What is the Cellular Vehicle-to-Everything (C-V2X) Market Size?

The global cellular vehicle-to-everything (C-V2X) market size was calculated at USD 1.25 billion in 2024 and is predicted to increase from USD 1.66 billion in 2025 to approximately USD 21.91 billion by 2034, expanding at a CAGR of 33.16% from 2025 to 2034. The market is experiencing significant growth, primarily due to the growing demand for connected mobility and enhanced road safety. This is further driven by the increasing adoption of autonomous vehicles, which rely heavily on real-time, low-latency communication, infrastructure, and pedestrians. Additionally, the rollout of 5G networks provides robust, high-speed, and reliable connectivity, further accelerating market growth.

Market Highlights

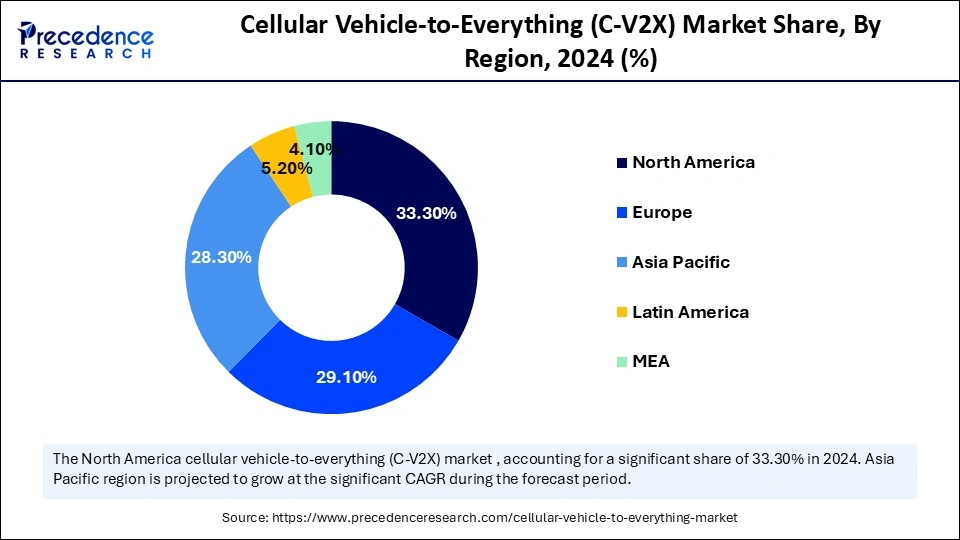

- North America held the largest cellular vehicle-to-everything (C-V2X) market share of 33.3% in 2024.

- Asia Pacific region is expected to witness the fastest CAGR during the foreseeable period.

- By communication type, the vehicle-to-vehicle (V2V) segment held the largest market share of 34.2% in 2024.

- By communication type, the vehicle-to-grid (V2G) segment is expected to witness the fastest CAGR of 15.1% during the foreseeable period.

- By offering, the hardware segment dominated with a market share 60% in 2024.

- By offering, the services segment is anticipated to grow at a 13.2% CAGR from 2025 to 2034.

- By vehicle type, the passenger vehicles segment led with a market share of 52.8% in 2024.

- By vehicle type autonomous vehicles segment is expanding at a 16.4% CAGR from 2025 to 2034.

- By application, the traffic management segment held the major market share of 26.5% in 2024.

- By application, the autonomous driving segment is expected to witness the fastest CAGR of 14.8% during the foreseeable period.

- By technology, the LTE-V2X segment led the market in 2024 and is expected to grow further in the coming years.

- By end user, the automotive OEMs segment held the largest market share of 39.7% in 2024.

- By end user, the telecom providers segment is expected to witness the fastest CAGR of 12.7% during the foreseeable period.

Market Size and Forecast

- Market Size in 2024: USD 1.25 Billion

- Market Size in 2025: USD 1.66 Billion

- Forecasted Market Size by 2034: USD 21.91 Billion

- CAGR (2025-2034): 33.16%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Cellular Vehicle-to-Everything (C-V2X)?

Cellular Vehicle-to-Everything (C-V2X) stands for a communication system that enables vehicles to exchange real-time information with a wide range of entities. This communication network is based on 3GPP LTE and 5G cellular standards. This technology enables communication between vehicles (V2V), vehicles and infrastructure (V2I), vehicles and pedestrians (V2P), and vehicles and the broader network (V2N) using cellular networks.

How Can AI Impact the Cellular Vehicle-to-Everything (C-V2X) Market?

Artificial intelligence (AI) is transforming the cellular vehicle-to-everything (C-V2X) market by analyzing vast amounts of real-time data from vehicles and infrastructure, enabling advanced capabilities like predictive traffic management, enhanced safety features, and optimized traffic flow. AI improves accident prevention and allows for faster emergency response by enabling vehicles and infrastructure to communicate and coordinate more effectively. Furthermore, the AI helps to manage traffic more efficiently by providing real-time data analytics for better route planning, congestion reduction, and traffic signal optimization.

What Are the Key Trends in the Cellular Vehicle-to-Everything (C-V2X) Market?

- Development of Smart Cities: The growth of urban areas and the concept of smart cities, which prioritize intelligent transportation systems to manage traffic and improve urban living, along with governments and urban planners, are investing in smart city infrastructure, contributing to C-V2X demand.

- Government Support and Regulations:Governments worldwide are actively promoting C-V2X technology to reduce traffic congestion, lower accident rates, and improve overall road safety through investments.

- Increasing Vehicle Electrification and Sales: The rapid growth of the automotive industry, coupled with the manufacturing of electric and connected vehicles, is creating a larger market for integrated C-V2X solutions.

- Growing Demand for Vehicle Telematics: The increasing popularity of vehicle telematics, which provides valuable data for vehicle management and driver assistance, along with smartphone connectivity, further drives the demand for connected technologies like C-V2X.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.25 Billion |

| Market Size in 2025 | USD 1.66 Billion |

| Market Size by 2034 | USD 21.91 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 33.16% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Communication Type, Offering, Vehicle Type, Application, Technology, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Enhancing Road Safety and Enabling Autonomous Driving

The primary driver for the cellular vehicle-to-everything (C-V2X) market is enhancing road safety and enabling autonomous driving, supported by government initiatives, smart city projects, and the development of advanced 5G networks and AI technologies. C-V2X provides real-time information about traffic conditions, hazards, and potential accidents, allowing vehicles to communicate with each other and their surroundings to prevent collisions and improve situational awareness. The development of 5G networks offers the high bandwidth, low latency, and reliability needed for advanced C-V2X services.

Restraint

Lack of Widespread Infrastructure and the High Cost of Deployment

The primary restraint for the cellular vehicle-to-everything (C-V2X) market is the lack of widespread infrastructure and the high cost of deployment, particularly for emerging economies. The initial setup cost for C-V2X infrastructure, such as V2X-enabled intersections, is substantial, making it a barrier to entry, especially in developing nations. Adequate high-speed network coverage is essential for C-V2X functionality, but this infrastructure is lacking on many highways and in emerging economies, limiting connectivity.

Opportunity

Development and Deployment of 5G-Enabled Autonomous and Connected Vehicles

The main key future opportunity in this market is the development and deployment of 5G-enabled autonomous and connected vehicles, which leverage ultra-low latency communication for enhanced safety and real-time decision-making. 5G technology enables rapid, real-time data sharing between vehicles and infrastructure, which is crucial for the complex decision-making required by fully autonomous vehicles. This is supported by emerging market trends like AI at the edge, enabling faster data analysis for predictive traffic management to create efficient transportation systems.

Segment Insights

Communication Type Insights

What Made the Vehicle-To-Vehicle (V2V) Segment Lead the Cellular Vehicle-to-Everything (C-V2X) Market in 2024?

The vehicle-to-vehicle (V2V) segment dominated with a market share of 34.2% in 2024. This is because it directly improves road safety by allowing vehicles to share real-time data on speed, location, and direction, helping prevent collisions and other hazards. Supported by existing C-V2X technologies, this vital safety feature offers immediate benefits like forward collision warnings and blind-spot alerts, significantly reducing accidents, injuries, and fatalities. V2V technology gives drivers crucial real-time information about nearby vehicles, increasing their awareness of surrounding traffic.

The vehicle-to-grid (V2G) segment is expected to grow rapidly with a CAGR of 15.1%. This is because electric vehicles (EVs) serve as decentralized battery storage to stabilize power grids during peak demand and support renewable energy integration, which is vital for a more electric transportation system. It helps integrate intermittent renewable sources like solar and wind by providing flexible energy storage that balances supply fluctuations.

Offering Insights

How Did the Hardware Segment Dominate the Cellular Vehicle-to-Everything (C-V2X) Market in 2024?

The hardware segment led with the market share of 47.6% in 2024, mainly because it supplies the essential embedded modules, on-board units, and roadside units needed to enable real-time data collection and communication. These components unlock core safety and efficiency features of C-V2X technology by allowing timely data transfer about traffic, weather, and hazards, directly improving road safety and lowering fatality rates. This is a key driver for market growth and adoption, as these tangible components deliver safety and efficiency benefits.

The services segment is predicted to be the fastest-growing part of the market with a CAGR of 13.2%. It leverages data-rich C-V2X technology to provide valuable, actionable information for safety, traffic management, and new vehicle features—moving beyond basic connectivity to deliver real benefits. These insights significantly enhance road safety with features like accident warnings, alerts for wrong-way drivers, and traffic jam notifications. Growth is driven by AI and machine learning, which analyze C-V2X data to create predictive analytics and smart services.

Vehicle Type Insights

How Did the Passenger Vehicles Segment the Cellular Vehicle-to-Everything (C-V2X) Market in 2024?

The passenger vehicles segment led with a market share of 52.8% in 2024. This is because automakers have integrated advanced safety features into passenger cars, and governments support connected vehicle initiatives. Additionally, 5G-enabled C-V2X offers the low-latency, high-speed communication necessary for emerging autonomous driving systems and smarter mobility solutions. Worldwide, regulators and governments are pushing for V2X technology adoption in vehicles to improve road safety and optimize traffic flow, prompting automakers to prioritize integration in passenger models.

The autonomous vehicles segment is expected to grow the fastest with a CAGR of 16.4% because C-V2X communication is critical for autonomous vehicles (AVs) to reach their full potential. It enables them to perceive beyond onboard sensors and react to unseen hazards, which is essential for safety and proper functioning. This growth is supported by ongoing research, smart city initiatives, and partnerships between automakers and tech firms, improving overall safety and reliability.

Application Insights

Why Did the Traffic Management Segment Lead the Cellular Vehicle-to-Everything (C-V2X) Market in 2024?

The traffic management segment led with a market share of 26.5% in 2024 because it offers practical solutions to major urban challenges such as congestion, pollution, and long commutes, providing clear benefits for governments and citizens alike. C-V2X enables real-time data exchange for smarter traffic control, optimized routing, and adaptive signals, leading to smoother traffic flow, better safety, and more predictable travel times. By optimizing traffic, C-V2X also helps reduce congestion, cut travel times, and improve overall road safety and efficiency.

The autonomous driving segment is expected to grow fastest with a CAGR of 14.8% in the near future, as C-V2X is crucial for enabling vehicles to perceive, communicate, and navigate safely and efficiently. It supplies real-time data, advanced sensors, and AI-driven decision-making, which are key for AV operation. The rise of autonomous vehicle development increases demand for sophisticated C-V2X infrastructure, including features like predictive traffic management and accurate positioning in dynamic environments.

Technology Insights

What Made the LTE-V2X Segment Lead the Cellular Vehicle-to-Everything (C-V2X) Market in 2024?

The LTE-V (PC5) – direct communication sub-segment of the LTE-V2X segment dominated with a market share of 62.1% in 2024. This is because it offers a reliable, budget-friendly, and flexible solution that uses existing LTE cellular infrastructure, providing an affordable way for automakers to enter the market. It leverages well-established LTE networks, reducing the need for new infrastructure in both cities and rural areas. It also offers dependable real-time, short- and long-range communication, a single-module solution for various applications, and a standardized roadmap for 5G.

The LTE-V2X segment is likely to expand quickly, particularly the LTE-V (Uu) – network-based communication sub-segment with a CAGR of 12.6%, due to its ability to utilize existing cellular networks, offering better mobility support, reliability, and security than earlier options. It performs well in dense traffic, supports both short- and long-range communications, and provides a scalable path toward 5G services, boosting its use in connected and autonomous vehicles for safety and efficiency, and supporting intelligent transportation systems.

End User Insights

How Did the Automotive OEMS Segment Lead the Cellular Vehicle-to-Everything (C-V2X) Market in 2024?

The automotive OEMs segment held the largest market share at 39.70% in 2024. This is because they control how C-V2X technology into vehicles, which is essentialfor realizing the technology's potential for enhanced safety, efficiency, and the development of autonomous driving systems. OEMs are the primary entities that integrate C-V2X hardware and software into new vehicles. This integration is the foundational step for any V2X application to reach consumers and is responsible for the development and implementation of specific V2X applications.

The telecom providers segment is experiencing rapid growth with a CAGR of 12.70% by expanding existing cellular networks, offering crucial Vehicle-to-Network (V2N) capabilities vital for advanced autonomous and smart transportation features. Telecom companies own and operate the extensive 5G and 4G/LTE networks that support high data transfer rates and low latency necessary for critical vehicle, infrastructure, and cloud communications.

Regional Insights

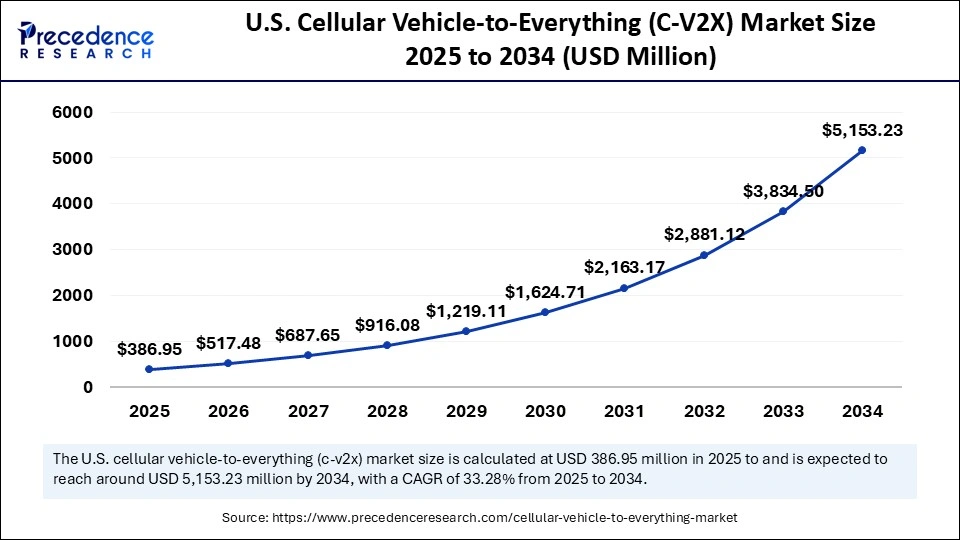

U.S. Cellular Vehicle-to-Everything (C-V2X) Market Size and Growth 2025 to 2034

The U.S. cellular vehicle-to-everything (C-V2X) market size was exhibited at USD 291.38 million in 2024 and is projected to be worth around USD 5,153.23 million by 2034, growing at a CAGR of 33.28% from 2025 to 2034.

How Did North America Lead the Cellular Vehicle-to-Everything (C-V2X) Market in 2024?

North America led with a market share of 33.3% in 2024. This is due to strong government backing, quick 5G network deployment, advanced vehicle connectivity, robust infrastructure investment, and a focus on safety and autonomous driving. Both the U.S. and Canadian governments have been strong proponents of C-V2X technology. They have created favorable regulatory environments and prioritized V2X deployment to enhance road safety and traffic efficiency. Strong federal support from agencies like the U.S. Department of Transportation and the Federal Communications Commission has been crucial in promoting V2X deployment for C-V2X technology to function effectively.

The U.S. Cellular Vehicle-to-Everything (C-V2X) Market Trends

The U.S. plays a distinctive role in the global market. This is mainly due to fostering adoption through government initiatives, a strong automotive and tech industry, and early integration of 5G technology. The U.S. Department of Transportation released plans to accelerate V2X deployment, and regulatory bodies have allocated spectrum for C-V2X. Leading U.S. and global companies like Ford, GM, and Qualcomm are developing C-V2X technologies, driven by increasing investment in smart infrastructure and vehicle connectivity.

Canada Cellular Vehicle-to-Everything (C-V2X) Market Trends

Canada plays an evolving role in the market. This is mainly government support, infrastructure development, with industry stakeholders to improve road safety and traffic efficiency. Its push for decarbonization and sustainable transportation, coupled with increasing investment in electric and autonomous vehicles, creates a strong ecosystem for C-V2X technology. The government actively supports the development of smart cities, which involves funding real-world tests and deployments of C-V2X technology within these urban environments.

Why is Asia Pacific Considered the Fastest-Growing Region in the Cellular Vehicle-to-Everything (C-V2X) Market?

Asia-Pacific is anticipated to be the fastest-growing region in the cellular vehicle-to-everything (C-V2X) market with a CAGR of 12.90%. This is mainly due to its rapid urbanization, massive vehicle production, significant investment in smart city initiatives, and supportive government policies. As it is major is a major hub for vehicle manufacturing, home to numerous automotive giants, and has a large, growing middle class with increasing demand for advanced automotive features like connected and autonomous vehicles. This growth is fostered by a large and growing consumer base with increasing demand for connected vehicles and autonomous driving, and the presence of major automotive and tech companies actively rolling and technological innovations.

Cellular Vehicle-to-Everything (C-V2X) Market Companies

- Qualcomm Technologies Inc.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- NXP Semiconductors N.V.

- Autotalks Ltd.

- Quectel Wireless Solutions Co., Ltd.

- Savari Inc.

- Fibocom Wireless Inc.

- Autotalks

- Bosch

- Continental

- Nokia

Leaders' Announcements

- In June 2025, Qualcomm Incorporated announced, Qualcomm Technologies, Inc. had completed the acquisition of Autotalks. With this acquisition, automakers and the broader ecosystem will have a comprehensive portfolio of production-ready, automotive-qualified global V2X solutions for deploying in roadside infrastructure. Nakul Duggal, Group GM, Automotive and Industrial and Embedded IoT, Qualcomm Technologies, also commented that together enhance road safety and optimize traffic efficiency with reliable solutions.(Source: https://www.qualcomm.com)

Recent Developments

- In May 2024, DENSO Products and Services unveiled its latest innovation, MobiQ. MobiQ represented our dedication to mobility, intelligence, and quality, stated Hiroshi Yanone, Senior Manager of Connected Services at DENSO Products and Services Americas. With 75 years of automotive expertise, we enhance the safety, efficiency, and sustainability of vehicle movement and cargo transport.(Source: https://autoheights.com)

- In June 2025, Verizon Business commercially launched Edge Transportation Exchange. These solutions allow vehicles to communicate and share important data, pedestrians, and connected roadway infrastructure such as traffic signals, in near real time. The 5GAA joint demonstration included use cases such as informing drivers about vulnerable road users, dangerous weather, and roadway conditions, and traffic signal phase and timing at intersections.

(Source: https://www.verizon.com)

Segments Covered in the Report

By Communication Type

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

- Vehicle-to-Network (V2N)

- Vehicle-to-Pedestrian (V2P)

- Vehicle-to-Grid (V2G)

- Vehicle-to-Device (V2D)

By Offering

- Hardware

- On-board Units (OBUs)

- Roadside Units (RSUs)

- Antennas

- Controllers

- Software

- V2X Stack Software

- V2X Middleware

- Security and Cryptographic Modules

- Services

- Consulting

- Deployment and Integration

- Maintenance and Support

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

- Autonomous Vehicles

By Application

- Traffic Management

- Emergency Vehicle Notification

- Fleet and Asset Management

- Autonomous Driving

- Parking Management

- Remote Monitoring and Diagnostics

- Collision Avoidance

- Infotainment and Telematics

By Technology

- LTE-V2X

- LTE-V (PC5) – Direct Communication

- LTE-V (Uu) – Network-based Communication

By End User

- Automotive OEMs

- Government and Transportation Authorities

- Fleet Operators

- Telecom Providers

- Infrastructure Providers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting