What is the Paper And Paperboard Packaging Market Size?

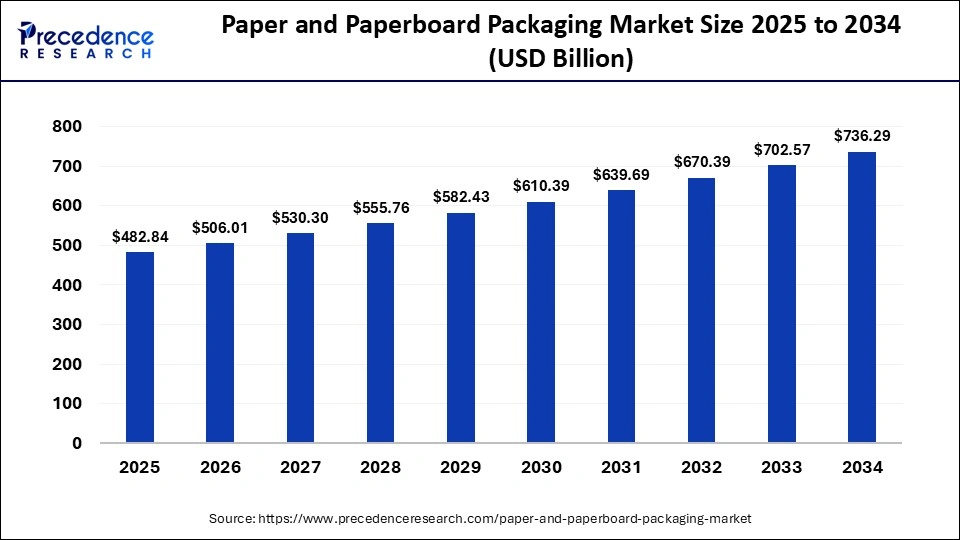

The global paper and paperboard packaging market size is calculated at USD 482.84 billion in 2025 and is predicted to increase from USD 506.01 billion in 2026 to approximately USD 768.98 billion by 2035, growing at a CAGR of 4.76% between 2026 and 2035.

Paper And Paperboard Packaging Market Key Takeaways

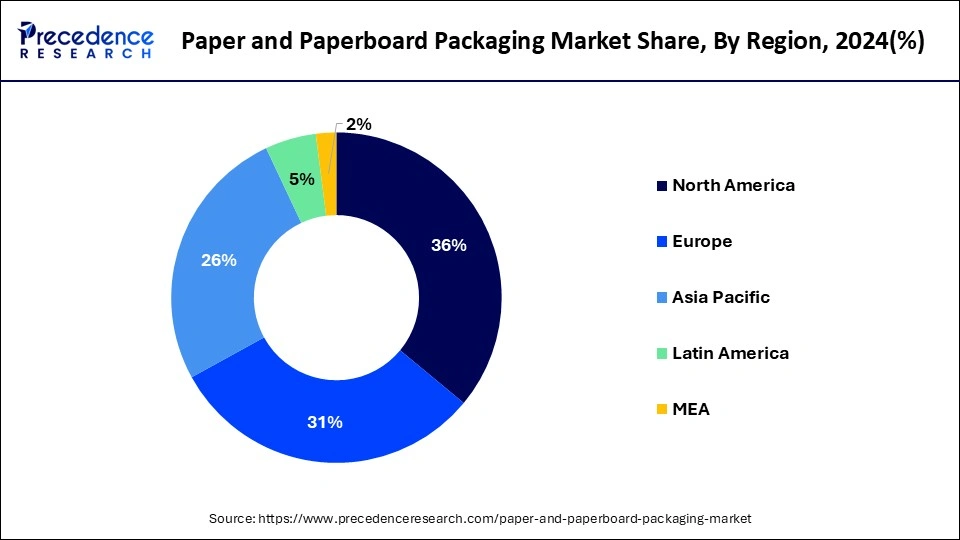

- North America held the largest share of the market at 36% in 2025.

- Asia Pacific is projected to expand at the fastest CAGR during the forecast period.

- By Product Type, the folding cartons segment held the largest market share of 53% in the paper and paperboard packaging market in 2025.

- By Product Type, the corrugated boxes segment is expected to grow at a notable CAGR of 7.1% over the projected period.

- By End-user, the food and beverages segment had the largest market share of 69% in 2025.

- By End-user, the personal care segment is predicted to grow at a remarkable CAGR during the forecast period.

What is Paper and Paperboard Packaging?

Paper and paperboard packaging are versatile and sustainable materials utilized in crafting a diverse array of packaging solutions. Derived from wood pulp, these materials possess the flexibility to be shaped into various forms and sizes, rendering them suitable for a wide spectrum of applications. Within the realm of paper packaging, you'll find items like corrugated boxes, cartons, bags, and labels, while paperboard packaging encompasses materials such as folding cartons, blister cards, andbeverage packaging.

One of the chief merits of paper and paperboard packaging lies in its eco-friendliness. These materials are not only recyclable but also biodegradable and sourced from renewable wood pulp. Moreover, they offer exceptional printability, rendering them ideal for branding and marketing purposes. Simultaneously, they excel in safeguarding and preserving products, ensuring their integrity and freshness throughout transportation and storage. It's these qualities that have propelled paper and paperboard packaging to prominence across diverse industries, including food and beverage, healthcare, cosmetics, and consumer goods.

Beyond the Box: The Ascendance of paper & paperboard packaging in a Circular Century

The global paper and paperboard packaging market has entered a transformative phase, driven by rising sustainability obligations, cost-efficient convertibility, and a resurgence of consumer preference of biodegradable minerals. As brands recalibrate their packaging strategies away from plastics, paper-based formats have become the cornerstone of next-generation packaging, valued for their recyclability, printability, and ability to support premium product aesthetics.

Rapid growth in e-commerce, food service delivery, and customisation-driven retail is further strengthening the sector's momentum. The market is steadily evolving toward solutions that are lighter, stronger, and engineered for reduced environmental impact, positioning paper. Rapid growth in e-commerce, food service delivery, and customization driven retail is further strengthening the sector's momentum.

Paper And Paperboard Packaging Market Growth Factors

Paper and paperboard packaging represent versatile and sustainable materials extensively employed in diverse packaging solutions across industries. Derived from wood pulp, these materials offer flexibility in shaping and sizing, making them suitable for an array of applications, including corrugated boxes, cartons, labels, and more. Notably, they align with eco-friendly trends due to recyclability, biodegradability, and renewable sourcing.

The global paper & paperboard Packaging market thrives on several growth drivers. The heightened emphasis on sustainability and eco-friendliness has fueled the adoption of paper-based packaging materials. Additionally, the burgeoning e-commerce industry's demand for robust packaging has boosted these materials' utility. Furthermore, increasing consumer awareness of environmental concerns andpreferences for recyclable packagingdrive market growth.

Industry trends encompass innovative packaging designs and customization to cater to diverse product needs. The incorporation of digital printing technologies for branding and marketing has gained prominence. Eco-friendly packaging solutions and a shift towards lightweight packaging materials are prevailing trends. Furthermore, the COVID-19 pandemic has accelerated the need for hygienic and tamper-evident packaging solutions. Challenges in the paper & paperboard packaging market include addressing competition from alternative materials like plastics. Achieving a balance between sustainability and performance can be complex. Supply chain disruptions and fluctuations in raw material costs pose challenges.

Additionally, stringent regulatory requirements on packaging materials need to be met. Business opportunities abound in innovating sustainable packaging solutions and customizations. The e-commerce sector presents a growth avenue, as does expanding into emerging markets with rising consumer demands. Leveraging digital printing technologies and exploring collaborations for recycling initiatives offer further prospects. Meeting the demand for tamper-evident and hygienic packaging is a valuable opportunity in the current market landscape.

Major Key Trends in Paper and Paperboard Packaging Market

- Increased Adoption of Smart Packaging: The incorporation of smart technologies, including sensors and NFC tags, into paper packaging improves product tracking, freshness assessment, and consumer interaction, particularly in the food, beverage, and healthcare industries.

- Advancements in Eco-Friendly Coatings:The creation of biodegradable and recyclable coatings, such as water-based and bio-based options, enhances moisture resistance and barrier features, minimizing plastic dependence and supporting environmental sustainability initiatives.

- Focus on Premium and Personalized Packaging: There is a rising trend towards luxurious, customizable paperboard packaging with features like embossing, foil stamping, and matte finishes, catering to high-end products and enhancing brand uniqueness.

Market Outlook

- Industry Outlook: The paper and paperboard packaging market is experiencing significant growth, as increasing demand for paper and paperboard packaging from the food and beverage, healthcare, personal care, electronics, and e-commerce industries.

- Sustainability trend: sustainability is no longer a value-add; it is the structural backbone packaging market. Climate-neutral manufacturing, renewable fiber sourcing, and water-efficient pulping processes are becoming industry norms. The move towards environmentally benign coatings such as bio-polymers, algae-derived films, and fully compostable linings is defining the next frontier of barrier technology. Increasing investment in circularity, including closed-loop recycling partnerships with retailers and municipal bodies, is transforming waste streams into valuable fiber reservoirs.

- Major Investment: Major investors in the paper and paperboard packaging industry include huge, established publicly traded companies that invest in their own processes and make strategic acquisitions, as well as several prominent private equity and venture capital organizations.

- Sustainable ecosystem: the sustainable ecosystem for paper and paperboard packaging is built on the pillars of responsible forestry, circular recycling, renewable energy usage, and low carbon logistics chains. Forest stewardship certification are becoming a prerequisite for global brands, while recycling alliances are enhancing fiber recovery rates.

- Industry Growth Overview:The paper and paperboard packaging market is experiencing significant growth, as increasing demand for paper and paperboard packaging from the food and beverage, healthcare, personal care, electronics, and e-commerce industries.

- Global Expansion:The paper and paperboard packaging industry expanded globally because rising pressures to lower plastic packaging for food resulted in increasing demand for paperboard packaging of fruits and vegetables. North America is dominant in the market due to increasing consumer demand for sustainable choices.

| Country | Country | Key products in paper and paperboard packaging |

| United States | Fibre pack solution | Corrugated boxes, kraft liners and folding cartons. |

| Canada | Maplepaper industries | Pulp-based cartons and frozen food boxes. |

| Germany | AlpenPack AG | High-barrier paperboard and luxury folding cartons. |

| Sweden | Nordwood Fiber Tech | Virgin Kraft paper, coated paperboard. |

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 482.84 Billion |

| Market Size in 2026 | USD 506.01 Billion |

| Market Size by 2035 | USD 768.98 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.76% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Consumer environmental awareness and e-commerce growth

Increasingly, consumers are prioritizing eco-friendly packaging choices. Paper and paperboard packaging materials are preferred due to their recyclability, biodegradability, and renewable sourcing from wood pulp. Brands that adopt these materials demonstrate their commitment to sustainability, resonating with environmentally conscious consumers. This heightened awareness has not only driven the demand for paper-based packaging but also incentivized businesses to opt for eco-friendly options to meet consumer preferences.

Moreover, the explosive expansion of e-commerce platforms has revolutionized the retail landscape. With more products being shipped directly to consumers' doorsteps, the need for sturdy, protective, and sustainable packaging has never been greater. Paper and paperboard materials offer an ideal solution, as they are lightweight yet durable, ensuring product safety during transit. Their versatility allows for various packaging formats, from corrugated boxes to labels, making them well-suited to the diverse packaging requirements of e-commerce. As consumers continue to embrace online shopping, the demand for paper and paperboard packaging in this sector continues to grow robustly.

Restraint

Competition from alternative materials

Paper and paperboard packaging face stiff competition from alternative materials like plastics. While paper-based materials offer sustainability benefits, plastics often excel in terms of durability, moisture resistance, and shelf life extension. This competition necessitates continuous innovation to enhance the performance of paper-based packaging to match the attributes of alternative materials.

Moreover, Striking the right balance between packaging performance and sustainability can be challenging. Businesses often grapple with the need to provide packaging that meets stringent performance requirements while minimizing environmental impact. This challenge is particularly relevant when packaging needs to protect sensitive products or ensure a longer shelf life.

Opportunity

Sustainable packaging solutions and digital printing

The global shift towards sustainability and eco-conscious consumer preferences has placed sustainable packaging solutions at the forefront of the paper & paperboard packaging market. Paper and paperboard are inherently eco-friendly materials, offering recyclability, biodegradability, and renewability. As environmental concerns intensify, businesses are increasingly adopting paper-based packaging to align with sustainability goals.

Furthermore, innovations in sustainable packaging, such as reduced packaging waste and minimalistic designs, appeal to consumers and reduce the environmental footprint of packaging materials. This green approach not only meets regulatory requirements but also fosters positive brand image and consumer loyalty.

Moreover, the advent of digital printing technologies has revolutionized branding and marketing in the packaging industry. Paper and paperboard materials are well-suited for digital printing, enabling intricate, customized, and eye-catching designs that enhance product visibility and shelf appeal. This level of personalization and flexibility is particularly valuable for brand differentiation in competitive markets.

Digital printing facilitates rapid prototyping, shorter production runs, and cost-effective variations, making it an ideal choice for businesses seeking dynamic packaging solutions. As consumer expectations for visually appealing and informative packaging rise, the demand for paper and paperboard packaging, combined with digital printing capabilities, continues to surge, driving market growth.

Impacts of COVID-19

The COVID-19 pandemic had a multifaceted impact on the paper & paperboard packaging market. Initially, the pandemic led to disruptions in global supply chains and manufacturing processes, causing uncertainty and delays in the packaging industry. The closure of production facilities and transportation challenges affected the availability of raw materials, impacting production schedules.

However, as the pandemic continued, several key trends emerged that influenced the paper & paperboard packaging market positively. With consumers shifting toward online shopping and e-commerce surging during lockdowns, there was a notable increase in demand for packaging materials suitable for shipping and protecting products. Paper and paperboard packaging, known for their durability and versatility, became essential in ensuring the safe delivery of goods.

Furthermore, the pandemic accelerated the need for tamper-evident and hygienic packaging solutions, particularly in the food and pharmaceutical sectors. Paper-based packaging materials, including labels and cartons, were instrumental in meeting these requirements. Overall, while the initial disruptions posed challenges, the paper & paperboard packaging market adapted to the evolving landscape, emphasizing the critical role of packaging in ensuring product safety and convenience during a global health crisis.

Segment Insights

Product Type Insights

According to the product type, the folding cartons segment has held 53% revenue share in 2025. Folding cartons are flat, paper-based packaging containers that are folded into shape and commonly used for packaging various consumer goods. They are lightweight, customizable, and often feature high-quality printing, making them ideal for branding and marketing purposes. In the paper and paperboard packaging market, folding cartons have seen a trend towards eco-friendly materials and designs as sustainability becomes a key focus. Additionally, customization and personalization options are in demand to create unique and eye-catching packaging solutions.

The corrugated boxes segment is anticipated to expand at a significant CAGR of 7.1% during the projected period. corrugated boxes are sturdy and versatile packaging containers made from corrugated cardboard. They are known for their durability and are commonly used in shipping and transportation due to their protective qualities. In recent trends, there is a growing emphasis on lightweight corrugated materials to reduce shipping costs and environmental impact. Additionally, the e-commerce boom has driven the demand for corrugated boxes, with a focus on designs that enhance unboxing experiences and ensure product safety during transit.

End User Insights

Based on the end user, food and beverages segment held the largest market share of 69% in 2025. In the paper and paperboard packaging market, the food and beverage sector is a prominent end-user. Paperboard cartons, containers, and labels play a vital role in preserving the freshness and integrity of food products. The trends in this segment include a growing demand for sustainable and eco-friendly packaging solutions to align with consumers' green preferences. Additionally, innovative packaging designs that enhance shelf appeal and provide convenience, such as easy-open cartons and single-serve options, are gaining traction as consumer lifestyles evolve.

On the other hand, the personal care segment is projected to grow at the fastest rate over the projected period. The personal care segment in the paper and paperboard packaging market encompasses various products, from cosmetics and skincare to toiletries. Brands in this sector are increasingly adopting paperboard packaging for its eco-friendly image and recyclability. Trends in personal care packaging include minimalist designs, premium finishes, and the use of recycled or biodegradable materials. Additionally, personalized packaging and small-sized, travel-friendly options cater to consumer preferences for convenience and customization in the personal care products they use daily.

Regional Insights

What is the U.S. Paper and Paperboard Packaging Market Size?

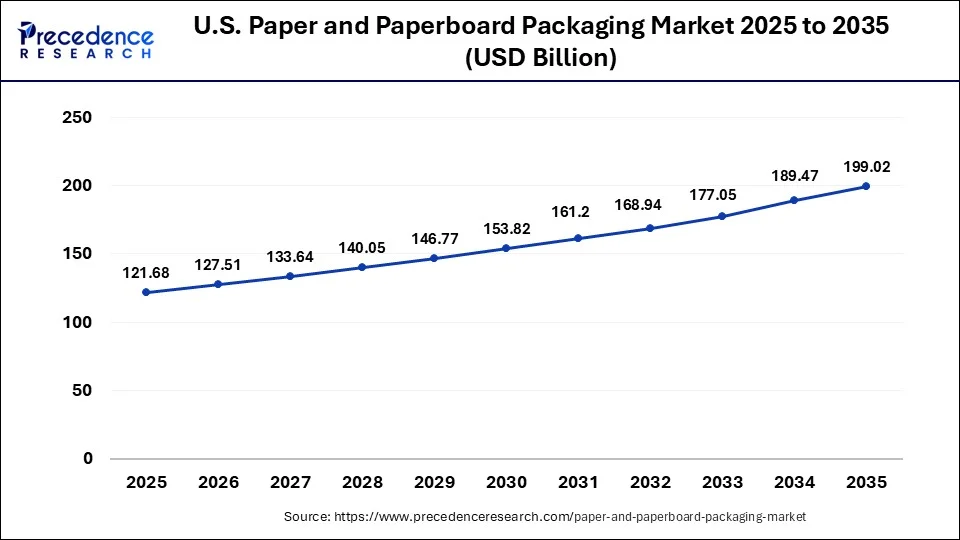

The U.S. paper and paperboard packaging market size is calculated at USD 121.68 billion in 2025 and is expected to be worth around USD 199.02 billion by 2035, at a CAGR of 5.04% between 2026 and 2035.

North America has held the largest revenue share 36% in 2025. North America's paper and paperboard packaging market is defined by a strong emphasis on sustainability and eco-friendliness. As consumers increasingly prioritize environmentally responsible packaging, paper and paperboard materials gain prominence. The region witnesses a growing trend of reducing plastic usage and adopting recyclable, biodegradable packaging solutions. Additionally, e-commerce growth during the pandemic has fueled the demand for sturdy and protective paper-based packaging. Personalized packaging, driven by digital printing technologies, is also on the rise, catering to brand differentiation and consumer engagement.

Asia-Pacific is estimated to observe the fastest expansion. The Asia Pacific paper and paperboard packaging market showcases a robust growth trajectory influenced by economic expansion, urbanization, and a burgeoning middle-class population. In this region, the trend of lightweight and sustainable packaging is particularly pronounced, aligning with cost-efficiency and environmental concerns. Customized packaging solutions, especially for food and beverage products, are on the rise to cater to diverse consumer preferences. The adoption of digital printing for branding and marketing purposes is gaining momentum, enhancing product visibility and appealing to the region's tech-savvy consumers.

In the European paper and paperboard packaging market, sustainability remains a dominant trend. European consumers are increasingly eco-conscious, leading to a surge in demand for sustainable packaging solutions. Manufacturers are responding by adopting recyclable, biodegradable, and FSC-certified paper and paperboard materials. Another notable trend is the push for minimalist and functional packaging designs, reflecting European consumers' preference for simplicity and functionality. Additionally, digital printing technologies are gaining ground, enabling customized and visually appealing packaging that resonates with European aesthetics.

Middle East & Africa Paper and Paperboard Packaging Market Trends:

The Middle East and Africa region is witnessing a steady rise in a paper and paperboard packaging, supported by expanding retail sectors, urbanization, and regulatory pushes toward more sustainable packaging forms. Growing consumer awareness around environmental impacts has accelerated the transition from traditional plastics to recyclable substrates. Local converters are increasingly investing in modern

Middle East and Africa Paper and Paperboard Packaging Market Trends:

In the GCC nations, particularly the UAE and Saudi Arabia, demand is propelled by premium retail formats, luxury goods, and a thriving logistics ecosystem. South Africa is becoming a manufacturing hub for kraft paper and recycled paperboard due to improved collection systems and a rising culture of waste valorization. Nigeria and Kenya are experiencing growing adoption spurred by information in the FMCG distribution, spurred by information to the formal retail transition. Across these markets, the government's sustainability roadmaps are accelerating investment in recyclable, fiber-based packaging capacities.

Europe Paper and Paperboard Packaging Market Trends:

Europe remains the global vanguard of the paper and paperboard packaging sector, guided by strict environmental regulations, advanced recycling infrastructure, and strong consumer preference for eco-friendly packaging. Packaging innovation in Europe prioritises reduced carbon impact, lightweighting, renewable feedstocks, and high-end printing applications. Demand from cosmetics, pharmaceuticals, organic foods, and artisanal beverage markets continues to elevate the role of premium paperboard. The region's well-established circular ecosystem ensures higher recycling rates and strong consistency in supply chain flows, making Europe a model for sustainable packaging transformation.

Germany Paper and Paperboard Packaging Market Trends:

Germany and Nordic countries lead in fibre innovation, adopting cutting-edge technologies such as bio-coatings, compostable barriers, and nano-cellulose reinforcements. France and Italy remain pioneers in luxury packaging using fine paper boats with superior asthetics attributes. The UK's packaging ecosystem is undergoing rapid digitalization as e-commerce accelerates the need for robust corrugated solutions. Eastern European countries, including Poland and the Czech Republic, are emerging as competitive production hubs due to their cost advantage and manufacturing capacities.

Value Chain Analysis - Paper and Paperboard Packaging Market

- Raw Material: The significant raw material for paper and paperboard packaging is cellulose fiber, sourced mainly from virgin wood pulp and recycled paper, supplemented by non-wood fibers such as straw or bagasse.

Key Players:Smurfit Kappa Group and Mondi Group - Production Processes: It includes an integrated industrial technology that changes raw fibers into high-performance protective materials via three main phases: pulp production, papermaking, and conversion in the packaging.

Key Players:DS Smith Plc and Georgia-Pacific LLC - Recycling Management: Paper and paperboard recycling management includes collection, sorting, shredding, de-inking, processing, and reforming into novel products.

Key Players:Tetra Pak International S.A. and Amcor plc

Paper and Paperboard Packaging Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

United States |

Strong brand reputation |

In November 2025, International Paper announced the closure of its packaging facilities in Compton, California, and Louisville, Kentucky. The facilities will cease operations by January 2026. All customers will be served from other nearby locations. |

|

|

United States |

Strong focus on sustainability with innovative fiber-based solutions |

In January 2025, Smurfit Westrock launched a 100% biodegradable paper pallet wrap to support organizations in founding environmentally sustainable supply chains. |

|

|

Smurfit Kappa Group |

Ireland |

Leadership in sustainable practices |

Smurfit Westrock, a worldwide leader in sustainable paper and packaging, operates in 40 countries with more than 100,000 employees working across 500+ packaging converting operations and 62 paper mills. |

|

Mondi Group |

United kingdom |

Sustainability Leadership |

In November 2025, Mondi, a worldwide leader in sustainable packaging and paper, is strengthening its position as a trusted partner for the food sector with the launch of an extended range of food packaging products. |

|

DS Smith Plc |

United kingdom |

Focus on circular economy principles |

In January 2025, International Paper announced the completion of its acquisition of DS Smith plc. The combined company creates a worldwide leader in maintainable packaging solutions. |

Other Major Key Players

- Georgia-Pacific LLC

- Tetra Pak International S.A.

- Amcor plc

- Sonoco Products Company

- Sealed Air Corporation

- Huhtamaki Oyj

- Cascades Inc.

- Graphic Packaging Holding Company

- BillerudKorsnäs AB

- Mayr-Melnhof Karton AG

Recent Developments

- In June 2024, Green Bay Packaging revealed its acquisition of SMC Packaging, a provider of packaging materials and corrugated boxes. This strategic acquisition aims to broadens Green Bay Packaging's product lineup and fortify its market presence in the paper and paperboard packaging sector.

- In July 2024, Smurfit Kappa completed its acquisition of WestRock, broadening its sustainable packaging offerings. This acquisition aims to decrease environmental impact while addressing the growing demand for eco-friendly packaging solutions in the paper and paperboard packaging sector.

- In May 2023, Stora Enso launched Tambrite Aqua+, a recyclable folding box board solution tailored for frozen, chilled, and dry food packaging. This product utilizes a water-based dispersion coating, cutting down on plastic use and aligning with sustainability objectives.

- In 2022, WestRock Company successfully acquired Grupo Gondi's remaining interest for USD 970 million plus debt assumption. The acquisition includes four paper mills, nine corrugated packaging facilities, and six high graphic facilities in Mexico. This strengthens WestRock's position in Latin America's expanding corrugated packaging, consumer goods, paperboard, and containerboard markets.

- In 2022,Mondi concluded the merger of Mondi Tire Kutsan and Mondi Olmuksan to create Mondi Turkey Oluklu Mukavva. This new entity, part of Mondi's corrugated packaging business, operates nine corrugated packaging facilities, a containerboard mill in Tire, Turkey, and a wastepaper collection facility in Adana, Turkey. Mondi holds an 84.65% ownership in Mondi Turkey Oluklu Mukavva, which employs approximately 1,600 workers and is traded on the Istanbul Stock Exchange (BIST).

- In 2022,In collaboration with FRESH!PACKING, Mondi introduced the Fresh!Bag, an advanced cooler bag designed for transporting frozen or chilled foods. The bag's exterior layer is constructed entirely from Mondi's robust kraft paper, replacing non-recyclable multi-material packaging. The cooling section is made from Ipulp, enclosed in recyclable kraft paper, simplifying bag construction.

- In 2022, Smurfit Kappa announced its acquisition of PaperBox, a packaging facility located in Saquarema, Brazil. This strategic move expanded Smurfit Kappa's operational footprint in Brazil, complementing its existing presence in Minas Gerais, Rio Grande do Sul, and Ceará, strengthening the company's position in the Brazilian packaging market.

Segments Covered in the Report

By Product Type

- Folding Cartons

- Corrugated Boxes

- Others

By End-user

- Food

- Beverage

- Healthcare

- Personal Care

- Electrical

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting