Zirconium Market Size and Forecast 2025 to 2034

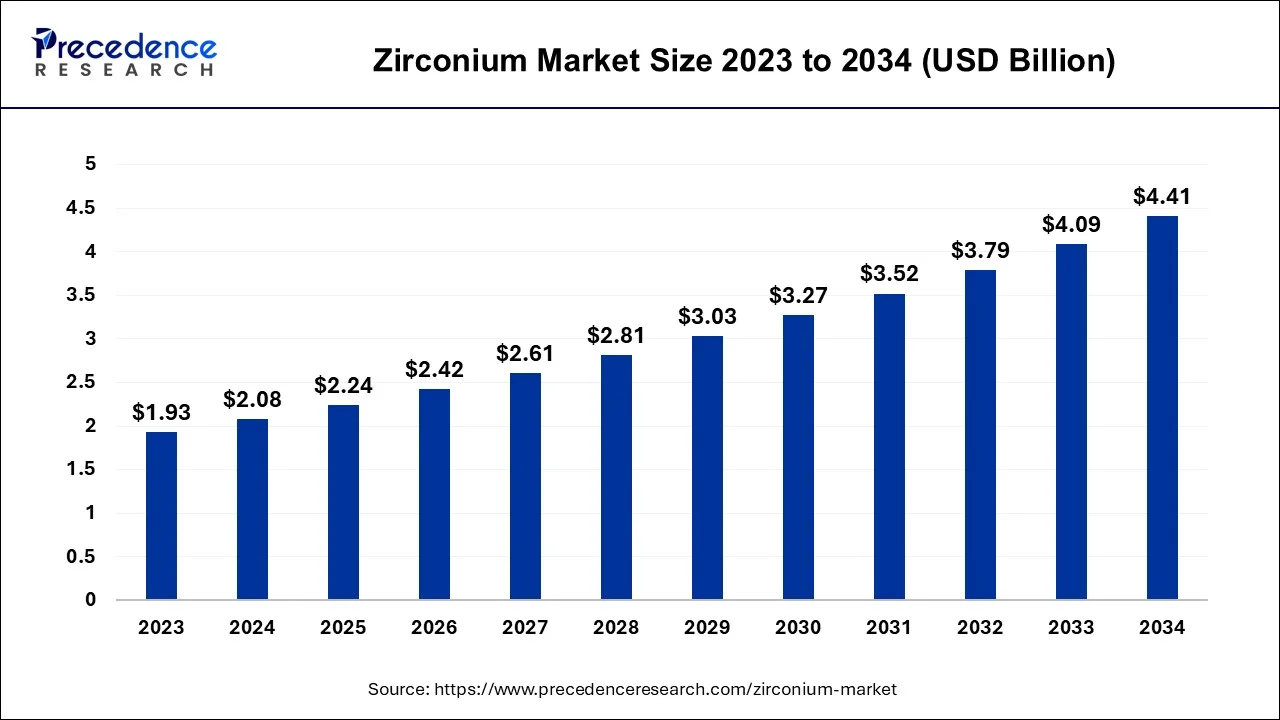

The global zirconium market size was estimated at USD 2.08 billion in 2024 and is predicted to increase from USD 2.24 billion in 2025 to approximately USD 4.41 billion by 2034, expanding at a CAGR of 7.80% from 2025 to 2034.

Zirconium Market Key Takeaways

- In terms of revenue, the market is valued at $2.24 billion in 2025.

- It is projected to reach $4.41 billion by 2034.

- The market is expected to grow at a CAGR of 7.80% from 2025 to 2034.

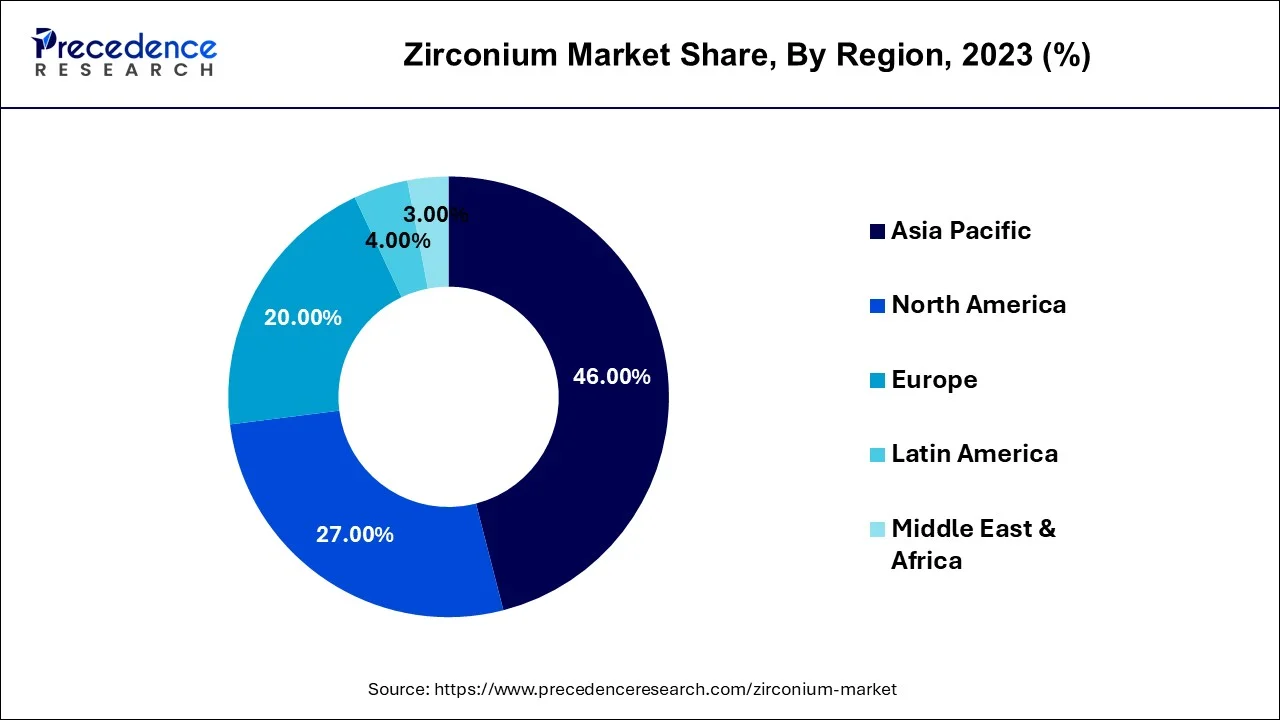

- Asia Pacific contributed more than 46% of revenue share in 2024.

- North America region is estimated to expand the fastest CAGR between 2025 and 2034.

- By occurrence type, the zirconia segment has held the largest market share of 35% in 2024.

- By occurrence type, the others segment is anticipated to grow at a remarkable CAGR of 8.8% between 2025 and 2034.

- By application, the zircon flour/milled sand segment had the largest market share of 29% in 2024.

- By application, the zircon metal segment is expected to expand at the fastest CAGR over the projected period.

Asia Pacificc Zirconium Market Size and Growth 2025 To 2034

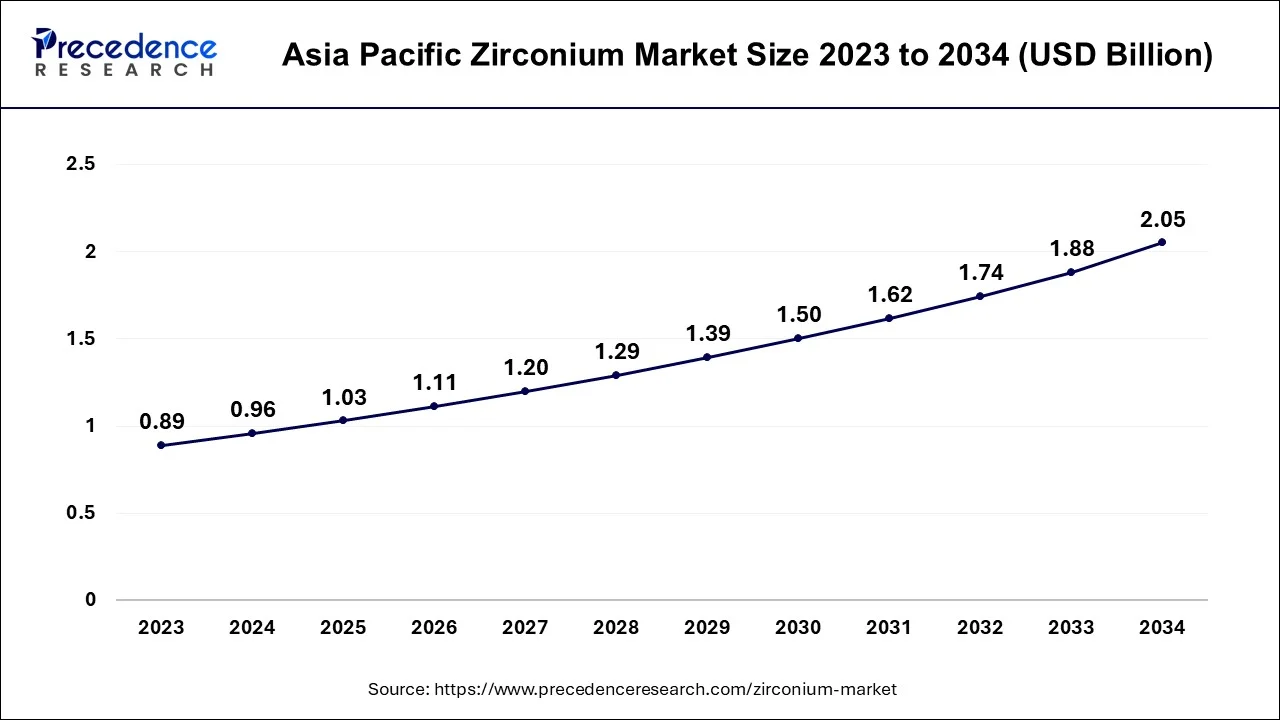

The Asia Pacific zirconium market size was estimated at USD 0.96 billion in 2024 and is expected to reach USD 2.05 billion by 2034, growing at a CAGR of 7.88% from 2025 to 2034.

Asia Pacific has held the largest revenue share of 46% in 2024. Asia Pacific exerts significant dominance in the zirconium market, driven by an array of distinctive factors. The region's robust industrial landscape and rapid urbanization dynamics act as pivotal drivers, propelling the demand for zirconium-based materials across diverse sectors, including construction, electronics, and the automotive domain.

Notably, Asia Pacific assumes a leading role in the burgeoning nuclear energy sector, amplifying zirconium's deployment within nuclear applications. The region benefits from bountiful zirconium reserves, notably in countries such as Australia and China, and their proactive involvement in zirconium mining and refining cements Asia Pacific's authoritative position in the global zirconium market.

North America is estimated to observe the fastest expansion.North America holds significant growth in the zirconium market for several reasons. The region boasts a robust aerospace and defense sector, which is a major consumer of zirconium due to its unique properties. Additionally, North America's advanced healthcare industry relies on zirconium for medical implants, further increasing demand.

The continent's well-established manufacturing infrastructure and technological advancements in zirconium production contribute to its dominance. Furthermore, the focus on sustainability and eco-friendly practices aligns with zirconium's recyclability, bolstering its use in various applications. These factors collectively position North America as a key player in the global zirconium market.

Europe is observed to grow at a considerable growth rate in the upcoming period, spurred by developments in sectors like automotive, aerospace, electronics, and nuclear energy. The region's focus on sustainable methods and rigorous environmental regulations is promoting the use of zirconium-based materials, which are known for their resistance to corrosion and stability at high temperatures. Moreover, the expansion of the construction industry and the rise in demand for advanced ceramics are driving the consumption of zirconium products throughout Europe.

Germany

Germany distinguishes itself within the European zirconium market because of its strong manufacturing base and technological innovation. The nation's flourishing ceramics sector, especially in the production of tiles and sanitary ware, significantly depends on zirconium compounds for their strength and visual appeal. Additionally, the automotive and aerospace sectors in Germany employ zirconium alloys for components that require high strength-to-weight ratios and resistance to extreme conditions, highlighting the material's versatility and significance in the country's industrial framework.

Market Overview

The zirconium market is a distinctive and vital segment in the global materials industry. Zirconium, recognized for its resistance to corrosion, holds a pivotal position in nuclear energy, chemical processes, and aerospace applications due to its exceptional qualities. The market's dynamics are closely tied to the performance of these key sectors, rendering it susceptible to market shifts. Primary zirconium production remains limited, with the majority sourced as a byproduct of titanium refining. Prices are influenced by supply-demand dynamics, geopolitical factors, and technological advancements. Although relatively compact compared to other metals, the zirconium market plays a fundamental role in numerous advanced and industrial applications.

Zirconium Market Growth Factors

- Increasing demand for lightweight, corrosion-resistant materials in the aerospace industry fuels the zirconium market growth.

- The expansion of nuclear energy programs worldwide boosts zirconium demand for fuel rod production.

- Zirconium's resistance to corrosive chemicals drives growth in its use for reactors, pipes, and vessels. Zirconium's contribution to lightweight materials in the automotive sector spurs market expansion.

- The growing use of zirconium alloys in medical implants propels market growth in the healthcare sector. Zirconium's use in capacitors and as a heat-resistant material in electronics contributes to market expansion.

- Zirconium's suitability for 3D printing applications leads to increased market demand.

- Infrastructure projects requiring durable materials boost zirconium market growth. Zirconium's corrosion resistance in harsh environments supports its use in the oil and gas industry.

- The use of zirconium in wind turbines and solar panels contributes to market growth in renewable energy sectors.

Major Key Trends in Zirconium Market

- Growth in Nuclear Energy Uses: The favorable characteristics of zirconium, including low neutron absorption and excellent corrosion resistance, position it as a perfect choice for nuclear fuel cladding, leading to increased demand as nations invest in nuclear energy generation.

- Expansion in Advanced Ceramics Industry: The increasing application of zirconium dioxide in high-tech ceramics for electronics, dental implants, and thermal barriers is propelling market growth due to its remarkable thermal and mechanical properties.

- Innovations in Processing Technology:Advancements in the extraction and refining methods for zirconium are improving purity levels and lowering production costs, which consequently widens its use in high-performance materials and emerging technologies.

Zirconium Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.80% |

| Market Size in 2024 | USD 2.08 Billion |

| Market Size in 2025 | USD 2.24 Billion |

| Market Size by 2034 | USD 4.41 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Occurrence Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Nuclear energy

Nuclear energy serves as a catalyst of paramount importance, propelling the zirconium market into robust growth. This is attributed to the extraordinary attributes of zirconium, notably its unparalleled resistance to corrosion and its capacity to withstand intense temperatures, rendering it an indispensable cornerstone within nuclear reactors. In a world that increasingly craves sustainable and dependable energy sources, the resurgence of the nuclear industry stands as a pivotal force directly shaping the expansion of the zirconium market.

In the nuclear realm, zirconium finds its vital role primarily in the composition of fuel rods and reactor components. It acts as a protective shield, segregating nuclear fuel from the cooling system, thereby averting the escape of radioactive materials. The construction and amplification of nuclear power plants, particularly in burgeoning economies, have instigated a surge in the demand for zirconium. Additionally, the advent of innovative reactor designs such as small modular reactors (SMRs) and next-generation nuclear technologies introduces fresh avenues for the utilization of zirconium.

Restraint

Limited supply sources

The restraint stemming from the limited availability of supply sources constitutes a substantial obstacle to the zirconium market's expansion. Zirconium heavily relies on a select few key suppliers, primarily centered in Australia and South Africa. This concentrated supply chain renders the market susceptible to disruptions emanating from various origins. To begin, geopolitical unrest in these supplier regions can disrupt the extraction and export of zirconium ores, leading to scarcities in the market.

Regulatory adjustments and constraints imposed on mining activities in these countries can further constrict the accessibility of zirconium, intensifying market unpredictability. Additionally, the pronounced dependence on a handful of sources makes the market vulnerable to price oscillations. Imbalances between supply and demand and external economic factors can precipitate fluctuations in zirconium prices, impacting production costs and consumer pricing.

Moreover, this constraint curtails the diversification of supply sources, an imperative element for a resilient and secure supply chain. A dearth of supply alternatives hinders the market's capacity to adapt to shifting circumstances and effectively meet surging demand. Consequently, the zirconium market remains exposed to the risk of supply disruptions and price instability, both of which can hinder its overarching growth and advancement.

Opportunity

Advanced ceramics

Cutting-edge ceramics, where zirconium plays a pivotal role, are sculpting exclusive avenues of potential within the zirconium market. These innovative ceramics, renowned for their extraordinary mechanical, electrical, and thermal properties, serve as multifaceted assets across diverse domains, including aerospace, electronics, and medical devices. In aerospace, ceramics enriched with zirconium are ingeniously woven into critical components like turbine blades, capitalizing on their tenacity in high-temperature environments and robust mechanical prowess.

As the aerospace industry relentlessly pursues lightweight, high-performance materials, ceramics imbued with zirconium emerge as fertile ground for market expansion. Within the electronics realm, the ever-escalating demand for ceramics endowed with dielectric properties positions zirconium-infused ceramics as prized commodities, particularly in capacitors and insulating elements. The ceaseless surge in electronics manufacturing and the onset of pioneering technologies bolster the insatiable hunger for zirconium-based ceramics. In the medical sphere, zirconium-based ceramics make substantial contributions to dental implants and prosthetics, courtesy of their biocompatible essence and impressive fortitude.

The thriving healthcare sector and the mounting necessity for state-of-the-art medical devices offer additional thoroughfares for market growth. Collectively, the incorporation of zirconium-based advanced ceramics within these sectors is poised for steadfast advancement, unearthing extraordinary vistas of opportunity within the zirconium market.

Impact of COVID-19

- The zirconium market grappled with profound supply chain disturbances triggered by the COVID-19 pandemic. Lockdowns, workforce shortages, and travel restrictions threw the mining and processing of zirconium ores into disarray, leading to substantial production delays. These upheavals subsequently caused scarcities in zirconium materials, ushering in price volatility and supply uncertainties. Given the zirconium market's reliance on a limited range of sources, the pandemic-induced supply chain disruptions cast a significant shadow over market stability.

- A multitude of industrial projects tethered to zirconium-based materials found themselves either delayed or abandoned due to the uncertainties sown by the pandemic. The postponement in the integration of zirconium products into sectors like nuclear energy and advanced ceramics bore tangible ramifications on the market's expansion.

Occurrence Type Insights

The zirconia segment held 35% revenue share in 2024. The zirconia segment's substantial market presence can be credited to its prevalence in various structural configurations and its extensive utility across multiple industries. Its malleability and versatility render it an appealing choice for applications spanning advanced ceramics, dental prosthetics, fuel cells, and electronic components. Given its ability to cater to the diverse requirements of different sectors, zirconia emerges as the favored option, securing a significant portion of the zirconium market.

The others segment is anticipated to expand at a significant CAGR of 8.8% during the projected period. The segment commands significant growth in the zirconium market due to the diversity of sources from which zirconium is extracted. While zircon, a zirconium silicate mineral, represents a substantial portion, other minerals, such as baddeleyite and various industrial by-products, also contribute. This diverse range of sources ensures a stable and robust supply, reducing the market's vulnerability to disruptions from a single source. It provides a degree of flexibility and resilience, making it a pivotal component in meeting the varied and growing demand for zirconium across multiple industries and applications.

Application Insights

The zircon flour/milled sand segment is anticipated to hold the largest market share of 29% in 2024. The zircon flour/milled sand segment asserts a significant market share in the zirconium industry due to its extensive applicability across diverse end-user sectors. Zircon flour, recognized for its high refractoriness and outstanding capacity to withstand extreme temperatures, finds widespread usage in the foundry, ceramics, and refractory industries. Furthermore, it assumes a pivotal role in the production of zirconium compounds, which are integral components in nuclear reactors and advanced ceramics. This segment's versatility and indispensable role across these varied industries solidify its prominence as a dominant and highly sought-after segment within the zirconium market.

The zircon metal segment is projected to grow at the fastest rate over the projected period. The zircon metal segment commands a significant growth in the zirconium market primarily due to its extensive use in various key end-user industries. Its exceptional properties, including corrosion resistance and heat tolerance, make it indispensable in the nuclear industry for fuel rods and reactor components. Additionally, it finds applications in aerospace, ceramics, and refractory materials. The booming nuclear energy sector and advancements in aerospace and ceramics drive robust demand for zircon metal. Its versatility and unique attributes establish it as a dominant force in the zirconium market across diverse industrial applications.

Zirconium Market Companies

- Tronox Holdings plc

- Iluka Resources Limited

- E. I. Du Pont de Nemours and Company

- Alkane Resources Ltd.

- Kenmare Resources plc

- Foskor (Pty) Ltd.

- Richards Bay Minerals

- Exxaro Resources

- MZI Resources Ltd.

- Luxfer Group

- Wah Chang

- Astron Advanced Materials

- Zircomet Limited

- Alkane Resources Ltd.

- Namakwa Sands

Recent Developments

- In October 2023, Tronox Holdings plc proclaimed a price increase for its zirconium oxide products across all grades and regions, effective immediately. This change is a response to strong demand and inflationary pressures, aiming to maintain product quality and availability.

- In August 2023, Iluka Resources unveiled plans to establish a rare earth oxide refinery at Eneabba, Western Australia, receiving backing from the Australian Government. This facility intends to boost the processing of zirconium and rare earth elements, strengthening supply chains.

- In May 2023, Eramet has launched its initial audit under the Initiative for Responsible Mining Assurance system, highlighting its commitment to sustainable and ethical mining practices in the extraction and processing of zirconium.

- In October 2023,Tronox Holdings plc made headlines by revealing a hike in the prices of their zirconium oxide products, encompassing all grades and geographical regions. This swift price adjustment came into immediate effect and was prompted by Tronox's response to the robust demand for zirconium oxide and the persistent pressures of inflation.

- In February 2023,Iluka, the globe's foremost zircon producer, unveiled impressive sales figures, which were ascribed to the escalating prices within the zircon market. As a preeminent global provider of top-tier zircon, Iluka reaped the rewards of prevailing market dynamics, which witnessed an upward trajectory in zircon prices. Zircon, a pivotal material in various sectors including ceramics, foundry operations, and nuclear power generation, played a pivotal role in this market dynamic.

Segments Covered in the Report

By Occurrence Type

- Zircon

- Zirconia

- Other Occurrence Types

By Application

- Zircon Flour/Milled Sand

- Zircon Opacifier

- Refractories (Zirconia)

- Zircon Chemicals

- Zircon Metal

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting