What is Passive and Interconnecting Electronic Components Market Size?

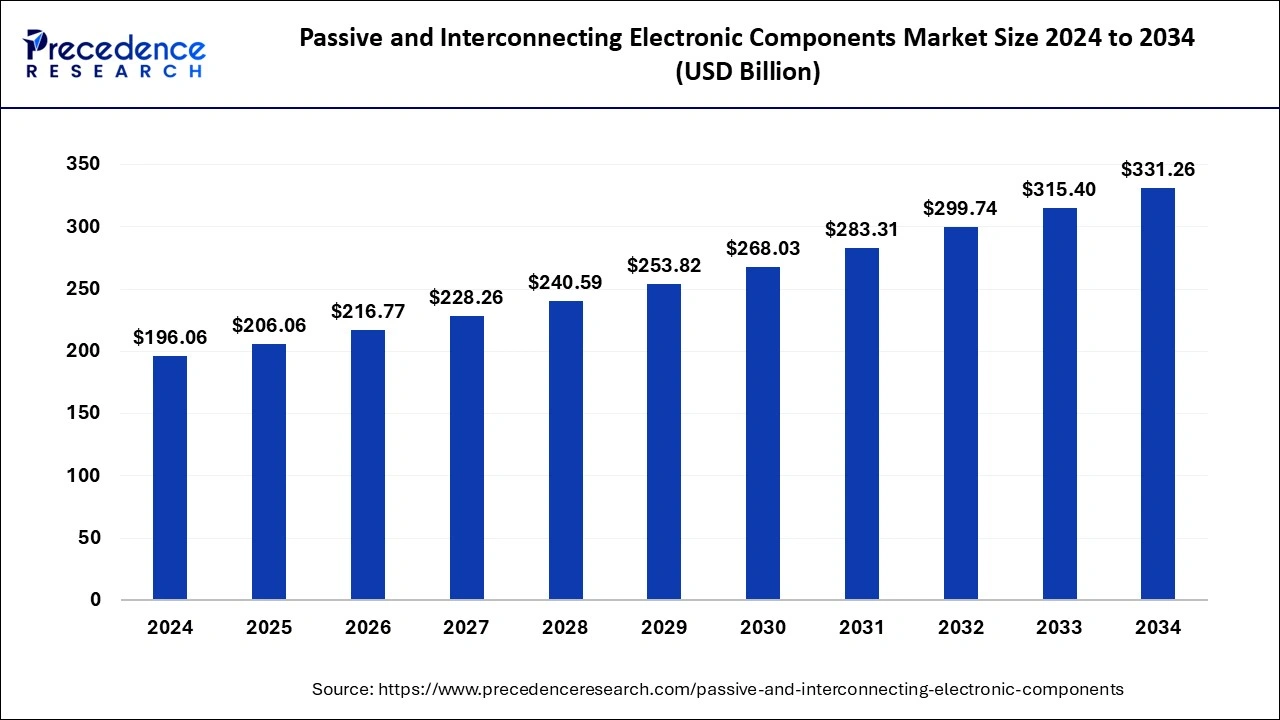

The global passive and interconnecting electronic components market size is accounted for USD 206.06 billion in 2025 and is anticipated to reach around USD 331.26 billion by 2034, growing at a CAGR of 5.38% from 2025 to 2034. The increasing industrial automation and use of control systems like robots and computers which help the growth of the passive and interconnecting electronic components market.

Market Highlights

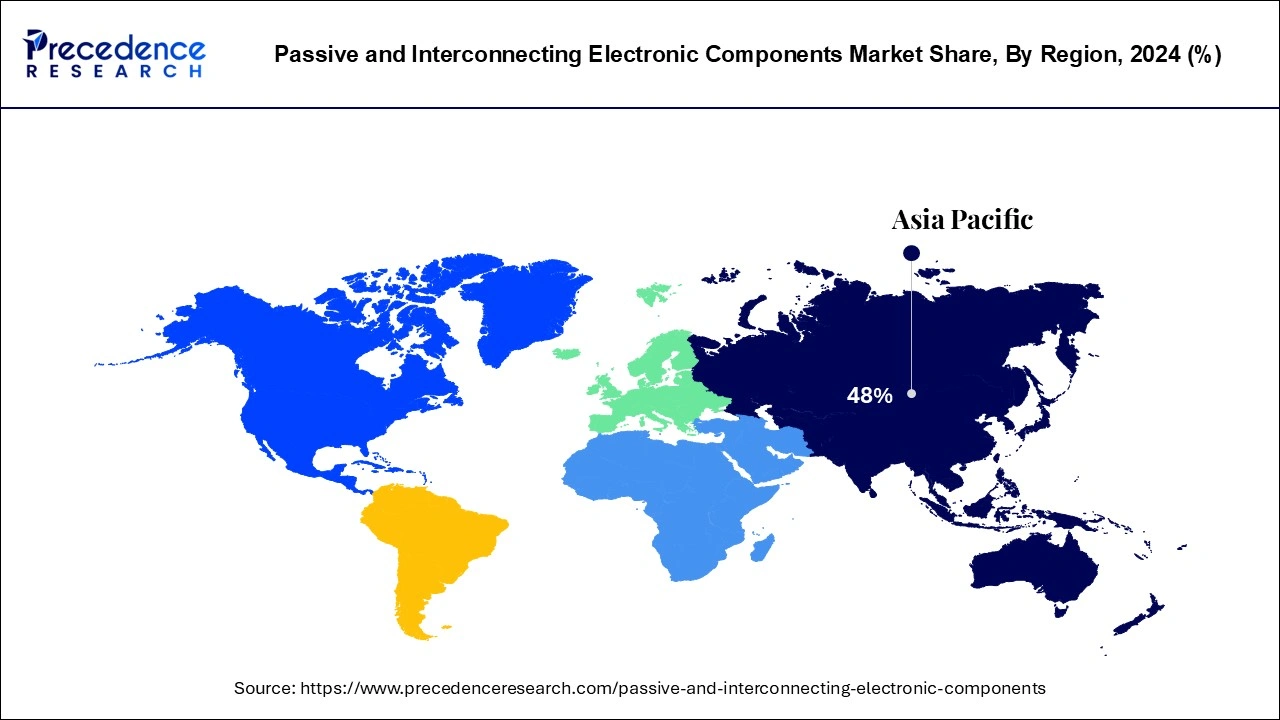

- Asia Pacific dominated the global passive and interconnecting electronic components market with the largest market share of 48% in 2024.

- China is expected to expand at a solid CAGR of 5.08% during the forecast period.

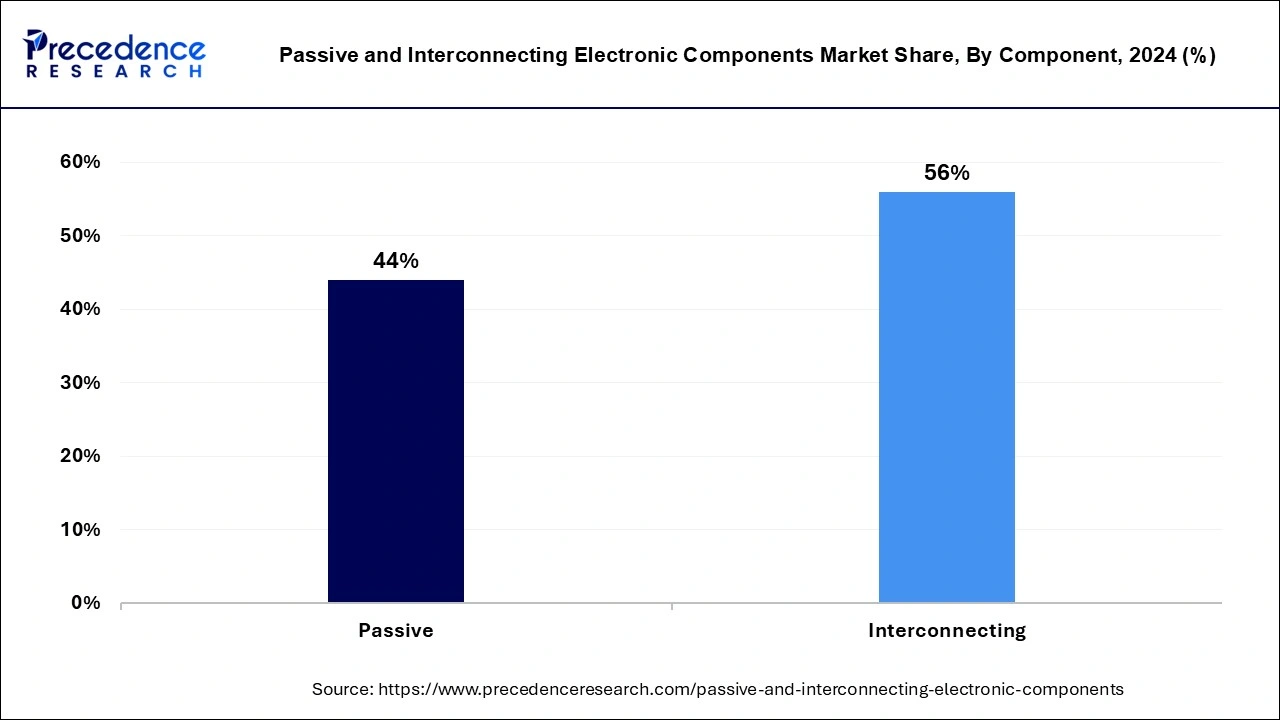

- By component, the interconnecting segment contributed the highest market share of 48% in 2024.

- By component, the passive segment is projected to grow at a notable CAGR during the forecast period.

- By application, the consumer electronics segment accounted for the highest market share of 36% in 2024.

- By application, the automotive segment is expected to grow at a healthy CAGR during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 206.06 Billion

- Market Size in 2026: USD 216.77 Billion

- Forecasted Market Size by 2034: USD 331.26 Billion

- CAGR (2025-2034): 5.38%

- Largest Market in 2024: Asia Pacific

How is AI changing Passive and Interconnecting Electronic Components?

Artificial intelligence (AI) can transform the passive and interconnect design. Applications of AI in these components include handling large datasets and, the need for multiple distributed GPUs, and CPUs communicating in real-time. AI in electronics is used to improve device functionality and user experience, allowing features like facial and voice recognition, predictive maintenance, and effective energy management across a range of devices from smartphones to industrial machinery. AI is used in the electronic industry which makes easier and faster product development to enhance quality and strengthen supply chains which helps the growth of the passive and interconnecting electronic components market.

Passive and Interconnecting Electronic Components Market Growth Factors

- Electronic equipment such as cellphones, computers, electrical home appliances, and gaming consoles make use of passive and interconnected electronic components. As a result, the surge in demand for smartphones, laptops, gaming consoles, and household appliances is likely to be the primary driver of market growth.

- The infrastructure for 5G networks is being rapidly built in key countries such as the United States, China, South Korea, Japan, and the United Kingdom.

- The impending 5G services, together with a growing demand for high-speed internet connectivity among customers, have fueled global demand for 5G devices.

- The surge in demand for 5G devices across a variety of industries, including industrial, automotive, and consumer electronics, is expected to drive the market for passive and linking electrical components.

Opportunity

The industrial sector is quickly changing as a result of the widespread adoption of Internet of Things (IoT) devices. By providing simplicity of operation and reducing total system downtime, industrial IoT devices assist manufacturing facilities in increasing overall productivity and operational efficiency. In addition, as part of the fourth industrial revolution (Industrial 4.0), numerous manufacturing facilities are installing a variety of connected devices to improve operational operations via remote monitoring. As a result, the market is likely to grow faster as IoT devices are deployed across a wide range of industrial applications, such as process automation and motion control.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 206.06 Billion |

| Market Size in 2026 | USD 216.77 Billion |

| Market Size by 2034 | USD 331.26 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.38% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application and region |

| Regional Scope |

North America, Europe, Asia Pacific, LAMEA |

Segment Insights

Component Insights

The interconnecting segment contributed the highest market share of 48% in 2024 and it is also considered to grow significantly during the forecast period. It's due to the increased demand for various types of capacitors in consumer electronic devices, industrial applications, and other uses.

The transformer product segment is also expected to grow significantly during the forecast period owing to the vital role of the transformer in an electronic device by stepping down the high voltage to the required voltage for the circuit. As a result of the increased manufacturing of various types of household appliances, industrial digital devices, and other consumer electronic items, transformer demand is expected to skyrocket.

The interconnecting segment includes printed circuit boards (PCB), connectors/sockets, switches, relays, and others. Additionally, the surge in demand for networking and storage devices in data centers is further anticipated to boost the market growth.

Application Insights

The consumer electronics segment accounted for the highest market share of 36% in 2024. It's owing to a surge in demand for passive and linking components for a variety of consumer gadgets, including wearables, smartphones, set-top boxes (STBs), and household appliances.In addition, demand for security cameras, sensor-based devices, and robotics is fast rising across a wide range of industrial applications, including process automation and remote monitoring. And it is projected that these characteristics will propel the market forward.

The increased demand for networking devices such as modems, gateways, and repeaters is likely to drive market expansion in the office automation and residential application segments. Furthermore, 5G telecom infrastructure development is accelerating, and telecom operators are substantially spending in order to give higher bandwidth experiences to their consumers, which is expected to stimulate the growth of the IT and telecommunication application market. Furthermore, the market is expected to increase due to strong demand for infotainment systems, driver assistance systems, Global Positioning Systems (GPS), and other electronic systems for automotive applications.

Regional Insights

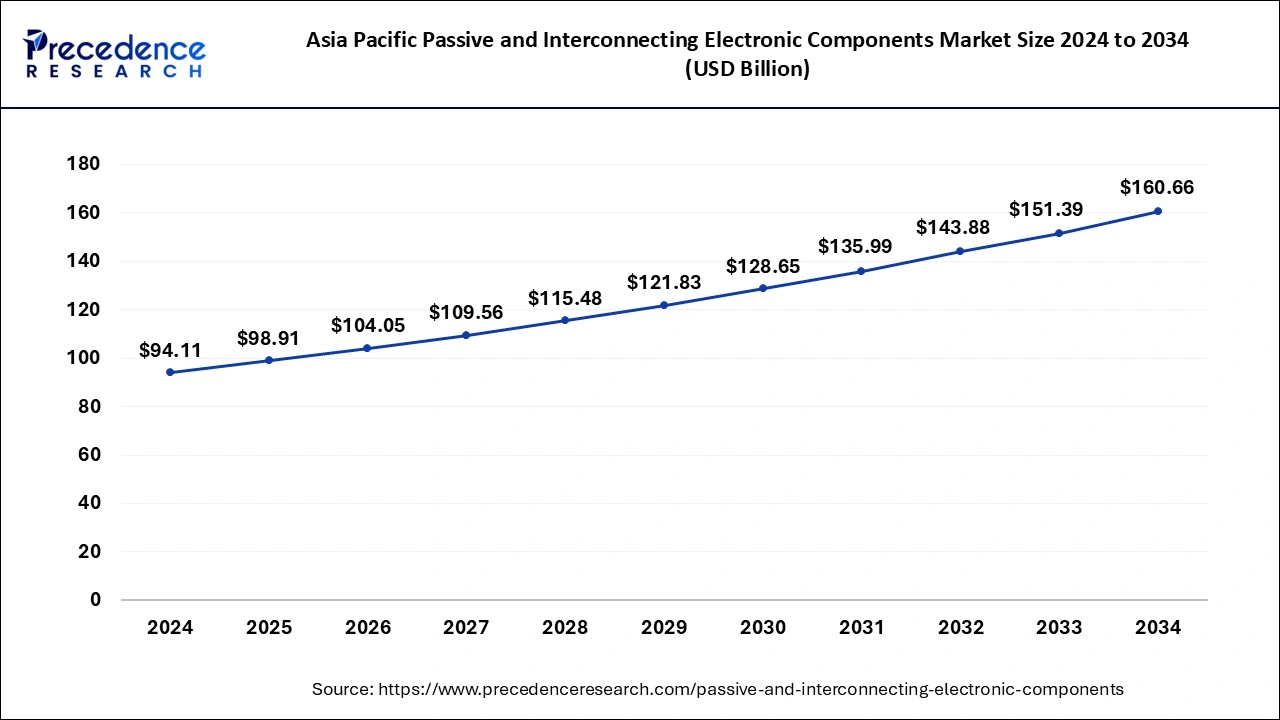

Asia Pacific Passive and Interconnecting Electronic Components Market Size and Growth 2025 to 2034

The Asia Pacific passive and interconnecting electronic components market size is evaluated at USD 98.91 billion in 2025 and is predicted to be worth around USD 160.66 billion by 2034, rising at a CAGR of 5.49% from 2025 to 2034.

Due to the presence of major market players in the region such as Samsung Electronics Co., Ltd., BBK electronics (Includes brands such as Oppo, Realme, and Vivo), Foxconn Technology Group, and Xiaomi Corporation, Asia Pacific dominated the Passive and Interconne. citing Electronic Components Market, contributing a revenue share of more than USD 97.1 billion in 2020. China dominates the passive and interconnecting electronic components market in this region and is the major exporter of electronics products across the world. For instance, In 2018,

What are the Major Trends in India that Influence the Market?

In India, the market is being driven by rapid growth in consumer electronics, automotive electronics, and industrial automation sectors. Government initiatives such as “Make in India” and investments in domestic electronics manufacturing are strengthening local supply chains. The Ministry of Electronics and Information Technology introduced seven projects amounting to ₹5,532 crore, one each in Madhya Pradesh and Andhra Pradesh, and five in Tamil Nadu, under the Electronics Component Manufacturing Scheme (ECMS).

Boom of 5G Technology in the North American Market

How is the Rise of the U.S. in the North American Market?

The U.S. is a major contributor to the North American passive and interconnecting electronic components market, driven by the rapid adoption of advanced electronics in automotive, aerospace, and defense sectors. The U.S. government supports the broader semiconductor and electronics industries through advanced research & development. The CHIPS Act and related programs focus on R&D, semiconductor manufacturing, and packaging facilities, and they also support the entire supply chain.

Why is Europe Considered a Significantly Growing Area in the Market?

Europe is expected to see significant growth in the passive and interconnecting electronic components market, driven by industrial automation, IoT adoption, 5G network expansion, and developments in the renewable energy sector. The European CHIPS Act further supports this growth, providing significant public and private investments through 2030 to strengthen semiconductor and electronic component manufacturing across the region. Germany is leading the market in Europe. The German government offers extensive support to the electronics industry through broad programs for research and innovation. It emphasizes advancing medical technology, autonomous vehicles, manufacturing equipment, and telecommunications. The European Chips Act significantly benefits Germany by focusing on the broader semiconductor supply chain.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is experiencing a notable rise in the market for passive and interconnecting electronic components due to the expansion of the consumer electronics industry and the integration of renewable energy sources. Brazil leads the market in Latin America. This is mainly due to the expansion of local manufacturing and assembly facilities, coupled with government incentives for technological innovation.

In September 2024, Brazil committed BRL 186.6 billion to drive industrial digitalization by advancing chip, robotics, and cloud technologies. Certain initiatives, such as the Semicon Program, are designed to drive growth and innovation across areas such as Industry 4.0, industrial automation, precision agriculture, edge computing, IoT, smart homes, and smart cities.

What Potentiates the Growth of the Passive and Interconnecting Electronic Components Market in MEA?

The market in MEA is expected to grow steadily in the coming years due to increasing adoption of 5G technologies and investments in renewable energy and infrastructure. Significant government investments in smart city infrastructure, defense, telecommunications, and renewable energy boost demand for electronic components in the MEA region. Certain government initiatives and programs aim to develop the domestic electronic components industry as part of its Vision 2030 economic diversification strategy. These initiatives mainly focus on semiconductors and general electronic components, including passive components.

Saudi Arabia Passive and Interconnecting Electronic Components Market Trends

Saudi Arabia's market is being shaped by the country's push toward industrial diversification under Vision 2030, with significant investments in smart cities, renewable energy, and automation projects. The expansion of the 5G network and growing demand from the automotive and electronics manufacturing sectors are driving component adoption. Additionally, government incentives for local production and technology transfer are encouraging domestic manufacturing, further boosting market growth..

Passive and Interconnecting Electronic Components Market Companies

- AVX Corporation; Vishay Intertechnology, Inc.

- Mouser Electronics, Inc.

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Taiyo Yuden Co., Ltd.

- Samsung Electro-Mechanics

- Hosiden Corporation.

- Yageo Corporation

- Nichicon Corporation

- Panasonic Corporation

- Fujitsu Component Limited

- Fenghua (HK) Electronics Ltd.;

- Rohm Co., Ltd.;

- United Chemi-Con

- TE connectivity;

- Molex Incorporated.

Recent Developments

- In October 2024, a new silicone capacitor production line was launched by Murata Manufacturing Co., Ltd.

- In February 2024, the introduction of a new MHQ1005075HA series of inductors for automotive high-frequency circuits was announced by TDK Corporation.

Instances to support opportunity

- In November 2024, India's electronic manufacturing sector's first supercapacitor production facility a major leap in electronics manufacturing was launched by Keltron at Keltron Component Complex Limited (KCCL) in Kannur.

Segments Covered in the Report

By Component

- Passive

- Resistors

- Capacitors

- Inductors

- Transformers

- Diode

- Interconnecting

- PCB

- Connectors/Sockets

- Switches

- Relays

- Others

By Application

- Consumer Electronics

- Mobile Phones

- Personal Computers

- Home Appliances

- Audio and Video Systems

- Storage Devices

- Others

- IT & Telecommunication

- Telecom Equipment

- Networking Devices

- Automotive

- Driver Assistance Systems

- Infotainment Systems

- Others

- Industrial

- Mechatronics and robotics,

- Power Electronics

- Photo Voltaic Systems

- Others

- Aerospace & Defense

- Aircraft systems

- Military Radars

- Others

- Healthcare

- Medical Imaging Equipment

- Consumer Medical Devices

- Others

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting