What is Honeycomb Paper Market Size?

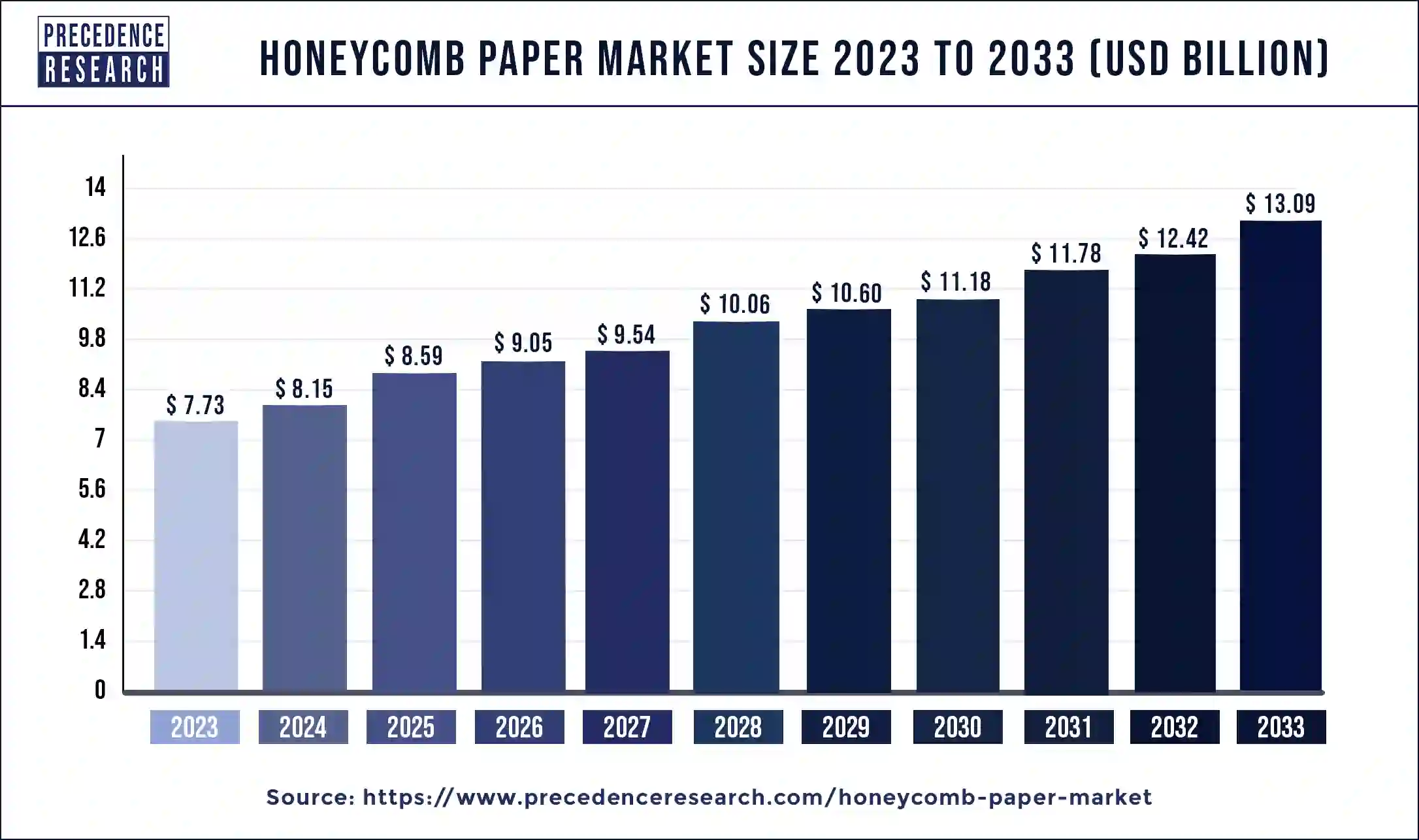

The global honeycomb paper market size is valued at USD 8.59 billion in 2025 and is anticipated to reach around USD 14.43 billion by 2035, growing at a CAGR of 5.32% from 2026 to 2035. Manufacturers are looking for alternatives to reduce packaging cost, this factor is observed to expand the growth of the honeycomb paper market.

Market Highlights

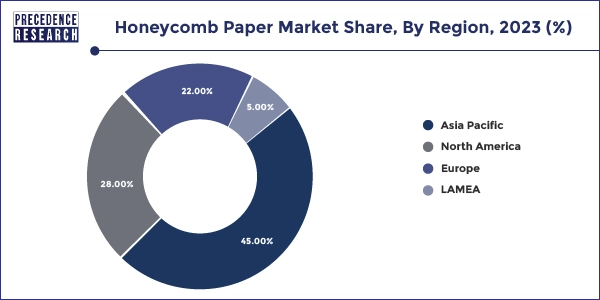

- Asia Pacific dominated the market with the largest revenue share of 45% in 2025.

- North America is another fastest growing region in the honeycomb paper market.

- By core type, the continuous paper segment led the market with the largest share in 2025.

- By cell size, the 10-30 mm cell size segment has held a biggest revenue share of 50% in 2025.

- By end use, the home decor segment led the market in 2025.

Market Overview

The honeycomb paper market continues to thrive, driven by its versatility and eco-friendly nature. With increasing emphasis on sustainability, industries ranging from packaging to construction are adopting honeycomb paper solutions. Its lightweight nature combined with impressive strength makes it ideal for reducing transportation costs and ensuring product protection.Additionally, honeycomb paper's recyclability aligns with consumer demands for environmentally conscious options. Industries such as automotive, furniture, and consumer goods are increasingly integrating honeycomb paper into their manufacturing processes to enhance product performance while minimizing environmental impact.

Moreover, advancements in manufacturing technology are further fueling market growth, enabling customization and scalability to meet diverse industry needs. The market's upward trajectory is projected to persist as more industries recognize the economic and environmental benefits of honeycomb paper solutions, positioning it as a key player in the global packaging and materials market.

Honeycomb Paper Market Growth Factors

- Honeycomb paper is used in various industries, including packaging, automotive, and furniture.

- Despite being lightweight, honeycomb paper is remarkably strong, providing excellent product protection.

- Its recyclable nature appeals to environmentally conscious consumers and industries.

- More industries are recognizing the benefits of honeycomb paper for both economic and environmental reasons.

- Continuous improvements in manufacturing technology enhance the quality and scalability of honeycomb paper products.

- Honeycomb paper can be tailored to meet specific industry needs and product requirements.

- Using honeycomb paper can lead to cost savings in transportation, packaging, and manufacturing processes.

- Companies are increasingly adopting sustainable materials like honeycomb paper to meet consumer demand and corporate sustainability goals.

- Government regulations promoting environmental sustainability drive the adoption of eco-friendly materials like honeycomb paper.

- Growing consumer preference for environmentally friendly products fuels the demand for honeycomb paper across various industries.

Market Scope

| Report Coverage | Details |

| Honeycomb Paper Market Size in 2025 | USD 8.59 Billion |

| Honeycomb Paper Market Size in 2026 | USD 9.05 Billion |

| Honeycomb Paper Market Size by 2035 | USD 14.43 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.32% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Core Type, By Cell Size, By End-use Industry, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Eco-friendly option for packaging

One significant driver propelling the honeycomb paper market forward is its exceptional eco-friendliness. As global awareness of environmental issues continues to rise, industries are under increasing pressure to adopt sustainable practices and materials. Honeycomb paper emerges as a compelling solution due to its inherently eco-friendly characteristics. honeycomb paper is highly recyclable. After serving its primary purpose, it can be easily recycled into new products or materials, minimizing waste and conserving natural resources. This recyclability aligns with circular economy principles, where resources are kept in use for as long as possible through recycling and repurposing.

Moreover, the production process of honeycomb paper typically involves fewer environmental impacts compared to traditional materials like plastics or metals. It often requires less energy and generates fewer greenhouse gas emissions, contributing to a lower carbon footprint overall.

Overall, the eco-friendliness of honeycomb paper makes it an attractive choice for industries striving to meet sustainability goals and consumer preferences for environmentally responsible products. As environmental concerns continue to drive market trends, the demand for honeycomb paper is expected to grow steadily in the coming years.

Restraint

Significant initial investment

Despite its numerous benefits, one significant restraint facing the honeycomb paper market is the significant initial investment to adopt it along with competition from alternative materials, particularly those derived from petrochemicals. While honeycomb paper offers eco-friendly advantages, such as recyclability and renewable sourcing, it faces tough competition from materials like plastics and metals, which have established market and may offer certain performance advantages in specific applications.

Moreover, the initial investment and transition costs associated with adopting honeycomb paper solutions can deter some industries from making the switch. For companies accustomed to using traditional materials, such as plastics or metals, integrating honeycomb paper into their manufacturing processes may require substantial investments in equipment with training which can pose a barrier to entry.

Opportunity

Adoption from the aerospace industry

An exciting opportunity for the honeycomb paper market lies within the aerospace industry, particularly in aircraft interiors and components. Honeycomb paper's lightweight yet robust characteristics make it well-suited for various applications within aircraft design and manufacturing. One notable opportunity is in the production of aircraft interior panels. Honeycomb paper panels can be used to create lightweight, durable, and customizable interior components such as overhead bins, cabin partitions, and bulkheads. These components can contribute to reducing the overall weight of the aircraft, leading to fuel savings and improved operational efficiency which is a critical consideration for airlines aiming to lower their operating costs and reduce carbon emissions.

- For instance, in 2023, Kevlar1 mil N636 Paper got recognized at the 2023 Edison Awards. Kevlar 1 mil N636 paper won a silver award for high performance design in the aerospace & flight technologies category. Kevlar 1 mil N636 paper is a promising innovation offering an ultra-thin, ultra-light honeycomb paper product that can be used in aircraft cabins to help achieve effective lightweighting.

Segment Insights

Core Type Insights

The continuous paper honeycomb segment led the honeycomb paper market in 2025 and the segment is observed to continue the growth at a considerable rate during the forecast period. Continuous paper honeycomb cores offer exceptional strength-to-weight ratios, making them ideal for lightweight construction applications such as aerospace, automotive, and marine industries. As industries increasingly prioritize fuel efficiency and sustainability, the demand for lightweight materials like continuous paper honeycomb cores is expected to rise.

Continuous paper honeycomb cores are typically made from recycled paper or sustainably sourced paper pulp, aligning with the growing emphasis on environmental sustainability. As regulations tighten and consumer preferences shift towards eco-friendly products, manufacturers are likely to prefer materials with lower environmental footprints, thus driving the demand for continuous paper honeycomb cores.

Continuous paper honeycomb cores can be easily customized to meet specific design and performance requirements, offering versatility across a wide range of applications. Whether it's providing thermal insulation, acoustic damping, or structural reinforcement, continuous paper honeycomb cores can be tailored to suit various industry needs, thereby expanding their market potential.

Cell Size Insights

The 10-30 mm cell size segment held a significant share of the market in 2025. Similarly, the segment is observed to witness a significant growth rate in the honeycomb paper market in during the forecast period. Honeycomb structures with cell sizes between 10-30 mm offer a balance between strength and weight, making them suitable for a wide range of applications requiring structural integrity and stability. The 10-30 mm cell size range caters to various industries, including aerospace, automotive, construction, packaging, and furniture. Its versatility makes it adaptable to different manufacturing processes and product requirements, driving demand across multiple sectors.

Despite their robustness, honeycomb structures with 10-30 mm cell sizes remain lightweight, contributing to fuel efficiency in transportation applications and reducing overall product weight without compromising strength. Honeycomb structures with smaller cell sizes within the 10-30 mm range offer improved energy absorption capabilities, making them suitable for applications requiring impact resistance and crashworthiness, such as automotive crash structures and protective packaging. As environmental concerns continue to drive market trends, the use of honeycomb structures with 10-30 mm cell sizes aligns with sustainability goals due to their recyclability and potential use of eco-friendly materials. Continuous improvements in manufacturing processes and material compositions enable the production of honeycomb structures with precise cell sizes within the 10-30 mm range, enhancing their performance and affordability.

End-use Insights

In the honeycomb paper market, the home decor segment stands out as a dominant end-use segment and is poised for further growth. With increasing awareness of environmental sustainability, consumers are gravitating towards eco-friendly home decor options. Honeycomb paper products fit this trend perfectly, as they are made from recyclable materials and are biodegradable, appealing to environmentally conscious consumers. Honeycomb paper offers immense versatility in design, allowing for the creation of unique and visually appealing home decor items such as lampshades, room dividers, wall art, and decorative accents. The ability to customize shapes, colours, and patterns makes honeycomb paper an attractive choice for interior designers and homeowners seeking distinctive decor elements.

Honeycomb paper products are lightweight and easy to handle, making them convenient for DIY home decor projects. Unlike traditional materials like wood or metal, honeycomb paper requires minimal installation effort and can be easily mounted or assembled, appealing to consumers looking for hassle-free decorating solutions. Honeycomb paper products often offer cost advantages compared to traditional home decor materials, making them accessible to a wider range of consumers. This affordability factor contributes to the growing popularity of honeycomb paper in the home decor market.

Manufacturers are continually innovating and expanding their product offerings in the honeycomb paper home decor segment. From new shapes and designs to improved durability and functionality, ongoing advancements drive consumer interest and market growth.

Regional Insights

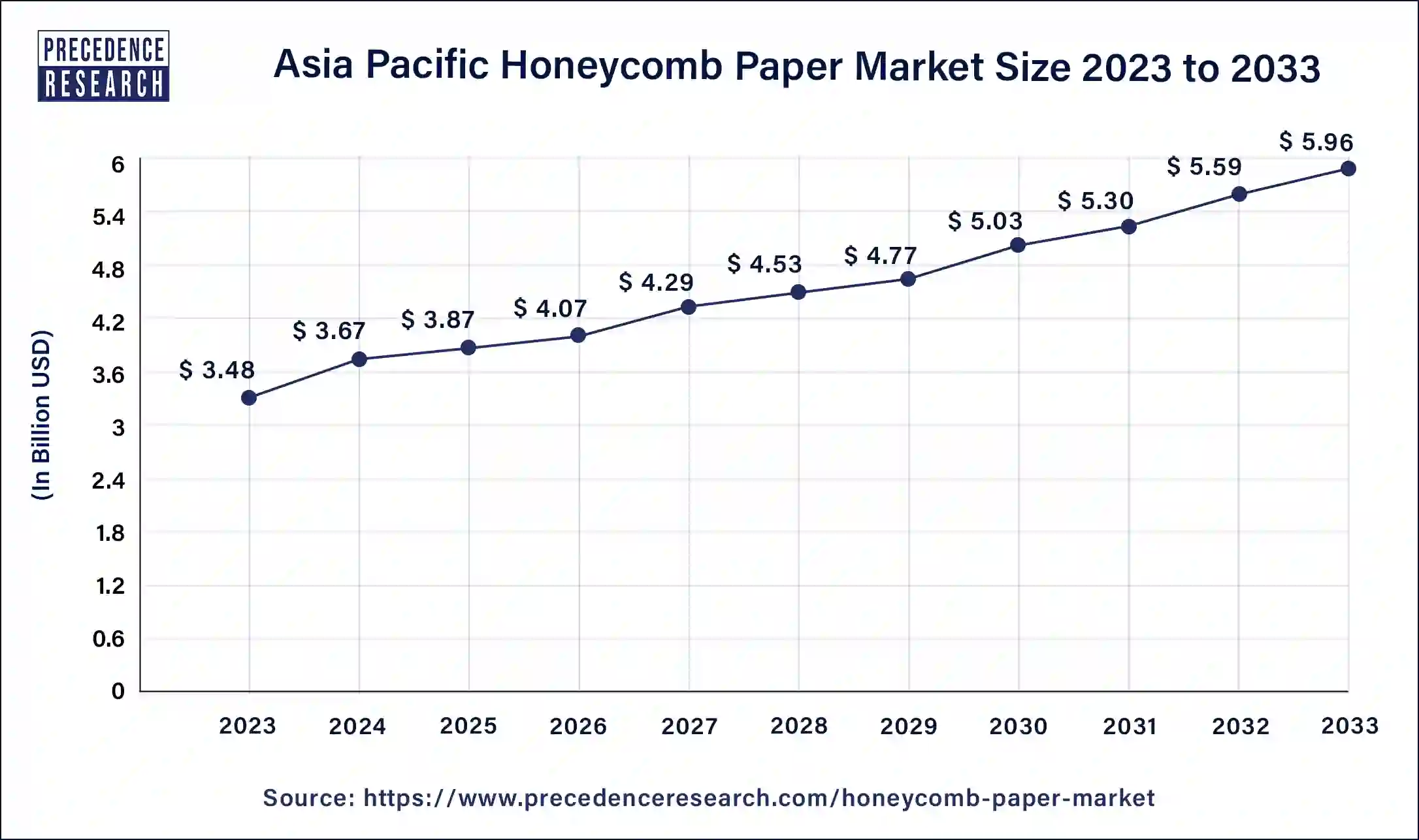

Asia Pacific Honeycomb Paper Market Size in the 2026 to 2035

The Asia Pacific honeycomb paper market size is estimated at USD 3.87 billion in 2025 and is predicted to be worth around USD 6.7 billion by 2035, at a CAGR of 5.64% from 2026 to 2035.

Asia Pacific held the largest share of the honeycomb paper market in 2025. Further, the region is observed to sustain the position during the forecast period. The major reason behind this is, Asia Pacific region is undergoing rapid industrialization, driving demand for packaging, construction, automotive, and other sectors where honeycomb paper finds extensive applications. Increasing awareness among consumers regarding environmental sustainability is driving demand for eco-friendly packaging solutions, boosting the adoption of honeycomb paper in the region.

The booming e-commerce industry in Asia Pacific is fuelling the demand for innovative packaging solutions to ensure product protection during transit. Honeycomb paper's lightweight and strong properties make it an attractive choice for e-commerce packaging. Ongoing infrastructure development projects across countries like China, India, and Southeast Asian nations are driving demand for construction materials, including honeycomb paper for applications such as doors, partitions, and false ceilings. Supportive government policies and initiatives promoting sustainable practices and materials are further bolstering the growth of the honeycomb paper market in the Asia Pacific region.

North America is experiencing rapid growth in the honeycomb paper market due to increased demand for sustainable packaging solutions, driven by environmental concerns. Additionally, the growing e-commerce sector is fuelling demand for lightweight, protective packaging materials, where honeycomb paper excels. The United States and Canada are pivotal players in the rapidly growing honeycomb paper market in North America. In the United States, increased awareness about environmental sustainability is driving the demand for eco-friendly packaging solutions, with honeycomb paper being recognized for its recyclability and lightweight properties. The country's thriving e-commerce sector further amplifies this demand, as businesses seek efficient and protective packaging materials for shipping products.

Advancements in manufacturing technologies have also contributed to the market's expansion by enhancing the efficiency and versatility of honeycomb paper products. Moreover, the region's robust infrastructure and strong presence of key players in the packaging industry further stimulate growth. As a result, North America is emerging as a significant player in the global honeycomb paper market, poised for continued expansion in the coming years.

- For instance, In September 2023, DuPont and Point-Blank Enterprises announced a partnership that will see North American state and local police agencies offered body Armor constructed with Kevlar EXOTM aramid fibre.

Recent Developments

- In November 2023, Hexcel announced its cutting-edge lightweight material solutions, such as the HexPly M79 prepregs made of intermediate and high modulus fibres. The company will also display components made by customers utilizing Hexcel materials, which are high-performance superyachts and windships.

- In July 2023, Schütz Composites will present their lightweight materials' many benefits and practical uses. Featuring its cutting-edge CORMASTER material, which boasts unparalleled mechanical strength and resistance while remaining remarkably lightweight due to its honeycomb structure, Schütz Composites will showcase a wide range of potential uses.

Honeycomb Paper Market Companies

- Lsquare Eco Products Pvt. Ltd.

- Helios Packaging

- Crown Holdings Inc.

- Greencore Packaging

- Axxor

- YOJ-Pack-Kraft

- Schütz GmbH & Co. KGaA

- MAC PACK

- EcoGlobe Packaging Private Limited

- Honicel Nederland B.V.

Segments Covered in the Report

By Core Type

- Expanded Paper Honeycomb

- Expanded Paper Honeycomb Blocks Paper Honeycomb

- Continuous Paper Honeycomb

- Others

By Cell Size

- Upto 10 mm

- 10 to 30 mm

- Above 30 mm

By End-use Industry

- Home Decor

- Transport and Logistics

- Automotive

- Building and Construction

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting