What is the Flexible Paper Packaging Market Size?

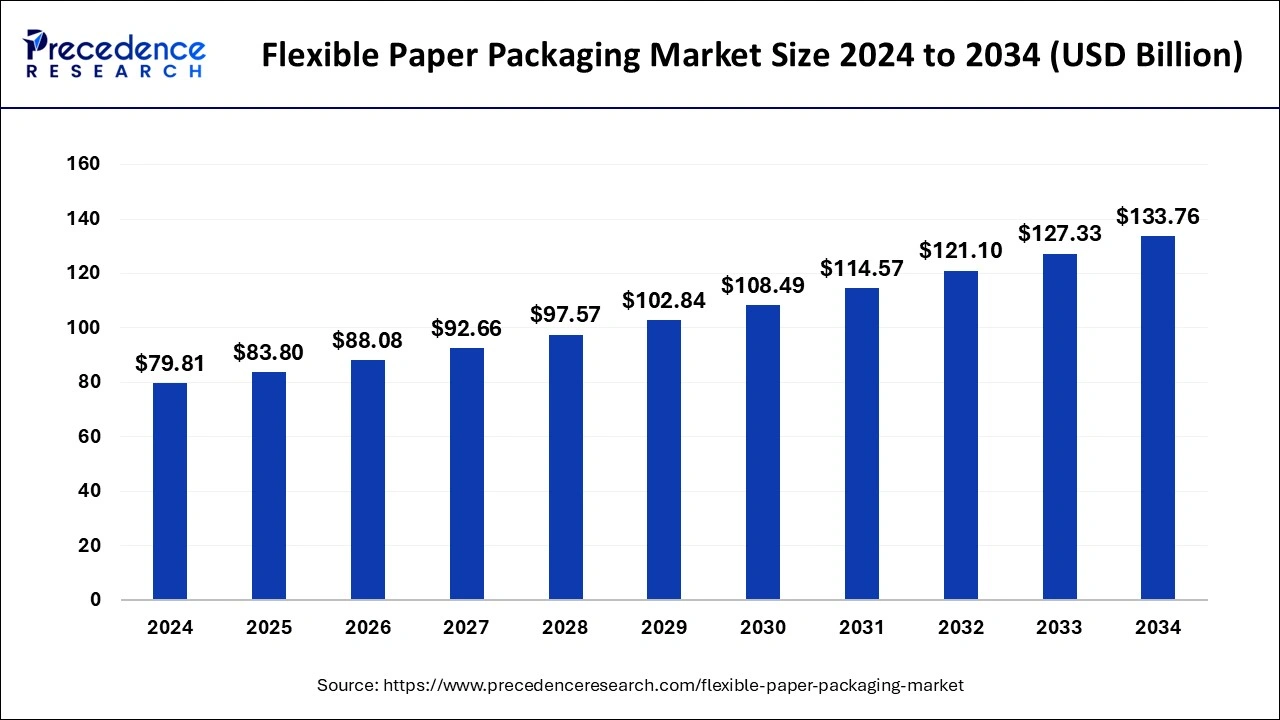

The global flexible paper packaging market size is valued at USD 83.80 billion in 2025 and is predicted to increase from USD 88.08 billion in 2026 to approximately USD 140.19 billion by 2035, expanding at a CAGR of 3.75% from 2026 to 2035.

Flexible Paper Packaging Market Key Takeaways

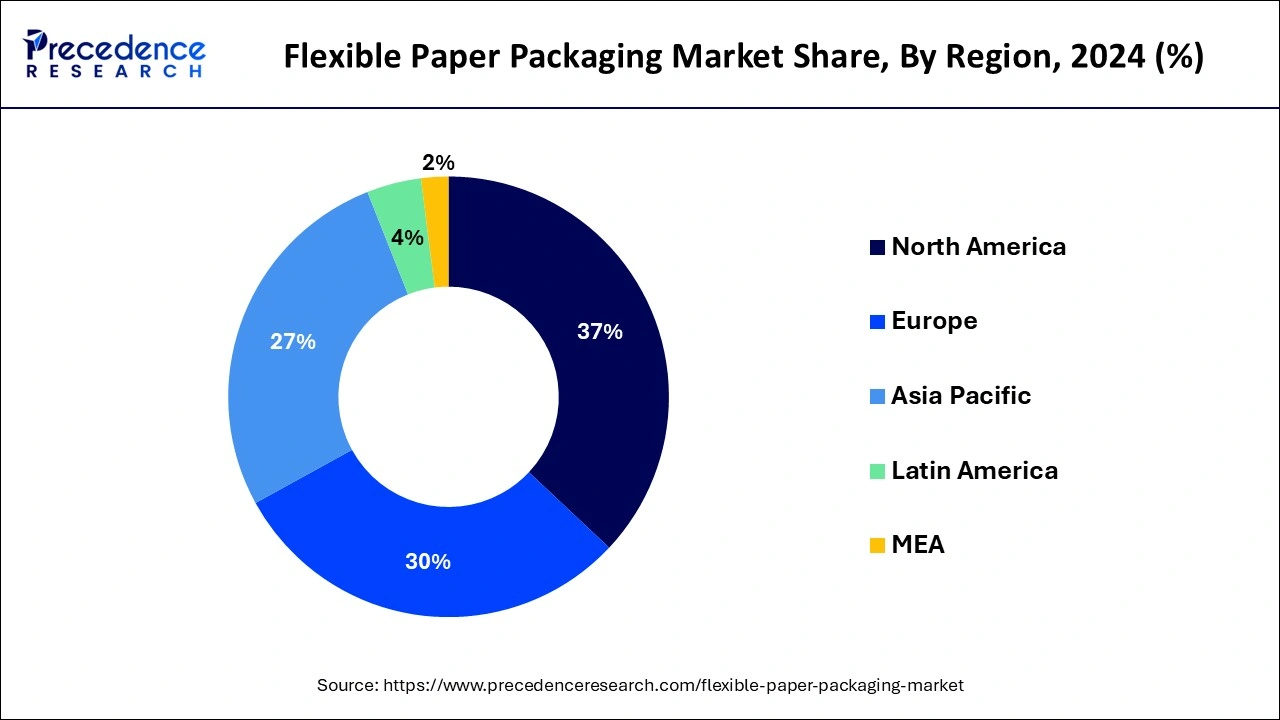

- North America led the market with a maximum market share of 37% in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR during the forecast period.

- By Material, the paper segment has held the biggest revenue share of 43% in 2025.

- By Material, the bioplastics segment is estimated to expand at a CAGR of 5.8% during the projected period.

- By Product, the films & wraps segment held the major market share of 29% in 2025.

- By Product, the bags segment is estimated to grow at the fastest CAGR over the projected period.

- By Application, the food & beverages segment had the largest market share of 57% in 2025.

- By Application, the pharmaceutical segment is projected to grow at the fastest CAGR over the projected period.

What is Flexible Paper Packaging?

Flexible paper packaging refers to a versatile and sustainable form of packaging primarily composed of paper materials. This packaging category includes a diverse range of solutions such as pouches, bags, wrappers, and sachets, serving various industries, including food, pharmaceuticals, and personal care. It combines the strength and lightweight properties of paper with the ability to conform to different shapes and sizes.

Flexible Paper Packaging Market Growth Factors

Several key drivers fuel the growth of the flexible paper packaging market including the global shift toward sustainability and eco-friendliness has propelled the adoption of paper-based packaging materials. Consumers increasingly seek environmentally responsible packaging options, making flexible paper packaging a preferred choice. Moreover, the convenience and versatility of flexible paper packaging have garnered attention, particularly in the food industry, where it provides ease of use and preservation of product freshness. Additionally, innovations in printing technologies enable eye-catching branding and designs, further boosting the market. Industry trends encompass innovations in recyclable and biodegradable packaging solutions, aligning with sustainability goals.

Customization and personalization of flexible paper packaging designs are on the rise, catering to diverse product needs and branding requirements. Moreover, the COVID-19 pandemic has emphasized the need for hygienic and tamper-evident packaging, which flexible paper packaging materials can provide. Challenges in the flexible paper packaging market include addressing competition from alternative materials like plastics and ensuring that sustainability goals do not compromise packaging performance. Fluctuations in raw material costs and supply chain disruptions also pose challenges for manufacturers. Business opportunities in the market include innovating sustainable packaging solutions, exploring collaborations for recycling initiatives, and expanding into emerging markets with rising consumer demands for eco-friendly packaging options. Meeting the demand for hygienic and tamper-evident packaging is another valuable opportunity in the current market landscape.

Market Outlook

- Industry Growth Overview:

The flexible paper packaging market is experiencing significant growth, as continued rapid demand from the global pharmaceutical and medical industry. Novel and advancing applications in the health and personal care sectors - Global Expansion:

The market expanded globally because of the rise in its applications from snack wrappers and coffee pouches to medical sachets and cosmetic products. North America is dominant in the market due to the presence of strict environmental guidelines and high online shopping growth. - Major investors:

Major investors in the market are significantly large, multinational packaging corporations and paper groups that spend in R&D, partnerships, and facility expansions to tackle the growing demand for sustainable services. It includes Amcor Plc, Mondi Group, Huhtamaki Oyj, International Paper Company, and many others.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 140.19 Billion |

| Market Size in 2025 | USD 83.80 Billion |

| Market Size in 2026 | USD 88.08 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.75% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Innovations in printing, convenience and versatility

The integration of cutting-edge printing technologies has revolutionized the appearance and functionality of flexible paper packaging. Digital printing, in particular, allows for intricate, high-quality graphics, vibrant colors, and customizable designs. This level of customization enhances brand visibility and consumer engagement, making products more appealing on the retail shelf. The ability to print detailed product information, QR codes, and captivating visuals on flexible paper packaging not only aids in branding but also conveys crucial product details, fostering consumer trust.

As a result, businesses are increasingly turning to flexible paper packaging to leverage these printing advancements for effective marketing and product differentiation. Moreover, Flexible paper packaging embodies two indispensable attributes: convenience and versatility. Pouches, sachets, and bags made from flexible paper are not only easy to open and reseal but also lightweight, reducing transportation costs.

Additionally, their flexibility facilitates space-saving storage. This convenience factor resonates with modern consumers' busy lifestyles and their preference for on-the-go, hassle-free packaging solutions. The ease of use, combined with the material's sustainability, underscores the growing consumer demand for flexible paper packaging, thereby driving its market demand.

Restraints

Concerns about the possibility of errors in complex battle situations

One of the significant restraints affecting the flexible paper packaging market is competition from alternative packaging materials, particularly plastics. While flexible paper packaging is favored for its eco-friendliness and recyclability, plastics offer advantages such as durability, moisture resistance, and longer shelf life for certain products. In industries where these properties are critical, manufacturers may opt for plastic-based packaging solutions, posing a challenge to the market. To overcome this restraint, the flexible paper packaging industry needs to continually innovate, offering enhanced performance and features while maintaining its sustainability credentials.

Moreover, another notable restraint is supply chain disruptions, which have become more prevalent due to various global factors such as the COVID-19 pandemic, natural disasters, and geopolitical issues. Disruptions in the supply chain can lead to delays in the availability of raw materials and packaging components, affecting production schedules and creating uncertainty in the market. This can hinder the timely delivery of flexible paper packaging solutions to customers, potentially leading to a loss of business. To mitigate this restraint, companies in the flexible paper packaging market must invest in robust supply chain management strategies, diversify sourcing options, and ensure adequate inventory levels to address unforeseen disruptions effectively.

Opportunities

Sustainable packaging solutions, customization and personalization

The global shift towards sustainability and eco-friendliness has ignited a surging demand for flexible paper packaging. Consumers increasingly seek environmentally responsible packaging options that minimize their carbon footprint. Flexible paper packaging, made from renewable and biodegradable materials, aligns perfectly with these preferences. As consumers become more conscientious about their choices, manufacturers are responding by embracing sustainable practices, such as utilizing recyclable and FSC-certified paper. This emphasis on sustainability not only meets regulatory requirements but also fosters a positive brand image and consumer loyalty.

Moreover, in an era of personalized experiences, customization and personalization have emerged as key drivers of flexible paper packaging's popularity. Brands are leveraging digital printing technologies to craft visually appealing and unique packaging designs. Whether it's tailored messaging or intricate branding elements, flexible paper packaging allows for versatile and individualized packaging solutions. This trend not only enhances product visibility but also fosters a sense of connection with consumers, making it a valuable tool for brand differentiation in competitive markets. As consumers increasingly seek products that resonate with their preferences, customization and personalization options have surged the demand for flexible paper packaging, underscoring its importance in the packaging industry.

Material Insights

According to the material, the paper segment has held 43% revenue share in 2025. Paper-based flexible packaging involves the use of paper materials as the primary substrate for packaging solutions. This eco-friendly option offers recyclability, biodegradability, and sustainability, aligning with the global emphasis on eco-conscious packaging choices. Trends in paper-based flexible packaging include advancements in barrier coatings, which enhance the packaging's ability to protect products from moisture and oxygen, making it suitable for various applications. Additionally, digital printing technologies are gaining prominence, allowing for intricate and customizable designs on paper-based packaging, thereby enhancing product visibility and brand differentiation.

In February 2025, Mondi announced a collaboration with Proquimia to launch paper-based stand-up pouches for dishwashing tabs in Spain and Portugal. Mondi's internal product impact assessment indicates that the new packaging has significantly lower CO2 emissions from cradle to gate compared with the previous plastic packaging.

The bioplastics segment is anticipated to expand at a significant CAGR of 5.8% during the projected period. Bioplastics in the flexible paper packaging market: Bioplastics are an emerging trend in the flexible paper packaging market. These materials, derived from renewable sources like cornstarch and sugarcane, offer biodegradability and reduced environmental impact compared to traditional plastics. Bioplastics can be integrated into flexible paper packaging to enhance its sustainability profile. This trend aligns with the increasing consumer demand for eco-friendly alternatives, and it reflects the industry's commitment to reducing its carbon footprint while maintaining packaging functionality and performance.

Product Insights

Based on the product, films & wraps segment held the largest market share of 29% in 2025. In the flexible paper packaging market, the films and wraps segment encompasses packaging materials that are thin, pliable, and suitable for various applications. These materials include paper-based films and wraps used for items such as snacks, confectionery, and small consumer goods. A notable trend in this segment is the increasing use of paper-based films and wraps for single-use packaging, driven by sustainability concerns. Brands are opting for these materials to provide eco-friendly options to consumers, emphasizing recyclability and biodegradability. Additionally, innovations in coatings and barrier technologies enhance the performance of paper films, making them more resilient to moisture and external factors while maintaining their eco-friendly appeal.

On the other hand, the bags segment is projected to grow at the fastest rate over the projected period. The bags segment in the flexible paper packaging market refers to pouches, sachets, and bags made from paper materials. These bags are popular for packaging a wide range of products, including snacks, coffee, and personal care items. An emerging trend in this segment is the demand for customizable and aesthetically pleasing bags. Brands are leveraging digital printing technologies to create visually appealing packaging with unique designs and branding elements. Moreover, there is a growing preference for resealable and easy-to-open bags, catering to consumer convenience and product freshness. Sustainable packaging remains a key focus, with brands using recyclable and compostable materials for bag production to align with eco-friendly packaging goals.

Application Insights

In 2025, the food & beverages segment had the highest market share of 57% on the basis of the installation. Flexible paper packaging in the food and beverages sector refers to the use of paper-based materials for packaging various food products and beverages. This type of packaging offers eco-friendly and sustainable solutions for preserving the freshness and quality of edibles. In this segment, there is a growing trend towards eco-conscious packaging to align with consumer preferences. Innovative designs, such as stand-up pouches and resealable paper bags, are gaining popularity. Additionally, the demand for hygienic and tamper-evident packaging solutions, fueled by the COVID-19 pandemic, has led to the adoption of flexible paper packaging in this sector to ensure product safety and convenience.

In September 2024, Marigold Health Foods partnered with Sonoco to launch its fully recyclable packaging for a variety of natural, plant-based food products, including stock cubes, sauces, and meat and fish alternatives.

The pharmaceutical is anticipated to expand at the fastest rate over the projected period. In the pharmaceutical industry, flexible paper packaging involves the use of paper-based materials to package pharmaceutical products, medicines, and medical devices securely and in compliance with stringent regulatory requirements. This segment is witnessing an increased emphasis on safety and security, driven by tamper-evident packaging solutions. Moreover, the demand for single-dose and unit-dose packaging formats has grown. Sustainable packaging is also a notable trend in pharmaceutical flexible paper packaging, as manufacturers strive to meet eco-friendly standards while ensuring product integrity and patient safety.

Regional Insights

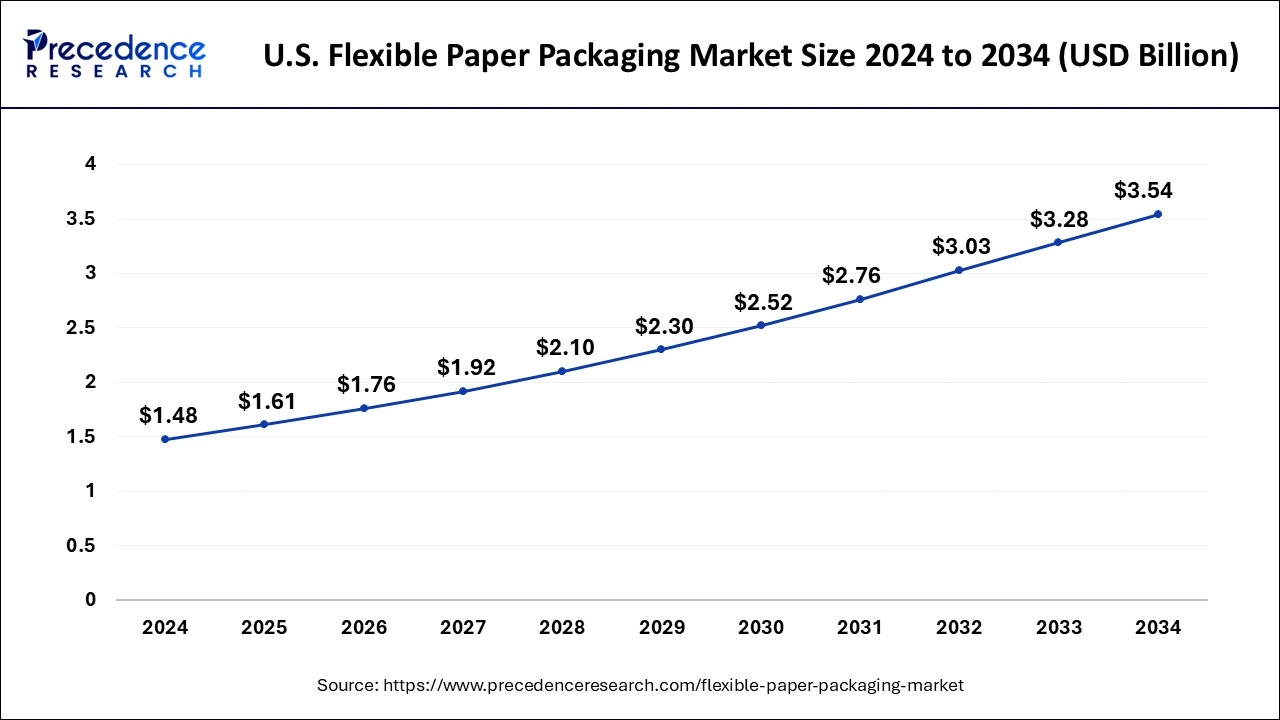

U.S. Flexible Paper Packaging Market Size and Growth 2026 to 2035

The U.S. flexible paper packaging market size is valued at 1.61 billion in 2025 and is projected to reach around USD 3.80 billion by 2035, growing at a CAGR of 6.53% from 2026 to 2035.

North America: Diverse Range of Sustainable Paper-Based Packaging Solutions in North America

North America has held the largest revenue share 37% in 2025. In North America, the flexible paper packaging market encompasses a diverse range of sustainable paper-based packaging solutions. Driven by a heightened emphasis on sustainability, there is a growing demand for eco-friendly packaging materials that reduce environmental impact. Additionally, the adoption of digital printing technologies has surged, enabling brand personalization and visually appealing packaging. The COVID-19 pandemic reinforced the importance of hygienic packaging, leading to increased use of flexible paper materials in food and healthcare sectors.

In July 2024, the Biden-Harris Administration announced its intent to phase out all single-use plastics across US federal government agencies by 2035 and all single-use plastic products in foodservice, packaging, and events by 2027.

U.S. Flexible Paper Packaging Market Trends

In the U.S. increase in trends of flexible packaging offers brands and retailers an affordable, suitable, and sustainable way to promote and package their products. The U.S flexible packaging sector is vibrant and growing because it creates unique solutions for many packaging tasks.

Asia Pacific: Substantial Shift Towards Paper-Based Materials

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific Flexible paper packaging market is marked by a robust demand forsustainable packaging solutions. As environmental concerns mount, there is a substantial shift towards paper-based materials due to their recyclability and biodegradability. The region is also witnessing a surge in customized and personalized packaging designs, driven by digital printing technologies. With the e-commerce boom, flexible paper packaging has gained prominence for its role in secure and convenient product delivery. The pandemic further heightened the need for hygienic and tamper-evident packaging solutions, propelling the use of flexible paper materials in the healthcare and food sectors.

China Flexible Paper Packaging Market Trends

In China, flexible paper-based packaging is gaining popularity, with a share of 30–35%, due to the increasing consumer preference for sustainable and recyclable options. Retailers, foodservice brands, and e-commerce giants are growing their switch from plastic to paper, citing government pressure, customer expectations, and sustainability commitments, which drives the growth of the market.

Europe: Substantial Shift Towards Paper-Based Materials

Europe is significantly growing in the market as this region is increasingly shifting towards paper-based flexible packaging, which provides many benefits, including reduced plastic waste, a smaller carbon footprint, and biodegradability. Guidelines like Germany's 95:5 paper-to-plastic ratio goal to limit non-fibre materials to 5%, attaining the required packaging safety.

The UK Flexible Paper Packaging Market Trends

A nationally-representative survey of 500 UK adults found paper and cardboard to be the most preferred packaging material for eco-friendliness, practicality, and recyclability. In this region, increasing omnichannel growth and the rising popularity are. In 2025, the UK will have 59 million e-commerce users, which will increase the demand for flexible paper packaging.

Value Chain Analysis - Fiber-Based Packaging Market

- Raw Material:

Raw materials of fiber-based packaging involve wood, agricultural waste, forest residue, municipal waste, or recycled fiber.

Key Players: Smurfit WestRock and International Paper - Production Processes:

The primary manufacturing process used in fiber-based packaging is pulp molding, which transforms renewable or recycled fibrous materials into rigid, three-dimensional forms.

Key Players:DS Smith and Sonoco Products - Recycling Technology:

Recycling technologies for fiber-based packaging significantly focus on mechanical processes such as pulping and shredding, chemical methods like breaking down polymers/coatings, and advanced sorting/separation.

Key Players:WestRock and Stora Enso

Top Companies in the Flexible Paper Packaging Market & Their Offerings:

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Mondi Group |

United Kingdom |

Advanced manufacturing and strong innovation in sustainable materials |

In November 2025, Mondi will strengthen its position as a trusted partner for the food industry with the launch of an extended food packaging portfolio. |

|

Smurfit Kappa Group |

Ireland |

Innovation and design expertise |

In September 2025, Smurfit Westrock launched its novel Bag-in-Box Powergrip to support companies in complying with forthcoming stricter European packaging regulations. |

|

Amcor plc |

Switzerland |

Increasing Innovation & Sustainability |

In March 2025, Amcor launched its advanced AmFiber Performance Paper stand-up pouch, a paper-driven pack for instant coffee and dry beverage products. |

|

DS Smith Plc |

Switzerland |

Innovation and design expertise |

In February 2025, International Paper (IP) finalized its bid to acquire London-based multinational paper and packaging company DS Smith, as the merger officially took effect and is estimated to be worth about $7.2 billion. |

|

Tetra Pak International S.A. |

Switzerland |

Integrated solutions provider |

In December 2025, Tetra Pak, in partnership with García Carrión, today unveiled the first-ever use of its paper-based barrier advancement for juice packaging. |

Flexible Paper Packaging Market Companies

- Mondi Group

- Smurfit Kappa Group

- Amcor plc

- DS Smith Plc

- Tetra Pak International S.A.

- WestRock Company

- BillerudKorsnäs AB

- Sonoco Products Company

- UPM-Kymmene Corporation

- Nippon Paper Industries Co., Ltd.

- Georgia-Pacific LLC

- Huhtamaki Oyj

- Stora Enso Oyj

- KapStone Paper and Packaging Corporation

- International Paper Company

Recent Developments

- In April 2025, Lecta announced the launch of Creaset HGP, a new grease-resistant paper aimed at flexible packaging applications such as pet food bags and butter wraps. The product is said to offer a strong grease barrier while also being free from per- and polyfluoroalkyl substances (PFAS), a class of chemicals increasingly scrutinized for their environmental and health impacts. The company reports that the paper has received a recyclability score of 95 out of 100 from the Confederation of European Paper Industries (CEPI) and a Level A certification from Aticelca, indicating its compatibility with existing recycling streams.

- In February 2025, Koehler Paper partnered with Astrabio on flexible paper packaging for pasta. Under this partnership with Italian pasta company Astrabio, Koehler Paper's flexible packaging paper is said to be heat-sealable and maximize shelf life, has been utilized for pasta packs.

- In March 2025, Ahlstrom launched LamiBak Flex, the latest addition to its LamiBak portfolio of high-performance base papers. It is designed specifically for flexible packaging. LamiBak Flex builds on the proven success of the original LamiBak product line. This launch reinforces Ahlstrom's commitment to providing innovative solutions that address the growing need for safe and sustainable high-barrier packaging materials.

- In 2023, Amcor plc finalized an agreement to acquire Phoenix Flexibles, a flexible packaging manufacturer based in Gujarat, India. This strategic acquisition complements Amcor's existing network of four packaging facilities in India and is poised to significantly enhance the company's market footprint and capabilities within the region.

- In 2020, Mondi joined forces with Unilever to create an innovative packaging solution aimed at promoting the circular economy. This partnership highlights their commitment to sustainable packaging and environmental responsibility.

- In 2019, Amcor collaborated with Nestlé to introduce sustainable packaging for Smarties, becoming the first confectionery brand in Australia to transition to recyclable paper packaging. This partnership showcases Amcor's commitment to eco-friendly solutions and addresses the preferences of environmentally conscious consumers.

Segments Covered in the Report

By Material

- Plastic

- Paper

- Metal

- Bioplastics

- Others

By Product

- Pouches

- Bags

- Films & Wraps

- Others

By Application

- Food & Beverage

- Pharmaceutical

- Cosmetics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting