What is the Ambulatory Surgical Center Market Size?

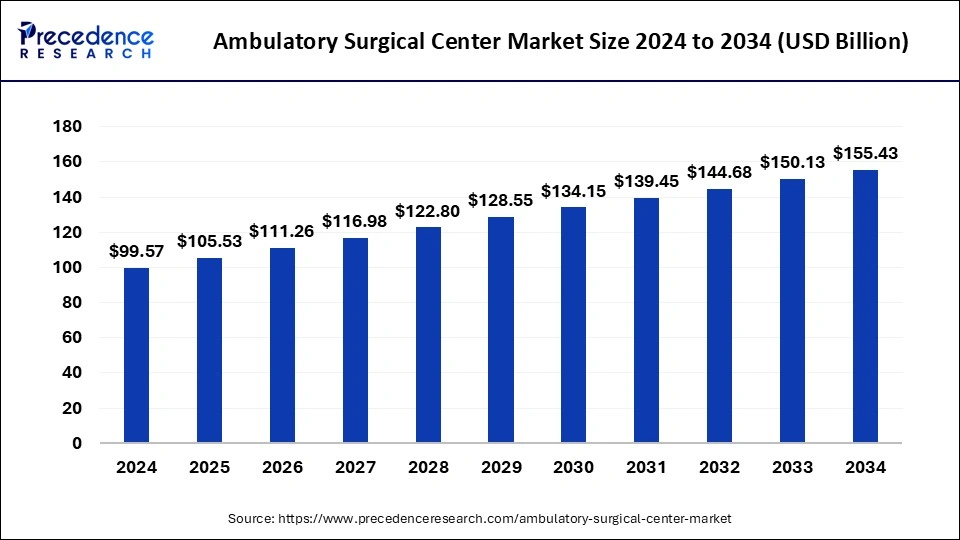

The global ambulatory surgical center market size is calculated at USD 105.53 billion in 2025 and is predicted to increase from USD 111.26 billion in 2026 to approximately USD 160.83 billion by 2035, expanding at a CAGR of 4.30% from 2026 to 2035.

Ambulatory Surgical Center Market Key Takeaways

- In terms of revenue, the ambulatory surgical center market is valued at $105.53 billion in 2025.

- It is projected to reach $155.43 billion by 2034.

- The ambulatory surgical center market is expected to grow at a CAGR of 4.30% from 2026 to 2035.

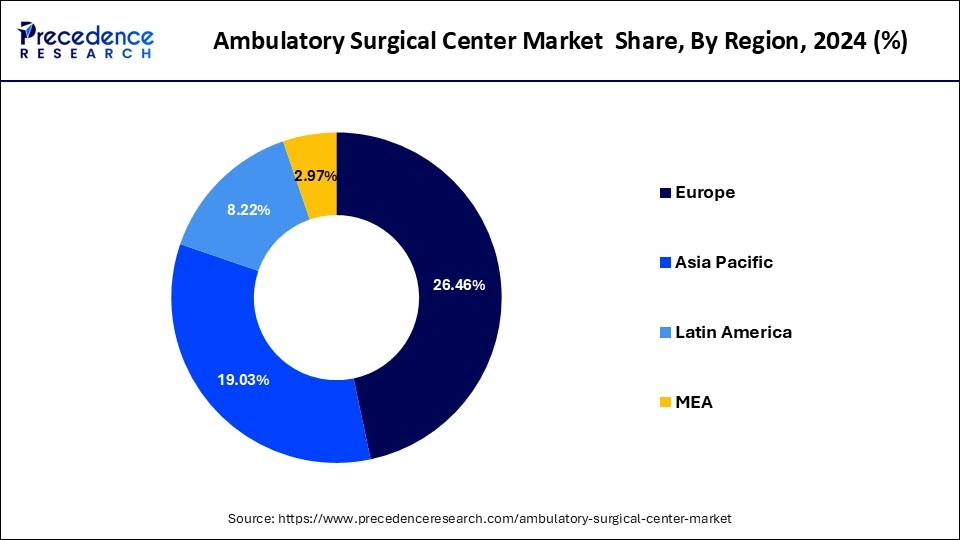

- North America has accounted for a market share of around 26.46% in 2025.

- Europe has held a market share of around 19.03% in 2025.

- By ownership, the physician only segment has accounted for a market share of 59.56% in 2025.

- By surgery type, ophthalmology segment has captured a market share of 23.51% in 2025.

- By speciality type, the singlespeciality segment has generated the highest market share of 60.61% in 2025.

- By service, the treatment segment has garnered 74.24% market share in 2025.

Market Overview

Major Recent Breakthroughs in Ambulatory Surgical Center Market

In June 2025, a grand opening of a multi-million dollar ambulatory surgery center (ASC), which is situated at 9408 SW 87th Avenue, Suite 303 in Miami's Kendall neighborhood, was announced by Amavita Heart and Vascular Health™, which is a pioneer in minimally invasive cardiovascular care. This facility is considered to be the first dedicated cardiovascular ASC in the region, with the presence of an award-winning Med Square Health Class A medical complex, which in turn, will provide transformative outpatient care for vascular and heart conditions.

In May 2025, ambulatory surgery centers with improved access, support for physicians and care teams, and streamlined care delivery will be established by the collaboration between the Cleveland Clinic and Regent Surgical, as per the recent announcement. These centers will offer a substitute for traditional hospital-based care. Furthermore, the surgeries conducted at ASC will allow patients with a short recovery time in the centres, where they can return to their homes to complete their recovery. Thus, this enhances the ease of access for the patient requiring surgical care. Source: Amavita Heart and Vascular Health™ Unveils Multi-Million Dollar State-of-the-Art Cardiovascular Ambulatory Surgery Center in Kendall Cleveland Clinic to Partner with Regent Surgical for Ambulatory Surgery Centers

Ambulatory Surgical Center Market Growth Factors

Ambulatory surgical centers are modern outpatient surgery centers that specialize in same day surgical procedures such as diagnostic and preventative procedures. These centers generally serve individuals who do not require hospitalization. The therapy can be performed outside of the hospital, and the patient can be released as soon as the medical procedure is completed. Ambulatory surgical centers are an excellent choice for people who cannot afford significant medical bills. For the convenience of patients, ambulatory surgical facilities offer mobile surgical procedures. For on-site surgical operations, ambulatory surgical facilities are fully equipped with an operating room. Ambulatory surgical centers are best for non-invasive and minor operations.

The sustained growth of the ambulatory surgical center market is expected to be fueled by the exponential rise in healthcare expenses over the last decade, which has resulted in changing healthcare practices. In addition, the increased frequency of chronic disorders that necessitate regular minor procedures that may be performed in ambulatory settings is a major driver of the ambulatory surgical center market. A major driver of the ambulatory surgical center market is the growing burden of surgical procedures on hospitals and healthcare organizations. The need to reduce inpatient surgeries, particularly for simple procedures as well as growing acceptance of ambulatory surgical centers, are driving the market for ambulatory surgical centers to rise.

- Surging medical costs drive doctors and patients toward more cost-effective alternatives, making ASCs for affordable surgical procedures a choice option.

- The rising incidence of chronic diseases such as cardiovascular problems, diabetes, and arthritis has led to increased demand for minor and diagnostic procedures in the ambulatory setup.

- By lowering the demand for hospital beds, simple surgeries are being encouraged to shift to ASCs for relief to inpatient facilities and optimization of healthcare resources.

- More patients are preferring Amenities like convenience, short recovery time, and same-day discharge, increasing ASC adoption among these people.

- Maintaining surgical instruments and procedures have undergone technological change, thereby affecting the efficiency and reach of ASCs, enhancing the significance of these centers in outpatient care.

Key Market Trends

- Patients are increasingly seeking outpatient care as an alternative to inpatient procedures, as it provides a more convenient, cost-effective, and efficient option for these patients, making them a preferred choice for various surgical procedures.

- Technological advancements in minimally invasive surgeries (MIS) have led to a rise in outpatient procedures. These types of techniques are less invasive, result in shorter recovery times, and can be performed with ease, thus boosting the market growth.

- Rehabilitation services are increasingly being incorporated into the market, offering an easy and quick recovery process. These services help patients recover much faster and return to their daily activities more quickly, making it a popular choice.

- The concept of telemedicine is gaining traction in today's market, allowing patients to consult with specialists remotely. These technologies provide pre- and post-operative consultations in an effective and efficient manner, thus improving patient convenience.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 155.43 Billion |

| Market Size by 2026 | USD 155.43 Billion |

| Market Size by 2025 | USD 105.53 Billion |

| Growth Rate | CAGR of 4.55% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drug Type, Process, Type, Therapeutic Area, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A rise in the number of surgeries, the surge in the older population, and a rise in the frequency of chronic disorders are all driving the ambulatory surgical center market during the forecast period. The surge in outpatient hospitalizations could also be attributed to the use of technologically advanced treatments in outpatient clinics, which makes treatment more cost-effective and speedier. The advanced surgical methods allow tests and surgeries to be carried out without the requirement for a hospital admission rates in such situations. In addition, technological advancements, the growth of outpatient services, and increased desire for less invasive surgeries all contribute to the ambulatory surgical center market's expansion.

A growth in the demand for ambulatory surgical centers in developing countries is likely to create new lucrative opportunities during the forecast period. Due to advancements in medical technology and the affordability of facilities, the ambulatory surgical center market is rising. The convenient locations, cost savings, technical developments, and patient happiness by ambulatory surgical centers all influence the growth of the ambulatory surgical center industry. Ambulatory surgical centers offer low-cost treatments and amenities as well as the convenience of day surgery for patients. The evolution of less invasive surgical approaches has resulted in an increase in the number of procedures that can be performed in ambulatory surgical centers.

Another significant element driving the ambulatory surgical center market is favorable reimbursement possibilities for services supplied by ambulatory surgical centers. Medical coverage through state run and private healthcare insurance makes ambulatory surgery clinics appealing for surgical operations, particularly minor ones, in emerging nations. Most ambulatory surgical centers do not require a hospital stay and are costly than hospital surgeries.

Due to the rise in chronic disorders prevalence, the worldwide outpatient surgical center market is expected to expand over the projection period. The ambulatory surgical center sector is also expected to benefit from the growing number of collaborations and acquisitions around the globe. The ambulatory surgical center industry is growing as a result of rising demand for minimally invasive treatments, surgeon tools and equipment, technological developments in surgical tools and equipment, and physician control over equipment selection. The rise in global demand for ambulatory surgical facilities is expected to be stymied by a low health care professional rate.

Thus, rising healthcare costs are a major cause of concern for the company, as they result in many individuals being unable to afford treatment, especially surgical procedures. As a result, healthcare professionals have been working to devise innovative tactics and strategies to reduce the cost of therapies while maintaining high quality of surgeries which will benefit patients on large scale. The ambulatory surgical centers have shown to be viable alternative in this case.

Market Dynamics

Driver

High-Quality Care

To make sure they adhere to strict standards of care, ASCs frequently apply for accreditation from institutions like the Joint Commission or the Accreditation Association for Ambulatory Health Care (AAAHC). Ensuring the exceptional qualifications and continual education of all medical personnel, including nurses, anesthesiologists, and surgeons. Placing a strong emphasis on patient education, communication, and participation in decision-making. Purchasing cutting-edge surgical instruments and upholding strict maintenance and sterilization guidelines for those instruments. Expansion in the range of operations that can be carried out as an outpatient as a result of improvements in minimally invasive surgical methods. The transition from inpatient to outpatient surgical settings is being driven by patient choice for shorter hospital stays and economic pressures.

Restraints

Competition from Emerging Technologies

In ASCs, robotically assisted surgery is becoming more and more common. During operations, these devices give surgeons more control, flexibility, and precision. Patients may find ASCs to be a desirable alternative because of the less invasive nature of robotic surgery, which can also result in shorter recovery periods, less discomfort following surgery, and a decreased risk of infection. Better preoperative and postoperative treatment is made possible by advances in telemedicine and remote monitoring technologies. Telehealth systems allow patients to have follow-up visits and consultations, which eliminates the need for in-person appointments. Remote monitoring tools can keep tabs on a patient's vital signs and progress, guaranteeing prompt actions if problems develop. Patients are receiving constant health monitoring because of wearable technology and Internet of Things (IoT) advancements.

Opportunity

Patient-Centered Care Models

In the ambulatory surgical center market, patient-centered care (PCC) models emphasize giving healthcare that is considerate of and sensitive to patients' preferences, requirements, and values. By ensuring that patient values inform all clinical decisions, these models seek to improve patient happiness and care quality. In the ambulatory surgical center (ASC) market, patient-centered care (PCC) models emphasize giving healthcare that is considerate of and sensitive to patients' preferences, requirements, and values. By ensuring that patient values inform all clinical decisions, these models seek to improve patient happiness and care quality. establishing a relaxing and friendly atmosphere at the ASC in order to lessen anxiety and enhance the general patient's experience.

Segment Insights

Speciality TypeInsights

The single-specialty segment held the largest share in the ambulatory surgical center market. In the Ambulatory Surgical Center (ASC) sector, ASCs that concentrate on a particular field of medicine or surgery are referred to as single-specialty ASCs. These facilities specialize in offering specialist care in a specific area, such as pain treatment, orthopedics, gastroenterology, or ophthalmology. More focused and effective care can be provided using the single-specialty model, which frequently results in improved outcomes and increased patient satisfaction. The aging population's need for specialized surgical treatments and the rising incidence of chronic diseases are driving up demand for single-specialty ASCs. Single-specialty ASCs are appealing to consumers and insurers alike since they frequently have lower prices than hospital-based outpatient departments.

The multi-specialty segment is expected to be the fastest-growing market. Within the Ambulatory Surgical Center (ASC) business, the multi-specialty category is a significant and expanding industry. Ambulatory Surgical Centers are medical establishments that provide patients with the option to have surgical operations performed outside of a conventional hospital. These facilities offer same-day surgical care, including diagnostic and prophylactic procedures, and have gained popularity as an alternative to hospitals because of their effectiveness, affordability, and quicker recovery periods. Due to decreased overhead, procedures carried out at ASCs typically cost less than those conducted in hospitals. Both patients and insurance companies may experience large cost savings as a result of this.

Ownership Insights

The physician only segment held the largest share in the ambulatory surgical center market. Within the Ambulatory Surgical Center (ASC) market, the physician-owned segment represents a sizable and expanding portion of the healthcare sector. Facilities with physician ownership stakes are known as physician-owned ASCs, and they frequently provide better treatment and more efficient operations. The growing demand for outpatient operations and procedures has resulted in significant development in the physician-owned ASC market. With the development of minimally invasive surgical techniques and medical technology, increasingly difficult treatments can now be carried out in ASCs. Since physicians directly participate in both clinical and administrative decisions, physician ownership frequently results into a higher standard of care.

The hospital only segment is expected to be the fastest growing market. A growing and substantial share of the ambulatory surgical center (ASC) market is made up of hospital-owned facilities. Ambulatory Surgical Centers are medical establishments that focus on offering outpatient surgical procedures, allowing patients to return home the same day of the procedure. Hospitals are using ASCs to broaden their services, improve patient care, and maximize operational efficiencies, which makes this market segment crucial. Surgery can be performed in hospital-owned ASCs for less money than in conventional hospital settings. Both patients and payers, such as Medicare and insurance companies, find this cost efficiency appealing.

Application Insights

Orthopedics is the leading application segment in the market of ambulatory surgical centers. Patients prefer ASCs for orthopedic procedures because of lower chances of infections, rigid safety protocols, and shorter waiting hours in comparison to hospitals. These centers thus provide an environment fit for any surgery and are considered viable for joint and bone surgeries, such as hip and knee replacements, on their preference list due to convenience and cost-effectiveness. The rising demand for minimally invasive orthopedic procedures only strengthens the dominance of this segment in the market.

Otolaryngology may register the fastest growth in ambulatory surgical centers. The faster growth of this segment is owing to a consistent rise in the number of disorders of the ear, nose, and throat and increasing adoption of outpatient ENT surgeries. In ASCs, patients receive faster recovery and treatments at lower costs; hence, it is more convenient as compared to hospitals. With hearing loss and other related conditions arising from factors such as noise exposure becoming rampant, demand for otolaryngology services at ASCs is rampantly accelerating and has now become the fastest-growing application segment.

Services Insights

The treatment segment dominated the market. Since the treatment service category is governed by ambulatory surgical centers, it took advantage of the rise of minimally invasive surgical technologies, anesthesia, and so on. The patients have increasingly begun to rely on the ASC alternative for hospital treatment as a safer, faster, more economical option. The adoption of said treatments from ASCs has seen additional promotion through accommodating government policies and insurance coverage.Treatment will remain the highest in demand for same-day surgery with the shortest recovery time, giving treatment the largest service category, thus establishing the ASCs firmly as preferred centers for outpatient medical and surgical care.

Diagnosis services are anticipated to witness the fastest growth in the ASC market. Increased emphasis on the early detection of chronic and lifestyle diseases has been pushing demand for less costly, more accessible diagnostic procedures outside traditional hospital settings. ASCs have started integrating next-generation diagnostic tools, enhancing perception and convenience for patients. Public awareness around preventive healthcare, coupled with the time-efficient and cost-effective services of ASCs, has led countless individuals to opt for diagnostic care in these centers, marking this channel as the fastest-growing one.

Regional Insights

What is the U.S. Ambulatory Surgical Center Market Size?

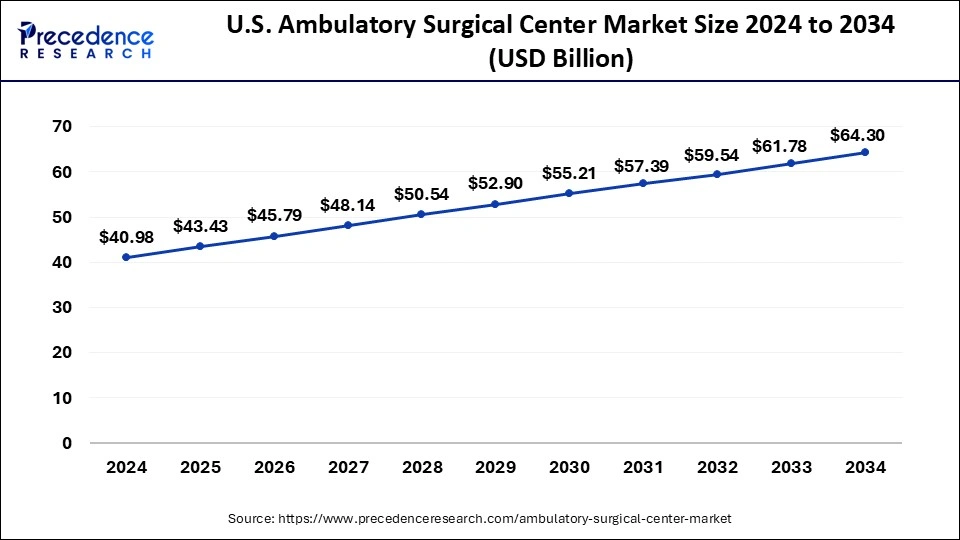

The U.S ambulatory surgical center market size is exhibited at USD 43.43 billion in 2025 and is projected to be worth around USD 66.63 billion by 2035, growing at a CAGR of 4.37% from 2026 to 2035.

North America dominated the ambulatory surgical center market with revenue share of over 43.32% in 2024. Increased government support for primary care services and expanding outpatient coverage are major elements driving the ambulatory surgical center market's expansion in the North America region.

Ambulatory services have positively influenced the U.S. healthcare system, enhancing accessibility, efficiency, and cost-effectiveness for both patients and providers. The count of inpatient admissions has noticeably declined in recent years because procedures are being moved to ASCs. In the United States, over 65% of operations take place in ASCs. This is mainly because of elevated inpatient hospitalization expenses and an increase in the use of advanced technologies by ASCs, facilitating swift and economical treatment delivery.

Based on the Definitive Healthcare SurgeryCenterView product, the U.S. hosts almost 9,600 operational ASCs.

The rising prevalence of chronic conditions like diabetes, heart disease, and cancer, alongside the growing demand for surgeries in India, has resulted in a notable increase in the expansion of Ambulatory Surgical Centers. In India, there has been a significant increase in the popularity of Ambulatory Surgical Centers because of their outstanding efficiency, unparalleled convenience, and remarkable cost-effectiveness. Due to the constantly growing population and the resulting increase in the need for healthcare services, the urgency for prompt and effective provision of medical care has become essential.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. The expansion of outpatient facilities has resulted from rising healthcare expenditures due to the rise in prevalence of chronic diseases, the ageing population, high healthcare expenditure, and growing hospitalizations rates. All these aforementioned factors are driving the growth of the ambulatory surgical center market in the region.

Europe is expected to grow significantly in the ambulatory surgical center market during the forecast period. The increasing incidence of disease in Europe is increasing the demand for ambulatory surgical centers. At the same time, the advancing healthcare sectors are also establishing new ambulatory surgical centers for delivering affordable and efficient surgical approaches.

Moreover, the adoption of advanced technologies is also attracting patients for minimally invasive surgical procedures. This, in turn, also enhances the safety and recovery periods. Furthermore, the government is also providing its support with the help of various investments as well as policies. Thus, all these factors promote medical tourism as well as market growth in Europe.

Latin America Ambulatory Surgical Center Market Trends

Latin America is witnessing significant growth in recent years and is expected to keep growing during the forecast period. This growth and development are due to various factors such as the rising preference for outpatient care, advancements in surgical technologies, and increasing government and insurance support for outpatient procedures.

In addition to that, the region has a rapidly growing geriatric population, which leads to the rise in chronic diseases, thus contributing to the increased demand for ambulatory surgical centers. The increasing shift towards outpatient care and the growing demand for cost-effective healthcare solutions are driving the growth of the region.

Middle East and Africa Ambulatory Surgical Center Market Trends

The Middle East and Africa are seen to be continuously expanding and are expected to maintain their steady growth trajectory in the upcoming years. This growth is due to the increasing demand for minimally invasive procedures, rising healthcare costs, and a growing focus on outpatient care.

The region is witnessing several advances in medical technology, supported by strong government initiatives that aim to improve healthcare infrastructure. These factors reflect a shift towards more accessible and patient-focused care. Other growth factors include surgical specialization, technological advancements, and patient care quality.

Ambulatory Surgical Center Market Companies

- Cerner Corporation

- Allscripts Healthcare Solutions Inc.

- McKesson Corporation

- Medical Information Technology Inc.

- Advanced Data Systems Corporation

- Surgical Information Systems

- NextGen Healthcare

- Philips Healthcare

- Epic Systems Corporation

- GE Healthcare

Recent Developments

- In May 2025, Oath Surgical introduces OathOS, the first end-to-end operating system for outpatient surgery, integrating proprietary AI technology with Oath's surgical centers for scalable value-based care.

(Source:https://www.businesswire.com) - In March 2025, Northtowns Ambulatory Surgery Center chose DistalMotion's DEXTER Robotic Surgery System as its outpatient surgical robot, marking a significant milestone in expanding robotic surgery access in outpatient care.

(Source: https://www.globenewswire.com) - In June 2024, WTWH Media LLC broadened its targeted health care industry reporting by introducing Ambulatory Surgery Center News, a specialized news and business insights platform for operators, investors, and other stakeholders in the ambulatory surgery center sector.

- In March 2025, Steindler Orthopedics declared the official opening of its new clinic and outpatient surgery center in North Liberty. The occasion would celebrate Steindler's 75th year of service to the Cedar Rapids–Iowa City Corridor, Eastern Iowa, and the broader Midwest. The newly built 100,000-square-foot facility in North Liberty includes a clinic layout with both on-stage and off-stage components to improve patient movement and promote teamwork among staff.

- In April 2024, Commons Clinic, a prominent value-oriented physician group transforming musculoskeletal care, announced its $9.75 million investment in Marina Orthopedic & Spine Institute, an innovative independent surgery center in the Los Angeles area that has established a national benchmark for minimally invasive spine and joint surgeries.

- GE Healthcare released Edison Datalogue. Software for Cryochain in 2019, MEDITECH and Google teamed up to make electronic health records data available on the Google Cloud Platform. This aided in the secure delivery of patient data as well as scalability and interoperability.

- Epic Systems and Teledoc Health teamed in 2019 to connect Teledoc's virtual care platform with Epic's App Orchard, allowing the firm to conduct telehealth video visits.

- Terveystalo purchased Attendo's Finland-based healthcare services in December 2018, and the combined operations were expected to begin in January 2019. This acquisition has helped the corporation get a stronger foundation in the Finnish market.

- AMSURG announced the acquisition of Horizon Eye & LASIK Center in May 2018 to introduce ophthalmology to its network of ambulatory surgery centers for better patient care.

- AmSurg Corporation declared in June 2016 that it would merge with Envision Healthcare Holdings Inc. a firm that delivers healthcare services with tremendous opportunities, fair treatment, and new innovations that benefit patients.

The demand in the ambulatory surgical center market is being fueled by an increase in research on service portfolios in mobile operative systems, which is being fueled by the rise of the healthcare sector. The key market players in the healthcare industry are investing in research and development in order to build mobile surgery centers. The acquisitions, mergers, collaborations, and product portfolio enhancement through substantial research and development are the main techniques used by businesses to increase revenue. The major market players are employing a variety of inorganic and organic growth tactics to acquire a significant market position and maintain industry rivalry in the ambulatory surgical center industry.

Segments Covered in the Report

By Ownership

- Physician Only

- Hospital Only

- Corporation Only

- Physician & Hospital

- Physician & Corporation

- Hospital & Corporation

By Surgery Type

- Dental

- Otolaryngology

- Endoscopy

- Obstetrics / Gynecology

- Opthalmology

- Orthopedic

- Cardiovascular

- Neurology

- Plastic Surgery

- Podiatry

- Others

By Speciality Type

- Multi-specialty

- Single specialty

By Service

- Diagnosis

- Treatment

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting