What is the Small Modular Reactor Market Size?

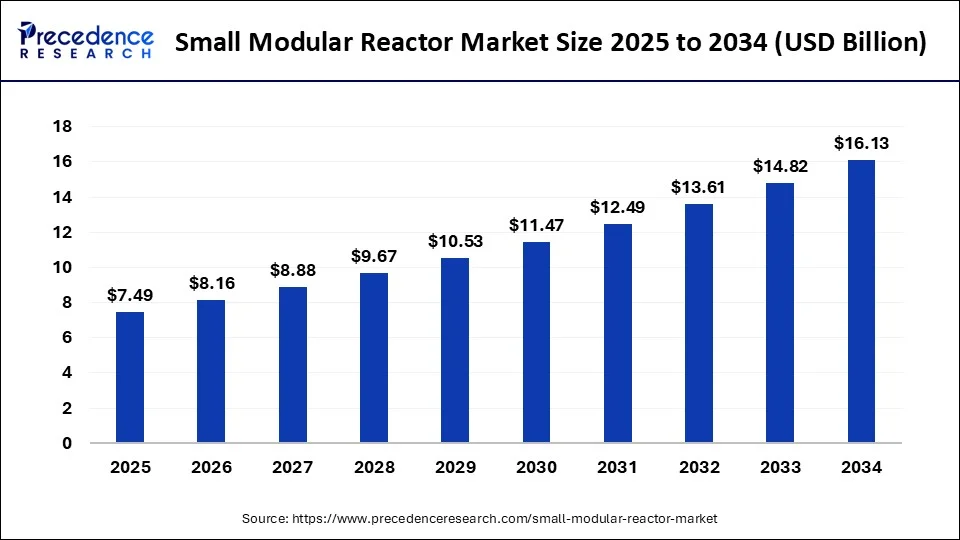

The global small modular reactor market size accounted for USD 7.49 billion in 2025, and is expected to reach around USD 16.13 billion by 2034, expanding at a CAGR of 8.9% from 2025 to 2034.

Market Highlights

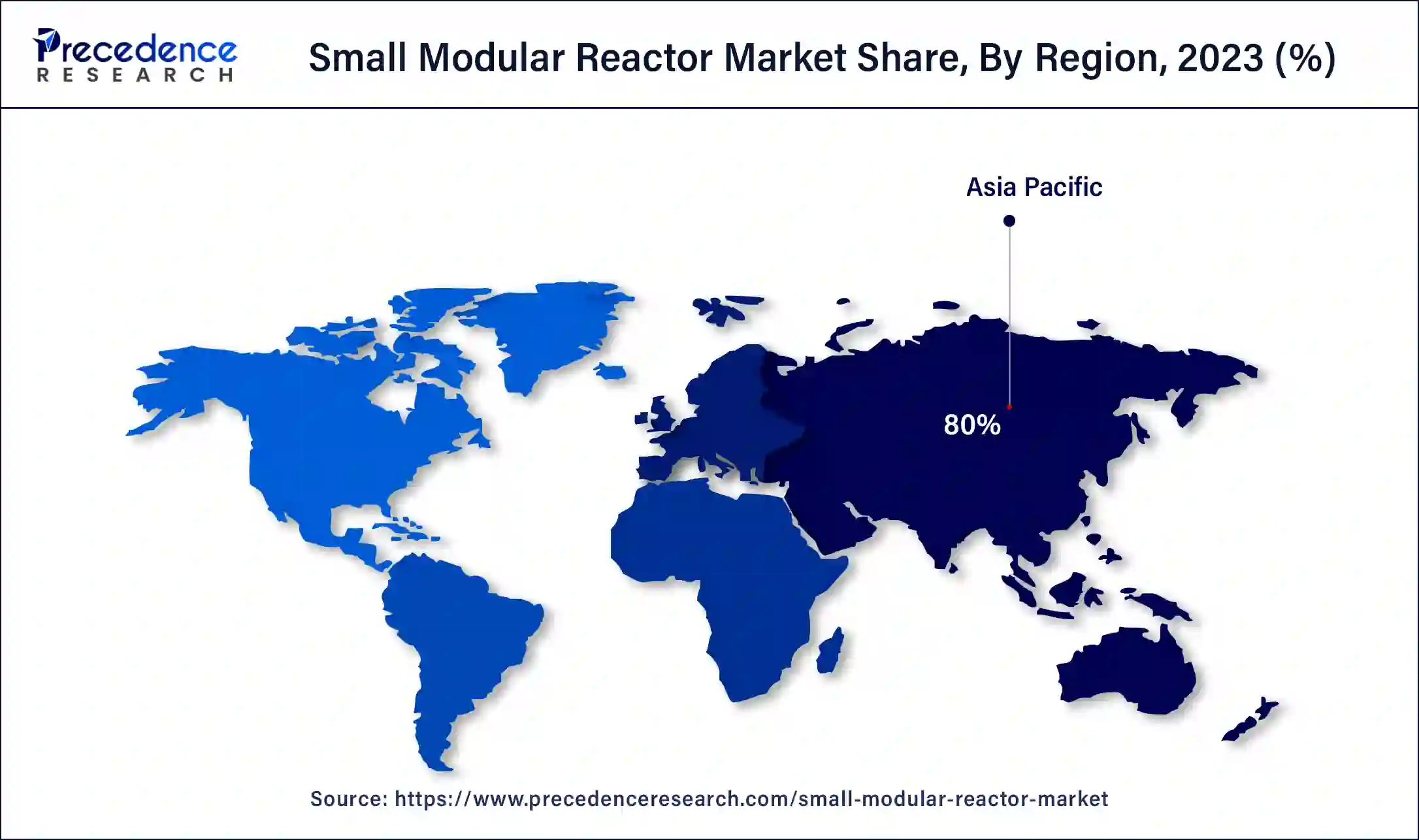

- Asia-Pacific led the global market with the highest market share of 80% in 2024.

- By Reactor Type, the heavy water reactors segment dominated the market in 2024.

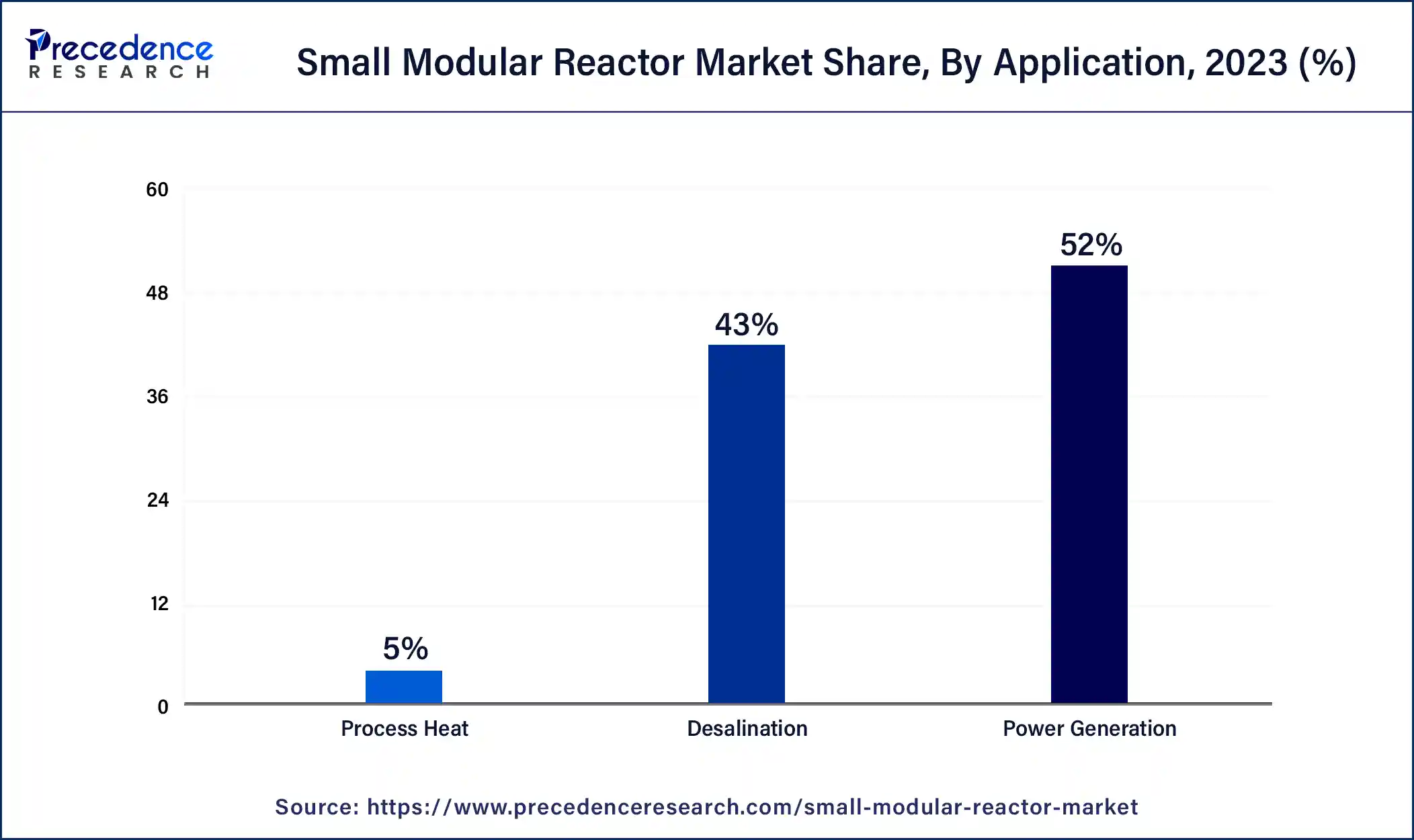

- By Application, the power generation segment dominated the market in 2024.

Market Size and Forecast

- Market Size in 2025: USD 7.49 Billion

- Market Size in 2026: USD 8.16 Billion

- Forecasted Market Size by 2034: USD 16.13 Billion

- CAGR (2025-2034): 8.9%

- Largest Market in 2024: Asia Pacific

Market Overview

Small modular reactors (SMRs) are gaining interest as a potential solution to reduce the capital costs of nuclear power plants and provide power to small grid systems. The construction of prototypes such as CAREM-25 in Argentina and KLT40S in the Russian Federation and the progress of other designs indicate that SMRs are becoming a more viable option for nuclear power generation.

To assess the potential market for SMRs in the short to medium term, the Nuclear Energy Agency (NEA) is collecting and analyzing economic and market data, including factory production cost estimates. This project will provide a better understanding of the economic viability of SMRs and help inform decision-makers on the role of SMRs in the future of nuclear power generation.

It is worth noting that SMRs face several challenges, including regulatory hurdles and the need for significant investment in research and development. However, if these challenges can be overcome, SMRs could play a significant role in meeting the growing demand for energy while reducing greenhouse gas emissions.

Growing global electricity demand and the flexibility of SMRs in terms of size and power output are some factors driving the global small modular reactor market. The older generation of nuclear power plants is extensive and requires significant capital and building time. Atomic reactors are challenging to install in areas far from large power grid systems. As a result, setting up a nuclear reactor in remote locations is not feasible, paving the way for developing smaller atomic reactors. With a greater emphasis on achieving political and technological solutions to climate change, many experts worldwide highlight nuclear reactors' virtually emissions-free power.

In August 2022 the DOE's Nuclear Energy University Program approved funds to Core Power, the MIT Energy Initiative, and Idaho National Laboratory (INL) to research the economic and environmental benefits of floating advanced nuclear power generation.

Market Trends

- The rapid growth of generative AI is transforming industries by automating tasks, enhancing creativity, and introducing new risks and opportunities.

- The rising focus on sustainability, with a commitment to net-zero carbon emissions and transparent reporting drives the growth of the market.

- The widespread adoption of 5G technology is enabling advancements in connected devices, smart cities, and real-time data processing, particularly impacting manufacturing and healthcare sectors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.49 Billion |

| Market Size in 2026 | USD 8.16 Billion |

| Market Size by 2034 | USD 16.13 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.9% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Reactor Type, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing electricity demand

Increasing residential and industrial electricity usage encourages governments to prioritize sustainable power over conventional power generation to reduce their carbon footprint. Furthermore, the increasing electrification of connected devices, transportation, and other critical services is increasing the demand for more power, increasing the demand for tiny modular reactors emitting less carbon. For instance, according to world energy & Climate statistics, global energy consumption shows 5% growth in 2021, After a 4.5% decline in 2020.

The growing interest in developing renewable energy sources is expected to open significant industry opportunities. Furthermore, governments worldwide are aware of the deteriorating environmental balance and are taking necessary steps to restore it, including imposing strict limits on hazardous emissions. As a result of these regulations, new investors are flocking to compact modular reactors. Aside from that, the capital needed to construct a small modular reactor facility is less than that required to build a traditional nuclear facility. Small modular reactors necessitate less construction, which reduces investment costs.

Challenges

Regulatory barriers

The first and most significant challenge is the presence of regulatory barriers. Many SMR designs include novel features such as enhanced passive safety systems and multi-modular deployment (i.e., multiple reactor modules on the same site or pool). NuScale, for example). The SMR vendors argue that these features could reduce operational staffing requirements (see discussion in Rothwell, 2016: 168) and the size of emergency planning zones due to the application of regulations. As for any NPP, the safety and security requirements for SMR are precise, but the question is how SMR will demonstrate that they can meet those requirements. Regulators and technical support organizations will also require time to decide on these options and innovations, which may cause delays.

Opportunities

Reduction of carbon dioxide emissions into the atmosphere

SMRs have the potential to significantly reduce greenhouse gas emissions. They could provide an alternative baseload power source, allowing the retirement of older, smaller, and less efficient coal-fired power plants that would otherwise not be suitable for retrofitting with carbon capture and storage technology. They could be used in the U.S. and the world where other carbon-free energy sources, such as solar and wind, are scarce. There could be technical or commercial constraints, such as expected energy demand growth and transmission capacity, allowing SMRs but not GW-scale LWRs to be installed. The manufacturing base required for SMRs can be established domestically, which is critical for onshore production.

Segments Insights

Reactor Type Insights

Based on the reactor type, heavy water reactors dominated the market. The heavy water reactors are significantly more expensive than ordinary light water, it provides improved substantially neutron economy, allowing the reactor to operate without fuel enrichment facilities (offsetting the additional expense of the heavy water) and improving the reactor's ability to use alternate fuel cycles. Furthermore, heavy water reactors regulate their isotopic purity for optimal reactor physics performance. For example, increasing the isotopic purity of heavy water improves fuel economy and reduces waste generation. This can be accomplished by minimizing light water ingress into heavy water systems and maximizing the purity of recovered water before it is returned to the reactor. p in controlling isotopic purity to achieve optimal reactor physics performance.

Application Insights

Based on application, the power generation segment dominated the small modular market in 2024and is expected to continue to lead during the forecast period.On the other hand, the desalination segment is the second fastest-growing market owing to the increasing demand for potable water in semi-arid and arid zones.

Small molecular reactors are used for nuclear desalination, and where portable water is produced from seawater in the facility. Desalination plants are designed to make portable water or used as co-generation atomic power plants to generate electricity.

Regional Insights

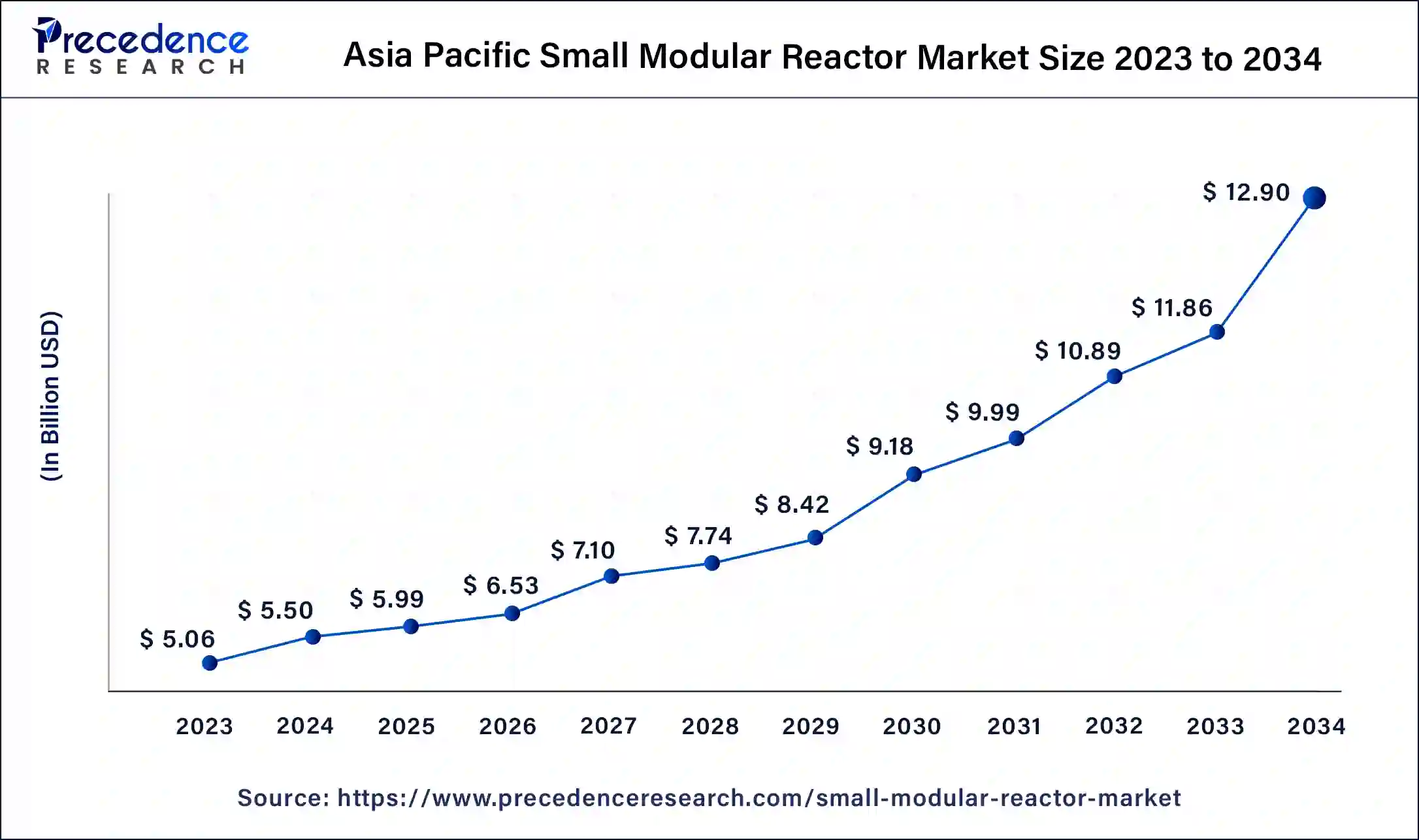

Asia Pacific Small Modular Reactor Market Size and Growth 2025 to 2034

The Asia Pacific small modular reactor market size was estimated at USD 5.99 billion in 2025 and is predicted to be worth around USD 12.90 billion by 2034, at a CAGR of 9.1% from 2025 to 2034.

Asia Pacific is dominating thesmall modular reactor market and is expected to grow in the forecast period

China is highly active in the field of SMRs, with many designs, competition among various manufacturers, and many projects in the planning and construction stages. China is interested in using SMRs for multiple applications, including electricity generation, process, and district heating. China funds several research, development, and demonstration programs for advanced reactors, including Generation III and IV, for commercial and sustainable development.

Nuclear power has grown dramatically in China over the last decade because of political decisions to promote technology. The potential market for SMRs is significant within China. How well this translates to the export potential for the SMR designs remains to be seen, as the only Chinese NPP built outside of China is in Pakistan. Various regulatory and other issues could act as roadblocks.

Nowadays, Interest in SMRs has been steadily increasing, but this interest has yet to be translated into many projects. SMR deployment plans are apparent in the United States, Canada, the United Kingdom, China, and Russia. When contemplating deploying new SMR designs, the FOAK plants become significant for the future, as they can be viewed as demonstration plants in some cases, particularly for non-LWR structures. With clear, national-level interest in the project, the number of actors willing to take a risk on a FOAK SMR is unlimited. Government such as US and UK have signalled their interest in supporting a new build and then exporting the technology. Without this level of support, It is presumable that many designs will die in innovation valley death.

U.S. has provided larger-scale support for SMRs since 2012 when the Department of Energy (DOE) allocated USD 450 million to develop an advanced US-based LWR. Initially, the B&W mPower design was given permission, which was later shelved. The DOE has supported a variety of plant designs, but the NuScale 60 MWe SMR is currently the design with the most funding behind it. NuScale is presently undergoing NRC design certification, which is expected to be completed by 2022. The first fully commercial 12-module and 720 MWe plants are expected to come online by 2027 at DOE's Idaho National Laboratory site.

The UK government announced a grant of £210 million to Rolls-Royce SMR to match private investment in this venture in 2021. Rolls-Royce Group, BNF Resources UK, and Exelon Generation will each invest £195 million in it over the next three years. According to Rolls-Royce, the SMR business will now "proceed rapidly with a range of parallel delivery activities, including entry into the UK generic design assessment (GDA) process and identifying sites for the factories that will manufacture the modules that enable onsite assembly of the power plants." The reactor is intended to produce hydrogen andsynthetic fuels, as well as the generation of electricity. In addition, Rolls-Royce announced in November 2022 that it had identified four priority locations in the UK for the construction of SMR-based power stations, including Trawsfynydd, Wylfa, and Old bury. All of the sites are on land owned by the UK Nuclear Decommissioning Authority (NDA). Before the NDA commits to SMR development, the Department of Business, Energy, and Industrial Strategy must first approve it.

Small Modular Reactor MarketCompanies

- ARC Energy LLC

- China National Nuclear Corporation

- Fluor Corporation

- GE Hitachi Nuclear Energy

- Holtec International

- IHI Corporation

- Leadcold Reactors AB

- Mitsubishi Power Ltd.

- Moltex Energy Ltd.

- NuScale Power

- LLC.

- OKBM Afrikantov

- Rolls-Royce plc

- SNC-Lavalin Group

Recent Development

- In 2022, The French government announced that the Nuward SMR design will be included in the France 2030 plan, granting it access to $1.1 billion (€1 billion) in public funding. The government expects to see an SMR prototype by 2030, which will help the country reach its goal of 25 GW of new nuclear generation by 2050.

- In 2021, GE HNE announced a partnership with Ontario Power Generation to build Canada's first SMR. GE HNE is already working on refurbishing the four existing conventional reactors at the Darlington Nuclear Generation Station. According to the terms of the December agreement, the new BWRX-300 reactor would begin operations as the fifth unit of the Darlington Nuclear Generation Station in 2028.

- In 2021, NuScale had announced that the DOE in 2022 would fund Ukraine's State Scientific and Technical Center for Nuclear and Radiation Safety to conduct an independent review of NuScale Power's safety analysis report for its SMR technology.

Segments Covered in the Report

By Reactor Type

- Heavy water Reactor (HWR)

- Light water Reactor (LWR)

- Fast neutron Reactor (FNR)

By Application

- Desalination

- Power Generation

- Process Heat

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting