What is the Resistor Market Size?

The global resistor market size is valued at USD 10.38 billion in 2025 and is predicted to increase from USD 10.76 billion in 2026 to approximately USD 14.86 billion by 2035, expanding at a CAGR of 3.65% from 2026 to 2035.

Resistor Market Key Takeaways

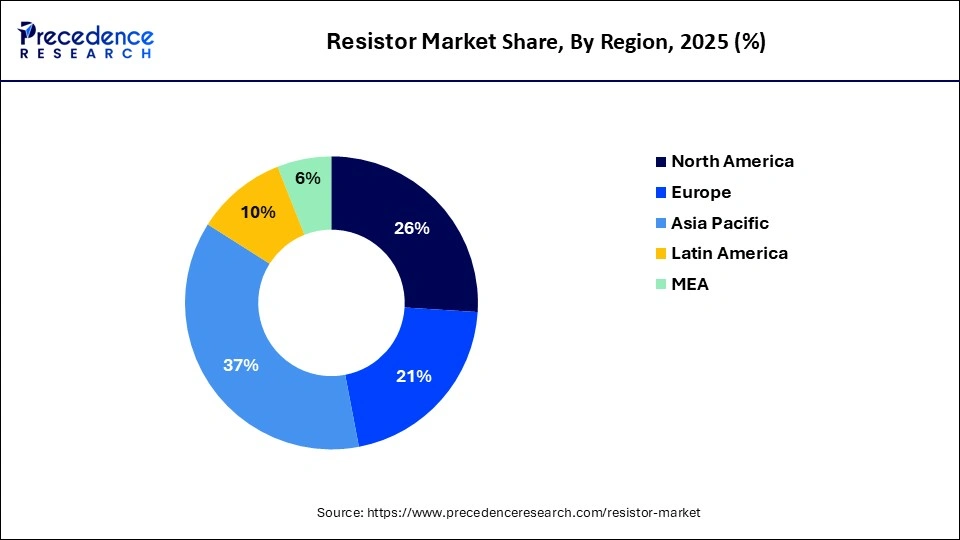

- Asia-Pacific contributed more than 35% of revenue share in 2025.

- North America is estimated to expand the fastest CAGR between 2026 and 2035.

- By type, the thick film segment has held the largest market share of 43% in 2025.

- By type, the thin film segment is anticipated to grow at a remarkable CAGR of 4.2% between 2026 and 2035.

- By application, the automotive and transportation segment generated over 34% of revenue share in 2025.

- By application, the aerospace and defense segment is expected to expand at the fastest CAGR over the projected period.

What is the Resistor?

A resistor is a fundamental electronic component designed to impede the flow of electric current within a circuit. Its primary function is to introduce resistance, measured in ohms (Ω), which limits the current passing through it. Resistors are crucial for controlling the voltage and current levels in various electronic devices. They come in various shapes and sizes, ranging from small, discrete components to larger, power-handling resistors.

Resistors can serve diverse purposes in electronic circuits, including voltage division, current limiting, and signal conditioning. They are often employed to set bias points, ensuring the proper operation of transistors and other active components. Additionally, resistors find extensive use in voltage dividers for sensors and feedback networks in amplifiers. Their ubiquitous presence in electronic systems underscores their importance in tailoring and optimizing the performance of circuits, making resistors essential building blocks in the realm of electronics.

How is AI contributing to the Resistor Industry?

AI reinforces resistors by doing analog computing, creating optimization, and intelligent choice of components. Neuromorphic hardware can be efficient through programmable resistors. Machine vision enhances the precision of inspection. Circuit reliability is optimized by means of design simulation tools. The selection of power management helps to modernize the infrastructure globally with data centers that are energy efficient.

Resistor Market Growth Factors

- Rising Demand in Consumer Electronics: The expanding market for smartphones, laptops, and other consumer electronics is driving the demand for resistors, and essential components in these devices.

- Automotive Electrification: The global trend toward electric vehicles and increased electronic content in traditional vehicles is a significant growth factor for resistors in the automotive sector.

- Industry 4.0 and IoT Adoption: The surge in Industry 4.0 initiatives and the widespread adoption of Internet of Things (IoT) devices are fueling the demand for resistors in smart manufacturing and connected devices.

- 5G Technology Expansion: The deployment of 5G networks worldwide is boosting the demand for resistors, which are crucial in ensuring efficient communication and signal processing.

- Growing Renewable Energy Sector: The development of renewable energy, like solar and wind power, requires advanced electronics, contributing to the demand for resistors in power systems.

- Trend of Miniaturization: As gadgets get smaller, there's a growing need for tiny resistors, making miniaturization a significant growth factor.

- Medical Electronics: The expanding field of medical electronics, including wearable devices and diagnostic equipment, is a key growth driver for resistors.

- Advancements in Aerospace Technology: The aerospace industry's continuous advancements, including the development of more electronic systems in aircraft, contribute to the demand for high-performance resistors.

- E-mobility Revolution: The rapid growth of electric mobility, including electric bikes and scooters, is propelling the demand for resistors in battery management systems and motor control.

- Increased Connectivity in Home Appliances: The integration of smart features in home appliances is boosting the demand for resistors, supporting enhanced connectivity and functionality.

- Growth in Robotics: The expansion of robotics in industrial and consumer applications is creating opportunities for resistors in motor control and precision electronics.

- Rise in Edge Computing: The increasing adoption of edge computing solutions requires robust electronic components like resistors for efficient data processing at the edge of networks.

- Electric Industrial Equipment: The electrification of industrial equipment, such as machinery and manufacturing tools, contributes to the demand for resistors in control systems.

- Emerging Technologies like Blockchain: The adoption of emerging technologies like blockchain in various industries increases the need for reliable electronic components like resistors.

- Focus on Energy Efficiency: With a global emphasis on energy-efficient technologies, the demand for resistors designed for low power consumption and high efficiency is on the rise.

- Government Initiatives in Electronics Manufacturing: Supportive government policies and initiatives promoting electronics manufacturing contribute to the growth of the resistor market.

- Increased Consumer Awareness of Electronic Devices: Growing consumer awareness and demand for advanced electronic devices contribute to the overall expansion of the resistor market.

- Rapid Prototyping and Innovation: The need for rapid prototyping and innovation in electronics drives the demand for resistors as essential components in the design and development process.

- Globalization of Supply Chains: The globalization of supply chains in the electronics industry creates opportunities for resistor manufacturers to cater to a wider market.

- Sustainable Practices: The growing emphasis on sustainability and environmentally friendly practices in electronics manufacturing influences the development of eco-friendly resistors, meeting the demand for greener technologies.

Market Outlook

- Industry Growth Overview: The electric vehicles, complicated networks, and automation drive the demand for resistors, as they demand increased power components.

- Sustainability Trends: Manufacturers use halogen-free designs and lead-free terminations and processes that are more efficient in terms of sustainability.

- Major Investors: Yageo Corporation, Vishay Intertechnology, TE Connectivity, Murata, Bourns, and KOA Panasonic invest globally in a strategic manner.

- Startup Ecosystem: Established players that promote innovation in the market, develop thin film stability, and increase shunt performance requirements.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.65 Billion |

| Market Size in 2026 | USD 10.01 Billion |

| Market Size by 2035 | USD 14.37 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.68% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Electronic device proliferation and 5G technology deployment

The widespread use of electronic gadgets and the rollout of 5G technology are driving a surge in demand for resistors. As everyday items increasingly incorporate electronic features, such as smartphones and smart appliances, the necessity for resistors as essential components rises significantly. These resistors play a vital role in managing and directing the flow of electric current within these devices, ensuring they function effectively and reliably.

Additionally, the introduction of 5G technology, promising faster data speeds and enhanced connectivity, necessitates advanced and efficient electronic components. Resistors, as foundational elements in circuitry, become crucial in supporting the complex signal processing required for seamless communication in 5G networks. With the escalating need for higher data transfer rates and expanded network capabilities, the demand for resistors tailored to meet these technological demands is escalating, driving growth in the resistor market.

Restraint

Commoditization and price pressure

Commoditization and price pressure present significant challenges restraining the growth of the resistor market. The commoditization of basic resistor types has led to a situation where these components are viewed as standardized and interchangeable, fostering intense price competition among manufacturers. This heightened competition places considerable pressure on profit margins, limiting the financial resources available for research and development initiatives.

Moreover, as resistors are perceived as commodities, differentiation becomes challenging, hindering the ability of manufacturers to establish unique selling propositions. The focus on cost-cutting measures in commoditized markets may also compromise product quality and innovation. This dynamic discourages investment in advanced technologies or the development of specialized resistors, impacting overall market growth. In order to overcome these constraints, resistor manufacturers need to strategically position themselves through innovation, emphasizing value-added features, and diversifying their product portfolios to navigate the challenges posed by commoditization and price pressures.

Opportunity

5G network expansion

The expansion of 5G networks presents substantial opportunities for the resistor market. As 5G technology continues to proliferate globally, the demand for high-performance resistors escalates, particularly in critical applications within communication infrastructure and devices. The intricate and advanced circuitry of 5G base stations and devices requires resistors with precision and efficiency to ensure optimal signal processing and transmission.

Moreover, the increased data speeds and connectivity promised by 5G necessitate electronic components capable of handling the elevated demands on network infrastructure. Resistors play a pivotal role in supporting the functionality of 5G-enabled devices, including smartphones, IoT devices, and other connected systems. As the deployment of 5G networks expands, resistor manufacturers have the opportunity to provide specialized components that meet the stringent requirements of this transformative technology, positioning themselves at the forefront of a dynamic and rapidly growing market.

Segment Insights

Type Insights

In 2025, the thick film segment had the highest market share of 43% on the basis of the type. Thick film resistors are a kind of electronic part known for their resistive layer, made from a thicker ceramic material. Unlike thin film resistors, the thick film variety is produced using a deposition process, allowing for a more substantial resistive layer, which brings advantages in terms of durability, cost efficiency, and easy large-scale production. The thick film resistor segment is witnessing a trend towards miniaturization, improved power handling capabilities, and increased demand for customized resistors to meet specific application requirements.

The growing adoption of thick film resistors in automotive electronics, consumer electronics, and industrial applications reflects the industry's inclination towards robust and versatile electronic components.

The thin film segment is anticipated to expand at a significant CAGR of 4.2% during the projected period. Thin-film resistors in the market are crafted by layering a thin resistive material onto a substrate, providing accurate resistance and stability in different conditions. A rising trend in this category is the call for smaller and more precise electronic components. These resistors, valued for their compact size and reliable performance, are increasingly popular in sectors like telecommunications, medical devices, and consumer electronics. The increased demand is fueled by the necessity for efficient and precise components in contemporary electronic devices.

Application Insights

According to the application, the automotive and transportation segment has held 34% revenue share in 2025. In the automotive and transportation sector of the resistor market, resistors find application in crucial vehicle components like electric drivetrains, battery management systems, lighting, and electronic control units. The ongoing trends in this segment include the growing adoption of electric vehicles (EVs), the overall electrification of vehicles, and the integration of advanced driver-assistance systems (ADAS).

The aerospace and defense segment is anticipated to expand fastest over the projected period. The aerospace and defense segment commands a significant growth in the resistor market due to its critical role in enhancing electronic systems within aircraft, satellites, and defense equipment.

The sector's stringent requirements for reliability, precision, and durability drive the demand for specialized resistors. Ongoing technological advancements in aerospace, the proliferation of unmanned aerial vehicles (UAVs), and the need for lightweight yet high-performance electronic solutions further contribute to the dominance of this segment. As these industries continue to evolve, the demand for advanced resistors tailored to their unique specifications remains robust.

Regional Insights

What is the Asia Pacific Resistor Market Size?

The Asia Pacific resistor market size is valued at USD 3.63 billion in 2025 and is expected to be worth around USD 5.20 billion by 2035, growing at a CAGR of 3.66% from 2026 to 2035.

Asia-Pacific has held the largest revenue share 35% in 2025. Asia-Pacific commands a significant share of the resistor market due to the region's robust electronics manufacturing sector, particularly in countries like China, Japan, and South Korea. The burgeoning demand forconsumer electronics, automotive technologies, and industrial automation has fueled the need for resistors. Moreover, the rapid adoption of emerging technologies such as 5G, IoT, and electric vehicles further boosts the demand. The region's role as a manufacturing hub, coupled with increasing technological advancements, positions Asia-Pacific as a key player in driving the growth of the resistor market.

China Market Trends

China's resistor market is driven by booming automotive, 5G, IoT, electronics, and renewable energy sectors, with a need for miniaturized, high-precision, and specialized types such as shunt and thin film resistors. Additionally, China's position as a global manufacturing hub and investments in advanced resistor technologies are further boosting market expansion.

What Makes North America the Fastest-Growing Region in the Market?

North America is estimated to observe the fastest expansion. North America commands substantial growth in the resistor market due to a robust presence of key industries such as automotive, aerospace, and electronics. The region's advanced technological infrastructure, coupled with a high adoption rate of electronic devices, fuels the demand for resistors. Moreover, the aerospace and defense sectors in North America are significant contributors to the market, relying heavily on resistors for critical applications. The region's emphasis on innovation and the presence of major market players further solidifies North America's dominant position in the global resistor market.

U.S. Market Trends

The resistor market in the U.S. is expanding due to strong demand from the consumer electronics, automotive, aerospace, and industrial automation sectors. Growth in electric vehicles, renewable energy systems, and advanced electronic devices is driving the need for high-precision and power resistors. Additionally, ongoing investments in semiconductor manufacturing and technological innovation are supporting the market's continued development.

What Potentiates the Market in Europe?

The resistor market in Europe is expected to grow at a significant rate during the forecast period. This is mainly due to growth in renewable energy, electric vehicles, and Industry 4.0, requiring high-power, miniaturized resistors. Growth in wind, solar, and grid storage boosts the need for power resistors in energy management. Germany is a major contributor to the European market, driven by a strong need from the booming automotive sector and industrial automation.

How is the Opportunistic Rise of Latin America in the Resistor Market?

Latin America is expected to experience robust growth in the market over the projection period. This growth is mainly driven by growth in industrial automation and renewable energy, which creates the need for power resistors. Countries like Brazil and Mexico are seeing higher adoption of electric vehicles, industrial automation, and smart devices, which drives the need for high-performance resistors. Additionally, growing investments in electronics manufacturing and infrastructure development are creating new opportunities for market players in the region.

Brazil Market Trends

Brazil's resistor market is being driven by growing technology adoption, automotive manufacturing, industrial automation, and renewable energy. Key trends include increasing demand for advanced resistor types, innovations in high-performance components, a focus on cost efficiency, and expanding opportunities in sectors such as healthcare, telecommunications, and automotive.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) presents immense opportunities for the resistor market. These opportunities arise from the rapid industrialization, expanding automotive production, and growing investments in renewable energy and infrastructure projects. Increasing adoption of consumer electronics, smart devices, and industrial automation is driving demand for high-precision and power resistors. Additionally, government initiatives to support technology development and local manufacturing present significant growth opportunities for market players in the region.

Value Chain Analysis of the Resistor Market

- Raw Material Procurement: The procurement of high-purity silicon ingots, substrates, and specialty chemicals as the resistor's physical base structure.

Key players: Nichrome, Tantalum, Aluminum Nitride (AlN), Alumina (Al2O3), Carbon Film (Top Suppliers: Materion - Wafer Fabrication (Front-end): It involves the preparation of circular silicon wafers by repetition of chemical processes to accommodate a large number of integrated resistor circuits, and this is done effectively.

Key players: Vishay, Yageo, KOA Corporation, Panasonic, Susumu, Rohm Semiconductor - Photolithography and Etching: Ultraviolet masks are used to transfer resistor patterns, which are then etched to remove the excess material that defines precise geometry consistently.

Key players: JSR Corporation, Tokyo Ohka Kogyo (TOK), DuPont, Fujifilm, Shin-Etsu Chemical - Doping and Layering Processes: The dopants and layered films are introduced to adjust the conductivity and reliably determine the final resistance values.

Key players: Nichrome (NiCr) deposition, Tantalum Nitride (TaN) deposition, Silicon Chrome (SiCr) sputtering - Assembly and Packaging (Back-end): Slicing wafers into dies, then encapsulating the protective resin packages, then continuing to test the final resistance specifications throughout.

Key players: Yageo, Panasonic, Vishay, KOA Speer, Bourns, Samsung Electro-Mechanics

Resistor Market Companies

- Yageo Corporation: Yageo distributes thick and thin film chip resistors and automotive-grade series that are used in harsh environments where high performance and durability are required.

- Vishay Intertechnology: Vishay has offered precision foil, wirewound, and thin film resistors that meet the industrial and military reliability needs that require extreme stability and accuracy conditions.

- Murata Manufacturing: Murata supplies ceramic resistors and thermistors that allow temperature sensing and circuit protection in mini-electronics that need space efficiency, reliability, and integration.

Other Major Key players

- Panasonic Corporation

- Samsung Electro-Mechanics

- Rohm Co., Ltd.

- TE Connectivity

- KOA Corporation

- Bourns, Inc.

- Ohmite Manufacturing Company

- Caddock Electronics, Inc.

- Viking Tech Corporation

- Ralec Electronic Corp.

- Stackpole Electronics, Inc.

- Walsin Technology Corporation

Recent Developments

- In January 2026, ROHM introduced the UCR10C Series of sintered metal shunt resistors for automotive and industrial current sensing, offering the highest power ratings for 2012-size resistors. With resistance values from 10 mΩ to 100 mΩ, they are rated at 1.0 W and 1.25 W, doubling the power of similar products.

(Source: https://www.newelectronics.co.uk ) - In October 2025, Vishay Intertechnology introduced a high-power metal strip resistor in a compact 1206 size, delivering 5 watts. This product meets demand for high-performance, space-efficient resistors, suitable for power supplies, motor controls, automotive, and industrial applications, featuring reliable operation and enhanced thermal performance. (Source: https://www.bisinfotech.com )

- In June 2023, Yageo Corporation, a prominent chip resistor manufacturer, revealed a strategic partnership with TSMC, a leading semiconductor foundry. Their joint effort aims to create advanced chip resistors tailored for 5G and automotive applications. The primary focus of this collaboration is the development of chip resistors characterized by low inductance and exceptional reliability, catering to the evolving needs of these high-performance sectors.

- Similarly, in May 2023, Vishay Intertechnology, a key player in chip resistor manufacturing, joined forces with Murata Manufacturing, a major passive components manufacturer. Their collaboration is centered on the creation of high-density chip resistors designed for applications in wearables and the Internet of Things (IoT). The key emphasis lies in developing chip resistors with compact footprints and superior performance to meet the demands of these emerging and compact electronic applications.

Segments Covered in the Report

By Type

- Thick Film

- Thin Film

- Others

By Application

- Consumer Electronics

- Automotive

- Industrial

- Aerospace & Defense

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting