What is the Robotics Technology Market Size?

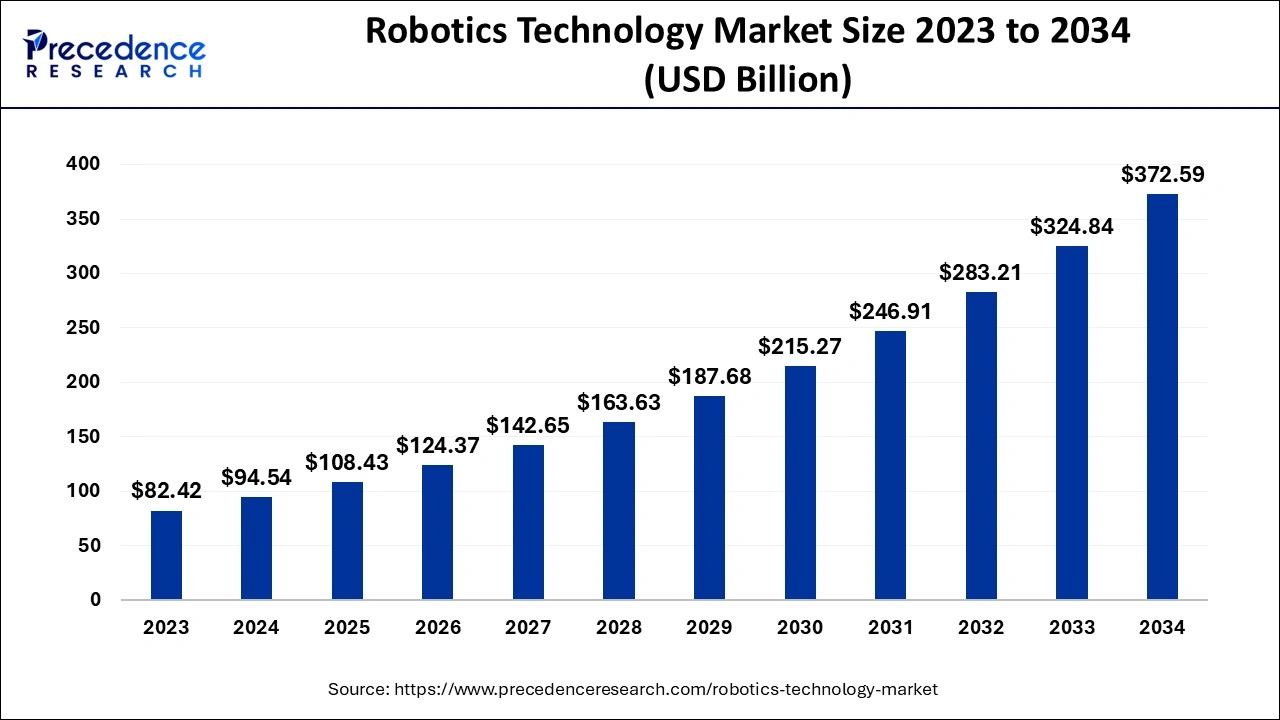

The global robotics technology market size is valued at USD 108.43 billion in 2025 and is predicted to increase from USD 124.37 billion in 2026 to approximately USD 416.26 billion by 2035, expanding at a CAGR of 14.40% from 2026 to 2035.

Robotics Technology Market Key Takeaways

- By type, the traditional industrial robots segment has captured 52% market share in 2025.

- By component, the hardware segment has hit 72% market share in 2025.

- By application, the manufacturing segment has accounted for 68% of revenue share in 2025.

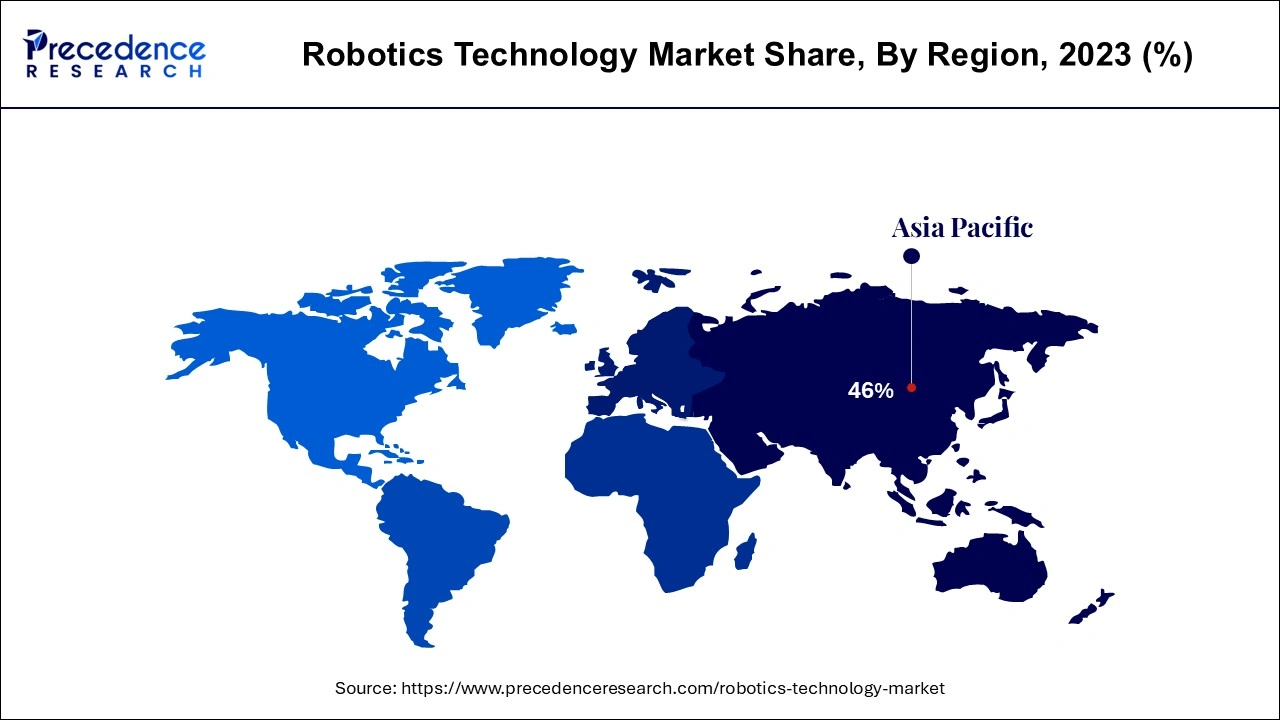

- Asia Pacific region has reached the highest revenue share of 46% in 2025.

Robotics Technology Market Growth Factors

One of the key factors driving the growth of global robotics technology market is the growing number of investments and fundings in the field of technology. As per the International Federation of Robotics' World Robotics report, demand for robots has been fueled by investments in new vehicle production capabilities and modernization of industrial areas. In addition, the surge in demand for industrial robots is driving the growth of the global robotic technology market. BMW AG, for example, signed an agreement with KUKA in 2020 to deliver roughly 5,000 robots for new manufacturing lines and factories around the world. These industrial robots will be deployed globally at BMW Group's foreign manufacturing locations to manufacture current and future vehicle models, according to KUKA.

Another significant factor boosting the growth of the global robotic technology market is the growing utilization of service robots all around the world. There are 2,384,600 building janitors and cleaners, according to the Bureau of Labor Statistics. Annually, businesses spend around USD 60 billion. This does not include the rising cost of insurance, as the cleaning business has one of the highest rates of workplace injuries. As a result, this factor is driving demand for cleaning robots, which is supporting the growth of the global robotic technology market over the forecast period.

The market for robotic technology is very fragmented. The robotic technology industry offers attractive potential because of Industry 4.0 and regional digitalization initiatives. Given the number of robotic trade exhibitions that occur across different areas on a regular basis, the level of transparency is considerable. Overall, there is fierce competition among existing players. The huge organizations are expected to make collaboration and business expansions with new entrants that are focused on modernization.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 108.43 Billion |

| Market Size by 2035 | USD 416.26 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 14.40% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Robot Type, Application, and Geography |

Product Insights

The traditional industrial robots segment dominated the robotics technology market in 2025. The introduction of various types of production control techniques, as well as the implementation of automation solutions, are significant components of current production improvement plans. Furthermore, as industrial robots become more popular, they are being used in a variety of industries, including manufacturing and healthcare. Industrial robotics is a rapidly growing sector with applications in a wide range of industries.

The cobots segment is the fastest-growing segment of the robotics technology market in 2022. Collaborative robots, or cobots, are designed to assist humans in doing certain activities that are both sophisticated and precise. Humans and robots collaborate closely. The robots are capable of detecting odd activity in their environment and collaborating with humans without being physically separated. Cobots are more appealing to employ in factories and industries because of their smarter, smaller, more flexible, and user-friendly qualities. The need for Cobots is being driven by increased rivalry in numerous industries, as well as a greater focus on automation.

Application Insights

The healthcare segment dominated the robotics technology market in 2025. The robots in the healthcare sector assist with minimally invasive treatments, personalized and frequent monitoring for patients with chronic conditions, intelligent therapies, and social interaction for the elderly.

The logistics segment is the fastest growing segment of the robotics technology market in 2022. The robots in the logistics sector manage the storage and movement of items as they move through the supply chain. They're frequently used to arrange and transfer things in warehouses and storage facilities, a procedure known as intralogistics, but they can also be employed in other locations. Logistics robots have considerably higher uptime than manual labor, resulting in significant productivity and economic increases for businesses who use them.

Regional Insights

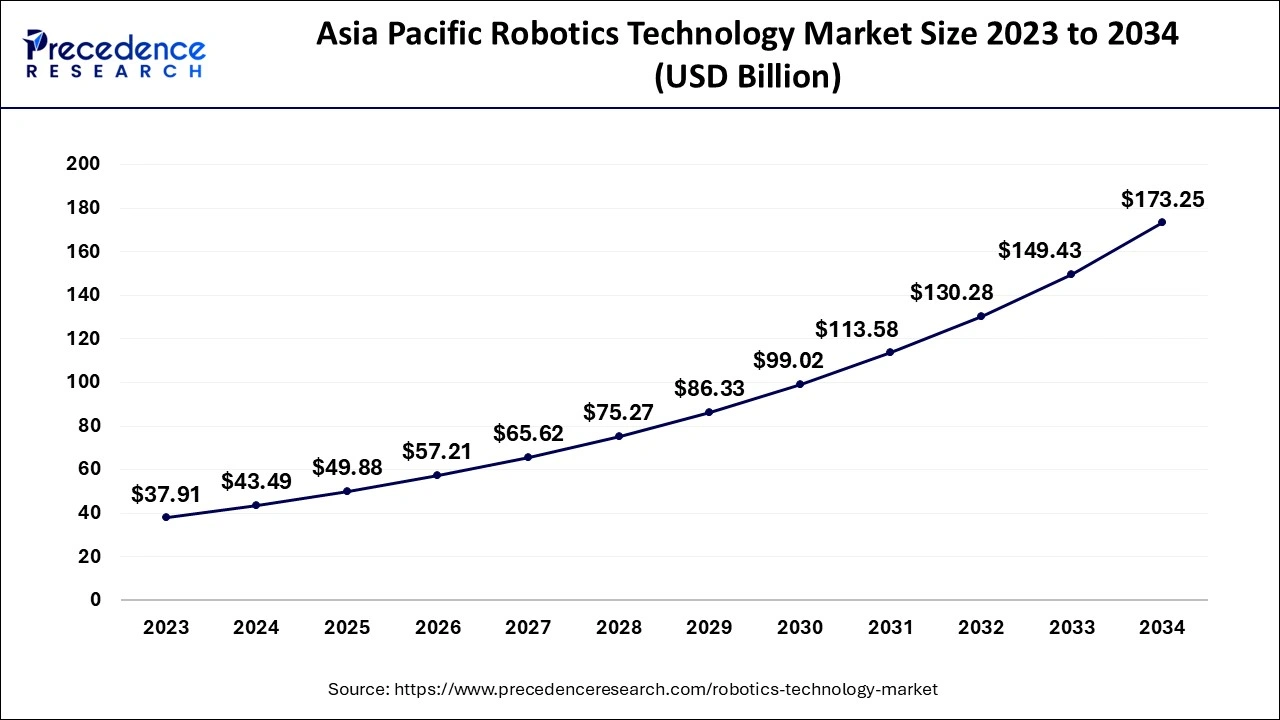

Asia Pacific Robotics Technology Market Size and Growth 2026 to 2035

The Asia Pacific robotics technology market size is evaluated at USD 49.88 billion in 2025 and is predicted to be worth around USD 197.07 billion by 2035, rising at a CAGR of 14.73% from 2026 to 2035.

Asia Pacific dominated the robotics technology market in 2025. China, South Korea, and India dominated the robotics technology market in Asia-Pacific region. The growth of robotics technology market in Asia-Pacific region is being driven by growing constant efforts by government towards the technological developments. Furthermore, the Housing Development Board at Singapore, plans to use autonomous drones or robots to identify which areas of public housing blocks need to be cleaned. The main goal is to save water by cleaning only the dirty areas. In addition, market players are adopting various strategies, which is boosting the growth of Asia-Pacific robotics technology market. The Adibot robotic disinfection system combines Ubtech's robotics andartificial intelligencewith UV-C technology to disinfect specific surfaces and air by destroying the DNA and RNA of hazardous microorganisms.

What Makes Europe the Fastest-Growing Region?

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the robotics technology market in Europe region. Educational robots, industrial robots, interactive entertainment robots, and service robots have all seen increased demand in recent years in Europe. Denmark, Germany, Sweden, and Italy are the top European countries where industrial robots are widely used. The European regional market is growing as a result of the rising usage of robots in both the industrial and domestic sectors. The region's regional market is being driven by advanced expansion and the development of cutting-edge robotics technology.

India Robotics Technology Market Analysis

The market in India is being driven by increasing automation across manufacturing, healthcare, logistics, and agriculture, as companies adopt robots to enhance efficiency, reduce labor costs, and improve precision. Additionally, advancements in AI, IoT, and machine learning, along with government initiatives promoting Industry 4.0 and smart manufacturing, are accelerating the deployment of intelligent, connected robotic systems across sectors.

In October 2025, the International Telecommunication Union (ITU) and the Department of Telecommunications (DoT) hosted the ‘Robotics for Good Youth Challenge India 2025' at India Mobile Congress (IMC) 2025. According to the Indian Economy Report published in December 2025, nine new technology centers were added under the Technology Centre Systems Programme (TCSP). Such initiatives also drive the market.

France Robotics Technology Market Analysis

The market in France is primarily driven by a surge in industrial automation. Manufacturers across sectors like automotive, electronics, and food processing are adopting robots to boost efficiency, precision, and competitiveness. The rise of collaborative robots (cobots), applications in healthcare, logistics, and agriculture, and the integration of AI, IoT, and cloud technologies for smarter, connected automation are helping diversify and expand the market beyond traditional industrial use.

Why is North America Considered a Significant Region in the Robotics Technology Market?

North America is expected to grow significantly in the market in the upcoming period. Regional market growth is attributed to the North American government's robotics R&D initiatives and funding. The national robotics initiative under the National Science Foundation (NSF) also drives market growth. Moreover, the region is at the forefront of technological innovation, thereby contributing to market growth.

What are the Major Factors Contributing to the Robotics Technology Market Within Latin America?

The market in Latin America is driven by the strong growth of e-commerce and logistics, which increases demand for warehouse automation to handle inventory, order fulfilment, and materials management more efficiently. The expansion of industrial sectors, especially automotive, electronics, mining, and manufacturing, that require precision, safety, and high throughput, is driving the adoption of industrial robots and automation systems.

- In July 2025, THALAMUS, an autonomous security robot, made its grand entry into Latin America at one of Argentina's revolutionary events.

What Opportunities Exist in the Middle East & Africa for the Robotics Technology Market?

The Middle East & Africa (MEA) presents immense opportunities for the market, driven by the e-commerce boom and the development of smart cities and infrastructure. The government launched several programs that focused on industrial automation. Moreover, the growing use of robotics in non-manufacturing sectors supports market growth.

Robotics Technology Market Top Companies

- Universal Robots A/S

- Boston Dynamics

- Northrop Grumman Corporation

- Omron Corporation

- Fanuc Corporation

- KUKA AG

- Yaskawa Electric Corporation

- DENSO, orporation

- iRobot Corporation

- Nachi-Fujikoshi Corp.

- Kawasaki Heavy Industries, Ltd.

- Honda Motor Co. Ltd.

- ABB Group

- Sony Corporation

- Mitsubishi Electric Corporation

Key Market Developments

- In March 2025, Google launched two new AI models for the rapidly growing robotics industry.

( Source: https://www.reuters.com ) - In December 2025, NASA and industry partners planned to fly and operate a commercial robotic arm in low Earth orbit to revolutionize in-space operations through the Fly Foundational Robots mission set to launch in late 2027.

( Source:https://www.nasa.gov )

Segments Covered in the Report

By Component

- Hardware

- Software

- Service

By Robot Type

- Traditional industrial robots

- Cobots

- Professional service robots

- Others

By Application

- Manufacturing

- Healthcare

- Aerospace & Defense

- Media & Entertainment

- Logistics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting