Collaborative Robots Market Size and Forecast 2025 to 2034

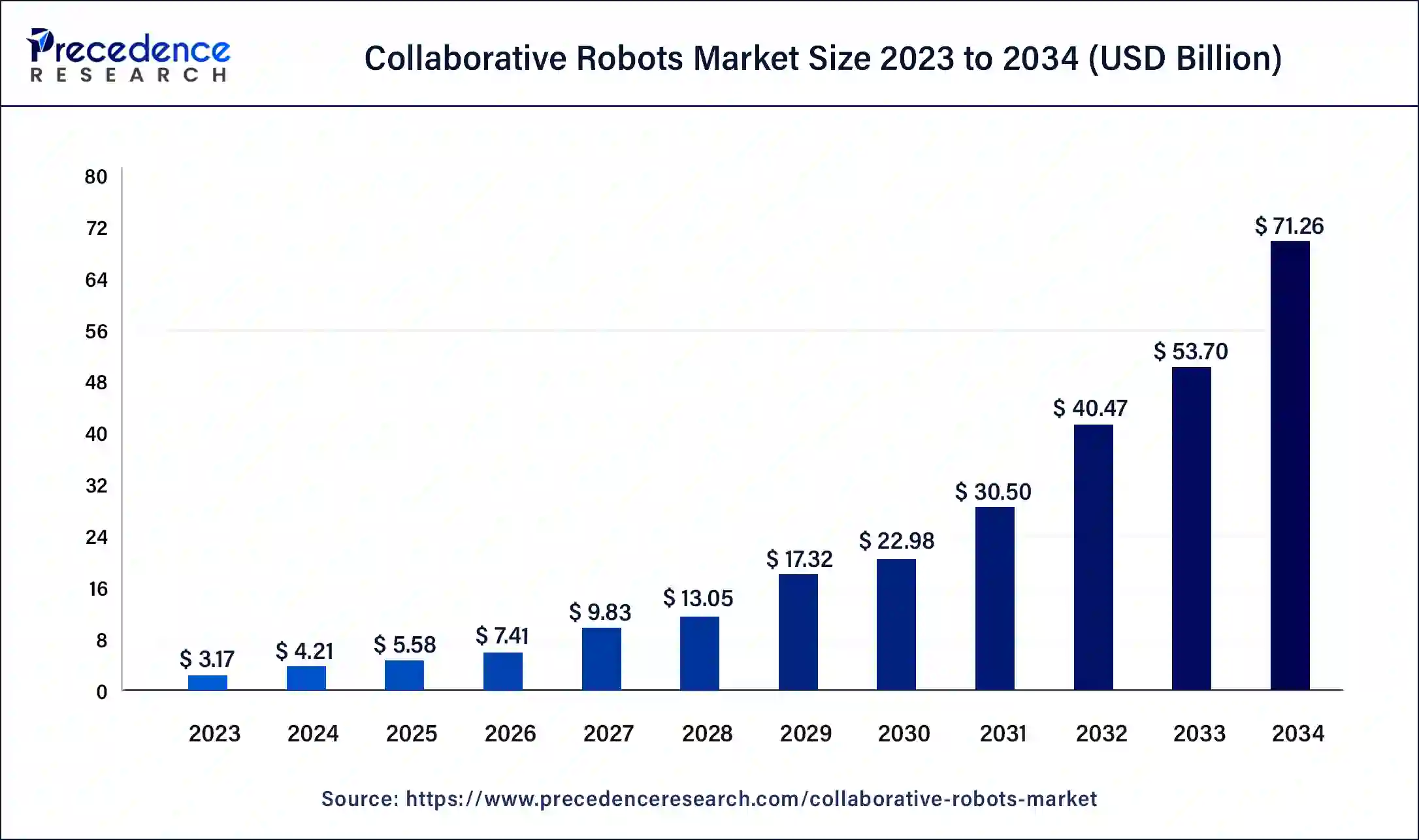

The global collaborative robots market size was estimated at USD 4.21 billion in 2024 and is predicted to increase from USD 5.58 billion in 2025 to approximately USD 71.26 billion by 2034, expanding at a CAGR of 32.70% from 2025 to 2034.

Collaborative Robots Market Key Takeaways

- In terms of revenue, the collaborative robots market is valued at $5.58 billion in 2025.

- It is projected to reach $71.26 billion by 2034.

- The collaborative robots market is expected to grow at a CAGR of 32.70% from 2025 to 2034.

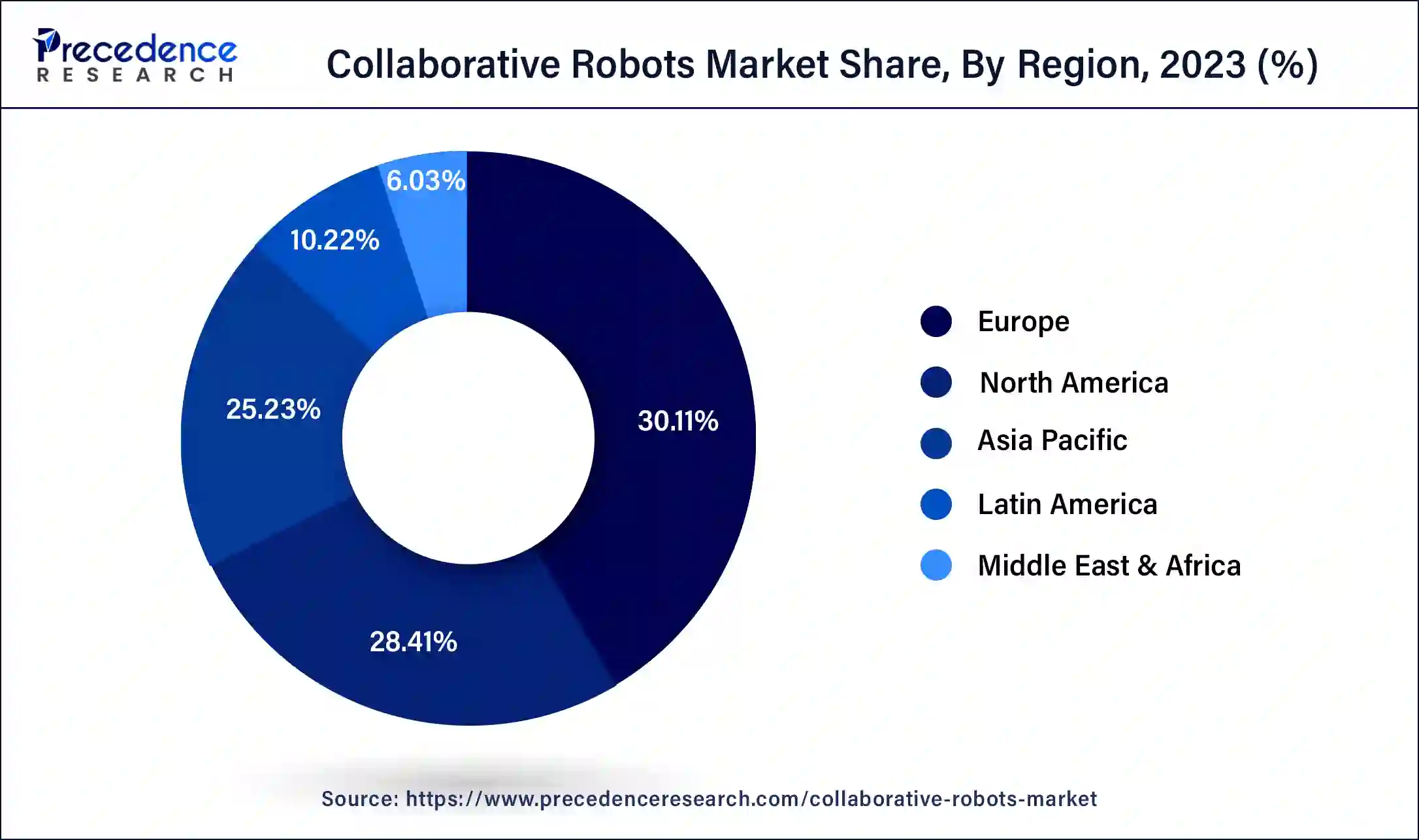

- Europe led the global market with the highest market share of 30.11% in 2024.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By payload capacity, the up to 5kg segment held the largest revenue share in 2024 and is expected to continue the same pattern over the forecast period.

- By application, the handling segment is expected to capture the largest market share during the forecast period.

- By industry vertical, the automotive segment is expected to dominate the market during the forecast period.

Europe Collaborative Robots Market Size and Growth 2025 to 2034

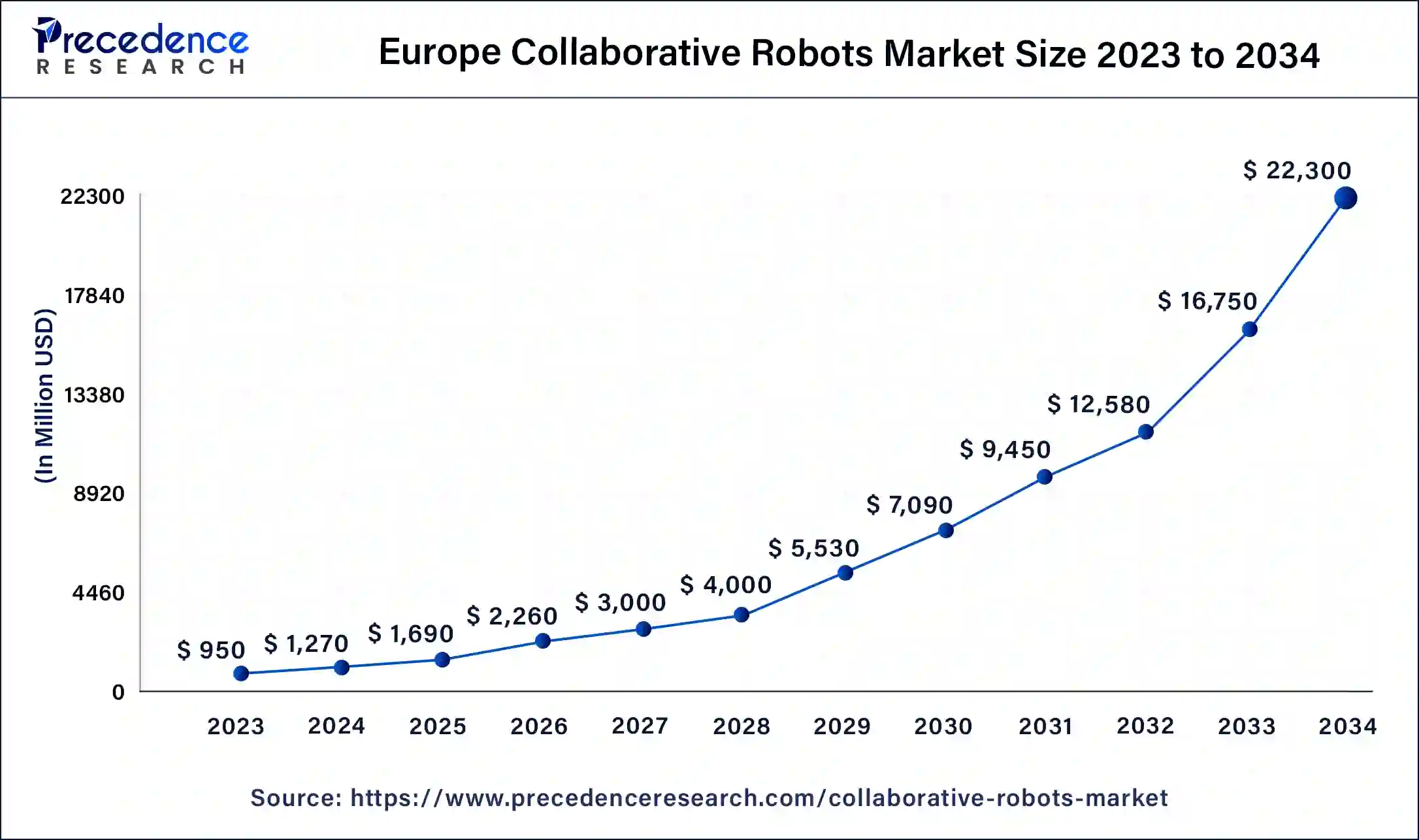

The Europe collaborative robots market size was estimated at USD 1,270 million in 2024 and is predicted to be worth around USD 22,300 million by 2034, at a CAGR of 33.18% from 2025 to 2034.

Europe is expected to capture a significant market share of the collaborative robots market over the analysis period. The region has witnessed increased adoption of cobots across industries such as automotive, electronics, manufacturing, healthcare, and logistics, in turn, drive the market expansion. Moreover, Europe is known for its strong industrial base, which provides a favorable environment for the deployment of collaborative robots. Countries such as Germany, France, Italy, and the United Kingdom have a robust manufacturing sector, and the automotive industry, in particular, has been an early adopter of cobots in the region.

The presence of an established manufacturing infrastructure and a focus on innovation has contributed to the adoption and growth of cobots in the region. Furthermore, the region places a strong emphasis on safety standards and regulations. Cobots are designed to operate safely alongside human workers, and European countries have stringent regulations in place to ensure the safety of cobots in industrial environments. The development and implementation of safety standards, such as ISO 10218 and ISO/TS 15066, have facilitated the widespread adoption of cobots in the region.

Asia Pacific is expected to grow at the highest CAGR over the forecast periodowing to government initiatives. The government in the region recognized the importance of collaborative robots in driving industrial growth and competitiveness. They have introduced initiatives, policies, and funding support to promote the adoption and development of collaborative robots. These initiatives focus on fostering innovation, enhancing manufacturing capabilities, and creating favorable environments for businesses to embrace automation technologies. Furthermore, rising labor costs, aging populations, and changing workforce demographics in the countries like China and Japan have created a need for automation solutions, including collaborative robots. Cobots provide a cost-effective alternative to manual labor, allowing businesses to improve efficiency, reduce reliance on labor-intensive tasks, and address workforce challenges. The ability of cobots to work with human workers and adapt to changing production needs makes them well-suited for the region's evolving labor market. Thereby, driving the market growth in the region.

Market Overview

Known as cobots, collaborative robots, are a kind of robotic system designed to work alongside humans in a shared workspace or collaborate with them on tasks. Collaborative robots which are typically confined to safety cages and require strict separation from human workers, collaborative robots are developed to operate safely near humans. The key characteristic of collaborative robots is their ability to interact and cooperate with humans without causing harm or posing danger. They are equipped with advanced sensors, safety features, and intelligent programming to ensure safe and efficient collaboration. These robots are often designed to be lightweight, compact, and mobile, allowing them to be easily repositioned and integrated into existing work environments.

- According to data from the National Bureau of Statistics, China has consistently increased its yearly output of industrial robots by 29.2%.

- According to the World Robotics 2022 report, China ranked first in the world for robot density, surpassing the United States for the first time due to enormous investments in industrial robots. In the manufacturing sector, the ratio of operational industrial robots to workers reached 322 units per 10,000 workers.

Collaborative Robots Market Growth Factors

Collaborative robots can be used in a wide range of industries and applications. They can perform repetitive or physically demanding tasks alongside human workers, such as assembly, pick-and-place operations, packaging, quality control, and machine tending. Cobots are also used in research and development settings, healthcare, logistics, and various other domains where human-robot collaboration can enhance productivity, efficiency, and safety. The collaborative robot market is driven by several factors including rising demand for automation in various industries, advancements in robotic technologies, shortage of skilled labor, and growing concern for safety in risky workplaces.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 4.21 Billion |

| Market Size in 2025 | USD 5.58 Billion |

| Market Size by 2034 | USD 71.26 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 32.70% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Payload Capacity, By Application, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver:

Cost-effectiveness and return on investment (ROI)

Collaborative robots are becoming more affordable and cost-effective, making them accessible to a broader range of businesses. Compared to traditional industrial robots, cobots have lower upfront costs, require less complex integration, and have shorter deployment times. Additionally, their flexible and modular nature enables businesses to easily reconfigure them for different tasks, providing a high return on investment. The potential for cost savings, increased productivity, and improved operational efficiency is attracting businesses to invest in collaborative robots. Thus, the cost-effectiveness and return on investment (ROI) are expected to offer a lucrative opportunity for the revenue growth of the market over the forecast period.

Restraints:

Limited payload and speed capabilities

Collaborative robots are typically designed to handle lower payload capacities and operate at slower speeds compared to traditional industrial robots. While this is necessary for ensuring safe collaboration with humans, it can limit their applicability in industries that require heavy lifting or high-speed operations. Certain industries may still rely on more powerful robots for specific tasks, leading to a narrower market scope for collaborative robots.

Opportunities:

Increasing demand for automation

Due to the rising need for automation, intense competition in the e-commerce sector, and advancements in technologies like the internet of things (IoT) and artificial intelligence (AI), the market for collaborative robots has seen substantial expansion. Robotics utilization has increased worker safety and seen development in this sector as well. Automated obstacle identification, navigation, and cargo transportation have all been made easier for businesses by integrating robots with AI and machine vision technologies. The market for collaborative robotics is being driven by suppliers who are being drawn to automate warehouses and put robots there. For instance, in March 2023, at Promat in Chicago, FANUC America, a pioneer in industrial automation, showcased its newest robots, cobots, and industrial automation for warehousing and logistics. Thus, this type of product launch in the cobot industry is expected to provide enormous opportunities for market growth over the forecast period.

Payload Capacity Insights

Based on the payload capacity, the global collaborative robots market is segmented into up to 5kg, up to 10kg, and above 10kg. The 5kg segment held the largest revenue share in 2024 and is expected to continue the same pattern over the forecast period. This segment includes collaborative robots that can handle payloads of up to 5kg. These cobots are suitable for a wide range of applications, including assembling, pick-and-place operations, packaging, and small-part manipulation. They are commonly used in industries such as electronics, automotive, consumer goods, and pharmaceuticals, where tasks require precision and dexterity.

On the other hand, the above 10 kg segment is expected to grow at the highest CAGR over the forecast period. The above 10 kg payload capacity cobots segment is designed for applications that involve heavier objects, such as loading and unloading of heavy components, metalworking tasks, and certain manufacturing processes. Industries like automotive, aerospace, and metal fabrication often utilize cobots in this payload capacity range to improve efficiency, reduce manual labor, and enhance worker safety. Thus, this is expected to drive the segment growth over the analysis period.

Application Insights

Based on the application, the global collaborative robots market is segmented into packaging, pick & place, handling, assembly, quality testing, machine tending, gluing & welding, and others. The handling segment is expected to capture the largest market share during the forecast period. This segment includes collaborative robots focused on material handling tasks. These cobots are capable of lifting, moving, and transporting materials within the workplace. They can load and unload pallets, transport material between different workstations, and organize the inventory. The handling cobots are utilized in several industries such as logistics, warehousing, and manufacturing, where efficient and safe material handling is essential for optimizing supply chains and reducing manual labor.

Industry Vertical Insights

Based on the industry vertical, the global collaborative robots industry is divided into electronics, metal & machinery, furniture & equipment, plastic & polymers, food & beverage, automotive, pharma, and others. The automotive segment is expected to dominate the market during the forecast period. In the automotive industry, these cobots are used in various applications which include assembly line, material handling and logistics, quality control, and inspection, painting and finishing, and testing and validation.

In the assembly line of the automotive industry, cobots are designed for various tasks including component insertion, screw fastening, welding, and quality control checks. They work with human workers, assisting in repetitive and precise assembly operations, thereby improving productivity, reducing errors, and enhancing worker safety. These cobots are also utilized for various purposes such as engine assembly, interior and exterior component assembly, and electrical system installation. Thus, the growing demand for cobots in various applications in the automotive industry is expected to propel segment revenue growth.

Collaborative Robots Market Companies

- Epson Robots

- KUKA AG

- ABB Group

- Energid Technologies Corporation

- F&P Robotics AG

- Fanuc Corporation

- Yaskawa Electric Corporation

- MRK-Systeme GmbH

- Universal Robots A/S

- Rethink Robotics, Inc

- Robert Bosch GmbH

- Precise Automation, Inc

- DENSO Robotics

Recent Developments

- In April 2025, FANUC America launched the Cobot and Go web tool for collaborative robot solutions. Jerry Perez, manager of FANUC America, stated, “When paired with our reliable line of CRX cobots, businesses of all types can be up and running quickly, with the added benefit of FANUC's reliability, efficiency, and customer service behind every purchase.”

- In February 2025, Delta, a global leader in power management and a provider of IoT-based smart green solutions, announced a new collaborative robot for the Indian smart manufacturing market at ELECRAMA 2025. These 6-axis cobots boast payload capacities up to 30 kg and speeds as fast as 200 degrees per second; thus, they are designed to empower industries with smarter, more efficient production processes, such as electronics assembly, packaging, materials handling, and even welding.

- In April 2024, Universal Robots (UR), the world's leading collaborative robot (cobot) company, integrated the Standard Robot Command Interface (SRCI) into its software. UR is proud to be among the first cobot vendors to offer this functionality.

- In December 2024, Aeva, a leader in next-generation sensing and perception systems, announced the expansion of its strategic collaboration with SICK, a leading global supplier of solutions for sensor-based industrial applications.

- In April 2024, Collaborative Robotics, a leader in the development of practical collaborative robots, announced it raised USD 100 million in Series B funding led by General Catalyst and joined by Bison Ventures, Industry Ventures, and Lux Capital. Cobot also announced that industry leader Teresa Carlson has joined the company as an Advisor.

- In October 2024, Robust.AI, a San Carlos, Calif., based cobot manufacturer, launched Carter Pro, a new collaborative mobile robot that combines AI and interaction models. Rodney Brooks, co-founder and CTO of Robust AI. Said, “Carter Pro is aware of its environment and people around it in a way no other robot is, and its AI makes it responsive to circumstances in a way that makes sense to people working with or near the robot.

- In May 2023, the TM AI Cobot TM255, a brand new robot launched by Techman Robot. According to the company, the 25 kilogram maximum payload capacity of the TM255 model of the TM AI Cobot S Series makes it the “ultimate choice” for a variety of industrial applications. The TM255 provides unmatched versatility and adaptability in a variety of operating conditions because of its “longest reach” in the 25 kg payload cobot industry (almost 190 cm).

- In May 2023,at the Automate show, Dobot announced the launch of its new CRA Series collaborative robots and the smart camera CRV500. The CRA Series offers a considerable performance gain over its predecessor and is also safe and user-friendly. By utilizing Dobot's self-developed 2.5D spatial compensation technology, the CRV500 smart camera paves the way for a range of vision-based automation scenarios by enabling robots to grasp slanted or inclined products more.

- In May 2023, Universal Robots and Denali Advanced Integration, a prominent provider of technology integration announced their strategic partnership. Industry-leading technology and industry-leading services are combined in this alliance. Combining Universal Robots, the market leader in collaborative robots, and Denali, an experienced IT/OT partner, enables them to provide customers with the best automation ideas while generating a significant return on their technological investments.

Segments Covered in the Report

By Payload Capacity

- Up to 5kg

- Up to 10kg

- Above 10kg

By Application

- Packaging

- Pick & Place

- Handling

- Assembly

- Quality Testing

- Machine Tending

- Gluing & Welding

- Others

By Industry Vertical

- Electronics

- Metal & Machinery

- Furniture & Equipment

- Plastic & Polymers

- Food & Beverage

- Automotive

- Pharma

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content