What is the Electronic Equipment Repair Service Market Size?

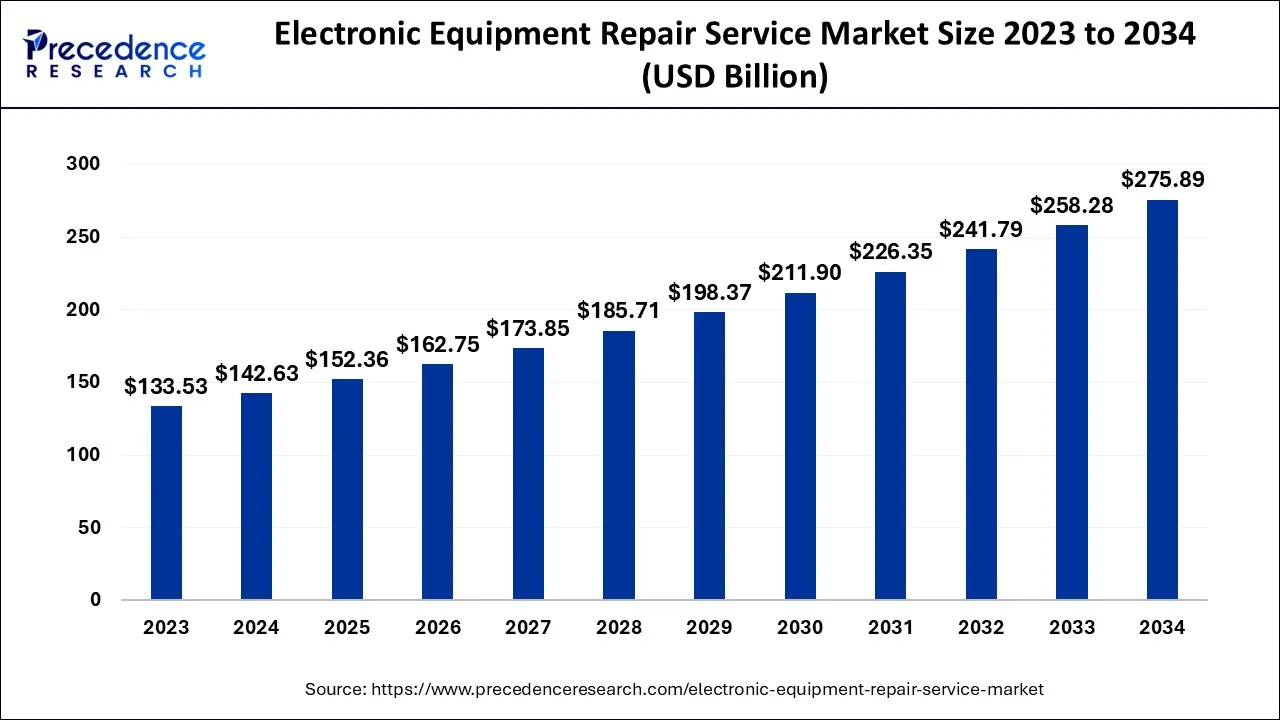

The global electronic equipment repair service market size is valued at USD 152.36 billion in 2025 and is predicted to increase from USD 162.75 billion in 2026 to approximately USD 293.50 billion by 2035, expanding at a CAGR of 6.78% from 2026 to 2035.

Electronic Equipment Repair Service Market Key Takeaways

- Asia Pacific region is anticipated to record the largest CAGR between 2026 and 2035.

- By Product Type, the home appliances segment is expected to expand at a remarkable CAGR between 2026 and 2036.

- By End-Use, the residential segment dominated the with revenue share of 80% in 2025.

- By End-Use, the non-residential segment has held revenue share of 20% in 2025.

- By Service Type, the out-of-warranty repair segment is currently dominating the global market.

Strategic Overview of the Global Electronic Equipment Repair Service Industry

The electronic equipment repair service market refers to the industry that specializes in repairing and maintaining electronic devices and equipment, including computers, smartphones, televisions, and other consumer electronics. This market is driven by the increasing use of electronic devices in everyday life, as well as the need for cost-effective repair solutions to prolong the lifespan of these devices.

The electronic equipment repair market is highly fragmented and competitive, with a large number of small and independent repair shops operating locally. However, larger national and international repair chains are also present, and they are increasingly expanding their services to cover a wider range of devices and technologies.

The market is expected to grow in the coming years due to the increasing complexity and sophistication of electronic devices, as well as the growing awareness of the environmental benefits of repair and reuse over disposal. Additionally, the market is also driven by the rising trend of do-it-yourself (DIY) repair and maintenance, which has created new opportunities for small repair shops and individual entrepreneurs. Overall, the electronic equipment repair market is a dynamic and growing industry that is expected to continue to expand in the coming years, driven by the increasing demand for repair services and the growing awareness of the environmental and economic benefits of repair and reuse.

One of the key elements influencing the market trends for electronic equipment repair services is the growing importance of the reconditioned business for electronic devices. For instance, in 2020, 2GUD.com, a marketplace for refurbished products owned by Flipkart, had almost 2.5 million product listings, of which 3-4% were for refurbished electronics like Televisions and phones. Also, over the next few years, the sector will have plenty of attractive growth prospects as global concern about the increasing generation of e-waste rises.

Artificial Intelligence: The Next Growth Catalyst in Electronic Equipment Repair Service

AI is fundamentally reshaping the electronic equipment repair service industry by transitioning from reactive fixes to predictive maintenance and high-precision diagnostics. AI-driven diagnostic software now allows technicians to rapidly pinpoint circuit-level failures by comparing real-time thermal and electrical data against massive historical datasets, significantly reducing troubleshooting time.

The integration of AI-powered computer vision and augmented reality (AR) provides step-by-step repair overlays for complex hardware, enabling less-experienced staff to perform intricate micro-soldering and component replacements accurately.

Market Outlook

- Market Growth Overview: The electronic equipment repair service market is expected to grow significantly between 2025 and 2034, driven by the sustainability and e-waste reduction, proliferation of connected devices, and right to repair legislation.

- Sustainability Trends: Sustainability trends involve the expansion of the repair bonus model, mandatory repairability indexing, and institutionalization of right-to-repair laws.

- Major Investors: Major investors in the market include Apollo Global Management, Samsung Electronics & Apple Inc., Siemens AG, Cisco Investments, and BMW.

- Startup Economy: The startup economy is focused on AI-powered diagnostics, decentralized repair-as-a-service, and robotic refurbishment.

Market Scope

| Report Coverage | Details |

|

Market Size in 2025 |

USD 142.63 Billion |

|

Market Size in 2026 |

USD 162.75 Billion |

| Market Size by 2035 | USD 275.89 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.78% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type, By Service Type, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Rise in the use of automated systems

The surge in demand for electronic products like cell phones, televisions, air conditioners, and laptops has led to an increase in the need for repair services for electronic equipment. Also, the need for electronic products repair services is being driven by the expansion of automated systems across numerous industries. Due to the high cost of electronic goods, consumers are choosing to buy reconditioned gadgets more frequently than new ones.

It is projected that during the forecast period, this will generate profitable market possibilities. An increase in dependence on electronic appliances has been brought on by rising disposable money and changing consumer lifestyles. It is anticipated that this will increase household demand for technological equipment.

Rising equipment failure rates

The market for consumer electronics repair and maintenance is anticipated to be driven by rising equipment failure rates and the financial advantages of restoring outdated equipment as opposed to throwing it away. Low-cost products, both branded and unbranded, are constantly flooding the market.

Whether they were manufactured with subpar materials or require constant maintenance, they eventually need to be repaired. Yet, research indicates that businesses are now adopting a different strategy and creating items that may be readily repaired for use because mending a problem with a device is always a more affordable alternative than buying a new one, increasing the customer's trust.

Consumers are more likely to purchase and use products from a company that provides spare parts, repair manuals, support, and instructions for repairing the product. The older iPhone is now being assembled by Apple in India. People are coming together to collaborate on mending electronics thanks to organisations like iFixit and Repair Café.

In 2021, the European Commission plans to examine requirements for eco-friendly smartphone design, as well as availability to spare parts and repair information. The market for consumer electronics repair and maintenance is therefore being stimulated by a rise in equipment failure rates and the cost savings of repairing obsolete equipment.

Growing environmental awareness

Consumers are increasingly aware of the environmental impact of electronic waste and the importance of repairing and reusing devices rather than disposing of them. This creates a market for repair services that offer environmentally friendly solutions.

Key Market Challenges

Poor quality or duplicate spare parts of electronic equipment

The use of poor quality or duplicate spare parts in electronic equipment repairs is a major challenge for the electronic equipment repair market. These parts may be cheaper than genuine parts, but they often fail to meet the quality and performance standards of the original parts. Poor quality parts may fail prematurely, leading to additional repairs or even device failure.

This can reduce the lifespan of the device and increase repair costs over time. Poor quality parts may not meet safety standards, leading to potential safety risks for the user of the device. This is especially true for devices that are designed to operate at high temperatures or voltages. The use of poor quality or duplicate parts can damage the reputation of repair shops and technicians, leading to decreased customer trust and fewer referrals.

Price volatility

Price volatility is another challenge that the electronic equipment repair market faces. This refers to the instability and fluctuations in the prices of electronic components, such as microchips, circuit boards, and other parts, that are needed for repairs. Price volatility can be caused by several factors, including changes in supply and demand, fluctuations in currency exchange rates, and geopolitical factors. These price fluctuations can make it difficult for repair shops and technicians to accurately estimate the cost of repairs, which can lead to unexpected costs for consumers.

Key Market Opportunities

Introduction of AR

Service providers for consumer electronics maintenance and repair are concentrating on employing augmented reality (AR)-based maintenance and repair techniques. In augmented reality (AR), computer-generated pictures are placed over a user's perspective of the real world and merged with direct and indirect views of physical world environments. By employing this augmented reality (AR) based repair or maintenance techniques, users can improve their field of vision with current digital information.

The user can get step-by-step directions on how to fix an asset with the help of this information. For instance, the new 2022 AR Assistant app from US-based technology company Dell employs augmented reality to walk customers through step-by-step, at-home repairs or replacements for over 97 different systems in 7 different languages. Using AR and instructional overlays on the machine being serviced, the AR Assistant app lets users see their gadgets and provides repair guidance. In order to make at-home repairs simpler, less stressful, and less wasteful, the software also offers an augmented clone technology on some systems that displays a cloned server in any desired place and allows full 360-degree interactivity.

Increasing consumer demand for repair services

Consumers are increasingly interested in repairing their electronic devices rather than replacing them, driven by environmental concerns and a desire to save money. This presents an opportunity for repair shops and technicians to expand their services and reach a wider customer base.

Segment Insights

Product Type Insights

Based on technology, the electronic equipment repair service market is segmented into consumer electronics, home appliances, industrial equipment, and medical equipment. The home appliances segment is anticipated to rule the global market during the forecast period. This can be attributed to the significant global consumer demand for appliances like refrigerators and televisions. Appliances are frequently bought by consumers to save time and reduce effort. Appliances for the home are effective and simple to use.

In the upcoming years, it is also projected that the global market for electronic equipment repair services would be driven by product advancements, product differentiation, new product development, and the integration of several features which are adding value in consumer electronics.

End-Use Insights

On the basis of end-use, the electronic equipment repair service market is segmented into residential, industrial, or commercial. The residential segment dominated the global electronic equipment market in 2023 and is expected to maintain its dominance during the forecast period owing to the rise in demand for consumer electronics in the domestic market. This segment is expected to dominate the electronic equipment repair service market due to the increasing demand for these devices, coupled with their frequent malfunctioning.

The growing trend of recycling and refurbishing electronic devices has also contributed to the growth of this segment. The need for residential electronic device repair services is anticipated to grow more quickly in the near future. Additionally, in the residential sector, the consumer electronics and automotive electronics segments are expected to see the most significant growth, driven by the increasing adoption of electronic devices in households and the need for repair services for personal devices and vehicles.

Furthermore, in the industrial or commercial sector, the industrial electronics segment is expected to see the most substantial growth, driven by the need to repair and maintain the electronic equipment used in factories, warehouses, and other industrial settings. Manufacturing, healthcare, automotive, IT, and telecom industries heavily rely on electronic equipment for their operations, and any malfunction can lead to significant losses. This in turn augments the growth of the end-use segment in the electronic equipment repair market.

Service Type Insights

On the basis of service type, the electronic equipment repair service market is segmented into in-warranty and out-of-warranty. Out of these service types, the out-of-warranty repair segment is currently dominating the electronic equipment repair market. This is because electronic devices often require repairs after the manufacturer's warranty period has expired, and consumers are increasingly choosing to repair their devices rather than replacing them.

In the out-of-warranty segment, the demand for repair services is driven by the need to repair electronic devices that have malfunctioned or have been damaged after the warranty period has expired. This segment offers significant growth opportunities due to the increasing use of electronic devices and the need for affordable repair services. However, this segment is also highly competitive, and service providers need to offer competitive prices, quality services, and fast turnaround times to remain competitive.

The in-warranty segment of the market is mainly driven by the need to ensure that the electronic devices are functioning correctly during the warranty period and to provide customers with a hassle-free repair service. The growth of this segment is closely tied to the sales of electronic devices, and the market is expected to grow at a steady pace due to the increasing sales of electronic devices, especially in emerging markets. However, this segment is highly competitive, and manufacturers often provide in-house repair services or authorize a limited number of service centers to provide in-warranty repair services.

Regional Insights

On the basis of geography, Asia Pacific is anticipated to witness the highest growth rate during the forecast period due to the presence of numerous domestic and foreign players in the area. Among Asia Pacific's top users of electronic goods are Japan, China, and India. Also, it is anticipated that the region's robust R&D activities would open up new potential for the market for electronic equipment repair services in the coming years. The region is also home to several well-established electronics repair companies.

India Electronic Equipment Repair Service Market Trends

In the Asia Pacific, India is expected to grow at the fastest CAGR over the forecast period. The growth of the country can be attributed to the rapid urbanization, increasing device usage, and e-waste concerns. Moreover, high demand for laptops, smartphones, and other home appliances fuels maintenance needs, driving market growth soon.

Growth is further supported by increasing sustainability awareness and e-waste concerns, prompting consumers and policymakers to favor repair and refurbishment to extend device lifecycles and reduce waste.

The North American electronic equipment repair service market is driven by the high demand for repairing electronic gadgets such as smartphones, tablets, and laptops. The region is also home to several well-established electronics repair companies. Additionally, the European electronic equipment repair service market is expected to grow at a moderate rate due to the increasing adoption of smart devices and rising demand for IoT-enabled devices.

Canada Electronic Equipment Repair Service Market Trends

In North America, Canada is expected to grow at the fastest CAGR over the forecast period. The growth of the country can be credited to the surge in environmental awareness and the government's push towards circular economies. Furthermore, ongoing advancements in repair technologies such as remote troubleshooting and AI-driven diagnostics are making the repair process more effective, boosting market growth soon.

The UK Electronic Equipment Repair Service Market Trends

The UK market is growing steadily as consumers and businesses seek cost-effective and sustainable alternatives to device replacement amid rising electronics prices. Increasing environmental awareness and concerns over e-waste are encouraging repair, refurbishment, and reuse, aligning the market with circular economy goals. Supportive policy momentum, including right-to-repair initiatives and discussions around incentives or reduced VAT on repairs, is improving accessibility and demand.

Germany and the UK are the major markets in this region. Furthermore, it is anticipated that shifting consumer attitudes in developing nations would present considerable prospects for industry expansion.

China Electronic Equipment Repair Service Market Trends

China's market is being revolutionized by AI and digital twins, which have achieved near-perfect accuracy in identifying micro-defects and improving first-time-fix rates. Government initiatives targeting a 7% manufacturing growth rate are providing tax incentives for high-tech firms to modernize their aftermarket and refurbishment services. Traditional wholesale hubs like Shenzhen's Huaqiang North are successfully pivoting into specialized clusters that support global brand refurbishment and advanced smart device diagnostics.

U.S. Electronic Equipment Repair Service Market Trend

The U.S. market is being reshaped by landmark "Right to Repair" laws, such as Oregon's ban on parts pairing, which empowers independent shops with better diagnostic access. While high 2025 tariffs on imported microchips are inflating service costs, the industry is offsetting these pressures by integrating AI and AR to boost first-time fix rates and streamline e-waste refurbishment.

How Did Europe Notably Grow in the Electronic Equipment Repair Service Market?

The European market is expanding through the institutionalization of the EU Right to Repair Directive, which mandates manufacturer support and spare part access for up to 10 years. Financial stimulants, such as the "Repair Bonus" models in France and Germany, have successfully lowered consumer costs by subsidizing up to 50% of repair expenses. The market is further bolstered by the European Repair Index, which forces brands to compete on device fixability, and the expansion of industrial refurbishment hubs in Eastern Europe.

Germany Electronic Equipment Repair Service Market Trend

Germany's market is characterized by a "Right to Repair" surge, driven by the mandatory Repairability Index and legal extensions on warranties for repaired goods. The expansion of regional "Repair Bonus" subsidies is significantly lowering consumer costs, while the industrial sector is pivoting toward AI-powered retrofitting to extend the life of high-value machinery.

Value Chain Analysis of the Electronic Equipment Repair Service Market

- Spare Parts Manufacturing & Component Sourcing:

This foundational stage involves the production of original equipment manufacturer (OEM) parts, such as microchips, displays, and high-capacity batteries.

Key Players: Samsung Electronics, Intel Corporation, Foxconn, Texas Instruments, and Murata Manufacturing. - Diagnostic Tools & Software Development:

This stage provides the technical infrastructure required to identify hardware and software failures without invasive disassembly.

Key Players: Keysight Technologies, Fluke Corporation, iFixit (Manuals & Tools), Cisco Systems (Network Diagnostics), and Microsoft (Auto-diagnostic suites). - Repair Service Execution (Authorized & Independent):

This is the core stage where physical repairs, such as screen replacements, micro-soldering, and modular upgrades, are performed by skilled technicians.

Key Players: Best Buy (Geek Squad), Asurion, uBreakiFix, B2X Care Solutions, and Apple Inc. (Self-Service Repair). - Refurbishment & Quality Assurance:

After repair, devices enter a testing phase where they are graded and certified for resale or return to the user.

Key Players: Back Market, Gazelle, Siemens AG (Industrial Refurbishment), Brightstar, and HCL Technologies. - E-Waste Recovery & Material Recycling:

The final stage manages components that are beyond repair by harvesting precious metals (gold, silver, palladium) and rare earth elements.

Key Players: Umicore, Waste Management (WM), Veolia, Sims Limited, and Kuusakoski Recycling.

Electronic Equipment Repair Service Market Companies

- Encompass Supply Chain Solutions Inc.

Encompass acts as a critical link in the repair ecosystem by distributing over 8 million OEM replacement parts and providing sophisticated parts-management software to service providers. - uBreakiFix

As a major retail brand under the Asurion umbrella, uBreakiFix offers standardized, same-day repair services for smartphones, tablets, and computers across hundreds of North American locations. - iCracked, Inc.

iCracked revolutionized the repair market by developing a "mobile" service model where certified technicians travel directly to the customer's location to perform on-site smartphone repairs. This decentralized approach expanded the reach of the repair economy beyond traditional brick-and-mortar shops, focusing on extreme convenience and rapid turnaround. - ModusLink Global Solutions

ModusLink provides end-to-end supply chain and aftermarket services, including complex reverse logistics and global refurbishment programs for electronics manufacturers. They help OEMs recover value from returned goods by integrating repair, recovery, and redistribution services into a single circular management platform. - Mendtronix Inc.

Mendtronix specializes in technical repair services for high-value professional equipment, including medical devices, audiovisual systems, and logistics technology. Their expertise in specialized niche markets allows them to provide life-extending maintenance and certified repairs for mission-critical hardware. - The Cableshoppe Inc.

The Cableshoppe focuses on the repair and refurbishment of broadband and telecommunications equipment, such as set-top boxes, modems, and routers. They play a vital role in the telecommunications supply chain by helping service providers reduce electronic waste through high-volume equipment renewal. - Redington Services

As a dominant player in the Middle East and Africa, Redington Services operates extensive authorized service centers for global brands like Apple, HP, and Samsung. - Electronix Services

Electronix Services provides specialized industrial electronic repair, focusing on complex components like PLCs, power supplies, and printed circuit boards (PCBs). They contribute to industrial efficiency by offering component-level fixes that prevent the need for expensive full-system replacements in manufacturing environments. - B2X Care Solutions GmbH

B2X is a global leader in providing digitally-managed customer care and repair frameworks for smartphone and IoT device manufacturers. They integrate repair networks with advanced cloud-based software to optimize the entire customer service journey and ensure consistent global repair quality. - Quest International, Inc.

Quest International provides specialized aftermarket services for the healthcare and industrial sectors, including field service, depot repair, and regulatory compliance management. - Quanzhou Journey Bags Co., Ltd.

While primarily a manufacturer, this company contributes to the protective side of the market by producing specialized carrying cases and protective bags for delicate electronic equipment.

Recent Developments

- In November 2025, Knorr-Bremse and Cojali introduced the ECU Repair Service “ESB REMAN'. This new sustainable repair service contributes substantially to boosting resource conservation and the circular economy. (Source: https://newsroom.knorr-bremse.com )

- In July 2025, John Deere introduced Operations Center PRO Service, a tool created to improve repair capabilities for its turf, agriculture, forestry, and construction equipment. This platform provides innovative features like software reprogramming for electronic components. (Source:https://equipmentfinancenews.com/ )

- August 2022- LG has given Dayton Appliance Parts (DAP) permission to distribute LG repair parts from DAP's locations in three states, according to an announcement from Encompass Supply Chain Solutions, a top supplier of replacement parts and supply chain services for a wide range of product brands.

- March 2021- Milwaukee Tool and Associated Builders & Contractors announced a strategic alliance that will allow contractor members and ABC chapters to serve the construction market. The company wants to collaborate closely with contractors to fully comprehend the demands of their dynamic workplace and to provide best-in-class solutions for safer, more efficient work environments.

- November 2020- In order to deliver effective and affordable total medical and non-medical device recall management services, Mendtronix Inc. and TRIEVR Inc. have established a collaborative marketing and operation agreement. According to the contract, a robust and comprehensive offering for recalled devices is provided by the combination of TRIEVR's Recall/Field Action/Field Alert SaaS solution and Medtronic's inventory management and technical services.

Segments Covered in the Report

By Product Type

- Consumer Electronics

- Notebooks & Laptops

- PC sets

- Tablets

- Set-top Boxes

- Televisions

- Smartphones and Mobile Phones

- Others

- Home Appliances

- Washing Machines

- Mixers, Grinders, and Food Processors

- Microwaves

- Air Conditioners & Coolers

- Refrigerators

- Others

- Medical Equipment

- CT Scanners

- Dental Clinic Equipment

- Lab Equipment

- Medical Monitors

- Others

- Industrial Equipment

- Motors & Generators

- Machineries

- Frequency Counters

- Laser Equipment

- Pulse & Signal Generators

- Voltmeters

- Others

By Service Type

- Out of Warranty

- In Warranty

By End-Use

- Residential

- Industrial or Commercial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting