Materials for Green Hydrogen Market Size and Forecast 2025 to 2034

The materials for green hydrogen market is witnessing growth as energy companies invest in green fuels. Advanced materials improve electrolysis efficiency, enabling large-scale hydrogen deployment worldwide. Green hydrogen production relies heavily on advanced materials such as membranes, catalysts, electrodes, storage tanks, and pipelines, each playing a vital role in ensuring efficiency and scalability.

Materials for Green Hydrogen MarketKey Takeaways

- Europe dominated the global materials for green hydrogen market in 2024.

- Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By material type, the electrolyzer membranes & electrodes segment held the largest market share in 2024.

- By material type, the storage materials segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the electrolyzer manufacturing segment accounted for a considerable share of the market in 2024.

- By application, the fuel cells segment is projected to experience the highest growth rate between 2025 and 2034.

- By end-user industry, the energy & power segment captured the highest market share in 2024.

- By end-user industry, the mobility & transportation segment is set to experience the fastest CAGR of market growth from 2025 to 2034.

- By distribution channel, the direct supply to the electrolyzer/fuel cell OEMs segment generated the major market share in 2024.

- By distribution channel, the long-term contracts with the energy companies segment are projected to expand rapidly in the coming years.

How is Artificial Intelligence Impacting the Materials for Green Hydrogen Market?

Artificial Intelligence (AI) is revolutionizing the green hydrogen materials landscape by accelerating innovation and optimizing performance. AI-powered modeling tools are being used to design novel catalysts, enabling researchers to predict performance and durability with remarkable precision. Machine learning algorithms assist in simulating material behavior under different electrolysis conditions, thereby reducing the need for lengthy physical trials. AI also enhances predictive maintenance for hydrogen infrastructure by identifying potential failures in membranes, electrodes, or pipelines before they occur. In addition, data-driven approaches streamline supply chain management, ensuring efficient sourcing of critical materials while minimizing costs. As AI continues to evolve, it is poised to become an indispensable enabler in achieving cost-effective and scalable green hydrogen production.

Market Overview

The global materials for green hydrogen market covers the development, production, and supply of specialized materials used in electrolysis, storage, transportation, and end-use applications of green hydrogen. Key materials include catalysts, membranes, electrodes, tanks, pipelines, and structural alloys designed to withstand hydrogen embrittlement, high pressure, and corrosive environments. Growth is driven by the rapid expansion of electrolyzer manufacturing, government decarbonization policies, renewable energy integration, and investments in hydrogen infrastructure for mobility, power, and industrial sectors.

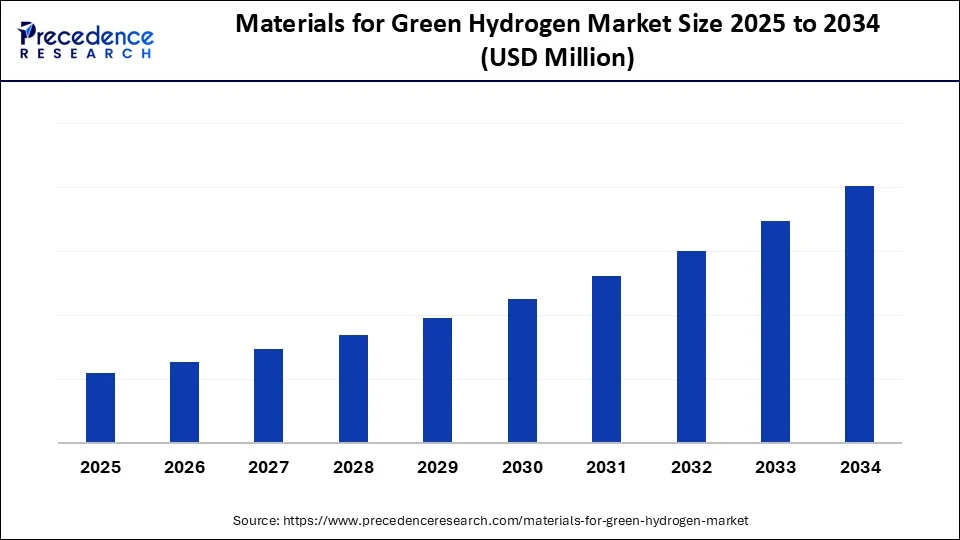

The materials for green hydrogen market is experiencing robust growth due to rising investments in renewable energy infrastructure. With governments setting ambitious net-zero targets, the adoption of hydrogen technologies is scaling rapidly. Materials such as advanced catalysts, ion-exchange membranes, and corrosion-resistant alloys are central to optimizing electrolysis efficiency and reducing overall system costs. Furthermore, the market is supported by collaborations between research institutes and industrial players focused on material innovation. Supply chain localization and recycling are also emerging as key themes to ensure resilience. Overall, the market is projected to expand significantly, driven by the dual forces of policy support and technological advances.

Key Market Trends

- Increasing focus on nanostructured catalysts and high-performance membranes.

- Rising investments in material recycling and circular economy models.

- Growing collaborations between material scientists, energy companies, and governments.

- Rapid advancements in lightweight composites for hydrogen storage solutions.

- Emergence of localized supply chains to reduce geopolitical dependence.

- Integration of digital twins and AI in material testing and development.

Market Scope

| Report Coverage | Details |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Application, End-User Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Decarbonization Goals Fuel Material Innovation in the Materials for Green Hydrogen Market

The most significant driver of the materials for green hydrogen market is the global pursuit of decarbonization and carbon-neutral economies. Countries worldwide are committing to stringent emission reduction targets, creating an urgent need for clean energy alternatives like green hydrogen. This urgency fuels investments in developing cost-efficient and durable materials for electrolysis, storage, and distribution. Materials like corrosion-resistant alloys, advanced composites, and ion-conducting membranes are in high demand to ensure scalability. Furthermore, governments are providing financial incentives and grants to accelerate R&D in advanced material sciences. As industries pivot toward low-carbon processes, the need for cutting-edge materials is expected to grow exponentially. Ultimately, the decarbonization movement acts as a catalyst for innovation, propelling the market forward.

Restraint

High Costs and Supply Chain Vulnerabilities

Despite strong growth prospects, the materials for green hydrogen market faces challenges primarily driven by high costs and supply chain vulnerabilities. Materials such as platinum-group metals, advanced polymers, and specialized ceramics are expensive and often sourced from geopolitically sensitive regions. This dependence increases the risk of price volatility and supply disruptions. The complex manufacturing processes required to produce high-performance membranes and catalysts further add to cost barriers. Additionally, recycling technologies for critical materials remain underdeveloped, exacerbating concerns about resource scarcity. Without significant breakthroughs in cost reduction and recycling, the large-scale deployment of green hydrogen infrastructure may face bottlenecks. Addressing these restraints will be critical to achieving the industry's long-term growth potential.

Opportunity

The Path to Scalable Hydrogen Infrastructure

The growing need for large-scale hydrogen infrastructure presents immense opportunities for the materials market. Electrolyzers, pipelines, storage tanks, and fuel cells all depend on specialized materials with superior efficiency and durability. This infrastructure expansion is creating demand for both established materials and next-generation composites. Emerging opportunities lie in recycling rare elements used in catalysts, reducing reliance on imports, and enhancing sustainability. Additionally, opportunities are emerging in hybrid material innovations that combine strength, conductivity, and lightness. Private and public investments in hydrogen hubs, ports, and industrial clusters further amplify the need for advanced material solutions. Thus, the path toward scalable hydrogen infrastructure offers a vast horizon of opportunities for manufacturers and innovators in this field.

Material Type Insights

Why Electrolyzer Membrane & Electrodes Are Dominating the Materials for Green Hydrogen Market?

Electrolyzer membranes and electrodes form the backbone of green hydrogen production, making them the most dominant material category in this market. Their efficiency directly determines the performance, durability, and scalability of electrolyzers, which are central to large-scale hydrogen generation. With increasing investments in renewable-powered hydrogen plants, demand for high-performance membranes and electrodes is surging. Their dominance is further reinforced by continuous R&D aimed at reducing costs and enhancing conductivity. Governments and private players alike are prioritizing these materials to ensure high conversion efficiency and long-term reliability. As electrolyzer deployment accelerates worldwide, membranes and electrodes will remain the cornerstone of green hydrogen infrastructure.

Their dominance is further reinforced by continuous R&D aimed at reducing costs and enhancing conductivity. Governments and private players alike are prioritizing these materials to ensure high conversion efficiency and long-term reliability. As electrolyzer deployment accelerates worldwide, membranes and electrodes will remain the cornerstone of green hydrogen infrastructure. Additionally, the widespread adoption of proton exchange membrane (PEM) and solid oxide electrolyzers highlights the indispensable role of advanced materials in enabling efficiency gains. The ability of electrodes and membranes to withstand extreme operating conditions while minimizing degradation gives them a technological edge that alternative materials cannot match.

Storage materials are rapidly emerging as the fastest-growing category, driven by the need to safely and efficiently store hydrogen for transport, mobility, and industrial use. With hydrogen's low volumetric energy density, advanced storage materials such as high-pressure composites, metal hydrides, and cryogenic systems are gaining significant attention. The rise of hydrogen-powered mobility, including fuel-cell vehicles and aircraft concepts, is amplifying the importance of storage innovation. Countries focusing on hydrogen trade and cross-border supply are also fueling this growth. As technology matures, storage materials are expected to witness exponential adoption, bridging the gap between hydrogen production and end-use consumption.

The rise of hydrogen-powered mobility, including fuel-cell vehicles and aircraft concepts, is amplifying the importance of storage innovation. Countries focusing on hydrogen trade and cross-border supply are also fueling this growth. As technology matures, storage materials are expected to witness exponential adoption, bridging the gap between hydrogen production and end-use consumption. Moreover, the global ambition to establish hydrogen export-import corridors places storage at the heart of the supply chain, making it not just a support material but a critical enabler of international hydrogen commerce. This ensures that storage materials will expand their footprint well beyond niche applications into mainstream energy infrastructure.

Application Insights

Why Electrolyzer Manufacturing Is Dominating the Materials for Green Hydrogen Market?

The electrolyze manufacturing is dominating the market, as these systems are indispensable for converting renewable electricity into green hydrogen. Global investments in gigawatt-scale hydrogen projects are driving the demand for high-quality materials that enhance electrolyzer performance and reduce degradation. The dominance of this application is further supported by supportive government policies and subsidies promoting green hydrogen adoption. Manufacturers are focusing on scaling up production lines while improving efficiency, reinforcing the centrality of this segment. As nations race to decarbonize heavy industries, electrolyzer manufacturing will continue to command the largest market share.

Manufacturers are focusing on scaling up production lines while improving efficiency, reinforcing the centrality of this segment. As nations race to decarbonize heavy industries, electrolyzer manufacturing will continue to command the largest market share. Beyond utility-scale projects, the increasing commercialization of modular electrolyzers for localized hydrogen production strengthens the application's dominance. This flexibility ensures that electrolyzer materials find use not only in massive industrial hubs but also in smaller distributed generation models.

Fuel cells are the fastest-growing segment in the materials for green hydrogen market, due to their role in mobility and distributed energy generation. Hydrogen-powered fuel cells are being adopted in buses, trucks, trains, and even aircraft prototypes, creating vast demand for specialized materials. Rapid urbanization, coupled with global commitments to net-zero emissions, is accelerating fuel cell integration into power systems and transportation networks. The versatility of fuel cells across stationary and mobile applications further strengthens their growth trajectory. With technological advancements improving durability and lowering costs, fuel cells are poised to become a central pillar of the hydrogen economy.

In addition, the growing recognition of fuel cells as a complementary technology to batteries offers them an advantage in hybrid energy systems, particularly where long-duration energy storage and heavy-duty transport are concerned. This positioning amplifies their role as a high-growth application in the hydrogen landscape.

End User Insights

Why Energy & Power Are Dominating the Materials for Green Hydrogen Market?

The energy and power sector is the dominant end-user segment, as green hydrogen is increasingly deployed for grid stabilization, energy storage, and large-scale industrial decarbonization. Power utilities are integrating hydrogen into renewable energy projects to balance intermittent supply and demand. Its role in replacing fossil fuels in power generation, refining, and ammonia production further cements its dominance. Government-backed energy transition strategies continue to prioritize hydrogen adoption in the power sector. With global momentum toward clean energy, this segment will remain at the forefront of hydrogen material demand.

Government-backed energy transition strategies continue to prioritize hydrogen adoption in the power sector. With global momentum toward clean energy, this segment will remain at the forefront of hydrogen material demand. Furthermore, hydrogen's capacity to serve as a long-duration storage solution enhances its relevance for the power industry, enabling renewable electricity to be stored seasonally and released on demand. This ensures its dominance not only in current projects but also in long-term energy planning.

Mobility and transportation represent the fastest-growing end-user, driven by the rapid adoption of hydrogen fuel cell vehicles and the push for cleaner logistics. Hydrogen-powered buses, trucks, ships, and trains are gaining traction as alternatives to battery electric vehicles in long-range and heavy-duty applications. The aviation industry is also exploring hydrogen-based propulsion, adding another layer of growth. As governments roll out hydrogen corridors and refueling infrastructure, demand from this segment is expected to skyrocket. The transportation sector's transition toward hydrogen will create significant opportunities for advanced materials tailored to mobility solutions.The strong alignment of hydrogen mobility with zero-emission policies worldwide ensures accelerated adoption, while pilot projects in the aviation and maritime sectors signal its expansion beyond land-based transportation. This makes mobility the most dynamic and future-oriented end-user segment.

Distribution Channel Insights

Why Direct Supply to Electrolyzer / Fuel Cell OEMs Is Dominating the Market?

The direct supply to the electrolyzer is dominating the market because most material suppliers focus on establishing strong partnerships with equipment producers. This channel ensures quality control, customization, and faster adoption of advanced materials into commercial electrolyzers. The rising number of large-scale electrolyzer manufacturing facilities has further solidified this model. Material suppliers benefit from direct collaborations, ensuring they meet performance specifications and long-term reliability requirements. Given the concentrated nature of the electrolyzer market, this channel will continue to lead.

The long-term contract with energy is the fastest-growing in the market, reflecting the rising trend of integrated hydrogen supply chains. Energy companies are increasingly securing stable supplies of membranes, electrodes, and storage materials to support their large-scale projects. Such contracts reduce risks of price volatility and ensure supply security, especially for multi-gigawatt projects tied to national decarbonization plans. As hydrogen hubs and cross-border projects expand, long-term material agreements will become a standard practice. This shift toward strategic partnerships positions energy companies as a key growth driver for material suppliers.

Regional Insights

Why Europe is Leading the Materials for Green Hydrogen Market?

Europe dominated the green hydrogen materials market, Europe currently dominates the global market, driven by strong policy frameworks, green energy funding, and leadership in material science innovation. The European Union's ambitious hydrogen roadmap has spurred significant investments in electrolyzer manufacturing and infrastructure development. European research institutions are at the forefront of developing next-generation membranes and catalysts with improved performance and lower costs. Additionally, collaborations between European governments, universities, and private enterprises are fostering innovation ecosystems. The continent's commitment to a circular economy is also pushing advancements in material recycling and sustainable sourcing. With strong policy backing and a robust innovation base, Europe is positioned as the undisputed leader in shaping the future of this market.

Why Is Asia Pacific Leading the Materials for Green Hydrogen Market?

Asia Pacific is rapidly emerging as the fastest-growing region in the materials for green hydrogen market, fueled by rising energy demand and strong government commitments to net-zero goals. Countries such as China, Japan, South Korea, and India are heavily investing in hydrogen projects and building large-scale production facilities. This surge is driving demand for specialized materials like advanced alloys, composites, and high-performance membranes. Furthermore, the region benefits from its strong manufacturing base, which enables cost-effective scaling of material production. Strategic collaborations with global technology leaders are also helping accelerate innovation. As the Asia Pacific continues to prioritize energy independence and sustainability, its role in driving the global materials for the green hydrogen market will become increasingly pivotal.

Materials for Green Hydrogen Market Companies

- Air Liquide

- Linde plc

- Air Products & Chemicals

- Plug Power

- Nel ASA

- Siemens Energy

- ITM Power

- BP plc

Recent Developments

- In August 2025, Toyota Chairman Akio Toyoda recently remarked that a single electric vehicle (EV) generates as much pollution as three hybrid vehicles combined. In the context of escalating climate change impacts, alternative green fuels such as hydrogen are emerging as a promising solution. However, if the process of extracting hydrogen, such as splitting it from water, results in carbon emissions, it cannot be considered a truly clean energy source. Moreover, existing methods of producing genuine green hydrogen remain highly cost-intensive. (Source: https://www.thehindubusinessline.com)

Segments Covered in the Report

By Material Type

- Catalysts (Platinum, Iridium, Nickel-based, non-precious metal catalysts)

- Electrolyzer Membranes & Electrodes (PEM, Alkaline, Solid Oxide)

- Storage Materials (Carbon Fiber Composites, Advanced Polymers, Metal Hydrides)

- Pipeline & Distribution Materials (Stainless Steel, Composite Pipes, Hydrogen-Compatible Alloys)

- Insulation & Sealing Materials (Polymers, Elastomers, Coatings)

By Application (Value Chain Stage)

- Electrolyzer Manufacturing

- Hydrogen Storage (tanks, underground storage, hydrides)

- Hydrogen Transportation (pipelines, shipping)

- Fuel Cells (mobility, stationary power)

- Industrial End-Use (refining, steel, ammonia, chemicals)

By End-User Industry

- Energy & Power (renewable integration, grid balancing)

- Mobility & Transportation (fuel cell vehicles, aviation, shipping)

- Industrial Manufacturing (steel, cement, chemicals)

- Oil & Gas (refining, blending)

- Aerospace & Defense

- Research & Pilot Projects

By Distribution Channel

- Direct Supply to Electrolyzer / Fuel Cell OEMs

- Materials Distributors & Specialized Suppliers

- Long-Term Contracts with Energy Companies

- Online / Technical Procurement Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting