What is the Sustainable Pharmaceutical Packaging Market Size?

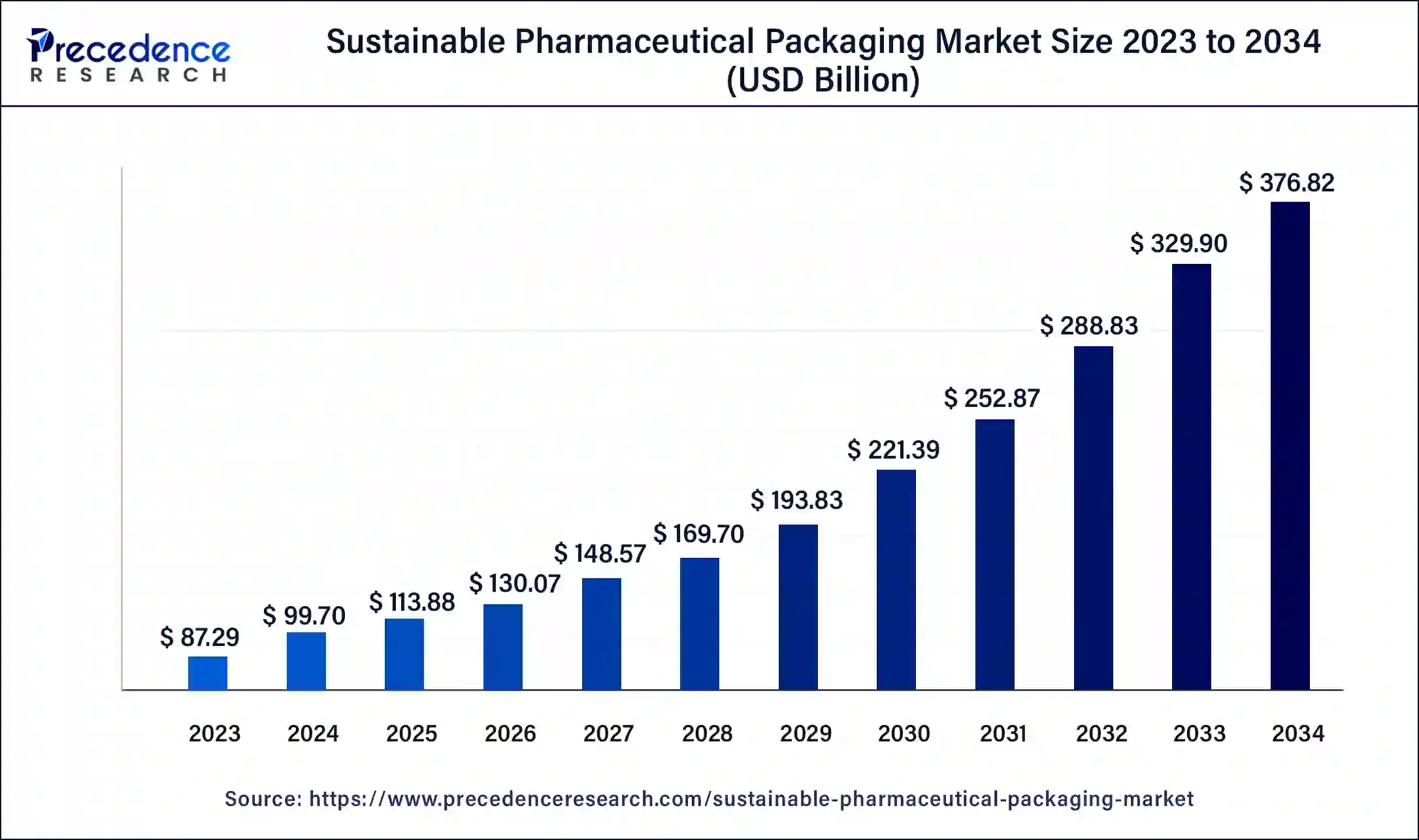

The global sustainable pharmaceutical packaging market size is calculated at USD 113.88 billion in 2025 and is predicted to increase from USD 130.07 billion in 2026 to approximately USD 419.84 billion by 2035, expanding at a CAGR of 13.94% from 2026 to 2035.

Sustainable Pharmaceutical Packaging Market Key Takeaways

- In terms of revenue, the global sustainable pharmaceutical packaging market was valued at USD 113.88billion in 2025.

- It is projected to reach USD 419.84billion by 2035.

- The market is expected to grow at a CAGR of 13.94% from 2026 to 2035.

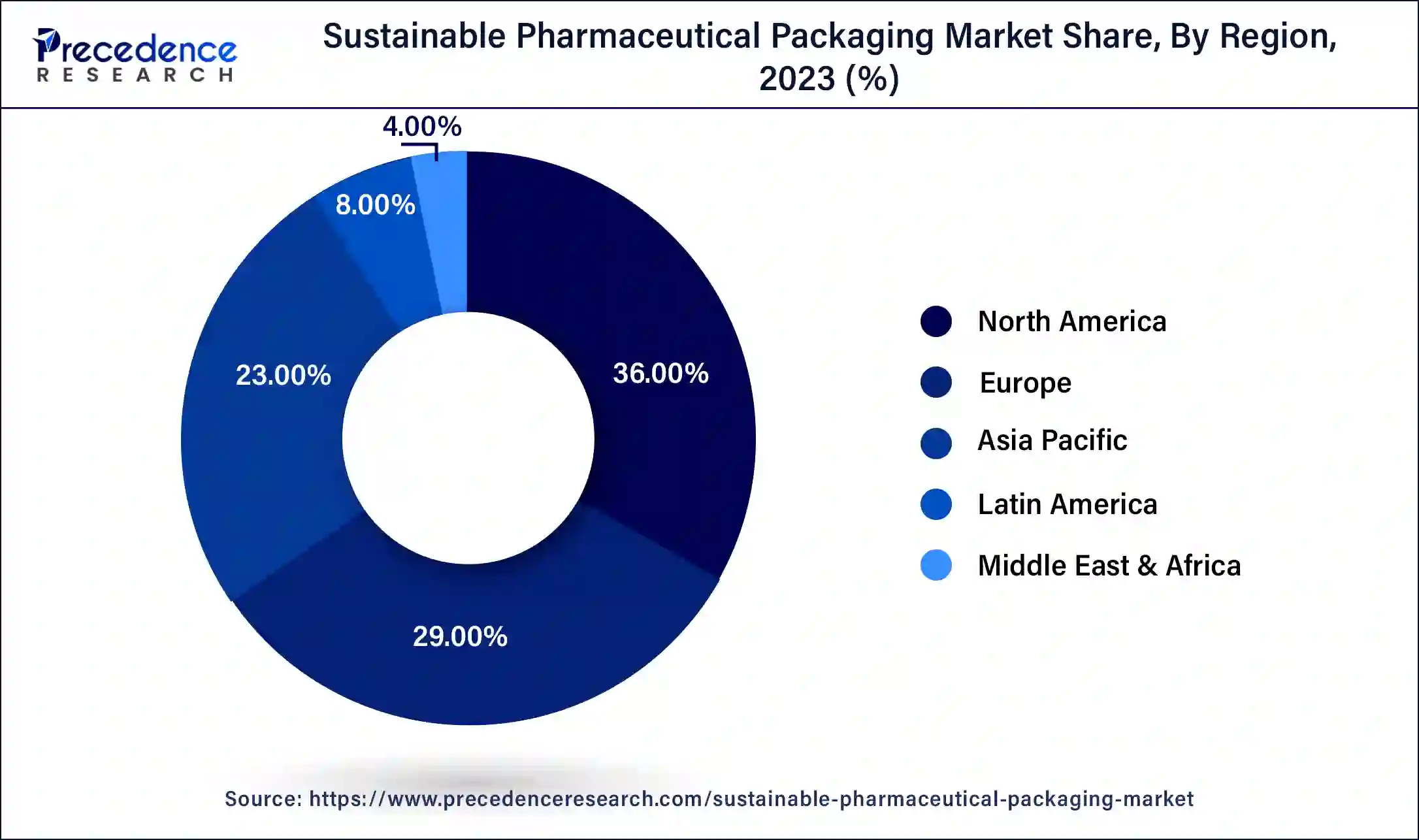

- North America contributed the highest market share of 36% in 2025.

- Asia Pacific is expected to grow at a double digit CAGR of 17.62% over the projected period.

- By material, the plastic segment has held a major market share of 37% in 2025.

- By material, the paper & paperboard segment is expected to grow at the fastest rate in the market during the forecast period.

- By product, the primary segment generated the biggest market share of 80% in 2025.

- By product, the secondary segment is anticipated to grow at the fastest rate in the market over the projected period.

- By process, the recyclable segment dominated the market with the largest market share of 64% in 2025.

Market Overview

Sustainable pharmaceutical packaging is the utilization of eco-friendly procedures and materials in the packaging of pharmaceutical products designed to lessen the environmental effects. Sustainable pharmaceutical packaging can also leverage a third-party logistics company for cross-docking, inventory management, and product packaging. The third-party logistics model also provides greater asset use and sharing alliances, which in turn raises demand and can have a positive impact on the sustainable pharmaceutical packaging market. The application of this can include primary and secondary packaging for medications that are made to ensure product integrity and safety.

Role of AI in the Sustainable Pharmaceutical Packaging Market

AI-based systems can be used to optimize production and management in the sustainable pharmaceutical packaging market. These systems can generate demand forecasts, analyze historical data, and assess storage conditions to predict the type and quantity of packaging needed. This can help reduce overproduction and waste, making packaging production more aligned with actual demand. Additionally, AI can be utilized to monitor and track products during the packaging process and identify any anomalies or defects.

- In April 2023, Sea Vision Group launched its latest technology, which uses artificial intelligence (AI) for optimized packaging solutions. The solutions aim to use AI to improve the quality and efficiency of packaging lines for cosmetics and pharmaceuticals. The technology can help manufacturers detect defects, such as cracks and dents in packaging, with greater accuracy and speed.

Sustainable Pharmaceutical Packaging Market Growth Factors

- Rising consumer demand for eco-friendly products.

- Advancements in packaging technology are making sustainable methods more affordable and realistic.

- Growing utilization of biodegradable packaging will likely contribute to the sustainable pharmaceutical packaging market expansion further.

- A growing focus on reducing plastic waste.

- Government initiatives are also an important factor in boosting market growth shortly.

Market Outlook

- Market Growth Overview: The sustainable pharmaceutical packaging market is expected to grow significantly between 2025 and 2034, driven by the rising consumer demand, focus on reducing waste through reusable systems and maximizing material recovery, and adoption of corporate responsibility.

- Sustainability Trends: Sustainability trends involve material innovation, design for circularity, and integration of digital technologies.

- Major Investors: Major investors in the market include Amcor, Berry Global, WestRock, Sonoco, Mondi, DS Smith, Gerresheimer, AptarGroup, and SCHOTT Pharma.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 419.84 Billion |

| Market Size in 2025 | USD 113.88 Billion |

| Market Size in 2026 | USD 130.07 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.94% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Product, Process, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Expansion of manufacturing facilities

The sustainable pharmaceutical packaging market is witnessing substantial growth due to increasing demand for various pharma products, especially in the context of drug delivery devices and chronic diseases. This trend is mainly propelled by emerging economies, demographic shifts, and healthcare facilities addressing the requirements of populations with financial hurdles. Furthermore, the vendors are growing their production abilities with investments in new factories such as Schott AG's facility in China, etc.

In June 2024, Evertis launched the Evercare brand for the healthcare packaging market, which was designed to provide superior performance and support regulatory compliance to the healthcare market. Evercare sits in a vertically integrated group that delivers a value proposition to healthcare customers in terms of innovation, sustainability, and supply chain security.

Restraint

Limited availability of suitable materials

Sustainable, high-quality materials that fulfill the pharmaceutical demand and standards are not available readily. This scarcity can lengthen the adoption of sustainable packaging solutions. This is a major obstacle to the sustainable pharmaceutical packaging market. Moreover, sometimes businesses may struggle to get materials that give adequate protection and meet consumer criteria.

Opportunity

Growing adoption of QR codes for packaging

Quick response (QR) codes on packaging can offer better functionality for the sustainable pharmaceutical packaging market. These can reduce the requirement for physical leaflets or pamphlets that would have generally been needed for the pharmaceutical product. This practice is called e-labeling. Additionally, QR codes are becoming more adaptable to the packaging of medical and pharmaceutical devices.

- In October 2023, Bayer Consumer Health UK, in partnership with AIPIA member Zappar, introduced a new Accessible QR code (AQR) on its Canescool Soothing Gel Cream product packaging to help those who are blind or partially sighted. Canescool is reportedly the world's first women's intimate health brand to adopt QR codes on its product packaging.

Segment Insights

Material Insights

The plastic segment dominated the sustainable pharmaceutical packaging market in 2025. The dominance of the segment can be attributed to the cost-effectiveness, versatility, and ability of plastic to meet strict regulations while providing eco-friendly alternatives. Additionally, the lightweight nature of plastic packaging can further contribute to its popularity in sustainable pharmaceutical packaging enabling it to dominate the market over the forecast period.

- In January 2024, Bormioli Pharma, an international provider of pharmaceutical packaging and medical devices, and Loop Industries, Inc., a clean technology company whose mission is to accelerate a circular plastics economy by manufacturing 100% recycled polyethylene terephthalate (PET) plastic and polyester fiber, have unveiled a pharmaceutical packaging bottle manufactured with 100% recycled virgin-quality Loop PET resin.

The paper & paperboard segment is expected to grow at the fastest rate in the sustainable pharmaceutical packaging market during the forecast period. The growth of the segment can be driven by the rising utilization of Paper-based pharmaceutical packaging such as labels, folding cartons, and inserts. Furthermore, these materials are easy to print with important information, offering a practical solution for branding and labeling while maintaining compliance with stringent regulatory standards.

Product Insights

The primary segment led the global sustainable pharmaceutical packaging market. This is due to its key role in ensuring pharmaceutical products' efficacy, safety, and integrity. The primary packaging is the materials that come directly in contact with the medication or drug product. which includes bottles, vials, blister packs, and sachets made from sustainable biodegradable materials.

The secondary segment is anticipated to grow at the fastest rate in the sustainable pharmaceutical packaging market over the projected period. The growth of the segment can be linked to the rising usage of recycled paperboard, which minimizes the utilization of inks and adhesives and includes designs that lessen material waste. Also, increasing focus on sustainable practices and innovations in outer packaging solutions can further enhance the adoption of Secondary packaging solutions.

Process Insights

The recyclable segment dominated the sustainable pharmaceutical packaging market in 2025 and is anticipated to grow at a rapid rate over the studied period. The dominance and growth of the segment can be credited to the increasing environmental concerns and a growing need for more sustainable and environmentally friendly packaging solutions. Moreover, recyclable packaging helps conserve resources and decrease waste by keeping materials in longer circulation, thus contributing to the segment's growth.

Regional Insights

What is the U.S. Sustainable Pharmaceutical Packaging Market Size?

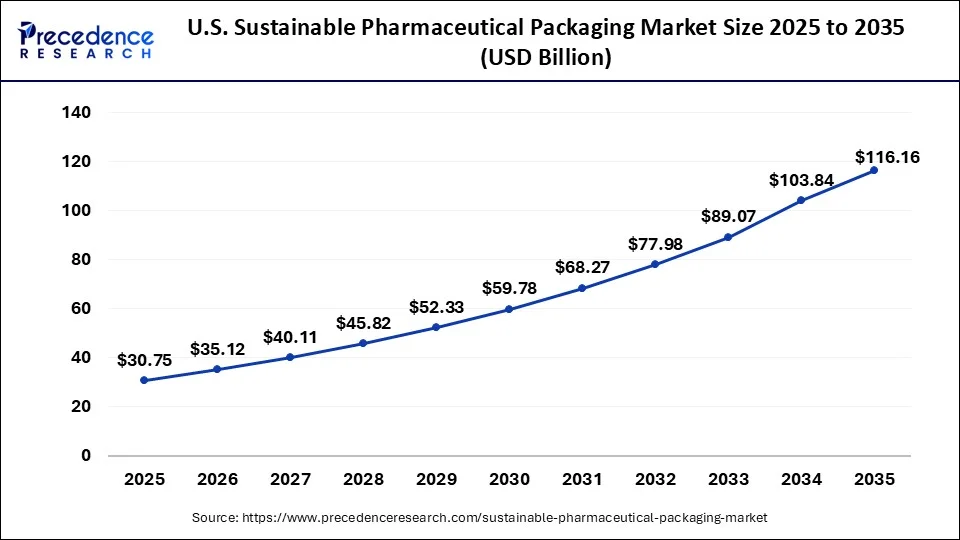

The U.S. sustainable pharmaceutical packaging market size was exhibited at USD 30.75 billion in 2025 and is projected to be worth around USD 116.16 billion by 2035, poised to grow at a CAGR of 14.21% from 2026 to 2035.

North America led the global sustainable pharmaceutical packaging market in 2025. The dominance of the region is due to the rising environmental policies and stringent regulations that enable pharmaceutical companies to adopt more sophisticated pharmaceutical packaging solutions. The U.S. sustainable pharmaceutical packaging market is fueled mainly by rising consumer awareness and the need for sustainable products.

- In November 2023, Amcor, a global leader in developing and producing responsible packaging solutions, announced the launch of the next generation of its Medical Laminates solutions. Amcor's latest innovation enables the development of all-film packaging that is recyclable in the polyethylene stream.

U.S. Sustainable Pharmaceutical Packaging Market Trends

U.S.'s stringent global regulations and heightened consumer eco-consciousness mandate a transition from conventional plastics to circular alternatives. This shift is driven by material innovations, including the widespread adoption of plant-based polymers like PHA and PLA, alongside high-performance recycled paper solutions.

Asia Pacific is expected to show the fastest growth in the sustainable pharmaceutical packaging market over the projected period. This is because of expanding industrialization and economic growth in economies such as China, India, and South Korea. Additionally, Governments in these nations are implementing stringent regulations on plastic utilization and waste management, which is encouraging pharmaceutical companies to adopt sustainable packaging alternatives.

China Sustainable Pharmaceutical Packaging Market Trends

China's shift toward advanced mono-materials and plant-based polymers like PLA and PHA to ensure high recyclability and compliance with stringent national circularity mandates. This transition is supported by significant investments in chemical recycling and the adoption of digital integration, such as RFID and QR codes, which enhance supply chain transparency while reducing reliance on physical labeling.

Top biotechnology and pharmaceutical companies ranked by revenue in USD billion

| Company | Year 2023(Bn USD) |

| Johnson & Johnson | 85.16 |

| Sinopharm | 84.06 |

| Roche | 68.48 |

| Merck & Co. | 60.12 |

| Pfizer | 58.50 |

| AbbVie | 54.32 |

| Bayer | 51.72 |

| Sanofi | 46.84 |

| AstraZeneca | 45.81 |

What Is Driving the Significant Growth of the European Sustainable Pharmaceutical Packaging Market?

The European sustainable pharmaceutical packaging market is expected to witness significant growth over the forecast period. The European Union has rolled out a lot, such as the Circular Economy Action Plan or European Green Deal, which requires waste levels to be reduced considerably, and recyclable materials to be used where they are possible. The existence of these regulations has resulted in a very favorable environment for the adoption process of sustainable packaging solutions in the pharmaceutical industry. The business of creating pharmaceutical products is recognizing the need to incorporate the area of sustainability into the core products, packaging applications, and this is fostering innovation and association with green materials suppliers.

In the United Kingdom, the use of sustainable pharmaceutical packaging solutions is being fuelled by regulatory movement. The UK government has achieved significant promissory efforts minimizing plastic waste and carbon emissions in different sectors, such as healthcare. Such policies are forcing pharmaceutical producers to switch to environment-friendly options like compostable blistering, recycled component containers, and plant-based containers.

How Are Sustainability Trends Shaping the Pharmaceutical Packaging Market in the Middle East & Africa?

The Middle East & Africa show a notable growth in the sustainable pharmaceutical packaging market. Because of an increased interest in the environment and changes in the regulatory system. Governments in the region are understanding that they need to curb plastic waste and improve the state of sustainability in the health industry, and so policies that promote environmentally friendly processes. Alongside regulatory trends, the MEA region has witnessed a considerable spurt in investments in healthcare infrastructure, especially in the likes of Saudi Arabia, UAE, and Qatar. These countries are also significantly investing in contemporary medical care and inviting global pharmaceutical companies to set foot in the arena. The manufacturers are considering other options such as recyclable blister packaging, paper-based materials, and minimized packaging waste technology.

Major Countries and Stringent Regulations to Revolve Sustainable Pharmaceutical Packaging Practices

U.S. Extended Producer Responsibility (EPR) Law

Five states of the U.S, including Maine, Colorado, California, Oregon, and Minnesota have passed the EPR laws in 2021-2024. The states makes about 17% of the U.S. population (56.3 million people), together, and slowly started to move into law implementation the Circular Action Alliance (CAA), the Producer Responsibility Organization (PRO) for four of the five states, submitted a draft EPR program plan in Colorado and received approval from Oregon for their previously submitted and revised program plan, in 2025 for take-back, recycling, and final disposal, encouraging them to design more sustainable products and packaging.

The National Medical Products Administration (NMPA) of China

China's National Medical Products Administration has released appendices to the GMP guidelines for areas including pharmaceutical excipients and packaging materials. The appendices are scheduled to come into effect in 2026. The regulation will impact the use of material in pharmaceutical packaging and encourage the adoption of more sustainable options in China's packaging expertise.

Value Chain Analysis of the Sustainable Pharmaceutical Packaging Market

- Raw Material Sourcing (Upstream): This stage involves the procurement of eco-friendly, renewable, or recycled feedstocks, such as bio-based plastics, recycled paper/paperboard, and infinitely recyclable materials like glass and aluminum.

Key Players: TotalEnergies Corbion, Stora Enso, Loop Industries, Bormioli Pharma. - Design and Engineering (R&D): Companies design packaging to be lightweight, minimize materials, and ensure compliance with strict pharmaceutical, safety, and sterilization standards.

Key Players: Amcor plc, WestRock Company, Constantia Flexibles, Origin Pharma Packaging. - Manufacturing and Conversion (Operations): This stage involves transforming raw materials into primary, secondary, and tertiary packaging components, such as vials, blister packs, and folding cartons.

Key Players: Gerresheimer AG, Syntegon Technology, Berry Global Inc., CCL Healthcare.

Sustainable Pharmaceutical Packaging Market Companies

- Amcor plc: Amcor provides a broad range of recyclable, lightweight, and lower-carbon flexible and rigid packaging solutions, including the AmSky™ recycle-ready thermoform blister system.

- Berry Global Inc.: Berry focuses on circularity by increasing the use of post-consumer recycled (PCR) content and developing mono-material alternatives to improve recyclability, such as their ClariPPil polypropylene bottles.

- Sonoco Products Company: Sonoco contributes through its EnviroCan™ paper-based packaging made from 100% recycled fiber and its GREENCAN solutions, which are designed to be fully recyclable in the paper stream.

- WestRock Company: WestRock specializes in sustainable, fiber-based, and renewable paperboard packaging, aiming to replace plastics in pharmaceutical, child-resistant, and clinical trial applications.

- CCL Healthcare: CCL Healthcare contributes by offering sustainable label solutions and, in partnership with other industry leaders, supports the development of sustainable, high-performance packaging.

- SGD Pharma: SGD Pharma, as a leading glass manufacturer, contributes to the market by producing Type I, II, and III molded glass vials, which are inherently sustainable, inert, and 100% recyclable.

Other Major Key Players

- OLIVER

- Gerresheimer AG

- West Pharmaceutical Services, Inc.

- Nottingham Spirk

- Crown Packaging Corp.

- Nipro Europe Group Companies

- Origin Pharma Packaging

- Syntegon Technology GmbH

- Bormioli Pharma S.p.A.

Recent Developments

- In January 2025, DS Smith, an international fibre-based packaging solutions company, launched the TailorTemp, the latest radical innovation within temperature-controlled packaging for the pharmaceutical industry, at PharmaPack Europe 2025.

- In January 2025, Aluflexpack launched its 4∞ Form fully recyclable blister pack at Pharmapack 2025.

- In January 2025, Berry Global showcased its new packaging innovations at Pharmapack, including the ClariPPil line of clarified polypropylene bottles and the new easy-squeeze ophthalmic bottle. The events allow visitors to engage with Berry's experts to learn about its CDMO (Contract Development and Manufacturing Organisation) services, which accelerate market entry for healthcare packaging and devices.

- The PHARMAP 2025, The Congress provides a dedicated platform for professionals to discuss strategies, share best practices, and drive meaningful change in the pharmaceutical manufacturing and packaging industry, was held on 14-15 April 2025 in Berlin, Germany. The platform showcased various Transforming manufacturing and packaging solutions.

- In March 2024, MM Group, a secondary packaging specialist, became the first European company to receive triple-A accreditation from the Carbon Disclosure Project. This feat helped the company gain global notoriety. This landmark accreditation also helped to establish the company's reputation in the market.

- In February 2024, Schreiner Group, a Germany-based company specializing in pharmaceutical labeling and packaging solutions, launched a new sustainable closure seal called Needle-Trap Closure Seal. This product is designed to prevent needles from being reused and to ensure the integrity of pharmaceutical packaging.

- In January 2024, Stora Enso developed its EcoFishBox concept to incorporate sustainable fiber-based pharmaceutical packaging. The innovative packaging method is intended to replace plastic containers for solid-dose pharmaceuticals. Made from renewable materials, the packaging is recyclable and biodegradable, making it a more environmentally responsible alternative to typical plastic bottles.

- In December 2023, West Pharmaceutical Services introduced a new line of bio-based elastomeric stoppers for injectable pharmaceuticals. The stoppers are constructed from plant-based materials, which have a lower carbon footprint than standard synthetic rubber stoppers. This innovation addresses the growing demand for sustainable pharmaceutical packaging components.

- In August 2023, Amcor plc announced the acquisition of a scalable, flexible packaging plant in the high-growth Indian market. This strategic move involves the acquisition of Phoenix Flexibles, expanding the company's capacity in India.

Segments Covered in the Report

By Material

- Plastics

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polystyrene (PS)

- Bioplastics

- Others

- Paper & Paperboard

- Glass

- Metal

- Others

By Product

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Blister Packs

- Prefillable Inhalers

- Pouches

- Medication Tubes

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

By Process

- Recyclable

- Reusable

- Biodegradabl

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting