What is the Industrial Automation and Control System Market Size?

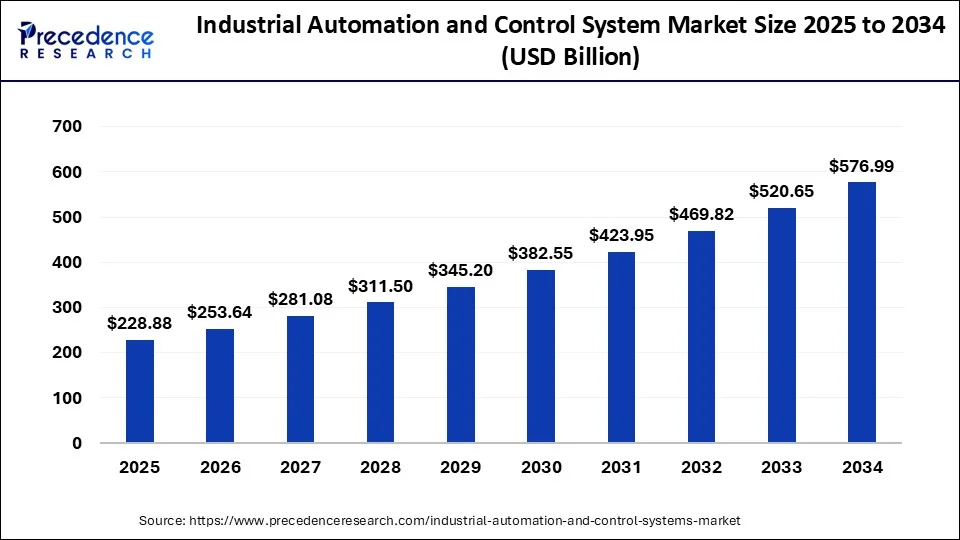

The global industrial automation and control system market size is accounted at USD 228.88 billion in 2025 and predicted to increase from USD 253.64 billion in 2026 to approximately USD 576.99 billion by 2034, representing a CAGR of 10.82% from 2025 to 2034.The industrial automation and control system market is gaining traction as businesses are demanding a system that improves the safety, quality, and efficiency of their business.

Industrial Automation and Control System Market Key Takeaways

- In terms of revenue, the industrial automation and control system market is valued at $228.88 billion in 2025.

- It is projected to reach $576.99 billion by 2034.

- The industrial automation and control system market is expected to grow at a CAGR of 10.82% from 2025 to 2034.

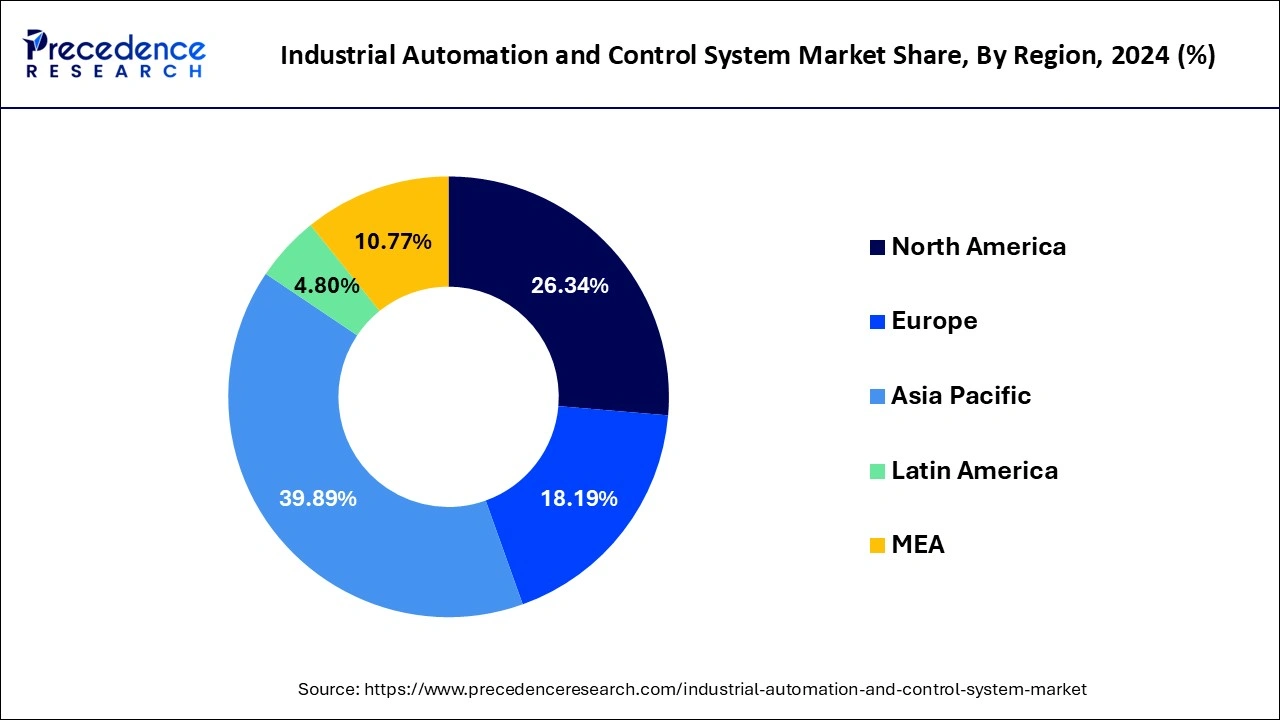

- Asia Pacific dominated the global industrial automation and control system market with the largest market share of 38.89% in 2024.

- North America is expected to expand at a solid CAGR of 9.9% during the forecast period.

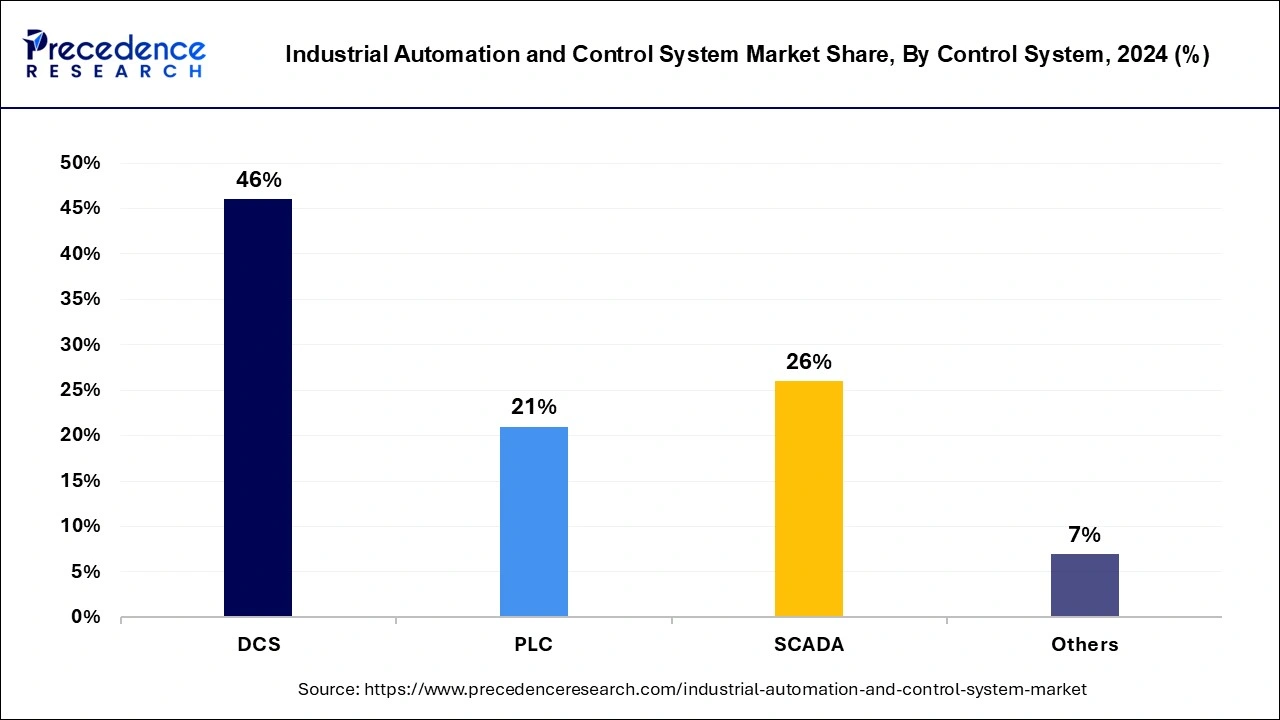

- By control system, the DCS segment contributed the highest market share of 46% in 2024.

Automation's Next Era

Industrial automation and control systems (IACS) is a set of technological devices including computer software and robotics within the manufacturing plant. It helps in manufacturing and streamlining other processes, reducing cost, improving quality, managing supply chains, and achieving energy efficiency by monitoring, connecting, and programming industrial assets. Industrial automation and control system utilizes a secure infrastructure for communication, data transfers and smart devices for data collection. Incorporation of industrial automation and control systems into business has proven to benefit them by improving their productivity and optimising manufacturing facilities.

How is Artificial Intelligence (AI) Improving Industrial Automation

The integration of artificial intelligence into industrial automation and control systems offers high reliability. AI algorithms offer convenient operations, improve working efficiency, enhance the accuracy of its control, and improve the quality of industrial production. All these factors play a crucial role in promoting the modernization of enterprises. AI not only offers accurate control but also is used during the design of the controller to significantly improve the ability of anti-interference and adaptability of information and data which accelerates the speed of the design. The role of artificial intelligence in the construction of industrial automation and control systems includes neural network control platforms, fuzzy control technology and expert decision systems.

Industrial Automation and Control System Market Growth Factors

- Industrial automation and control system adoption is highly preferred as it reduces the operation cost by increasing efficiency, reducing waste, and reducing labour costs.

- The is significantly lower machine maintenance associated with industrial automation and control systems due to the reduced frequency of equipment failure. The low possibility of machine failure leads to lower maintenance.

- The production is boosted with the help of industrial automation and control systems in a faster and less costly way. Additionally, this reduces the cycle times and increases throughput.

- Several companies are opting for industrial automation and control systems to enhance security and reduce costs which increases product development quality.

Market Outlook

- Industry Growth Overview:

The industrial automation and control systems market is increasing, driven by the broad adoption of Industry 4.0, the demand for greater efficiency, and the incorporation of technologies such as AI, IoT, and cloud-based systems. - Global Expansion:

The industrial automation and control systems market is expanding due to the push for 4.0 technology and smart manufacturing, goal of increasing effectiveness, productivity, and safety. North America is dominated in the market by massive industrialization, regulatory support for advanced manufacturing, and major investment in sectors such as electronics, automotive, and energy. - Major investors:

Major investors in the industrial automation and control systems market include major organizations such as Siemens, Rockwell Automation, Honeywell, Schneider Electric, and ABB.

Key Trends in 2025 for Industrial Automation and Control Systems

Integration of AI and ML: The major trend that industrial automation and control systems are witnessing is the integration of AI and ML. These cutting-edge technologies are expected to hold their dominance in decision-making factors, predictive maintenance, and quality control. Predictive maintenance plays a key role in industrial automation by leveraging the capabilities of AI to analyze huge volumes of data in real-time, which can predict the potential of machine failure before it occurs. Such proactive approaches to predictions are critical in terms of costs and maintenance of equipment for longer periods.

Application of 5G network:Another significant trend for the industrial automation and control system market is the application of 5G networks, which is transforming industrial automation by providing ultra-fast connectivity, minimizing latency, and ensuring high authenticity. Industries are seeking to deploy 5G to increase machine-to-machine communication, monitor remotely, and enhance automated processes. For instance, in automated warehouses, real-time inventory tracking is mandatory, which is achieved by 5G networks. Also, drones in industrial settings benefit from 5G speed and help improve logistics and transportation operations.

Market Scope

| Report Highlights | Details |

| Market Size By 2034 | USD 576.99 Billion |

| Market Size in 2026 | USD 253.64 Billion |

| Market Size in 2025 | USD 228.88 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.82% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Mentioned | Component, Control System, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamic

Drivers

Improves productivity

Manufacturers are constantly looking for solutions that can help them raise productivity with little assets, driven by the constant demand to improve profitability. In this case, industrial automation catalyses increased dependability and efficiency, resulting in a higher return on investment (ROI). By adopting innovative and integrated technologies, industrial automation improves production rate and quality while also lowering production costs. It takes mechanization a step further by substituting computer programming and automation devices for human labour, resulting in a performance that is superior to manual operation.

Restraint

Initial Cost

The Industrial automation and control system has several drawbacks including the initial cost of design and installation and the complexity of integrated systems and technology which require hiring or training experts to operate and maintain the system which adds up the cost of labour. The primary drawback that majorly everyone has to deal with is the initial cost. Implementation of automation can be economically challenging. Most of the initial money is spent on automation-required facilities such as infrastructure, technology, and installation.

Opportunity

Industrial Changes

The industrial market is anticipated to advance more towards smarter tech such as artificial intelligence (AI) and machine learning. A noticeable difference will be observed in the integration of smart manufacturing systems and Internet of Things (IoT) devices. Businesses are demanding more efficient work which encourages them to use predictive maintenance and better ways to collect data. The popularity of automation will rise continuously as plenty of companies are investing in automation for better decision-making and to increase productivity.

Component Insights

Based on the component the market is classified as HMI, industrial robots, control valves, sensors and other components. The control valve type is the most dominating in the year 2024 due to the rapid growth in the technologies and it is expected to continue in the forecast period. Environmental, economic, and competitive issues are becoming more prevalent in modern process facilities. As a result, an increasing number of industrial enterprises are investing in cutting-edge technology and instruments in order to obtain a competitive advantage.

Technology advancements have resulted in creative solutions that can help process facilities become more productive by optimizing their operations. Control valves and valve automation solutions suppliers will continue to create products and procedures that solve these new issues as industry requirements evolve and change.

The industrial robotics is gaining immense popularity due to the adoption of industrial internet of things (IIOT) technology which provides profitability and productivity. These smart sensors and actuators at the edge of production to capture data that was previously unavailable to manufacturers are used by robots. This trend is currently under progress, and it will result in new levels of efficiency and production. Apart from capturing and analyzing data in real time, the driving principle behind IIoT is that smart devices are better than people at transmitting crucial information that can be used to make accurate and faster business decisions.

Control System Insights

The DCS segment contributed the highest market share of 46% in 2024. The DCS has the most prominent share in the industrial automation and control system market due to its advantages in the automation and control system. A distributed control system (DCS) is a platform for automating plant or industrial process control and operation. A DCS combines the HMI, logic solvers, history, common database, alarm management, and a common engineering suite into a single automated system.

The shift of consumers towards such PLCs that handle greater responsibility in overall machine control, PLCs are now being designed with an emphasis on enhanced functionality. PLCs are now capable of performing a major amount of motion control tasks, allowing programmers to utilize the same language for motion control as they use for PLCs, simplifying the setup process. As consumers want PLCs that handle greater responsibility in overall machine control, PLCs are now being designed with an emphasis on enhanced functionality. PLCs' rising processing capacity allows them to do a major amount of motion control tasks, allowing programmers to use the same motion control language as the PLC.

Vertical Insights

The vertical segment is classified into aerospace & defense, automotive, chemical, energy & utilities, food & beverage, healthcare, manufacturing, mining & metal, oil & gas, transportation and others. The manufacturing sector has the significant share in the industrial automation and control system market. Manufacturing industry trends are in the spotlight as the industry undergoes its most significant transformation in recent years. Automation firms are rehiring more workers every day as a result of the latest technology in the manufacturing industry.

Further, the healthcare industry is the fastest growing in the market due to the increase in investment and the urgent need for advanced digital solutions.RPA in healthcare can improve workflows by automating rule-based tasks and processes, according to the Institute for Robotic Process Automation (IRPA). Bots used for automation can perform tasks such as data storage, data manipulation, transaction processing, and system calibration. Above all, healthcare automation can enhance outcomes and eliminate system faults caused by inefficient operations and manual processing.

Regional Insights

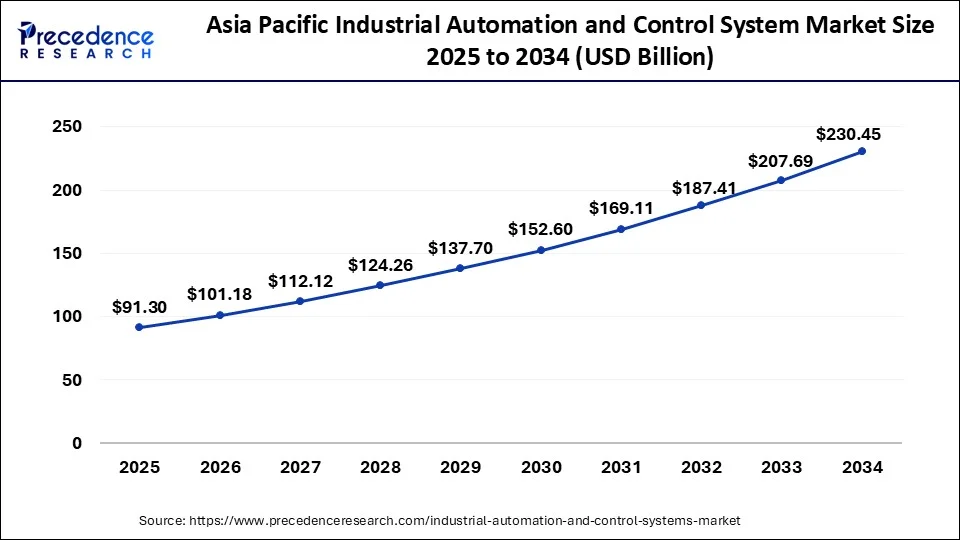

Asia Pacific Industrial Automation and Control System Market Size and Growth 2025 to 2034

The Asia Pacific industrial automation and control system market size is exhibited at USD 91.30 billion in 2025 and is predicted to be worth around USD 230.45 billion by 2034, rising at a CAGR of 10.84% from 2025 to 2034.

Asia Pacific dominated the global industrial automation and control system market with the largest market share of 38.89% in 2024. followed by North America and Europe. Investors are seeking for other manufacturing destinations as the cost of production in China rises and the Yuan strengthens against the dollar. India aspires to be the preferred manufacturing destination for multinational corporations. However, it must concentrate on high-quality production (zero defects) and environmentally friendly manufacturing to achieve this (zero effect). Only through a thorough understanding and implementation of industrial automation are both of these things achievable.

China's Automation Ascent

China's market for industrial automation and control systems is growing rapidly, driven by strong government support through initiatives like "Made in China 2025" and rising labor costs. The focus is on integrating advanced technologies, including AI, IoT, and robotics, to achieve smart manufacturing and enhance global competitiveness across various sectors like electronics and automotive

North America is anticipated to be expanding at a solid market share during the forecast period. The growth of this region's industrial automation and control system is observed due to extensive government initiatives by offering tax incentives and grants to businesses with investments in automation. This financial support consists of the costs of implementation of advanced technologies, making more accessible integrated automation for companies. Moreover, the U.S. federal government has made a strategic investment through several policies, initiatives, and public-private partnerships, such as Bipartisan Infrastructure Law, National Robotics Initiative 3.0, CHIPS Act, Advanced Robotics for Manufacturing and many more. All these factors contribute to the strengthening of the market.

U.S. Market Modernization

The U.S. market is expanding through a focus on technological innovation to boost efficiency and maintain a competitive edge. Key drivers include the adoption of sophisticated technologies such as AI and robotics, coupled with the advent of Industry 4.0 and the Internet of Things, all aimed at modernizing its established industrial base.

Green Giant: Europe's Efficiency Drive Fuels Industrial Automation Boom

Europe is significantly driving the growth of the industrial automation and control systems market as this region massively focuses on energy efficiency, driven by EU policies on carbon emissions, which encourage automation for optimization and waste lowering. The European Union is largely encouraging digital and sustainable manufacturing by initiatives such as the Industrial Strategy for Europe and the AI Act, which contribute to the growth of the market.

UK: Technological Advancement

In the UK, there is a shortage of labor, helpful government regulations for technology adoption, an extensive push towards Industry 4.0 and digital revolution, and the growing demand for efficiency and productivity in the manufacturing and various sectors. The incorporation of technologies such as AI, edge computing, machine learning, and 5G is allowing smarter, more autonomous, and interconnected industries.

South America's Cloud Automation Boom: 4.0 Tech Drives Productivity

South America is significantly driving the growth of the market, as increasing adoption of advanced 4.0 technologies, regulatory initiatives, the expansion of major industries, and the desire for superior operational productivity. There is an increasing trend of cloud-based automation for multi-site and analytics management, replacing on-premise systems applied for significant control in this region, which drives the growth of the market growth.

Brazil: Increasing Government Regulation

In Brazil, there is a large and diversified economy, a strong push for production and efficiency by industrial 4.0 technologies, and national guidelines encouraging modernization and sustainability. National industrial guidelines and environmental policies are driving the adoption of smart and energy-efficient automation services.

Industrial Automation and Control Systems Market - Value Chain Analysis

- Raw Material Sourcing:

Raw material sourcing in industrial automation and control systems contributes to detecting, evaluating, and procuring important materials like plastics, metals, and electronics required to manufacture automation devices such as controllers, sensors, and actuators.

Key Players: Mitsubishi Electric and Yokogawa Electric - Installation and Commissioning:

Installation and commissioning of industrial automation and control systems, including installing wiring and hardware, then methodically testing and calibrating the system to confirm it operates as intended and meets project stipulations.

Key Players: Schneider Electric and Emerson Electric - Product Lifecycle Management:

Product lifecycle management (PLM) for industrial automation and control systems is the tactical process of handling a product's whole journey from conception to disposal, consuming an integrated system of processes and software.

Key Players: Siemens and ABB

Top Vendors in the Industrial Automation and Control Systems Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Emerson Electric Co. |

United States |

Diversified portfolio |

Emerson's next-generation industrial automation and control services optimize industrial processes safely, securely, and reliably to give consumers peace of mind. |

|

Rockwell Automation, Inc. |

United States |

innovative portfolio |

In October 2025, Rockwell Automation Ushers in a New Era in Industrial Control with the Launch of the ControlLogix 5590 Controller. |

|

Schneider Electric |

France |

Robust automation and digital transformation |

It's a comprehensive EcoStruxure platform, and the continuing integration of next-generation technologies such as AI, edge computing, and digital twins. |

|

Siemens AG |

Germany |

Strong partner ecosystem |

Siemens is presenting advances in industrial AI, software-defined automation, and digital twin processes. |

|

Honeywell International, Inc. |

United States |

Innovation and strong brand reputation |

It offers enhanced safety, productivity, and sustainability in different sectors with IoT, automation, cybersecurity, and improved sensor solutions. |

Recent development

- In April 2025, a global leader in digital transformation for energy management, Schneider Electric Company, introduced the open automation movement. The movement highlights its intent and includes liberalizing industrial automation to make it more accessible with the help of open and software-defined solutions. This initiative holds the vision of software-driven and vendor-agnostic automation solutions achieved by Schneider Electric.

- In March 2025, Oxa tapped NVIDIA to enhance industrial mobility automation. A self-driving vehicle software introduces, reinforcing its collaboration with the leader in the AI processor to expand its plans in the IMA sector. This can be attained with the support of physical AI, creating photoreal virtual real-world states to escalate its training tools.

- In November 2024, GigaDevice, a leading semiconductor supplier launched its EtherCat SubDevice Controller Chip, an ultra-high-performance industrial automation MCU series -GD32H75E. This new product is designed to meet the industrial automation market demand by providing optimal solutions for applications such as servo control, variable frequency drivers, industrial PLCs, and communication modules.

- In October 2024, Siemens launched the SIRIUS 3RC7 intelligent link module which offers s quick and easy way to gain complete data transparency. This innovation is equipped with Totally Integrated Automation (TIA) from Siemens which provides seamless integration into the existing automation environment.

Latest Announcements by Industry Leaders

- In October 2024, Andreas Matthé, CEO of Electrical Products at Siemens Smart Infrastructure said, “Transparency down to field level is becoming increasingly important. However, many devices are not connected to the automation system, which means important data is missing. By digitalizing the field level, we are creating a new dimension of transparency and enabling data-driven decisions.”

Segments Covered in the Report

By Component

- HMI

- Industrial Robots

- Control Valves

- Sensors

- Others

By Control System

- DCS

- PLC

- SCADA

- Others

By Vertical

- Aerospace & Défense

- Automotive

- Chemical

- Energy & Utilities

- Food & Beverage

- Healthcare

- Manufacturing

- Mining & Metal

- Oil & Gas

- Transportation

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting