What is the Medical Implants Market Size?

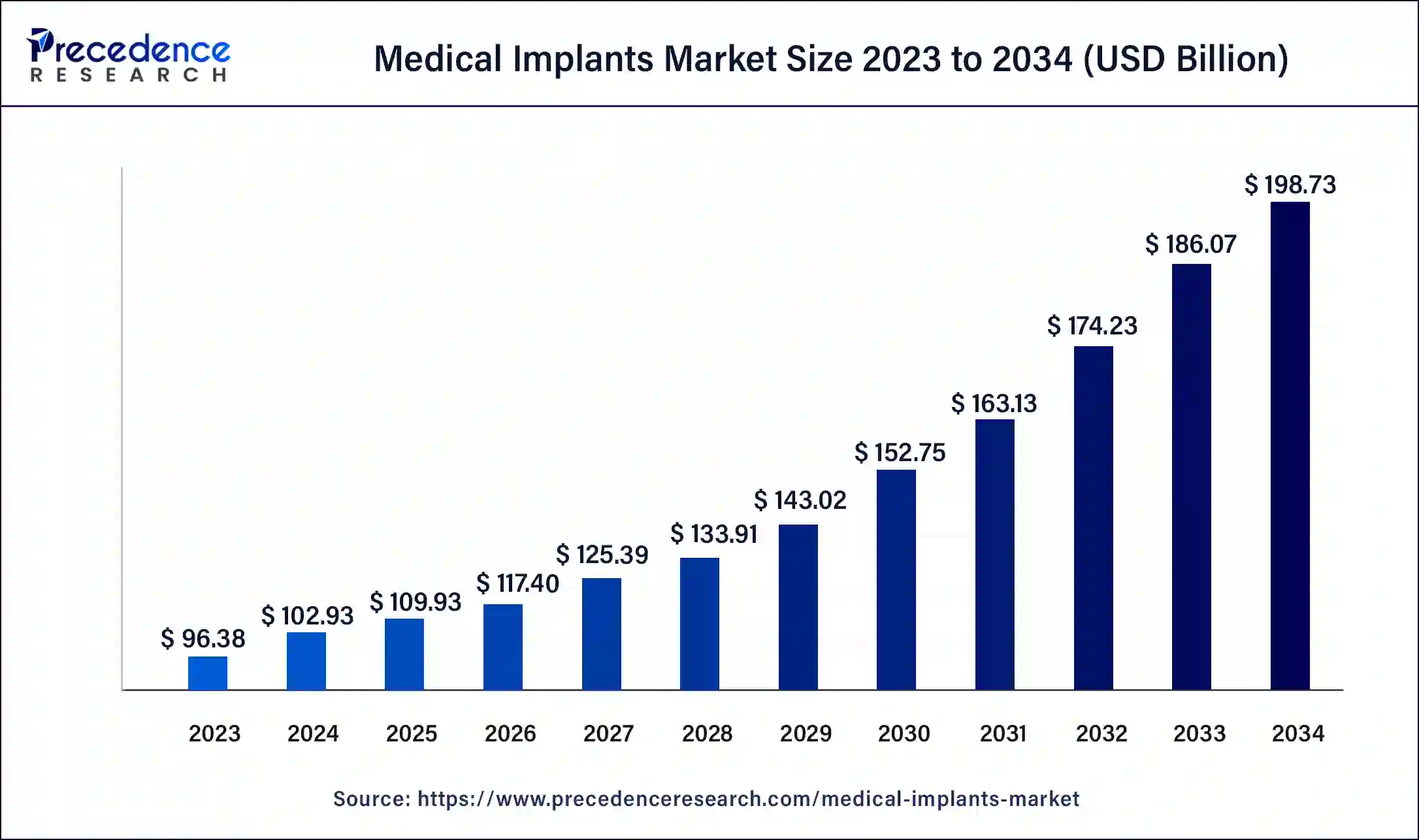

The global medical implants market size is calculated at USD 109.93 billion in 2025 and is predicted to increase from USD 117.40 billion in 2026 to approximately USD 210.84 billion by 2035, expanding at a CAGR of 6.73% from 2026 to 2035.

Medical Implants Market Key Takeaways

- North America led the global market with the highest market share of 44% in 2025.

- By product type, the orthopedic segment has held the largest market share in 2025.

- By biomaterial, the metallic segment captured the biggest revenue share in 2025.

How is AI contributing to the Medical Implants Market?

The medical implants market gets a significant advantage from AI in terms of accuracy in design, predictive modeling, and individual treatment. The heavy data sets from the medical field are analyzed by AI to help in the selection of implants and the creation of patient-specific surgical plans that are patient-specific. AI is the primary cause for increased early diagnosis precision; it is also the one that facilitates monitoring and clinical decisions. Automated insights are the main tool of the latter. AI-powered smart implant systems allow health monitoring from a distance, and the optimization of devices and the analysis of healing after surgery are all done in a manner that is more rewarding for the patients and the overall control of the treatment in the long term.

Medical Implants Market Growth Factors

The rising prevalence of chronic diseases ad growing geriatric population across the globe are the primary drivers of the global medical implants market.According to the United Nations, there were around 382 million old age people, aged 60 years or above, across the globe in 2017 and this number is expected 2.1 billion by 2050. The old age people are prone to various chronic diseases such as cardiovascular diseases, endovascular diseases, orthopedic disorders, and dental disorders, which can foster the demand for the medical implants across the globe. The kidney implants, joints implants, eye implants, and heart implants are some of the common medical implants among the geriatric people. Furthermore, the increasing awareness regarding the availability of medical implants, presence of advanced healthcare infrastructure, rising disposable income, and increasing consumer expenditure on healthcare are the prominent drivers that boosts the adoption of the medical implants among the patients. Moreover, availability of wider range of different medical implants serves a wider need for the implants such as cardiovascular implants, orthopedic implants, and various other types of implants.

Moreover, the rising concerns regarding the aesthetics and physical appearances among the population is another factor that drives the demand for the medical implants. The technological advancements in the healthcare industry has allowed the people to improve their looks and enhance their beauty by implanting medical implant devices such as dental implants, breast implants, pectoral implants, deltoid implants, and cochlear implants. Moreover, the presence of numerous market players and various developmental strategies adopted by them plays a prominent role in influencing the market. Moreover, the rising number of cases in which limbs or organs are damaged is a major factors that may drive the demand for the medical implants across the globe. All these factors are expected to drive the growth of the global medical implants market during the forecast period.

Medical Implants Market Outlook

Continuous expansion of the market mainly due to new technologies, longevity of the population, and better medical services.

More and more attention is paid to the use of biocompatible biodegradable implant materials, which are supporting environmentally responsible healthcare solutions worldwide.

Stronger and stronger growth in developing regions with better healthcare access and implant technology penetration.

Continuous funding and innovation from Johnson & Johnson, Medtronic, Stryker, and Zimmer Biomet, who are the main players behind innovations in the field.

3D printing, personalized implants, and smart technologies are the main factors that contribute to the vibrancy of startup Jinnovations and product diversification.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 109.93 Billion |

| Market Size in 2026 | USD 117.40 Billion |

| Market Size by 2035 | USD 210.84 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.73% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Biomaterial, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Medical Implants Market Segment Insights

Product Type Insights

Based on the product type, the orthopedic segment dominated the global medical implants market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. Orthopedic implants are extensively used across the globe for replacing the missing bones or joints and to support the damaged bones. The rising cases of accidents that leads to damage bones and joints is augmenting the growth of this segment. Further the rising cases of rheumatoid arthritis is giving rise to the elbow joint replacement surgeries. According to the Australia Bureau of Statistics, around 458,000 people have rheumatoid arthritis. In 2017-18. Moreover, according to the Arthritis Report UK, around 17.8 million people were living with a musculoskeletal condition in 2018. Hence, this is resulting in the increased number of orthopedic surgeries that may boost the growth of the orthopedic implants in the forthcoming years.

On the other hand, the dental segment is estimated to be the most opportunistic segment during the forecast period. This is simply attributed to the rising demand for the dental implants to improve physical appearances of face. According to the American Academy of Implant Dentistry (AAID), around 3 million US people have dental implants and it is expected to grow by 500,000 per year. Hence, the rising adoption of dental implants is estimated to drive the market growth in the forthcoming years.

Biomaterial Insights

Based on the biomaterial, the metallic segment dominated the global medical implants market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. This can be attributed to the rising cases of road accidents and trauma cases across the globe coupled with the rising demand for the minimally invasive surgeries among the people. Moreover, the dominance of this segment is attributed to the increased adoption of the metal implants in the orthopedic surgeries to provide strong support to the damaged bones or joints. Hence, this segment is further expected to grow owing to the rising cases of arthritis among the global population.

Medical Implants Market Regional Insights

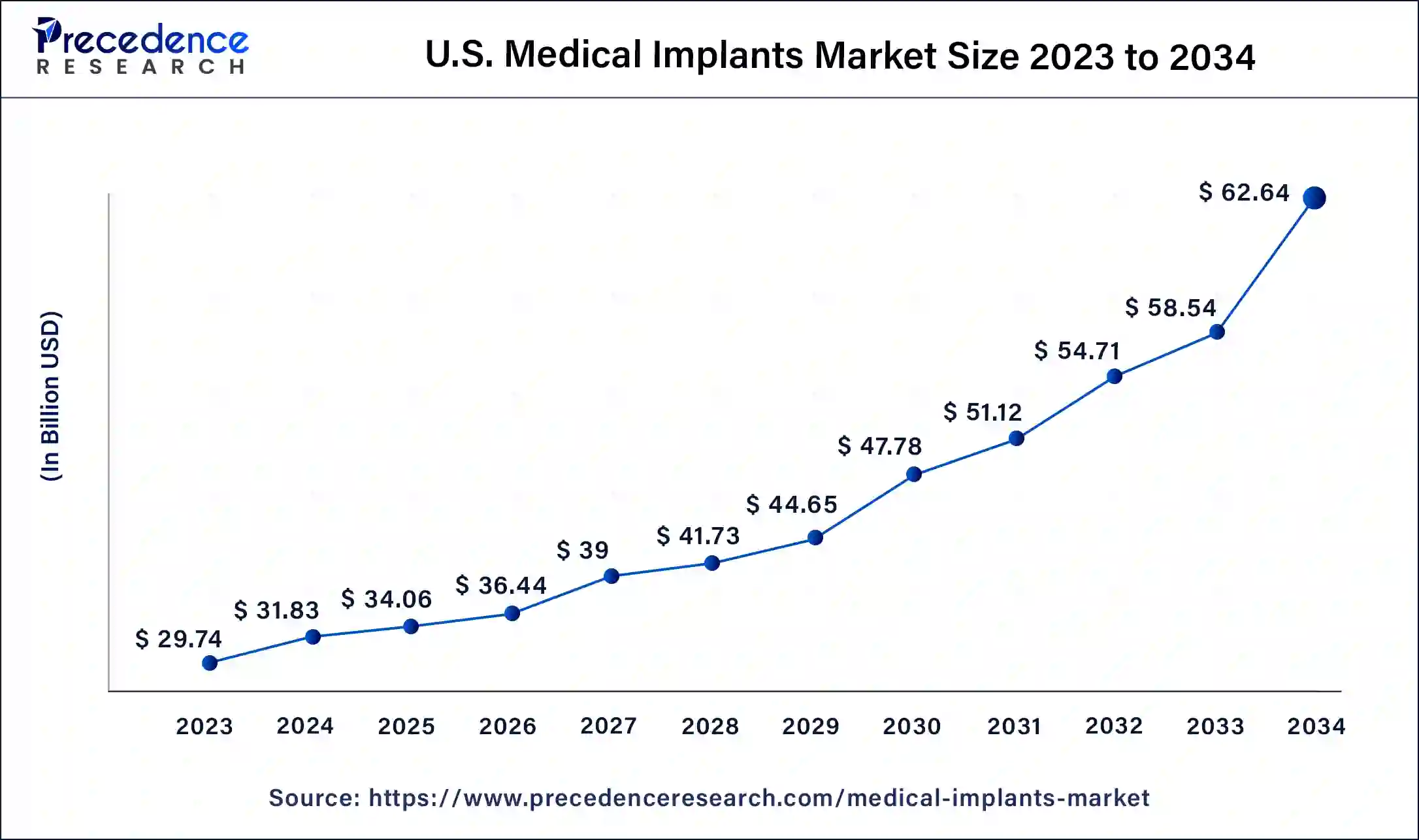

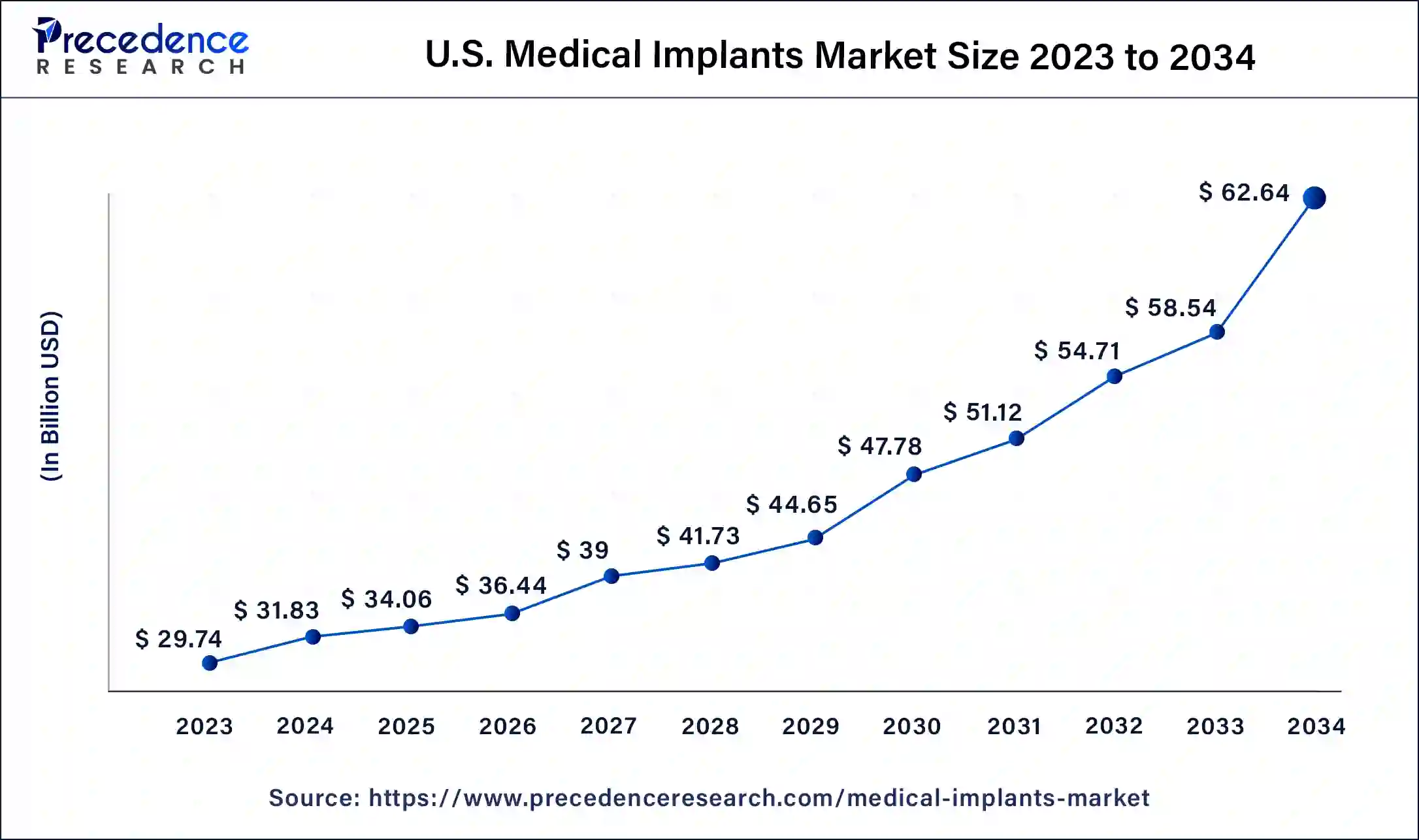

The U.S. medical implants market size is estimated at USD 29.74 billion in 2023 and is predicted to be worth around USD 62.64 billion by 2034, at a CAGR of 7% from 2024 to 2034.

Based on region, North America dominated the global medical implants market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. North America is characterized by the increased prevalence of various chronic diseases and increasing geriatric population. Further, the increased disposable income, presence of advanced healthcare infrastructure, increasing adoption of minimally invasive surgeries, and rising consumer expenditure on healthcare are the major factors that are expected to drive the growth of the medical implants market in the region. Further, the number of medical visits in the US is rising. According to the CDC, approximately 64% of the US population of age between 18 years to 64 years, visited clinics related to their medical health in 2017. Moreover, the increased awareness among the population in North America regarding the availability of various medical implants has significantly contributed towards the market growth in the past.

It is a dominant market due to the presence of the USA and Canada, which have high-quality health care systems, well-developed research facilities, and good reimbursement policies. Smart implants, as well as the value-based approach, are contributing to the market's growth. Other factors regarding chronic diseases that need implants across orthopedics, cardiology, and neurology treatments.

Thanks to well-established healthcare systems, a strong industry presence, and the quick adoption of cutting-edge implant solutions, the US market is the strongest one worldwide. High consumer awareness, coupled with the availability of skillful professionals and the integration of technology, strengthens the market and confirms the continuous focus on advanced therapeutic devices.

A mature market characterized by the highest medical standards and biomaterial innovation. Regulation compliance is difficult under device directives, however, opportunities for sustainable, biocompatible solutions and personalized implants in orthopedic, cardiovascular, dental, and reconstructive use cases are still strong.

The fastest-growing region globally is a result of the increased expenditure on health, the establishment of more hospitals, and the increase in the number of patients going abroad for medical treatment. The large patient population promotes the use of advanced implants, the production of locally-made devices, and the development of inexpensive innovations aimed at supporting accessibility and treatment.

On the other, Asia Pacific is estimated to be the most opportunistic market during the forecast period. This is attributed to the rising geriatric population. According to the United Nations, around 80% of the global geriatric population is expected to be living in the low and middle income nations. Further, the rising government and corporate investments in the development of advanced healthcare infrastructure in the region is anticipated to boost the market growth in the region.

Both countries stimulate growth through the implementation of healthcare programs aimed at providing access and promoting local production. The reforms in the regulations related to medical devices have sped up their approval process, while the manufacturing parks are not only increasing the production capacity for implants but also facilitating the technology transfer for orthopedics, dental, and cardiovascular procedures.

Medical Implants Market Value Chain Analysis

Health needs spotting, idea generation for products, tech implant manufacturing, and testing.

Key Players: Medtronic, Johnson & Johnson

Test the safety of the trial contestants, and the drug, and thus the market's efficacy, legal permission is through.

Key Players: IQVIA, ICON plc

The implant material is sterilized and turned into stable and easy-to-inject forms.

Key players: Stryker, Zimmer Biomet)

Products are boxed, and bar codes for tracking purposes and to verify the authenticity are attached.

Key Players: Amcor, Oliver Healthcare Packaging)

Implants that are still in the form of finished products are sold to hospitals, clinics, and other specialized medical outlets.

Key players: Cardinal Health, McKesson

Medical Implants Market Companies

Covers a domain of implantation of heart devices, neurostimulation, and pain management solutions mainly for chronic disorder treatment devices.

Producing comprehensive surgical support along with orthopedic implants for hip, knee, and spine reconstruction.

Points out through the provision of stents, pacemakers, and spinal stimulators that these products are for cardiovascular and neurological treatment applications.

Other Major Key Players

- Biotronik

- LivaNova PLC

- Globus Medical, Inc.

- NuVasive, Inc.

- Integra LifeSciences Holding Corporation

- InstitutStraumann AG

- Conmed Corporation

Recent Developments

- In December 2025, Eurofins Medical Device Services North America launched a GMP PFAS testing solution for the medical device industry, aiding manufacturers in understanding global PFAS regulations and enhancing medical device and patient safety.

(Source: finance.yahoo.com) - In September 2025, BVI won four 2025 Medical Device Network Excellence Awards for Innovation, Research and Development, Investments, and Product Launches in advancing eye care technology.

(Source: medicaldevice-network.com )

Medical Implants Market Segments Covered in the Report

By Product Type

- Cardiovascular

- Orthopedic

- Neurostimulators

- Spinal

- Opthalmic

- Facial

- Dental

- Breast

By Biomaterial

- Ceramic

- Metallic

- Polymers

- Natural

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting