What is the Sustainable Materials Market Size?

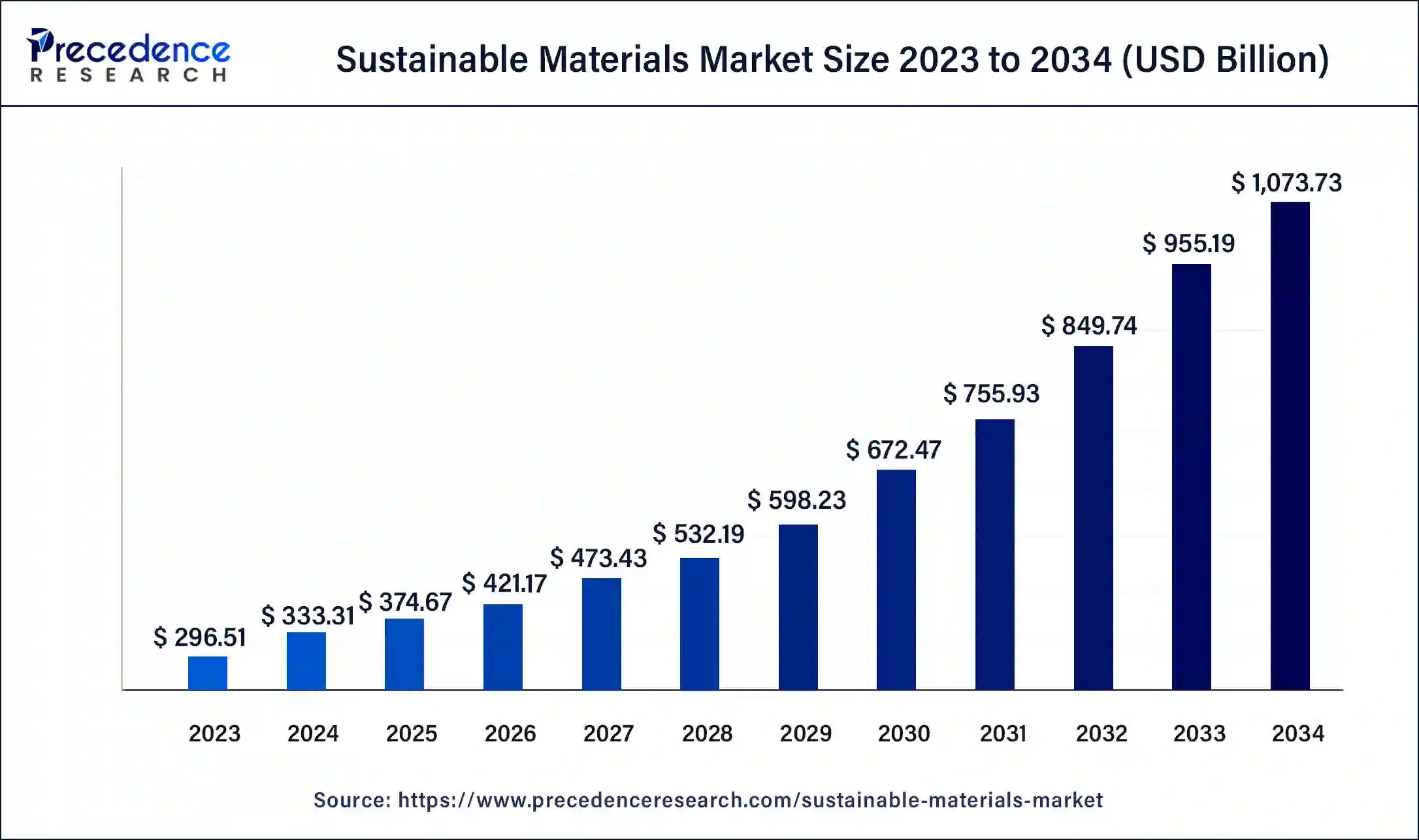

The global sustainable materials market size was evaluated at USD 374.67 billion in 2025 and is predicted to increase from USD 421.17 billion in 2026 to approximately USD 1,183.54 billion by 2035, expanding at a CAGR of 12.19% from 2026 to 2035. The sustainable materials market growth is attributed to the increasing demand for eco-friendly products and sustainable practices across various industries

Sustainable Materials Market Key Takeaways

- Europe held a significant share of the sustainable materials market in 2025.

- Asia Pacific is expected to grow with the fastest CAGR during the forecast period.

- By type, the recycled metals segment dominated the global market in 2025.

- By type, the biodegradable plastics segment is projected to grow rapidly in the future years.

- By application, the packaging segment held a significant share of the market in 2025.

- By application, the automotive segment is projected to significantly expand in the market in the coming years.

- By end-user, the commercial segment dominated the global market in 2025.

- By end-user, the industrial segment is projected to expand rapidly in the coming years.

Market Overview

Rising consumer concerns about environmental conditions have been seen as the major driving force towards the development of the sustainable materials market. There is gradually more focus on sustainability, forcing industries to go green in almost all sectors of operation. This shift is driving change in such things as biodegradable plastics, reused metals, and renewable fibers.

The process used in biodegradable plastics is polymers that last for a comparatively shorter period than normal plastics and are damaging to the environment. Some of these innovations are environmentally friendly, besides being in harmony with contemporary sustainable development goals as outlined by the United Nations. Furthermore, sustainable practices are going to be incorporated more frequently as industries strive to satisfy the demand for sustainable materials.

Impact of Artificial Intelligence on the Sustainable Materials Market

Business entities use analytically oriented Artificial Intelligence (AI) to optimize materials and environmental benefits for products. Utilizing machine learning, manufacturers are able to estimate materials' performance in various conditions and quickly adapt that to market needs. AI is also used to address the issue of reducing the number of sustainable materials market products. It helps to sort through vast amounts of information to select environmentally friendly materials that meet high-quality standards. There is also the general environmental sustainability enhancement through the efficiency of the supply chain through the integration of AI, as well as the growth of different sectors.

Sustainable Materials Market Growth Factors

- Increasing adoption of green building certifications drives demand for sustainable materials in construction.

- Rising consumer demand for eco-friendly products boosts the use of sustainable materials in retail and consumer goods.

- Advancements in material science lead to the development of more effective and cost-efficient sustainable materials.

- Government subsidies and tax incentives for companies adopting sustainable practices enhance the sustainable materials market growth.

- Expansion of electric vehicle (EV) infrastructure increases the need for sustainable materials in automotive components.

- Corporate sustainability commitments push industries to integrate more sustainable materials into their supply chains.

- Growth in eco-tourism and green hospitality promotes the use of sustainable materials in the travel and leisure industry.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 1,183.54 Billion |

| Market Size in 2026 | USD 421.17 Billion |

| Market Size in 2025 | USD 374.67 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.19% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising awareness of climate change

An increase in the awareness level of climate change is anticipated to drive the sustainable materials market. People and organizations have shifted their preferences to green and sustainable practices. They are looking for any options that are less damaging to the environment. Due to this trend, consumer goods, such as automotive and electronics industries, are reporting the use of bio-based and biodegradable materials. Fashion leaders, along with other industry leaders, have started their transition to sustainable resources along the value chains of products. That shift of focus towards cutting down the emissions of greenhouse gases establishes the long-term need for sustainability solutions firmly still.

- The United Nations Environment Programme report reveals that at least 131 countries have set goals to reach net-zero emissions by 2050, thus exerting pressure on industries to use sustainable raw materials.

- The European Commission anticipates that the use of sustainable materials will cause the automotive sector to cut its CO2 emissions by about 20%.

| Metric | Data | Source |

| Global Commitments to Net-Zero Emissions by 2050 | Over 130 countries |

United Nations Environment Programme |

| Economic Potential of Circular Economy Practices | USD 4.5 trillion by 2030 | Ellen MacArthur Foundation |

| Projected CO2 Emission Reduction in Automotive | 20% reduction by 2030 | European Commission |

| Corporate Pledges for 100% Sustainable Materials | Adidas, IKEA, and others are aiming for 100% by 2030 | Ellen MacArthur Foundation |

| Annual Global Investment in Sustainability (2023) | USD 1.6 trillion | International Energy Agency (IEA) |

Restraint

High costs of production

The high cost of production of hampers is expected to limit the widespread adoption of sustainable materials, thus hampering the sustainable materials market . Creating new materials that perform the conventional materials can be achieved only after investing a lot of money and time. The above-mentioned costs act as a barrier to the increased use of sustainable material solutions in those production sectors with low profit margins, such as the construction and car manufacturing industries. Furthermore, the cost issues are expected to limit the market's growth in areas with limited or no access to governmental subsidies or financial stimuli.

Opportunity

Surge in investments in research and development activities

Surging investment in research and development (R&D) for sustainable materials is likely to create immense opportunities for the players competing in the sustainable materials market in the coming years. Business and research organizations are investing time and money in search of materials that provide performance indicators similar to conventional materials. It is necessary, especially for such industries as construction, automobile industry, and electronics production, where high-strength and high-performance materials are needed. These recent research and developments show that there is a positive future if researchers continue to work harder on biodegradable polymers and recycled composites.

- The U.S. Department of Energy, on the same note, has pledged USD 200 million in research into the technologies of clean manufacturing such as sustainable materials.

- The IEA stated that global expenditure on sustainable energy and materials R&D was USD 35 billion in 2022. This focus on innovation is expected to yield better and more sustainable raw materials, hence fuelling the market over the next decade.

Segment Insights

Type Insights

The recycled metals segment dominated the global sustainable materials market in 2025 due to the growing demand in the construction, automotive, and electronics industries. Recycled metals such as aluminum and steel, such as aluminum and steel, are beneficial for minimizing costs and carbon emissions. Recycling of metals has been promoted across the world through incentives for a circular economy, especially in the EU and North America. This has been propelled by the European Union's Circular Economy Action Plan, which includes recycling initiatives that set requirements for several industries, including recycling objectives that are anticipated to strengthen the demand for recycled metals in the subsequent years.

- A report from the International Aluminium Institute stated that using scrap aluminum to produce aluminum products saves at least 95% of the energy required from bauxite ore, which considerably reduces emissions.

The biodegradable plastics segment is projected to grow rapidly in the sustainable materials market in the future years, owing to the increasing shift towards measures aimed at minimizing plastics, and the implementation of strict measures on single-use plastics has led to the search for more bio-degradable plastics. Industries, such as packaging, agriculture, and consumer, are now using biodegradable plastics to meet corporate environmental management objectives.

- The United Nations Environment Programme (UNEP) has estimated that the global community throws away 400 million tons of plastic waste every year; of this, only 10% is collected for recycling.

- According to the Ellen MacArthur Foundation's 2023 report, the market for biodegradable plastics has the potential to expand at a rate of 15% per annum on account of enhancing buyer awareness and pressures from legislation.

Application Insights

The packaging segment held a significant share of the sustainable materials market in 2025 due to the increasing demand for environmentally friendly packaging and growing awareness of environmental issues and legislation. Increasing people's consciousness about environmental issues and the negative effects of plastic wastes on the sea and the land creates a demand for environmentally friendly materials like biodegradable plastics. Sustainable packaging has been incorporated in various food and beverage companies and cosmetic and retailing industries as their corporate social responsibility. The ban on single-use plastics by the European Union, and the rigorous procedures for the management of plastic waste by China have boosted the segment. Moreover, the growing awareness of the environment being surrounded by packaging waste and are demand for sustainable packaging further boosts the utilization of sustainable packaging innovations in this industry.

- The Ellen MacArthur Foundation suggests that the worldwide market for sustainable packaging is rising at a rate of 7% annually and that consumer demand for ‘green' products has not been slowed by the recent recession.

The automotive segment is projected to significantly expand in the sustainable materials market in the coming years, owing to the rising sales of EVs and lightweight materials. Automotive manufacturers continue to innovate on sustainability initiatives; bio-based plastics, used or recycled metals, and renewable composites have been adopted to minimize the weight of automobiles. This improves their fuel efficiency and meets the increasingly stringent emission standards. Furthermore, automobile manufacturers around the world, including Tesla, Ford, and BMW, have declared intentions to use sustainable materials in future models.

- As the IEA report also shows, electric vehicle sales increased by 14 million in 2023, and this trend proves that the market for green solutions in the transportation industry is growing.

End-user Insights

The commercial segment dominated the global sustainable materials market in 2025 due to the incorporation of green building codes and corporate responsibility programs. Companies, especially those operating in retail, office, and hospitality, have been embracing sustainability as a way of adding to their sustainability status. Furthermore, various large-scale organizations are determined to involve eco-friendly materials in construction and rebuilding processes to meet their green initiatives and clients' demands.

- The U.S. Green Building Council, LEED faculties of commercial buildings and structures are 30% energy saving and 35% water saving from those which have no such certification.

The industrial segment is projected to expand rapidly in the sustainable materials market in the coming years, owing to the growing trend of sustainability in manufacturing and other heavy industries. The trend in the use of environmentally friendly materials in industries is attributed to the complete elimination of waste. Automobile manufacturing industries, aerospace sectors, and construction industries are incorporating used metallic materials, bio-based composites, and sustainable insulation materials. Additionally, the increase in the number of industrial sustainability initiatives is expected to fuel this segment as many organizations strive to lower their environmental footprint as well as the costs of operation.

- The IEA has gone further to estimate that industrial energy efficiency measures will cut global CO2 emissions by 25% by 2030.

Regional Insights

Europe held a significant share of the sustainable materials market in 2025 due to the region's stringent environmental policies and total support for sustainability. The European Union has recently put forward its Green Deal package and the Circular Economy Action Plan, which have very high goals in terms of CO2 emission and recycling. Furthermore, the favorable regulatory environment that has been placed on sustainable materials and high consumer visibility in Europe further propels the market in this region. This made European countries pioneers in the implementation of sustainable materials within all industrial fields, such as construction, automobile, and packaging industries.

- In the latest report by the European Environment Agency (EEA), it is stated that Europe is on a better trend through the improvement of recycling rates and the reduction of plastic waste, whereas the EU will recycle 46% of municipal waste in the year 2022.

Asia Pacific is expected to grow with the fastest CAGR in the sustainable materials market during the forecast period, owing to the increase in industrialization, urbanization, and awareness of sustainability. China and India provide relevant investment in environmental protection and sustainable infrastructure. These technologies help to meet the demand of the global market and address severe problems, such as pollution and contributions to climate change, as per signed international treaties.

China's 14th Five-Year Plan underlines the goals related to green development and investment in renewable energy and sustainable materials. The International Energy Agency noted in a report that green technologies such as sustainable materials were adopted most actively in China, with a predicted average growth rate of ten percent in the Asia Pacific market in the subsequent year. Moreover, there is an increasing demand for energy-efficient solutions, a rising middle-income population in the region, and favorable policies to support green building and manufacturing.

Sustainable Materials Market Companies

- 3M Company

- BASF SE

- Coca-Cola Company

- Dow Inc.

- DuPont

- Ford Motor Company

- General Electric

- IBM

- IKEA

- Interface Inc.

- Kimberly-Clark Corporation

- LG Electronics

- Nike, Inc.

- Owens Corning

- Patagonia, Inc.

- Philips Lighting

- Procter & Gamble

- Saint-Gobain

- Schneider Electric

- Siemens AG

- Steelcase Inc.

- Tesla Inc.

- Toyota Motor Corporation

- Unilever

- Vestas Wind Systems

Recent Developments

- In September 2024, PepsiCo introduced a groundbreaking line of beverage bottles crafted from 100% recycled ocean plastic. This initiative is part of PepsiCo's effort to combat plastic pollution and support marine conservation. This move is expected to cut the need for virgin plastic by approximately 10,000 tons annually and aligns with the company's goal of reducing its carbon footprint by 50% by 2030.

- In August 2024, Nike launched a new collection of sneakers under its 'Move to Zero' initiative. This collection aims to support Nike's ambitious target of achieving zero carbon and zero waste. The 'Move to Zero' campaign aims to have all Nike products made from sustainable materials by 2025. Early sales have surpassed projections by 20%, reflecting strong consumer interest in sustainable fashion.

- In July 2024, Coca-Cola unveiled a new bottle cap technology made from plant-based materials, specifically sugarcane-derived polyethylene. This innovation aims to decrease reliance on fossil fuels and enhance the recyclability of packaging. The new caps are expected to reduce carbon emissions associated with cap production by 15% and are part of Coca-Cola's broader strategy to integrate sustainable practices throughout its supply chain.

- In May 2024, BASF announced the launch of a new range of bio-based construction materials designed to enhance sustainability in the building sector. The company projects a 25% reduction in carbon footprints for construction projects using these materials and is also focusing on developing solutions for low-energy and passive house construction.

Segments Covered in the Report

By Type

- Recycled Metals

- Biodegradable Plastic

- Eco-friendly Textiles

- Renewable Fibers

- Sustainable Packaging Material

By Application

- Automotive

- Construction

- Consumer Goods

- Packaging Industry

- Electronics

By End-user

- Commercial

- Residential

- Industrial

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting