What is the Ambulatory Cardiac Monitoring Devices Market Size?

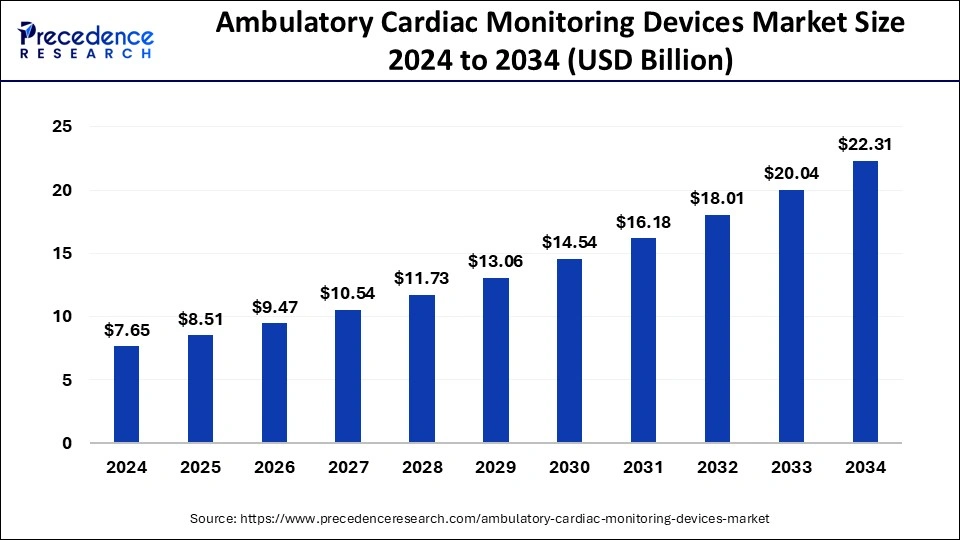

The global ambulatory cardiac monitoring devices market size was estimated at USD 8.51 billion in 2025 and is predicted to increase from USD 9.47 billion in 2026 to approximately USD 22.31 billion by 2034, expanding at a CAGR of 11.30% from 2025 to 2034.

Market Highlights

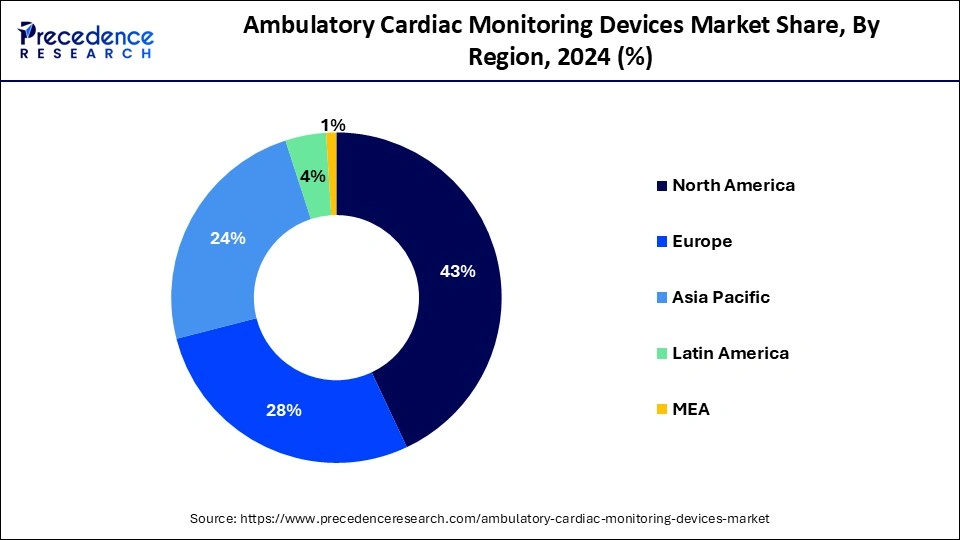

- North America generated more than 43% of revenue share in 2024.

- Asia-Pacific is expected to grow at a CAGR of 4.1% during the forecast period.

- By device type, the Holter monitors segment dominated the market with a 31.20% share in 2024.

- By device type, the patch-based monitors segment is expected to grow at the highest CAGR of 10.90% over the forecast period.

- By technology, the lead-based monitoring devices segment held a 38.70% market share in 2024.

- By technology, the AI-based/smart diagnostic devices segment is expected to grow at the highest CAGR of 12.70% over the forecast period.

- By application, the atrial fibrillation segment dominated the market with a 66.10% share in 2024.

- By application, the ventricular arrhythmia segment is expected to grow at the highest CAGR of 8.90% during the projected period.

- By end user, the hospitals & cardiology clinics segment held a 41.60% market share in 2024.

- By end user, the home healthcare settings segment is expected to grow at the highest CAGR of 11.40% during the forecast period.

- By Mode of Deployment, the monitoring services included segment dominated the market with 56.90% share in 2024 and is expected to grow at the highest CAGR of 9.60% over the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 8.51 Billion

- Market Size in 2026: USD 9.47 Billion

- Forecasted Market Size by 2034: USD 22.31 Billion

- CAGR (2025-2034): 11.30%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

The ambulatorycardiac monitoringdevices market pertains to the sector within themedical device industrythat specializes in portable, wearable, or implantable gadgets crafted to track a patient's heart activity outside the usual clinical environments. These devices are indispensable for diagnosing and overseeing diverse cardiac ailments, such as arrhythmias and heart rhythm irregularities. The market has witnessed substantial growth due to rise in the incidence of cardiovascular diseases and the need for non-invasive, continuous monitoring solutions. Innovations in technology, such as encompassing wireless connectivity and remote monitoring capabilities, have further propelled market expansion, offering patients and healthcare providers valuable tools for early detection and enhanced cardiac healthcare.

Ambulatory Cardiac Monitoring Devices Market Growth Factors

The ambulatory cardiac monitoring devices market is a thriving sector in the realm of medical apparatus, specializing in the creation and dissemination of portable, wearable, and implantable instruments tailored to monitor cardiac activity in non-clinical environments. These devices hold a pivotal role in diagnosing and managing various cardiac conditions, including arrhythmias and heart rhythm irregularities, by offering continuous and non-intrusive monitoring solutions. The market's impressive growth is driven by a multitude of influential factors.

A significant trend within the sector pertains to the escalating prevalence of cardiovascular maladies, propelling the demand for ambulatory cardiac monitoring devices. As cardiac-related ailments become increasingly widespread, these devices take on a critical role by providing early detection and uninterrupted monitoring, empowering healthcare professionals to provide more precise diagnoses and timely interventions. Additionally, technological strides such as wireless connectivity and remote monitoring capabilities are reshaping the landscape. These innovations grant patients and healthcare providers' access to real-time data, enhancing the quality of patient care and treatment outcomes.

The ambulatory cardiac monitoring devices market also faces distinct challenges. One notable hurdle is the intricate and stringent regulatory framework due to the critical nature of cardiac monitoring. Navigating the maze of regulatory approvals and compliance requisites can prove demanding and resource-intensive for manufacturers. Furthermore, the sector is marked by intense competition, leading to pricing pressures and necessitating perpetual innovation to uphold competitiveness.

Amidst these challenges, alluring business prospects materialize within this market. The increasing awareness regarding the significance of early cardiac condition detection and the pivot toward preventive healthcare presents substantial growth avenues. Manufacturers can explore collaborations with healthcare providers and insurers to furnish comprehensive cardiac monitoring solutions, tapping into a broader clientele.

Furthermore, venturing into emerging markets equipped with expanding healthcare infrastructure offers prospects for market expansion and global outreach. In summary, the ambulatory cardiac monitoring devices industry occupies a pivotal position in modern healthcare, spurred by the surging prevalence of cardiovascular diseases and breakthroughs in technology. While regulatory obstacles and competitive pressures persist, the market beckons with promising opportunities, including initiatives in preventive healthcare and potential global expansion, rendering it a dynamic and evolving segment within the domain of medical devices.

Market Scope

| Report Coverage | Details |

| Market Size in 2034 | USD 22.31 Billion |

| Market Size in 2025 | USD 8.51 Billion |

| Market Size by 2024 | USD 7.65 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.30% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Rising cardiovascular disease prevalence

The surge in the prevalence of cardiovascular diseases (CVDs) serves as a pivotal impetus propelling the proliferation of the ambulatory cardiac monitoring devices industry. CVDs, encompassing ailments like arrhythmias, atrial fibrillation, and heart rhythm aberrations, have experienced a pronounced escalation in their ubiquity on a global scale. This pronounced upswing in CVD cases has engendered an exigent demand for cutting-edge cardiac monitoring solutions, with ambulatory monitoring devices taking the vanguard position in addressing this imperative need.

As the number of individuals diagnosed with or susceptible to CVDs continues its ascent, the importance of early detection and uninterrupted monitoring has attained unprecedented significance. Ambulatory cardiac monitoring devices offer a patient-centric, non-invasive modality for tracking cardiac activity over extended durations, facilitating the expeditious discernment of irregularities. Consequently, these devices wield a pivotal role in advancing patient care, constraining healthcare outlays, and elevating overall healthcare outcomes.

The burgeoning incidence of CVDs is instigating widespread assimilation of these devices among healthcare providers and patients, firmly establishing their stature as an indispensable constituent of contemporary cardiac healthcare. This prevailing trajectory is facilitating the sustained and robust expansion of the ambulatory cardiac monitoring devices industry.

Restraints

Limited awareness and high costs

Limited awareness and high costs pose substantial impediments to the ambulatory cardiac monitoring devices industry growth. Insufficient knowledge among healthcare professionals and patients about the advantages and availability of these monitoring devices constrains their adoption. Many individuals and even some medical practitioners may lack comprehensive information about the merits of continuous cardiac monitoring in contrast to conventional methods. This lack of awareness can lead to underutilization and missed opportunities for early detection and intervention.

Furthermore, the elevated expenses associated with ambulatory cardiac monitoring devices create a formidable barrier to access. Patients may encounter financial constraints in acquiring these devices, even when covered by insurance. Additionally, healthcare facilities may exhibit reluctance in investing in costly equipment, particularly in resource-constrained settings.

The overall cost of ownership, inclusive of maintenance and data analysis, can become onerous. Mitigating these challenges necessitates targeted efforts in educational and awareness campaigns to enlighten healthcare providers and patients alike about the value of these devices. Additionally, innovations aimed at cost reduction and enhancing affordability are imperative to expand the market's reach.

Opportunities

Partnerships and collaborations

Partnerships and collaborations are fostering significant opportunities within the ambulatory cardiac monitoring devices industry. By joining forces with healthcare providers, insurers, and other stakeholders, device manufacturers can create comprehensive cardiac care solutions that cater to the diverse needs of patients and providers. These collaborations can facilitate bundled services that encompass device provision, continuous monitoring, and timely treatment. This integrated approach not only enhances patient care but also streamlines the healthcare delivery process, reducing administrative burdens and costs.

Moreover, partnerships enable access to a broader customer base and market reach. Device manufacturers can leverage the established networks and customer relationships of healthcare providers to introduce their monitoring solutions to a wider audience. In the era of value-based care, collaborations also support the shift towards outcome-driven healthcare. By aligning incentives and sharing data, stakeholders can work together to improve patient outcomes and reduce healthcare costs, which is particularly relevant in the management of cardiac conditions. Overall, partnerships and collaborations are instrumental in shaping the future of ambulatory cardiac monitoring, creating opportunities for innovation and improved patient care while strengthening the market presence of device manufacturers.

Segments Insights

Device Type Insights

The Holter monitors segment dominated the market with a 31.20% share in 2024. The dominance of the segment can be attributed to the rising incidence of cardiovascular diseases (CVDs) such as atrial fibrillation (AFib) along with the rapidly surging aging population. Holter monitors are important for catching occasional heart rhythm abnormalities that can go undetected during a standard, short-term ECG.

The patch-based monitors segment is expected to grow at the highest CAGR of 10.90% over the forecast period. The growth of the segment can be credited to the ongoing innovations in real-time monitoring and the development of smaller devices. Furthermore, patch-based devices are common to remote monitoring systems, which include communication networks, wearable sensors, and cloud analytics platforms.

End-use Insights

The hospitals & cardiology clinics segment held a 41.60% market share in 2024. Hospitals and clinics are primary healthcare settings where patients receive diagnoses and treatments for various cardiac conditions. These facilities rely heavily on advanced monitoring solutions to provide accurate assessments and timely interventions. Additionally, the presence of skilled healthcare professionals and the need for continuous monitoring during inpatient care contribute to the dominance of this segment. The integration of ambulatory cardiac monitoring devices into hospital and clinic workflows further solidifies their prominent role in cardiac care, leading to a major market share.

The home healthcare settings segment is expected to grow at the highest CAGR of 11.40% during the forecast period. The growth of the segment can be attributed to the innovations in user-friendly and portable devices, along with an ongoing shift towards outpatient and remote care. Furthermore, increasing investments in R&D further contributed to the overall segment expansion.

Technology Insights

The lead-based monitoring devices segment held a 38.70% market share in 2024. The dominance of the segment can be linked to the rising awareness of cardiac health, coupled with the growing integration of telehealth with remote patient monitoring. In addition, growing shifts towards home-based and outpatient care boost demand for devices that can monitor heart activity.

The AI-based/smart diagnostic devices segment is expected to grow at the highest CAGR of 12.70% over the forecast period. The growth of the segment can be driven by the growing incidence of cardiovascular diseases and the aging population, which requires continuous remote monitoring. The integration of ML and AI cardiac monitors enables real-time detection of abnormalities with more sophisticated analysis.

Mode of Deployment Insights

The monitoring services segment dominated the market with a 56.90% share in 2024 and is expected to grow at the highest CAGR of 9.60% over the forecast period. The dominance and growth of the segment can be credited to the growing dependence on digital platforms and e-commerce, along with the need for accountability and regulatory compliance. Moreover, various sectors are adopting remote control and monitoring systems to enhance overall operational efficiency.

Regional Insights

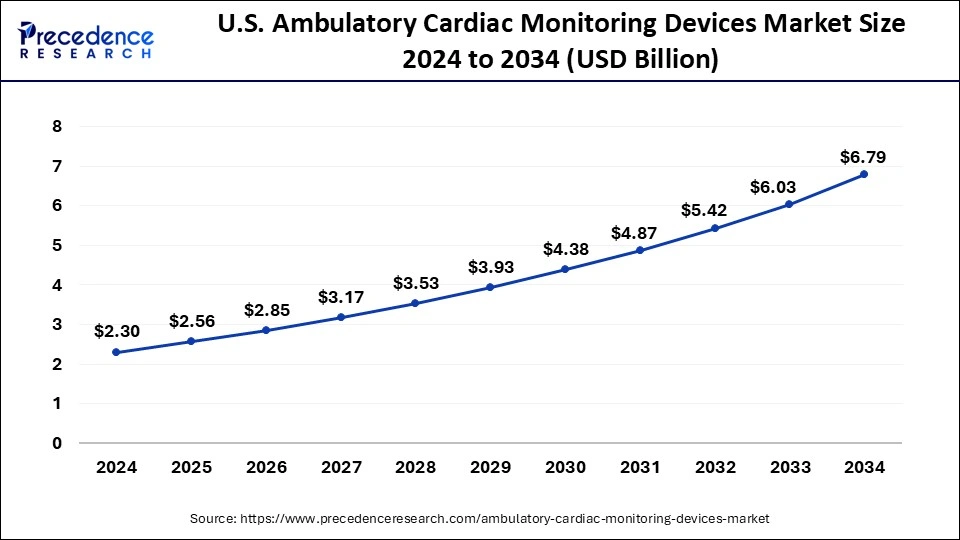

U.S. Ambulatory Cardiac Monitoring Device Market Size and Growth 2025 to 2034

The U.S. ambulatory cardiac monitoring devices market size accounted for USD 2.56 billion in 2025 and is expected to be worth around USD 6.79 billion by 2034, growing at a CAGR of 11.43% from 2025 to 2034.

North America held the largest revenue share of 43% in 2024. North America dominates the ambulatory cardiac monitoring devices market due to several factors. It boasts a high prevalence of cardiovascular diseases, a rapidly aging population, and a well-established healthcare infrastructure. Moreover, robust research and development activities and early adoption of advanced medical technologies contribute to the region's market leadership. Favorable reimbursement policies and healthcare reforms further stimulate the demand for ambulatory cardiac monitoring devices. Additionally, strategic partnerships between device manufacturers and healthcare providers have bolstered market growth. All these factors combined make North America a major player in the ambulatory cardiac monitoring devices market.

Asia-Pacific is growing at a CAGR of 4.1% during the forecast period. The Asia-Pacific region commands a substantial growth in the ambulatory cardiac monitoring devices market due to several key factors. This region has witnessed a rising prevalence of cardiovascular diseases, driven by lifestyle changes and an aging population. Additionally, improving healthcare infrastructure, increasing healthcare expenditures, and growing awareness of cardiac health have fostered demand for advanced monitoring devices. Furthermore, the presence of a large patient population and expanding access to healthcare services in emerging markets within Asia-Pacific have contributed to its major market share. These factors collectively make the region a lucrative and high-growth market for ambulatory cardiac monitoring devices.

Ambulatory Cardiac Monitoring Devices Market Companies

- Koninklijke Philips N.V

- Hill-rom Services, Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- ZOLL Medical Corporation

- NIHON KOHDEN CORPORATION

- FUKUDA DENSHI

- iRhythm Technologies Inc

- Biotronik SE & Co. KG

- General Electric Company

- Abbott

Recent Developments

- In 2022,Smart Cardia introduced its innovative 7-lead Cardiac monitoring patch, known as the 7 L patch, to the Indian market. This cutting-edge patch monitor seamlessly integrates wearable medical technology with artificial intelligence (AI), offering predictive and personalized patient insights through remote monitoring.

- In 2022,AlveCor unveiled the KardiaMobile card, a sleek and ultra-convenient personal ECG device. The KardiaMobile card boasts top-tier AI capabilities in an incredibly convenient form factor.

- In 2018,BIOTRONIK assumed the role of the exclusive distributor for InfoBionic's MoMe Kardia external cardiac diagnostic monitor in the United States. This strategic move expanded BIOTRONIK's product portfolio in the realm of cardiovascular solutions, further supporting physicians in delivering swift and efficient patient care.

- In 2017,Nihon Kohden initiated the establishment of a sales branch in Kenya, a strategic endeavor that bolstered the company's foothold in the Middle East and Africa region, strengthening its customer base in these vital markets.

Segments Covered in the Report

By Device Type

- Holter Monitors

- Event Monitors

- Mobile Cardiac Telemetry (MCT) Devices

- Insertable Loop Recorders (ILRs)

- Patch-Based Monitors (e.g., Zio Patch)

- Wearable ECG Monitors (Smart Wearables, Chest Belts, etc.)

By Technology

- Lead-Based Monitoring Devices

- 1-Lead

- 3-Lead

- 6-Lead

- 12-Lead

- Wireless and Connected Devices

- Bluetooth Enabled

- Cellular Network-Based

- Wi-Fi Enabled

- AI-Based/Smart Diagnostic Devices

- Cloud-Based Monitoring Platforms

- Traditional (Non-Connected) Devices

By Application

- Atrial Fibrillation

- Bradycardia

- Tachycardia

- Ventricular Arrhythmia

- Conduction Disorders

- Syncope or Transient Loss of Consciousness

- Post-Operative Cardiac Monitoring

- Others (e.g., Palpitations, Chest Pain, Silent Myocardial Ischemia)

By End User

- Hospitals & Cardiology Clinics

- Ambulatory Surgical Centers

- Diagnostic Imaging Centers

- Home Healthcare Settings

- Individual Users (Consumer Market)

By Mode of Deployment / Monitoring Service

- Device Only (Hardware Sale)

- Monitoring Services Included (Subscription or Service Bundled)

- Real-Time Monitoring (24/7 surveillance)

- Retrospective/Event Monitoring

- Cloud Subscription Model (Software as a Service)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting