What is the Printed Circuit Board Market Size?

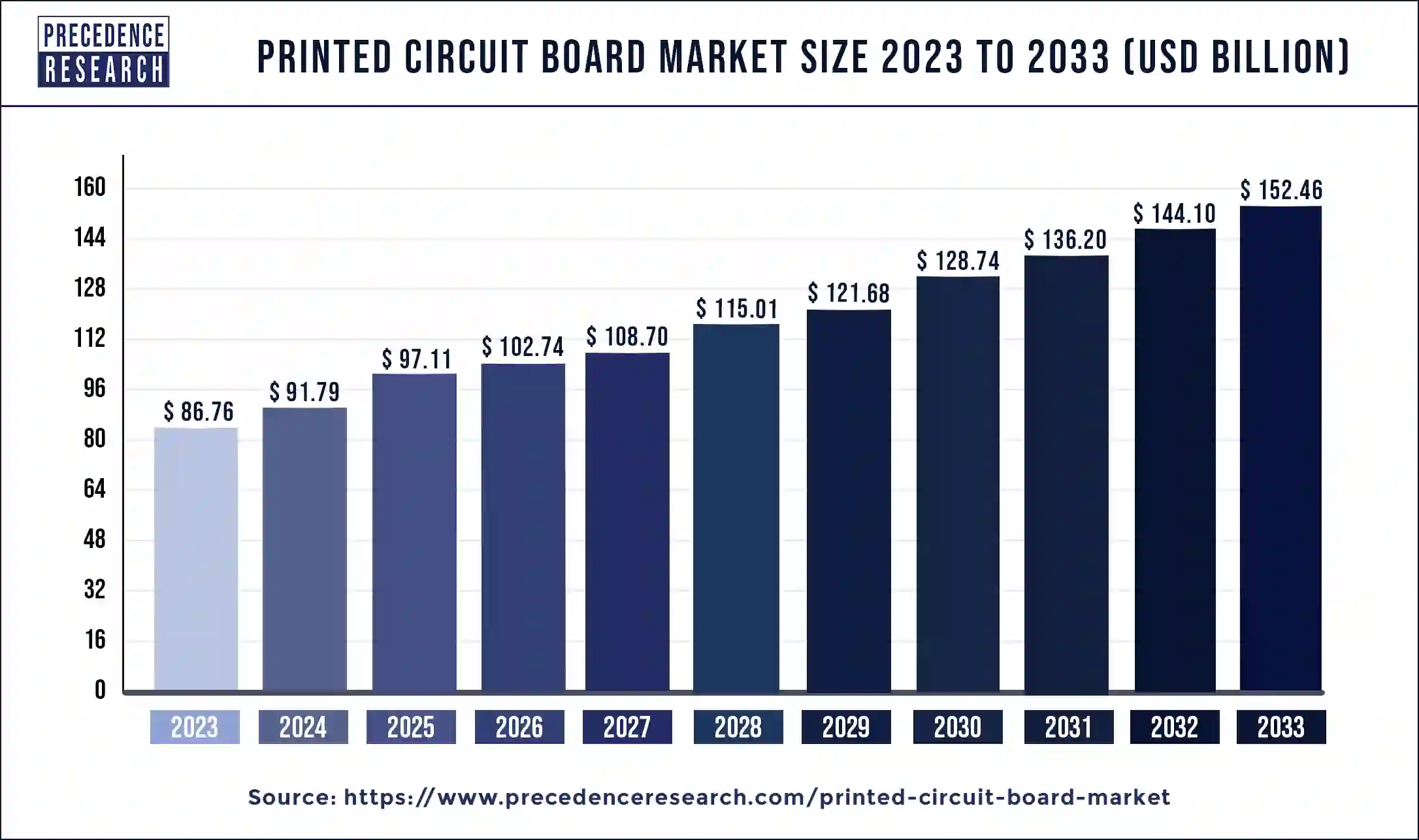

The global printed circuit board market size is valued at USD 97.11 billion in 2025 and is predicted to increase from USD 102.74 billion in 2026 to approximately USD 169.18 billion by 2035, expanding at a CAGR of 5.71% from 2026 to 2035. The PCB market is driven by increasing demand for electronic devices, technological advancements, increasing integration of electronic components in the automotive industry, continuous expansion of telecommunication infrastructure globally, and stability and efficiency of the supply chain.

Printed Circuit Board Market Key Takeaways

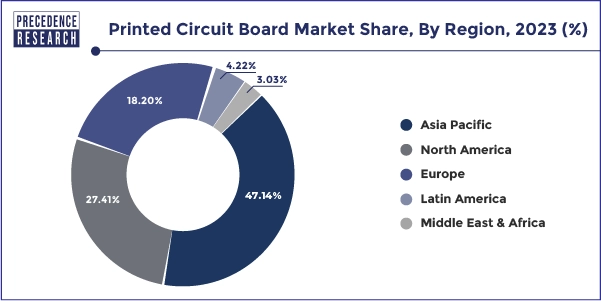

- Asia-Pacific dominated the market with a revenue share of 47.14% in 2025.

- By product, the HDI /build-up/microvia segment has accounted largest market share in 2025.

- By application, the consumer electronic segment holds the highest revenue share in 2025.

- By substrate, the rigid PCB segment hit 86% revenue share in 2025.

What is a Printed Circuit Board?

The printed circuit board (PCB) market is a vital component of the global electronics industry, serving as the foundation for electronic devices and systems. The foundational building block of most modern electronic devices is printed circuit boards or PCBs. Printed circuit boards are made up of printed pathways that link the board's various components, including integrated circuits, resistors, electrolytic capacitors, PLCs, transistors, and resistors, which also offer mechanical support. A printed wiring board or printed wiring cards are also known as PCB. Most frequently, materials like composite epoxy, fiberglass, or other composite materials are used to make them. The PCB is operated in numerous automobile applications, including battery control systems, engine timing systems, digital displays, audio systems, power relays, antilock brake systems, and many more.

Nowadays, the usage of printed circuit boards in the automotive sector has transformed how people drive. Printed circuit boards are becoming more necessary as additional accessories are requested by drivers and car owners. A printed circuit board for a car or truck needs to be extremely durable and dependable. Smart devices and rising customer demand for consumer electronics are the main drivers of industry expansion. Additionally, variables including rising consumer expenditure, rapid expansion in loT gadgets, increased electronic waste-related demand for eco-friendly PCBs, and expanding demand from emerging nations are the main driving factors for the growth of the PCBs market.

Printed Circuit Board Market Statistics and Data

- The Indian government has launched programmes to support indigenous manufacturing, especially within Micro, Small, and Medium-Sized Enterprises (MSMEs), under the Atmanirbhar Bharat project. This includes the implementation of a 10 percent import charge on PCBs in order to stimulate indigenous manufacture, as well as the government has offered special grants worth Rs. 50,000 crores. and funding such as the Rs. 50,000 crores.

- By May 2023, China exported printed circuit boards of $1.4 billion.

- To ensure the domestic production of printed circuit boards (PCBs), U.S. president signed a Defence Production Act in March 2023 with $50 million in order to boost the manufacturing of advanced chips and PCBs.

- Taiflex Scientific, the manufacturer of FCCL, moved quickly, committing US$35 million up front to the construction of a factory in Thailand by the end of 2022. The new facility will make double-sided, non-adhesive copper foil substrates; mass production is anticipated to start in the middle of 2024.

- The northern Vietnamese province of Nam Dinh granted an investment certificate to Quanta Computer, an Apple supplier, in 2023 in order that the Taiwanese electronics manufacturer would be able to build a $120 million factory.

Market Outlook

- Industry Growth Overview:

The printed circuit board market is experiencing significant growth, driven by the expansion of customer electronics, automotive technology, and the proliferation of 5G and IoT devices. - Global Expansion:

The market is experiencing significant global expansion, driven by the transition to electric vehicles (EVs) and the incorporation of developed driver-assistance systems (ADAS) are significant drivers, as modern vehicles need a greater number of high-reliability PCBs for battery management, sensors, and control systems. Asia Pacific is dominated in the market as a huge electronics production base. - Major investors:

Major investors in the market include large electronics manufacturers, diversified conglomerates (Sumitomo), specialized PCB firms such as Zhen Ding, Unimicron, AT&S, TTM Technologies, governments (EU, China, India), and various VC/Investment funds.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 97.11 Billion |

| Market Size in 2026 | USD 102.74 Billion |

| Market Size by 2035 | USD 169.18 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.71% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Substrate, Laminate Materials, Raw Material, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

PCB Market Dynamics

The main important factor that is propelling the growth of the printed circuit board market is the growing demand for electronic gadgets such as smartphones laptops, smart televisions, and others all across the globe. These electronic devices are increasingly becoming a necessity for consumers all across the globe in this modern era. These electronic gadgets use printed circuit boards as automated machinery and cell tower.

Additionally, the rising global population coupled with the rising penetration of electronic devices across the world majorly in developing economies has led to a proliferation in the requirement for printed circuit boards in the industries like consumer electronics, automobiles, IT & telecom, and others. Moreover, aerospace & military, and other government institutions are also using electronic devices for various purposes which in turn is likely to bolster the demand for the growth of the market in terms of value sales. Furthermore, the rising application of advanced electronic devices in military & defense sectors all across the globe is anticipated to offer immense opportunities to propel the printed circuit board market growth during the forecast years.

Furthermore, advancements in technology in industrial automation, medical devices, and the growing adoption of modern electronic gadgets among consumers are some of the factors that are contributing to the increasing demand for printed circuit boards from various industries. The rising requirement for printed circuit boards in vehicles that allows drivers to link their smartphones with the vehicle in order to check the battery status, start climate control systems, unlock doors, and others, are some additional key factors propelling the growth of the market. Additionally, the market is witnessing positive growth in the printed circuit board market due to the increased potential for small, high-performance printed circuit boards, smart wearable, many portable electronics, medical devices, and light-weighted.

The rising demand for additive manufacturing in the electronics sector carries accurate components therefore, it aids drive the growth of the PCB market. Moreover, additive manufacturers have been taking initiative in designing printed circuit boards beyond the prototyping stages. Therefore, it aids in improving the performance as well as the functionality of the devices. Henceforth, the rising development in additive manufacturing as well as 3D printing, is accelerating the growth of the printed circuit boards market.

Product Insights

By product, the market is segmented into rigid PCBs, standard multilayer, HDI/build-up/microvia, flexible circuits, IC substrate, and others. The HDI /build-up/microvia segment is expected to be the fastest-growing segment during the forecast period. High density interconnect (HDI) PCBs has an excellent circuit density over traditional circuit boards and thus it is considered to be the most promising technology in the industry. High density interconnects (HDI) technology also enables manufacturers to deploy one or more elements on both sides of the raw printed circuit board by offering multiple alternatives. Therefore, the abovementioned facts have driven the growth of the overall market in terms of value sales.

The complex size of the rigid PCB is adopted in heavy-duty applications and complex circuit applications which included high voltage variation and high frequency. Moreover, a printed circuit board ensures its enhancement in industrial automation applications like automation machinery, robots, and pressure controllers which drive the growth of the market. The increasing industry progression or development in rigid printed circuit boards is due to the increasing trends of automated machinery and industrial robots in manufacturing plants.

Application Insights

Depending on the application, the consumer electronic segment holds the largest market share in the global market in the year 2023. PCBs (Printed circuit boards) are widely used in the electronic gadgets including calculators, smartphones, large circuit boards, smartwatches, and others. Growing advancement helps propels the printed circuit boards market but variability in raw material restraints market growth during the forecast period. In addition to this, these electronic gadgets are in high demand among the consumers especially the among millennials that plays a vital role in propelling the overall growth of the printed circuit board market in terms of value sales.

Laminate Material

FR-4 high Tg segment holds the largest share of the printed circuit board market. A particular kind of flame-retardant material called FR-4 is frequently used to produce printed circuit boards (PCBs). "high Tg" refers to the "glass transition temperature," a crucial factor in assessing the material's thermal stability. High Tg FR-4 PCBs better tolerate higher temperatures than regular FR-4 materials. The glass transition temperature is the temperature at which a substance changes from a stiff, glassy condition to a softer, rubbery state. A greater Tg is preferable in PCBs since it denotes improved thermal stability and high-temperature performance.

High Tg materials can tolerate higher working temperatures without causing appreciable dimensional changes or electrical property degradation. This is important for automotive, industrial, or high-power electrical devices where the PCB may be subjected to high temperatures. High Tg FR-4 materials guarantee that the PCB can operate at its best under a range of temperature settings, which adds to the overall reliability of electronic equipment. This is particularly crucial for situations where frequent temperature changes occur.

Raw Material

Glass fabric segment holds the largest share of the printed circuit board market. One of the frequently utilized substrate materials in PCB production is glass fabric. It is renowned for having superior mechanical strength, dimensional stability, and electrical insulating qualities. Usually, glass cloth is impregnated with epoxy resin to form a laminate, which serves as the PCB's foundation material. Glass cloth is an excellent option for applications where electrical insulation is essential because of its high dielectric strength and low dissipation factor. Glass fabric gives the PCB good mechanical strength and stiffness. This is necessary to preserve the circuit board's structural integrity, particularly when the board might be subjected to mechanical stress.

Glass fabric ensures the dimensional stability of the PCB under various operating conditions, as it expands and contracts less than other materials with temperature changes. Its good thermal insulation properties are crucial for PCBs operating at high temperatures, helping to prevent deformation or failure in high-temperature situations. The flame-retardant nature of many glass fabric laminates used in PCBs adds an extra layer of safety to electronic devices. Glass fabric is often the material of choice for many applications due to its affordability compared to some alternatives.

Regional Insights

Asia Pacific Printed Circuit Board Market Size and Growth 2026 to 2035

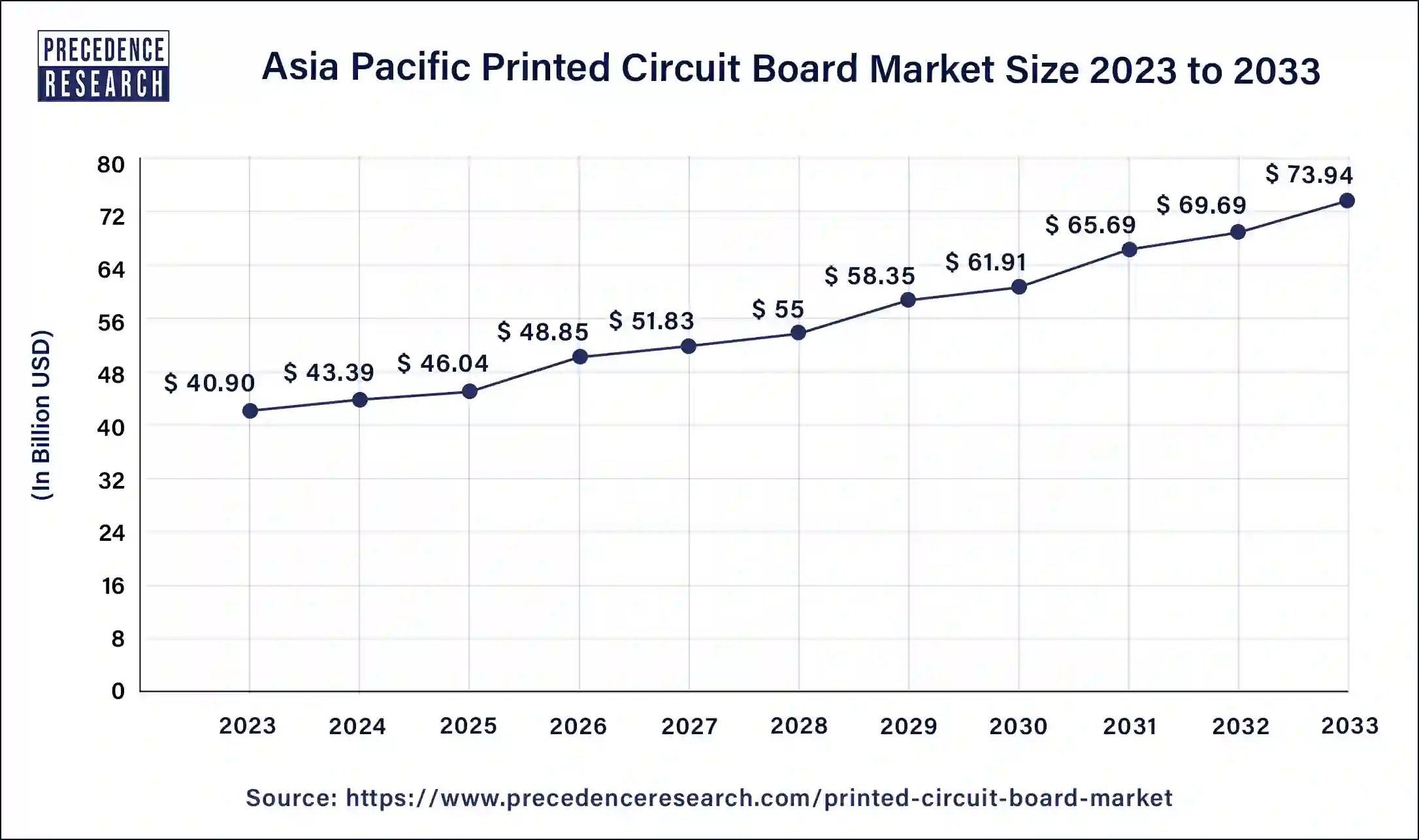

The Asia Pacific printed circuit board market size is estimated at USD 46.04 billion in 2025 and is predicted to be worth around USD 82.15 billion by 2035, at a CAGR of 5.96% from 2026 to 2035.

Asia Pacific: Growing acceptance of smart electronic gadgets

In the year 2025, Asia-Pacific is the dominating region in the printed circuit board market owing to the rising application of PCBs (printed circuit board) in the electronics devices and also due to existence of manysemiconductorproducers in APAC region. Moreover, the proliferation of PCBs (printed circuit board) market in this region is also due to growing acceptance of smart electronic gadgets in countries like China, India, Japan and others. Moreover, the rising internet penetration in developing countries like India is expected to offer immense growth opportunities for the printed circuit board market. APAC printed circuit boards are driving the growth of the market by increasing deployment in the 5G network in countries such as South Korea, China, and Japan.

- Thailand established a number of laws in 2022 pertaining to electric vehicle incentives, which excluded up to 80% of annual taxes for electric vehicles registered within a given time frame. For the production and assembly of electric vehicles, imported components are free from tariffs in tax-free or free trade zones, which is a major boost for auto PCB producers.

- The Taiwan Printed Circuit Association scheduled two investment tours to Thailand in July 2023, as well as one each to Vietnam and Malaysia. Additionally, the association hosted the Thailand PCB Industry Link Summit in order to discuss major issues in the PCB industry.

- In 2023, Chin-Poon Industrial focused on growing its business in Thailand and reaffirmed its dedication to provide PCBs for the automotive sector as well as other specialised sectors like high-end communications, low-Earth orbit (LEO) satellites, and mid-volume PCBs.

North America: Advanced materials and technologies

The North American market is expected to be one of the fastest-growing regions in the printed circuit board market during the forecast period. This is attributable to the rising demand for electronic devices from the aerospace & defense sector. U.S. President has applied restrictions on manufacturers in the U.S. to source from domestic suppliers, hence, providing job opportunities in the country.

India Printed Circuit Board Market Trends

In India, growing government initiatives like Make in India are increasing this momentum, cheering domestic production to lower reliance on imports and bolster local novelty. Major manufacturers are increasing to meet the requirements of diverse sectors, from consumer electronics to industrial applications.

U.S. Printed Circuit Board Market Trends

In the U.S., increasing printed circuit boards for military and aerospace applications, telecommunications, and early computing skills drove the demand for PCB manufacturing. Companies such as IBM and HP spearheaded innovation, and the region's strong manufacturing base allowed rapid technological development. The U.S. led the global PCB innovation and manufacturing.

Europe: Rapid growth in smart factories

Europe is significantly growing in the printed circuit board market due to major European organizations specializing in implantable medical devices and sophisticated diagnostic equipment, requiring biocompatible and highly challenging micro-PCB services. Europe's huge automotive base, particularly in Germany, creates constant demand for developed PCBs used in Electric Vehicles (EVs) and autonomous increasing systems, which contributes to the growth of the market.

The UK Printed Circuit Board Market Trends

Strong UK defense, aerospace, industrial automation, and medical sectors increase demand for reliable, high-performance PCBs for avionics, medical devices, and smart production. Spending in R&D for advanced substrates and miniaturization for 5G, IoT, and autonomous vehicles positions the UK as an innovation hub.

Top Companies in the Printed Circuit Board Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Wurth elektronik group |

Germany |

Comprehensive customer service |

In October 2025, Wireless modules powered by the Nordic nRF54L15 SoC offer high performance and development flexibility. |

|

TTM Technologies, Inc. |

United States |

Integrated lifecycle solutions and deep engineering expertise |

TTM is a global leading printed circuit board manufacturer for Industrial and Instrumentation applications. |

|

Becker & Müller Schaltungsdruck GmbH |

Germany |

Development and manufacturing of demanding PCBs |

Becker & Müller is a medium-sized family business specializing in the development and manufacture of demanding printed circuit boards in sample, small and medium series. |

|

Advanced Circuits Inc. |

United States |

Focus on high-growth industrial and automotive |

Advanced Circuits is the third-largest PCB Manufacturer in the US. |

|

Sumitomo Corporation |

Japan |

Integrated logistics and commitment to long-term |

In August 2024, Telkomsel and Sumitomo Corporation are committed to working together in the development of B2B business in Indonesia, specifically focusing on IoT services. |

PCB Market Companies

- Wurth elektronik group (Wurth group)

- TTM Technologies, Inc.

- Becker & Muller Schaltungsdruck GmbH

- Advanced Circuits Inc.

- Sumitomo Corporation

- Murrietta Circuits

- Unimicron Technology Corporation

- Tripod Technology Corporation

- Nippon Mektron Ltd.

- Zhen Ding Technology Holding Limited

Recent Developments

- In August 2023, With characteristics that allow industrial-grade applications, IDEC Corporation announced launching its new printed circuit board (PCB) relays, the RC Series. The relays offer high-capacity power switching, are available in several low-profile variants, and function dependably in harsh conditions. According to the manufacturer, the RJxV Series PCB mount relays are upgraded and replaced by the RC Series.

- In October 2023, Krypton Solutions, a Texas-based company, plans to invest USD 100 million (about Rs 832 crore) to establish a Printed Circuit Board production unit in Karnataka. Meanwhile, Texas Instruments, a semiconductor manufacturing giant, has reaffirmed its commitment to expanding research and development in the state. This was discovered during a meeting in the US between the company representatives and an official delegation headed by M B Patil, the Minister of Large and Medium-Sized Industries for Karnataka.

- In January 2021, Orbotech, one of the key manufacturers of the printed circuit board has declared an R2R (roll to roll) manufacturing solution for the flexible PCBs that will elevate the mass production as well as the designing of modern electronic devices such as modern automobiles, advance medical gadgets, 5G smartphones, and others.

- In 19 Oct 2021, Luminovo acquired PCB software provider Electronic Fellows to create next-generation software tools. This is a Wiesbaden-founded startup of Electronic Partners rising the growth of existing processes as well as creating new opportunities of interconnectedness for the electronics industry.

- In March 2020, Zhen Ding Technology Holding Ltd was acquired by Boardtek Electronics Corporation by Share-swap. Boardtek Electronics Corporation would become the exclusively kept secondary of Zhen Ding. Boardtek Electronics Corporation is involved in research and, development sales of the multilayer printed circuit boards, a production that mainly focuses on high-frequency microwave, high-performance computing as well as higher efficiency of thermal dissipation.

- In Feb 2020, TTM Technologies Inc. declared Advanced Technology Center in Chippewa Falls. The Advanced Technology Center in Chippewa Fall Wisconsin strengthened the 40,000 sq. ft. facility which is situated at 850 Technology Way. Advanced Technology Center offers the most advanced printed circuit board manufacturing solutions with the capability to manufacture substrate-like printed circuit boards offered in North America.

Segments Covered In The Report

By Product

- Rigid PCBs

- Standard multilayer

- HDI/build-up/microtia

- Flexible circuits

- IC substrate

- Others

By Substrate

- Rigid

- Flexible

- Rigid-flex

By Laminate Materials

- FR-4

- FR-4 high Tg

- FR-4 halogen free

- Standard & Others

- Flexible (PI,PET)

- Paper

- Composites

- Others

By Raw Material

- Glass fabric

- Epoxy resin

- Kraft paper

- Phenolic resin

- Polyimide film

By Application

- Industrial electronics

- Aerospace & defense

- IT & telecom

- Automotive

- Consumer electronics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content