What is Space Robotics Market Size?

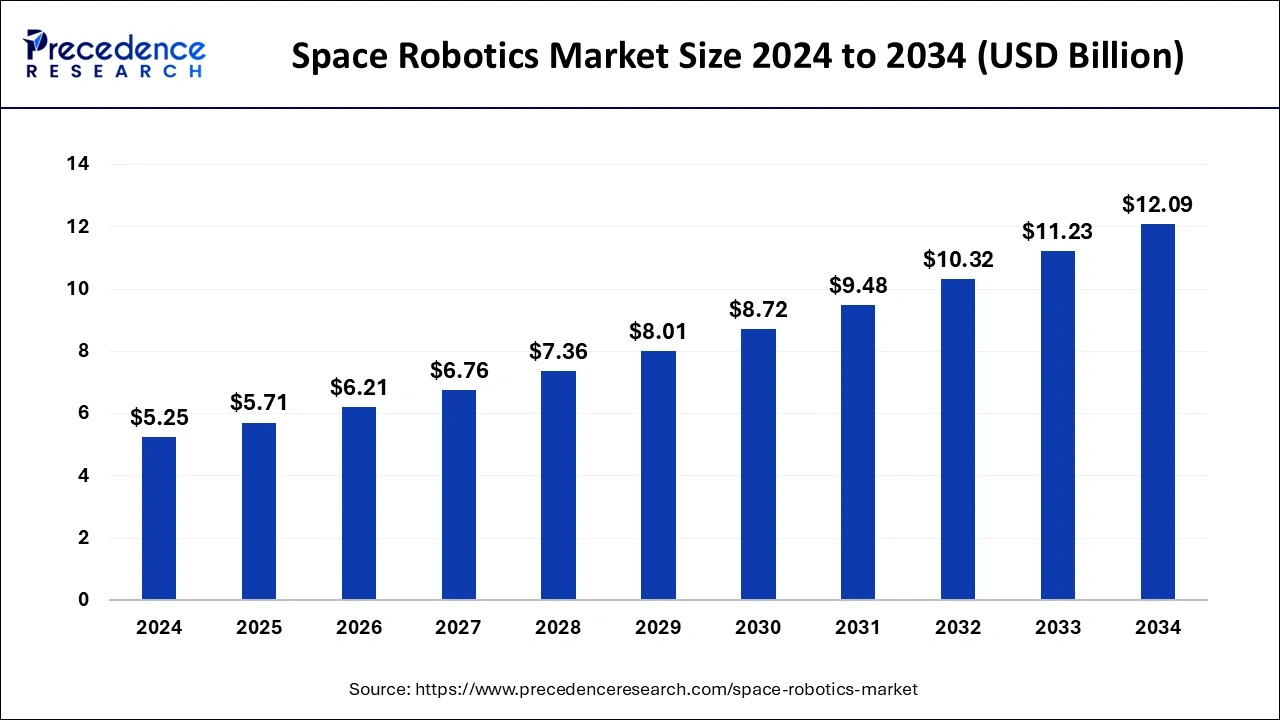

The global space robotics market size is estimated at USD 5.71 billion in 2025 and is predicted to increase from USD 6.21 billion in 2026 to approximately USD 12.09 billion by 2034, expanding at a CAGR of 8.70% from 2025 to 2034.

Market Highlights

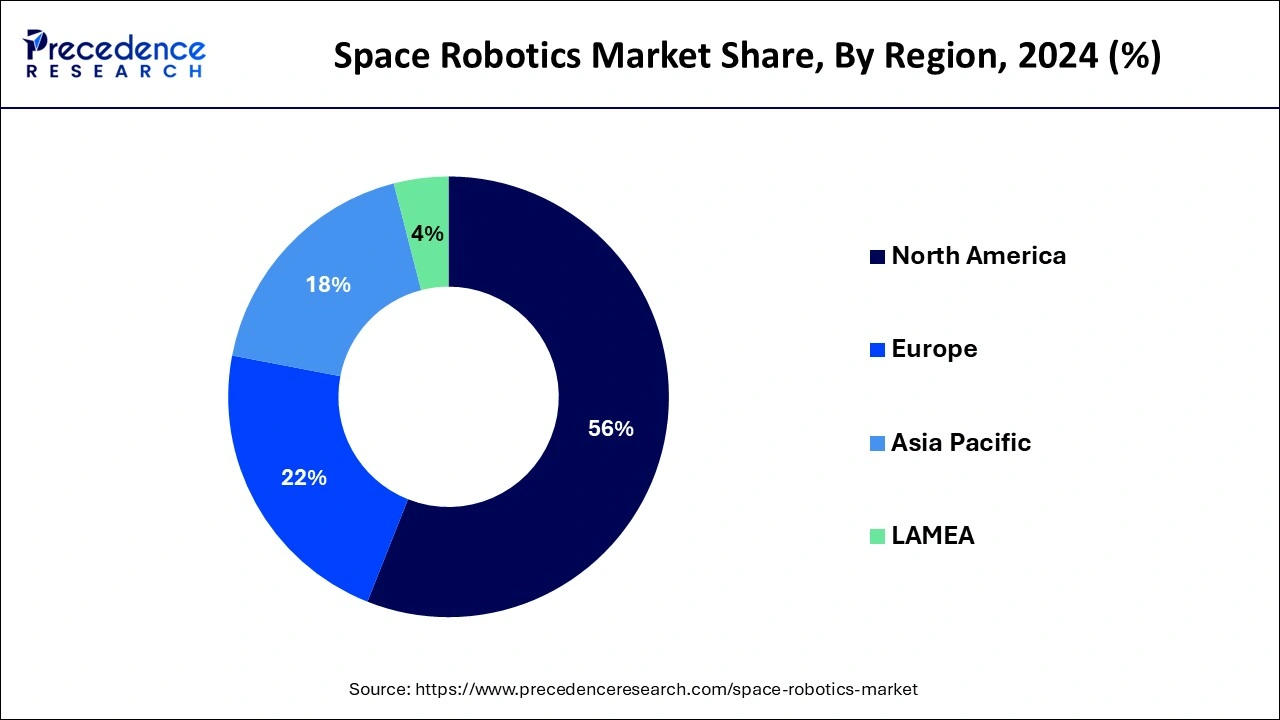

- North America dominated the market with the largest market share of 56% in 2024.

- By solution, the remotely operated vehicles segment has held the largest market share of 38% in 2024.

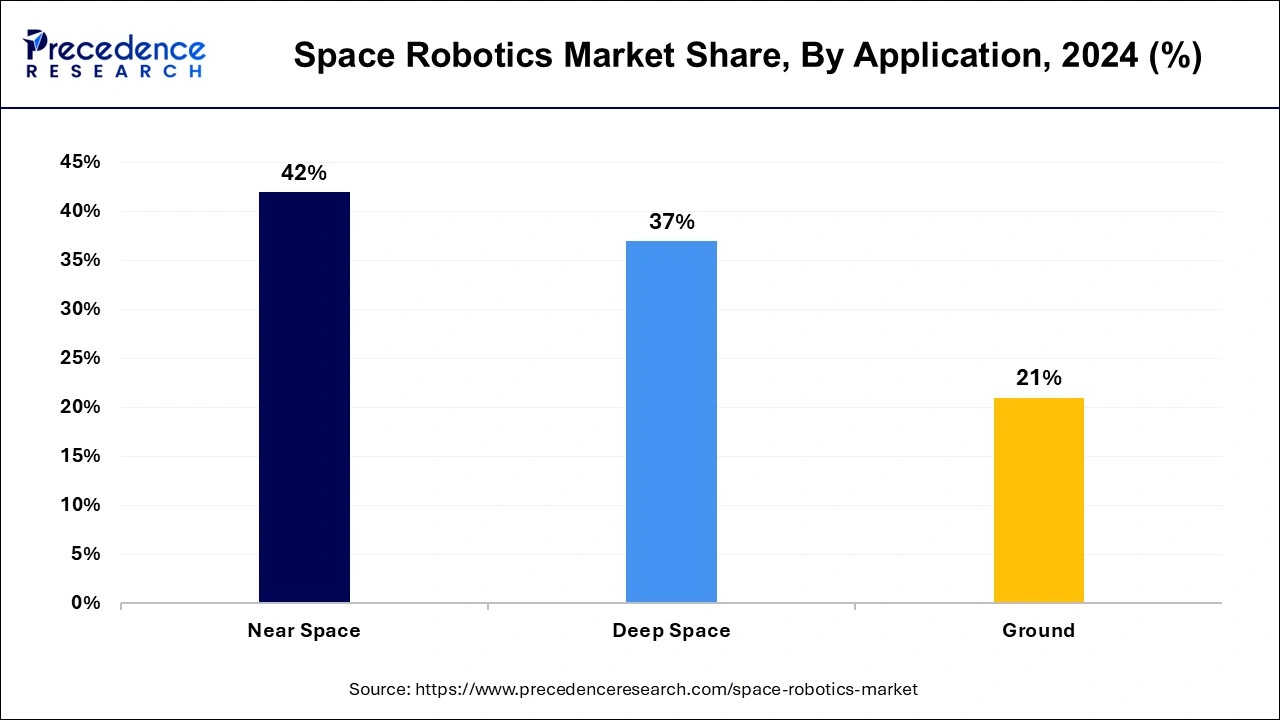

- By application, the near space segment has contributed the largest market share of 42% in 2024.

- By organization, the government segment has generated more than 71% of market share in 2024.

Space Robotics Market Overview: Transforming Space Economics

Space robotics is indispensable for the current and future advancement of mission-defined machinery tailored to survive and excel in space environments. They excel in exploration, assembly, construction, maintenance, and servicing tasks. This burgeoning field draws from diverse disciplines, including space engineering, terrestrial robotics, computer science, materials, and IT, representing a multi-disciplinary approach to innovation. Autonomous systems, in particular, play a pivotal role in reducing cognitive load on humans amidst the vast amounts of information requiring timely processing, thus enhancing both human and systems' safety. The development of robotic system technologies, encompassing both hardware and software, is pivotal in enabling and enhancing future space exploration missions.

As human presence in space expands, reliance on intelligent and versatile robots for mundane tasks will increase, allowing human and ground control teams to focus on more complex activities requiring human cognition and judgment. There is a pressing need for technological advancements in robotic systems to facilitate the efficient transport of crew, instruments, and payloads across planetary surfaces, small celestial bodies, and in-space environments.

- In May 2023, Space Robotics Startup GITAI secured US$30 million in funding.

- In December 2023, GreyOrange and Hai Robotics forged a dynamic partnership advancing automated robotic fulfillment.

Space Robotics MarketGrowth Factors

- Space robotics provide expanded access beyond the limitations of human spaceflight, allowing for exploration and operations in the harsh space environment. They also extend astronauts' capabilities by handling operations that would otherwise be challenging or risky for humans. This increased capability drives growth in the space robotics market.

- By enabling the deployment and operation of multiple assets without a proportional increase in ground support, space robotics significantly reduce the cost and risk associated with spaceflight, whether manned or robotic. This reduction in cost and risk makes space robotics relevant across all mission phases, from development to operation, thereby fostering space robotics market growth.

- Space robotics cover a wide range of applications, including exploration of planetary surfaces, orbital operations around Earth, and navigation/control sensors. This versatility in applications expands the potential of the space robotics market, contributing to its growth.

- The integration of artificial intelligence (AI) with heterogeneous and cooperative robotic systems enhances their effectiveness in utilizing space resources and increases autonomy in designing and controlling new space missions. This integration drives innovation and adoption of space robotics, fueling market growth.

- Space robotics showcase advancements in enabling technologies that facilitate high levels of autonomy and cooperation in space missions. These technologies enable new mission concepts and enhance the capabilities of space robotics systems, thus driving market growth.

- Utilization of multiple robots and autonomous systems in space missions allows for optimal use of space resources and increases autonomy in mission design and control. This efficiency in resource utilization and enhanced autonomy propels the growth of the space robotics market.

Space Robotics Market Outlook: Forecasting the New Space Race

- Industry Growth Overview: Increasing government and commercial investments in space exploration and satellite servicing are driving the industry growth in the market.

- Sustainability Trends: The use of active space debris removal and on-orbit servicing to prolong satellite lifespan and prevent the development of new hazardous junk is involved in the sustainability trends. The industries are also improving circular economy principles and developing biodegradable materials to reduce the environmental footprint.

- Major Investors: Corporate venture capital arms, specialized venture capital firms, private equity firms, and institutional asset managers are the major investors in the market. Lockheed Martin Ventures, Airbus Ventures, AE Industrial Partners, BlackRock, and other investors are some of the major investors.

- Startup Ecosystem: The development of novel technologies for on-orbit servicing and manufacturing, and enhancing autonomous navigation systems for deep space missions, is the focus of startup ecosystems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.71 Billion |

| Market Size in 2026 | USD 6.21 Billion |

| Market Size by 2034 | USD 12.09 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.70% |

| Dominating Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Solution, By Application, and By Organization, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Achievable technical goals

Advancements in space robotics are strategically aligned with crucial technical objectives aimed at extending humanity's reach and capabilities in space. These objectives include enabling efficient manipulation of assets and resources, enhancing access to space, supporting human crews in their operations, and maintaining preparing environments for human presence, and enhancing the efficiency of mission operations. Key areas of technological development driving these goals encompass improvements in robotic sensing and perception, mobility and manipulation capabilities, rendezvous and docking procedures, onboard and ground-based autonomous functionalities, and integration with human operators. These advancements not only address critical needs in space exploration and operations but also foster growth within the space robotics market by enabling safer, more efficient, and more effective space missions.

- In August 2023, an alliance was strengthened with robots for deeper space exploration.

Restraints

Harsh space environment

The increasing reliance on robots for maintenance and repair tasks in space is driven by their adaptability to the challenging space environment, offering a solution to mitigate health risks for human astronauts and address spacecraft repair challenges.

However, the harsh conditions prevalent in outer space, characterized by radiation exposure, vacuum conditions, temperature fluctuations, and unpredictable terrain, present significant obstacles to the development and operation of robotic systems. These constraints limit the growth potential of the space robotics market, as advancements in technology are required to overcome these environmental challenges and expand the capabilities of robotic systems for effective space exploration and maintenance tasks.

Opportunities

AI integration

Space robotics, augmented with artificial intelligence (AI), represents a pivotal technology for both planetary exploration and orbital services. Future space programs necessitate the utilization of AI-powered robotics to undertake tasks such as satellite construction, repair, and maintenance in orbit. The integration of AI into space robotics enhances their capacity to perform complex tasks, including experiments, structure construction, and planetary surface exploration.

These AI-powered robots offer unparalleled accuracy, versatility, and autonomy, making them indispensable assets for space missions. The incorporation of AI technology in space robotics not only enhances the capability to study and operate in space but also creates significant opportunities for growth in the space robotics market. This integration unlocks new possibilities for innovation, efficiency, and exploration within the space industry, driving the demand for advanced space robotics solutions.

- In January 2023, Berkshire Grey and Locus Robotics announced a partnership offering industry-first, cross-platform robotic automation.

Segment Insights

Solution Insights

The remotely operated vehicles (ROVs) is emerging as the dominant segment within the space robotics market, offering unparalleled benefits for exploration and safety in remote locations. These advanced vehicles have become the tool of choice for scientists, enabling exploration of the deepest parts of the sea and the farthest reaches of the solar system with minimal weight penalties and maximum flexibility. Their specialized designs eliminate the need to sustain human life in hazardous environments, mitigating risks and ensuring safety.

One standout example is the world-renowned all-terrain ROV, equipped with high payload capacity and multiple attachment options, facilitating various mission support activities. Its ability to operate hundreds of meters away enables reconnaissance and active surveillance, benefiting military, security, and police forces by keeping operators out of harm's way. ROVs excel in replacing humans in confined space work, offering safe and effective equipment handling, thus protecting employees and reducing operational risks.

Although ROVs may entail high initial costs, the long-term benefits are substantial. The investment in ROV technology translates into safeguarding personnel and assets, ultimately contributing to cost savings and operational efficiency. Moreover, their application in commercial and manufacturing settings offers additional avenues for cost reduction and improved productivity. With ROVs leading the charge in remote exploration and safety, businesses across industries stand to gain significant advantages in efficiency, risk mitigation, and overall operational performance.

Application Insights

The near space emerged as the dominant segment propelling growth within the space robotics market, with Near Space Labs leading the charge by actively providing timely, scalable, 10 cm imagery utilizing the largest fleet of zero-emission, stratospheric robots worldwide. Leveraging the Near Space Network, which offers robust communication services within one million miles of Earth, the company seamlessly integrates government and commercial assets to support a wide range of missions. With a focus on near-space exploration, including low-Earth orbit (LEO), geosynchronous orbit (GEO), and other regions just beyond Earth's atmosphere, Near Space Labs facilitates vital communication with spacecraft and supports various missions in science, human spaceflight, and technology demonstration.

The innovative blend of imaging capabilities and communication services offered by near space robotics not only advances understanding of the planet and the solar system but also opens up new opportunities for scientific discovery and exploration. As businesses and organizations seek to expand their presence and activities in near space, the solutions provided by near space labs offer unparalleled reliability, scalability, and efficiency, driving significant advancements in space exploration and technology development.

Organization Insights

The government segment held the largest share in the space robotics market. The dominance of this segment is supported by the plethora of aids and schemes supporting the research and development activities in the field of robotics as well as aeronautics industries. Due to the future scope of these sectors and their subsidiaries, private as well as state organizations are heavily investing in projects related to the market.

Regional Insights

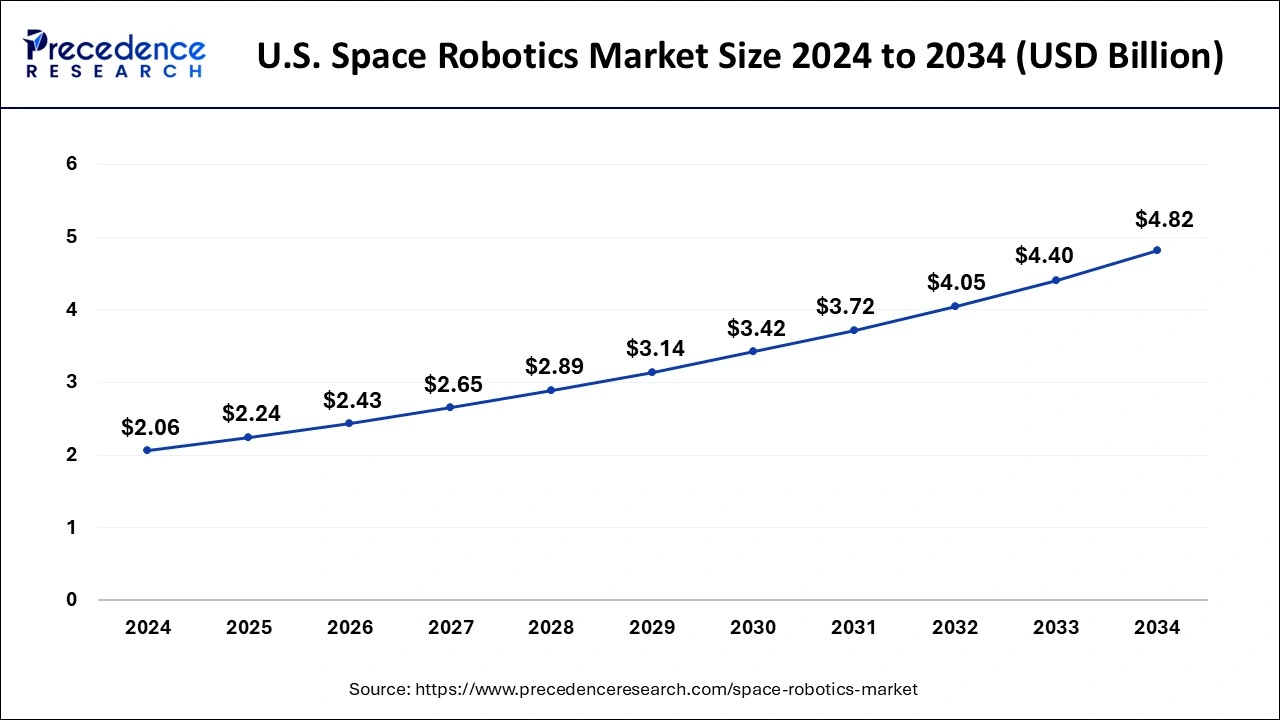

U.S.Space Robotics Market Size and Growth 2025 to 2034

The U.S. space robotics market size is estimated at USD 2.24 billion in 2025 and is predicted to hit around USD 4.82 billion by 2034 at a CAGR of 8.87% from 2025 to 2034.

Continuous Innovations Dominated North America

North America emerged as a dominant force propelling the growth of the space robotics market, driven by a rich history of innovation and technological advancement. The legacy of U.S. space exploration has inspired generations of students and innovators, laying the foundation for a thriving ecosystem of research and development. While NASA's role has evolved over time, the region continues to foster innovation through investments in education and scientific research.

The rise of robotics further underscores North America's leadership in technology adoption and industrial innovation. With over 232,000 robots deployed in U.S. factories, the region ranks second globally in robot use, showcasing a strong commitment to automation and efficiency. While the automotive industry remains a significant driver of robot adoption, diverse applications are emerging across sectors such as food services, construction, and agriculture.

North American key companies in the space robotics market witnessed a remarkable surge in robot purchases, with a 24% increase in orders compared to the previous year. Although fourth-quarter orders experienced a slight slowdown, the overall growth trajectory remains impressive, signaling a robust market demand for automation solutions. As industries across North America continue to embrace robotics and cutting-edge technologies, the region is poised to maintain its position as a global leader in innovation and economic competitiveness.

- In March 2022, Oceaneering launched new mobile robots specifically designed for the North American market at MODEX.

- In March 2024, U.S. Steel made a strategic investment in Freespace Robotics, a Pittsburgh-based pioneer in autonomous warehousing.Due to growing government support, the use of robotics in various space missions is increasing. Thus, in turn, it is driving the innovations and adoption of advanced technologies. The industries are also actively participating in the development of robotic solutions or software to withstand harsh space environments.

Increasing Space Programs Propel Asia Pacific

Asia Pacific is expected to grow significantly in the space robotics market during the forecast period, due to the growing number of space programs, which are increasing the interest in space robotics. They are further supported by the government investments. Additionally, the privet sectors are also developing new solutions and services, which are enhancing innovation, driving the market growth.

Strong Research Capabilities Boost China

The presence of robust research capabilities in China is increasing the development of space robotics. The growing nation space missions and expanding institutions are also increasing the development of space robotics systems. These advancements are supported by government policies.

Robust Institutions Drive Europe

Europe is expected to grow significantly in the space robotics market during the forecast period, due to the presence of robust institutions that are driving the development of the various solutions. Additionally, the growing interest in in-orbit assembly, cobots, and deep space robotics is also driving their development, where the private companies are also actively participating in these innovations, promoting the market growth.

German Space Robotics Ascends Rapidly

The German space robotics market is experiencing significant expansion, propelled by strong government investment in autonomy, AI, and lunar missions like the InSight lander. This growth is driven by rising demand for satellite servicing, deep space exploration, and advanced manufacturing technologies, positioning Germany as a key global innovator in robotic space systems.

Space Robotics Market Innovators: Key Players' Offering

- ALTIUS SPACE MACHINES. The company provides DogTag Grapple Fixture, MagTag modular Interface, EMBARC, etc.

- Honeybee Robotics: Advanced robotic systems are developed by the company.

- MAXAR TECHNOLOGIES: The company provides advanced robotic arms, geospatial intelligence, and satellite platforms.

- Metecs, LLC.: Specialized simulation software and engineering analysis for space robotics is provided by the company.

- Motiv Space Systems, Inc.: The company develops modular and space-rated robotic systems.

- Northrop Grumman: Space defence and exploration systems are provided by the company.

Space Robotics Market Companies

- ALTIUS SPACE MACHINES.

- ASTROBOTIC TECHNOLOGY

- BluHaptics, Inc.

- Honeybee Robotics

- Intuitive Machines, LLC.

- MAXAR TECHNOLOGIES

- Metecs, LLC.

- Motiv Space Systems, Inc.

- Northrop Grumman.

- Oceaneering International, Inc.

Recent Developments

- In February 2024, an Autonomous Robotic Arm System aimed to advance space station robotics.

- In January 2024, ABB expanded its leadership in next-generation AI-enabled mobile robotics through the acquisition of Sevensense.

- In June 2023, Intrinsic and Siemens collaborated to accelerate the integration of AI-based robotics and automation technology.

- In July 2022, NanoRacks and GITAI partnered for the second in-space demonstration of a robotic system on the ISS.

Segments Covered in the Report

By Solution

- Remotely Operated Vehicles (ROV)

- Rovers/Spacecraft Landers

- Space Probes

- Others

- Remote Manipulator System (RMS)

- Robotic Arms/Manipulator Systems

- Gripping & Docking Systems

- Others

- Software

- Services

By Application

- Deep Space

- Space Transportation

- Space Exploration

- Others

- Near Space

- Space Transportation

- Space Exploration

- In-space Maintenance

- Others

- Ground

By Organization

- Commercial

- Government

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content