Robotics System Integration Market Size and Forecast 2025 to 2034

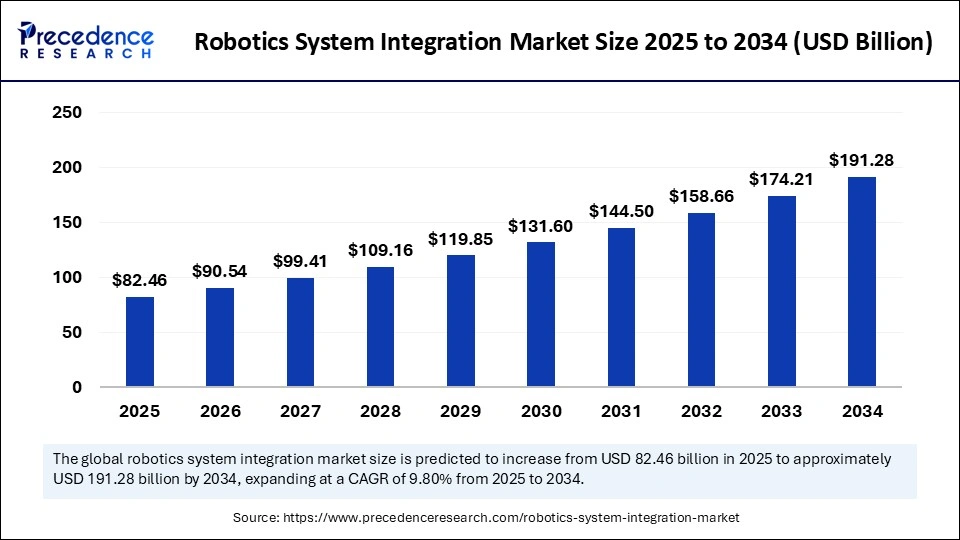

The global robotics system integration market size was estimated at USD 75.1 billion in 2024 and is predicted to increase from USD 82.46 billion in 2025 to approximately USD 191.28 billion by 2034, expanding at a CAGR of 9.80% from 2025 to 2034. The market growth is attributed to the increasing demand for automation across various industries, driven by the need for higher efficiency, precision, and cost-effectiveness.

Robotics System Integration Market Key Takeaways

- In terms of revenue, the robotics system integration market is valued at $82.46 billion in 2025.

- It is projected to reach $191.28 billion by 2034.

- The market is expected to grow at a CAGR of 9.80% from 2025 to 2034.

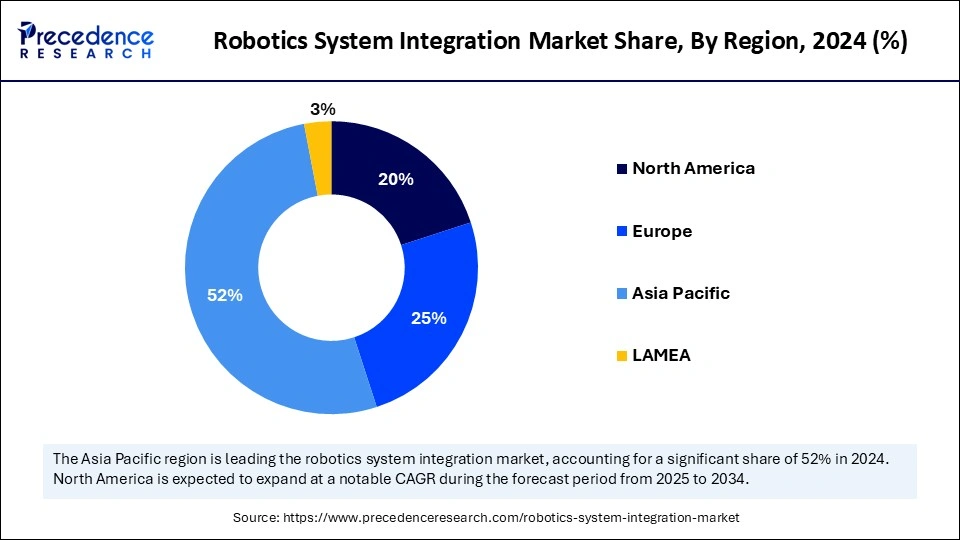

- Asia Pacific dominated the market with the largest market share of 52% in 2024.

- North America is expected to grow at a CAGR of 8.8% in the market during the forecast period.

- By type, the industrial robots segment held the major market share of 47% in 2024.

- By type, the service robots segment is expected to grow at a significant rate between 2025 and 2034.

- By application, the logistics & warehouse automation segment held the largest share of the market in 2024.

- By application, the material handling & packaging segment is projected to expand at the highest CAGR during the projection period.

- By end use, the automotive segment led the global market in 2024.

- By end use, the electronics & semiconductor segment is expected to expand rapidly in the coming years.

Impact of Artificial Intelligence on the Robotics System Integration Market

Robotics system integration achieves maximum accuracy through artificial intelligence (AI). The integration of AI technologies optimizes robot coordination and enhances motion planning operations. This leads to greater precision and reduced downtime in manufacturing operations. Furthermore, automotive manufacturers and logistics organizations deploy AI-powered robotics, as they enhance manufacturing efficiencies and inventory supervision. AI enables the seamless integration of robots into manufacturing and other industrial operations.

Asia Pacific Robotics System Integration Market Size and Growth 2025 to 2034

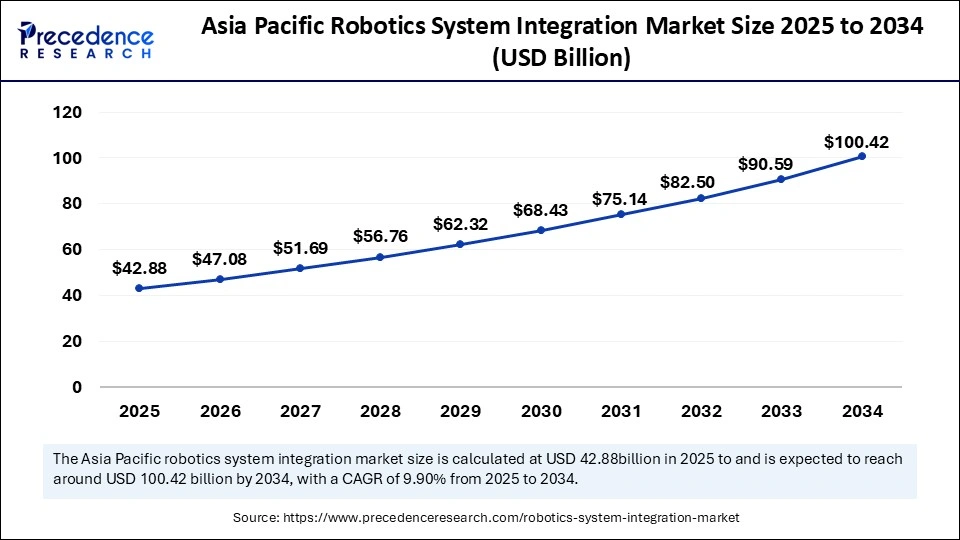

The Asia Pacific robotics system integration market size was evaluated at USD 39.05 billion in 2024 and is projected to be worth around USD 100.42 billion by 2034, growing at a CAGR of 9.90% from 2025 to 2034.

Asia Pacific held the largest share in robotics system integration market in 2024. The dominance of the market in the region is attributed to the rapid industrialization, especially in emerging countries like India, China, Japan, and South Korea. The Industry 4.0 revolution is encouraging the adoption of advanced technologies, including robotics systems. The rising focus on industrial automation is likely to support regional market growth.

China is a major contributor to the robotics system integration market in Asia Pacific. The rising manufacturing activities in China are prompting the need for robots. There is a high demand for industrial robots from the automotive and electronic manufacturing industries. Japan also directed its focus on healthcare robotics through government-directed projects which aim to deploy robotic solutions for elder care and rehabilitation.

On the other hand, North America is seen to grow at the fastest rate whereas the region held a considerable share in 2024. This is mainly due to the rising use of robotics in various industries. The region has a robust industrial base, with automotive, electronic, logistics, and healthcare businesses focusing on enhancing their operations. Several manufacturing companies in the U.S. and Canada have implemented robots in their production processes to achieve operational efficiency at reduced labor expenses. The shortage of labor increased the adoption of industrial robots in the region.

Europe is considered to be a significantly growing area. The growth of the market in Europe is mainly driven by the rising need for robotics across the automotive, aerospace, and logistics sectors to reduce human intervention. The German manufacturing sector extensively incorporates robotics. The European Union (EU) recognized that investments in energy-efficient robotics are necessary to support sustainability efforts. The shortage of labor is prompting the need for robots in various industries, supporting the growth of the market in the region.

Market Overview

The growth of the robotics system integration market continues to increase, as industries actively embrace automation throughout their operations. The demand for robotic systems is increasing in the manufacturing sector due to the rising need for better operational efficiency. Robotic systems also lower production expenses while delivering superior product quality, especially within the automotive, healthcare, and electronics sectors. Manufacturing industries increasingly use collaborative robots (cobots) and industrial robots to execute tasks, including assembly operations and material handling. The International Labour Organization (ILO) stated that robotics-driven automation raises productivity levels and solves staffing shortages in various sectors.

Robotics System Integration Market Growth Factors

- Growing Demand for Automation in Manufacturing: The increasing need for high-efficiency manufacturing processes across industries is expected to drive the robotics system integration market.

- Expansion of E-commerce: The growing e-commerce sector, requiring faster and more efficient logistics and warehouse solutions, is anticipated to increase the demand for robotics in warehousing operations.

- Advancements in Artificial Intelligence (AI): The integration of AI in robotics is projected to enhance operational efficiency, enabling robots to perform more complex tasks in manufacturing and healthcare.

- Labor Shortages: Ongoing labor shortages in key sectors, especially healthcare and manufacturing, are likely to drive the need for automated systems to maintain productivity levels.

- Rise in Industrial IoT Adoption: The growing use of the Industrial Internet of Things (IIoT) in smart factories is expected to drive the demand for robotics that can seamlessly connect and communicate with other systems.

- Increasing Demand for Precision in Healthcare: The healthcare sector's focus on precision medicine and minimally invasive surgeries is anticipated to propel the adoption of robotic systems in surgery and rehabilitation.

- Technological Advancements in Autonomous Systems: Ongoing improvements in autonomous robotics are likely to create new opportunities in industries such as logistics, manufacturing, and agriculture.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 191.28 Billion |

| Market Size in 2025 | USD 82.46 Billion |

| Market Size in 2024 | USD 75.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.80% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Year | 2025 to 2034 |

| Segments Covered | Type, Application, End Use and Region |

| Region Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Emphasis on Industrial Automation

There is a strong emphasis on industrial automation, which is expected to drive the growth of the robotics system integration market. As industrial automation requirements rise, so does the need for robotics systems. Integrating robots into manufacturing operations significantly enhances operational efficiency and production output. The automotive, electronics, and metal fabrication sectors now use integrated robotic systems in order to fulfill their needs for high precision and speed. The International Federation of Robotics states that about 276,288 industries implemented robots in 2023 to enhance operational efficiency. Advanced robotics integration demonstrates important advantages for manufacturing processes. These robots significantly improve manufacturing processes and quality by lowering human mistakes. Furthermore, the importance of robotics is increasing in regulatory compliance, specifically for pharmaceutical manufacturing, boosting the market's growth.

Restraint

High Initial Costs

The significant upfront costs required for robotics system integration are expected to hamper the growth of the robotics system integration market. Integrating advanced robots into existing systems requires significant investments in complex machinery and IoT technology. The total expenses of implementation and continuous software upgrading requirements deter smaller companies from acquiring these solutions. Additionally, organizations struggle to overcome the initial expenses of advanced robotic systems, which prevents them from committing funds, especially in regions where money is scarce, thus hampering the market.

Opportunity

High Adoption of Robotics in Logistics and Warehousing

The high adoption of robotics in logistics and warehousing is expected to create immense opportunities for key players competing in the robotics system integration market. The demand for integration services is increasing due to rising robotic adoption in logistics and warehousing operations. The growing e-commerce industry, alongside the need for efficient supply chains, has encouraged logistics companies to adopt robotic systems. Modern businesses need sophisticated robotic solutions that enhance storage capacity and inventory control functions while speeding up order fulfillment processes. The International Federation of Robotics' 2024 report indicates that professional robotic systems sales increased by 30% globally.

Type Insights

The industrial robots segment dominated the robotics system integration market with the largest share in 2024. This is mainly due to the increased adoption of industrial robots to support automation. These robots automate various tasks like inspection, sorting, and handling. Industrial robots, such as robotic arms, have increasingly gained traction in the automotive, electronics, and metal fabrication industries. The use of robotic arms enables industries to enhance their capacity to perform repetitive tasks. They enhance precision in tasks like welding, assembly, and packaging, reducing the need for human intervention. These robots enhance manufacturing output while minimizing human errors.

The service robots segment is expected to grow at a significant rate in the coming years. The segment growth can be attributed to the rising demand for these robots in the healthcare sector. Healthcare organizations increasingly use service robots for drug distribution and sanitation. These robots reduce the burden on hospital staff and make health services more efficient. Furthermore, the surge in service robot usage throughout logistics contributes to segmental growth.

Application Insights

The logistics & warehouse automation segment held the largest share of the robotics system integration market in 2024. This is mainly due to the increased logistics operations worldwide. E-commerce activities increased significantly, boosting the need for optimized supply chains. Robotics systems optimize the order fulfillment process and supply chains. The increased need for inventory management solutions further bolstered the segment's growth.

The material handling & packaging segment is projected to expand at the highest CAGR during the projection period. This is mainly due to the rising need to improve material handling operations. The adoption of robotic arms and automated systems to enhance picking and sorting operations is rising. Automating these operations results in greater efficiency and lower risk of mistakes. Furthermore, the manufacturing, food processing, and consumer electronics industries demand efficient solutions for automating repetitive tasks, which is expected to drive the growth of the segment.

End Use Insights

The automotive segment dominated the robotics system integration market in 2024. This is mainly due to the rapid transition of automotive manufacturers toward automated processes for boosting efficiency and precision. Robotics improves automotive manufacturing processes while simultaneously delivering exceptional product quality. Robots are widely applied in operations like assembly, painting, welding, and material handling. Statistics from the U.S. Department of Commerce (USDOC) show that the automotive sector made up a significant portion of robotics system integration in 2024. Robots execute operations with enhanced accuracy.

The electronics & semiconductor segment is expected to expand rapidly in the coming years, as robots perform essential tasks including component assembly, inspection, and packaging. Semiconductor production depends on robots as they are essential in delicate operations, including wafer handling and packaging. Additionally, robots play a key role in scaling up the production of electronic devices by handling and automating several tasks.

Robotics System Integration Market Companies

- Burke Porter Group

- CNC Robotics Ltd.

- Concept Systems Inc.

- Hitachi Ltd.

- IPG Photonics Corporation

- JH Robotics, Inc.

- Midwest Engineered Systems Inc.

- Mitsui & Co., Ltd.

- Motion Controls Robotics Inc.

- Phoenix Control Systems Ltd.

- Scott Technology Ltd.

- United Robotics Inc.

Recent Developments

- In June 2024, ABB Robotics launched OmniCore, a cutting-edge automation platform that is faster, more precise, and sustainable, designed to empower, enhance, and future-proof businesses. The OmniCore platform, the result of more than $170 million invested in next-gen robotics, represents a significant leap toward modular and future-proof control architecture. This platform integrates AI, sensors, cloud, and edge computing systems to create advanced and autonomous robotic applications. “Automation is becoming a strategic necessity for our customers, who seek greater flexibility, simplicity, and efficiency to respond to global trends like labor shortages, uncertainty, and the need for more sustainable operations,” stated Sami Atiya, President of ABB's Robotics & Discrete Automation Business Area.

- In May 2024, Flexxbotics, known for delivering workcell digitalization for robot-driven manufacturing, announced the latest version of the Flexxbotics solution. This new release brings powerful multi-factory capabilities for large-scale deployments, along with enhanced functionalities for in-line inspection, IT system integration, analytics, and mobile tablet and smartphone support. This new version enables global companies to implement advanced robotic machine tending, facilitating autonomous process control at scale across multiple locations to boost capacity, production yields, and EBITDA profitability.

- In May 2024, RobotShop Inc., the world's leading provider of robotics technology, announced the launch of its comprehensive Robotics Integration Services, set to revolutionize the landscape of industrial automation by offering cutting-edge robotics solutions, servicing, integration, and support.

- In February 2025, Delta, a global leader in power management and provider of IoT-based smart green solutions, announced its participation in ELECRAMA 2025 with a strong focus on Smart Manufacturing. At the event, the company unveiled its latest D-Bot series of Collaborative Robots for the Indian Market. These advanced 6-axis cobots offer payload capacities of up to 30 kg and can reach speeds of 200 degrees per second. Engineered to boost industrial productivity, the new D-Bot series is tailored for applications such as electronics assembly, packaging, material handling, and welding.

Segments Covered in the Report

By Type

- Autonomous Robots

- Collaborative Robots

- Industrial Robots

- Service Robots

By Application

- Inspection & Quality Control

- Logistics & Warehouse Automation

- Material Handling & Packaging

- Painting & Dispensing

- Welding & Assembly

- Others

By End Use

- Aerospace & Defense

- Agriculture

- Automotive

- E-commerce & Retail

- Electronics & Semiconductor

- Energy & Utilities

- Food & Beverage

- Pharmaceuticals & Healthcare

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting