than 100 pathogens, and they help in supporting the diagnostics of infectious diseases involving various conditions. Part of the strategy is to merge PCR with its DeepChek line of sequencing products that can extend its reach in precision medicine. (Source: https://www.abldiagnostics.com )

- In January 2025, QIAGEN received U.S. FDA approval of its QIAstat-Dx Gastrointestinal Panel 2 Mini B&V, a niche syndromic test to detect bacterial and viral gastrointestinal disease causes. In addition, the firm has a product launch initiative underway that would add QIAGEN to its syndromic testing products, offering a complete and refined set of alternatives to enhance inpatient and outpatient diagnostics. (Source:https://corporate.qiagen.com )

- In October 2024, Becton, Dickinson and Company (BD) achieved Health Canada approval for its Onclarity HPV Assay to run a self-collected vaginal sample to test humans in the home regarding the human papillomavirus (HPV). (Source: https://investors.bd.com )

In Vitro Diagnostics MarketSegments Covered in the Report

By Product

- Reagents

- Instruments

- Services

By Test Location

- Point of Care

- Home Care

- Others

By Technology

- Immunoassay

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Instruments

- Reagents

- Services

By Application

- Diabetes

- Cardiology

- Nephrology

- Infectious Disease

- Oncology

- Drug Testing

- Autoimmune Diseases

- Others

By End User

- Standalone Laboratories

- Hospitals

- Academic & Medical Schools

- Point-of-Care

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting