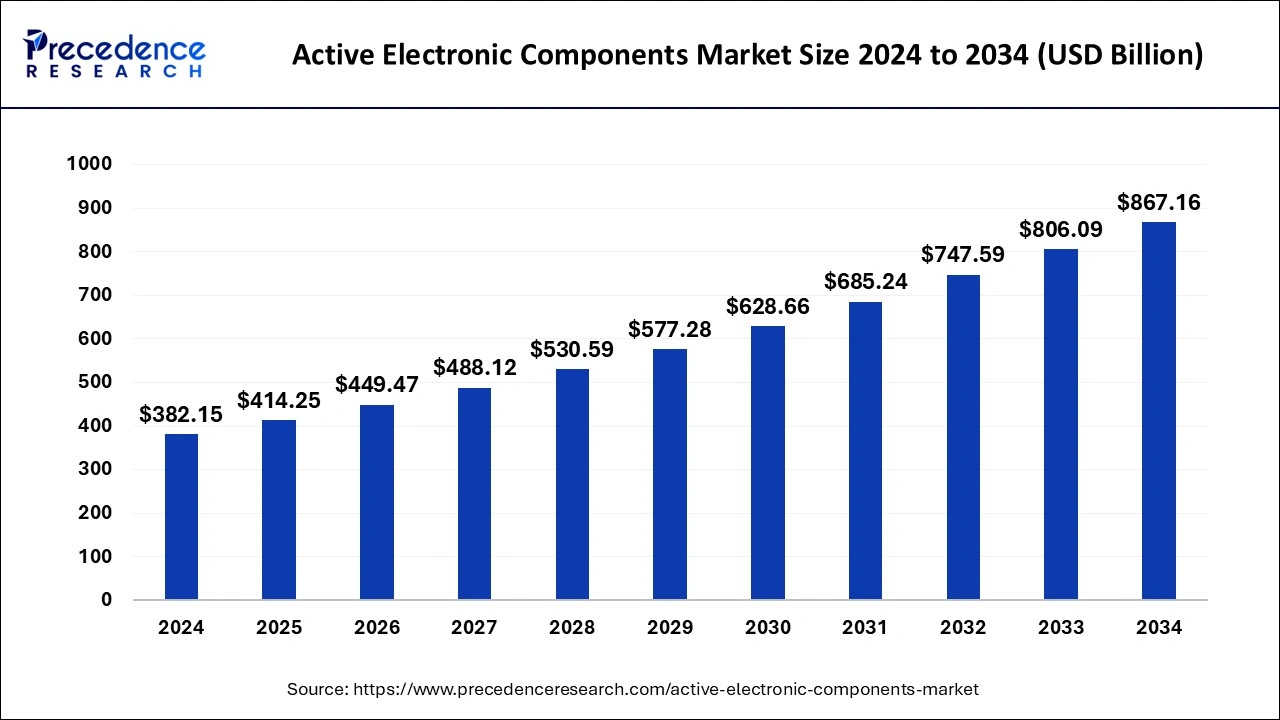

Active Electronic Components Market Size and Forecast 2025 to 2034

The global active electronic components market size was estimated at USD 461.6 billion in 2024 and is predicted to increase from USD 482.6 billion in 2025 to approximately USD 720.29 billion by 2034, expanding at a CAGR of 4.55% from 2025 to 2034.

Active Electronic Components Market Key Takeaways

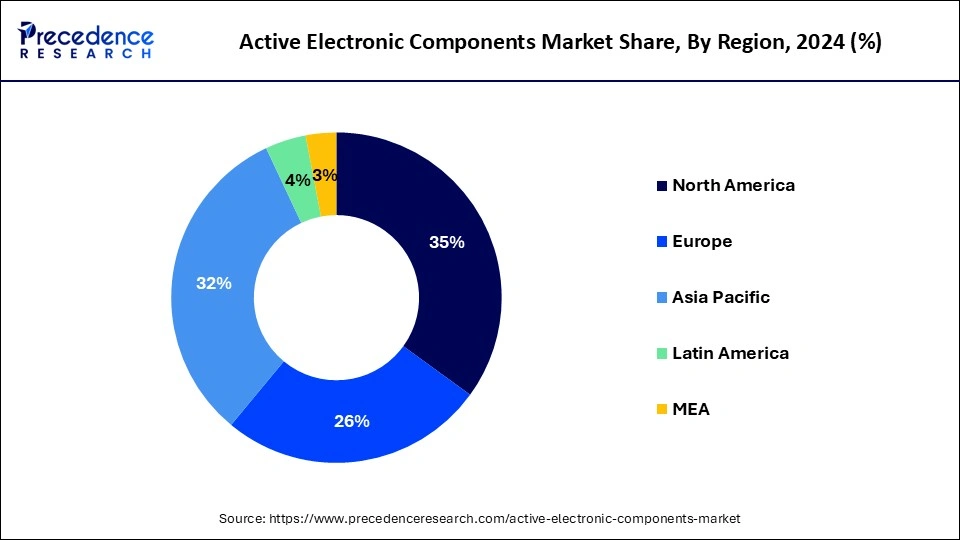

- Asia Pacific accounted highest revenue share of over 35% in 2024.

- By product, the semiconductor segment has accounted revenue share of over 58% in 2024.

- By End User, the consumer electronics segment has held the largest market share in 2024.

- By end-user, the consumer electronics segment has captured a revenue share of 32% in 2024.

Active electronic components are devices that can amplify a signal and feature an electronic filter for power gain. An oscillator, integrated circuit, or transistor is examples of active electronic components. These components work in a device to enhance or generate voltage, active power, or current as an alternating current circuit. The global active electronic components market is growing rapidly and will continue to do so in the coming years. In an electronic system, an electronic component is a simple physical device or object that affects electrons or their associated field. The increased need for high transfer speeds with reduced idle time among customers has enabled telecom administrators, particularly in emerging nations such as India, to deliver a cutting-edge 5G business framework. As a result, curiosity in new information technology and telecom hardware will grow, increasing item reception.

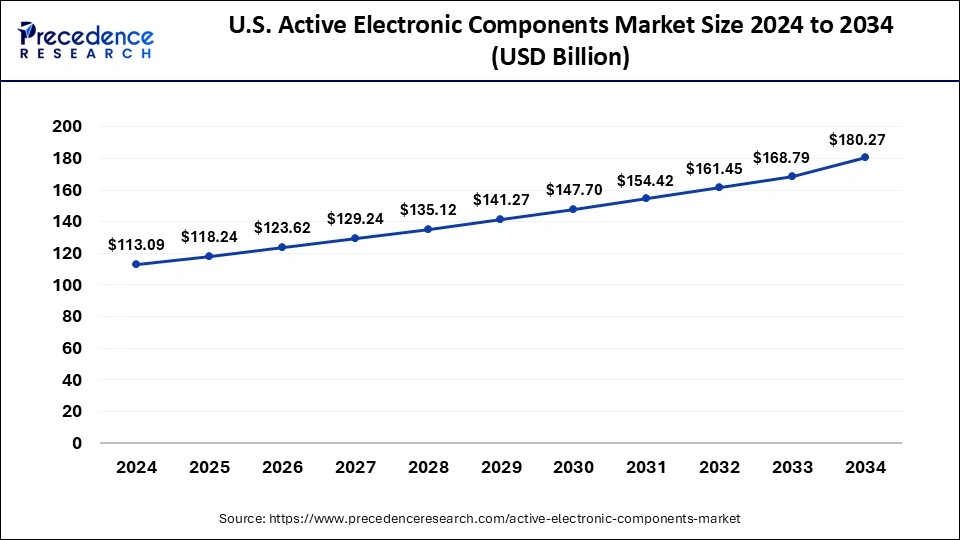

U.S. Active Electronic Components Market Size and Growth 2025 to 2034

The u.s. active electronic components market size was exhibited at USD 113.09 billion in 2024 and is projected to be worth around USD 180.27 billion by 2034, growing at a CAGR of 4.77% from 2025 to 2034.

The North America held the largest revenue share 35% in 2024. Due to an increase in internet customers and internet usage on smartphones and portable devices, the digital map is expanding rapidly. The Asia Pacific area benefits from the increased use of digital maps by opening up new prospects. Digital map systems are used in autonomous cars for navigation and route planning. The key driving force behind the Asian market's expansion is the recent developments in digital maps, such as 3D maps, and the simplicity with which a location may be found and understood.

Moreover, the industry is driven by enterprises' efforts to develop GPS. For instance, the mapping solutions company Esri India debuted a platform in January 2024 that will offer businesses, institutions, and state governments access to data-driven policymaking. The granular data provided by the interactive "Policy Maps" can be used to analyze the progress made. Policy Maps are primarily impersonal and get their information from reliable governmental sources. Policymakers can use the tool to construct and place different indicators on maps in accordance with demand.

China has also created a business ecosystem. Manufacturers profit from their well-developed supply chain in both procurement and distribution operations. Most components used in electronics may be supplied by local Chinese businesses, which enables manufacturers to reduce logistics expenses. In addition to lowering logistical expenses, shorter lead times also result in lower working capital requirements, which lessen the financial pressure on enterprises. This has had a positive influence on the Chinese active electronics market.

Top countries in North America

- United States: Home to tech giants like Intel, Texas Instruments, Qualcomm, and Broadcom, the U.S. dominates semiconductor design and innovation. Massive investments in AI, defence electronics, and IoT solutions also contribute significantly.

- Canada: Canada's growing role in telecommunications and clean technology hardware, coupled with R&D support for electronics manufacturing, positions it as a valuable contributor.

United States Active Electronic Components Market

The United States is a major contributor to the active electronic components market. The growing advancements in areas like industrial automation, consumer electronics, and electric vehicles increase demand for active electronic components like microprocessors, semiconductors, and integrated circuits. The strong government support for the development of advanced electronic components through initiatives like the CHIPS & Science Act helps the market growth. The growing adoption of electric vehicles, 5G, and IoT increases demand for active electronic components. The growing demand across key sectors like automotive, aerospace, electronics, and defense drives the overall market growth.

Canada Active Electronic Components Market

Canada is growing in the active electronic components market. The growing expansion of electric vehicles increases demand for active electronic components like battery management systems, electronic control units, and power modules. The strong government support for renewable energy projects and clean technology fuels demand for active electronic components like advanced connectivity solutions, sensors, and power semiconductors. The growing focus on digitalization and 5G infrastructure development helps the market growth. The participation in agreements like CUSMA and the growing demand for consumer electronics support the market growth.

Additionally, a significant portion of Malaysia's exports come from electronics production. Malaysia is home to manufacturing operations for international brands from nations like Germany, Japan, and South Korea. Computers, semiconductors, and cameras are some examples of products, with semiconductor fabrication receiving a lot of attention. Unexpectedly, Malaysia's labor costs are cheaper, and blue-collar workers make between 500 and 800 USD per month. On the other hand, in China, the average monthly wage is greater than USD 1,000. Therefore, it is essential to consider Malaysia's affordable labor expenses. As a result, the active electronics components industry would soon see a significant increase in the Asia Pacific region.

North America is estimated to observe the fastest expansion. The federal government of the U.S. is heavily investing in the creation of smart citiesaround the country. The growth is majorly attributed to the rising adoption of micro-electromechanical systems (MEMS) and renewable energy resources. In addition, the increasing demand for portable electronic devices in the region contributes as the key driver for the growth of active electronic components market. Apart from this, burgeoning trend for connected cars and smart homes in the U.S. has opened up new opportunities for the telecom operator in the region to invest huge amount for the deployment of 5G network infrastructure. For instance, in April 2020, AT&T announced investment of USD 5 Bn in the first quarter of 2020 only for expanding 5G network.

Meanwhile, the Asia Pacific seeks to be the most opportunistic region and projected to supersede North America during the forecast period. The region is expected to witness a CAGR of nearly 10.8% over the forecast period. The growth is mainly driven by the presence of huge consumer electronics market in the region. As per a research conducted by the European Council in 2017, China exhibits lucrative growth of 36-38% in the consumer electronics market in 2017. Along with this, China is the largest producer and exporter of consumer electronic products worldwide. Lucrative features and new technologies have transformed the consumer electronics product and thus flourishing the demand for active electronic components market in the region.

Top countries in Asia-Pacific

- China: The world's largest electronics manufacturing base. Government-backed initiatives like “Made in China 2025” accelerate chip development and self-reliance in active components.

- Japan: Known for precision engineering, Japan is a leader in high-performance semiconductors, photonics, and industrial electronics.

- South Korea: Global giants such as Samsung and SK Hynix fuel innovation and large-scale production of integrated circuits and memory chips.

- Taiwan: Home to TSMC, a global semiconductor foundry leader, Taiwan plays a central role in chip fabrication and design.

- India: With rising demand for smartphones, IoT devices, and government incentives under the PLI Scheme, India is fast-emerging as a major electronics manufacturing and design hub.

India Active Electronic Components Market

India is growing in the active electronics components market. The growing demand for consumer electronics like laptops, wearable devices, computers, smartphones, and other devices increases the demand for active electronic components. The increasing adoption of internet-based technologies like 5G, IoT, cloud computing, and smart home systems increases the adoption of active electronic components. The increasing domestic production and growing demand across industries like industrial machinery, automotive, and healthcare support the overall growth of the market.

Japan Active Electronic Components Market

Japan is growing in the active electronic components market. The high-quality production of electronics increases demand for active electronic components. The increasing production of miniaturized active electronic components and the growing development of advanced technologies like advanced semiconductors & MEMS help the market growth. The growing shift towards automation and the rise in electric vehicles increases demand for active electronic components. The growing demand across sectors like industrial applications, consumer electronics, and automotive drives the overall growth of the market.

Products launched around the globe

| Country | Company | Product |

| United States | Texas instruments | Automotive-grade integrated circuits |

| Japan | Sony | High-speed CMOS image sensors |

| South Korea | Samsung electronics | Advanced microcontrollers for IoT applications |

| Germany | Infineon technologies | Power semiconductor for electric vehicles |

| Taiwan | TSMC | 3nm process technology for high-performance chips |

Active Electronic Components Market Growth Factors

- Rising Demand for Consumer Electronics: The surge in smartphones, tablets, smart wearables, and home automation devices fuels demand for transistors, diodes, and integrated circuits.

- Automotive Electrification: Electric vehicles (EVs) and autonomous driving technologies demand high-reliability active components for sensors, controllers, and communication systems.

- 5G and IoT Expansion: High-speed communication technologies require powerful microprocessors and signal amplification systems.

- Healthcare Digitisation: The increasing use of medical electronics and remote monitoring devices drives demand for reliable, miniaturised components.

- Miniaturisation and Energy Efficiency: The need for compact and energy-efficient devices boosts innovation in semiconductors and power electronics.

Major Trends Contributing to Global Market Growth

- Surging AI and data center needs: There is a growing demand for high-speed processing and graphics chips driven by advancements in AI, machine learning, and cloud computing.

- Technological integration in automotive: The growing use of ECUs, sensors, and ADAS systems in vehicles is driving demand for reliable active electronic components.

- Global push for 5G rollouts: Upgrading infrastructure is essential for installing new base stations, RF amplifiers, and communication chips.

- Government support: Subsidies, tax incentives, and infrastructure support in regions like the U.S., India, and China are encouraging local manufacturing and R&D.

- Increased Defense and Aerospace Investment: Strategic defense technologies require specialized components with high reliability and precision.

Market Scope

| Report Highlights | Details |

| Market Size by 2034 | USD 720.29 Billion |

| Market Size in 2025 | USD 482.6 Billion |

| Market Size in 2024 | USD 461.6 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.55% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and Regional |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Surge in demand for active electronic components in various sectors

Printed circuit boards and consumer electronics were once the sole places where active electronic components were used. However, the military, space & satellite technologies, and vehicle applications have all seen an increase in the use of these gadgets. The market for active electronic components is developing due to increased use of renewable energy and a growing trend toward the use of electric and hybrid cars. UPS and invertors, panels, and solar turbines are only a few examples of renewable energy fixtures or equipment. Photodiodes and photo-transistors are examples of active electronic components.

Increasing Necessity of Electronic Devices

The popularity of different electronic devices, such as power inverters, controllers, driver assistance systems, power diodes, telematics, and GSP receivers, among others, has increased due to the automobile industry's increasing automation. Electric vehicles (EVs) and autonomous vehicles utilize these components frequently. Consequently, it is estimated that over the forecast period, the rising electronic car demand would accelerate product adoption. The manufacturing sector is undergoing a rapid transformation as a result of connected technology.

Battery electric vehicle sales in the world are still rising rapidly. For instance, according to data from the European Automobile Manufacturers' Association, 12.1% of the 9.1 million vehicles sold in the European market in 2022 were fully battery electric vehicles. This contrasts with a share of just 1.9% in 2019 and 9.1% in 2021. Initially, Dataforce reported that the Tesla Model Y SUV outperformed all EV models in 2022 with approximately 137, 819 sales in Europe.

Restraints

Fluctuation in prices

The greatest issue that these manufacturers have is figuring out how to produce even more electric energy at lower rates than they are now, taking into consideration the fact that raw material prices change greatly.

Fluctuating Cost of the Raw Material:

The price of raw materials is the main barrier to the manufacture of active electronic components. These prices are erratic and fluctuate greatly during the day. Labor expenses also raise the price of a finished good. The active electronic components market is severely constrained by this issue. Passive components typically come in the form of tailored pastes or powders. The most variable costs are associated with these materials. During September, the cost of these commodities climbed by more than 12%, indicating high demand. A significant concern for the electronics business is rising commodity prices. Supply networks may need to change significantly as a result of this. Price hikes may also reduce profitability because raw materials are important inputs in the production of finished high-tech products. Electronics businesses are therefore attempting to lessen the effects of these changes.

Opportunities

Growing penetration of smartphones

Smartphones and other wearable gadgets, as well as industrial automation, have boosted demand for active electronic components. The active electronic components market is boosted by rising demand for active electronic components from the automotive and healthcare industries, as well as rising technology usage. The deployment of active electronic components has accelerated as vehicle modernization and demand for technologically advanced automobiles has increased. The market's growth is fueled by the increasing use of active electronic components in consumer products and wearables, as well as the increasing usage of renewable energy resources. The rising use of active electronic components in connected devices is driving active electronic component adoption around the world.

Increase in the Production of the Semiconductors for Electronics and EVs:

An automobile manufacturer would run the risk of turning into an assembly plant if the majority of a product's economic value was produced by other industries. As a result of the pandemic's shortages of both conventional auto parts and semiconductor components, automakers are now thinking about expanding vertical integration into the design and production of semiconductors, particularly power devices for electric vehicles (EVs). For example, Bosch and BYD already had their own wafer fabs for producing power components that were self-designed. Federal programs and international strategic alliances will also fuel market expansion. For instance, in January 2023, the India Electronics and Semiconductor Association (IESA) and the U.S. Semiconductor Industry Association mutually announced plans to establish a commercial task group to improve cooperation between the two nations in the global semiconductor environment.

Challenges

High cost of raw materials

The costs of the raw resources required to produce this energy are volatile. They change dramatically from one day to the next, and even throughout the day. In addition, the cost of labor also adds to the final cost of the product. This is a major impediment to the active electronic components market's expansion.

Product Type Insights

Semiconductor devices held nearly half of the revenue share in the global active electronic components market in the year 2023 and analyzed to witness robust growth during the forecast period. The growth of the segment is mainly due to on-going product innovation along with rising demand for energy efficient devices in the market. The semiconductor devices segment is further bifurcated into transistors, diodes, optoelectronic components, and integrated circuits. Out of these, integrated circuits held significant revenue approximately USD 90 Bn in 2019, attributed to the robust rise in demand for integrated circuits incorporated with state of art devices such as vehicle automation systems, laptops, and network devices among others. The significant adoption of semiconductor devices across a variety of applications, including household appliances, personal computers, mobile phones,and network equipment, is credited with the segment's rise. In addition, the current trend of shrinking and the development of energy-efficient systems is boosting demand for semiconductor devices and related components.

The segment with the highest revenue share was semiconductor devices. The strong use of semiconductor devices across many applications, including home appliances, personal computers, smartphones, network equipment, laptops, and many others, is credited with the market growth. Additionally, the demand for semiconductor devices and associated components is benefiting from the current trend of shrinking and creating energy-efficient systems. For instance, gallium nitride (GaN) is gaining popularity due to its potential to provide higher power density and improved efficiency compared to conventional silicon MOSFETs and insulated-gate bipolar transistors (IGBTs). Additionally, GaN devices' smaller size and improved efficiency translate into significant cost savings, while an increase in power density enables the placement of more processing power on the data center rack in the form of additional processors, graphics, and RAM.

Over the past few years, smartphones have registered significant growth in demand, especially across under-developed and developing nations. Additionally, the demand for 5G chipset is increasing enormously in the developed countries with the introduction of 5G-enabled smartphones, along with fuelling demand for vehicle automation systems and other telecom equipment. Thus, the increasing demand for 5G chipset is presumed to offer lucrative growth in the integrated circuits segment.

End User Insights

With the biggest revenue share in the market in 2023, the consumer electronics sector took the lead. The need for microelectronics appliances for different consumer products, video game consoles, and several gadgets is expected to increase, which is primarily responsible for the growth. The need for networking hardware, such as modems, repeaters, routers, and gateways, is also rising, particularly in the areas of corporate automation and home application. For instance, India's router sales increased sequentially by 17.8% during the third quarter of the 2022 calendar year but somewhat decreased by 1.4% YoY by vendor revenues. With a 63.3% market share, Cisco once again held the top spot, followed by Juniper (14.3%), Nokia (14.2%), Huawei (2.7%), and Ekinops (1%). Therefore, the enactment of active electronics constituents is expected to grow over the projected period as a result of the rising demand for network devices and other IT gear.

Active Electronic Components Market Companies & Market Share Insights

The global active electronic components market is fragmented and highly competitive in nature owing to presence of several global along with regional players in the market. The prime strategies adopted by the market players to secure their market position are global expansion, and merger & acquisition to reach out to maximum customers with variable needs. For instance, in June 2020, Diotec Corporation announced to expand its global presence by opening new production facilities worldwide. Similarly, on July 2016, Infineon Technologies AG announced to acquire RF power and Wolf speed Power divisions of Cree Inc. The agreement helped Infineon to strengthen its footprint in semiconductor industry. With this acquisition, the Company has entered into the list of leading suppliers of power and RF power solutions in emerging markets such as renewables, electro-mobility, and next-generation 5G infrastructure relevant for IoT. The company has also established new sales offices in Singapore and South Korea. Furthermore, increasing investment in the active electronic components market has forced market players to develop more effective and attractive components.

Active Electronic Components MarketCompanies

- Infineon Technologies AG

- Fairchild Semiconductor International, Inc.

- Maxim Integrated Products Inc.

- Texas Instruments, Inc.

- Analog Devices, Inc.

- ST Microelectronics NV

- Diotec Semiconductor AG

- ON Semiconductor

- Toshiba Corporation

- NXP Semiconductors NV

- Everlight Electronics Co., Ltd.

- Vishay Intertechnology, Inc.

- Renesas Electric Corporation

- Panasonic Corporation

Recent Developments

- In January 2023, The HiRel DC-DC converter business of Infineon, comprising its hybrid and custom board-based power products, has been definitively agreed to be acquired by Micross Components, Inc. ("Micross"), according to an announcement from Infineon Technologies AG. This sale will allow Infineon to decrease its emphasis on companies that need more specialized product offerings for the high-reliability market and increase investments, and its attention on core semiconductor advancements for that market.

- In December 2022, In western Japan's Hyogo Prefecture, Toshiba revealed that it is going to build a new manufacturing facility for power semiconductors at the Himeji Operations. Production is expected to begin in the spring of 2025 once construction begins in 2024. In comparison to fiscal 2022, the project will almost treble Toshiba's Himeji manufacturing capabilities for automotive power semiconductors.Infineon Technologies AG announced in July 2016 that it would acquire Cree Inc.'s R.F. power and Wolf speed Power divisions. Infineon was able to strengthen its position in the semiconductor business as a result of the agreement.

- NXP Semiconductors N.V. announced the SR100T, a secure fine-ranging chipset, in September 2019. This chipset is primarily developed to deliver very accurate positioning performance for next-generation Ultra-Wide Band (UWB)-enabled mobile devices.

- Infineon Technologies AG purchased Cypress Semiconductor Corp. in June 2019 to expand its product portfolio and market position.

- In December 2022, Texas Instruments, a market pioneer in high-voltage semiconductor products, revealed that the newest 65-W laptop power adapter, Le Petit, by Chicony Power will be powered by TI's integrated gallium nitride (GaN) technology. Chicony Power and TI worked together to develop a design that reduced the size of Chicony's energy converter by 50% and increased efficiency by up to 94% while utilizing TI's LMG2610 half-bridge GaN FET with an integrated gate driver.

Segments Covered in the Report

By Product

- Semiconductor Devices

- Transistors

- Diodes

- Optoelectronic Components

- Integrated Circuits

- Display Devices

- Cathode-ray Tubes

- Microwave Tubes

- X-ray Tubes

- Triodes

- Photoelectric Tubes

- Optoelectronic

- Vacuum Tubes

- Others

By End User

- Consumer electronics

- Healthcare

- Automotives

- Aerospace and defense

- Information Technology

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content