What is Type 2 Diabetes Management Market Size?

The global Type 2 diabetes management market uncovers key drivers such as increasing healthcare expenditure, aging populations and regulatory support for diabetes education and self-management programs. The market is witnessing remarkable growth as global health systems increasingly prioritize chronic disease prevention and personalized care.

Market Highlights

- By region, North America dominated the market, holding the largest market share of 50% in 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR in the type 2 diabetes management market between 2025 and 2034.

- By drug class, the injectable medications segment held the largest market share in 2024.

- By drug class, the oral medications segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By device type, the management devices segment contributed the biggest market share in 2024.

- By device type, the monitoring devices segment is growing at a notable CAGR between 2025 and 2034.

- By end-user, the patients segment held the largest market share in 2024.

- By end-user, the hospital segment is set to grow at a remarkable CAGR between 2025 and 2034.

- By distribution channel, the pharmacies segment held the largest share in the type 2 diabetes management market during 2024.

- By distribution channel, the direct-to-consumer segment is expected to grow at a remarkable CAGR between 2025 and 2034.

What is Type 2 Diabetes Management?

The type 2 diabetes management market comprises a broad spectrum of products and services aimed at managing and treating type 2 diabetes. This includes pharmaceuticals such as oral anti-diabetic drugs like metformin, sulfonylureas, DPP-4 inhibitors, and SGLT2 inhibitors, as well as injectable therapies like insulin and GLP-1 receptor agonists. It also includes medical devices such as blood glucose monitoring devices (glucometers, test strips, lancets), insulin delivery systems (pens and pumps), and continuous glucose monitoring (CGM) systems. Additionally, the market encompasses digital health solutions, including mobile applications, telehealth platforms, and remote monitoring tools, as well as lifestyle management services that focus on diet, exercise, and behavioral modifications to support diabetes control. The market is primarily driven by the rising prevalence of type 2 diabetes globally, rapid technological advancements in healthcare, and an increasing focus on personalized care and patient self-management.

The type 2 diabetes management market is profoundly optimistic, fuelled by advancements in pharmacology, connected devices, and digital health platforms. Industry growth is expected to accelerate as public health initiatives and value-based care models align toward long-term disease remission and metabolic health restoration. Sustainability trends are manifesting in the eco-conscious production of medical devices and the minimization of pharmaceutical waste. The promise of scalable digital platforms, AI-driven diagnostics, and data-driven therapeutics draws major investors. The startup economy thrives on innovation in biosensors, telehealth interfaces, and non-invasive glucose monitoring. The key technological shift lies in the fusion of artificial intelligence with endocrinology, where algorithms predict fluctuations before symptoms arise, redefining precision medicine in diabetology.

Key Technological Shifts in the Type 2 Diabetes Management Market

Technology is transforming diabetes management from reactive treatment to predictive, precision-based care. Continuous glucose monitoring, AI-driven insulin dosing algorithms, and integrated digital therapeutics are reshaping patient experiences. Wearables and IoT-enabled devices enable real-time data capture, facilitating timely interventions. Machine learning is being used to predict blood glucose fluctuations and personalized therapy regimes. Telemedicine platforms connect patients with specialists without geographic constraints. Overall, these technological advancements are revolutionizing disease management by combining clinical accuracy, convenience, and proactive healthcare.

Type 2 Diabetes Management Market Outlook

- Industry Growth Overview: The industry has witnessed remarkable growth as the prevalence of type 2 diabetes continues to rise due to lifestyle, genetic, and environmental factors. Innovation therapies, continuous glucose monitoring systems, and digital platforms are expanding the market's reach and sophistication.

- Sustainability Trends: Sustainability in this market is gaining momentum through eco-conscious production of devices and the minimization of pharmaceutical waste. Companies are adopting biodegradable packaging, energy-efficient manufacturing, and crucial supply chains for sensors and monitoring equipment. Digital health solutions are also reducing the need for frequent hospital visits, lowering carbon footprints associated with travel.

- Startup Economy: The startup ecosystem is flourishing, driven by entrepreneurs focused on connected devices, mobile health apps, and AI-based predictive analytics. Startups are addressing gaps in accessibility, affordability, and real-time monitoring, particularly in underserved regions. Innovative solutions such as smart insulin pens, continuous glucose monitors, and digital coaching platforms are disrupting traditional care models. Many startups are leveraging cloud computing and machine learning to provide personalized interventions. Collaborative accelerators and incubators are nurturing these ventures, facilitating rapid scaling. The vibrant startup economy is infusing agility, creativity, and patient-centricity into the diabetes management sector.

Market Key Trends in Type 2 Diabetes Management Market

- The defining trend of this market is the transition from glucose control to holistic metabolic empowerment. Personalized therapy regimens, integrating nutrition, genetics, and behavior analytics, are revolutionizing patient management.

- The advent of smart insulin pens, closed-loop systems, and mobile applications is enabling real-time adjustments in therapy. Another trend is the rise of combination drugs targeting cardiovascular and renal protection alongside glycaemic management.

- Preventive screenings using AI-assisted risk profiling are fostering earlier interventions. Furthermore, patient-centric ecosystems emphasize community support, teleconsultations, and mental health integration. These collective transformations mark a shift from clinical oversight to informed self-management, reflecting a paradigm of empowerment through data and empathy.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

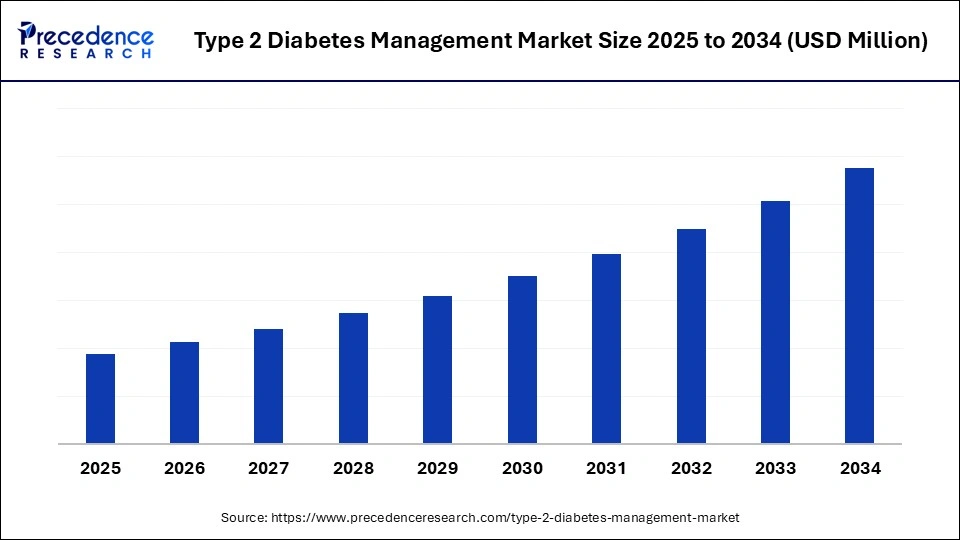

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Device Type, End User, Distrubution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Driver

Innovation as the Insulin of Progress

A surge in global diabetes prevalence is undeniably the prime catalyst driving expansion in the type 2 diabetes management market. The proliferation of wearable glucose monitors and AI-powered diagnostic platforms has made disease management more accessible and efficient. Growing awareness about preventive care, coupled with government initiatives promoting diabetes education, is fostering early diagnosis and treatment adherence. The pharmaceutical sector is innovating faster than ever, introducing long-acting insulins and oral GLP-1 receptor agonists that improve compliance. Meanwhile, digital therapeutics bridge the gap between healthcare providers and patients, offering continuous guidance and real-time analytics. As innovation flows freely, it fuels the insulin of progress, delivering precision, accessibility, and affordability to every diabetic patient across the globe.

Market Restraint

Affordability: The Achilles' Heel of Innovation

Despite its technological momentum, the type 2 diabetes management market is constrained by the enduring challenge of affordability. The high cost of continuous monitoring devices and next-generation drugs limits accessibility, particularly in developing regions. Unequal healthcare infrastructure amplifies disparities in diagnosis and treatment outcomes. Data privacy concerns in digital health solutions continue to impede widespread adoption. Moreover, inconsistent reimbursement frameworks and regulatory complexities hinder the seamless integration of novel therapeutics. A shortage of trained endocrinologists and diabetes educators further curtails effective management at the grassroots level. Thus, while the science surges forward, social and economic inequities remain the market's unresolved contradiction.

Market Opportunity

The Digital Dawn of Metabolic Health

The next great frontier in the type 2 diabetes management market lies in the digital democratization of healthcare. There is a vast opportunity in leveraging telemedicine, AI-powered predictive analytics, and cloud-based data sharing to personalize treatment and reduce clinical burden. The expansion of preventive programs within workplaces and communities opens avenues for early risk detection and intervention. Pharmaceutical collaborations with tech startups promise to yield hybrid ecosystems that integrate drug therapy with lifestyle tracking. Additionally, the growing elderly population in emerging markets presents untapped potential for remote patient monitoring. The fusion of wellness, data, and medicine heralds an era where diabetes management transcends disease control to embrace holistic human wellbeing.

Market Value Chain Analysis in Type 2 Diabetes Management Market

- Raw Material Sources: The market depends on a blend of biotechnological and chemical raw materials such as peptides, enzymes, and synthetic compounds used in drug formulations, alongside semiconductors and biosensor materials for device production. Sustainable sourcing and circular manufacturing principles are gaining traction to reduce environmental footprints.

- Technology Used: Key technologies encompass biosensors, non-invasive glucose monitoring, AI-based analytics, and data-integrated insulin pumps. The adoption of IoT-enabled smart devices ensures continuous and precise health monitoring, bridging the gap between clinical diagnostics and everyday living.

- Investment by Investors: Venture capitalists and institutional investors are actively funding AI-driven health startups, biosensor developers, and digital therapeutic platforms. Strategic partnerships between pharmaceutical giants and med-tech innovators are transforming the investment ecosystem into a hub for multidisciplinary collaboration.

- AI Advancements: Artificial intelligence has emerged as the cognitive core of modern diabetes care, enhancing predictive accuracy, automating diagnostics, and tailoring interventions to individual physiological responses. Machine learning models are refining insulin dosing algorithms, thereby minimizing human error and improving patient autonomy.

Segmental Insights

Drug Class Insights

Why Are Injectable Therapies Dominating the Type 2 Diabetes Management Market?

Injectable therapies remain the backbone of the type 2 diabetes management market, particularly for advanced or insulin-dependent cases. Their rapid action, predictable pharmacokinetics, and robust efficacy make them indispensable in clinical practice. Long-acting insulin analogs and GLP-1 receptor agonists are driving the segment's continued dominance. Clinicians prefer injectables for precise titration and personalized dosing protocols. Advanced training for patients ensures safe and effective self-administration, boosting compliance. The segments established infrastructure and long-standing clinical trust contribute to its leading market position.

Continual innovations in delivery devices, such as pre-filled pens and smart injectors, reinforce the dominance of these technologies. Improved patient comfort and reduced injection pain have mitigated historical barriers to acceptance. Pharmaceutical companies are investing in combination injectables that integrate multiple therapies into single doses. Accessibility programs and insurance coverage further expand patient reach. Clinical trials consistently demonstrate superior glycemic control compared to oral alternatives. Consequently, injectable medications remain the cornerstone of comprehensive diabetes management globally.

The oral medication segment is witnessing unprecedented growth as patients seek convenient, non-invasive alternatives to injectables. These formulations allow for improved adherence and flexibility in daily routines, making them particularly appealing for working adults. Pharmaceutical innovations have introduced combination therapies that target multiple mechanisms, enhancing glycemic control. Additionally, patient awareness campaigns are educating consumers about the benefits of oral regimens, driving adoption. Healthcare providers are increasingly prescribing oral medications in early-stage diabetes management to delay disease progression. Digital adherence tools and smart packaging solutions are further enhancing patient engagement and treatment compliance.

Oral medications are also benefiting from streamlined regulatory approvals and an expanding pipeline of novel compounds. Emerging markets are also showing a heightened preference for cost-effective, accessible oral therapies. Pharmaceutical companies are leveraging patient-centric studies to demonstrate real-world efficacy. Long-term safety profiles and fewer side effects are increasing confidence among both clinicians and patients. Collaboration with digital health platforms allows real-time tracking of adherence and glucose response. Overall, oral medications are reshaping patient expectations and therapeutic strategies in diabetes care.

Device Type Insights

Why Are Management Devices Dominating the Type 2 Diabetes Management Market?

Insulin pumps and automated delivery systems continue to dominate the device landscape in the type 2 diabetes management market due to their proven efficacy in controlling blood glucose levels. These devices offer precise dosing, programmable schedules, and integration with monitoring systems for closed-loop therapy. Clinicians favor management devices for patients requiring intensive insulin therapy or struggling with glycemic variability. The reliability and long-term clinical outcomes associated with these devices maintain their leadership in the market. Companies continuously innovate to improve usability, portability, and connectivity. Insurance coverage and patient training programs further reinforce adoption and adherence.

Advanced features like remote monitoring, data analytics, and mobile alerts complement management devices. Smart pumps and hybrid closed-loop systems reduce the risk of human error and improve patient quality of life. Device interoperability enables seamless data flow between healthcare providers and patients. Manufacturers are expanding offerings to cover different age groups, including pediatric and geriatric populations. Patient satisfaction surveys indicate high confidence and trust in these technologies. Overall, management devices remain central to structured, intensive, and technology-driven diabetes care.

Continuous glucose monitors (CGMs) and other monitoring devices are experiencing rapid adoption due to the demand for real-time insights into glycemic patterns. These devices empower patients to adjust lifestyle and medication, enhancing self-management proactively. Integration with smartphones and digital health platforms allows for remote monitoring and data sharing with clinicians. Technological advancements have improved accuracy, comfort, and battery life, making devices more user-friendly. Healthcare providers are increasingly relying on monitoring devices to guide treatment adjustments. Growth is further supported by reimbursement policies and patient education programs emphasizing preventive care.

Monitoring devices also facilitate predictive analytics and AI-driven alerts for hypo- and hyperglycemia. Wearable sensors and non-invasive technologies are being developed to enhance patient convenience further. Connectivity with insulin pumps and digital dashboards creates seamless management ecosystems. Data aggregation from multiple patients allows population-level insights for clinicians and researchers. Regulatory frameworks are evolving to support the safe integration of monitoring devices into standard care. As a result, these tools are revolutionizing diabetes management by combining precision, accessibility, and patient empowerment.

End User Insights

Why Are Patients Dominating the Type 2 Diabetes Management Market?

Patients remain the primary end-users and central drivers of the diabetes management market. With greater access to medications, devices, and digital health tools, individuals are actively participating in their care. Self-monitoring, adherence to treatment plans, and lifestyle interventions are critical factors influencing outcomes. Patient empowerment initiatives, including education and support communities, strengthen engagement. The availability of user-friendly devices and apps simplifies disease management, reducing dependency on clinical visits. Growing awareness of long-term complications motivates patients to adopt holistic management strategies.

Patient-centric innovations, such as telehealth, wearable sensors, and mobile reminders, further enhance compliance. Real-time feedback and predictive alerts improve decision-making and lifestyle adherence. Patients increasingly influence product development through feedback on usability and effectiveness. Social support networks and online communities provide guidance and motivation. Direct access to healthcare professionals via digital platforms fosters timely interventions. Consequently, patient engagement is both a market driver and a critical determinant of overall diabetes care success.

Healthcare providers are increasingly adopting integrated diabetes solutions to enhance patient outcomes. Clinics and hospitals are leveraging digital monitoring, decision-support systems, and connected devices to improve adherence and glycemic control. Physicians are incorporating telemedicine consultations to reduce travel burden and improve care continuity. Training programs equip providers with knowledge of advanced therapies and device management. Institutional partnerships with med-tech companies accelerate access to cutting-edge solutions. This growing focus on provider-centric tools is expanding their role in personalized diabetes management.

Providers also rely on aggregated patient data to identify trends and optimize treatment protocols. AI-driven insights help predict complications and guide therapy adjustments. The integration of electronic health records with device data enables seamless care coordination. Workshops and certification programs enhance provider competence in digital therapeutics. Increased reimbursement for provider-led interventions further fuels adoption. Collectively, healthcare providers are driving innovation and setting new standards in patient-centric diabetes care.

Distribution Channel Insights

Why Are Pharmacies Dominating the Type 2 Diabetes Management Market?

Pharmacies continue to dominate as the most accessible distribution channel in the type 2 diabetes management market. They provide a trusted interface for prescription fulfillment, patient counseling, and device demonstrations. Retail chains and independent outlets offer both oral and injectable therapies, along with monitoring supplies. Pharmacists often guide patients on dosage schedules, side effects, and device usage. Insurance partnerships and loyalty programs enhance accessibility and affordability. The established presence of pharmacies in urban and rural areas solidifies their dominance in the distribution landscape.

Pharmacies also facilitate awareness campaigns, educational materials, and preventive screening initiatives. Integration with digital health platforms allows seamless refills and subscription services. In-store demonstrations of monitoring devices enhance patient confidence and adoption. Collaborative efforts with healthcare providers ensure adherence and continuity of care. Technological upgrades, such as app-based refill reminders and tele-pharmacy, are modernizing the channel. Overall, pharmacies remain indispensable in bridging manufacturers, clinicians, and patients efficiently.

Direct-to-consumer (DTC) channels are expanding rapidly as patients increasingly prefer online purchases of medications, devices, and digital subscriptions. E-commerce platforms provide convenience, discreet packaging, and home delivery, catering to tech-savvy consumers. Subscription models and bundled offerings simplify adherence and device maintenance. Personalized recommendations and AI-driven health insights enhance the consumer experience. Teleconsultation integration ensures safe and guided product use. The growth of DTC channels is further accelerated by pandemic-driven adoption of online healthcare solutions.

Digital-first companies are leveraging data analytics to tailor marketing, reminders, and health interventions. Integration with mobile apps and wearable devices allows seamless monitoring and therapy management. DTC offerings often include educational content to improve self-management. Logistic partnerships ensure timely delivery even in remote areas. Consumer feedback loops drive iterative improvements in product design and usability. Consequently, direct-to-consumer channels are transforming how diabetes management solutions reach and engage patients.

Regional Insights - Type 2 Diabetes Management Market

Why Is North America Leading the Type 2 Diabetes Management Market?

North America leads the type 2 diabetes management market, holding a 50% share, driven by cutting-edge R&D, robust healthcare infrastructure, and strong patient awareness. The region's healthcare systems embrace telehealth and precision medicine at scale, fostering adoption of continuous glucose monitoring devices and smart therapeutics. Pharmaceutical and biotechnology companies lead in developing next-generation insulin analogs and digital health tools. Government initiatives supporting early screening and subsidized drug access further amplify the market's depth. The U.S., in particular, acts as the global nucleus for digital diabetes ecosystems, with startups merging AI, biosensing, and data analytics to redefine diabetic care paradigms.

In the second wave of innovation, North America's emphasis on patient empowerment, decentralized care, and sustainability continues to reshape the diabetic management framework. Integration of mental health support and lifestyle modification platforms underscores a holistic approach. Insurance reforms and partnerships between health-tech firms and traditional providers bridge accessibility gaps. As regulatory bodies adapt to accommodate digital therapeutics, the region stands poised to usher in a future where chronic disease care is as dynamic as technology itself.

Country Level Analysis

Will America's Digital Clinics Redefine Chronic Care in the Type 2 Diabetes Management Market?

The U.S. dominates the region's revenue share through a fusion of AI-driven therapeutics, large-scale insurance coverage, and a thriving telemedicine network. The convergence of pharma, health-tech, and policy innovation continues to shape a proactive healthcare model where technology meets empathy. In the type 2 diabetes management market, this integration is particularly transformative. AI-powered diagnostic platforms are enabling early detection and continuous glucose monitoring with higher precision, while predictive analytics assist in personalizing insulin therapy and medication regimens.

Major players are leveraging digital twins and machine learning models to simulate patient responses and optimize treatment outcomes in real time. Moreover, the widespread adoption of connected devices such as smart insulin pumps, continuous glucose monitors (CGMs), and wearable biosensors has enhanced patient engagement and adherence. Supportive reimbursement frameworks and government initiatives promoting digital health equity further reinforce the U.S. position as a global leader. Collectively, these factors are fostering a holistic and data-centric diabetes management ecosystem that prioritizes prevention, personalization, and long-term wellness.

Why Is the Asia Pacific Rising As the Epicenter of Preventive Care in the Type 2 Diabetes Management Market?

Asia Pacific is the fastest-growing type 2 diabetes management market, holding a 20% share, driven by a rapidly urbanizing population and increasing diabetes prevalence. Nations across the region are witnessing rising investments in healthcare digitization, particularly in mobile health and affordable diagnostic devices. Local manufacturers are collaborating with global companies to develop cost-effective biosensors and oral antidiabetic therapies. The awareness campaigns led by governments and NGOs are fostering early screening and lifestyle interventions at the community level.

In its second growth phase, the Asia-Pacific is transitioning from reactive treatment models to digital prevention ecosystems. Telemedicine platforms are expanding into rural regions, enabling access to endocrinologists through virtual consultations. The region's youth-driven startup ecosystem is particularly active in integrating wearables and smartphone-based glucose monitors. This intersection of innovation and accessibility positions the region as a beacon of digital health transformation.

Country Analysis

Why Is India Leading the Innovation in the Type 2 Diabetes Management Market?

India's booming healthcare-tech sector, coupled with government schemes promoting preventive care, is transforming the nation's approach to diabetes. Indigenous innovations ranging from AI-enabled risk profiling to low-cost continuous monitoring are empowering millions. With digital therapeutics on the rise, India could indeed turn its greatest health challenge into a wellness revolution.

Recent Developments

- In October 2025, a recent report by Morning News Today highlights a groundbreaking study published in Nature Medicine, revealing that prediabetes can be reversed even without weight loss. Conducted by researchers at the University Hospital Tubingen in Germany, the study found that participants who normalized their blood glucose levels through lifestyle changes, even if they did not lose weight, had a 70% lower risk of progressing to type 2 diabetes over five years compared to those who did not achieve remission

- In October 2025,People struggling with depression and anxiety often have elevated levels of stress hormones like cortisol,” explains Dr. Nishtha Laspal, Consultant Psychiatrist at Kailash Hospital, Noida. These hormones trigger the body to release glucose, causing blood sugar levels to rise even in the absence of food intake. Over time, this persistent elevation can impair insulin function and further disrupt glucose regulation. (Source: https://www.news18.com)

Top Type 2 Diabetes Management Market Companies

- Novo Nordisk: Novo Nordisk is the global leader in diabetes care, offering a wide portfolio of insulin analogs and GLP-1 receptor agonists such as Ozempic and Rybelsus. The company is driving innovation in oral insulin delivery and combination therapies, while also expanding into connected devices for real-time glucose and insulin management.

- Eli Lilly and Co.: Eli Lilly has established a strong presence with GLP-1 and dual agonist therapies, including Trulicity and Mounjaro, which target both glucose regulation and weight management. The company focuses on metabolic health innovation and has invested in integrated care solutions that combine medication with digital health support.

- Sanofi S.A.: Sanofi's diabetes portfolio includes long-acting insulins like Lantus and Toujeo, as well as biosimilar insulin solutions to improve affordability and access. The company continues to expand into digital diabetes management through partnerships that integrate continuous glucose monitoring and smart insulin delivery systems.

- AstraZeneca PLC: AstraZeneca leads in non-insulin-based Type 2 diabetes therapies, particularly SGLT2 inhibitors such as Farxiga and combination treatments like Xigduo. Its strategy focuses on cardio-renal-metabolic care, addressing diabetes-related complications such as heart failure and kidney disease.

- Abbott Laboratories: Abbott is a global frontrunner in continuous glucose monitoring with its FreeStyle Libre system, which enables real-time, needle-free glucose tracking. The company's ecosystem integrates CGM technology with digital health platforms to support personalized diabetes management and predictive insights.

Other Companies in the Type 2 Diabetes Management Industry

- Merck & Co., Inc.: Known for its DPP-4 inhibitor Januvia, Merck continues to expand its metabolic disease research pipeline for combination therapies and insulin alternatives.

- Boehringer Ingelheim International GmbH: Collaborates with Eli Lilly on SGLT2 inhibitor therapies such as Jardiance, targeting improved glucose control and heart health outcomes.

- Medtronic PLC: Develops advanced insulin pump and glucose sensor systems, integrating automated insulin delivery technology for more precise and personalized diabetes care.

- Dexcom, Inc.: Specializes in continuous glucose monitoring solutions with the Dexcom G6 and G7 systems, offering real-time glucose insights and digital health connectivity.

- Insulet Corporation: Manufactures the Omnipod insulin management system, a tubeless patch pump that simplifies insulin delivery and enhances patient convenience.

- Bayer AG: Provides oral antidiabetic medications and diagnostic solutions while investing in early-stage digital health technologies for metabolic monitoring.

- Takeda Pharmaceutical Co. Ltd.: Focuses on metabolic and endocrinology research, developing Type 2 diabetes therapies aimed at improving insulin sensitivity and gut hormone function.

Segments Covered in the Report

By Drug Class

- Oral Medications

- Biguanides

- Sulfonylureas

- DPP-4 Inhibitors

- SGLT2 Inhibitors

- Thiazolidinediones (TZDs)

- Injectable Medications

- Insulin

- Rapid-Acting Insulin

- Long-Acting Insulin

- GLP-1 Receptor Agonists

- Amylin Analogs

- Insulin

By Device Type

- Monitoring Devices- Fastest Growing

- Self-Monitoring Blood Glucose (SMBG) Devices

- Glucometers

- Test Strips

- Continuous Glucose Monitoring (CGM) Systems

- Real-Time CGM

- Flash Glucose Monitoring

- Self-Monitoring Blood Glucose (SMBG) Devices

- Management Devices

- Insulin Delivery Devices

- Insulin Pens

- Prefilled Pens

- Reusable Pens

- Insulin Pumps

- Insulin Delivery Devices

- Smart Insulin Pens

- Artificial Pancreas Systems

By End-User

- Healthcare Providers

- Hospitals

- Clinics

- Endocrinology Centers

- Patients

- Adults

- Geriatric Population

- Pediatric Population

- Caregivers

- Family Members

- Professional Caregivers

By Distribution Channel

- Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Hospitals and Clinics

- In-Hospital Pharmacies

- Outpatient Pharmacies

- Direct-to-Consumer

- Manufacturer Websites

- Third-Party E-commerce Platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content