Chip Resistor Market Size and Forecast 2025 to 2034

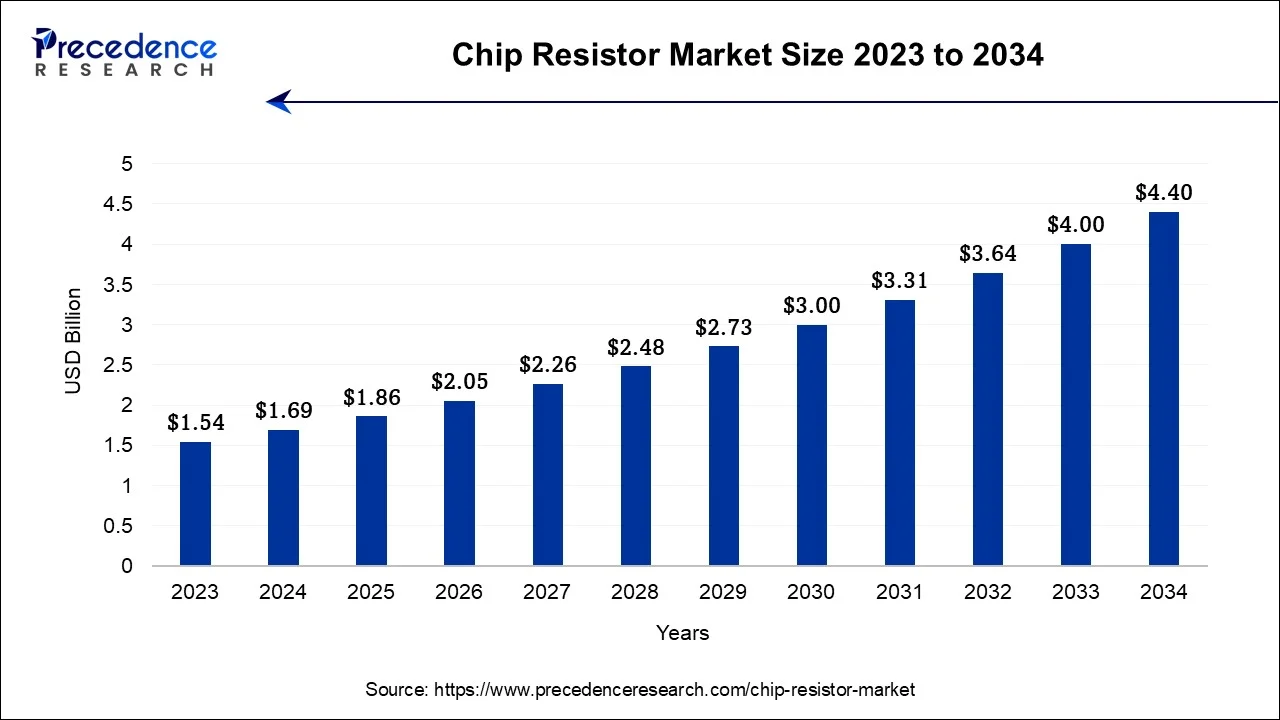

The global chip resistor market size was estimated at USD 1.69 billion in 2024 and is anticipated to reach around USD 4.40 billion by 2034, expanding at a CAGR of 10.04% from 2025 and 2034.

Chip Resistor Market Key Takeaways

- In terms of revenue, the chip resistor market is valued at $1.86 billion in 2025.

- It is projected to reach $4.40 billion by 2034.

- The chip resistor market is expected to grow at a CAGR of 10.04% from 2025 to 2034.

- By type, the thick film sub-segment is projected to generate a maximum revenue of 58% in 2024.

- The thick film segment is expected to hit a revenue of USD 1,653 million over the forecast period.

- The thin film segment is anticipated to generate a revenue of USD 1,393.5 million by 2034.

- The consumer electronic segment is projected to surpass USD 474.9 million by 2034.

Asia Pacific Chip Resistor Market Size and Growth 2025 to 2034

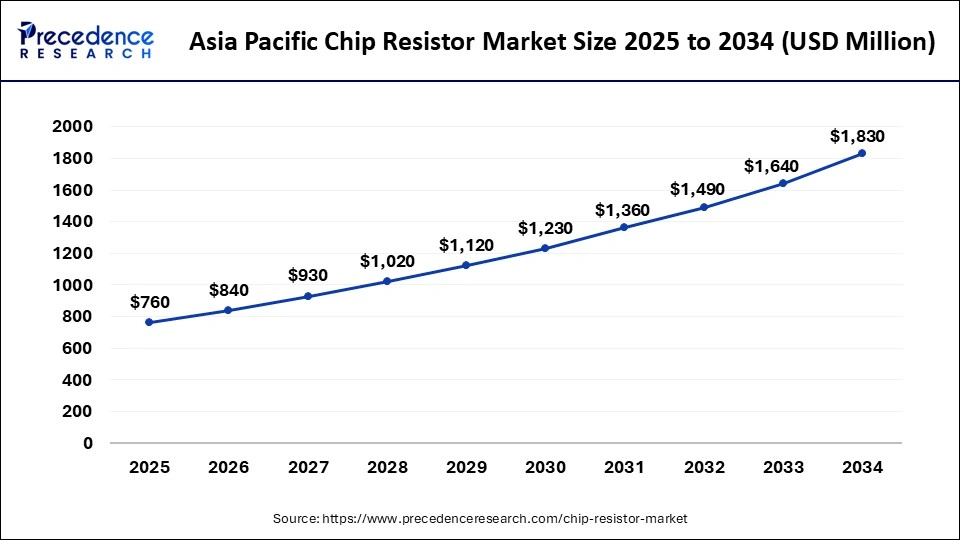

The Asia Pacific chip resistor market size accounted at USD 690 million in 2024 and is expected to be worth around USD 1830 million by 2034, growing at a CAGR of 10.25% from 2025 and 2034.

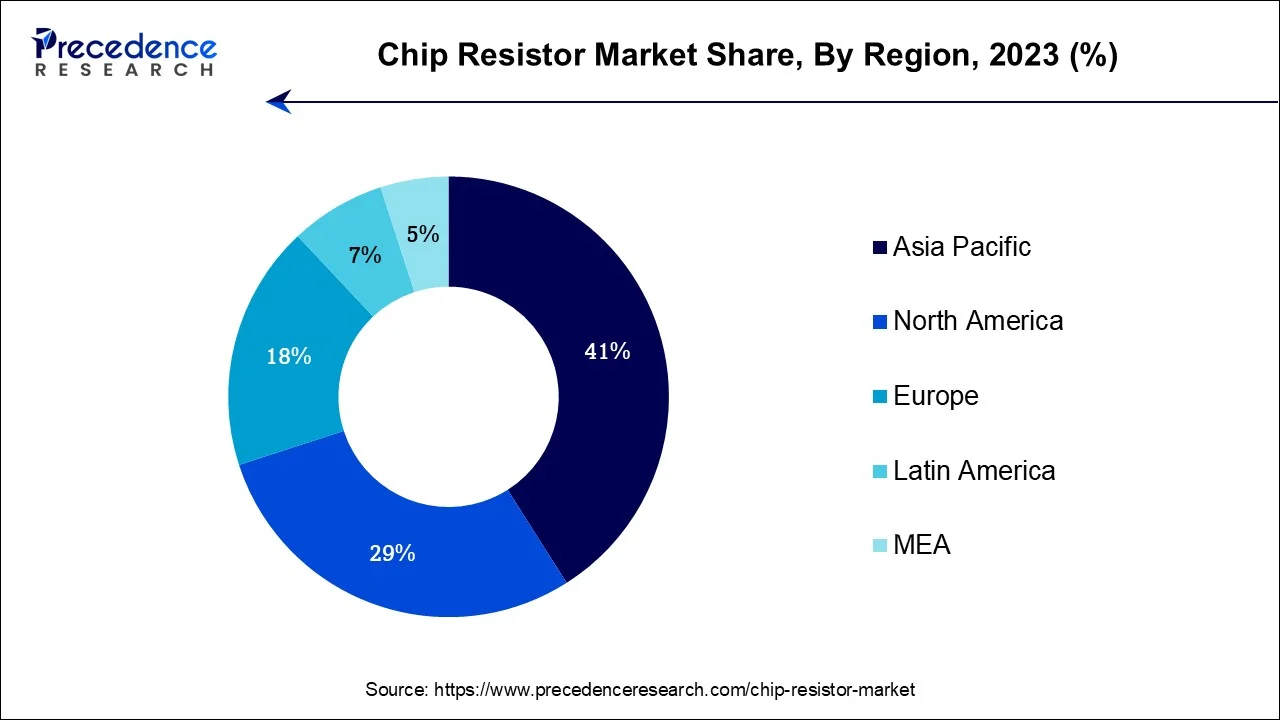

The Asia-Pacific region is expected to be the largest market for chip resistors.This is because the electronics industry in countries like China, Japan, and South Korea is growing rapidly. The demand for electronic devices such as smartphones, laptops, and wearable technology is also increasing, which is driving the demand for chip resistors in this region. Additionally, the popularity of the Internet of Things (IoT) and the use of smart homes and buildings are contributing to the growth of the chip resistor market in this region.

Asia Pacific is dominating the chip resistor market. Countries with strong and developing electronics manufacturing sectors, such as Japan, China, and South Korea, contribute a large portion of manufacturing facilities consisting of extensive supply chains. The social acceptance of technology like AI, IoT, and 5G highly supports the automotive industry. These factors lead to the highest demand, helping chip resistor companies to grow in this region.

Europe is also a significant market for chip resistors. This is because there are many electronics companies in the region and there is a high demand for electronic devices. The use of smartphones, laptops, and other mobile devices is increasing in Europe, which is driving the demand for chip resistors. The IoT is also becoming more popular in this region.

North America is another major market for chip resistors. This is because there are many electronics companies in the region and there is a high demand for electronic devices. The use of smart homes and buildings is increasing, as well as the popularity of wearable technology. The demand for electronic devices in industries like automotive and aerospace is also contributing to the growth of the chip resistor market in this region.

Market Overview

A chip resistor is a small electronic component that restricts the flow of electrical current. It is designed to provide a specific resistance to any current. The main purpose of the resistor is to block the flow of current. chip resistors are highly reliable and long-lasting. They are less prone to failure compared to other resistor types like variable resistors or potentiometers and can endure for many years under normal usage. Chip resistors are widely used in various electronic devices and systems, including automotive systems, consumer electronics, industrial applications, medical devices, and telecommunications.

Chip Resistor Market Growth Factor

The chip resistor market is experiencing growth due to the increasing demand for electronic devices such as smartphones, laptops, and other consumer electronics. These devices are widely used in various applications like entertainment, communication, and business, leading to a surge in demand for chip resistors.

Advancements in technology, such as the development of micro-electro-mechanical systems (MEMS) and advanced packaging, have also created new opportunities for the chip resistor market. These advancements have enabled the development of new and innovative electronic devices, increasing the demand for chip resistors.

Another factor contributing to the growth of the chip resistor market is the increasing demand for high-precision and high-reliability resistors in applications like automotive, industrial, and medical devices. These resistors are critical components in complex and sophisticated electronic devices and systems.

The growing adoption of advanced technologies like the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) is driving the demand for chip resistors. These technologies require a wide range of electronic components, including chip resistors, and their adoption is rapidly increasing.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.69 Billion |

| Market Size in 2025 | USD 1.86 Billion |

| Market Size by 2034 | USD 4.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.04% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 To 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The growing focus on miniaturization

Miniaturization is a growing trend in the electronics industry, driving the demand for smaller and more efficient resistors. This trend involves manufacturing smaller mechanical, optical, and electronic products and devices. It is motivated by factors such as portability, convenience, and improved functionality. The exponential scaling and miniaturization of silicon MOSFETs (MOS transistors) result in the number of transistors on an integrated circuit chip doubling every two years, known as Moore's law. The increasing use of Internet of Things (IoT) devices also contributes to the miniaturization trend. Chip resistors are well-suited for this trend as they are small and easily integrated into electronic devices.

The growth in the chip resistor market is driven by the increasing demand for electronic devices in various industries such as automotive, transport, industrial, consumer electronics, and IT & telecommunication. Technological advancements and the development of new types of chip resistors, such as ultra-low resistors and eco-friendly resistors, also contribute to the market growth. However, the manufacturing process for miniaturized electronic devices poses challenges, and electronics manufacturers are constantly innovating to overcome these challenges when dealing with smaller and more powerful electronic components.

Restraint

The growing competition from alternative technologies

The chip resistor market is facing tough competition from alternative technologies like thin-film and thick-film resistors. These alternatives are gaining popularity because they offer advantages such as lower cost and better performance. One major advantage of thin-film resistors is their affordability. They are made by depositing a thin layer of metal or metal oxide on a substrate, making them much cheaper to produce than chip resistors. This makes them a desirable choice for many applications, especially in consumer electronics where cost is a key factor.

Thick-film resistors also have several advantages over chip resistors. They are made by depositing a thick layer of metal or metal oxide on a substrate, and they have a wider range of resistance. This makes them suitable for various applications, from simple circuits to complex systems. Additionally, thick-film resistors have a higher temperature coefficient of resistance (TCR) than chip resistors, making them more accurate across different temperatures. The growing popularity of these alternative technologies poses a significant challenge to the chip resistor market. As more people start using these alternatives, the demand for chip resistors is likely to decrease. This could result in lower prices and increased competition in the market.

Opportunities

The increasing demand for electronic devices

The chip resistor market has a significant opportunity due to the increasing demand for electronic devices. As the global demand for electronic devices grows, the need for resistors, specifically chip resistors, also increases. This demand is driven by various factors, including the rise of the Internet of Things (IoT), the increasing use of smartphones and other mobile devices, and the growing popularity of wearable technology.

One of the main opportunities for the chip resistor market lies in the growing demand for electronic devices in the IoT. The IoT is a network of interconnected devices, sensors, and systems that can communicate with each other to collect and analyse data. Chip resistors are used in a wide range of IoT devices, such as smart thermostats, smart home security systems, and wearable fitness trackers. As the number of IoT devices continues to grow, the demand for chip resistors is expected to increase.

Another significant opportunity for the chip resistor market is the increasing use of smartphones and other mobile devices. Mobile devices require a variety of electronic components, including resistors, to function properly. Chip resistors are used in smartphones, tablets, and laptops to regulate power, control signals, and monitor the flow of electricity. As the demand for mobile devices continues to rise, the demand for chip resistors is likely to increase as well.

Lastly, the growing popularity of wearable technology is also creating opportunities for the chip resistor market. Wearable technology, such as smartwatches and fitness trackers, relies on a range of electronic components, including resistors. Chip resistors are used in wearable technology to regulate power, control signals, and monitor the flow of electricity. As the popularity of wearable technology continues to grow, the demand for chip resistors is expected to increase.

Impact of COVID-19:

The global chip resistor market went through significant changes before and after the COVID-19 pandemic. Prior to the pandemic, the market was growing due to the increasing demand for electronic devices in various industries. The development of 5G technology, IoT applications, and advancements in the automotive industry increased the need for chip resistors in products like smartphones and medical devices. However, when COVID-19 hit in early 2020, global supply chains were disrupted, leading to production delays, reduced consumer spending, and logistical difficulties. As a result, the chip resistor market experienced a sudden decline, with manufacturing activities affected and demand for electronic devices decreasing due to economic uncertainties.

After the pandemic, the chip resistor market saw a mixed recovery. The increased reliance on remote work, online education, and telemedicine sustained the demand for electronic devices. However, ongoing supply chain disruptions, shortages of raw materials, and intermittent lockdowns continued to pose challenges. The importance of reliable and efficient electronic components was highlighted by remote work arrangements, which drove the need for higher quality chip resistors. Additionally, the semiconductor industry demonstrated resilience and adaptability as manufacturers sought to mitigate supply chain vulnerabilities and diversify sourcing strategies. As economies gradually recovered, the chip resistor market regained momentum, with a greater emphasis on resilience, flexibility, and innovation in response to unpredictable global dynamics.

Technological Advancement

Technological advancements in the chip resistor market feature thin-film resistors, high-value resistors, consumer electronics, and automotive and transportation. The technology in automotive and transportation helps the automotive industry with various applications, including sensors, motor control, and engine control units (ECUs). Chip resistors in consumer electronics are applicable for laptops, wearables, and smartphones. The demand for chip resistors in the consumer electronics market is due to the convenience of their small size and high performance.

Chip resistors are used in several other industries, such as aerospace, industrial, and healthcare. For the enhancement of materials and manufacturing processes, thick chip resistors are used for improvement. Advancement in the new materials consists of silicon carbide (SiC). It's a contribution to the chip resistor market to design the chip in such a way that it can handle higher power and carry out operations in demanding environments.

Type Insights

The chip resistor market is projected to grow in the future due to the increasing demand for thick film resistors. Thick film resistors are a type of chip resistor that is created by applying a thin layer of conductive material onto a substrate, followed by layers of insulating and conductive materials. This manufacturing process allows for the production of resistors with precise resistance values, making them widely used in electronic devices like computers, mobile phones, and appliances.

One of the main advantages of thick film resistors is their high precision and stability. They are also relatively inexpensive to produce, making them a cost-effective choice for many applications. Additionally, thick film resistors are available in a wide range of resistance values, making them suitable for various uses. Thick film chip resistors have several advantages. They can provide high resistance values, reaching up to 10TW (tera-ohm). They also have excellent performance at high temperatures and can handle high voltages. These resistors are commonly used in various applications, such as high precision measuring or monitoring equipment, medical or audio devices, precision controls, and any electrical device that uses a battery or AC connection. Thick film chip resistors used in applications that require high wattage. Additionally, they maintain their resistance value even when exposed to high voltage, allowing for the use of high values.

Application Insights

Thick film chip resistors are suitable for use in the automotive industry due to their high resistance values, high-temperature performance, and high voltage capability. They are also reliable and can withstand harsh operating conditions, making them ideal for critical automotive applications. Thick film chip resistors are extensively utilized in the automotive sector for various applications, including sensors like fuel/air mixture and pressure sensors, engine and gearbox controls, airbag sensors, and ignitors. These resistors are preferred in the automotive industry due to their ability to provide high reliability and withstand extended temperature ranges.

The use of pulse handling chip resistors in automotive applications offers several benefits. These resistors are capable of providing stable and reliable performance even in harsh electrical environments. Additionally, they can withstand high voltage pulses without compromising their performance characteristics. This makes them a dependable option for use in automotive systems. The use of pulse handling chip resistors in automotive applications is becoming more common. These resistors are suitable for high voltage and high stress situations. By selecting the right type of resistor for the specific requirements of the application, designers can ensure reliable performance and long-term reliability in automotive systems.

Chip Resistor Market Companies

- Samsung

- Rohm Semiconductor

- YAGEO Corporation

- TE Connectivity

- Bourns, Inc.

- TT Electronics

- Vishay Intertechnology Inc.

- CTS Corporation

- Panasonic

- Koa Corporation

- Tzai Yuan Enterprise Co.

Recent Development

- In February 2025, Rostec created unique chip resistors based on glass instead of platinum and gold. Ruselectronics Holding introduced an innovative material fabrication technique for chip resistors, eliminating precious metals.

- In February 2025, ROHM redesigned chip resistors for higher power. The upgradation to achieve general-purpose chip resistors to leverage energy levels in smaller high-power applications.

- In December 2023, KOA Corporation took the lead in a new international standard for surface mount chip resistors. This initiative is a beneficial contribution to the chip resistor market.

- In June 2023,Yageo Corporation, a leading manufacturer of chip resistors, announced a collaboration with TSMC, a leading semiconductor foundry, to develop high-performance chip resistors for use in 5G and automotive applications. The collaboration will focus on developing chip resistors with low inductance and high reliability.

- In May 2023, Vishay Intertechnology, a leading manufacturer of chip resistors, announced a collaboration with Murata Manufacturing, a leading manufacturer of passive components, to develop high-density chip resistors for use in wearable and Internet of Things (IoT) applications. The collaboration will focus on developing chip resistors with small footprints and high performance.

Market Segmentation:

By Type

- Thick Film

- Thin Film

- Others

By Application

- Consumer Electronics

- Automotive

- Industrial

- Aerospace & Defense

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting