What is the Low-Loss Materials for 5G Market Size?

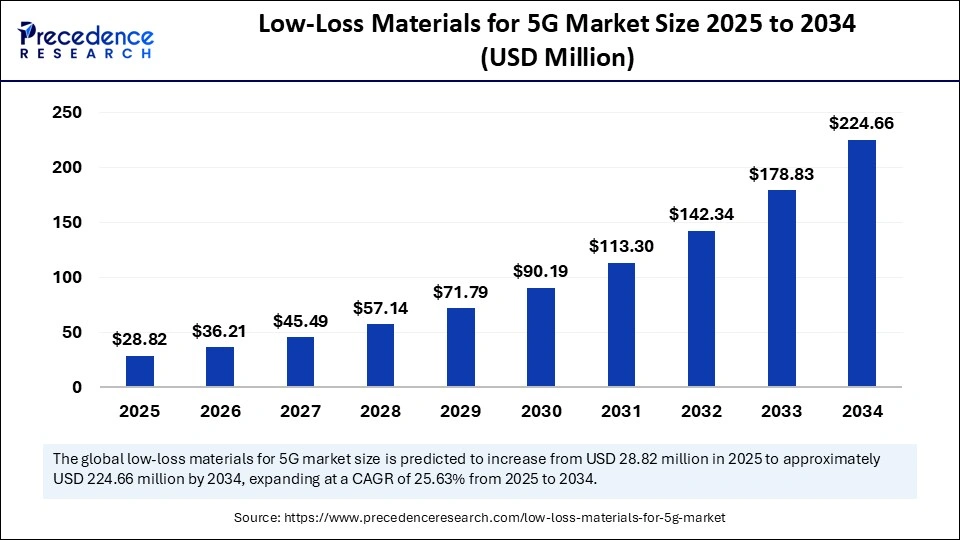

The global low-loss materials for 5G market size accounted for USD 28.82 million in 2025 and is predicted to increase from USD 36.21 million in 2026 to approximately USD 224.66 million by 2034, expanding at a CAGR of 25.63% from 2025 to 2034. The market for low-loss materials for 5G is driven by rising demand for high-speed, low-latency 5G connectivity.

Market Highlights

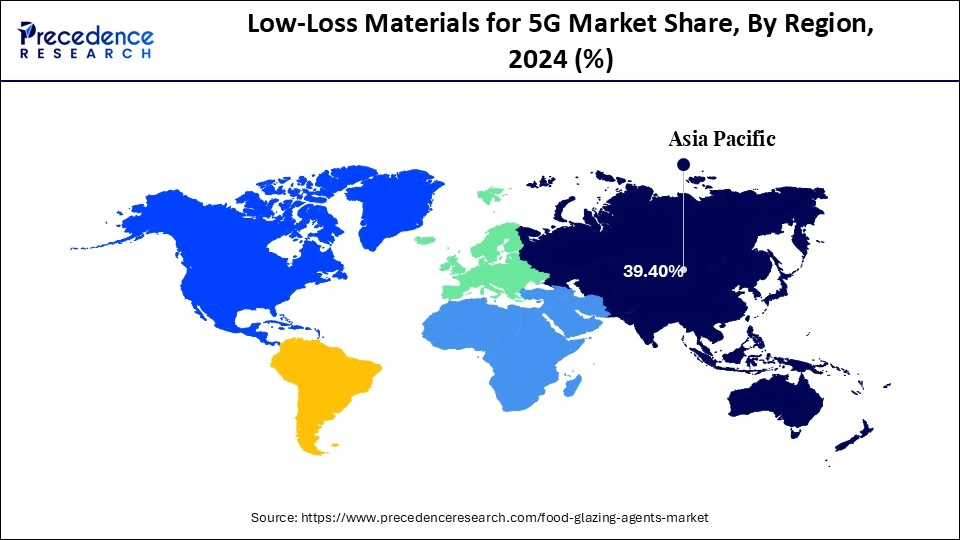

- Asia Pacific dominated the market, holding the largest market share of 39.4% in 2024 and is expected to grow at a 14.5% CAGR between 2025 and 2034.

- By material type, the polytetrafluoroethylene segment held the largest market share of 42.3% in 2024.

- By material type, the liquid crystal polymer segment is expected to grow at a remarkable CAGR of 13% between 2025 and 2034.

- By product form, the sheets & laminates segment contributed the highest market share of 50.4% in 2024.

- By product form, the films segment is growing at a strong CAGR of 13.4% from 2025 to 2034.

- By application, the antennas & radomes segment generated the biggest market share of 44.4% in 2024.

- By application, the RF modules & components segment is poised to grow at a solid CAGR of 13.2% from 2025 to 2034.

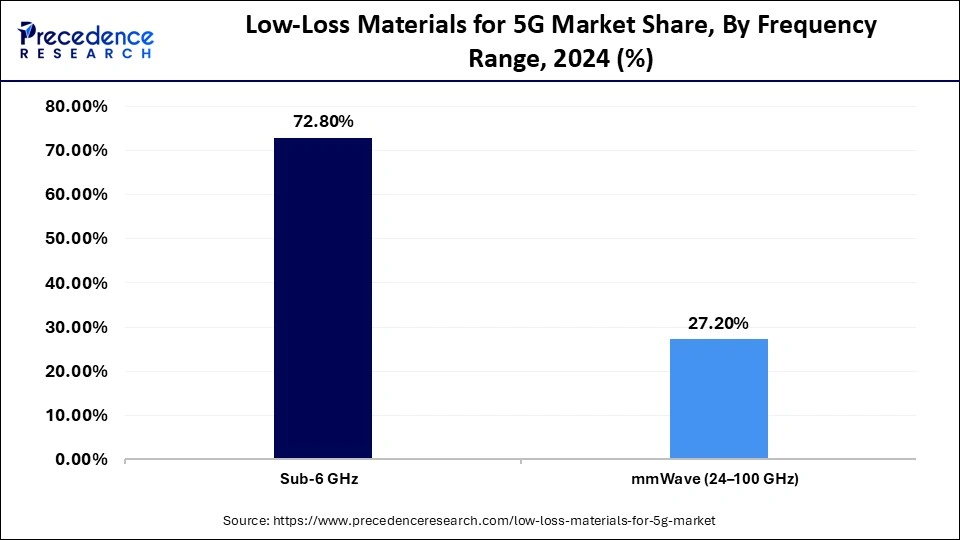

- By frequency range, the sub-6 GHz segment held the biggest market share of 72.8% in 2024.

- By frequency range, the mmwave (24–100 GHz) segment is expanding at a healthy CAGR of 13.3% between 2025 and 2034.

- By end use, the base stations segment captured the maximum market share of 40.5% in 2024.

- By end use, the smartphones and consumer device segment is expected to grow at a remarkable CAGR of 13.6% between 2025 and 2034.

Revolutionizing Connectivity: How Low-Loss Materials Are Powering the 5G Revolution

The low-loss materials for 5G market comprise the specialized dielectric and conductive materials that have been developed to minimize signal attenuation, delay, and thermal losses in high-frequency communication networks. As the 5G technology uses both sub-6 GHz and mmWave spectrums, signal integrity and energy efficiency are now important. These materials include polytetrafluoroethylene (PTFE), liquid crystal polymer (LCP), polyphenylene oxide (PPO), and high-level ceramics, which are used in components such as antennas, printed circuit boards (PCBs), radomes, and substrates.

Market growth is driven by the rapid deployment of 5G base stations, the growing use of high-frequency modules in smartphones and IoT devices, and the trend toward miniaturized RF components. As the world moves faster with telecom providers deploying 5G, demand has shifted toward materials that preserve signal fidelity at higher frequencies and enable the design of small, lightweight devices. The further advancement of materials is driven by innovations in low-dielectric-constant (dk) and low-dissipation-factor (df) polymer and hybrid ceramic composites to meet high-performance standards.

AI-Powered Advancements: Driving Precision and Performance in 5G Materials

Artificial intelligence is transforming the market by accelerating material innovation, optimizing processes, and analyzing performance. Simulations and predictive modeling based on AI help researchers develop materials with controlled dielectric properties, low dissipation factors, and improved thermal stability, thereby saving on development time and cost. In the manufacturing industry, AI is used to improve quality by detecting defects in real time and automating processes to improve material consistency. Moreover, the design of antennas and substrates with AI assistance enables the creation of miniaturized, high-frequency elements. With the development of the 5G ecosystem, material R&D and production are being combined with AI innovation to accelerate innovation, offering scalable, energy-efficient, and high-performance solutions for next-generation communication systems.

Low-Loss Materials for 5G Market Outlook

The increased adoption is being experienced in the market by the growth of 5G base stations, antennas, and RF modules that demand high signals. Continued research on low-dk/df polymer and ceramic substrates is improving performance in high-speed communication systems, particularly in reliability and thermal control.

The market is being led by Asia-Pacific due to massive 5G deployments in China, South Korea, and Japan, and then increasing infrastructure spending in North America and Europe. The emerging economies are also increasing their deployment speed, and new markets are emerging where suppliers of materials and OEMs can find new opportunities.

Market giants like Rogers Corporation, DuPont, Panasonic, and Mitsubishi Chemical are also spending heavily on new state-of-the-art low-loss materials to bolster their 5G offerings. The future needs to innovate substrate and laminate technologies through strategic mergers and alliances.

There is a dynamic startup atmosphere that is taking shape and is aimed at sustainable, miniaturized, and high-performance material solutions of next-gen wireless systems. Advanced polymers, nano-ceramics, and flexible substrates startups are coming into play with low sourcing of them by telecom and semiconductor giants.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 28.82 Million |

| Market Size in 2026 | USD 36.21 Million |

| Market Size by 2034 | USD 224.66 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 25.63% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North Ameirca |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Product Form, Application, Frequency Range, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Low-Loss Materials for 5G Market Segment Insights

Material Type Insights

Polytetrafluoroethylene: The polytetrafluoroethylene segment held a 42.3% share of the low-loss materials market for the 5G market in 2024, due to its excellent dielectric properties, chemical inertness, and thermal stability. This low dielectric constant and dissipation factor make PTFE the best material for high-frequency 5G applications, such as antennas, circuit boards, and radomes. Also, the ability of PTFL to work with advanced composite structures and multilayer laminates facilitates miniaturization and lightweight design, which are required for next-generation devices. Constant developments in processing methods and PTFE-based substrates are also enhancing its dominance in high-performance communication infrastructure.

Liquid Crystal Polymer: The liquid crystal polymer segment captured a 13.0% market share in 2024 and is expected to grow significantly due to its high electrical insulation, low moisture content, and wide dimensional stability. The characteristic of LCP in ensuring stability in its dielectric properties at mmWave frequencies, combined with its high flexibility, makes it a perfect material for flexible circuits, antennas, and 5G modules. It is lightweight and can be shaped easily, making it easy to incorporate into the device, which aligns with the growing trend of miniaturized RF devices.

Polyphenylene Oxide (PPO): PPO-based composites are known to exhibit good mechanical strength, low water absorption, and stable dielectric properties, and are applicable to multilayer PCBs and RF circuit boards. This is because the material is compatible with copper cladding and resistant to high thermal stress, which can be employed in high-density interconnects of 5G infrastructure. To achieve the highest signal integrity and the lowest production cost, manufacturers are planning to produce more PPO mixes with polystyrene and other resins. As 5G adoption increases, the PPO segment can be popularized for medium-frequency, cost-sensitive applications.

Product Form Insights

Sheets & Laminates: The sheets & laminates segment held a 50.4% share in the low-loss materials for 5G market in 2024, driven by their ubiquitous application in printed circuit boards (PCBs), antenna substrates, and radomes. These materials provide high-dimensional stability and mechanical and dielectric consistency required for 5G transmission of high-frequency signals. Base stations and communication facilities cannot function without sheets and laminates manufactured with PTFE, PPO, and ceramic composites to ensure low signal attenuation and optimal thermal control. The fact that they can be integrated into multilayer structures and that they can be easily produced only adds to production efficiency.

Films: The films segment captured a 13.4% share of the low-loss materials for 5G market in 2024. The filtration materials used to fabricate films based on liquid crystal polymers (LCPs) and polyimides are ideal for compact and foldable devices, antennas, and wearable electronics, owing to their flexibility and low dielectric behaviour. Further intensifying the uptake of low-loss films is the trend toward the miniaturization of RF modules and mobile components. There is also the development of ultra-thin film technology, which is increasing integration efficiency and lowering the devices overall weight, putting this segment on a path of sustained growth.

Tapes & Coatings: The tapes & coatings are dielectrically insulated, waterproof, and thermally protective for antennas, connectors, and PCBs. The coating, made of a PTFE-based, ceramic-impregnated material, reduces electromagnetic interference (EMI) and preserves signal quality at elevated frequencies. New technologies for consistent nanocoating and conductive adhesives are being developed to enhance performance consistency and energy efficiency. With the increasing size and complexity of 5G devices, tapes and coatings are becoming increasingly significant for reliability and longevity.

Application Insights

Antennas & Radomes: The antennas & radomes segment led the market, accounting for 44.4% share in 2024, driven by the growth in 5G base stations and the unprecedented deployment of high-frequency antennas. The application of sophisticated PTFE, ceramic, and composite materials is prevalent to enhance signal efficiency and stability, especially in outdoor and automotive communication networks. Polymer-based radomes with low loss have enhanced resistance to the stress environment and also RF transparency. The segment leadership position is supported by growing demand for mmWave antennas in smartphones, IoT devices, and infrastructure equipment.

RF Modules & Components: The RF modules & components segment is expected to grow at a significant CAGR over the forecast period, with a 13.2% market share. The implementation of high-speed wireless communication technologies. To maintain signal strength and reduce interference at high frequencies, RF front-end modules, filters, and couplers must be fabricated from low-loss materials. The trend toward smaller, more energy-efficient 5G components is driving demand for high-performance materials, such as LCP and PPO composites. The current material engineering and high-frequency packaging solutions research further improves the performance of this segment and enhances its scalability.

Printed Circuit Boards: The printed circuit boards segment contributed a significant portion of the low-loss materials for 5G market in 2024, due to the essential use of the PCBs in the transmission of high-frequency data over 5G hardware. PCBs require materials with uniform dielectric properties, low dissipation, and high heat resistance to ensure uniform performance in a fast network. PTFE, PPO, and hybrid ceramic laminates are being used to design multilayer PCBs with lower signal loss and reduced electromagnetic interference. The demands on PCB materials have also increased, as the complexity of 5G systems and massive MIMO and beamforming systems has grown.

Frequency Range Insights

Sub-6 GHz: The Sub-6 GHz segment held a 72.8% share of the low-loss materials for 5G market in 2024. The frequency range strikes a good compromise between coverage, capacity, and signal penetration, making it ideal for urban, suburban, and rural deployment. Low-loss materials, including PTFE, PPO, and LCP, are used in antennas and RF modules to transmit signals and maintain low attenuation. These conditions for an active market, leading and growth trajectory will persist as telecom operators around the globe begin to roll out their Sub-6 GHz 5G infrastructure.

mmWave (24-100 GHz): The mmWave (24-100 GHz) segment is poised for substantial growth in the low-loss materials for 5G market, holding a 13.3% share in 2024, driven by the desire to achieve extremely high-speed and low-latency communication in the high-density urban areas. mmWave frequencies enable high data rates to support applications in smart cities, autonomous systems, and high-definition streaming. With the current increase in technology and faster network densification, the adoption of mmWave is poised to rise considerably, offering strong prospects for new low-loss material applications, particularly for next-generation 5G and beyond.

End Use Insights

Base Stations: The base stations segment led the market, accounting for 40.5% in 2024, driven by the mass deployment of 5G infrastructure across cities and rural areas. Base stations require high dielectric stability, small signal loss, and thermal management materials to enable them to provide high-frequency and capacity data transmission. PTFE, ceramic composites, and laminates are used in antennas, radomes, and circuit boards to ensure device performance is not affected in harsh outdoor environments. The growing demand for mmWave base stations, small-cell networks, and beamforming technology has led to the adoption of low-loss materials as the optimal solution for channel-optimized signal propagation.

Smartphones & Consumer Devices: The segment is projected to grow at a significant CAGR over the forecast period, with a 13.6% share in 2024. Driven by the 5G opportunities of mobile and wearable electronics. Polyimides and LCPs are low-loss materials that have been used in antennas, flexible circuits, and RF modules to ensure consistent signal behaviour and enable miniature designs. The necessity of smartphones, tablets, and AR/VR devices to operate with fast and low-latency internet connections is shaping the creation of materials with opportunities, including miniaturization and energy efficiency.

Automotive (V2X Communication): The automotive (V2X Communication) market took a significant portion of the low-loss materials for 5G market in 2024, with the help of the increasing use of cellular vehicle-to-everything (V2X) technologies. Antennas, sensors, and control units in automotive applications require low-loss materials that enable real-time data transfer among vehicles, infrastructure, and pedestrians. Substances such as PTFE and ceramic composites are very signal-clear and electromagnetic-compatible, making them safe and reliable for connected and autonomous vehicles. The increased use of 5G-based telematics and advanced driver-assistance systems (ADAS) is also driving demand.

Low-Loss Materials for 5G MarketRegion Insights

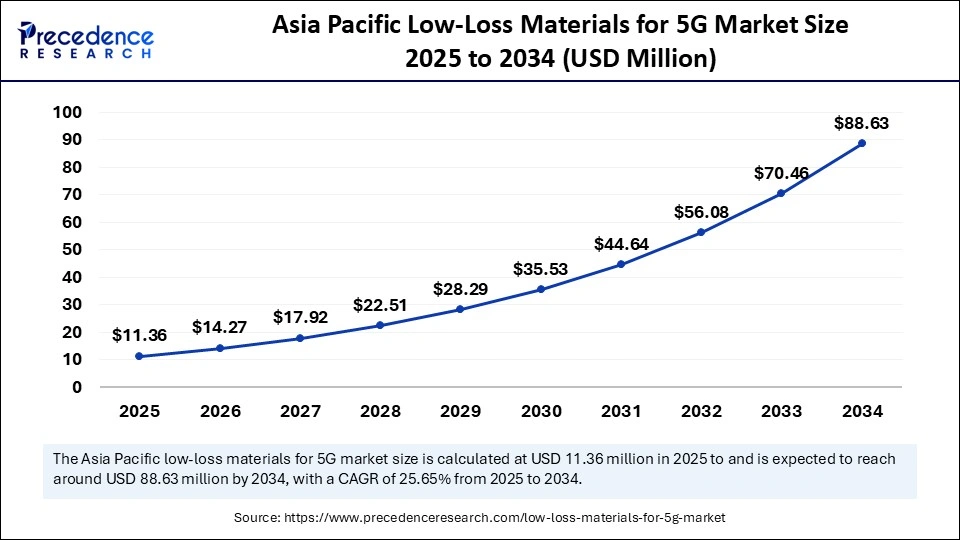

The Asia Pacific low-loss materials for 5G market size is expected to be worth USD 88.63 million by 2034, increasing from USD 11.46 million by 2025, growing at a CAGR of 25.64% from 2025 to 2034.

Why Did Asia Pacific Lead the Global Low-Loss Materials for 5G Market in 2024?

Asia Pacific led the global market with the highest market share of 39.4% in 2024, driven by rapid 5G innovation and substantial government financing for digital transformation. China, Japan, and South Korea are at the forefront of base station and mmWave network deployment, a trend driving high demand for PTFE, LCP, and low-loss ceramic-made materials. Market growth is further increased by the booming smartphone production, IoT applications, and smart city development. Besides, the growing partnerships between local material manufacturers and international OEMs are driving the development of new technologies for advanced substrates and laminates, making the Asia Pacific the center of 5G material production and utilization.

China Low-Loss Materials for 5G Market Analysis

In 2024, China occupied the first position in the Asia Pacific low-loss materials for 5G market, which was explained by the active implementation of the 5G base stations and significant funding of the national high-speed communication infrastructure in the country. With a well-developed electronics manufacturing industry and powerful government policies, including Made in China 2025, the country can produce high-end materials to build 5G-related products locally. In addition, the rapid adoption of 5G-enabled phones, industrial IoT networks, and connected vehicles has driven unabated material demand.

North America is estimated to achieve the highest CAGR throughout the forecast period, driven by rapid 5G deployment, robust industry growth, and the presence of major technology and telecommunications companies. The region emphasis on mmWave networks, smart infrastructure, and connected industries is increasing the need for advanced, low-loss materials. New opportunities in material innovation are associated with high-frequency applications in defense, aerospace, autonomous vehicles, and industrial IoT. The use of PTFE, LCP, and ceramic materials in the U.S. and Canada is growing as companies seek to improve signal integrity and energy efficiency in communication equipment modules. Technological innovations are driven by strategic alliances among suppliers and manufacturers of materials, chip companies, and telecommunications companies.

U.S Low-Loss Materials for 5G Market Trends

The U.S. is the growth leader in North America in the low-loss materials for 5G market, with the massive effort of modernizing the networks and robust investments into semiconductor manufacturing. The introduction of 5G by major cell phone companies in the country and government-funded infrastructure projects are augmenting demand for high-performance dielectric products. Rogers Corporation, DuPont, and 3M, the American companies, are pioneers in innovative PTFE and LCP antenna, PCB, and RF module composites. With the spread of 5G into autonomous vehicles, healthcare, and defense, the U.S. remains a key driver of global trends in the engineering of high-frequency materials.

The European low-loss material for 5G market is experiencing sustainable growth because of the increased investments in the 5G infrastructure, increased smart manufacturing, and increased necessity to offer high-speed connectivity in industries. The regions digital transformation and green communication technologies are driving the adoption of energy-efficient, low-loss materials such as PSOE, ceramic composites, and PPO laminates. Major European telecom network operators and material manufacturers are working together to develop high-performance substrates used in base stations, antennas, and RF modules that meet the stringent environmental and performance requirements.

UK Low-Loss Materials for 5G Market Trends

The UKs low-loss material for 5G market has gained momentum at a growing pace because the UK is resolved to become a nation with full 5G coverage and the evolution of the digital connection. Government-funded initiatives, including the 5G Testbeds and Trials Programme, are promoting innovation in high-frequency materials for communication infrastructure and smart city initiatives. UK-based research facilities and startups are busy developing more advanced dielectric polymers and ceramic composites for use in antennas, PCBs, and radar systems. The powerful automotive, aerospace, and defense industries in the country are also driving the adoption of low-loss materials for data transmission with high security and high speed.

Low-Loss Materials for 5G Market Companies

DuPont de Nemours, Inc. is a company engaged in the supply of high-speed speed low low-loss 5G and mmWave LCP films and Pyralux laminates.

Offers high-frequency circuit materials of type RO3000(r), RO4000(r) series that are ensured to deliver high signal integrity with 5G antennas and base stations.

Develops low dielectric material and thermally stable substrate in miniature and mini high-performance RF modules.

Mitsui Chemicals produces high-purity polymer resins and dielectric materials, which are 5G communications and semiconductor packaging optimization.

It produces the low-loss materials made out of fluoropolymer and ceramics utilized in the 5G networks in the antennas, radomes, and high-frequency PCBs.

Provides high-performance, low-loss laminates such as RO3000 and RO4000 series used in 5G antennas, base stations, mmWave devices, and high-frequency circuit boards requiring excellent dielectric stability.

Supplies advanced low-loss materials including PTFE laminates, flexible circuit materials, and high-frequency dielectrics designed for 5G RF modules, antennas, and high-speed interconnects.

Offers low-loss multilayer circuit materials and high-frequency resin systems used in 5G infrastructure, small-cell antennas, and high-speed IC packaging.

Develops specialty resins and low-dielectric materials engineered for mmWave 5G applications, semiconductor packaging, and high-density interconnects.

Produces fluoropolymer-based laminates, ultra-low-dielectric glass materials, and high-frequency substrates suitable for 5G antennas, phased-array modules, and RF front-end devices.

Recent Developments

- In September 2023, Shin-Etsu Chemical further advanced its Qromis Substrate Technology (QST) for GaN power devices, a breakthrough in high-performance materials. Although it is primarily focused on power electronics, this low-loss substrate technology has great potential to improve the efficiency and reliability of 5G components.(Source: https://www.shinetsu.co.jp)

- In June 2023, Doosan Corporation Electro-Materials launched its next-generation 5G connectivity solutions at IMS 2023, the Microwave/RF Exhibition in North America. These materials and mmWave antenna technologies were developed in cooperation with Movandis BeamX beamforming platform and are intended to enhance signal performance in small cells and wireless repeaters, accelerating the deployment of scalable5G infrastructure.(Source:https://cm.asiae.co.kr)

Low-Loss Materials for 5G MarketSegments Covered in the Report

By Material Type

- Polytetrafluoroethylene (PTFE)

- Liquid Crystal Polymer (LCP)

- Polyphenylene Oxide (PPO)

- Ceramics (Alumina, LTCC)

- Others (Polyimide, PPE, Resin Blends)

By Product Form

- Sheets & Laminates

- Films

- Tapes & Coatings

- Substrates

By Application

- Antennas & Radomes

- Printed Circuit Boards (PCBs)

- RF Modules & Components

- Cables & Connectors

By Frequency Range

- Sub-6 GHz

- mmWave (24-100 GHz)

By End Use

- Base Stations

- Smartphones & Consumer Devices

- Automotive (V2X Communication)

- Network Infrastructure Equipment

- Aerospace & Defense

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting